Dear readers, welcome to the weekly cryptocurrency summary of Gryphsis Academy. We bring you key market trends, in-depth insights into emerging protocols, and fresh industry news, all aimed at enhancing your expertise in cryptocurrencies and Web3.

Market and Industry Snapshot:

Layer 2 Overview:

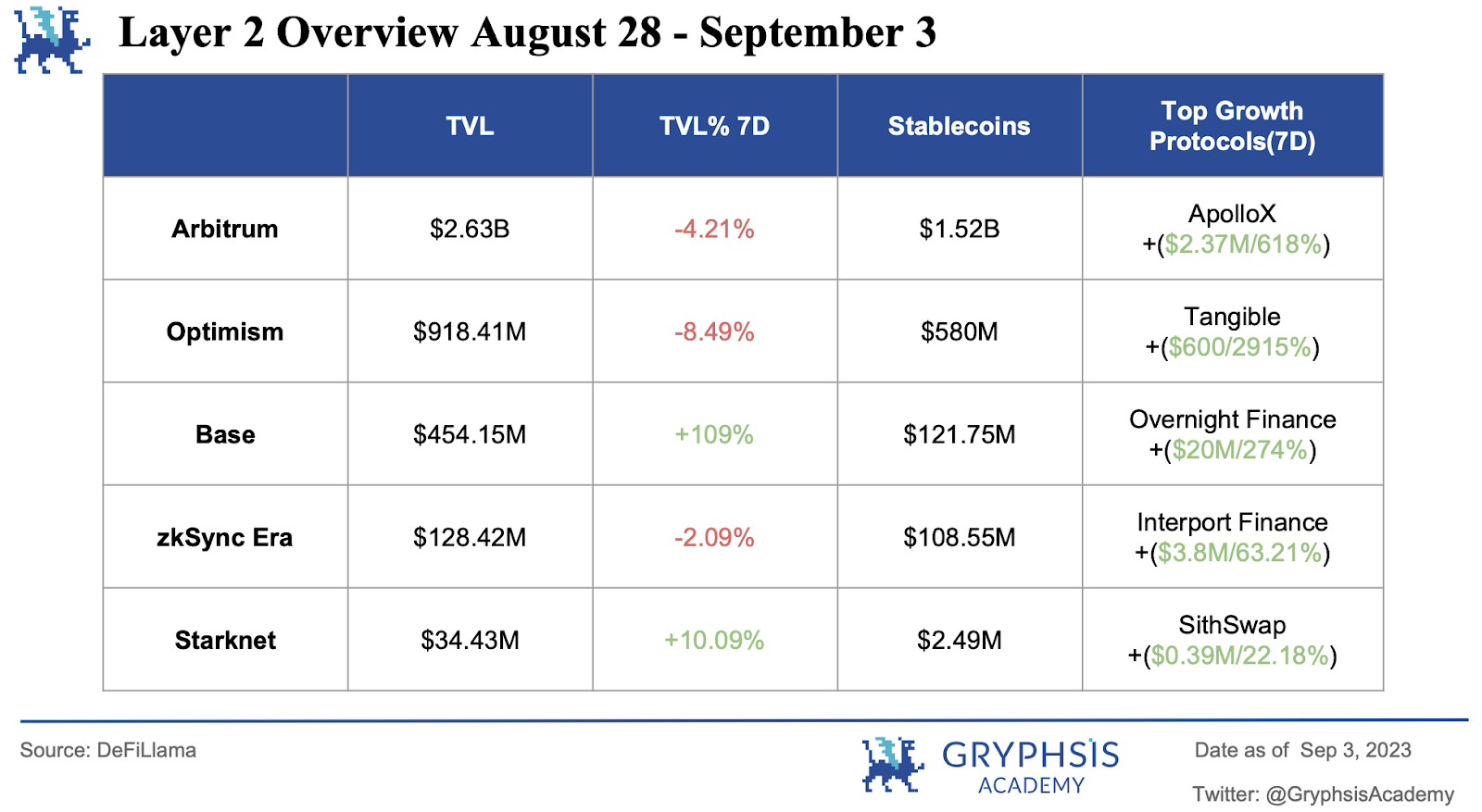

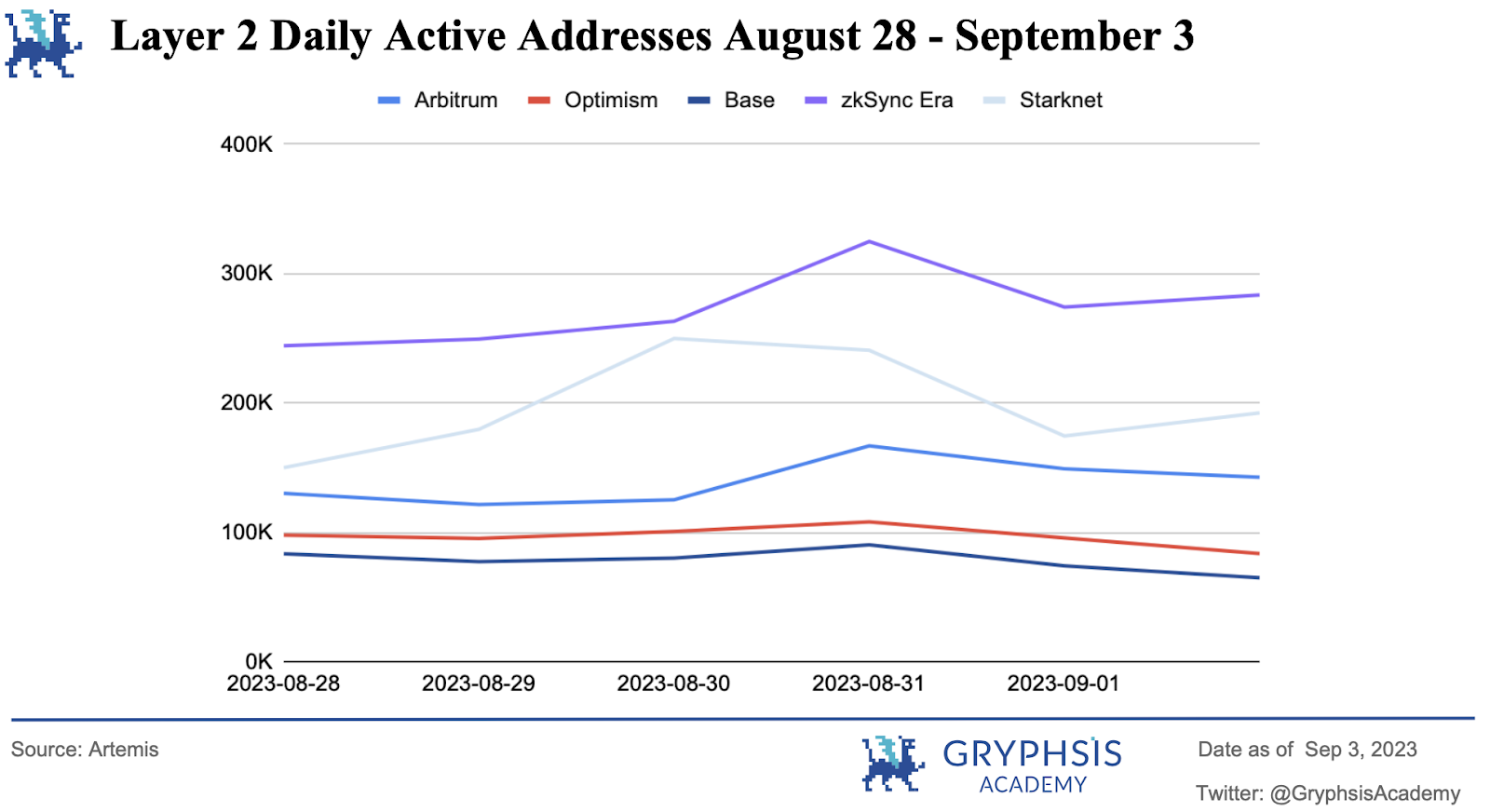

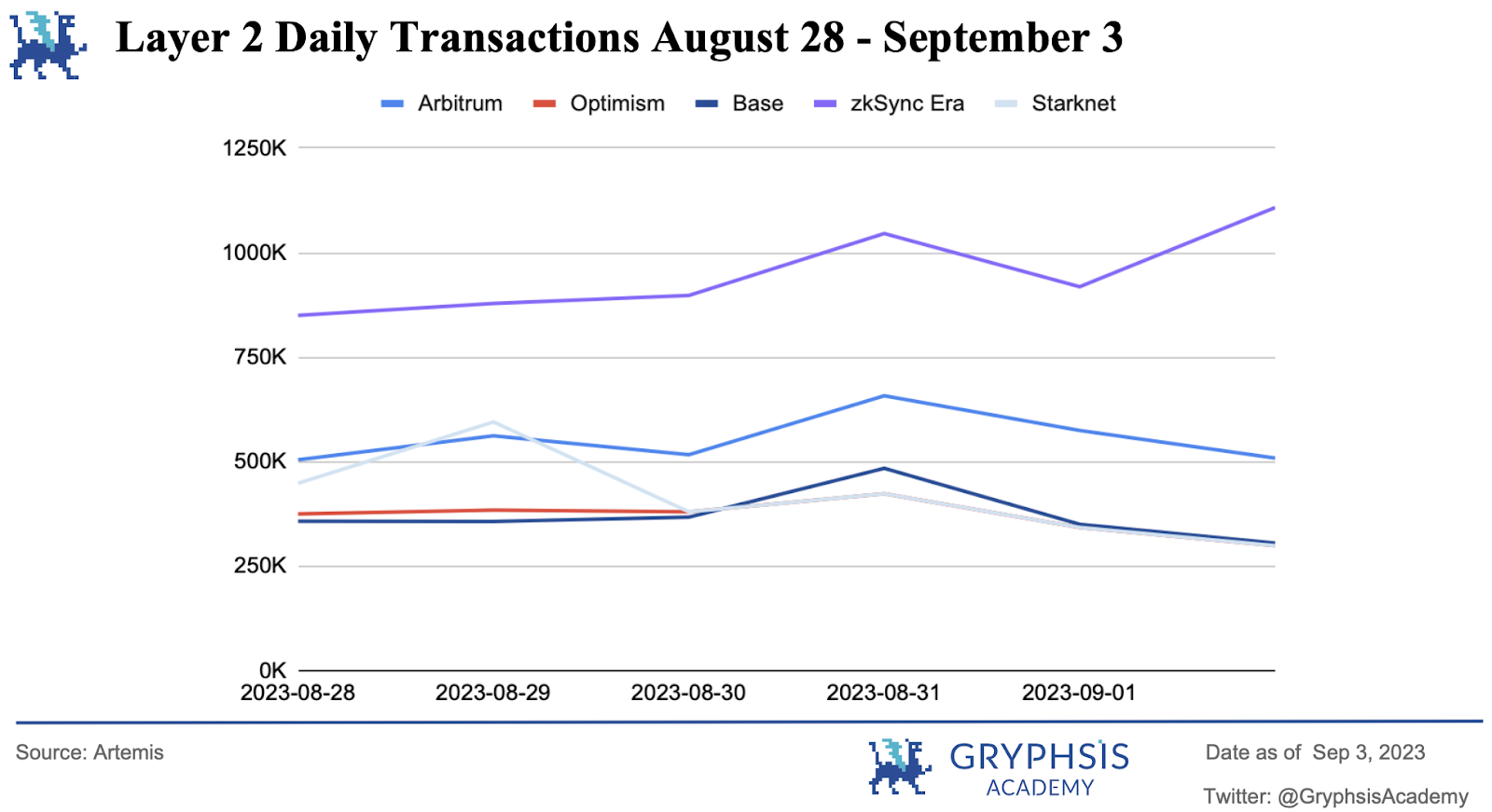

The most notable development in the Layer 2 space in the past week is the continued significant momentum of Base, with a 100% increase in total value locked (TVL) in the past 7 days, while most other networks have been trending downwards. Among the L2s we monitor, Optimism experienced the most significant decrease in TVL, dropping below 1 billion dollars. In terms of protocols, ApolloX, Tangible, Overnight Finance, Interport Finance, and SithSwap stand out as their TVL has significantly increased. It is worth noting that Overnight Finance and SithSwap have previously appeared on the list of top gainers, suggesting they may have sustained momentum.

