Review of the de-anchoring moment of mainstream stablecoins in 2023: reasons and suggestions

Original author -Riyad Carey

Original compilation - Odaily Nan Zhi

Overview

What is Depeg? In its simplest form, a depeg is when a stablecoin trades at a discount to the fiat currency it represents.

However, under the strictest and most practical conditions, this definition does not fully apply; USD stablecoins or transactions at a discount of one-tenth, one-hundredth, or one-thousandth of the dollar are considered unanchored. If we say that TUSD at $0.9998 is unanchored, then the term starts to lose its meaning.

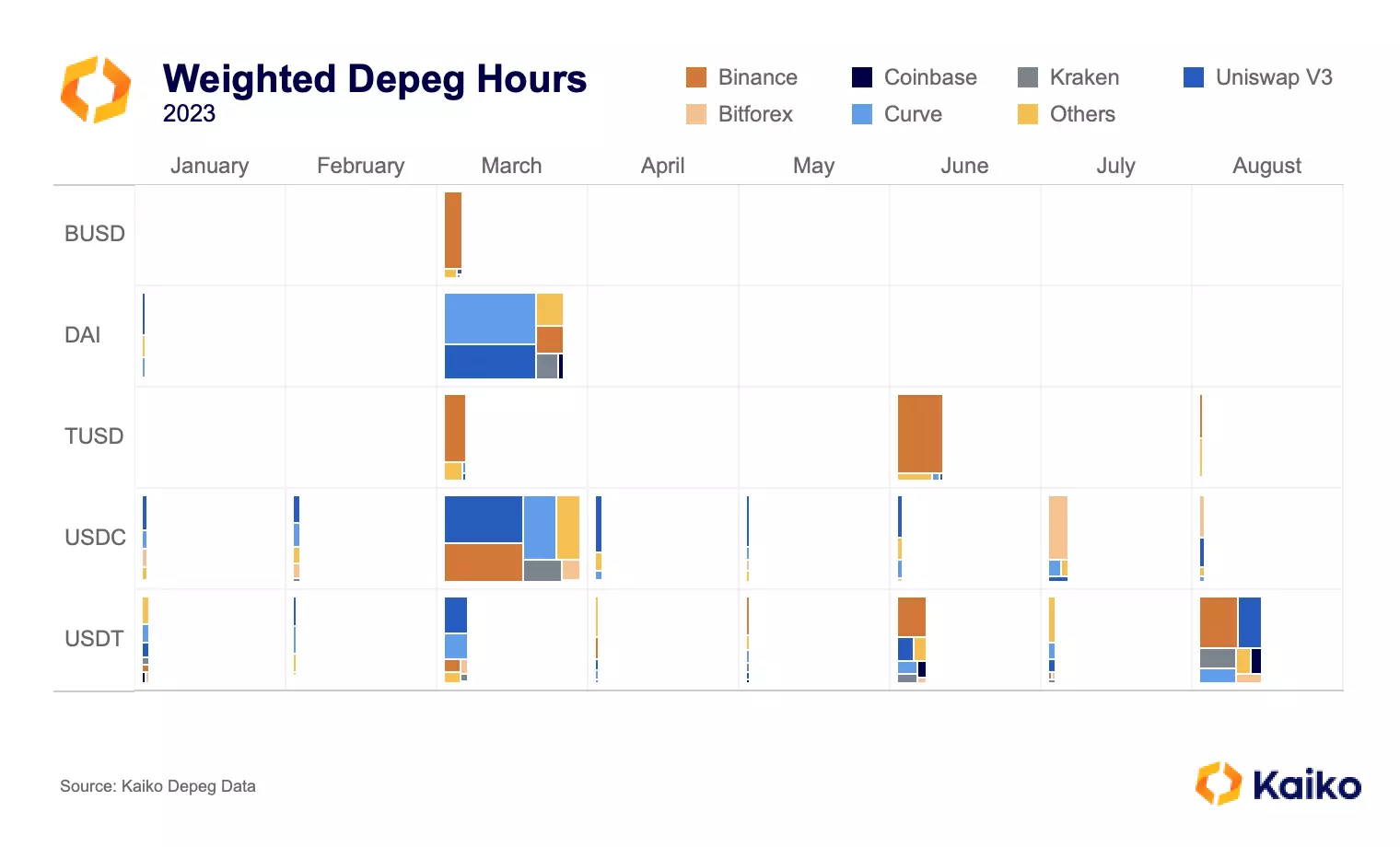

Therefore, the authors propose a metric that uses the total trading volume of stablecoins to create a depeg threshold, weighted based on the trading volume of different trading platforms.

