Huobi Ventures: Will the Web3 social track be the next bull market engine?

Every bull market has a different starting engine, and behind every bull market engine, there is a long bear market development process like grass snakes and gray lines. Crazy MEME, DeFi summer... With the development of Web3 technology and infrastructure, the social track has also ushered in new development opportunities.

Will the Web3 social track be the next bull market engine?

As a track that requires developers' imagination to be fully utilized at the application layer, social, identity, NFT, DAO, fans, etc. can all be classified into the category of Web3 social. The social track is still in its early stages, and with the launch of Cyber tokens, Twitter's renaming, and creator incentive programs, the market popularity of the social track is gradually rising.

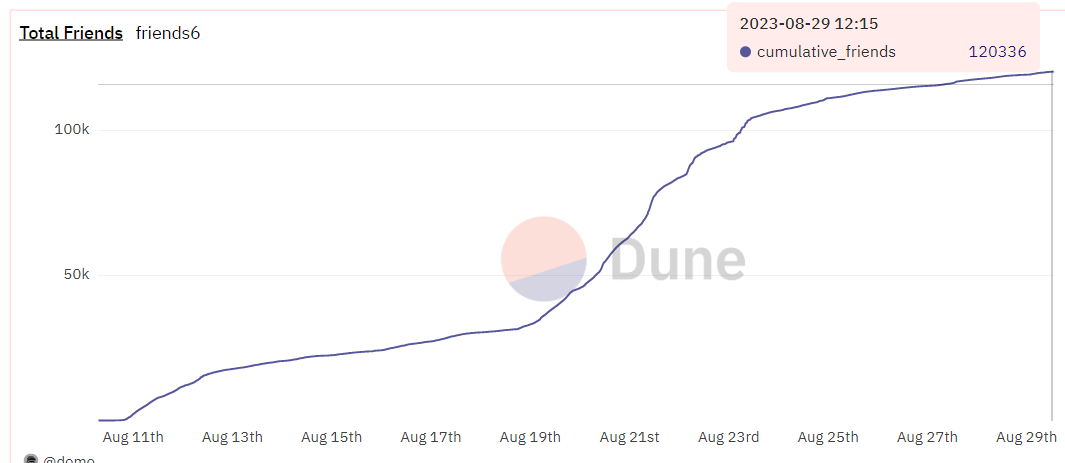

Social applications on the L2 chain BASE, such as Friend.Tech, have quickly gained popularity since their launch on August 10th. In less than 20 days, there have been over 120,000 registered addresses and over 20,000 active addresses.

Applications like CyberConnect and Lens Protocol have also attracted a large number of users and market attention.

This article discusses the current development status of Web3 social, the characteristics of track products, and also analyzes several head projects within the track. In addition, research has been conducted on the risks and challenges faced by this track. Overall, the future of the Web3 social track is promising, and this sector has good investment potential and prospects for development.

This research report is produced by Huobi Ventures, Huobi Ventures is Huobi's global investment division, integrating investment, incubation, and research to identify the best and most promising projects worldwide.

Why Should You Pay Attention to Social Media?

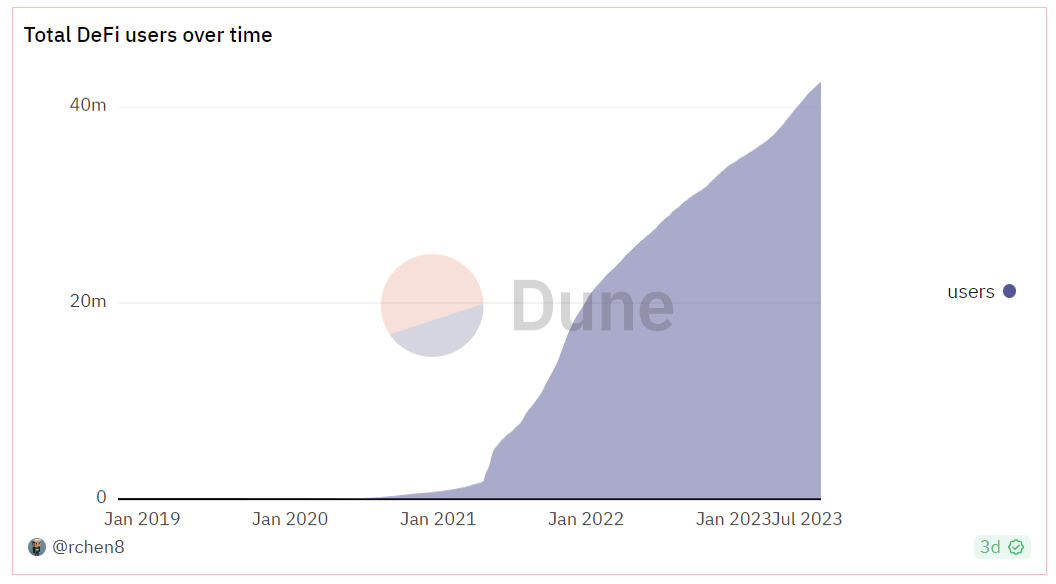

The encryption track has always been regarded as an interdisciplinary science integrating computer science, finance, cryptography, mathematics, and other disciplines. However, due to its relatively short existence, incomplete infrastructure, inconsistent regulatory standards, and certain learning barriers and costs, it has yet to achieve widespread popularity and usage worldwide. With the increasingly improved development of smart contract public chains represented by Ethereum, the development of on-chain Dapps has exploded since 2020, as shown in the figure below, with the cumulative number of Defi user addresses exceeding 40 million. Defi has taken the lead in bringing users to on-chain interactions, and its real and convenient application scenarios have driven the construction and development of on-chain economy, attracting and nurturing a group of on-chain Degen. Since 2021, blockchain games and NFTs have started to lead a new wave of users, and the new on-chain gameplay, token economic design based on the Ponzi effect, and diverse value systems have helped attract a large number of new users to the Web3 field. In terms of blockchain games, due to their "gold farming" effect, they have attracted many Web2 game players and low-income individuals in the third world. NFTs, on the other hand, have attracted a large number of collectors, art enthusiasts, and various traditional brands due to their attributes of identity value, collectible value, and brand value.

