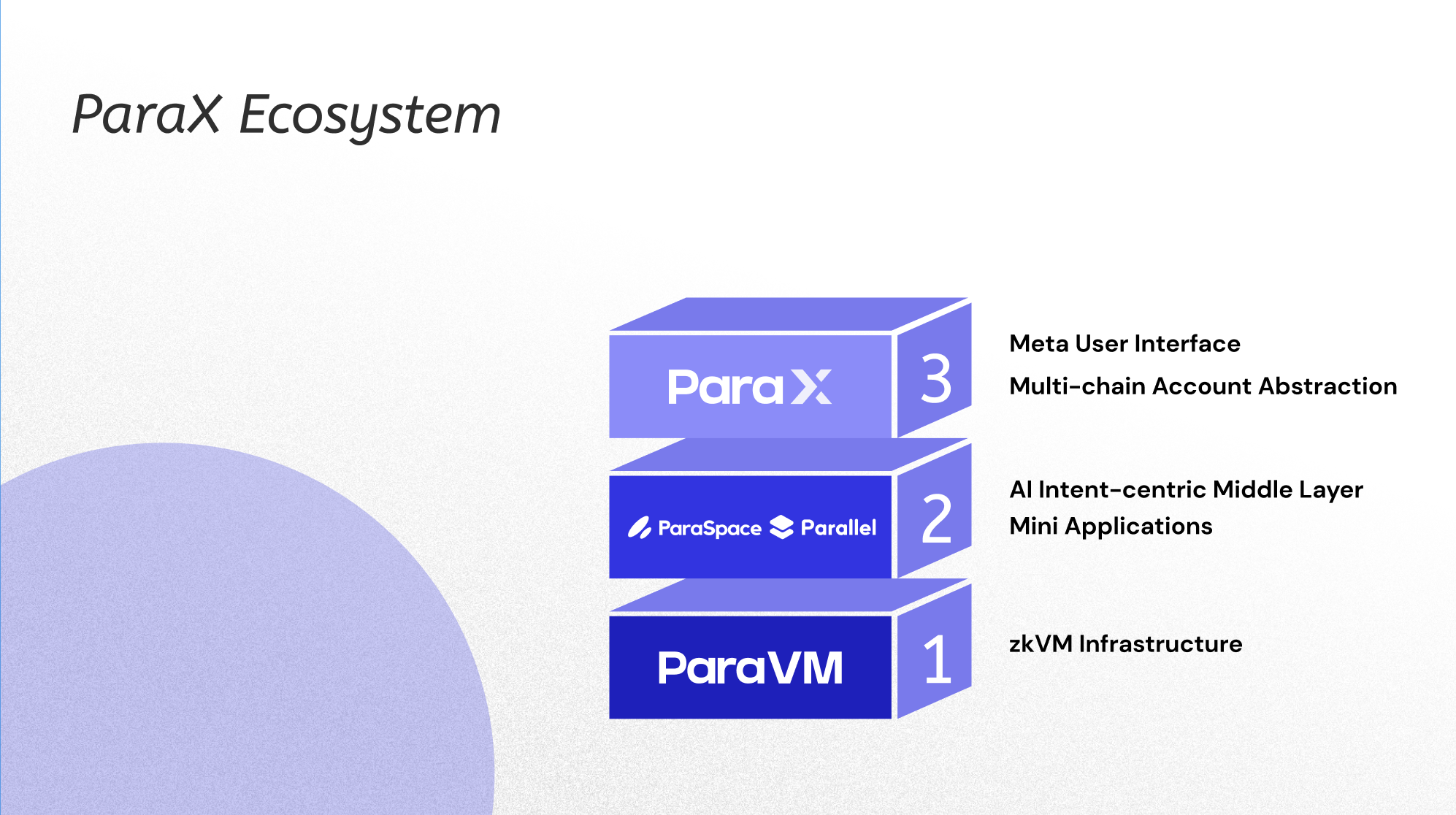

Integrating AA and zkVM, ParaX targets Web3 super traffic entrance

Original | Odaily

Author |

With the continuous development of the underlying infrastructure and applications of the blockchain, Web3 is becoming the promised land of the next generation of the Internet. However, Web3 still faces many challenges in practical applications, such as user experience, scalability, and policy regulatory environment.

Among the above-mentioned core issues, the latter two are making steady progress—scalability depends on the advancement of technology. At present, a multi-L2 universe centered on Ethereum is gradually forming. The new generation of L1 is vying for the deployment of leading applications, so network delays, Problems such as high gas fees do not restrict the entry and retention of users as in the past; the encryption laws of major countries are also developing and adapting to a clearer direction. Therefore, user experience is still a key issue that needs to be solved urgently.