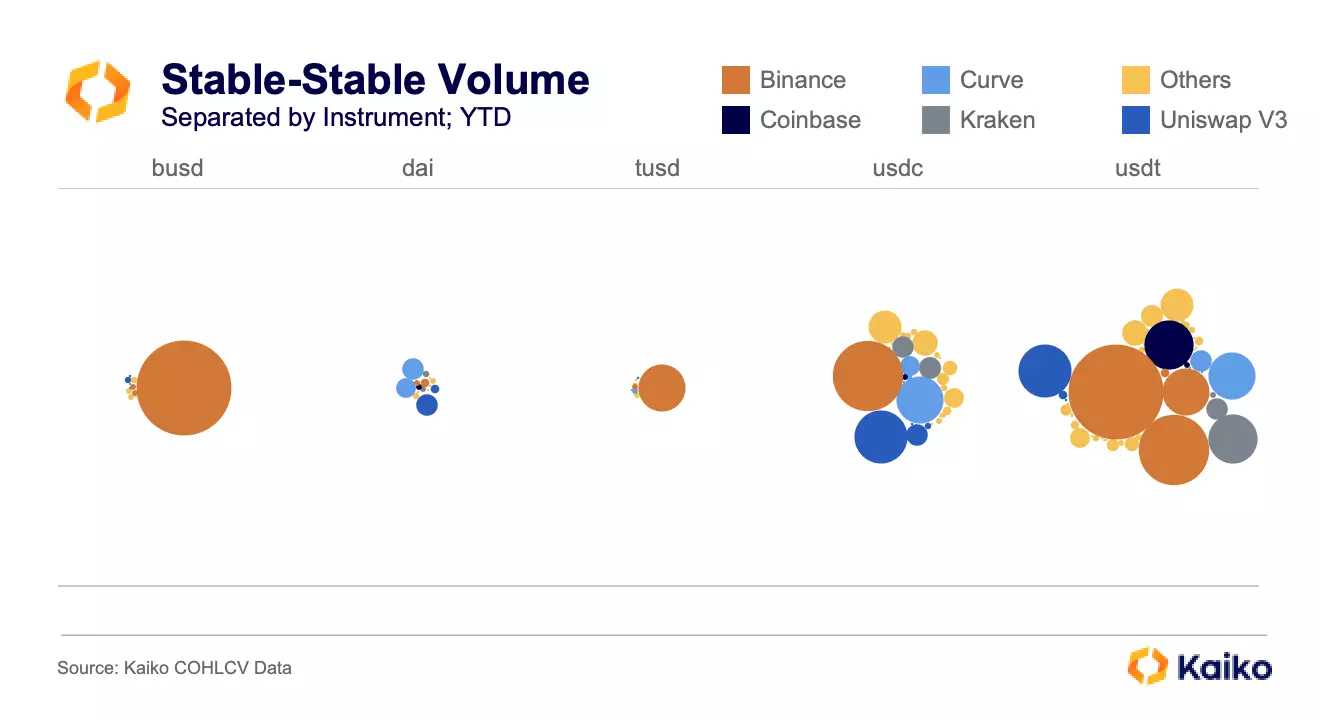

Based on this metric, the most severe unanchors among the top five stablecoins this year were USDC and DAI on March 12, TUSD on June 12, and USDT on August 7. It’s worth noting that USDT was slightly unanchored for most of August.

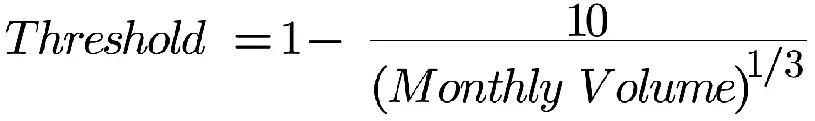

Unanchoring threshold

The authors use stablecoin global transaction volume to establish a depeg threshold that becomes smaller as stablecoin transaction volume increases. Simply put, a stablecoin with a monthly trading volume of $10 billion is far more serious if it trades at $0.995 than a stablecoin with a monthly trading volume of $10 million trading at the same price. The final formula is as follows:

Applied to the five stablecoins discussed, we get the following results:

TUSD’s depeg threshold quickly became smaller from February to March as Binance eliminated transaction fees on BTC-TUSD to promote this stablecoin.

BUSDs threshold widened from 0.998 to 0.9955 as its trading volume declined.

The USDT threshold has always been the lowest, at 0.998 in August.