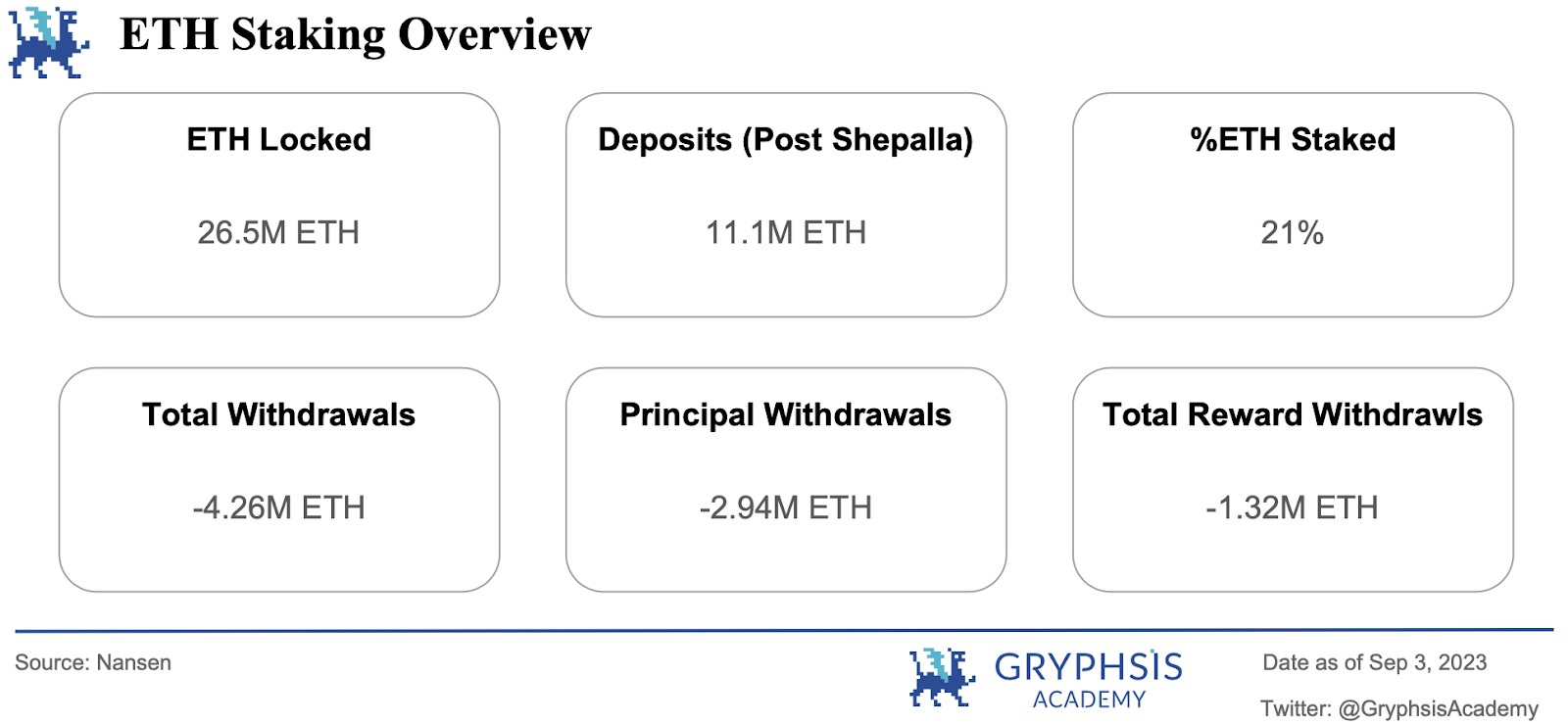

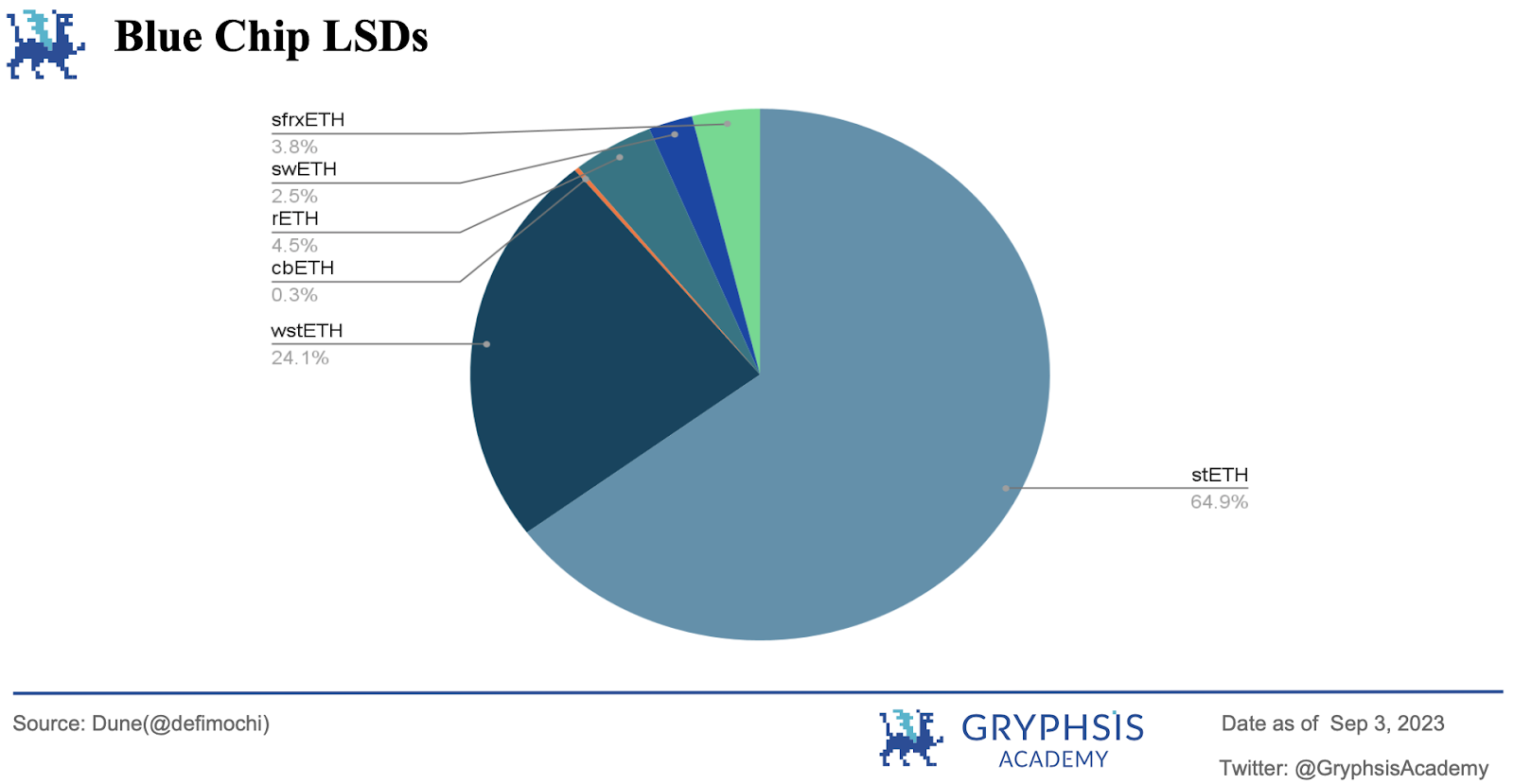

LSD Sector Overview:

As usual, the Liquidity Staking Derivatives (LSD) sector has experienced steady growth with all indicators on the rise. In terms of market share in the LSD sector, Lido's share has slightly increased, while other platforms have remained stable or slightly declined.