Accumulated number of Defi user addresses across the entire chain, Source: https://dune.com/rchen8/defi-users-over-time

Since 2022, the market has entered a long bear market, with the previous hot tracks such as games and NFTs losing their hype, and the Ponzi economic models collapsing rapidly due to insufficient incremental growth. The growth of Web3 users has reached a bottleneck period. Currently, Web3 innovation is still ongoing, with developers continuously exploring new possibilities in areas such as infrastructure construction, zero-knowledge proofs, payments, identity, and Defi 2.0. However, the core problem that Web3 development is facing is still the lack of a sufficient number of users. In today's bear market, a large number of ecosystems and projects on these ecosystems are facing the dilemma of completed construction but lacking real users. Excluding various airdrop studios and multi-wallet users, the number of real on-chain users may not be optimistic.

From the supply side, the development of Web3 currently needs to expand more application scenarios and create more ways to attract new users. It seems that the social track is expected to become the next explosive track for Web3 users. From the demand side, the social track has confirmed its strong potential in the traditional internet field, and its huge user base and commercial value have been fully utilized in this track. From the early period of MSN to the middle period of Facebook, Instagram, and later Tiktok, each technological iteration in the social track has accompanied the birth of internet giants and triggered a large number of employment opportunities in the industry chain. As people's awareness of the privacy value and commercial value of data ownership increases, more and more voices are calling for users to control their social information and data through Web3, and to enjoy the value of self-identity and behavioral data. Therefore, the exploration of social projects in the Web3 field is one of the most promising and commercially valuable topics in the foreseeable future.

With the maturity of ecosystems such as Cyber Connect and Lens Protocol, the entire social sector ecosystem is becoming more and more magnificent. The current social sector is in the early stage of eruption, and recently some social projects have attracted market attention. For example, the largest KOL in the cryptocurrency circle, Elon Musk, took over Twitter, and his behaviors such as repeatedly promoting Dogecoin and including Bitcoin in Tesla's official documents have brought global traffic to the cryptocurrency field. Although he has stated that Twitter will never issue tokens, speculations about social identity, token rewards, and payments around Twitter have long been discussed in the market. In addition, Lens Protocol completed a $15 million financing, leading internet social giants such as Instagram issued NFTs, Cyber tokens, etc., and simultaneously listed them on multiple leading exchanges, expanding the industry.

Characteristics of the Social Track

For Web3 social, there is currently no unified definition. We can classify all products involving the publishing, exchange, and user characterization of information between people into the field of social. From the current development achievements, it mainly includes social public chains, social graphs, social identities, various types of social applications, and service tools, etc.

In the Web2 field, traditional social platforms such as Twitter, Instagram, and Tiktok already have a large number of users and have developed mature and rich business models. When we mention Web3 social, it is necessary to verify the feasibility of Web3 social development. Compared with Web2, Web3 has a smaller user base in social development and is currently in the exploration stage in terms of technology. In summary, this article believes that the key factors for the development of Web3 social include:

1. Anonymity and resistance to censorship

One of the biggest advantages of Web3 social networking compared to Web2 social networking is anonymity and resistance to censorship. This characteristic has already been proven to be one of the user's needs. In the Web2 field, data is controlled by centralized institutions, and users may be subject to arbitrary scrutiny of their data information, forced to delete or modify their social comments, etc. Essentially, Web2 social networking is still a social model under a regulatory system, and users cannot protect their privacy. On the other hand, decentralized Web3 naturally protects user privacy and resists censorship from central institutions. These features can meet the demands of users in protecting privacy and maintaining their own security.

2. User Ownership of Data

In the Web2 social model, user data ownership belongs to centralized platform institutions. By controlling user data, platforms can create user profiles, analyze user behavioral preferences, and then deliver relevant advertisements and products to maximize traffic monetization. The data itself also has certain commercial analysis value. In the Web3 field, user ownership of data can be realized to enable users to obtain commercial value from data traffic. From the perspective of users, projects that make it easy for users to monetize data value are attractive. In fact, this model has been attempted and achieved certain results in the commercial models of Web2, such as Pinduoduo's cash rewards for watching videos and cash rewards for inviting friends to participate in "slashing prices" (essentially a social network to attract new users). Currently, there have been many attempts in the Web3 field, such as Nostra based on the Bitcoin Lightning Network, Lens based on Polygon, and multi-chain protocol CyberConnect, all trying to return data ownership to users. This article believes that in Web3, due to the diversity of tokens, the volatility of token value, and the richness of token economic design, there can be many interesting gameplay options to attract users and even surpass the wealth creation effect and user attraction effect of the previous blockchain gaming bull market.

3. Simplicity and Ease of Use

One of the elements of a social project is the abundance and free flow of information within the community, which relies on a large number of users. How to attract a large number of users is the biggest challenge and opportunity for Web3 social projects. One of the important reasons for the limited development of the encryption field is the small user base. First, there is a certain learning curve for users to enter the encryption field. Users need to master a certain level of computer and encryption knowledge to participate in on-chain interaction. Second, compared to Web2, current encryption projects are more complex and not as simple and convenient for users to use. For example, EOA wallets have complex mnemonic words and storage methods, potential fishing and stolen private key risks, software updates and compatibility issues, etc., all affecting the user experience. By blocking a large number of Web2 users from entering the encryption world, it also means that once the learning cost and entry barriers are resolved, and once there is a social project that is easy to use and has a user-friendly operation, it will bring tremendous user traffic.

4. Composability

In Web2 social networks, the existence of various centralized institutions has led to the formation of massive data silos. The internet giants formed by these enormous data silos have data access permissions and pricing power. Other projects in different categories that want to use this data or build applications on top of it need permission from the data owners. Additionally, there are compatibility issues and potential competition among these massive data silos, resulting in a lack of interoperability between many Web2 applications. Users often have to register new accounts and accumulate information and data again when using a different platform. This article argues that an ideal Web3 social product could potentially solve the problem of data silos. Projects like POAP and ENS attempt to address this problem by depicting user profiles. In the future, there may be simpler and more accessible standard protocols that allow users to easily control their data ownership while being compatible with most protocols. This area is one of the key exploratory directions for DID.

Overview of Head Projects

Based on different project types, social projects can be broadly categorized into social graph, social applications, and tool projects.

Social Graph

Social graph plays an infrastructure role in Web3 social networks, providing common standards and data information sources for other application projects. A social graph should have rich data sources, wide composability, and low barriers to entry. Therefore, the necessity of building standalone social projects on new public chains or on niche public chains is minimal as it adds isolation from other mature ecosystems. Currently, the mainstream choice for social graph development is building social identity standards on mature chains. Projects such as Lens Protocol, CyberConnect, and RSS3 are prominent players in this field.