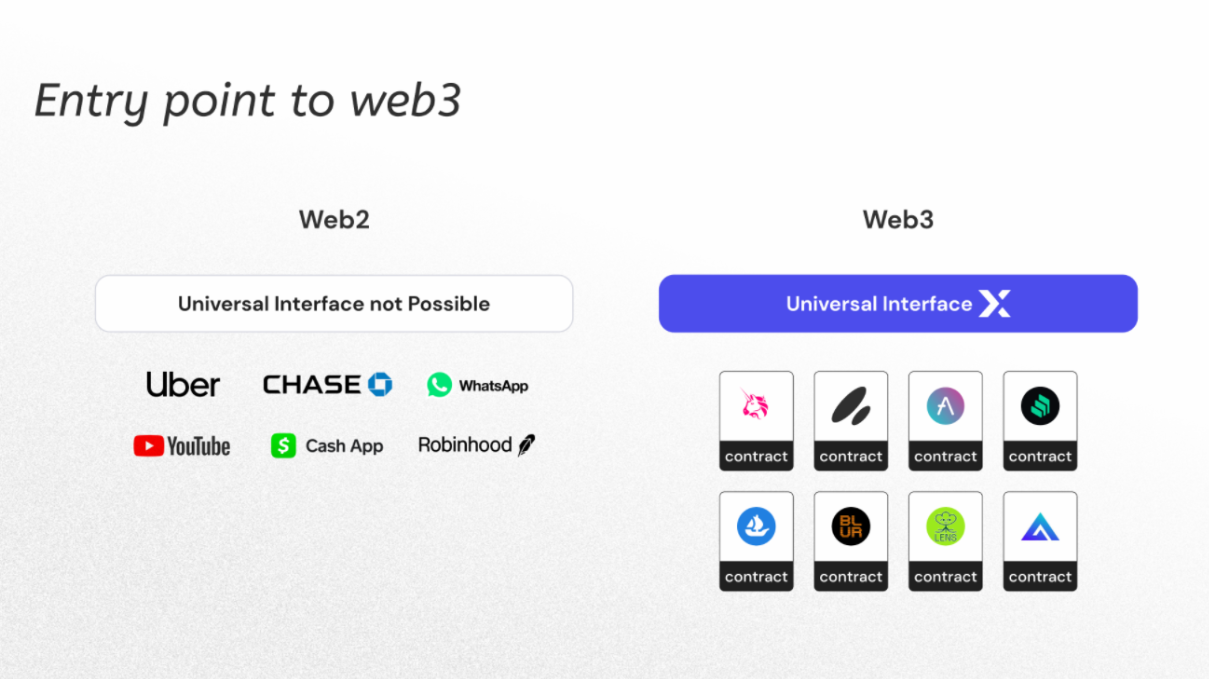

Web3 applications still have a certain learning curve and technical threshold for Web2 users. The lack of an intuitive, user-friendly interface and simplified operating procedures has limited wider adoption. in other words,Web3 lacks a real killer application platform, allowing novice to enjoy the same experience as Web2 without understanding the underlying technical logic of Web3. Killer applications need to be born at the entrance of Web3, so that more users with different needs can enter and experience Web3 without trace.

The closest thing to this existence at present is the Web3 wallet. The wallet integrates multiple chains and multiple applications to make on-chain activities more efficient; AA Wallet is also a popular track for entrepreneurship this year. However, despite the improvement in user experience of its own products, when it is necessary to interact with other DeFi applications, it still has to face complex processes and thresholds.

Is it possible to extend the wallet from a simple account attribute to a unified entry platform for multi-chain applications?ParaX recently interviewed by Odaily may give the answer.

What is ParaX?

ParaX is the result of the merger of ParaSpace and Parallel Finance. Founder Yubo has been cultivating the industry for many years as a serial entrepreneur and individual venture capitalist. Parallel Finance and ParaSpace, which he founded before, are well-known projects in the DeFi and NFT fields respectively, and have been favored by top venture capitals such as Polychain Capital, Coinbase, and Sequoia. Today, Yubo will import the accumulated experience, users, and funds to complete the cold start for ParaX.

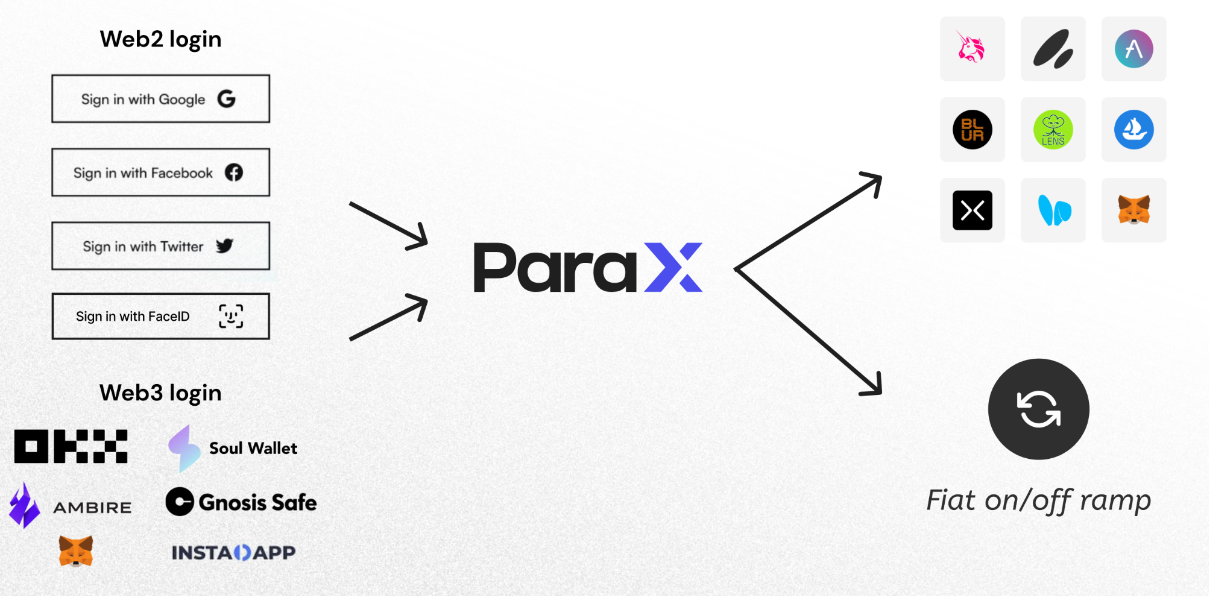

ParaX adopts the account abstraction (AA) model based on ERC-4337 and the large language model of cross-domain intent. At the same time, it cooperates with a fully functional and customizable UI interface to make it easier for users to participate in the Web3 ecosystem. Scale adoption paves the way.

