Foresight Ventures Market Weekly Report: NFT market remains sluggish, when will the winter end?

A. Market Viewpoint

I. Macro Liquidity

Tightening monetary liquidity. The rise in international oil prices to a 10-month high has increased inflation concerns. At the same time, US economic data has highlighted consumer demand and overall economic resilience, increasing the probability of avoiding a recession. The market has raised expectations of a rate hike by the Federal Reserve in November. The US dollar index has stabilized at a 6-month high, suppressing risk assets. Leading tech stocks in the US stock market plummeted, and mainstream cryptocurrencies experienced a general decline.

II. Market Overview

Top 100 market capitalization gainers:

The market continued to decline this week. Shitcoins had short-term momentum but lacked sustainability. The cryptocurrency market has a market capitalization of 1.1 trillion US dollars, of which BTC, ETH, and stablecoins account for 800 billion US dollars. The market capitalization of the remaining tens of thousands of shitcoins has shrunk to only 300 billion US dollars. The market lacks momentum, and there is short-selling pressure on contracts.

TON: With a market capitalization close to the top 10, it is the most powerful public chain in recent performance. TON has no technological innovation, mainly benefiting from Telegram's user base. The Telegram ecosystem has developed rapidly, and many bot projects similar to WeChat mini-programs have emerged.

SOL: VISA has chosen SOL chain for payments instead of ETH chain because SOL is faster and cheaper.

BANANA GUN: The trading robot project plans to airdrop tokens recently and has attracted many UNIBOT customers, similar to the relationship between SUSHI and UNI. Market expectations are that the airdrop could reach half the market value of UNIBOT.

III. BTC Market

1) On-chain Data

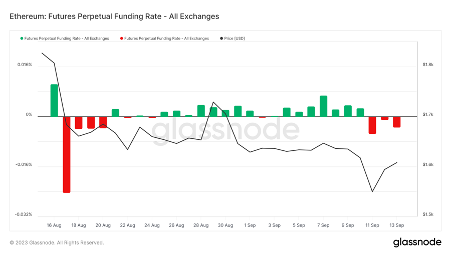

Risk appetite in the derivatives market has decreased. In 23, the activity in the ETH futures market is significantly lower than in 21-22, with average daily trading volume dropping to half of the past two years. Funds continue to flow out of the spot market, and liquidity in the derivatives market continues to decline. Overall, investors seem hesitant to re-enter the market.