- CyberConnect

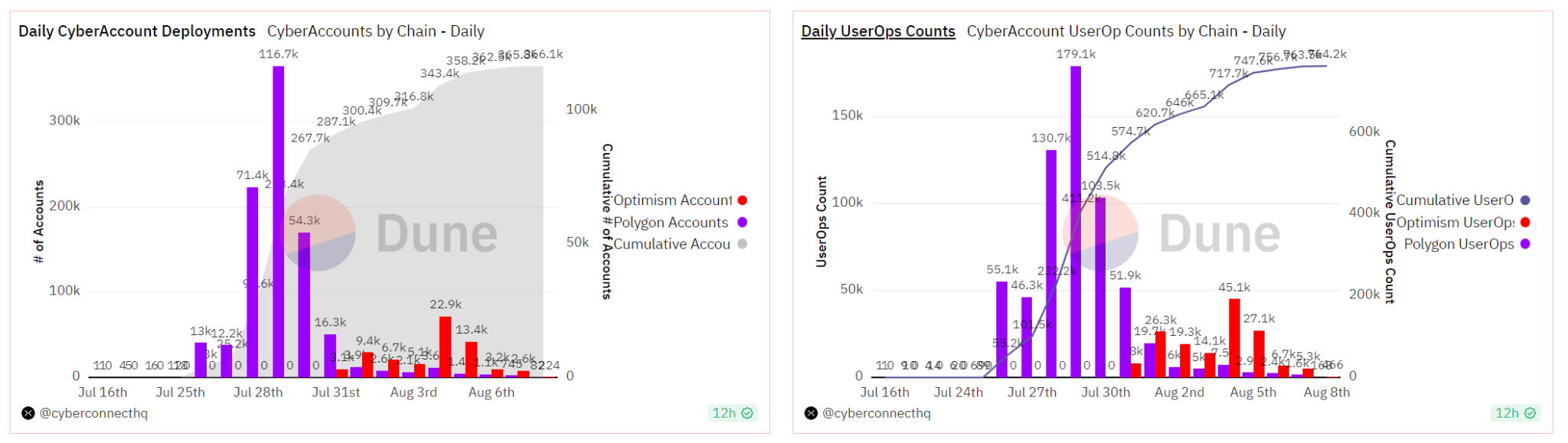

CyberConnect is a multi-chain social graph that verifies and deduces user interaction data, providing users with personal cards, social graphs, and smart contract wallets, and providing standard API data interfaces for other Dapps to achieve user data migration across multiple Dapps. Currently, CyberConnect has been integrated with Polygon, Linea, and Optimism, and will be integrated with networks such as Arbitrum in the future, with the potential for further user growth. As shown in the following figure, as of August 8, 2023, the cumulative number of accounts has reached 368k, and the cumulative number of user operations is 738k, with a total of over 1.25m user profiles.

CyberConnect user data

Source: https://dune.com/cyberconnecthq/cyberaccount-cyberconnects-4337-smart-account

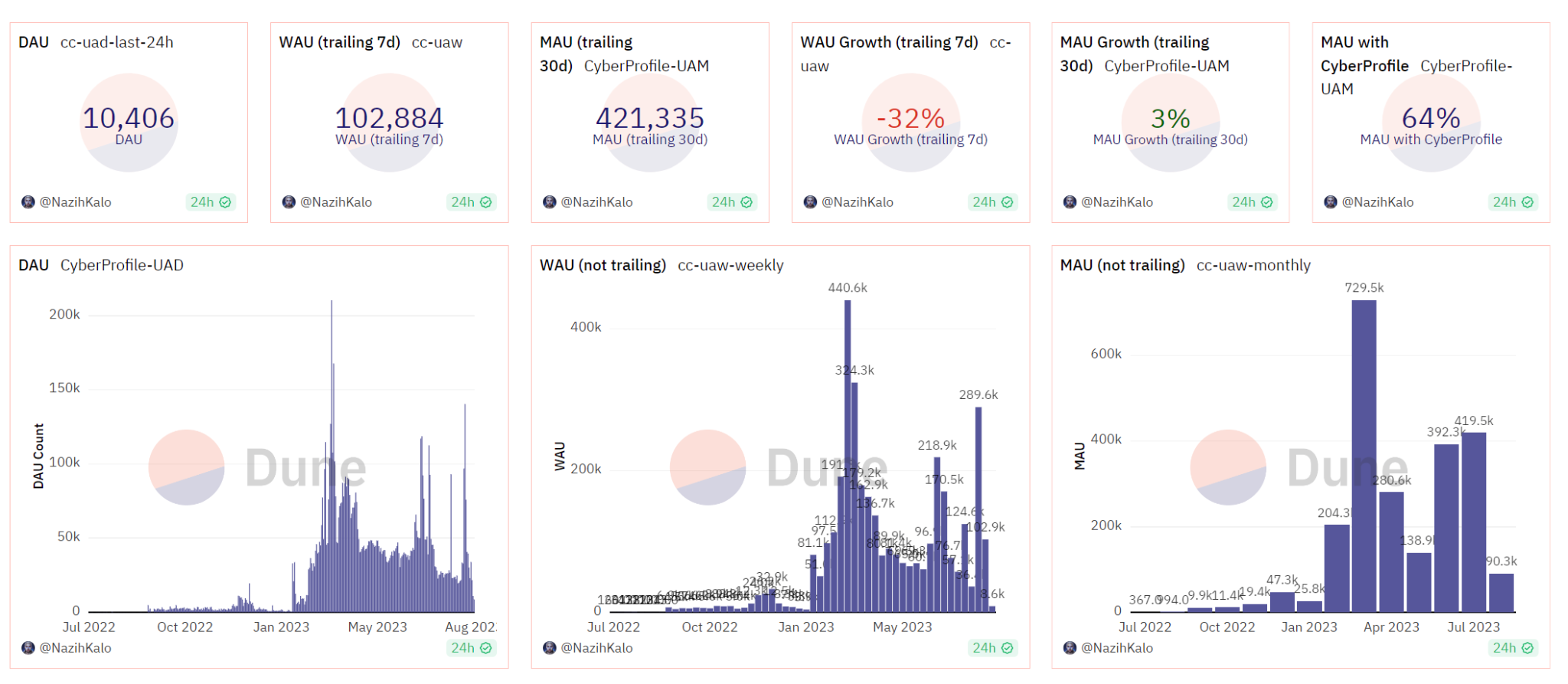

Despite the current downturn in the market, CyberConnect's daily active users (DAU) still maintains above 10k, with overall high traffic.