Multichain Account Abstraction (MAA)

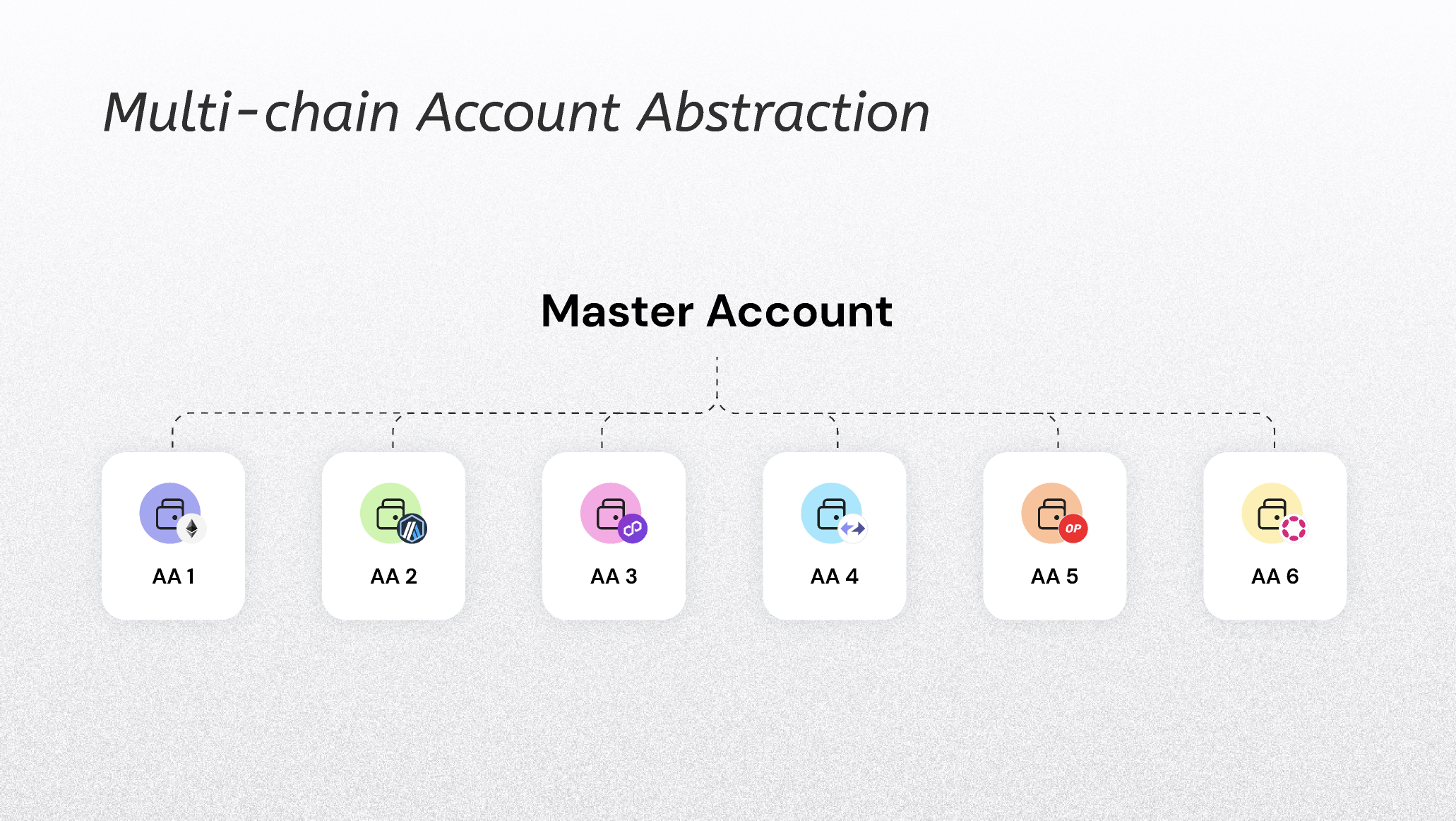

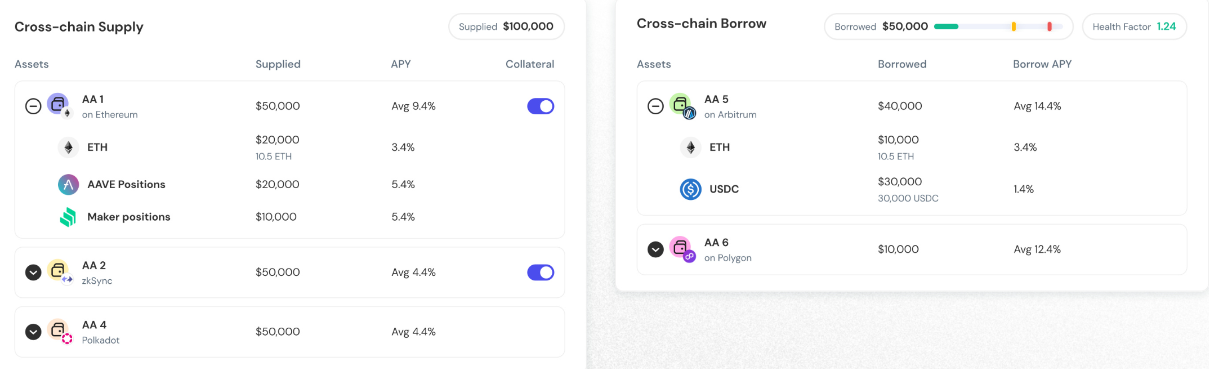

Multi-chain account abstraction (MAA) is to weaken the account attributes of each chain in the account and summarize them into unified account information, similar to the accounts of centralized exchanges.

