IOSG Ventures: Panoramic scan of the track for on-chain data tools

Author: Wendy, IOSG Ventures

TL, DR;

The characteristics of on-chain data make on-chain data analysis tools a strong demand. This article divides the existing products in the market into data-led or transaction-led types according to different focuses;

Data Kanban products are seriously involved, and differentiated competition is needed; automated trading tools are highly popular, and risks need to be paid attention to. The requirements of the two types of products are different, and the functions overlap but will not be completely replaced;

The commercialization of data products is an issue worthy of careful discussion. This article briefly describes the advantages and disadvantages of commercialization with or without tokens. For more detailed further discussion, see the next article;

The possible future development directions of on-chain tools include the development of socialfi and communities, personalized recommendations based on user portraits, and the combination with AI.

foreword

Whether it is web2 or web3, data is always a resource similar to oil in the information age, and it is also a place where multiple participants dig gold and must contend. On-chain Alpha refers to profitable and valuable information on the blockchain that has not been widely disseminated and discovered. Through the analysis of on-chain data, the time difference of market lag can be used to obtain excess return Alpha. The decentralized characteristics of the blockchain make the data on the chain a public treasure. However, with the enrichment and improvement of the multi-chain ecology, the diversification of the ecology on the chain such as NFT, Gamefi and Socialfi, while the Alpha content on the chain increases, from The difficulty of capturing Alpha on the chain has also increased, and the technical capabilities of ordinary users are difficult to achieve. Therefore, ordinary users with non-technical backgrounds have a great demand for tools to analyze data on the chain.

As for the data on the chain, its unique following characteristics make data tool products play an irreplaceable important role:

Information is open and transparent, and data owners on the chain can check and verify. For the project party and investors, it is both an opportunity and a challenge, and they complement each other, and a rising tide lifts all boats. For the project side, products need to be differentiated and competitive; for investors, it is necessary to continuously improve their ability to use tools and analysis.

The timeliness of information is high, and the update speed is fast, 24 hours without interruption. The timeliness of data on the chain is obvious, and trading opportunities are often fleeting; and compared with traditional financial data disclosure, the time it takes for data to be uploaded to the chain is almost negligible, and new on-chain behavior records are generated around the clock.

Information has multiple dimensions, multiple sources, and strong heterogeneity. The data on the chain not only includes transaction operations, but also various behaviors such as authorization and pledge, as well as cross-chain flow of funds.

The technical threshold is high. Most users have no knowledge about the setting of Gas fees and the underlying principles of blocks such as MEV. Under the premise of obtaining information, there is still a way for the Dark Forest on the chain to transform the information into actual operations and profits. Therefore, some automated tools give ordinary The magic of scientists on the player chain.

This article initially divides on-chain data analysis tools into two major categories: data-oriented and transaction-oriented according to the dimensions in the figure below (that is, whether the end-users are distinguished by data or transaction behavior), but many tools are actually both data and transaction tools. of.

data-oriented

Overall Market Data Kanban

Similar to the role of financial terminals such as Bloomberg in traditional finance, this type of tool is intended to provide users with an overall perspective of observing and monitoring the market, generally focusing on overall data on chains, protocols and currencies. In the early days of blockchain, the indicators for data analysis were relatively simple, such as token price, number of currency holding addresses, currency holding time, transaction records and other basic indicators. Later, with the rise of the Defi protocol and the development of various subdivisions such as NFT and gamefi, the dimensions of data have been greatly enriched. Defi protocols commonly use TVL, Marketcap, 24 h volume, token holding distribution, and token unlocking. Release visualization, NFT rarity ranking, floor price distribution, etc. Tokenterminal also provides indicators such as revenue fees and estimated price-to-sales ratio and price-to-earnings ratio. Because it has little to do with short-term trading, the data delay time is relatively long, while the data delay of platforms such as Nansen is at the minute level.