CyberConnect traffic data

Source: https://dune.com/cyberconnecthq/cyberconnect-link3-metrics

Lens Protocol

Lens Protocol is a social project developed by the well-known DeFi lending project AAVE team. It is a social graph protocol built on Polygon that allows anyone to create non-custodial social profiles and build new social dApps. Users can create their own social profile NFTs and interact with other users through social cards. Users can also build interactive dApps on top of Lens (users can use Lens to log in, interact within the Lens ecosystem, and interaction records will also be recorded in the Lens social profile).

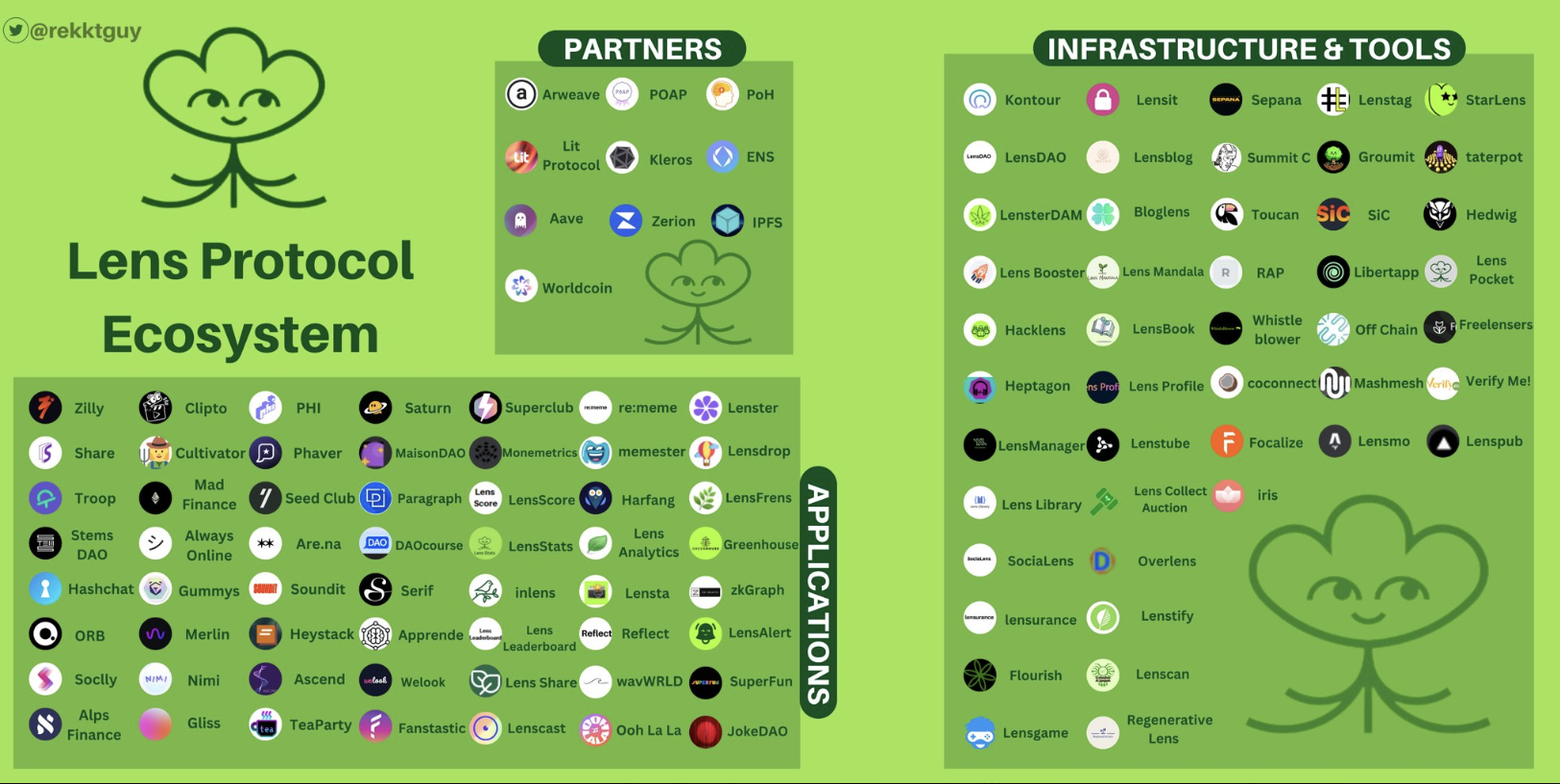

The image below shows some of the projects in the Lens ecosystem. Currently, over a hundred projects have been built on the Lens ecosystem, including various social, gaming, streaming, DAO tools, ad management, messaging, knowledge sharing, and lottery dApps. Although most of the ecosystem projects are still in the early to mid-stage of development, the overall quantity and variety are very rich, even surpassing some public chains. Overall, the social ecosystem created by Lens is very friendly to creator economies.

