Foresight Ventures Weekly Market Report: The market was bleak in August, and the L2 battle was fierce

A. Market perspective

1. Macro Liquidity

Monetary liquidity is tightening. The U.S. has lowered the number of jobs and lowered interest rate hike expectations, but the mainstream expectation in the market is that higher interest rates will be maintained for a longer period of time. U.S. stocks rebounded daily, and U.S. bond yields rose and fell. The encryption market follows the trend of US stocks, with a convergence rate of 70%.

2. Global market conditions

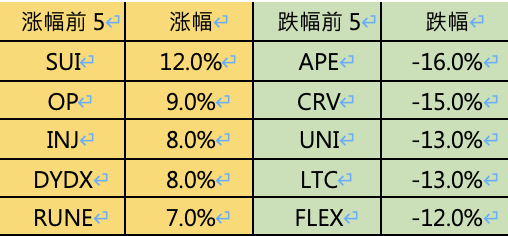

The top 100 gainers by market capitalization:

The market has experienced a sharp sell-off this week, ending a period of historically low volatility. Market hot spots revolve around the Base chain ecology.

1) OP: The Base chain based on OP technology has grown rapidly, with a transaction volume of 1.4 million, exceeding OP’s 400,000 and ARB’s 550,000 combined, mainly benefiting from the explosive growth of users of the social application Friend Tech.

2) PRIME: Parallel Life is an NFT card game similar to Hearthstone, and Paradigm invested $50 million. The background of the game is the five races that have evolved in the process of human exploration into space. It is currently one of the few game projects that has conducted in-depth research in the field of games and has a certain quality of products. However, token economics is generally designed, and the use of tokens is limited.

3) AKT: Akash is an AI decentralized computing power similar to RNDR in the Cosmos ecosystem, and it is holding a hackathon recently.

3. BTC market

1) Data on the chain

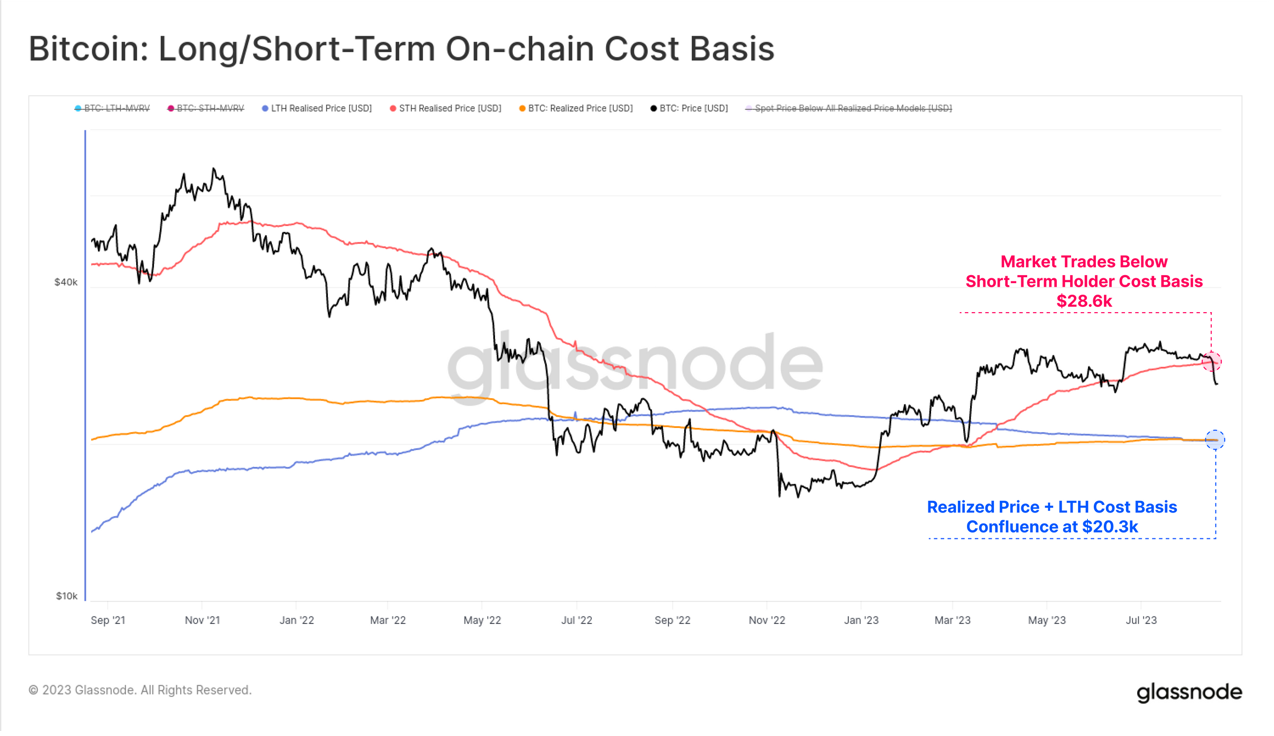

The market chip structure has deteriorated. Bulls now face a difficult task, with over 88% of short-term BTC holders (less than 6 months) at an unrealized loss, with most costs around $29,000.