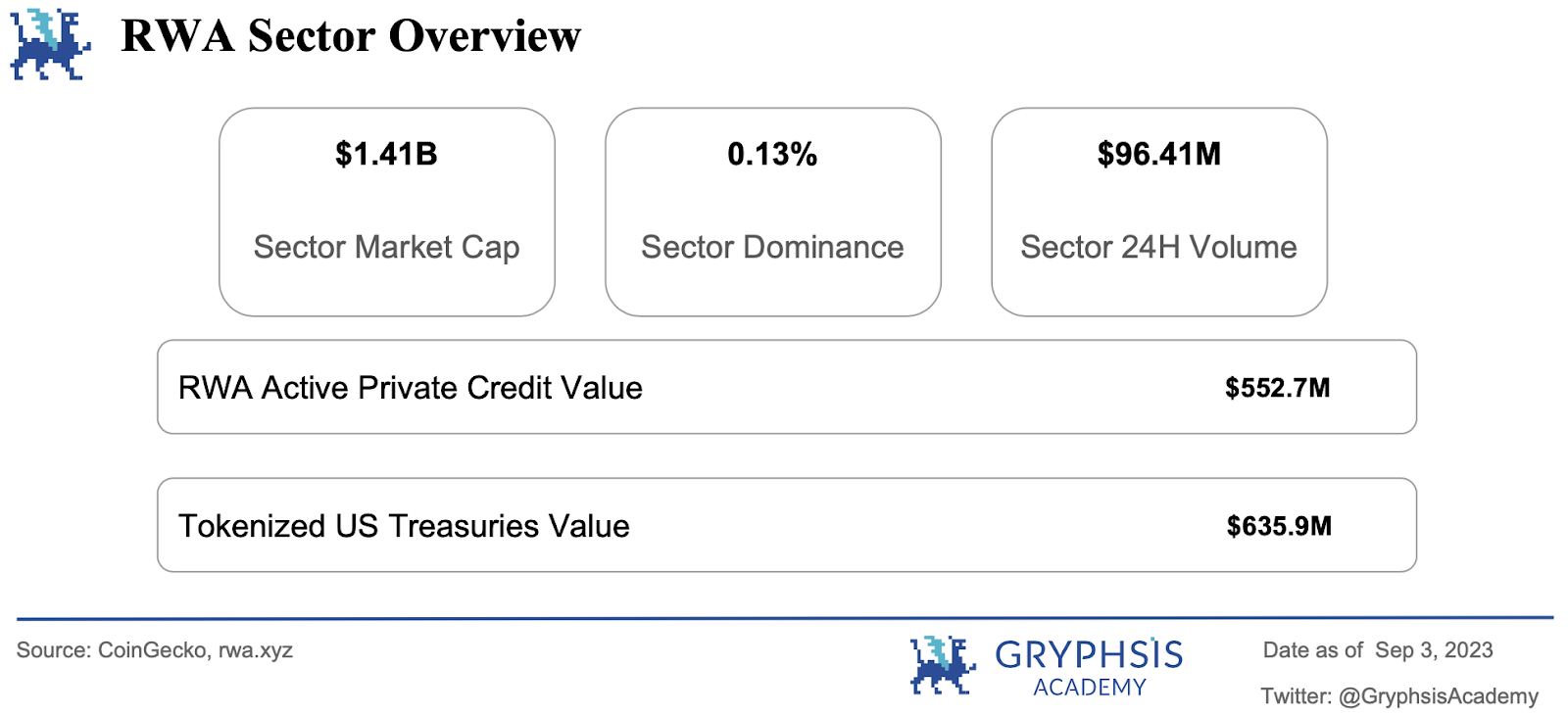

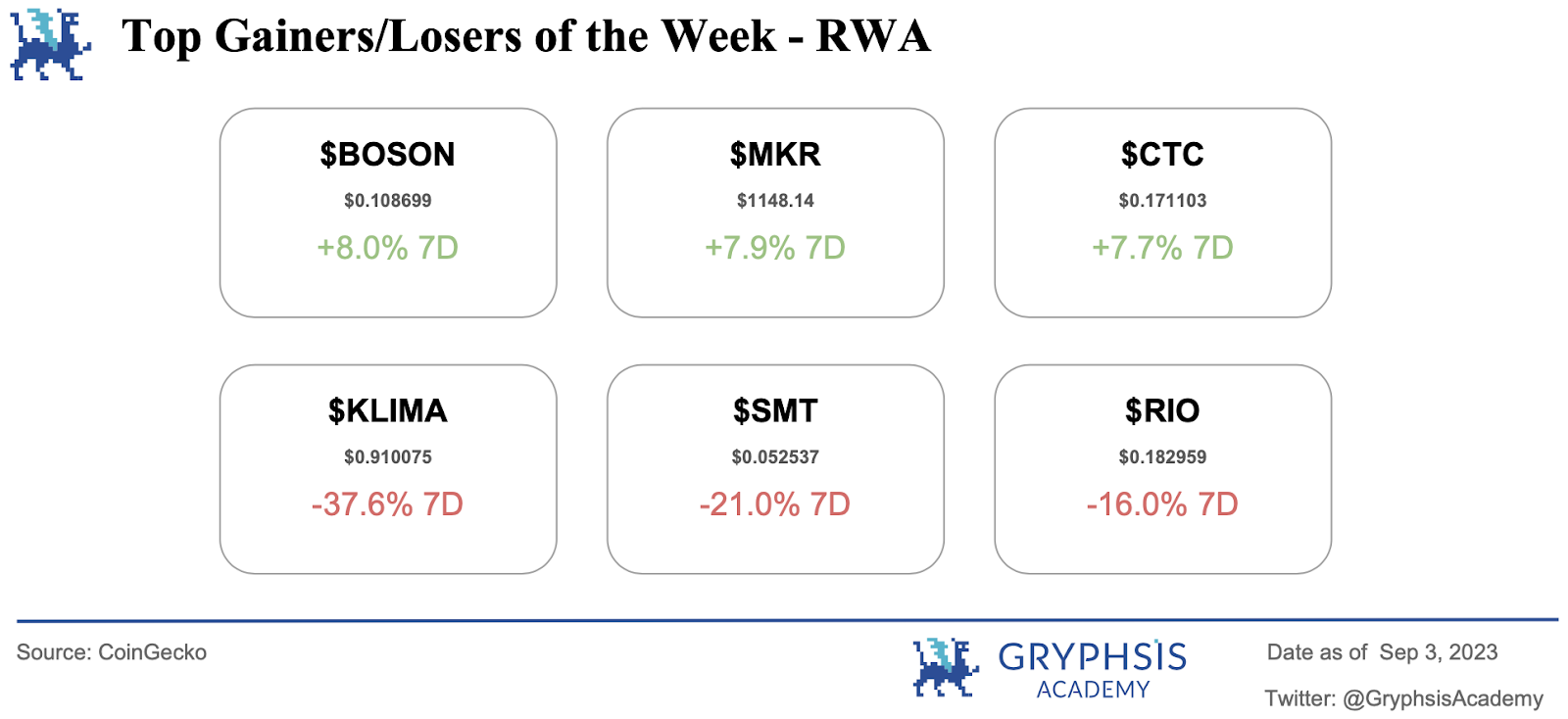

RWA Sector Overview:

In the past week, the Real World Assets (RWA) sector has seen slight increases in market value and industry dominance. However, there have been no significant changes in the total value of active loan worth or tokenized treasuries. The star winners this week include $BONSON, $MKR, and $CTC, while $KLIMA, $SMT, and $RIO have experienced significant declines.

Main Topics

Overview:

US Stock V.S. Crypto

Main Events of the Week:

Grayscale’s Legal Victory Over SEC - A Pathway to the First BTC-ETC?

Recommended Protocol of the Week:

AIMBOT

Weekly VC Investment Focus:

DeForm ($4.6 M)

StroomNetwork ($3.5 M)

Twitter Alpha:

@DefiIgnas on blockchain user activity

@wacy_time 1 's unplayed narratives hold 5-10 0x potential

@Deebs_DeFi's 8 timeless lessons to keep you alive in DeFi.

