The tokens issued by the blockchain project have not been returned, what should investors do?

Original author: Gao Mengyang

Recently, a friend came to inquire about a blockchain project he had participated in before. The project team issued Token before September 4, 2017. At that time, he got the quota through the introduction of a friend and invested about 300,000 US dollars (according to the price at that time). After 1994, the project team went overseas, but did not liquidate the tokens. Now he came to ask, can the investment money be returned? Situations like this are quite common in the domestic currency circle. After the September 4th announcement, currency issuance platforms either closed down or developed overseas, with few continuing to exist in the mainland. After asking professionals, it was found that there were indeed some currency projects that were transferred to unknown corners of the underground for operation, while others were not cleared and ignored the various requests of users. Next let’s talk about the legal issues involved.

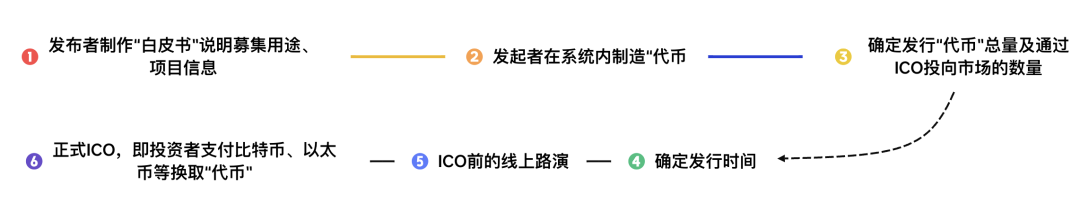

01 What is ICO?

ICO (Initial Coin Offering), that is, initial coin offering, originated from the concept of initial public offering (IPO) in the stock market. Unlike IPOs, ICO projects issue tokens rather than stocks and are blockchain projects. To put it bluntly, the initial issuance of tokens is like buying new stocks. You use mainstream currencies (Bitcoin, etc.) to buy newly issued tokens, and then conduct investment transactions.

ICO has created many myths about getting rich, so people in the currency circle (jiu) and scholars (cai) flock to it. However, there are few high-quality projects after all, and they can easily facilitate various financial and cyber crimes. Therefore, in 2017, seven departments of the central bank jointly issued the Announcement on Preventing Token Issuance Financing Risks (also known as the 94 Announcement ), characterization of the essence of ICO, which is an act of illegal public financing without approval, is especially suspected of illegal selling of tokens, illegal issuance of securities, illegal fund-raising, financial fraud, pyramid schemes and other illegal and criminal activities. As a result, all parties involved in domestic currency issuance have been affected one after another, and no one has been spared.

02 What are the legal risks of projects that have not been cleared?

The September 4th Announcement not only ordered all types of token issuance and financing activities to be stopped immediately, but also required organizations and individuals that have completed token issuance and financing to make arrangements such as liquidation and withdrawal. For a time, major project parties in Beijing, Shanghai and Shenzhen refunded their coins one after another, and the completion rate quickly reached 90%. Those project parties that have not withdrawn will be subject to varying degrees of legal sanctions.

First of all, the September 4th Announcement clearly stipulates that relevant departments will seriously investigate and deal with illegal activities in token issuance and financing activities that refuse to stop as well as completed token issuance and financing projects in accordance with the law. This makes all administrative supervision law-based. The Office of the Shanghai Leading Group for Special Rectification of Internet Financial Risks has required relevant ICO issuance platforms to immediately cease relevant business and organize liquidation as soon as possible in accordance with the law, and reasonably protect the rights and interests of users. It will focus on urging all trading platforms to ensure the smooth withdrawal of coins by investors. In principle, it requires Relevant platform executives and other personnel remain in Shanghai to assist in the liquidation process.

Secondly, according to existing laws, if you refuse to return the tokens, you may be suspected of committing a criminal offence. The currency issuance project party not only failed to clear out the money in accordance with the regulations, but also engaged in various frivolous operations, then it is very likely to get in: the project party itself promised various income items to defraud users of their investments, which may constitute illegal absorption of the public Deposit crime; if the platform party runs away with the money, misappropriates it privately or takes it for himself, it may constitute a crime of fund-raising fraud or financial fraud; even if the trading platform (exchange) is transferred to a lower level operation, it quietly provides matching transactions for both parties , on-site trading may also constitute the crime of illegal business operations. Of course, the above are only possibilities, and the specific criminal composition must be determined according to law. However, if you are targeted, you have already lost, right?

03 The project party has not cleared the project, what should the user do?

The September 4th Announcement proposed the withdrawal of projects. For those tokens with a premium, investors obviously do not want to withdraw the coins, because if they exit according to the issuance price, the losses from high-priced acquisitions will be unacceptable, and the losses will become a reality, so these investors insist Do not refund the coins and wait for the opportunity to trade on overseas trading platforms. Most investors often experience a price drop after holding the currency. It becomes a good opportunity to unwind at this time, but the project side is unwilling to liquidate.

For users, how to recover losses when faced with project parties (companies) that cannot communicate? Based on lawyer Mankiw’s experience and a large number of practical cases, there are two different paths for rights protection.

First, file a civil lawsuit in court. Investors (users) can file civil lawsuits in court, often on the grounds of unjust enrichment and requesting return. However, according to the current judicial caliber, the court will generally determine that the contract is invalid, and return the property involved in the case according to the legal consequences of the invalid contract. However, the court rarely decides to return the full amount, and all of them will return a certain amount based on the specific circumstances. virtual currency. However, some courts simply refuse to accept the case, which also adds considerable obstacles to investors rights protection.

Second, file a criminal complaint with the public security organ. This is also the method recommended by Lawyer Mankiw. Investors can complain to the public security organs for the aforementioned crimes and provide corresponding evidence to increase the success rate of prosecution. Generally, the police will conduct a preliminary investigation after receiving a case. After contacting the project party, the project party may take the initiative to clear the case after feeling the pressure from the judicial authorities; and if the conditions for filing a criminal case are met, the public security authority will file the case. At this time, the project party will be thoroughly investigated by the state authorities, and if necessary, the assets will be sold and returned to the investors at a discount, so that the investors can successfully recover their property. In short, criminal means are always the most direct and thorough way to protect rights.

04 Lawyer Mankiw’s summary

Since the country has regulations, we should still follow the regulations - project parties and exchanges should withdraw from mainland business, and they can only go overseas if they continue to operate; failure to withdraw or go underground is extremely risky. Users should not invest in underground projects; if they encounter projects that have not been cleared, they should take up legal weapons to safeguard their rights. If you have any legal questions, please consult attorney Mankiw.

Special statement: This article is an original article by Shanghai Mankiw Law Firm. It only represents the personal views of the author of this article and does not constitute legal consultation or legal opinions on specific matters. If you need to reprint the article, please contact Mankun Law Firm staff: MankunLawFirm