This model makes it easier for users to manage and control their multi-chain assets and identities when using Web3 applications. Users can have a unified identity, authenticate and authorize across multiple applications and platforms, thereby increasing users control over their own data.

The account model is as shown below:

ParaXs multi-chain account abstraction collects the users on-chain transaction and asset data by establishing smart contracts on different target chains, and presents them uniformly in the ParaX account interface.

Large language model based on cross-domain intent

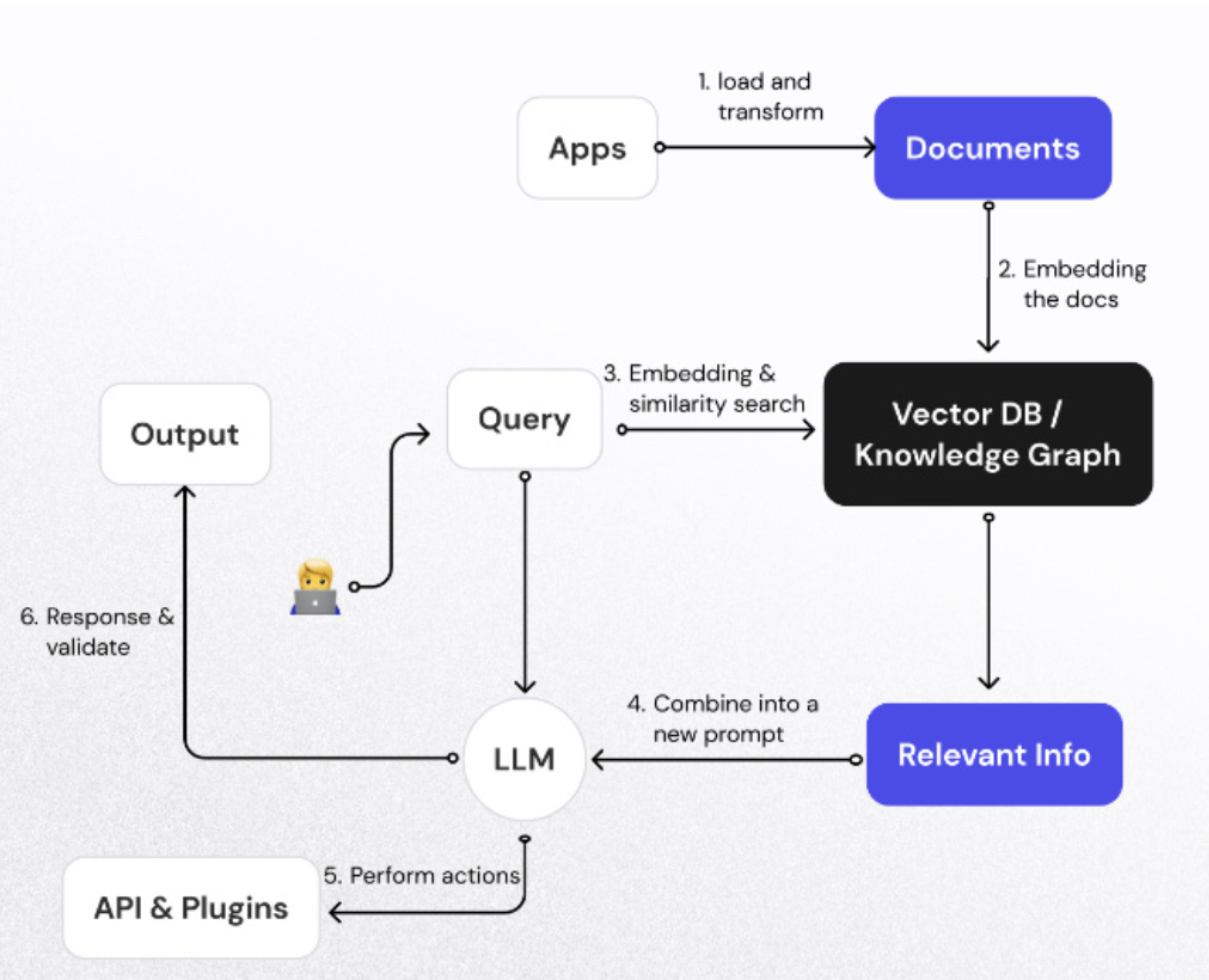

The Cross Domain Intent-based LLM (Cross Domain Intent-based LLM) uses a large number of DeFi-related data models to train the large language model (LLM), so as to realize the users transaction intentions for different scenarios.

The data model includes contract codes, mainstream protocol documents, etc. It aims to understand user intentions through natural language, translate them into desired goals and restrictions, and finally generate corresponding series of transactions and execute them on multi-chain contract accounts to achieve Transaction models across different application scenarios.