@Flowslikeosmo's 10 Crypto Assets to watch while they're trading at a discount

@DamiDefi's thread on @BoundFinance

Macro Overview

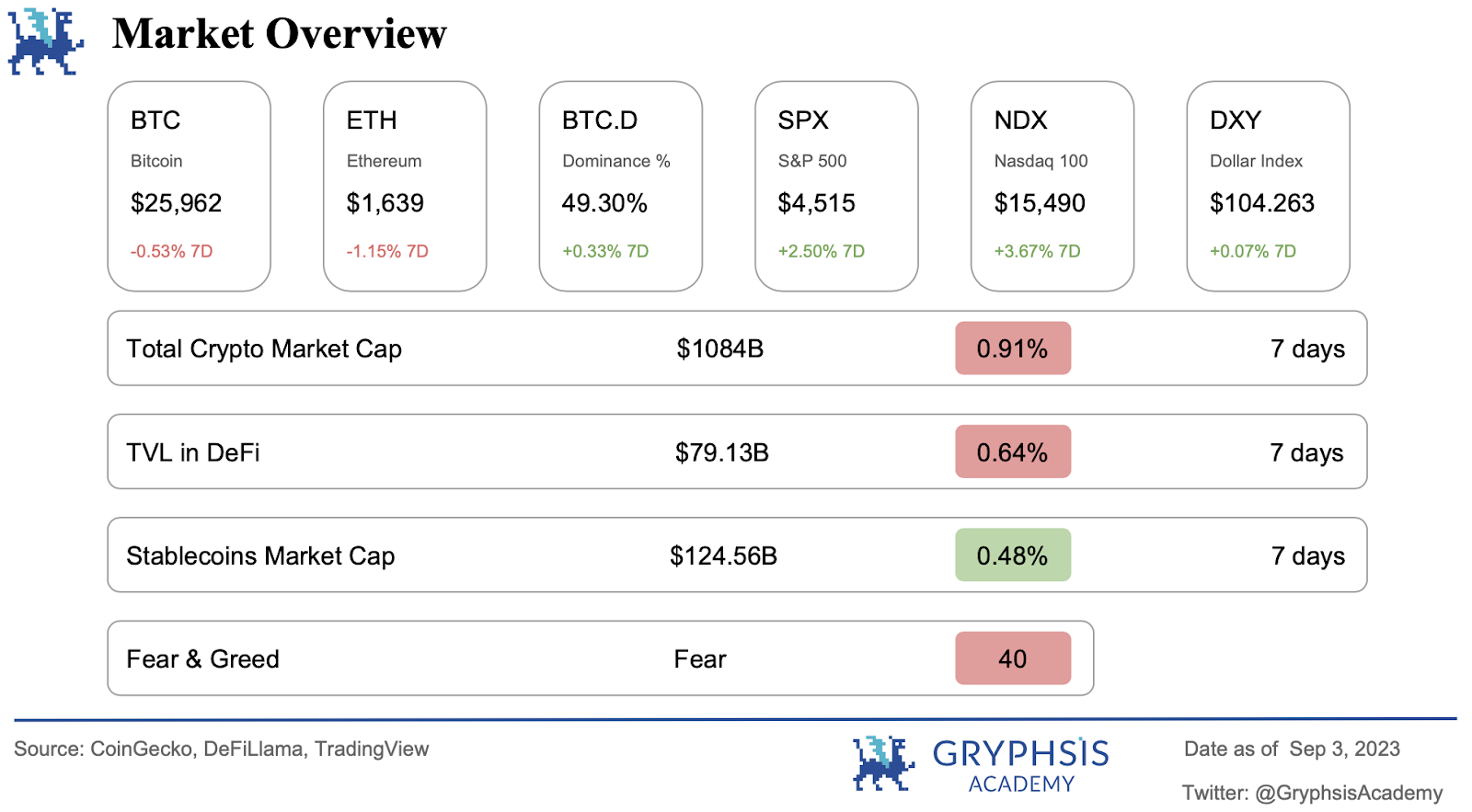

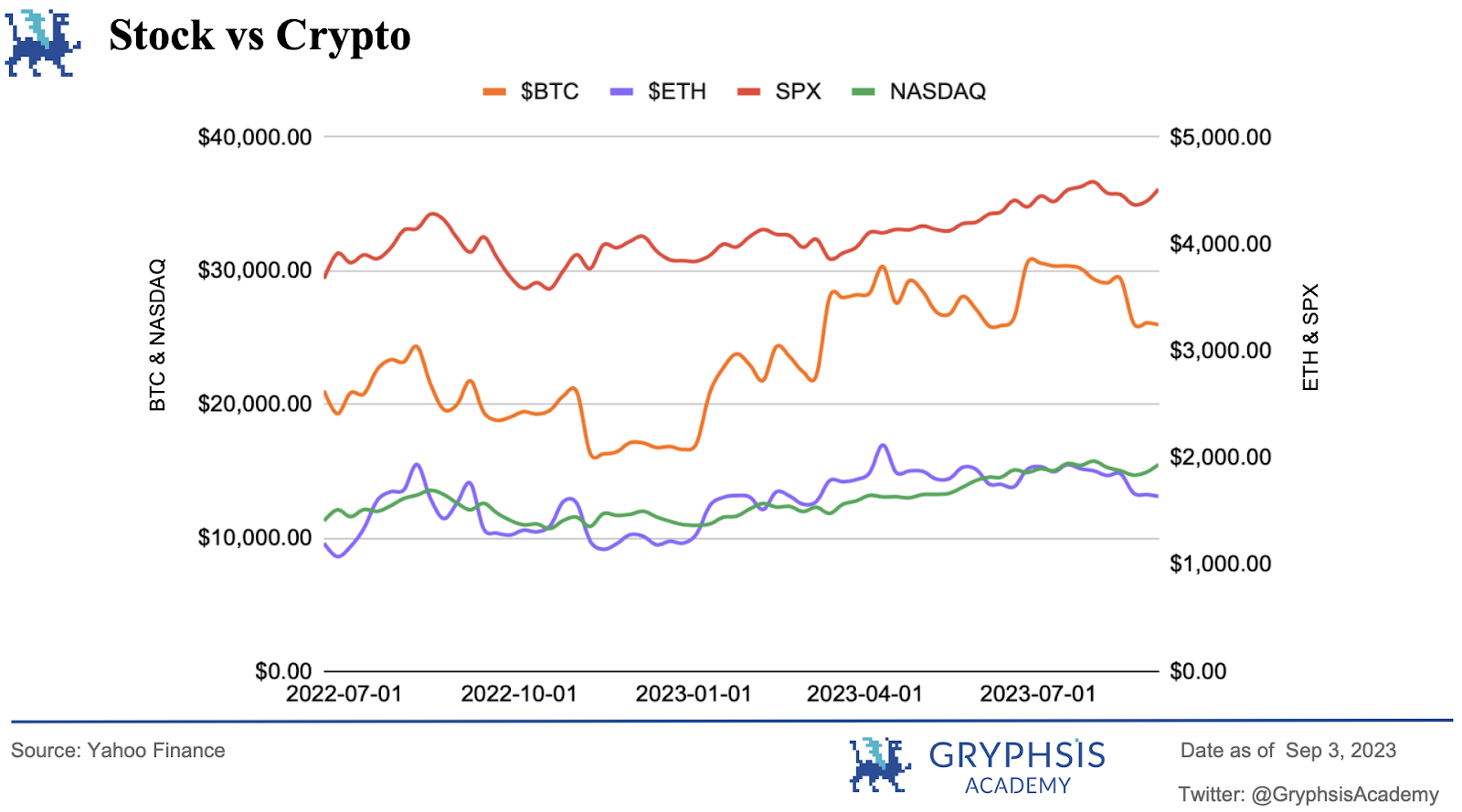

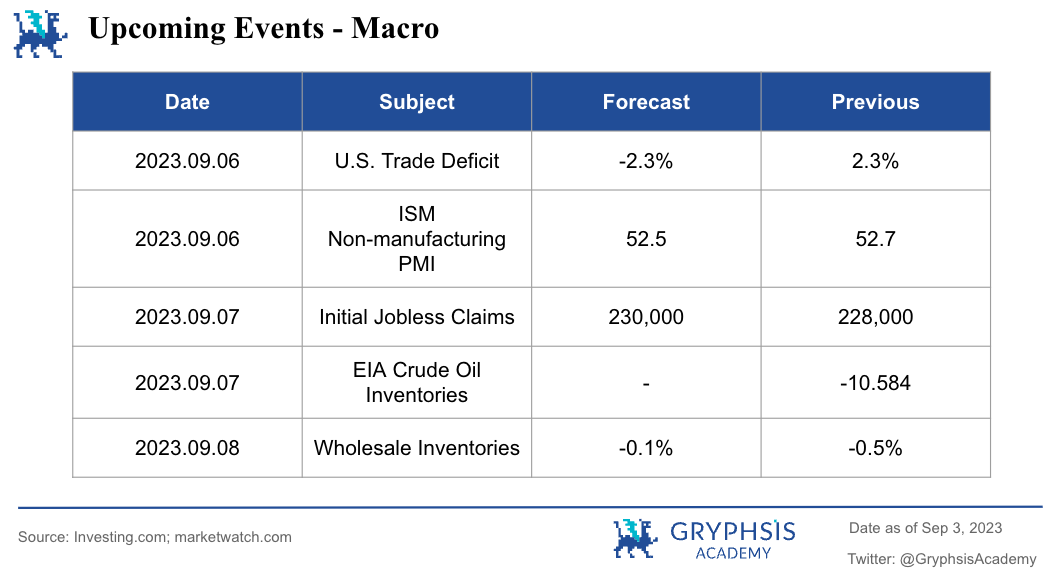

In the past week, the cryptocurrency market has experienced volatile conditions, primarily due to news from Grayscale and the decision to postpone all applications for a Spot Bitcoin ETF. The market initially saw an increase but then declined, with BTC and ETH closing below their weekly opening prices. In contrast, the stock market is recovering, with SPX and NAQ showing positive performance for the second consecutive week. Looking ahead, important events to watch next week include US trade deficit, ISM non-manufacturing PMI, initial jobless claims, EIA crude oil inventories, and wholesale inventories data releases.

Major Events this Week

Grayscale's Legal Victory Over SEC - A Pathway to the First BTC-ETF

The United States Court of Appeals has ruled in favor of Grayscale Investments, stating that the Securities and Exchange Commission (SEC) acted "arbitrarily" and "capriciously" in denying the conversion of Grayscale Bitcoin Trust (GBTC) into an Exchange-Traded Fund (ETF). This decision opens up the possibility of launching the first Bitcoin ETF. The court criticized the SEC for approving Bitcoin futures ETFs without providing sufficient explanation for rejecting Grayscale's Bitcoin ETF application.

Let's review the timeline:

1. In 2021, Grayscale applied to convert its GBTC trust into an ETF.

2. The SEC subsequently denied Grayscale's application, citing concerns about market manipulation.

3. Grayscale then appealed to the Court of Appeals, arguing that the SEC's actions may violate the Administrative Procedure Act. They claimed that the SEC had already approved Bitcoin futures ETFs, and there were no fundamental risk differences between futures ETFs and Grayscale's products.

4. On August 29, 2023, the court ruled in favor of Grayscale, requiring the SEC to reconsider its application.

This case dates back to October 2021 when Grayscale Investments initially applied to convert its closed-end fund, GBTC, into an ETF. However, the SEC rejected the application, citing concerns about issues such as market manipulation. In particular, the SEC approved several ETFs related to Bitcoin futures but remained skeptical of a spot Bitcoin ETF.

.This position has sparked widespread questioning and discussion in the industry.The decision could have an impact on other companies, including BlackRock and Fidelity, that are interested in creating Bitcoin ETFs. The ruling caused a surge in the prices of Bitcoin, Ether, and other major cryptocurrencies. Coinbase, listed as a custodial partner in multiple pending Bitcoin ETF applications, saw its stock price rise by over 14%.

Grayscale Investments, which manages the world's largest cryptocurrency fund, initiated this lawsuit after SEC rejected its application to convert its Bitcoin fund into an ETF. SEC cited concerns about market manipulation and investor protection. The court's decision is seen as an important step forward for US investors and the Bitcoin ecosystem.

The decision has broader significance, indicating that the SEC does not hold the ultimate authority over cryptocurrencies, and that the court system and Congress can provide legal interpretations. ETFs are important because they offer a regulated pathway for more traditional investors to enter the crypto market, and this ruling challenges the SEC's jurisdiction over digital assets.