Stablecoins are rising steadily. At present, the market narrative has not changed, and a large amount of funds are still looking forward to the BlackRock funds, the Feds interest rate cut and the arrival of the BTC halving cycle.

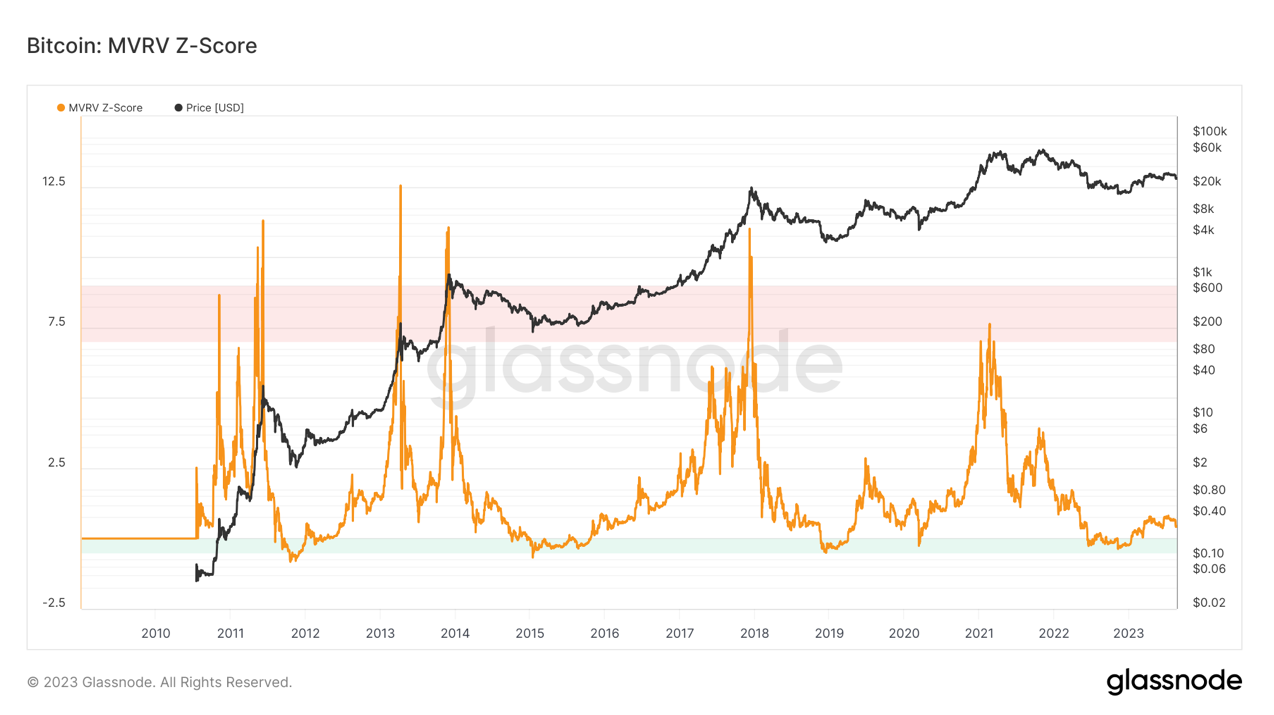

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is the top range; when the indicator is less than 2, it is the bottom range. MVRV fell below the key level of 1 and holders were generally in the red. The current indicator is 0.44, entering the recovery phase.