DeFiLlama User Interface

The involution of data products is relatively serious, so most teams are also seeking breakthroughs in differentiated competition:

Comprehensive research report output: Nansen and Messari output a lot of research reports. There are usually analysts in the data product team responsible for interpreting some data indicators, and research reports are usually included as part of their products.

Focus on vertical segments: NFTSCAN focuses on multi-chain NFT market data, and L2 Beat aggregates and visualizes various Layer 2 data.

SQL query tools: Products such as Dune Analytics and Bitquery provide user-defined SQL query statement functions, making the products more personalized, but there are relatively certain technical thresholds.

Enterprise solutions: The main business model of data products such as Chainanalysis and Amberdata is to provide complete blockchain data solutions to B-end users. The main users include exchanges and traditional financial institutions.

In addition, there are products like Crypto Bubbles that focus on visualization, as well as DexCheck, KaitoAI, etc. combined with AI. Generally speaking, market data billboard products are the most common and most frequently used on-chain data analysis tools. The functional focus of each product is different, but the overall competition is fierce.

The analysis of projects such as Nansen can be found in the previous article of IOSG: https://mp.weixin.qq.com/s/ o 1 pO 7 unj 3 cUS 9 sWt 4 q_gBw.

Address dimension analysis

In addition to providing data support from the scale of the overall market, another main analysis angle of on-chain data tool products is from the address. Products focusing on address dimension analysis mainly include the following categories:

Blockchain browsers represented by Etherscan, as underlying applications, can view various interactive activities of a single address, as well as gas consumption on the chain, etc.

Analysis platforms such as Debank can view the position, profit and loss, and transaction records of a single address. Bubblemaps visualizes the connection between addresses, allowing users to more intuitively discover the connection between addresses and the flow of funds. Nansen is also known for this type of analysis. Smart Money tracking can be used to track smart money, increase the possibility of profit by observing its trading behavior or following its transactions.

transaction oriented

With the recent popularity of telegram bot tools such as Unibot and Maestro, the token prices and TVL of many bot products have increased nearly tenfold in recent weeks, which is particularly prominent in the bear market. Telegram is a chat software with 700 million monthly active users. It can provide rich APIs for developers to easily and quickly access applets. Compared with data terminal products, transaction-oriented tools also cover the user-side operation process, which is extremely convenient for users, reducing the complexity and uncertainty from data analysis to transactions, but also increasing security. Risk and cost of capital (the cost of the transaction itself and the cost of using the instrument).