For example, Uniswap is responsible for transaction requirements, and Maker includes loan requirements. If users want to combine these requirements, they can use this solution. Even if the user is not clear about the relevant knowledge, operation path, and risk awareness, AI can also assist the user to automate the above operations and requirements.

This AI model converts intent into actionable requests, encapsulates and hides blockchain technical details, thereby lowering the threshold for users to enter Web3.

Meta User Interface (MUI)

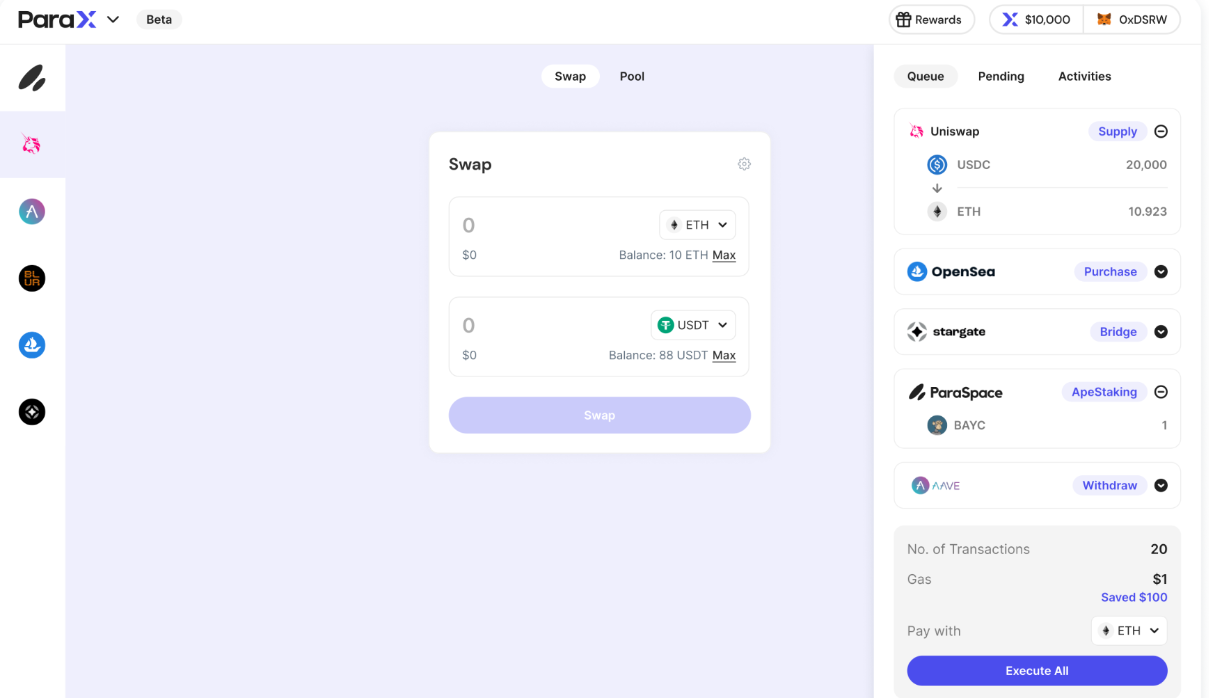

ParaXs UI is designed in a minimalist style without sacrificing functionality. As a platform, ParaX will integrate with more than 100 DApps, such as Uniswap, Opensea, Lens, Aave and other well-known applications, to create a one-stop Web3 entrance. The picture below shows the ParaX beta interface:

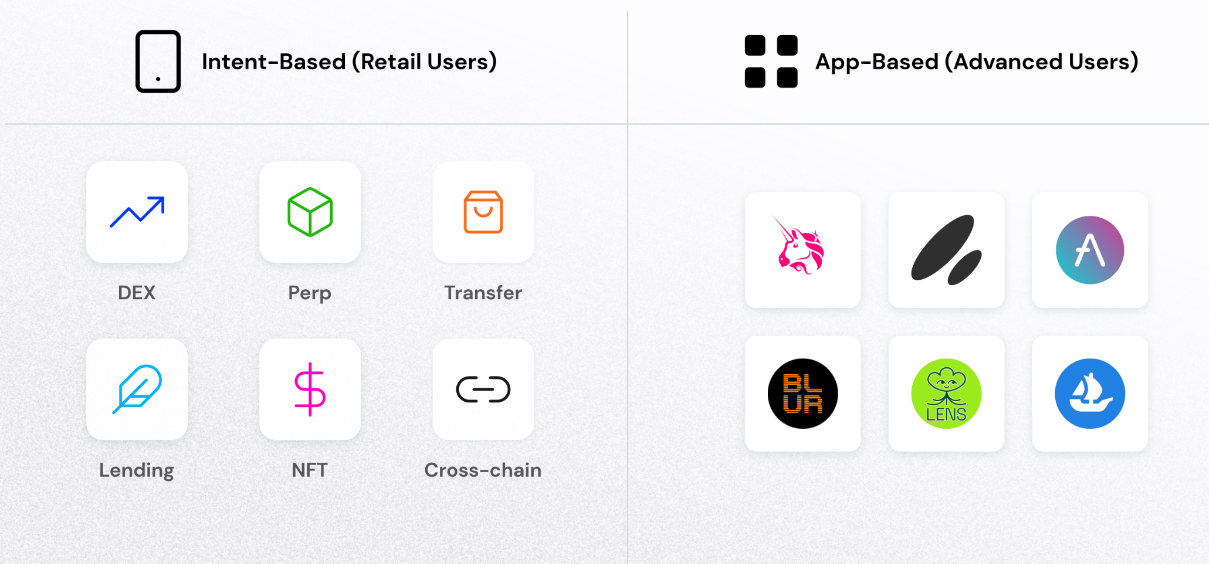

At the same time, ParaX provides two UI interfaces - simple version and professional version.

