Which VC invests in projects that love airdrops the most?

Original author | ardizor

Translation | Odaily Azuma

Editor's note:

Airdrops have always been the most exciting topic for retail investors in the crypto market. L1/L2, DeFi, NFT, GameFi, social... Users who are enthusiastic about airdrops will try to interact with more projects in various tracks in order to leverage greater potential returns at a low cost.

However, although the industry also makes judgments on the airdrop expectations of specific projects, there seems to be a lack of a clear set of criteria for selecting more viable airdrop targets.

In the following article, overseas KOL ardizor has compiled a group of active VCs in the industry and sorted out which projects invested by these VCs have conducted airdrops to the community. Furthermore, the airdrop rates of various VCs' investment targets are compared. The conclusions may have some reference value for users who are keen on airdrops.

Below is the translation of ardizor's original content by Odaily. For the sake of readability, there have been some deletions and modifications.

Recently, I (ardizor in first-person perspective) wanted to figure out which projects invested by VCs are more likely to airdrop, and how the airdrop rates differ among different VCs.

Below is my analysis process.

I selected 11 well-known VCs in the industry and created a database. After that, I organized all the disclosed investments made by these VCs in recent years and narrowed down the projects that have been airdropped.

To obtain more accurate data, I referred to the records of the following major databases:

Crypto Fundraising: https://crypto-fundraising.info

DefiLlama: https://defillama.com/raises

Cypherhunter: https://cypherhunter.com/en/discover/

Crunchbase: https://crunchbase.com

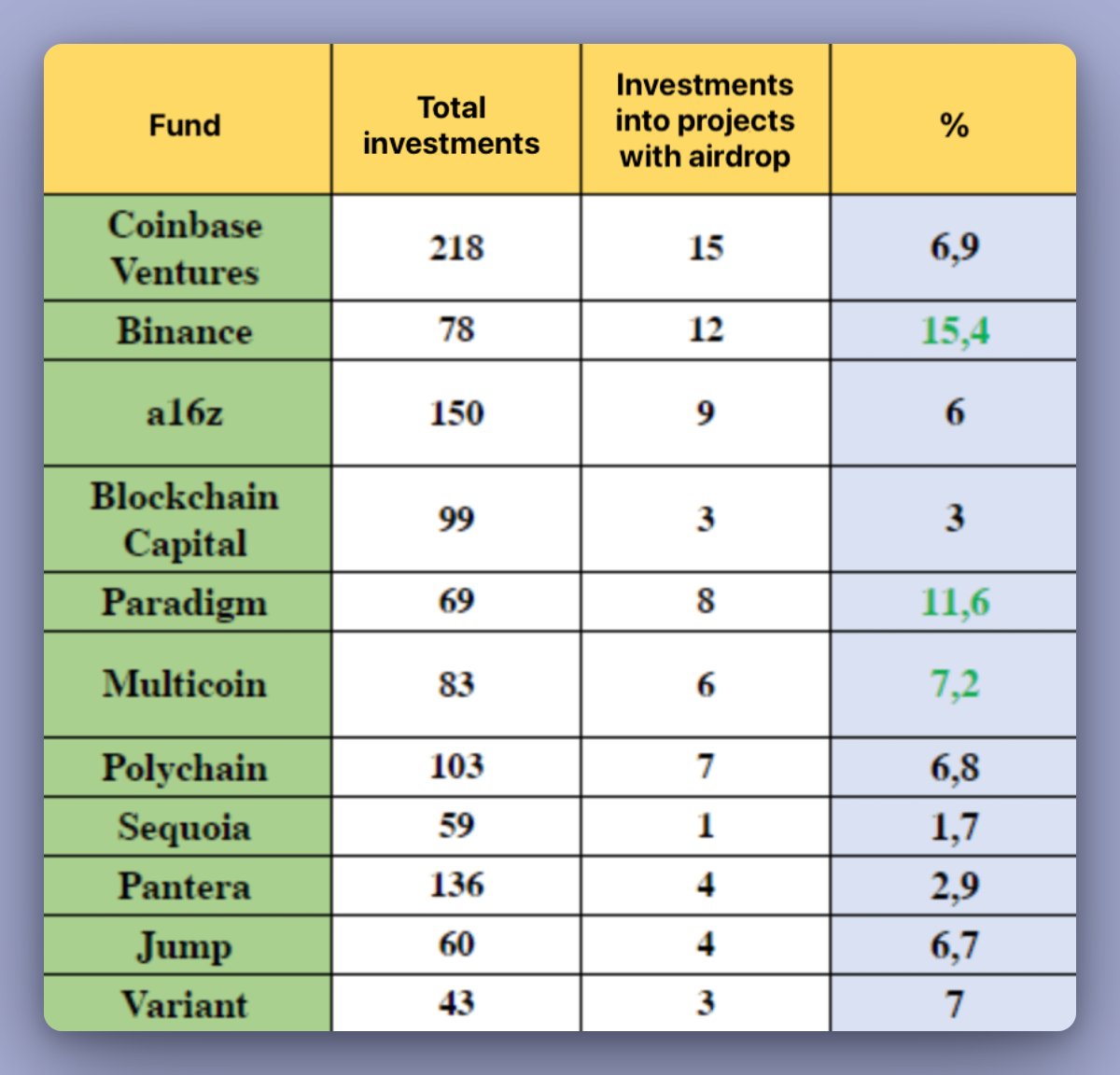

The final result is shown in the following figure:

Among the investment targets of Coinbase Ventures, 15 of them have been airdropped, including The Graph, Biconomy, Gnosis Safe, Aptos, and others.

Binance follows closely with 12 investment targets that have been airdropped, including Sei, Maverick Protocol, Space ID, and other Binance Launchpad projects - which is also one of the advantages of Binance as the industry's leading CEX compared to other VCs.

Following that are a16z, Paradigm, and other top VCs, with 9 and 8 investment targets that have been airdropped, including Uniswap, dYdX, Optimism, and others.

Next in line are Polychain, Multicoin, Pantera, Jump, Blockchain Capital, Variant, and several other major VCs, with 3-7 investment targets that have been airdropped.

The last place in the list is Sequoia Capital, with only Hooked Protocol having been airdropped in its investment targets. It seems that traditional internet top VCs do have certain differences in the crypto field.

So does this analysis end here? Not really. In order to determine which VCs are more fond of airdrops in their investments, I decided to calculate the airdrop rate of investment targets for each major VC using a simple division (number of airdropped projects / total investment count).

The final conclusion is shown in the following figure:

With a relatively low number of shots, Binance tops the list with a 15.4% investment target airdrop rate.

Following closely behind is Paradigm with an 11.6% airdrop rate, which is another VC with a target airdrop rate exceeding 10%.

Due to relatively more shots, Coinbase Ventures, which topped the previous list, dropped to the middle of the list with a 6.9% investment target airdrop rate. Similar situations include a16z, Multichain, Jump, Polychain, and other VCs.

Sequoia Capital is still the lowest with an investment target airdrop rate of only 1.7% .

Summary

This is the data statistics and analysis conclusion made by ardizor.

It needs to be clarified that the above content only provides a relatively rough analysis method. Obviously, this method will be objectively influenced by many factors, such as VCs not necessarily disclosing all investment situations, different preferences of major VCs in terms of style (such as some VCs prefer non-coin issuing infrastructure projects) and cycle selection, and the statistics do not include specific airdrop amounts.

However, it must be said that ardizor's analysis still provides a relatively intuitive picture of the airdrop market (even if it is only one perspective), which may help users who are keen on airdrops make choices when facing a large number of interactive targets.