TVL changes for multiple Telegram projects

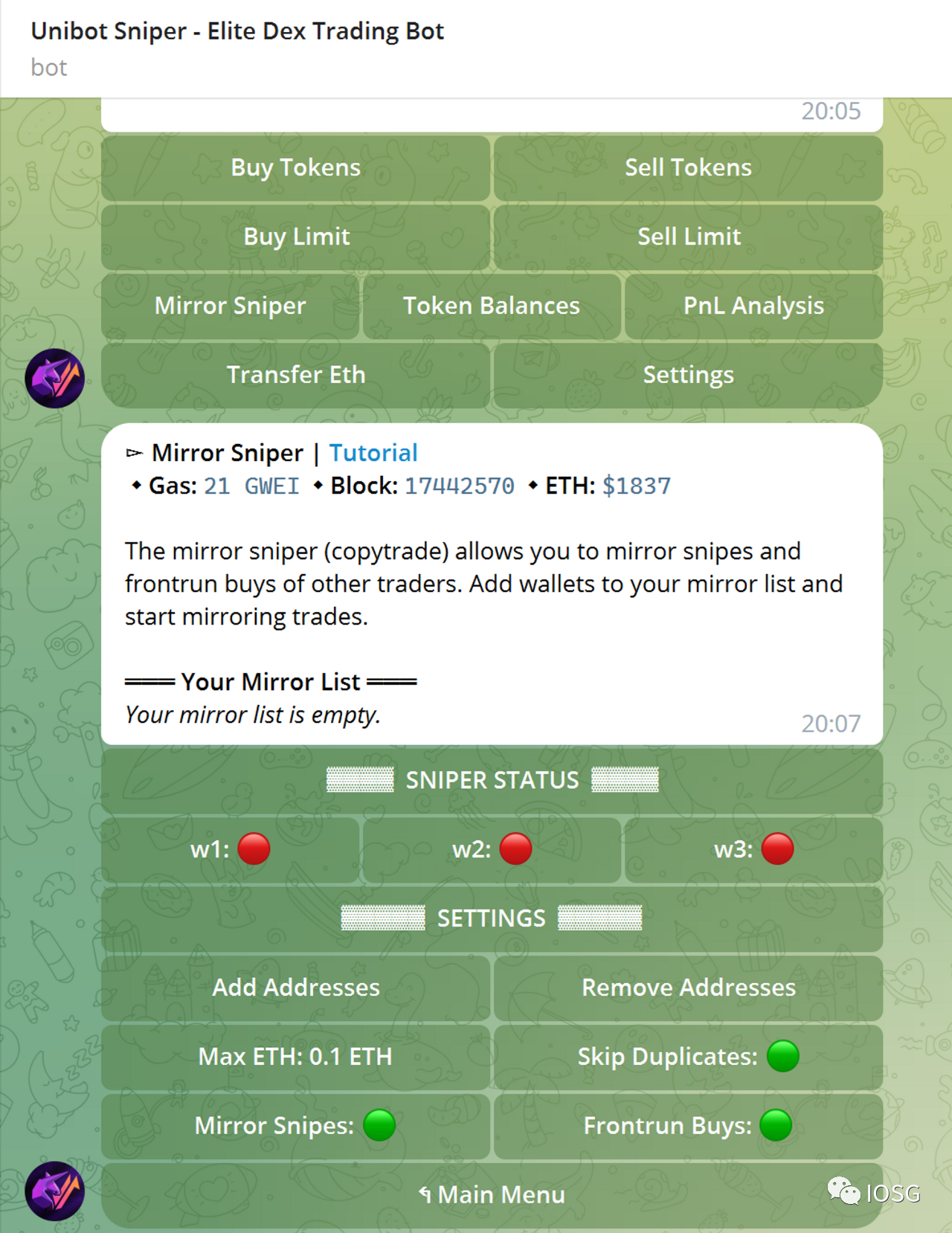

These automated trading tools will use the wallet address created by the agent to conduct transactions or interactive operations based on real-time data on the chain, or push on-chain intelligence information to email, Discord or Telegram in real time; there is also a type of automated trading tools that are farming-oriented and will Perform specified interactions in a random form in order to obtain airdrop rewards from the project party or perform some programmatic arbitrage. Taking Unibot and Maestro as examples, the functions of common on-chain automated trading tools include:

Limit order buying and selling: Similar to centralized exchanges, automated trading tools support limit orders for specific prices and quantities of tokens.

Copying: You can copy the transactions of a specified address. It is generally used to imitate the operations of smart money with a higher winning rate. It provides novices and passive investors with a way to profit from the crypto market with less effort.

Alert: You can set up push notifications for trends on a specific address chain, such as transfer transactions greater than a specified transaction amount, and real-time scanning of new token contract deployments on the chain.

Simulated trading: Simulate the profit and loss of a transaction before the actual transaction, such as whether it is possible that the transaction will fail or suffer a loss due to the setting of gas fees or slippage.

Private transactions (private transactions): avoid being attacked by frontrunners and sandwiches, thereby reducing potential losses.

farming: Randomly interact with projects, simulate users on-chain behavior in new projects, and increase the possibility of getting token airdrops.