● Simple version: only provides the functions required by users, omitting the intermediate process, and lowering the threshold of use.

● Professional version: provide the specific name of the corresponding DApp, and basic users can choose the DApp according to their usual preferences and needs.

Underlying layout: ParaVM

Yubo told Odaily: As the underlying infrastructure of ParaX, ParaVM will adopt the zkVM technical standard. The team can choose to develop it by itself or cooperate with existing projects according to the actual situation. The intended partners include RiskZero, Axiom, and HyperOracle.

As the underlying infrastructure, ParaVM runs in various applications of ParaX through off-chain certification, on-chain services, such as automatic arbitrage applications, which are similar to the cross-chain version of YFI. The users funds can be automatically adjusted in the whitelist agreement in advance, and the agreement with high interest rate will be automatically selected to make profits.

As the specific bottom layer of ParaX, ParaVM is developed to fully serve the requirements of ParaX applications, which will greatly improve the speed of proof and verification.

The birth of ParaVM means that ParaX will open up the vertical structure of infrastructure-application protocol-application front-end. Relying on the Web3 traffic entrance of ParaX as the front-end, it will attract developers to develop or migrate applications based on the second layer of ParaVM, enrich the ParaX ecology, and finally form Complete closed loop.

At present, ParaVM is still in the process of development, and the specific implementation progress needs to be paid attention to.

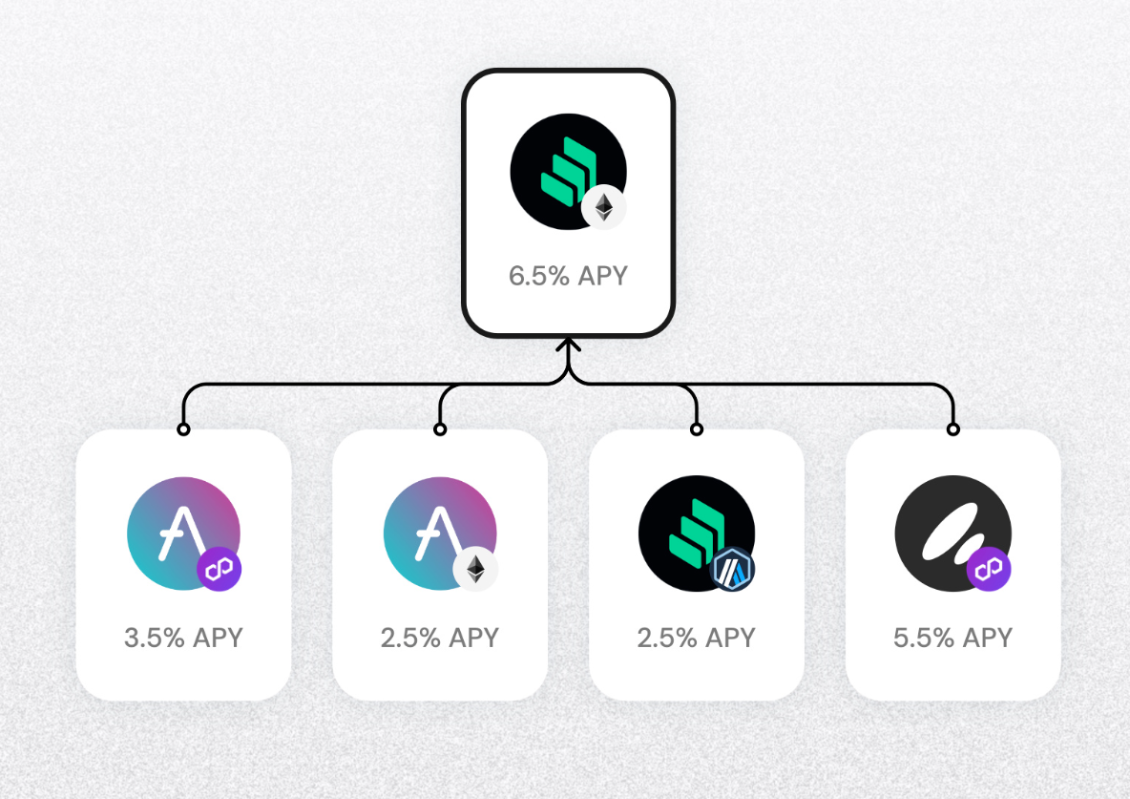

Three major aggregation mechanisms

ParaX provides users with better routing paths by seamlessly aggregating different DeFi and NFTFi protocols and collecting relevant data.

1. Automatic market arbitrage mechanism: present the income level of each lending agreement, and then select the most reasonable routing path to display the highest APY.

