Unveiling the Magical Indian Crypto Market that Led to Coinbase's Defeat

Original | Odaily

Author | 0xAyA

With more and more South Asian faces appearing on the Crypto stage, projects like Matic and Frontier are also wearing crowns in the decentralized world. But when it comes to exploring the Indian crypto market, local practitioners and investors can be said to be "unfortunate". In New Delhi, the crypto industry is still in a precarious state of instability.

The Situation of "Foreign Visitors"

Recently, according to TechCrunch, Coinbase has notified its customers via email that it plans to stop providing trading services to Indian users. Coinbase informed users that it will stop providing services to them from September 25th and advised them to withdraw funds from their accounts. In addition, Coinbase has banned new user registrations from India.

However, it should be noted that this notice applies only to customers who have violated trading platform standards and does not target all Indian customers. A Coinbase spokesperson revealed in an email on September 8th, "We are reaching out to let you know that we will be disabling access to all Coinbase retail services associated with your account, as we will be turning off the ability to access retail accounts that no longer meet our updated standards." The spokesperson added that during a recent routine review of the platform system, some accounts that no longer meet the updated standards may have been identified. Therefore, the platform will deactivate these accounts and allow customers to update their information at a future date.

Just over a year ago, Coinbase entered the South Asian market and has since faced regulatory challenges.

In April of last year, Brian Armstrong ambitiously stated in a blog post that Coinbase planned to expand its workforce in the Indian tech hub by 1,000 employees and double the number of employees in India by the end of 2022. However, just two months later, the Indian team contributed 8% of the job cuts in Coinbase's new round of layoffs, and according to insiders, "recruitment in the Indian market was put on hold."

In fact, the cumbersome and slow civil servant system and the difficulties in adapting to foreign culture have made Coinbase's journey into India difficult. Former Snapchat India executive Durgesh Kaushik, who was hired earlier as the Senior Director of Market Expansion, also left the position a few months after taking office. Additionally, Brian Armstrong's efforts to support the implementation of the Unified Payments Interface (UPI) in India have not been realized.

Life, Death, and Taxes

Coinbase's experience could be described as being "unwelcome guests". However, when compared horizontally, domestic exchanges have an even harder time. In July 2022, India implemented a new transaction tax law for centralized virtual digital assets (VDA), which includes:

(a) A fixed tax rate of 30% on VDA exchange profits starting from April 1, 2022;

(b) Withholding tax (TDS) of 1% on transactions exceeding 10,000 rupees starting from July 1, 2022;

(c) Prohibition of offsetting tax losses starting from April 1, 2022.

This policy aims to achieve three objectives: to track the VDA transactions and corresponding income sources of Indian residents; suppress speculation and trading of VDA; and establish protective measures for financial stability.

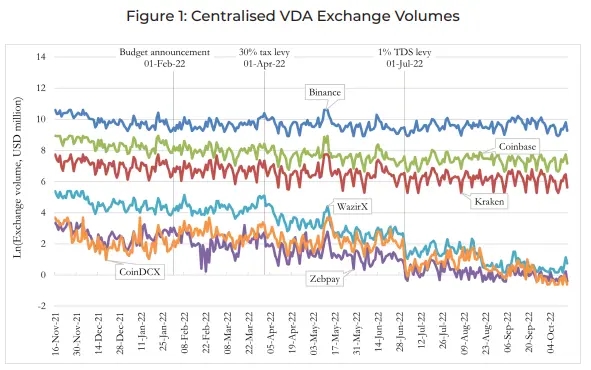

Although this move attempts to improve transparency of cryptocurrency assets and maintain macroeconomic stability, many experts believe that the current tax structure goes against its original intent. The implementation of withholding tax (deducting tax on income by the payer) makes Indian users unwilling to operate through domestic exchanges and more inclined to choose "guests from abroad". In fact, this is the case. In a report this year, Indian think tank Esya compared the data of domestic exchanges WazirX, CoinDCX, and Zebpay with overseas exchanges Binance, Coinbase, and Kraken. The results show that after the implementation of the new tax policy, the trading volume of domestic exchanges plummeted rapidly.