Our Perspective

Grayscale's victory immediately sparked intense discussion within the industry. This undoubtedly is good news that enhances confidence in the crypto sector. Bloomberg's senior ETF analyst has raised the likelihood of a spot ETF listing to 75%.

https://twitter.com/EricBalchunas/status/1696887691122548798?s=20

From the perspective of the entire crypto market, this victory not only potentially opens doors for Grayscale itself, but also paves the way for other financial institutions such as BlackRock and Fidelity to apply for spot Bitcoin ETFs. If the SEC cannot reject Grayscale's application based on concerns about market manipulation or find other reasons, they will need to approve Grayscale and all other spot Bitcoin ETFs. ETFs play a crucial role in expanding participation in the crypto market, providing a familiar and regulated investment pathway. This ruling allows billions of dollars in capital to enter the crypto market through stock exchanges.The field is open to possibilities that could further drive its adoption and growth. For Grayscale, transitioning from a closed-end fund to a spot Bitcoin ETF could eliminate the discount on GBTC. ETFs allow for redemptions, typically trading close to their net asset value. As Grayscale shifts from a trust structure to an ETF structure, this means that investors or authorized participants will now be able to transact directly with the fund, rather than just on the secondary market. This typically helps reduce the deviation between the fund price and its net asset value, allowing investors to buy and sell closer to the net asset value price. This change is advantageous for investors as it provides a more flexible and efficient trading mechanism. Therefore, this decision could attract a significant amount of institutional funds, as discounted Bitcoin may currently present an attractive investment opportunity. Although the market initially reacted positively to Grayscale's victory with a price increase of about 7%, the BTC price of 27,000-28,000 did not last long. On September 1st, after the SEC postponed the decision on spot Bitcoin ETFs for all applicants, the BTC price experienced a significant drop again. It is worth noting that Grayscale's argument in the lawsuit is based on "procedural justice" rather than "outcome justice." They argue that since the SEC has already approved other Bitcoin futures ETFs, and Grayscale's spot ETF carries similar risks and market manipulation potential, the SEC cannot reject their application based on this reason. Therefore, when the judge ruled in favor of Grayscale, the SEC only needs to "reconsider" the application. This ruling does not directly require the approval of Grayscale's application. Hence, theoretically, if they are determined to do so, the SEC can still provide a different reason from Grayscale's application to reject the spot ETF. In conclusion, the possibility of introducing a spot BTC ETF is increasing. However, there still exists a gap between the SEC and the issuers of spot BTC ETFs.One battle.

Weekly Protocol Recommendations

Welcome to Weekly Protocol Recommendations, where we focus on a protocol that has caught attention in the crypto space. This week, we have chosen Aim-Bot, a trading bot that scans the blockchain in real time to find the best new token releases and makes trading decisions using 20 adjustable parameters. It acts as an asset management protocol, using pooled funds for buying and selling, and distributing profits to holders of the utility token AIMBOT.

AIMBOT is positioned as a sniper robot designed specifically to purchase newly launched tokens when liquidity is added to the chain. Its primary objective is to execute buy orders within the first two blocks of the newly launched token, with the possibility of extending the purchase window to four blocks under specific conditions. AIMBOT token holders can passively participate in trading activities without manual intervention. The profits generated from the trades are periodically distributed to AIMBOT token holders.

The decision-making process of AIMBOT involves a three-layer AI system called CTB Gauge (Conscious Trading Brain). The Conscious Layer utilizes a memory system that considers past successful and unsuccessful trades. The Brain Layer considers real-time market conditions such as natural gas prices and buying pressure. Finally, the Trading Layer automatically executes trades based on pre-defined strategies. Token purchases are automated and stored in Wallet 1-4, while sell transactions are currently manually processed. Profits are manually distributed to a rewards contract, from which investors can claim their ETH rewards.

Among a total token supply of 1,000,000, AIMBOT has a relatively low supply. Buy/sell trades incur a 5% tax fee to support project growth and finance the initial sniper trading pool. 75% of AIMBOT's profits are shared with investors, with profit distribution occurring every few days based on trading volume. Detailed information regarding buy/sell trades and their performance can be tracked through the platform's portfolio page.