Unibot Sniper feature list

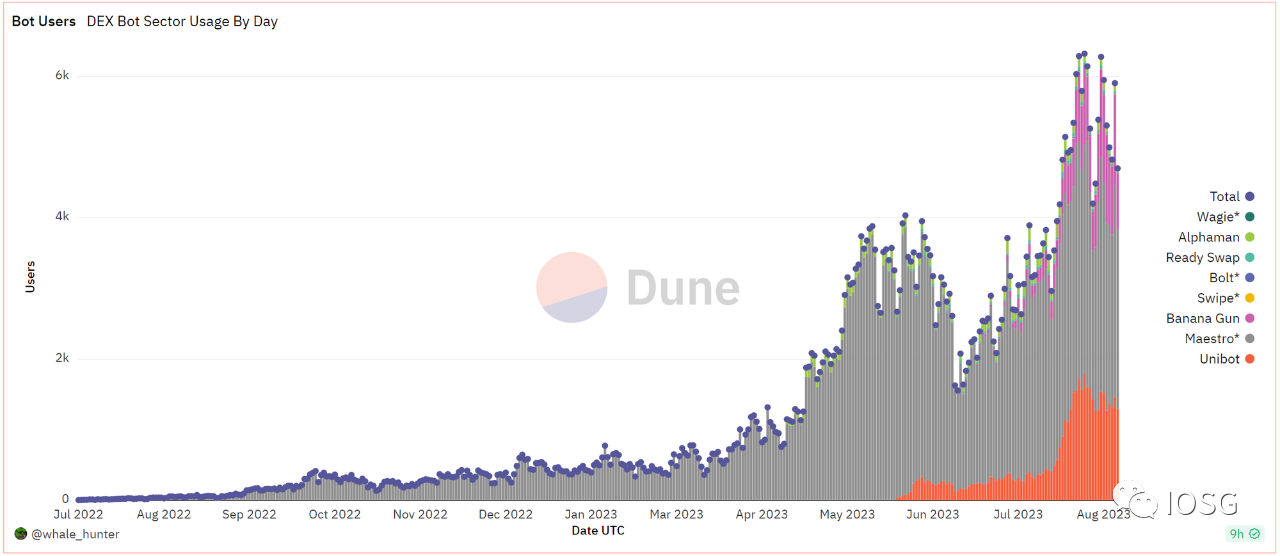

The number of users of automated trading tools has increased rapidly recently. The number of telegram bot users trading on the chain has recently approached 6,000 per day. Most of the users come from the long-running Maestro and the rising star Unibot, which account for 80% of the dex telegram bot. % or more of user share.

Number of bot users on Telegram chain

However, through the rise in token prices and the attention bubbles brought about by the rotation of hot spots in the market, the real demand behind it is worth careful scrutiny. The two most mainstream functions of Telegram bot - information push and copy trading are not new needs. In fact, there are already many centralized exchanges and relatively mature products (as shown below). The competition of Telegram bot compared to such products The power is obviously weak; therefore, the overall base of degen players in the encryption field is not large, and they can choose automated trading platforms with safer features and more comprehensive functions. Therefore, the author predicts that there will be fewer senior players in the user portraits of automated trading robots based on Telegram, and most people will It just uses the information push function; but from another optimistic point of view, Telegram, a social software with huge user traffic and encryption-friendly, combined with a simple and user-friendly bot, may become the new user of Web3 onboard. One of the traffic entrances.

Documentary platform products

Another product type that overlaps or is more related to automated trading tools is decentralized trading platforms such as Dexscreener and Dextools. This type of product is mainly used to check the price changes of token trading pairs in real time. It generally integrates dex swap and basic contract security functions on the front end, and will perform basic honeypot transaction tax and other detection on the contracts deployed on the chain. The Unibot team recently launched the trading terminal Unibot X, which is integrated with the DEX tracking website GeckoTerminal. Users can directly use the wallet address generated by the Telegram account to log in to the Unibot Smart money deals and more. It is foreseeable that DEX and Bot on the trading side may have closer connections and interactions in the future, thereby improving and enriching the user experience of decentralized trading. Although automated trading tools have greatly enhanced the technical capabilities of ordinary users, it is worth noting that such tools generally carry huge centralization risks. The wallet addresses of most automated trading tools are generated by the tool, and their private keys are completely exposed to the project side. As the famous saying in the encryption world says, Not your key, not your money. If users want to use automated trading tools, they can only Transfer funds to the address that the project party has control authority, and at this time, you are completely on the weak side in the risk game.