Image Source: Esya's survey report

Esya also provides its conclusions in the survey report:

(a) Compared to other countries that heavily adopt VDA, India's VDA tax policy is the most inert;

(b) The implementation of TDS has the greatest impact, and the trading volume of India's centralized VDA exchange has dropped by nearly 81% in the four months after the levy (i.e., July to October 2022);

(c) After these regulatory events, Indian investors have massively shifted from India's centralized VDA exchange to foreign exchanges (over 170,000 people from February to October 2022);

(d) From February to October 2022, a cumulative trading volume of nearly 38.52 billion US dollars flowed from India's centralized VDA exchange to foreign exchanges, of which 30.55 billion US dollars were transferred overseas in the first six months of this fiscal year;

(e) The current tax structure will result in a cumulative loss of 1.2 trillion US dollars in trading volume over the next four years. We recommend strategies to mitigate these unforeseen adverse effects.

Bloomberg reported in September of that year: "Since India levied a 1% withholding tax on cryptocurrency transactions in July, the daily trading volume of Indian cryptocurrency platforms has dropped by over 90%. Meanwhile, Binance's app downloads in India soared to 429,000, the highest level this year and nearly three times that of the second-place CoinDCX, FTX's downloads in India have reached nearly 96,000 times. "Affected by this, CoinDCX recently announced that it will undergo layoffs due to the long-term bear market affecting revenue. A spokesperson stated that the trading platform will dismiss 71 employees, stating that their roles do not align with the current business priorities. The company previously had about 590 employees, and multiple teams have been affected by the layoffs. Despite benefiting from the policies, CZ also expressed concerns about the heavy taxation on cryptocurrency trading in a panel discussion at the Singapore FinTech Conference, stating that it could "stifle the local crypto industry." Myth of the Digital Rupee: Compared to unregulated cryptocurrencies, Indian officials prefer central bank digital currencies that they can control. On July 7th, RBI Deputy Governor Sankar stated that they hope to launch a digital rupee in a measured and calibrated manner. According to insiders, India hopes to launch a digital rupee nationwide by the end of 2023. Last year, India initiated two CBDC pilot projects. One was CBDC-W, which started on November 1st, with the participation of 9 banks. The other was CBDC-R, launched by the Reserve Bank of India (RBI) on December 1st, with a trial conducted in 4 cities involving 4 banks. Each participating commercial bank tested the digital rupee among 10,000 to 50,000 users, and both customers and merchants had to download a dedicated digital rupee wallet. CBDC-W is limited to financial institutions and aims to improve interbank payment efficiency, while CBDC-R applies to the private sector and Indian citizens. Although the government informed Parliament that India will release CBDC-R during the 2022-23 fiscal year, the implementation date is still unknown. RBI is collaborating with banks to launch new features to promote the digital rupee. These features include allowing customers to conduct digital rupee transactions offline and connecting it with UPI. The Reserve Bank of India has been urging banks to achieve interoperability between the digital rupee and UPI through QR codes. This interoperability will allow payments to be made through widely used UPI QR codes. The functionality was announced in June this year and has been activated by major banks including the largest bank in India, the State Bank of India. However, currently, the average daily number of retail digital rupee transactions is about 18,000, which is far below RBI's target to reach 10 million daily transactions by the end of 2023.The average daily goal is 100,000 transactions. Conclusion: For local practitioners, the skies over New Delhi are still clouded: an immature market, unclear regulatory policies, high taxes, corruption and inefficiency caused by the cumbersome bureaucratic system inherited from the British colonial era, and even the impact of past Rug projects... with all these factors combined, it is not difficult to understand why most practitioners prefer to "moisten" abroad and explore new horizons. At the just-concluded G20 Summit, countries reached a consensus on the rapid implementation of the cross-border framework for encrypted assets. This framework will promote global information exchange on encrypted assets starting from 2027. Countries will automatically exchange encrypted transaction information between different jurisdictions each year, including transactions conducted on unregulated cryptocurrency exchanges and wallet providers. Several countries, including Argentina, Australia, Brazil, the United States, China, and France, will be affected by this framework, including India. During the meeting, Indian Prime Minister Modi called for global cooperation in further formulating cryptocurrency regulations and stated that as the Chair of the G20, India is "willing to take up the task of advocating the establishment of a comprehensive global cryptocurrency regulatory framework." - Although India itself does not even have a comprehensive set of regulatory laws, it still chooses to "come down heavily." Reference materials: 1. Esya's research report on Indian cryptocurrency transaction taxes 2. Indian Crypto Market Analysis Report: Rapid growth under regulatory uncertainty