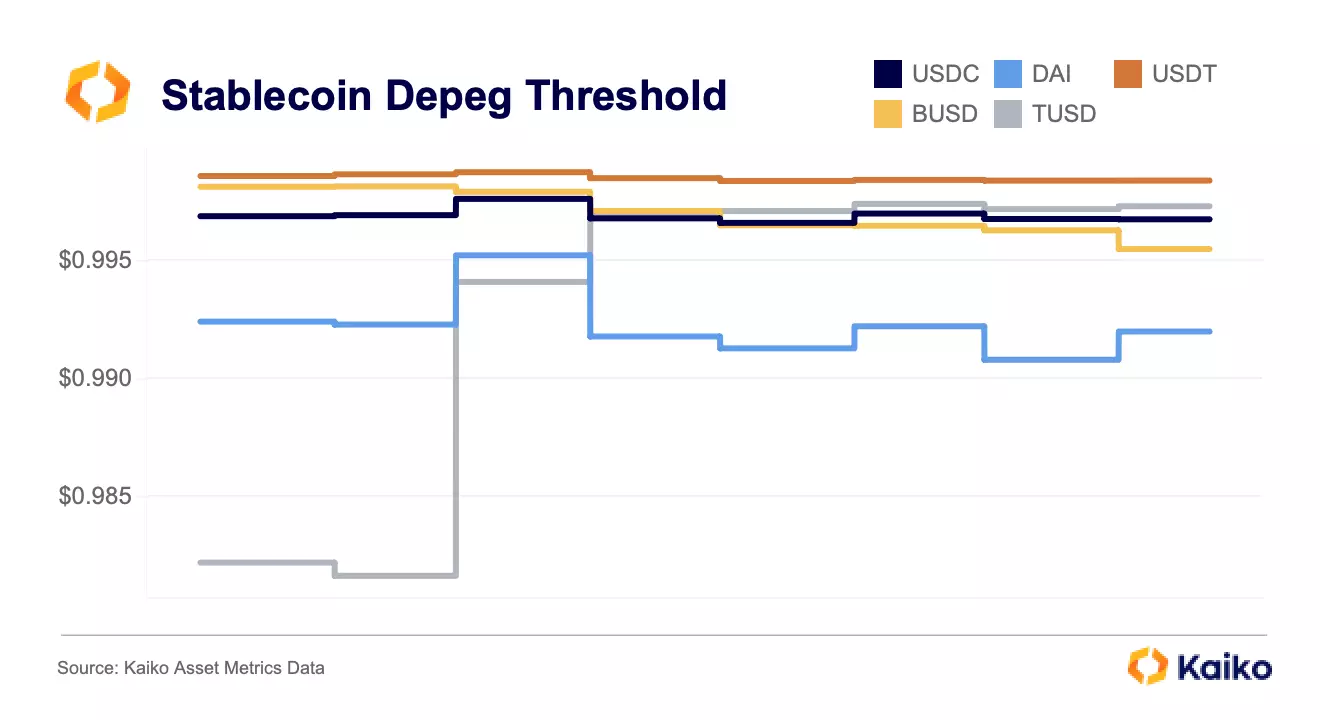

Trading volume measurement method

The chart below shows stablecoin-to-stablecoin trading volume so far this year, with the colors representing different exchanges. DAI has the lowest trading volume at just $17 billion, of which nearly $13 billion comes from Uniswap V3 and Curve. TUSD is next with only $24.5 billion in trading volume, $23.5 billion of which comes from a single trading pair: TUSD-USDT on Binance.

BUSD’s trading volume is $97.5 billion and is similarly highly concentrated, with $93 billion coming from the BUSD-USDT trading pair on Binance. USDC and USDT are quite different from other stablecoins. USDC’s trading volume is US$150 billion, distributed on 48 trading platforms, while USDT’s trading volume is US$320 billion, distributed on 75 trading platforms.

in conclusion

Looking at the situation in early August on an hourly basis, USDT experienced a major unanchoring of 98% on August 7, which meant that USDT was trading at a discount on almost every trading platform. A total of $500 million in USDT was sold on Binance, Huobi and Uniswap, which the author believes was due to the inflexibility caused by Tether’s redemption fees and minimum limits.

On a day-to-day basis, the most severe decoupling since May was the TUSD decoupling that occurred on June 7, reaching almost 60%, with most of the time spent trading at a discount on Binance.

TUSD, DAI, and BUSD are all relatively stable, among which TUSD benefits from its liquidity being almost completely concentrated on the same trading platform;

USDC experienced an unanchoring of more than 10% in March and has never exceeded 1% since then, and its stability is increasing day by day;

USDT has stability issues. Its redemption fees and minimum limits mean that for USDT holders, selling the token on the market is preferable to exchanging Tether for USD. As liquidity decreases, the market can no longer absorb large-scale USDT sales. Although the degree of de-anchoring in terms of price is low,Its continued discounting is worrying. The most direct solution is for Tether to remove its redemption fee and minimum limit. Tether reported profits of $850 million in the second quarter, and the removal of fees will have little significant impact on profits unless the company believes that reducing redemption costs will significantly reduce the supply of USDT.