The value logic of the data tool track

Advantages and Disadvantages of Business Models for Data Tools

In the entire Web3 field, compared to some products in emerging segments where it is difficult to prove actual demand, although the business logic of this tool product does not sound like a high ceiling and room for imagination for new narratives, its market demand is more grounded and real. . The business model of data tools is relatively mature, similar to the logic of web2 data companies, and has been successfully verified many times in the web2 field. Some tool projects have relatively stable cash flow income even if they do not issue their own tokens.

For projects that do not raise funds or collect taxes through tokens, the projects income sources include:

Users pay for C-side tools: Similar to Web2 SaaS, basic functions can be used for free, advanced functions require payment, or free services have a certain quota or quantity limit, such as only 10 addresses can be tracked. Charges for the C-side can generally be divided into two types, buyout and subscription: buyout is similar to a lifetime membership, and subscription refers to monthly/quarterly or annual;

B-side charges: packaging APIs or developing data systems, etc. Charges for developers and enterprises have also proved to be an effective monetization logic. For example, The Graph provides API services to several well-known defi/Gamefi projects, and Debank also has such services;

Advertising revenue: After the number of users reaches a certain level, the project party can monetize the traffic by placing advertisements.

Judging from the characteristics of on-chain data and current products, the on-chain data tool track is undoubtedly a track with certain opportunities and is destined to be a fiercely competitive track. This type of product requires a certain investment in infrastructure and equipment in the early stage. The disclosure and availability of data also make the data analysis tools on the Web3 chain lose their moat in terms of data sources. For example, the competition among market data billboard products has become very fierce. The newly launched Arkham has made some similar functions of Nansen free of charge, which will inevitably have an impact on paid tools. However, due to the complexity of the data field, whether it is an all-in-one comprehensive platform , or seize the subdivisions to make small and refined products, and it is still possible to become the leader in the vertical field. Tool products need to have faster product iteration updates and delivery capabilities, as well as the ability to mine more valuable indicators in massive data, provide more complete functions, and better help users improve the possibility of trading profits. The competition of product homogeneity establishes its own advantages and barriers.

Analysis of Token Economic Model of Data Tool Products

There are also some debates in the industry about whether tool products need to build a token economy. The voice of opposition mainly believes that the application scenarios of data tool product tokens are limited, and it is difficult to maintain the currency price after the popularity of issuance declines. Here we take Arkham and Unibot, which have issued tokens, as examples, representing the data-side and transaction-side products mentioned above respectively, to look at the token economic model design of such products:

Not long ago, Arkham issued its own token as a data tool, which caused a lot of heat. Arkham is a comprehensive data analysis platform with multiple functions such as market Kanban, address analysis, market alerts, and intelligence rewards. The ARKM token is the native token of the Arkham Intel Exchange ecosystem, with a total circulation of 1 billion. It is distributed as follows: 50% of the treasury, 20% of investors, 20% of the team, 5% of market making, and 5% of rewards.

ARKM token holders have governance rights and can vote on the strategic direction of Arkham. In addition, ARKM tokens can also be used to reward users who contribute to the Arkham ecosystem. You can obtain ARKM rewards by submitting information, pledging ARKM tokens, building ARKM ecological projects, recommending new users, etc.