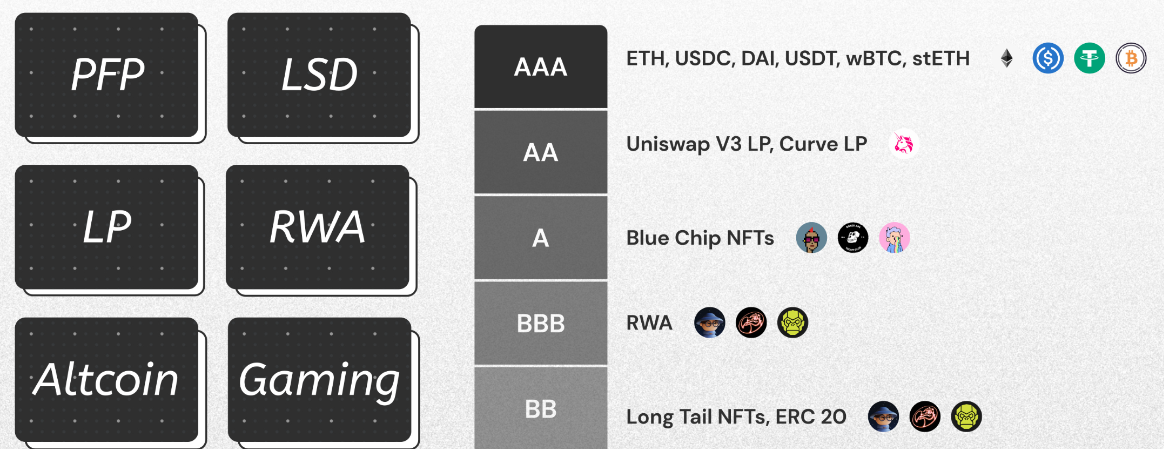

2. Full-chain credit loan mechanism: All assets on the chain can be mortgaged as guarantee.

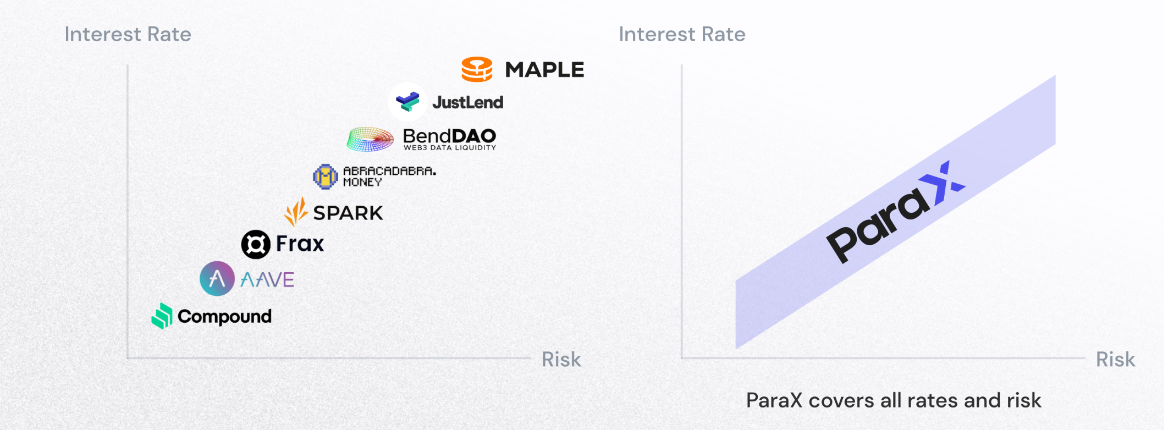

3. The market model mechanism of multiple lending rates: Summarize the lending rates and risk indicators of multiple well-known projects to form a risk rate curve, and at the same time define collateral rating standards according to different asset types. Suitable range loan.

Blurring the boundaries between Web2 and Web3

When Web2 users enter Web3, they will first face the knowledge of wallet mnemonic words. The mnemonic no mnemonic has caused some new users to fall at the door of Web3. ParaX allows new users to enter through traditional entrances, and generates keys to bind traditional accounts, so that users do not need to understand mnemonics without compromising security.

Why ParaX?

If ParaX wants to become a Web3 traffic portal, it must not only have its own innovation, but also the teams experience and ability are the key to the long-term operation of the project. ParaX is an application platform merged by Parallel Finance and its subsidiary ParaSpace. The ParaX team has rich industry experience and resources.

Parallel Finance

Parallel Finance was originally a DeFi parachain based on the Polkadot network, aiming to lower the barriers to entry into DeFi. The protocol provides a range of decentralized applications, including liquidity staking, automated market makers, decentralized money markets, liquidity crowdlending, streaming protocols, wallets, liquidity mining, and cross-chain functionality.

According to DeFiLlama, the current TVL of Parallel Finance is 164 million US dollars, and the historical trend is as follows:

ParaSpace

ParaSpace is a peer-to-pool NFT lending protocol that allows users to stake and lend NFT and fungible tokens.

At ParaSpace, users can use underutilized funds to further invest and earn income from it. A simple understanding is that users can package NFT and Token, and use the packaged combination to mortgage loans to improve asset utilization.

Currently, ParaSpace supports a total of 12 blue-chip NFT assets such as BAYC, MAYC, BAKC, CryptoPunks, Otherdeed, Azuki, CloneX, and Doodles, and supports a total of 8 ERC-20 assets such as APE, ETH, DAI, WETH, USDC, and USDT.Among them, the market share of Yuga series assets (BAYC, MAYC, BAKC) is in a leading position.