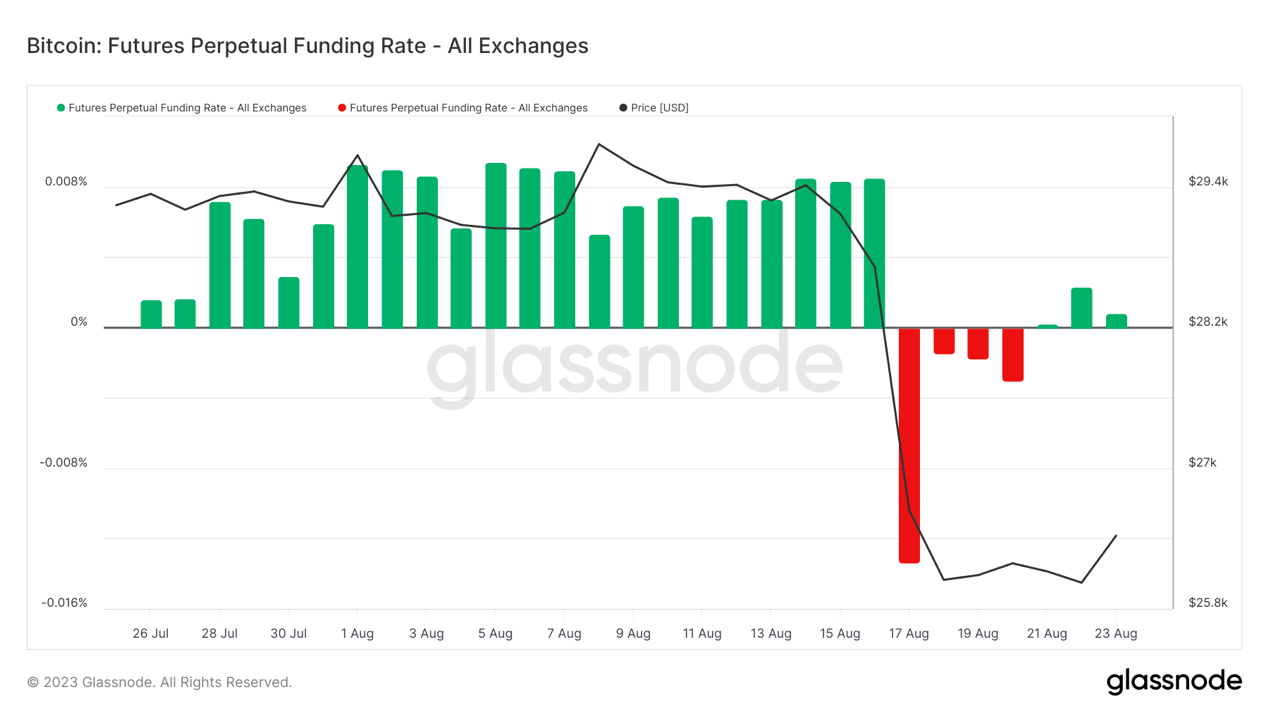

2) Futures market

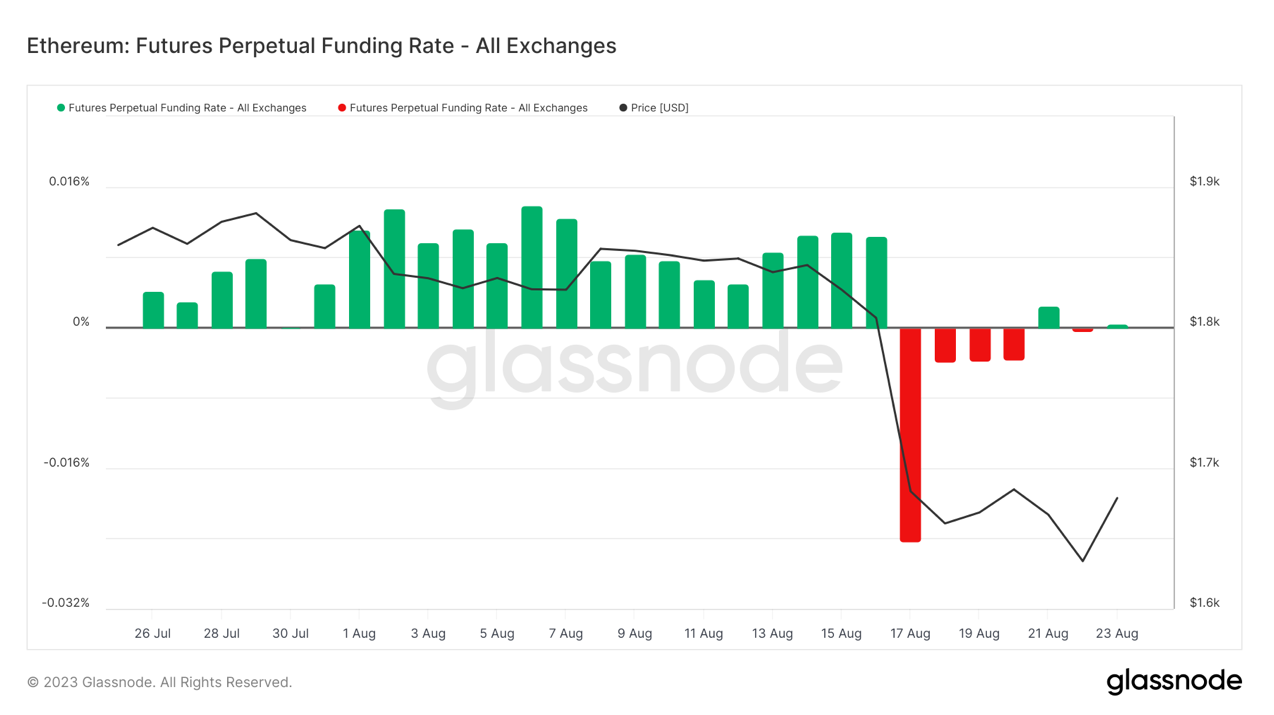

Futures funding rates: Rates are neutral to bearish this week. The fee rate is 0.05-0.1%, and the long leverage is more, which is the short-term top of the market; the fee rate is -0.1-0%, and the short leverage is more, which is the short-term bottom of the market.