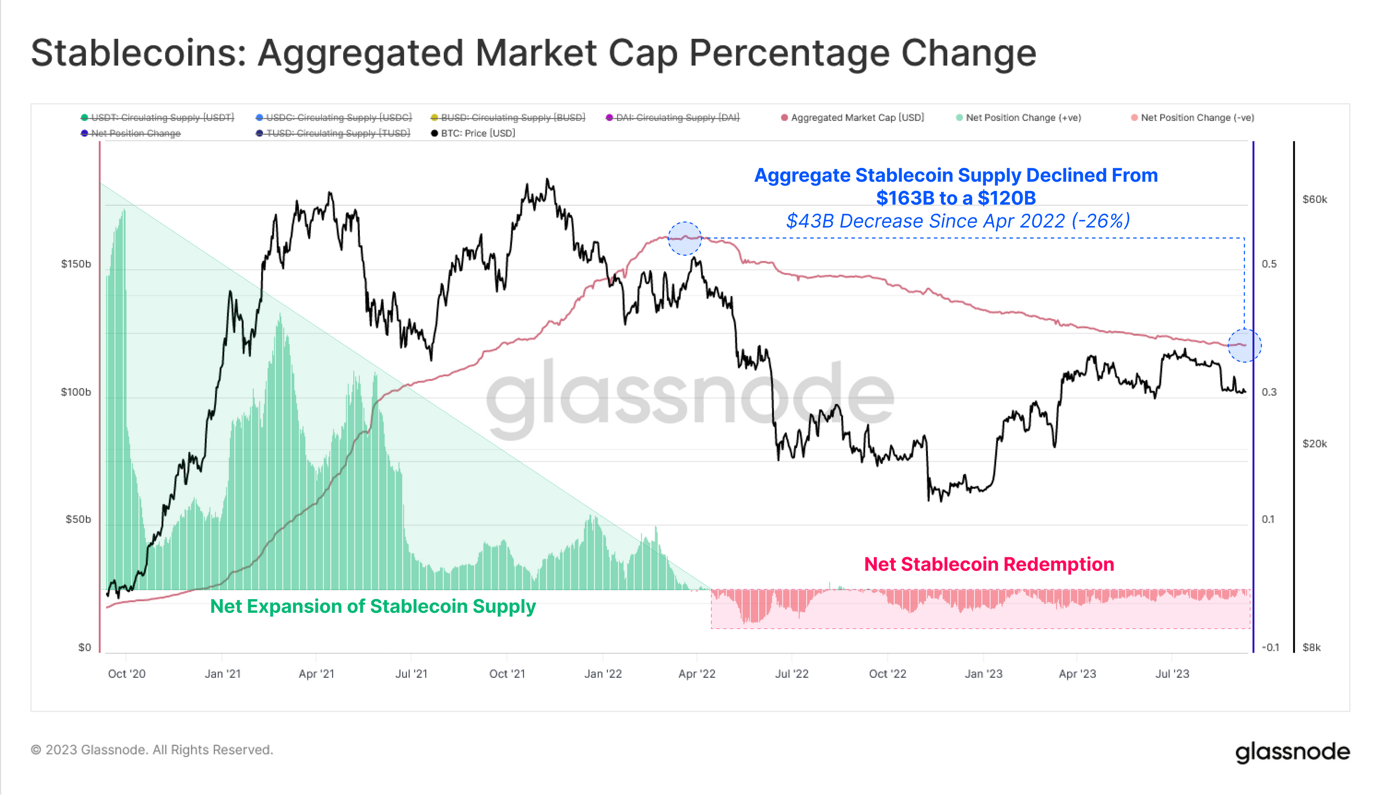

Stablecoins have significantly decreased. USDT market cap increased by $5 million, but USDC market cap decreased by $140 million, and USDC mainly represents US investors.

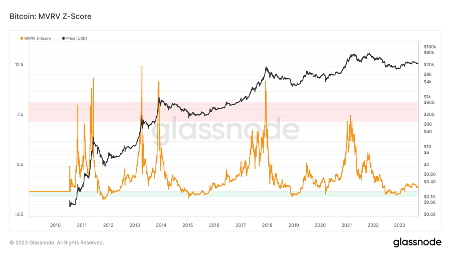

The long-term trend indicator MVRV-ZScore is based on the overall market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is in the top range; when the indicator is less than 2, it is in the bottom range. MVRV falling below the key level 1 indicates that holders are generally in a loss-making state. The current indicator is 0.4, entering the recovery phase.

2) Futures Market

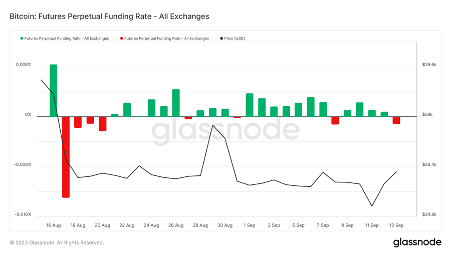

Funding rate: Neutral this week. Rates are 0.05-0.1%, indicating more long leverage in the market, which could be a short-term market top; rates -0.1-0%, indicating more short leverage in the market, which could be a short-term market bottom.

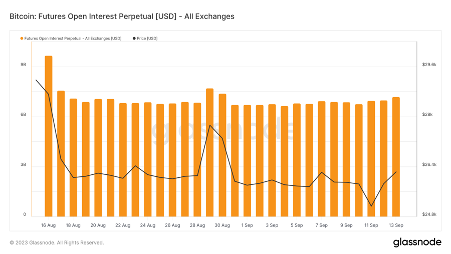

Futures Open Interest: The total open interest for BTC this week remains the same, with no new funds entering.