Partial ecosystem projects of Lens Protocol

Source: https://twitter.com/rekktguy/status/1582288617229406209?s=20

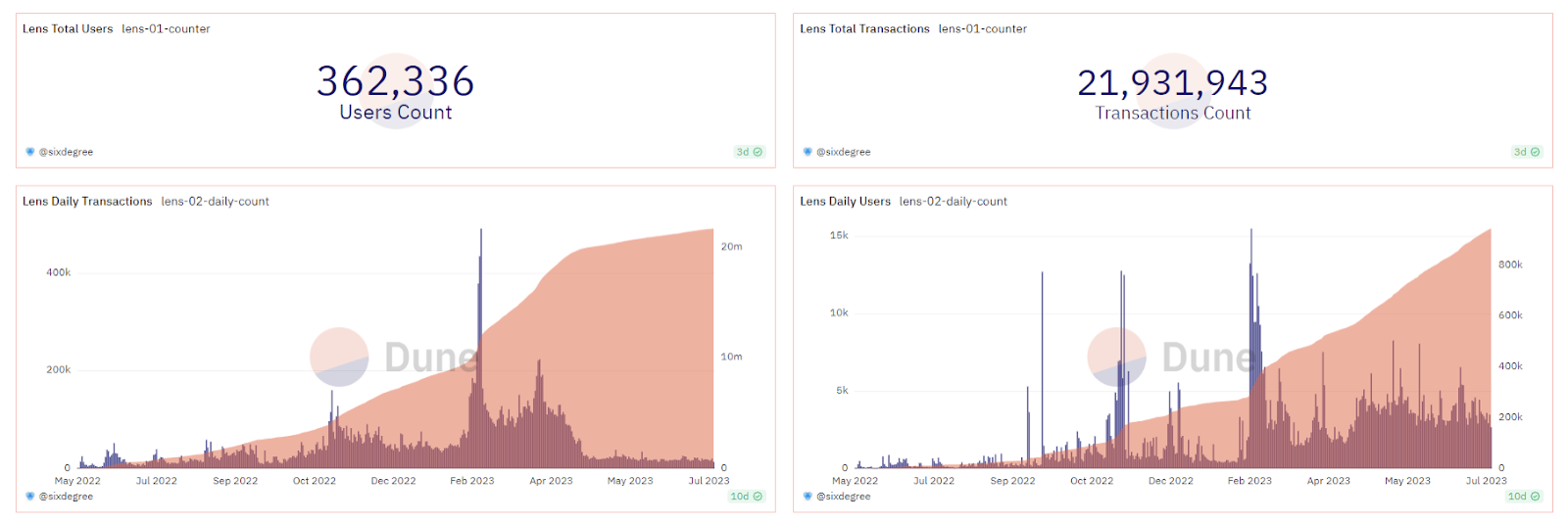

As of July 2023, over 110,000 addresses have obtained Profile social cards. As shown in the following image, Lens has accumulated over 360,000 users and a total transaction volume of 21.93 million. The peak of transactions and user numbers occurred in February 2023, likely due to the participation of a large number of retail investors or airdrop studios. Currently, the daily on-chain transaction volume ranges between 15,000 to 20,000 transactions, and the number of users participating in interactions daily is between 3,000 to 5,000 wallet addresses. Even in a bear market, there is still a significant number of users engaging in social interactions, demonstrating the good user data performance and growth potential of this sector.

Lens Protocol User Data

source: https://dune.com/sixdegree/lens-protocol-ecosystem-analysis

Overall, the social graph is the infrastructure and common tool of the entire social track. A unified, simple, and convenient social graph helps reduce user barriers to use and reduce usage barriers between different Dapps, while also accumulating more users and data. In comparison, Lens Protocol is built on Polygon, focusing on creating its own social ecosystem, while CyberConnect does not have its own content platform and ecosystem. It supports multiple chains and interacts with multiple applications, while also actively exploring ways for Web2 users to enter through wallets, focusing on creating an open social business card. Both projects currently belong to the top projects in the social track, and with the further construction and launch of Lens Protocol, the social track led by these two projects may usher in an explosive period.

Social Applications

Farcaster

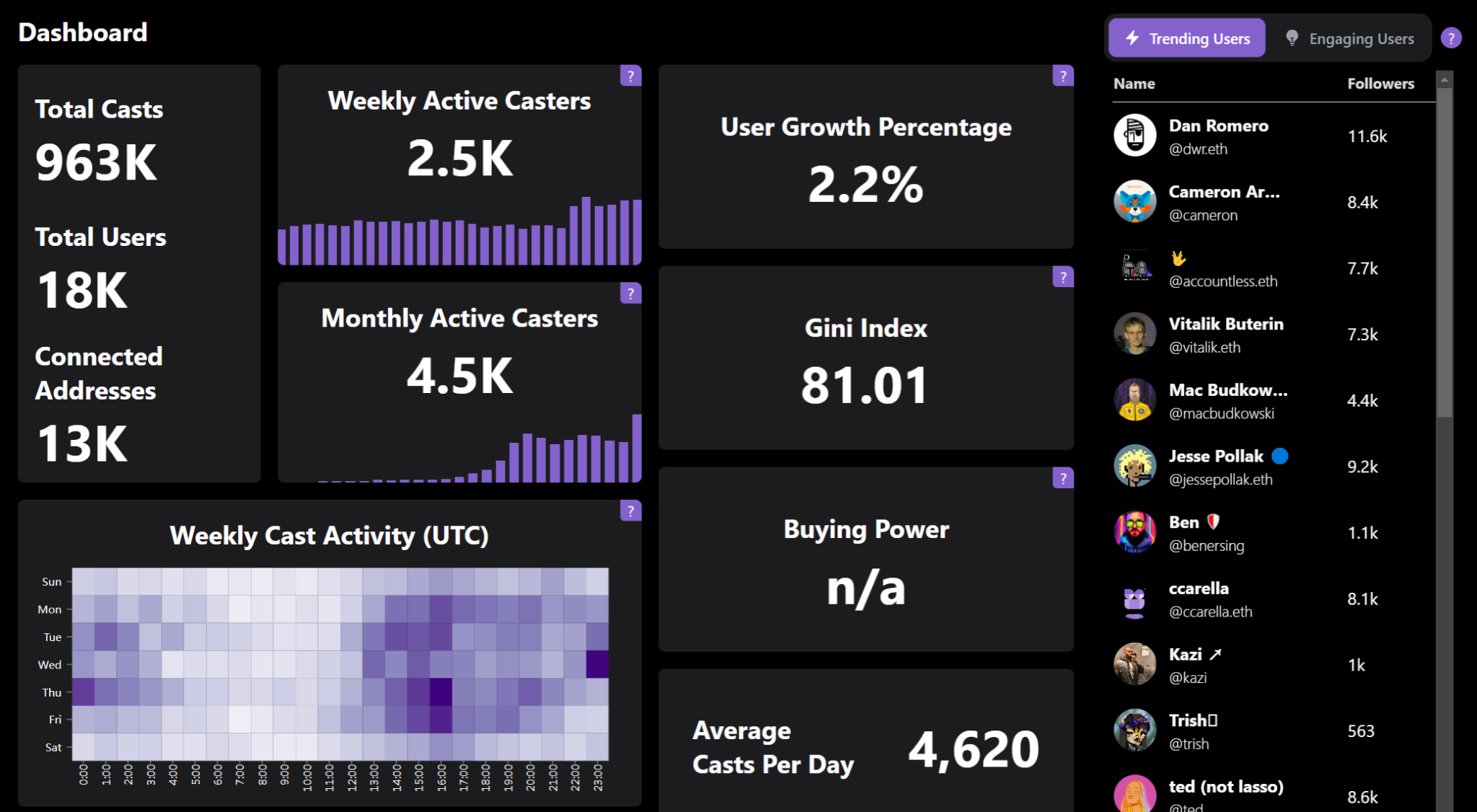

Farcaster is a decentralized social platform created by Dan Romero, a former executive of Coinbase. It is built on Ethereum and aims to rival Twitter. Currently, it is in the beta testing phase. Farcaster generates and stores user identity information on-chain and uses a database called Hub to store other information off-chain. This enables a fast and low-cost decentralized social interaction experience similar to Web2. Additionally, Farcaster allows users to use a self-hosted mode, allowing them to send and receive messages without a gateway, ensuring decentralization. Currently, there are nearly 20 derivative projects built within its ecosystem, including data analysis, image enhancement, trending topics, related topics, and search engines.