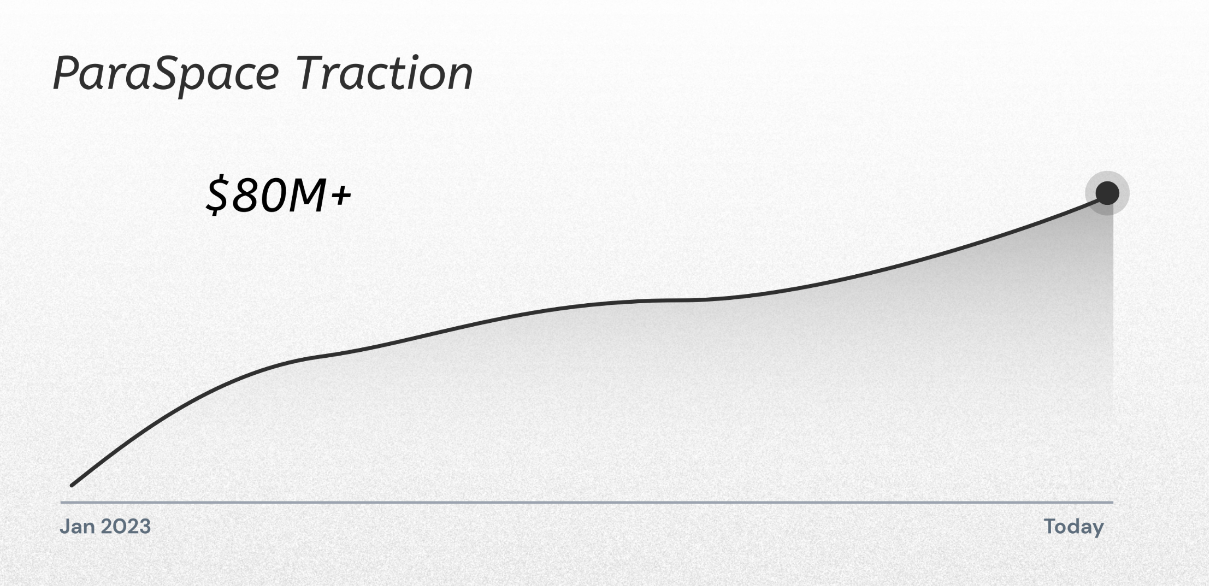

At present, ParaSpace is firmly in the top two on the NFTFi track, and its market share is at a relatively leading level. The following figure shows the recent TVL changes of ParaSpace:

ParaX team background

The background of ParaXs team is relatively bright. The founder Yubo is a technology entrepreneur and venture capitalist. After leaving Stanford University, he founded Parallel Finance in 2021 with the goal of popularizing DeFi. The protocol has become one of the important applications in the Polkadot ecosystem.

Most of the team members come from world-renowned companies such as Google, Meta, and Amazon. The team advisors are Dan Boneh and Naval Ravikant. The former is a professor at Stanford University and an advisor to a16z and the Ethereum Foundation, and the latter is a famous angel investor.

Since then, Parallel Finance has incubated ParaSpace to innovate again in the newly formed NFT financial ecosystem.

The successful launch of Parallel Finance and ParaSpace has attracted the favor of top capital including Polychain Capital, Coinbase Ventures, Starkware, Sequoia, etc., with a total financing of more than 30 million US dollars.

At the same time, in the process of building these two projects, the team has also established good cooperative relations with well-known projects in the industry such as Chainlink, LayerZero, and Delegate.

Through the introduction of the predecessor of ParaX, it is not difficult to find that the two core points of the Web3 application layer - DeFi and NFTFi, ParaX have dabbled in it before and achieved good results.

Yubo told Odaily: ParaX is not a new project, but an integration of existing project resources and brand upgrade, using Parallel Finance and ParaSpace as applications on the platform in a platform mode. Our original intention of the business has not changed— —bringing decentralized applications into the hands of a billion people.”

The existing scale of Parallel Finance and ParaSpace provides a solid user and capital base for ParaX to build a Web3 super traffic portal. From this perspective, ParaX has the prerequisites for a quick start.

ParaSpace and ParaX airdrop plans

After this resource integration and brand upgrade, ParaX will integrate Parallel Finance and ParaSpaces users token holdings and on-chain activities with the users on-chain activities of the new platform ParaX as the standard for short-term plans. Users can view their activities and points on Parallel Finance, ParaSpace and ParaX through the Points and Referrals Dashboard. These points will be redeemed for governance tokens.

On Parallel Finance, users token holdings and on-chain behavior are used as the criteria for airdrops.

On ParaSpace, users can earn points by borrowing, staking APE tokens, and participating in market activities.

On ParaX, users will earn reward points based on qualifying behaviors using the wallet, including creating wallets, trading, interacting with other apps, and resulting total locked value and transaction volume.

It can be seen from this thatParaX has followed the past economic system and opened up tokens so that old users can get more rights and interests.

For specific airdrop rules, please pay attention to the official website and Twitter of the project party.

Summarize

If you compare the evolutionary path of Web2, the project development path of ParaX is very similar to WeChat. WeChat uses IM instant messaging as the traffic point in the early stage, opens up development standards in the later stage, and forms an application platform relying on small programs.

However, there are data sharing and API restrictions in Web2, and it is difficult to have a unified entrance, so it can only be built by itself; while Web3 has a natural openness advantage, that is, it is not restricted by the traffic island with the company as the main body, and can form an application platform by integrating multi-chain DApps .

As a deep cultivator in the industry, ParaXs excellent project experience, team background and accurate prediction of the route direction may create basic conditions for the large-scale adoption of Web3.