The intelligence bounty section provides a new application scenario for its economic model. The intelligence bounty is controlled by a smart contract, and a handling fee of 2.5% and 5% is required to be paid when the bounty is released and the bounty is received. You can enjoy a 20% discount when settling with ARKM, and you can enjoy up to a 50% discount when settling by locking ARKM (but you need to lock the currency for more than 30 days). Users with clue information can also initiate auctions or submit intelligence clues to the platform. Like bounties, auctions have a 15-day lock-up period before the winning bidder can withdraw from the auction smart contract, but the auction initiator can withdraw early, but A 10% fee applies. Intelligence submitted to the platform will be rewarded with ARKM tokens according to different levels. The platform’s trading information is held exclusively by buyers and will be made available to all users after 90 days. This also promotes the intelligence and continuous development of the platform.

Almost all of Arkhams data-related functions are free and open. We can see that its ecological and token applications focus on the intelligence bounty platform, and this is the most controversial function of this product. The anonymity of cryptocurrency is a feature that is highly praised by everyone, but Arkham’s intelligence platform goes in the opposite direction, marking anonymous addresses on the chain with entities off the chain.

Compared with Arkhams token model, which focuses on innovative businesses, Unibots token model is more traditional and simple. Unibot is an automated trading robot based on Telegram. It is currently only deployed on Ethereum, with an FDV of US$176 million. It provides token exchange, limit orders, copy trading, private trading, liquidity provision and other functions. Users do not need any coding foundation. Trading orders can be placed only through the Telegram chat box. The wallet address can be generated by Unibot, or import your own private key (more risky).

As the leading project in the automated trading tool track, Unibots revenue has exceeded 4,000 ETH, mainly from tool fees and token transaction taxes. The token has a shared revenue function, and you must hold 10 $UNIBOT tokens to have it. qualifications. Rewards are proportional to the number of tokens held. Token holders will receive 40% of transaction fees on the utility platform and a transaction tax on UNIBOT token transactions (1% of the total amount). Rewards are calculated every 2 hours and can be claimed within 24 hours. If more than 200 tokens are transferred every 2 hours, the revenue share will be forfeited. The huge increase in currency prices has aroused FOMO emotions and attention in the market, resulting in a rapid growth of new users, and the entire automated trading tool track has also ushered in a rise.

A major risk of Arkhams economic model is its focus on innovative businesses, while the risk of Unibot tokens is mainly the unsustainability of currency price growth at this stage. By analyzing its revenue structure, it can be seen that 80% of its rapidly growing revenue % The transaction tax derived from tokens relies heavily on market popularity and the entry of new users. Once market popularity and transaction volume begin to decline, it is easy to suffer from the Davis double kill caused by both volume and price falling.

It can be seen that the debate on the token model of the tool track is not groundless. How to enrich the ecology and expand the application scenarios of tokens are issues that should be considered when designing economic models. There should also be a balance between short-term and long-term interests. Although the short-term wealth creation effect will greatly promote user growth, in the long run, a more sustainable construction direction should be found.

Possible future development directions

Integrate with Socialfi

We know that the basic condition for social networking is that enough users need to participate. The problem Socialfi has been facing is how to onboard more users and user retention. Even the threads launched by meta have poor user stickiness under the condition of strong binding with Instagram. The daily active users of Threads have decreased by 20% in the second week after its launch, and the average usage time of users has also dropped from 20 minutes when it was first launched. Down to less than 5 minutes. The current main social and UGC platforms of Web3 are web2 applications such as Twitter and Discord, which lack native Web3 social media. Users of the data platform have common interests and the density of information is relatively large, so it has certain potential to serve as the basis of socialfi. xueqiu futu The difficulty of data-driven social interaction.

Debanks Stream function is a reflection of the attempt to develop towards socialfi. Using the wallet address as the account can provide more verifiable information. Kols point of view is more convincing and will help promote the development of the field in a more transparent and trustworthy direction. Users also It is an ideal form of creator economy to reward valuable information.