As of August 9, 2023, the total number of wallet addresses on Facaster has exceeded 13k, including several prominent figures in the cryptocurrency industry such as Vitalik Buterin. The user growth rate for the week is 2.2%, with 2.5k dynamic updates in the past seven days. As an independent social application, it has a decent user base and user activity.

Currently, besides the advantage of decentralized anonymity, how to attract Web2 users to migrate from Twitter to Farcaster is an important research direction for the project's future development.

Facaster user data statistics

Source: https://farcaster.network/

Nostr

Nostr is a decentralized open-source social transmission protocol, developers can build Dapps based on Nostr. There are no centralized servers on Nostr. This protocol achieves information transmission through the design of clients and relays. Compared to Web2 social networks, this protocol achieves complete decentralization, can resist censorship, and protect user privacy. Damus is a decentralized Twitter-like social product built on Nostr. Users can enjoy decentralized, anonymous, and ad-free features on this platform, which is currently in the early stages of development. It has also received recommendations and support from Jack Dorsey, the founder of Twitter.

As a fully open, anonymous, decentralized, and censorship-resistant product, Damus has strong competitiveness in terms of privacy and security compared to traditional social products. It has a clear market and target customers. However, to attract a wider range of Web2 users or introduce new product designs and features, it may require further development.

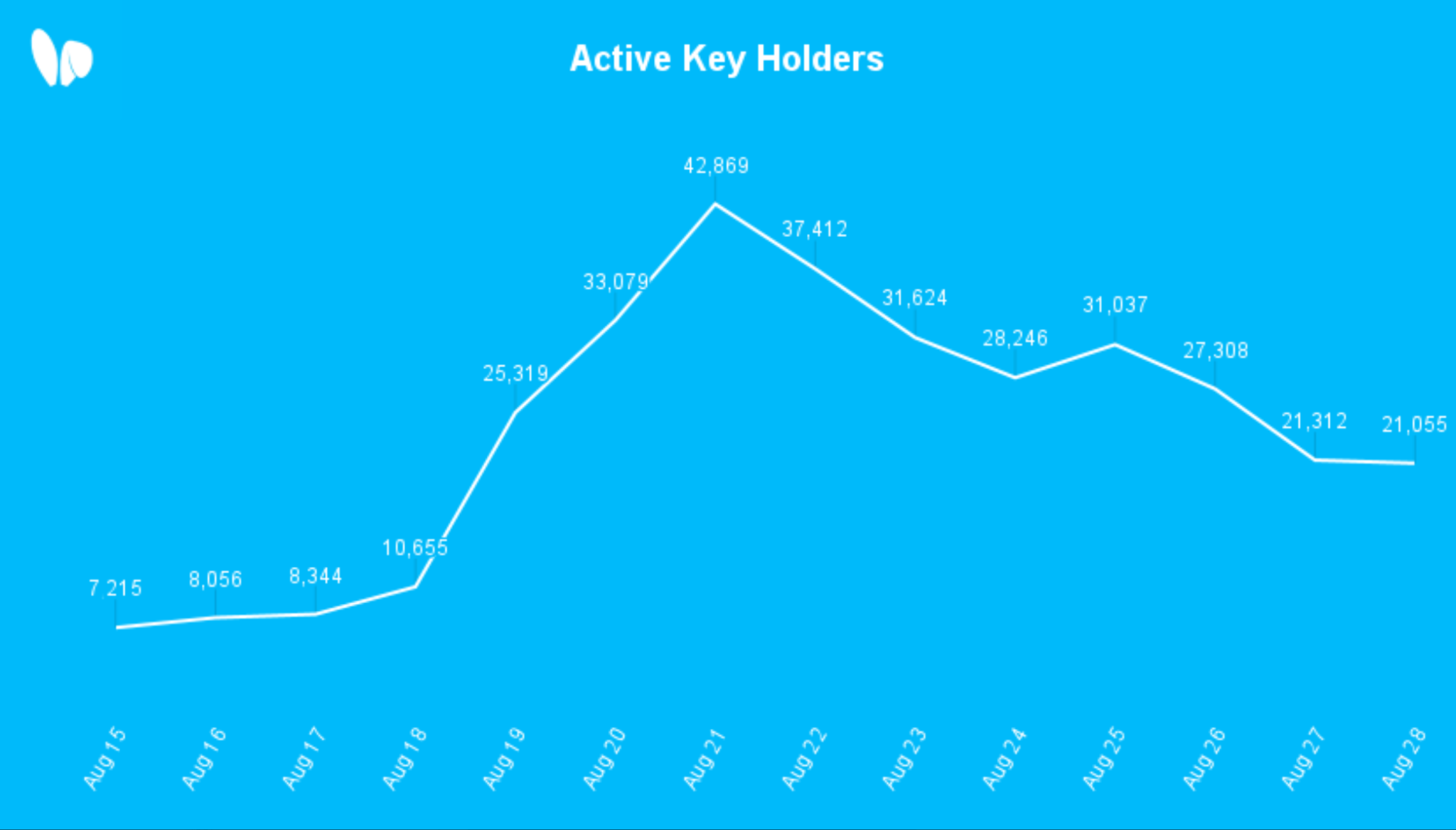

Friend.Tech

Friend.Tech is a social application deployed on the Coinbase L2 chain BASE, invested by Paradigm. This application is similar to traditional fan token/creator economy projects. The platform provides creators with fan communities and token issuance services. Users can join the creator's community by holding the tokens issued by the creator. Since its launch on August 10th, the product has quickly gained popularity. As of August 29th, 2023, in less than 20 days since its launch, there have been over 120,000 registered addresses and over 20,000 active addresses (users viewing user spaces) as shown in the figure.