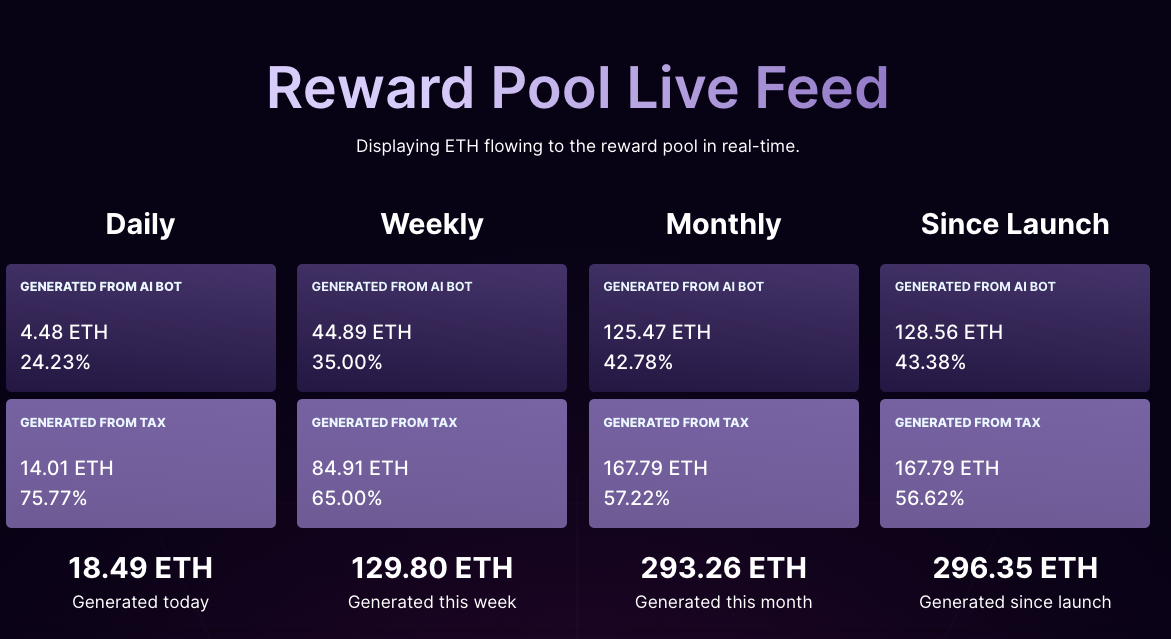

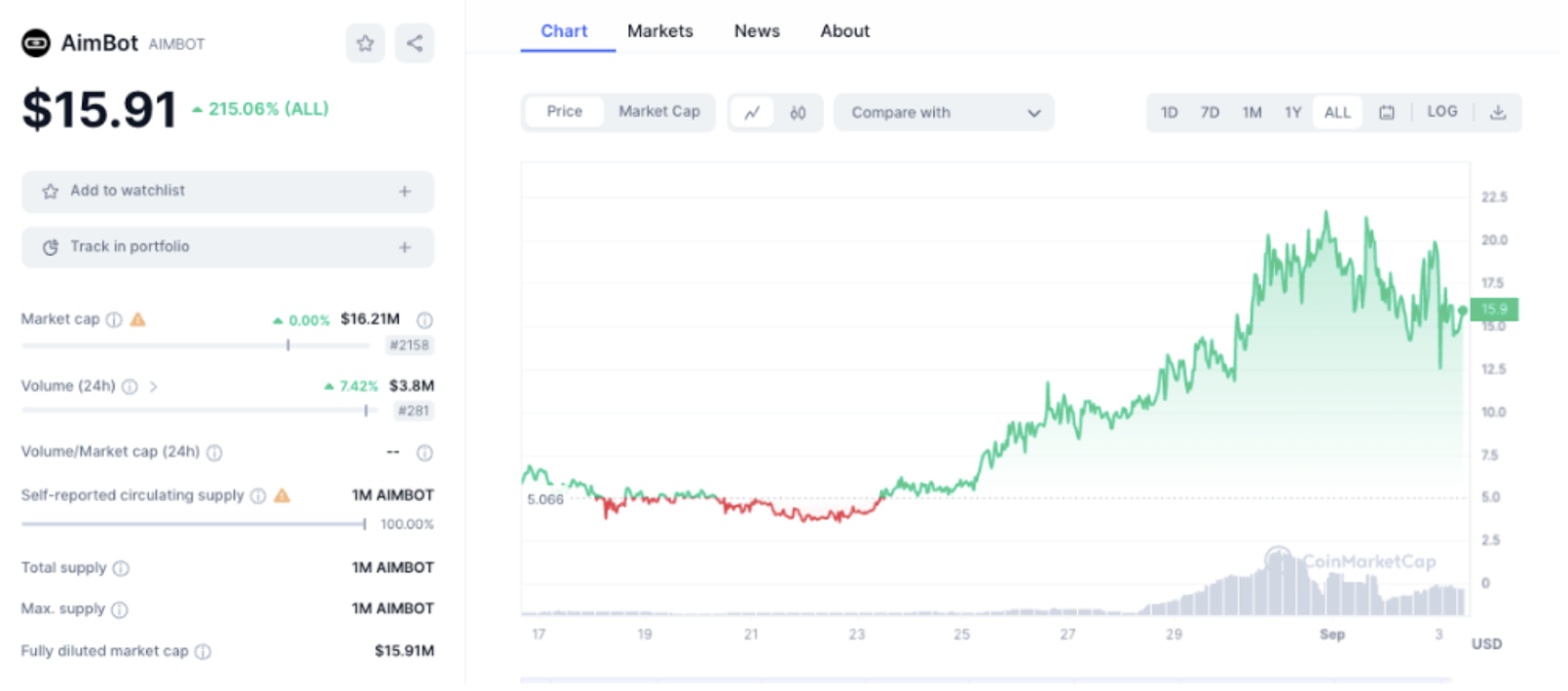

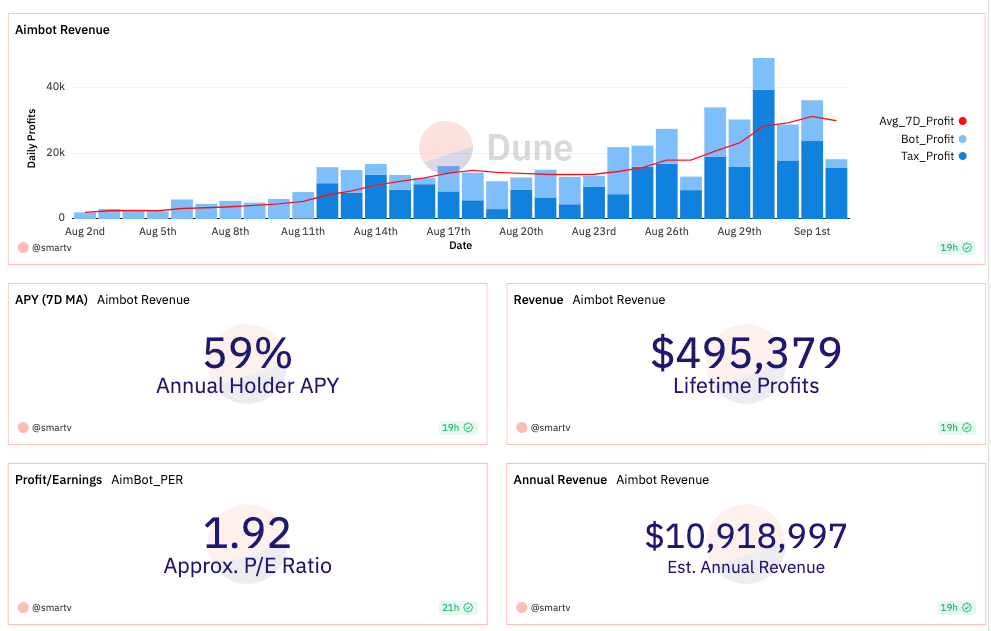

The protocol has performed well in terms of token price and profit generation. Within a month of its launch, the token price has tripled and achieved a 60% growth in the past seven days. The growth of the token price is supported by the profit generated by the protocol. AIMBOT's profit continues to steadily increase, with an annual percentage yield (7-day moving average) for holders of 59%. Since the launch of this protocol, it has generated a profit of 296.35 ETH.

https://twitter.com/AimBot_Coin/status/1697961133020172388?s=20

Our Insights

The popularity of Telegram trading bots has been around for a while, and Unibot has gained significant momentum due to its potential as a balanced trader. This has reignited market excitement for trading bots. Following the success of Unibot, AIMBOT has found a specific market niche targeting new token releases that have the potential for huge profits, possibly up to 100x returns. Within just one month of its launch, Unibot has already garnered attention from traders and enthusiasts.

AIMBOT attributes its success to two key factors: artificial intelligence and trading bots. The combination of these elements opens up vast possibilities for investors. The outstanding AI algorithms learn from past data and continuously improve their performance. With more trading decisions being made, we anticipate further enhancements to the Conscious Trading Brain (CTB Gauge). Additionally, the user-friendliness of the bot makes it easily accessible to beginners, serving as an entry point for mass adoption. The community surrounding AIMBOT is steadily growing, while the team remains committed to developing a diversified strategy system.