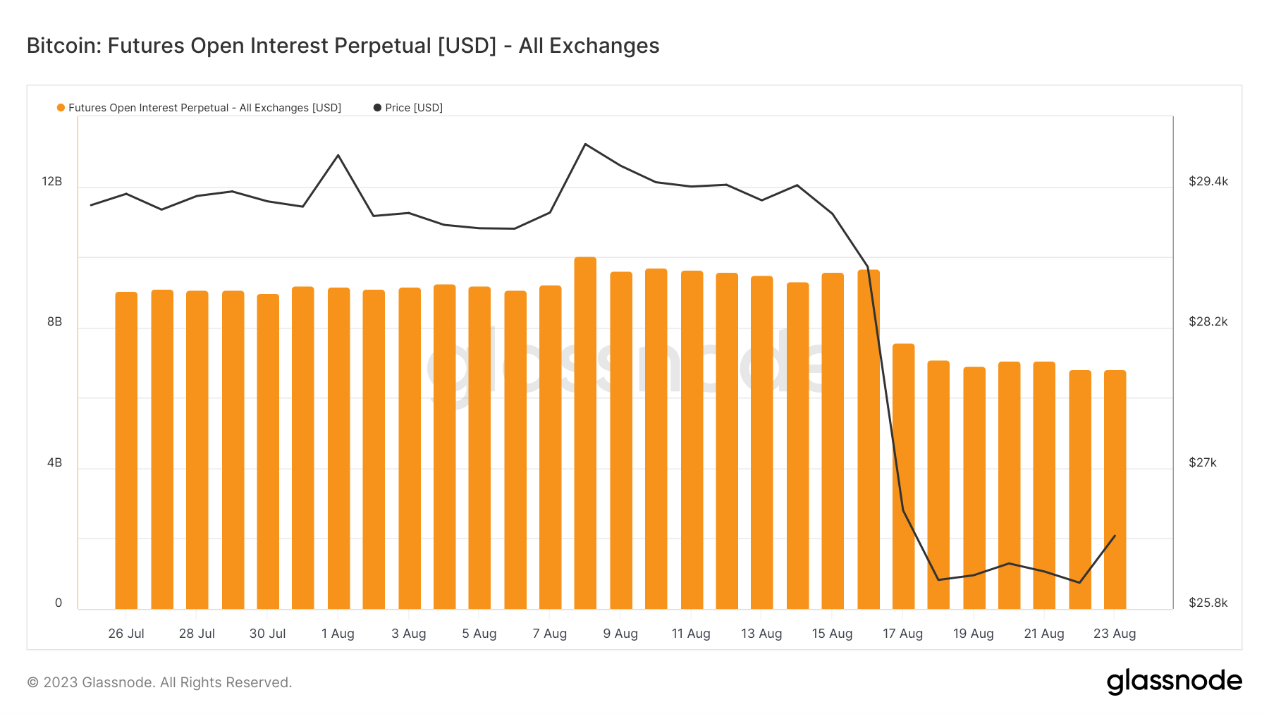

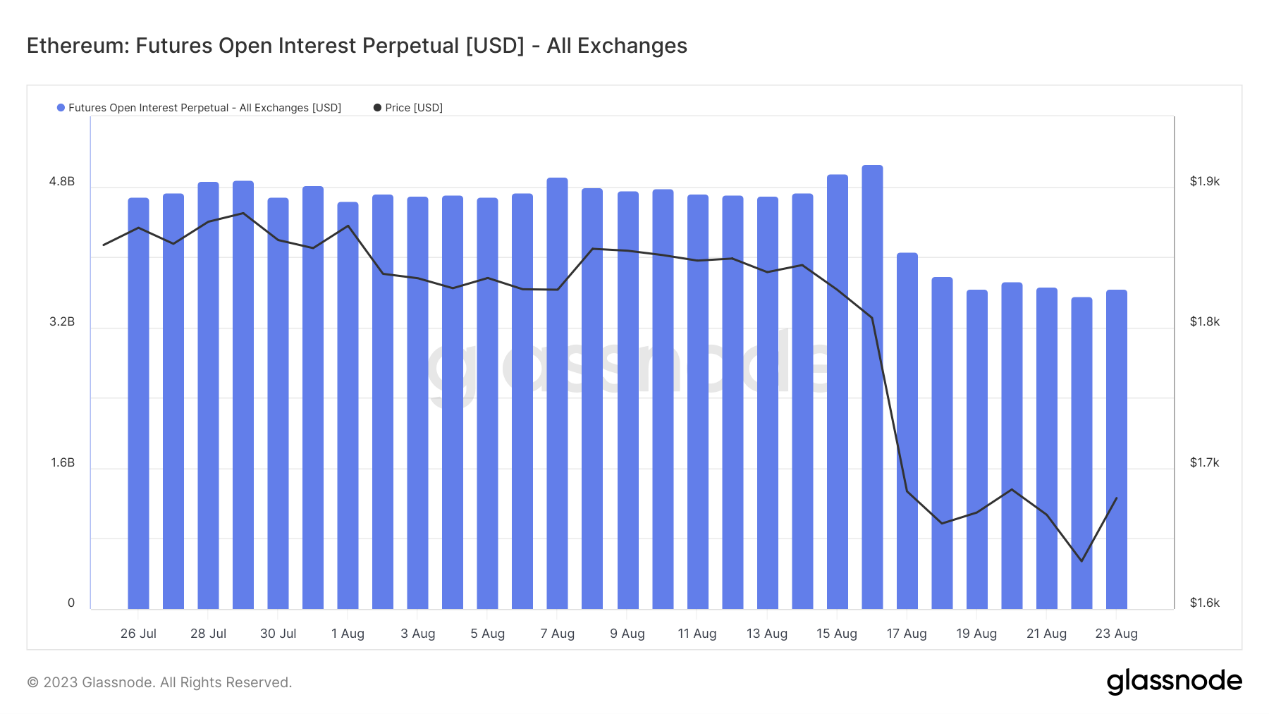

Futures open interest: The total open interest this week dropped sharply to the level of half a year ago, and the main force withdrew from the market.

Futures long-short ratio: 1.3. Market sentiment is neutral. Retail investor sentiment is mostly a reverse indicator, below 0.7 is more panic, and above 2.0 is more greedy. The long-short ratio data fluctuates greatly, and the reference significance is weakened.

3) Spot market

This week, BTC fluctuated sideways after breaking through the weekly level and falling. It is expected to follow the adjustment of US stocks for 2-3 months, and will not stabilize and rise until September 20 after the last Federal Reserve interest rate hike meeting. Considering that there are many benefits in the first half of next year, such as the halving of BTC production, the expected approval of the BTC spot ETF, the Federal Reserve