Source: https://dune.com/domo/friendtech

Source: https://twitter.com/friendtech/status/1696599323637846444/photo/1

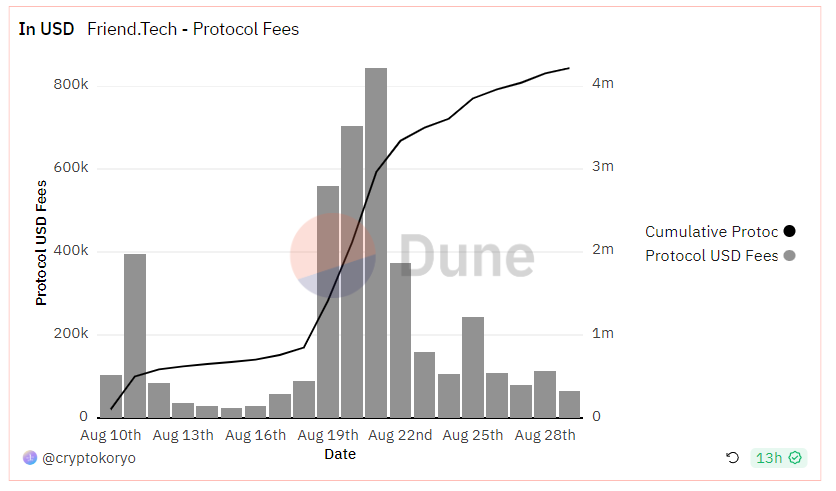

Users need to pay a transaction fee of 10% for each transaction. Out of this, 5% goes to the creator and 5% goes to the protocol. As shown in the figure below, as of August 28, 2023, the protocol has accumulated income of more than $4 million.

Source: https://dune.com/cryptokoryo/friendtech

The rapid rise of Friend.Tech products has attracted attention and speculation in the market about the social track. How did this product attract users so quickly and on a large scale? This article believes that in terms of the product itself, Friend.Tech has not deviated from the design of existing social products and token models, but its success at this stage can be attributed to the following points:

1. Ponzi Economics Design for Fan Tokens

Currently, there are two main models for the design of fan tokens: one is the issuance of fan tokens, where users can gain entry into creator communities by holding a certain amount of fan tokens. Fan tokens follow the rise and fall of market prices and may include designs such as token buybacks, destruction, revenue sharing, and pledging. The other model involves issuing fan NFTs, where users can gain entry into creator communities by holding NFTs. NFTs also follow the rise and fall of market prices and may involve the mapping of new tokens, airdropping new NFTs, or other rights realization.

In summary, in the token economy design prior to Friend.Tech, the buying and selling of fan tokens were mainly driven by user love for creators, and the attraction of token price fluctuations was neutral. However, Friend.Tech has disrupted the previously stagnant token economy mechanism with its user invitation mechanism and fan token economics. Friend.Tech has announced the distribution of 100 million points within six months, with the distribution rules yet to be disclosed. However, user points are widely believed to be linked to token airdrops. The combination of this mechanism with the user invitation mechanism promotes user acquisition motivation and encourages users to buy more shares of different creators to increase transaction fees and data. This strategy is similar to Blur's airdrop strategy, using long-term point incentives and airdrop expectations to attract user adoption. With a long cycle, it can increase user stickiness to the product and continue to occupy market share after the airdrop period ends.

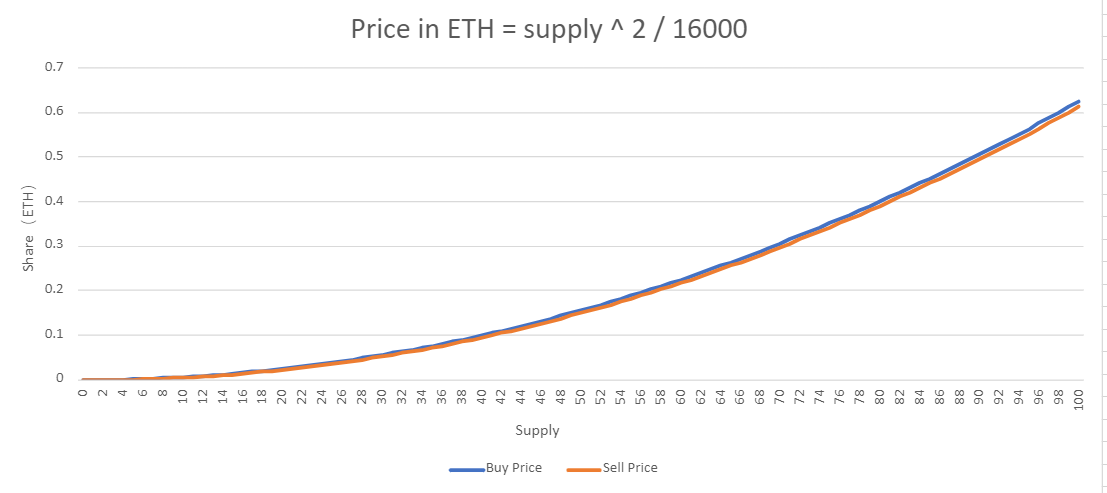

In the design of token economics, due to the lack of official disclosure of relevant calculations, according to Laurence Day's widely recognized estimation of the price model, as shown in the following chart, the price of Friend.Tech's fan token follows the price curve of P=suppy^2/16000. Under this pricing model, the price will experience exponential fluctuations in both upward and downward directions. Early investors have the opportunity to enjoy huge profits. This Ponzi-like economic design will continue to cause price surges until the buying and selling users reach equilibrium, attracting more speculative users to participate in token trading. This is also one of the most important reasons for the short-term explosion of the project. A similar design is also reflected in the Meme project XEN, which uses the Ponzi economic token design and early user dividend incentive mechanism to ignite market hotspots in a short period of time.

2. Initial incentives on the BASE chain

Friend.Tech was originally built on other chains and recently launched on the hot tracks of BASE and L2. Since the launch of Arbitrum in early 2023, the L2 track has performed very well in the bear market. Subsequently, the ecosystem of Zksync, OP Stack, and BASE has sparked market enthusiasm. It is expected that this year, there will be the launch and coin issuance expectations of Starknet, Scroll, and Zksync, combined with the upcoming Cancun upgrade. The entire L2 can be described as the most important and eye-catching track in the cryptocurrency market in 2023, and BASE is also backed by Coinbase, a listed cryptocurrency exchange. Friend.Tech chose to launch on BASE during the early stage, cleverly capturing the market's hotspots and timing dividends.

3.Paradigm, top VC background endorsement

As a top investment fund in the cryptocurrency market, endorsement from Paradigm naturally adds a lot of points to the project. Even when Friend.Tech had not yet developed a good web version, only had a rough beta version, and lacked various project whitepapers and explanatory materials, the market still trusted the project and invested a lot of enthusiasm, which was greatly influenced by Paradigm's endorsement. At the same time, the incentive design of the project's score mechanism is similar to Blur, indicating possible guidance from Paradigm.

Overall, Friend.Tech is relatively traditional in terms of product mechanism, but more daring in token economic design, customer acquisition strategy, and marketing tactics compared to traditional social projects. In the short term, Friend.Tech may replicate Blur's user growth path. However, as a social product, the realization of long-term social attributes will require observation after the product is launched.