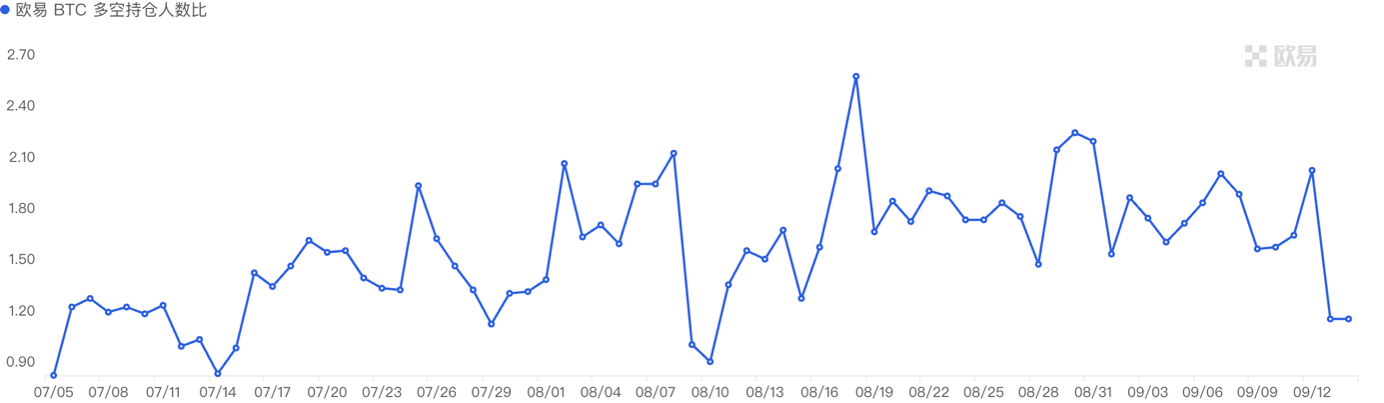

Futures Long/Short Ratio: 2.0. Market sentiment for bargain hunting is strong. Retail investor sentiment is often a contrarian indicator, with panic usually below 0.7 and greed above 2.0. The long/short ratio data is volatile, with diminished reference significance.

3)Spot Market Analysis

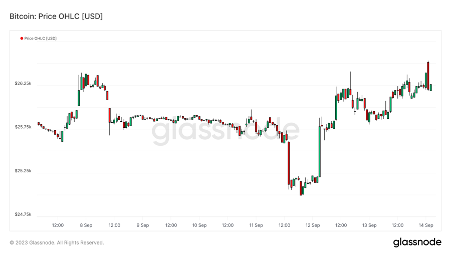

This week, BTC experienced a bearish oscillation. Investor sentiment is tepid, with CEX exchange recording the lowest trading volume of the year in August. The current bullish narratives are still the BTC spot ETF, BTC halving cycle, and the US Federal Reserve interest rate cuts. It is recommended to gradually accumulate positions during market declines.

B. Market Data

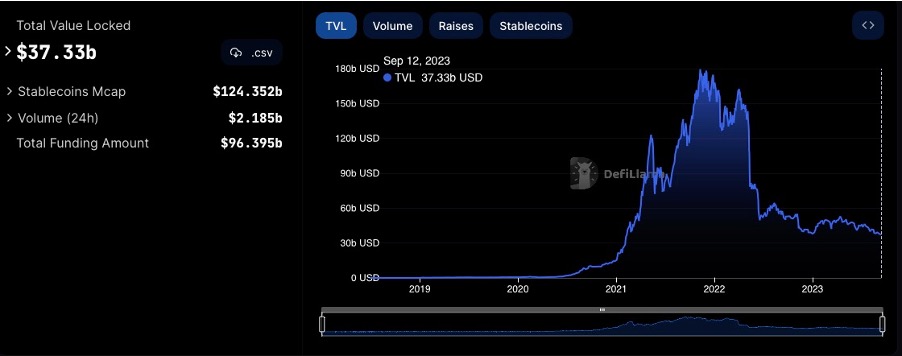

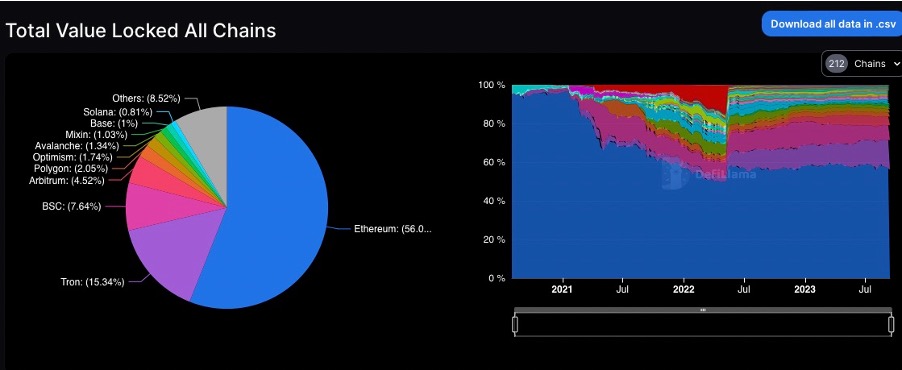

1. Total Locked Amount on Public Chains

2. Percentage of TVL on Different Public Chains

This week, the overall TVL increased by 0.6 b, representing a nearly 2% increase. However, the TVL has been on a downward trend in recent weeks. The TVL on the ETH chain decreased by approximately 5% this week. Other chains also experienced a general decline, reflecting the market's subdued sentiment. It is worth noting that the Base chain continued to experience a significant increase of up to 90% this week, with a cumulative increase of 792% over the past 30 days. The total number of protocols has reached 107, approaching a surpassing of Solana.