is expected to cut interest rates, etc., it is recommended to slowly increase the position during the decline, or it is the last opportunity to get on board before the bull market.

B. Market data

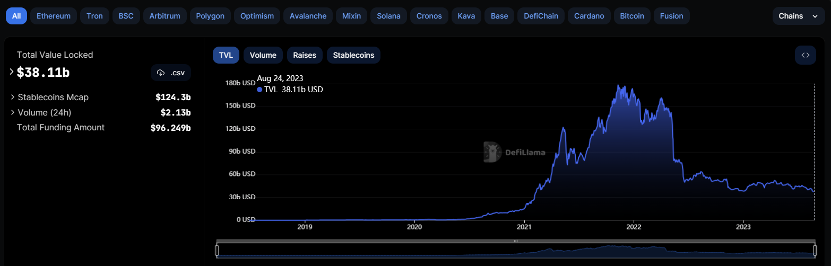

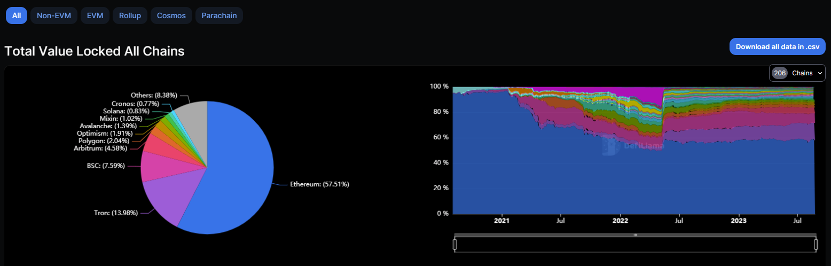

1. The total lock-up volume of the public chain

2. TVL proportion of each public chain

This week, the overall TVL fell by 1.65 b, a drop of 4.1%. In recent weeks, the TVL has shown an accelerated downward trend, and the decline has increased to a certain extent. This week, the proportion of the ETH chain decreased slightly, down 1.1%. All chains are basically facing an overall sharp decline. The BSC chain has a relatively small decline. It is worth noting that the Base chain has maintained a growth of 14% this week after a 222% increase last week. The overall number of agreements has reached 76. The number of Solana protocols may be exceeded in the short term.