The protocol has shown remarkable performance in token price appreciation and profit generation ability. Since its launch, the token price has tripled within a month and achieved a significant 60% growth in the past seven days. The strong profit-generating capability strongly supports the increase in token price. Based on the seven-day moving average, AIMBOT has an annual holder APY of 59%. Since its protocol launch, it has generated a total profit of 296.35 ETH.

Source: https://dune.com/smartv/aimbot-analysis (as of Sep 3)

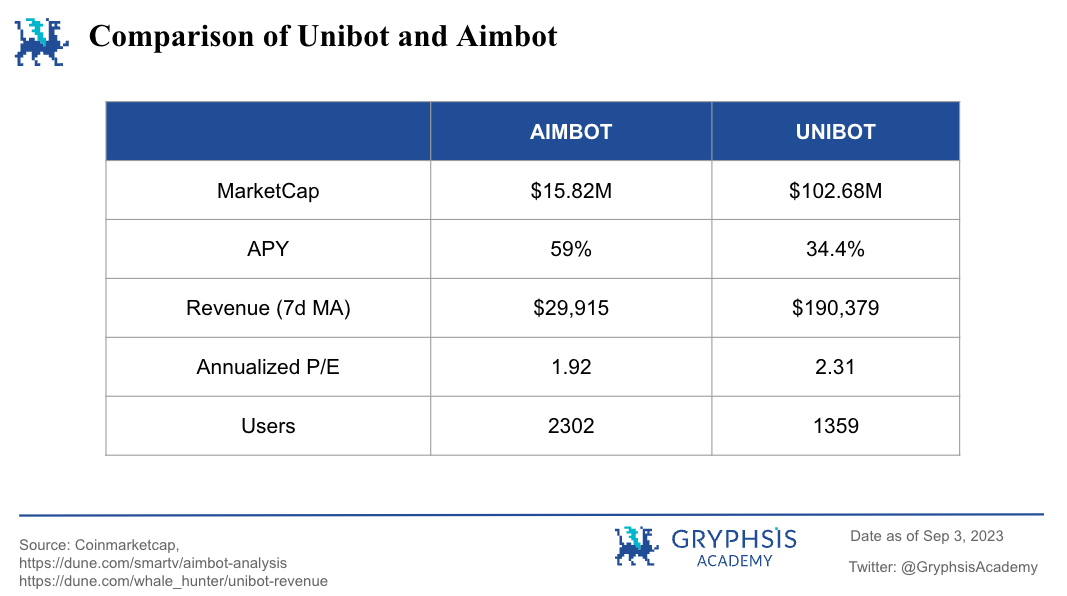

When comparing AIMBOT with UNIBOT, AIMBOT shows a higher annual holder APY (59%) while UNIBOT has an APY of 34.4%. Additionally, Aimbot has a slightly lower P/E ratio of 1.92 compared to Unibot's P/E ratio of 2.31. These data indicate that, considering its high APY, Aimbot has the potential to increase its market value. However, it's important to note that, like any investment, Aimbot also carries inherent risks. With only one trading strategy in place, it could easily reach the ceiling of that strategy. The cryptocurrency market is highly volatile and unpredictable, with no guarantees that AI algorithms will always make the best trading decisions. Understanding these risks is crucial for investors. Furthermore, since the protocol has only been launched for a month, investors should proceed with caution as certain aspects of the token economy may not be fully clear yet, and current sale transactions are still carried out manually.

Weekly VC Investment Focus

Welcome to our weekly investment focus, where we reveal the most significant venture capital developments in the crypto space. Each week, we will highlight the agreements that have received the most funding.