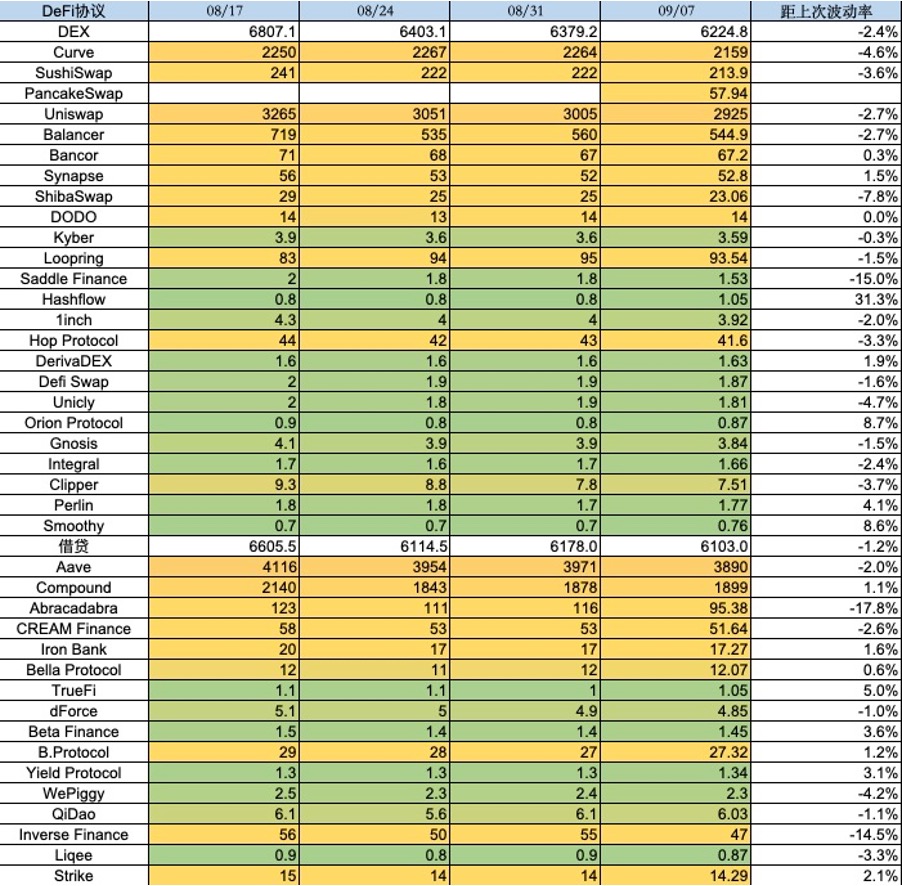

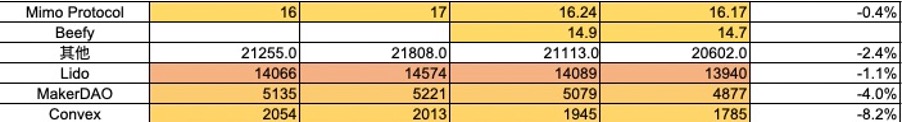

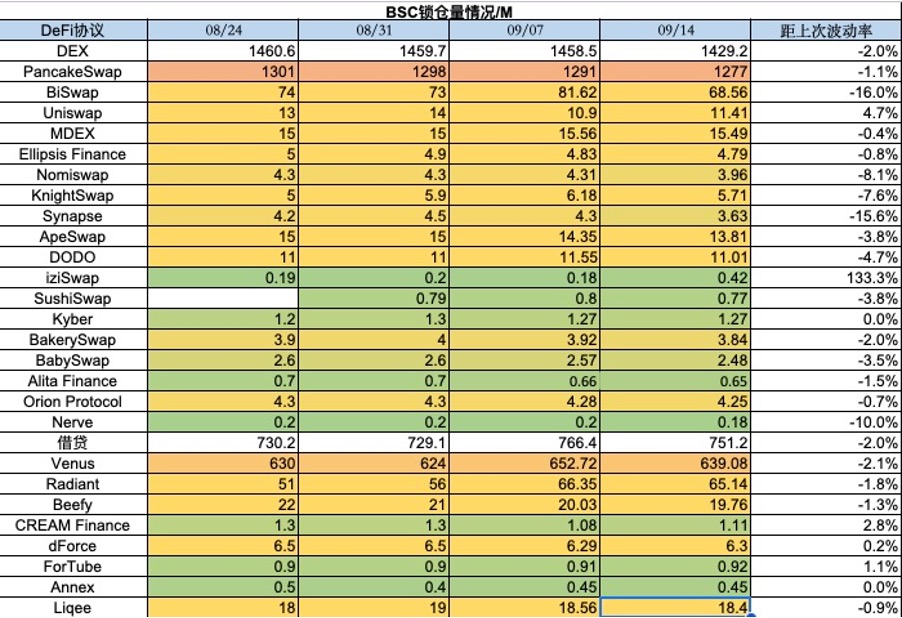

3. Locked Amount of Protocols on Different Chains

1) Locking Amount of ETH

2) BSC lock-up situation

3) Polygon lock-up situation

4) Arbitrum lock-up situation

5) Optimism lock-up situation

6) Base lock-up situation

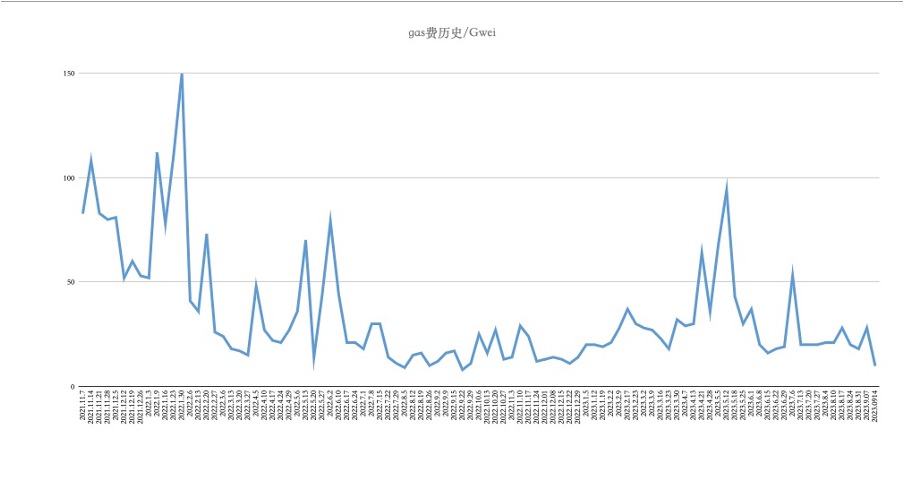

IV. ETH Gas Fee Historical Situation