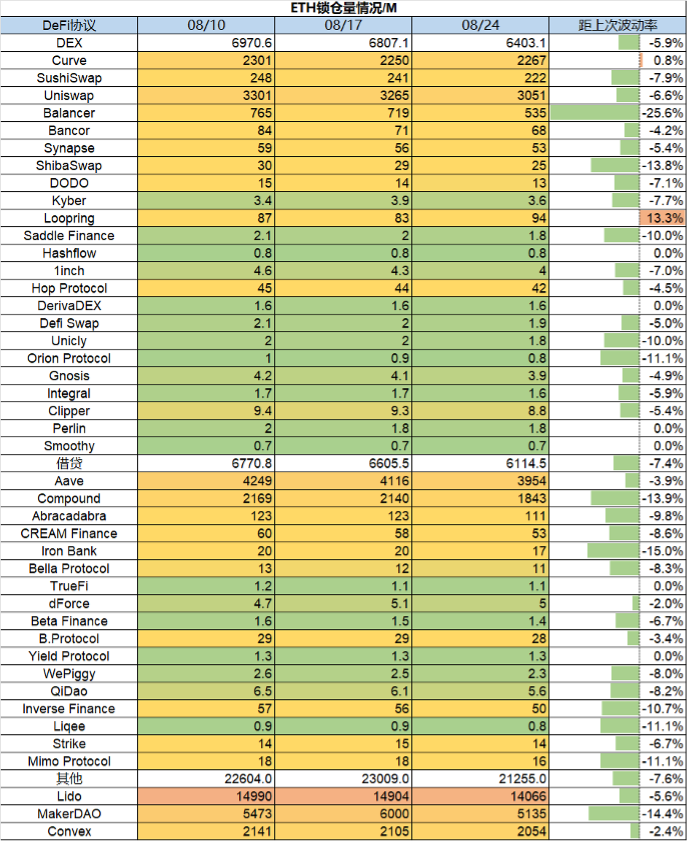

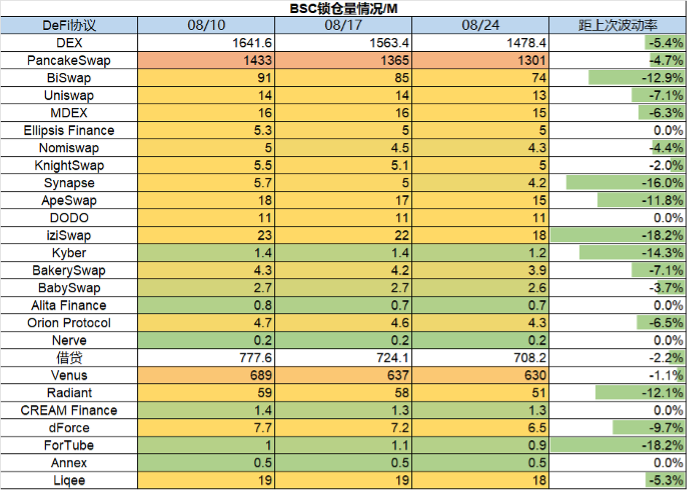

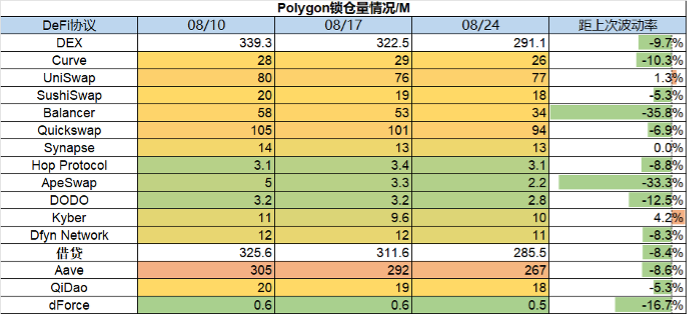

3. The lock-up volume of each chain agreement

1) ETH lock-up amount

2) BSC lock-up amount

3) Polygon lock-up amount

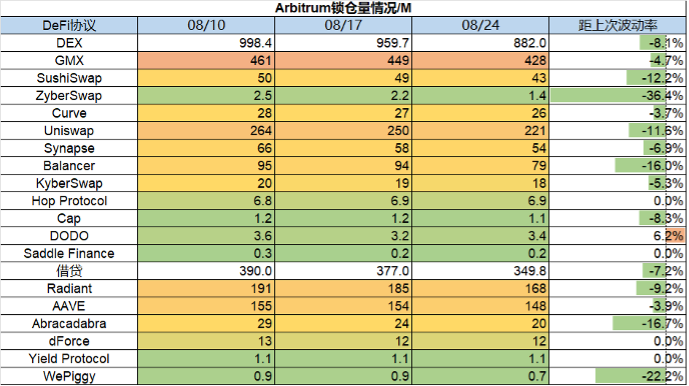

4) Arbitrum lock-up amount

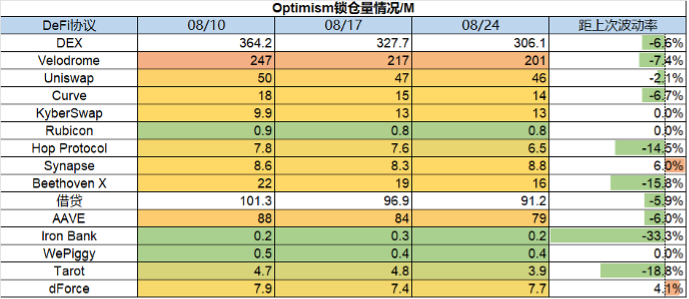

5) Optimism lock-up amount

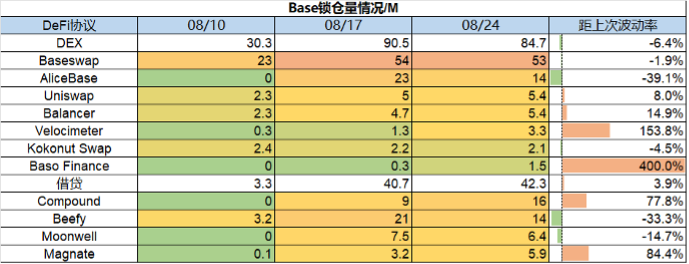

6) Base lock-up amount

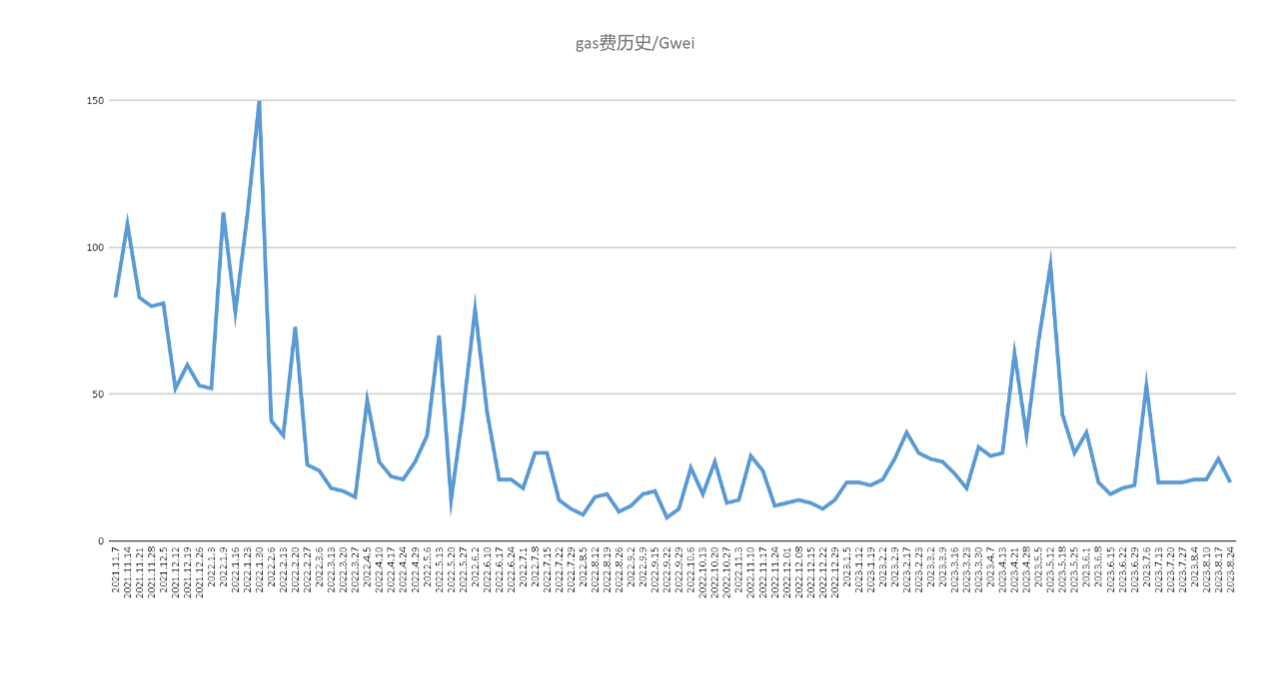

4. ETH Gas fee historical situation

Current on-chain transfer fees are approximately $1.89, Uniswap transaction fees are approximately $6.45, and Opensea transaction fees are approximately $2.5. Gas has declined this week. Gas has changed very little in recent weeks and lacks explosiveness, indicating an extreme lack of activity in the market. In terms of gas consumption, Uniswap occupies the top position.

Current on-chain transfer fees are approximately $1.89, Uniswap transaction fees are approximately $6.45, and Opensea transaction fees are approximately $2.5. Gas has declined this week. Gas has changed very little in recent weeks and lacks explosiveness, indicating an extreme lack of activity in the market. In terms of gas consumption, Uniswap occupies the top position.