We know that the basic condition for social networking is that enough users need to participate. The problem Socialfi has been facing is how to onboard more users and user retention. Even the threads launched by meta have poor user stickiness under the condition of strong binding with Instagram. The daily active users of Threads have decreased by 20% in the second week after its launch, and the average usage time of users has also dropped from 20 minutes when it was first launched. Down to less than 5 minutes. The current main social and UGC platforms of Web3 are web2 applications such as Twitter and Discord, which lack native Web3 social media. Users of the data platform have common interests and the density of information is relatively large, so it has certain potential to serve as the basis of socialfi. xueqiu futu The difficulty of data-driven social interaction.

personalized recommendation

The openness and transparency of data on the chain make it more logical to analyze personal behavior and preferences. Currently, Web3s personalized recommendation algorithm and engine are still in their infancy, and with the enrichment of multi-chain ecology and applications, the dimensions of user portraits will also increase.

If we use the top products of web2 as a comparison, the recommendation algorithm is already a very mature technology. Taobao, Douyin, Meituan, and Bilibili will all push products or videos that you may like. Nowadays, neither data products like dune nor trading markets like opensea can achieve personalized recommendations. As the amount of data increases, the accuracy of recommendations will also enter the positive feedback flywheel, and the data opened up by the blockchain Features will make the recommendation accuracy even better than web2. And with data sovereignty, it is possible to choose and fine-tune your own personalized model. Similar to the recommendations in multiple areas of food, clothing, housing and transportation in web2, social networking, transactions, and games in web3 also have their own application scenarios, and the recommendation algorithm can be like Lego blocks Generally spliced into different fields.

Combined with AI

The openness and transparency of data on the chain make it more logical to analyze personal behavior and preferences. Currently, Web3s personalized recommendation algorithm and engine are still in their infancy, and with the enrichment of multi-chain ecology and applications, the dimensions of user portraits will also increase.

If we use the top products of web2 as a comparison, the recommendation algorithm is already a very mature technology. Taobao, Douyin, Meituan, and Bilibili will all push products or videos that you may like. Nowadays, neither data products like dune nor trading markets like opensea can achieve personalized recommendations. As the amount of data increases, the accuracy of recommendations will also enter the positive feedback flywheel, and the data opened up by the blockchain Features will make the recommendation accuracy even better than web2. And with data sovereignty, it is possible to choose and fine-tune your own personalized model. Similar to the recommendations in multiple areas of food, clothing, housing and transportation in web2, social networking, transactions, and games in web3 also have their own application scenarios, and the recommendation algorithm can be like Lego blocks Generally spliced into different fields.

Summarize

This article analyzes and summarizes on-chain data tools from three parts: product type, business model and future development direction, hoping to give more inspiration and thinking to practitioners, institutions and individual investors in this field. Today, the Web3 industry is still in the early stage of exploration, but the data track has already produced several well-known unicorns with a valuation of one billion US dollars. From Defi Summer to NFT Summer, to Layer 2 Summer or Gamefi Summer that may appear in the future, from infra to applications, all scene judgments are inseparable from the use and support of on-chain data analysis tools. Every address and every Pen interaction has built a sea of stars in the decentralized world, and this highly potential track will also become one of the most important anchor points. In this data-native industry, we are still looking forward to the Alpha magic of on-chain data.

Due to space limitations, we will continue to discuss the specific practice of commercializing data products in the next article.

Reference

1. https://research.binance.com/en/analysis/crypto-data-tools-what-you-need-to-know

2.https://www.panewslab.com/zh/articledetails/h2sy0u17.html

3.https://mp.weixin.qq.com/s/- gppAenLC 5 c 71 Kninyqwrw

4.https://twitter.com/hc_capital/status/1679160372635533315

5.https://assets-global.website-files.com/ 62879326 fd 745 f 7489 b 43224 / 64 abc 4471879916 bc 4 e 2 aeb 0 _Arkham_Whitepaper_FINAL .pdf

6.https://research.binance.com/static/pdf/telegram-bots-exploring-the-landscape.pdf