Tool Projects

Social tool projects mainly serve as functional tools, and currently most of them are positioned to serve projects for Dapps, such as Lenscan for browsing data under LensProtocol, LensDAO for organization and community management, Alertcaster for information reminders under the Farcaster ecosystem, and FarQuest for launching surveys. Other miscellaneous auxiliary tools can also be classified as social tools, such as Debank Hi module for social promotion, Utopia for DAO treasury governance, as well as various NFT design tools, account management tools, wallet management tools, etc.

In general, the social track is a track that fully unleashes developers' imagination at the application layer. In addition to social graphs and application tools, there is a wide variety of social platforms, fan platforms, streaming platforms and other types of social applications. Currently, this track is still in its early stages, and the enthusiasm and efforts of developers and investors will continue to help this track accumulate achievements.

Risks and Challenges

The current encrypted social track has attracted numerous developers and capital participants. While seeing opportunities, we should also be aware of the risks and challenges that this track currently faces. The current problems mainly exist in the aspects of technology, user growth, and compliance.

Technical Challenges

Social products as a whole are more focused on the application layer, and their development depends on the maturity of infrastructure and technology. As the user base grows, social products will face more and higher requirements. At the same time, the development of social applications relies on the resolution of issues such as data storage, cross-chain information transmission, information transmission costs, network congestion, etc. However, the current infrastructure is not yet sufficient to accommodate the emergence of large-scale user social software at the level of Web2.

User Growth

Apart from anonymity and censorship resistance, why would Web2 users be willing to switch to Web3 social applications? It can be clearly stated that not every user has extremely high privacy requirements. There are a large number of users who can still achieve their social needs on existing centralized social platforms. Aside from these users, how to attract more users or focus solely on users with privacy needs? If considering using economic incentives to motivate users, how to design an economic model that can avoid economic closed loops or Ponzi economic dilemmas? At the user level, Web3 social has already gained considerable market popularity and traffic, but currently the popularity is still limited to the encrypted community. In the future, whether it is to solve existing social product problems or create new functions and demands, these are the issues that Web3 social products need to face in order to increase the number of users.

Compliance

The selling points of Web3 social products that distinguish them from Web2 products mainly include three aspects: decentralization, censorship resistance, and privacy protection; user ownership of data; and the ability for users to benefit from data ownership. The advantages of Web3 social products may also be potential risks to some extent. It is foreseeable that the characteristics of Web3 products are likely to attract participants in the black and gray industries, as well as the attention of regulatory agencies. With the maturity of the Web3 field and the expansion of user base, developers need to consider issues such as security, potential regulatory inquiries, etc. in advance.

Summary

The Web3 social field is in the early stage of development and relies on the maturity of other infrastructure construction, including but not limited to cross-chain information transmission, data storage, reduction of transaction costs, and compliance issues. Currently, social products in this field mainly include social graphs, social tools, and social applications, with social graphs being the underlying layer and social applications having the most diverse categories. At present, a large number of developers are trying to develop Web3 social products, and capital is gradually paying attention to and investing in this field. Examples include the launch of the Cyber token, Twitter's renaming, and creator incentive programs, all of which demonstrate the increasing market enthusiasm for the social field. While opportunities are presented in the social field, it is also necessary to fully realize the challenges currently faced by this field, including the incomplete development of infrastructure technologies, bottlenecks in new user growth, and potential compliance issues. In general, this report believes that the Web3 social field shows good development prospects, development trends, and market popularity. With the improvement of infrastructure, project development, capital aggregation, and token listing, this report believes that this sector has good investment potential and development prospects.

References

Web3 Social: Road to Mass Adoption (binance.com)

https://messari.io/report/web3-social-usage-and-engagement

https://mpost.io/web3-fundraising-report-for-q2-2023-trends-in-gaming-and-social-network/

Who Can Become a Hit? An Overview of Hot Web3 Social Projects - Web3 Caff

https://medium.com/@Cobo_Global/socialfi-fdb821e1e7da

About Huobi Ventures:

Huobi Ventures is the global investment arm of Huobi, integrating investment, incubation, and research to identify the most outstanding and promising teams globally. As a pioneer in the blockchain industry for the past decade, Huobi Ventures drives the development of cutting-edge technologies and emerging business models in the industry, providing comprehensive support to partner projects including financing, resources, and strategic consultation to establish a long-term blockchain ecosystem. Currently, Huobi Ventures has supported over 200 projects across various blockchain sectors, with some high-quality projects already listed on Huobi Exchange.

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as "Huobi Research Institute") was established in April 2016 and has been devoted to comprehensive exploration and research in various fields of blockchain since March 2018. With the focus on the broader blockchain domain, our research objectives include accelerating blockchain technology research and development, promoting the application of blockchain in various industries, and optimizing the blockchain industry ecosystem. The main research areas of the institute include industry trends, technological paths, application innovation, and model exploration in the blockchain domain. Guided by the principles of public welfare, rigor, and innovation, Huobi Research Institute will collaborate extensively and deeply with governments, enterprises, universities, and other institutions in various forms. We aim to build a research platform covering the entire blockchain industry chain, providing solid theoretical foundations and trend analysis for professionals in the blockchain industry, and promoting the healthy and sustainable development of the entire blockchain industry.

Disclaimer

1. There is no affiliation between Huobi Ventures and the projects or other third parties mentioned in this report that would affect the objectivity, independence, or fairness of the report.

2. The information and data quoted in this report are from compliant channels, and Huobi Ventures considers the sources of the information and data to be reliable and has conducted necessary verification of their authenticity, accuracy, and completeness. However, Huobi Ventures does not make any guarantee regarding their authenticity, accuracy, or completeness.

3. The content of this report is for reference only, and the conclusions and opinions in the report do not constitute any investment advice for related digital assets. Huobi Ventures does not assume any responsibility for losses resulting from the use of the content of this report, unless otherwise provided by laws and regulations. Readers should not make investment decisions solely based on this report, nor should they rely on this report to lose their ability to independently judge.

4. The information, opinions, and speculations contained in this report only reflect the judgments of the researchers on the day of finalizing this report, and there is a possibility of updating views and judgments based on industry changes and updated data information in the future.

5. This report is copyrighted by Huobi Ventures. If you need to cite the content of this report, please indicate the source. If you need to extensively cite, please inform in advance and use within the permitted range. Under no circumstances may the report be cited, edited, or modified in any way that contradicts its original intent.