5. Changes in NFT market data

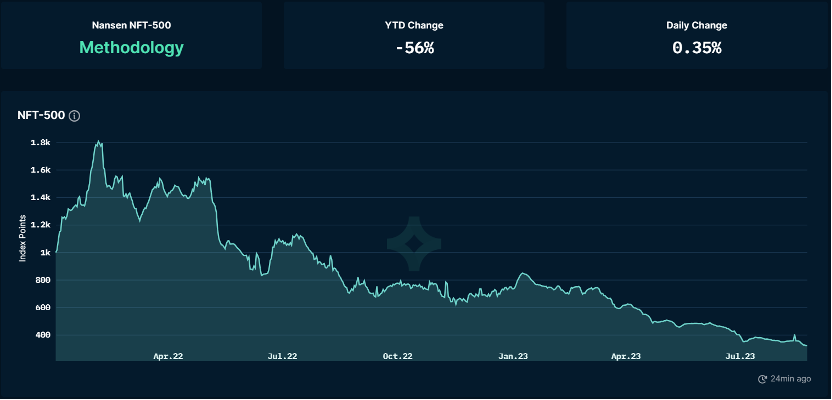

1) NFT-500 Index:

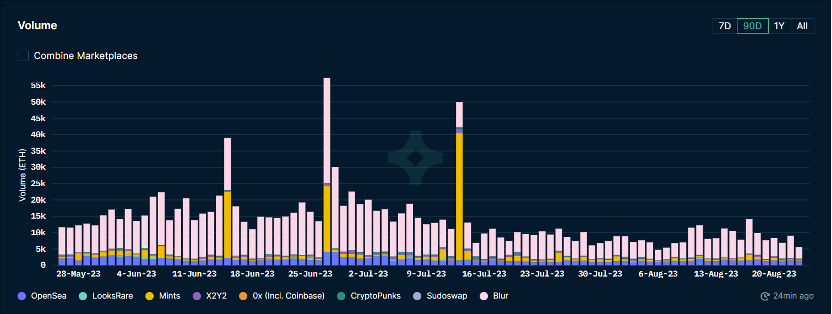

2) NFT market conditions:

3) NFT trading market share:

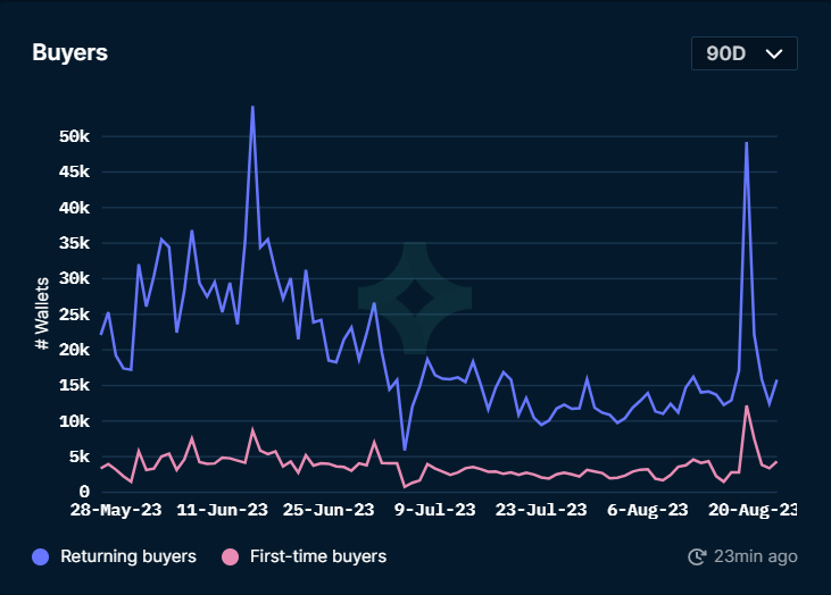

4) NFT buyer analysis:

This week, the leading blue-chip projects still experienced a substantial price drop, with the decline ranging from 15% to 25%. Degod has seen a substantial increase in transaction volume in the short term, but judging from the transaction situation, it should also be a large-scale shipment. As a result, the price fell by more than 50% within two weeks. The total market value of the entire NFT market fell further, and the market atmosphere was pessimistic.

Latest financing status of the project

About Foresight Ventures

Foresight Ventures is betting on the innovation process of cryptocurrency in the next few decades. It manages multiple funds: VC funds, secondary active management funds, multi-strategy FOF, and special purpose S fund Foresight Secondary Fund l. The total asset management scale exceeds 4 One hundred million U.S. dollars. Foresight Ventures adheres to the concept of Unique, Independent, Aggressive, Long-term and provides extensive support for projects through strong ecological power. Its team comes from senior people from top financial and technology companies including Sequoia China, CICC, Google, Bitmain and other top financial and technology companies.

Welcome to Odaily Official Community

Telegram subscription group:https://t.me/Odaily_News

Telegram communication group:https://t.me/Odaily_CryptoPunk

Official Twitter account:https://twitter.com/OdailyChina