DeForm

DeForm has secured a $4.6 million investment from Kindred Ventures. They specialize in developing a cryptocurrency-based Customer Relationship Management (CRM) platform that leverages on-chain data and activities to enhance marketing effectiveness. Their goal is to provide software tools specifically designed for creators, developers, and brands, enabling them to gain valuable insights from their customers and communities while effectively managing these relationships.

DeForm's native encrypted CRM offers diverse functionalities, including conducting online token-gated surveys, analyzing on-chain activities within communities, managing encrypted rewards like NFTs, and facilitating organization and communication with customer communities. These tools empower users to gather insights, engage with their audience, and drive meaningful interactions within the crypto ecosystem. Apart from their CRM platform, DeForm also promotes developer activities on new Layer 2 (L2) solutions by verifying contract deployment activities and collecting application information on the Base network. This enables the Base core team to reward early and influential contributors in their blockchain ecosystem through NFTs, using the data and verification capabilities provided by DeForm.

Overall, DeForm aims to revolutionize customer relationship management in the crypto space by offering customized tools and leveraging on-chain data, ultimately empowering businesses and individuals to establish stronger connections within their communities and drive marketing success.

https://twitter.com/deformapp/status/1696915753608581294?s=20

Stroom Network

Stroom Network, a mobile collateral protocol for Bitcoin Lightning Network, has successfully raised $3.5 million in a seed funding round led by crypto investment firm Greenfield. The funds will be used for team expansion and launching "Bitcoin mobile collateral" on the Lightning Network, including the release of a wrapped token called lnBTC based on Ethereum.

The Stroom Network protocol enables users to leverage their Bitcoin capital on both the Lightning Network and Ethereum network. By depositing Bitcoin on the Lightning Network, users can earn routing fees from network transactions. Additionally, Stroom has launched lnBTC, a wrapped Bitcoin token on Ethereum, allowing users to explore additional earning opportunities within the Ethereum ecosystem, similar to WBTC. Stroom Network aims to address the limited capacity and adoption challenges of the Lightning Network (LN). The goal of Stroom Network is to increase the total locked value (TVL) on the Lightning Network by attracting Bitcoin-DeFi users to participate in LN. They seek to bridge the gap between DeFi and LN by allowing users to utilize their BTC capital in both networks simultaneously. By eliminating the need for users to choose between DeFi and LN, Stroom Network aims to enhance the TVL of LN and strengthen the robustness of the Lightning Network.

https://twitter.com/ankrstaking/status/1697625360731713643?s=20

Protocol Events

GMX v2 beta live.

Cosmos votes on liquid staking plan in a bid to boost DeFi

dYdX Community Votes On Appchain Migration and V4 Deployment

Aerodrome Just Outpaced All DeFi Protocols on Coinbase Base

zk Pass Pre-alpha Testnet Opens for Public Testing

MakerDAO co-founder floats using Solana’s code to build a new chain

Base Network Rakes in the Fees Riding Crypto's Favorite Memes

Aave Launches sDAI Pool As MakerDAO Weighs Reducing Yields

Polygon Releases 'Chain Development Kit' for ZK-Powered Networks on Ethereum

Industry Updates

X, the Former Twitter, Has Licenses in Multiple U.S. States to Process Payments Including Crypto

Altcoin Diversification Is Aim of HashKey Capital's $ 100 M Digital Asset Fund

Social Network CyberConnect's CYBER Tokens Soar, Driving Up the Cost ofMargin Trading

The Trillion Dollar Crypto Opportunity: Real World Asset (RWA) Tokenization

BlackRock, Fidelity, Invesco Spot BTC ETF Application Decisions All Delayed by SEC

Vitalik sells MakerDAO stake as Christensen suggests Solana-based chain

The Incredible Shrinking Market Share of Circle’s USDC Stablecoin

Binance CEO CZ forecasts DeFi outgrowing CeFi in the next bull run

Twitter Alpha

Crypto Twitter Contains many Alpha, but navigating through thousands of Twitter threads can be difficult. Every week, we spend several hours researching and selecting insightful threads to curate our weekly featured list for you. Lets dive in!

https://twitter.com/DefiIgnas/status/1696621362801152165

https://twitter.com/wacy_time1/status/1698034041188958719

https://twitter.com/Deebs_DeFi/status/1697965116300648669

https://twitter.com/Flowslikeosmo/status/1697987798098383009

https://twitter.com/DamiDefi/status/1698266994548592788

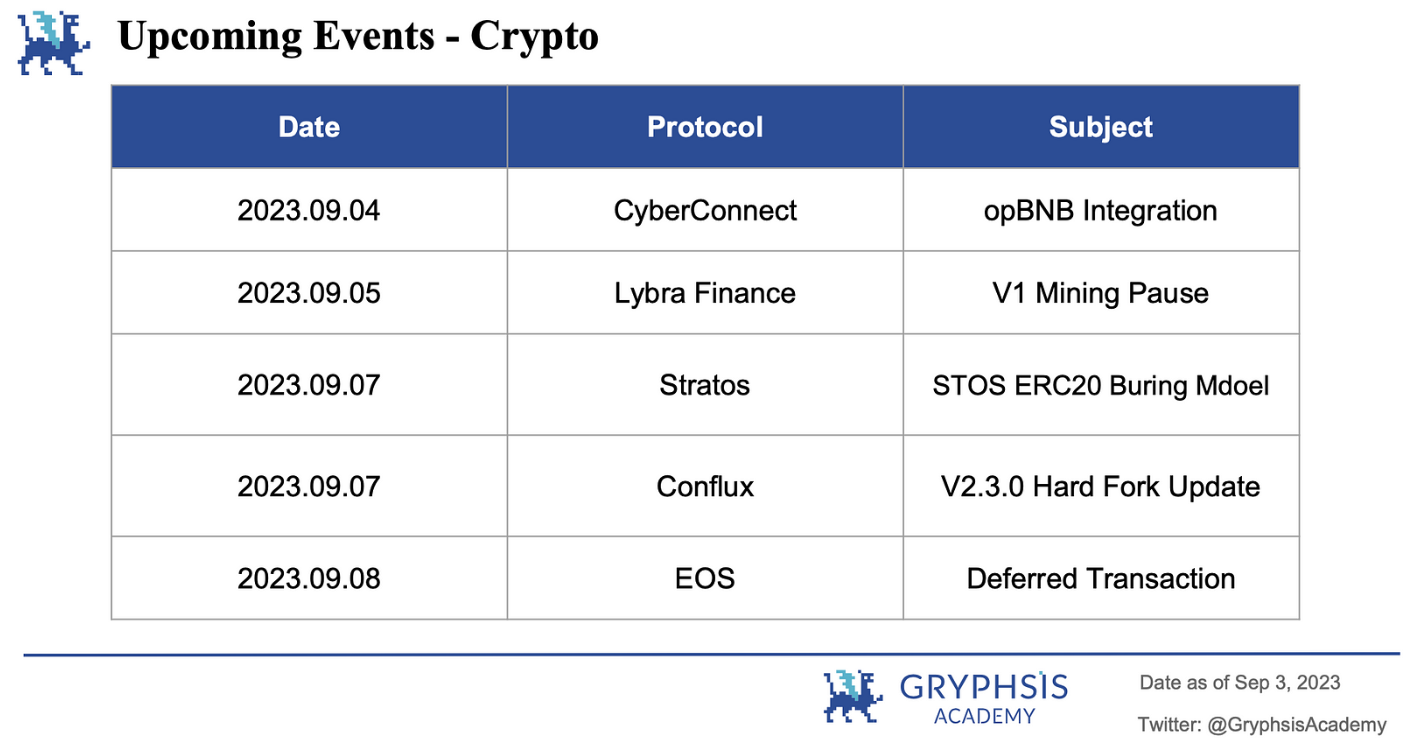

Upcoming Events

News Source:

https://www.theblock.co/post/248104/stroom-raise-bitcoin-liquid-staking-lightning-network

https://blog.deform.cc/seed-announcement

The above is all the content for this week. Thank you for reading this week's report. We hope you benefit from our insights and observations.

You can follow us on Twitter and Medium for real-time updates. See you in the next issue!

This report is for informational purposes only. It should not be taken as investment advice. Before making any investment decisions, you should conduct your own research and consult with independent financial, tax, or legal advisors. Past performance of any asset does not indicate future results.

Follow us on Twitter and Medium for more in-depth research and insights.