The cost of on-chain transfers is about $2.83, the trading fee for Uniswap is about $9.65, and the trading fee for Opensea is about $3.75. Gas has seen an increase this week, with minimal fluctuations in the past few weeks, reflecting the market's recent sluggish performance. In terms of Gas consumption, Uniswap still occupies the top position and has seen a 14% increase in the past 24 hours.

Fifth, NFT Market Data Changes

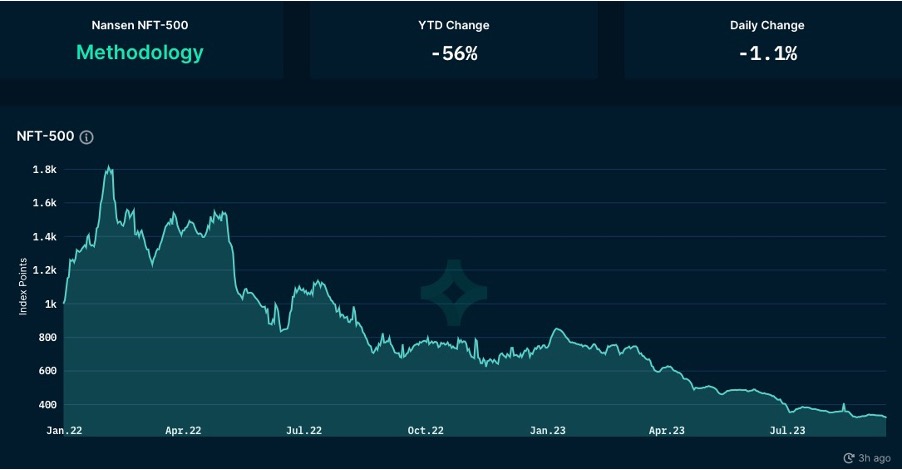

1) NFT-500 Index:

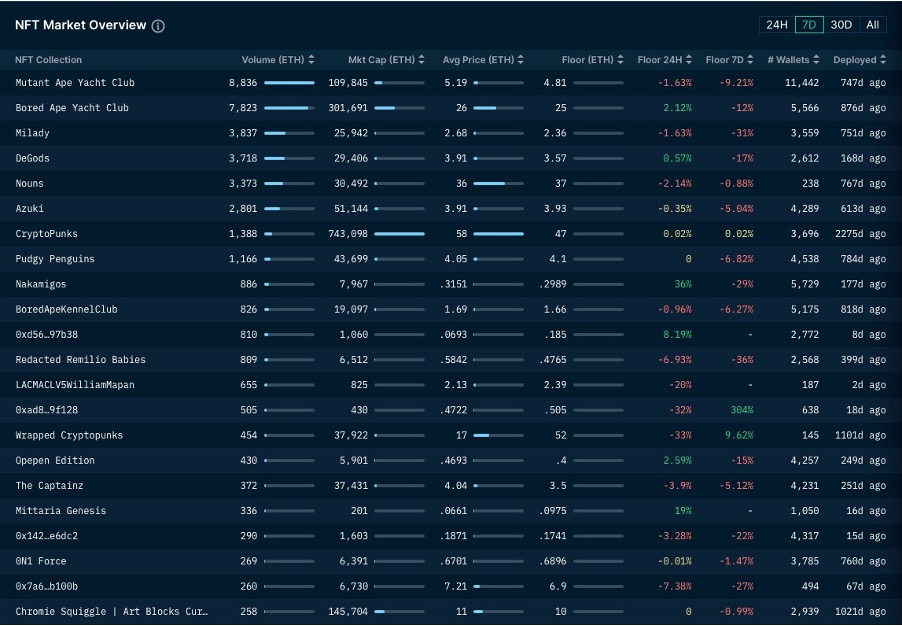

2) NFT Market Situation:

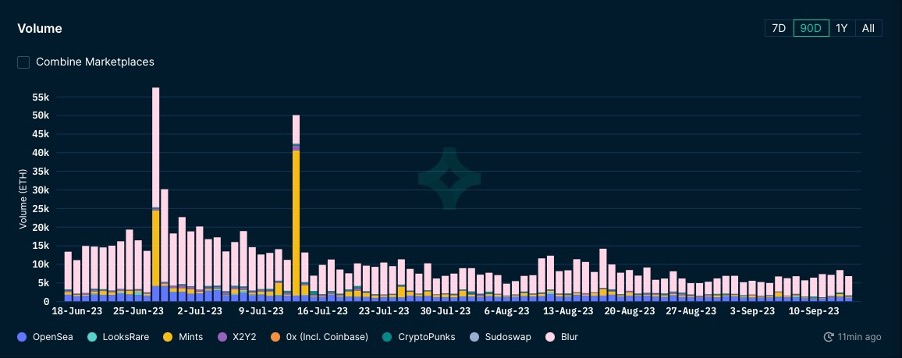

3) NFT Trading Market Share:

4) NFT Buyer Analysis:

This week, the floor prices of the top blue-chip projects all declined, with BAYC and MAYC both falling by more than 6%, and Milady falling by as much as 17%. The total number of wallets and repeat buyers are both in a declining trend, and the overall market conditions have also affected the number and enthusiasm of first-time buyers.

Sixth, Latest Financing Situation of Projects

About Foresight Ventures

Foresight Ventures is the innovation journey that focuses on the future of cryptocurrency for the next few decades. It manages multiple funds, including VC funds, secondary actively managed funds, multi-strategy FOF, and special purpose S funds, with total assets under management exceeding $400 million. Foresight Ventures adheres to the concept of "Unique, Independent, Aggressive, Long-term" and provides extensive support to projects through its strong ecological power. Its team consists of experienced professionals from top financial and technology companies, including Sequoia China, CICC, Google, and Bitmain.