Detailed Explanation of the Full Chain LSD Pair Entangle and Tenet: Can they Activate the Cosmos Ecosystem?

Original title: Brand New Track: The Full-Chain LSD Duo of Cosmos

Original author: yyy

I. Introduction

Cosmos is dead - Fud Cosmos comments have appeared frequently recently, full of disappointment, sadness and unwillingness from early supporters. The performance of Cosmos in recent times is indeed shocking, and the ecosystem is like a stagnant water. As for the next phenomenal Cosmos sub-chain, how far in the future will it be?

The Cosmos ecosystem is dead, but Cosmos never seems to lack innovation.

Even under the haze of the Terra thunderstorm, famous and popular sub-chains such as Evmos and Canto were born. Since then, the Cosmos ecosystem has been silent for a long time, and no phenomenal public chain has emerged.

However, the pace of exploration and innovation of Cosmos ecosystem developers has not stopped. The project we are going to talk about in this article is based on a brand new track - full-chain LSD.

The full name of LSD is Liquid Staking Derivatives, which is liquid staking derivatives. It is a very popular track in the encryption field this year. The core of LSD is to release the liquidity of the pledged PoS assets. While obtaining the node pledge income, it can also obtain the bonus of defi income;

According to DefiLlama data, the market value of ETH’s liquid pledged assets has exceeded US$20 billion.

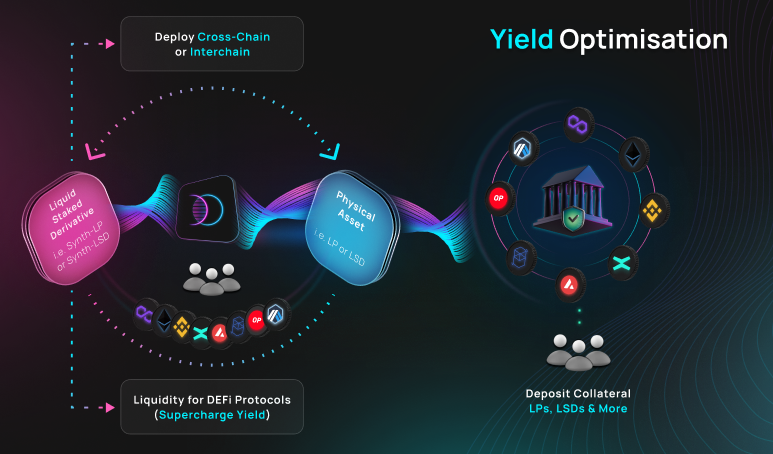

Full-chain LSD extends the form of asset empowerment to multiple chains, aiming to release the liquidity of pledged assets to a greater extent and achieve more value accumulation. It can also be simply understood as an additional layer of empowerment on the basis of LSD.

2. Full-chain LSD duo

Coincidentally, the full-chain LSD protocols Entangle Protocol and Tenet Protocol both come from the Cosmos ecosystem, and are temporarily called the full-chain LSD duo of Comos. Entangle and Tenet are both application chains built based on the Cosmos SDK and focus on the full-chain LSD scenario. Although the track positioning of the two is similar, their full-chain LSD implementation paths are quite different.

1. Entangle Protocol

Entangle is a native oracle-centric, EVM-compatible full-chain LSD application chain. Its full-chain attribute is reflected in the ability to create cross-chain LSDs that support any chain LP in other chains, thereby achieving multi-chain benefits. To give a simple example: 1 unit of AVAX/USDC LP token owned by a user on TraderJoe (DEX on Avalanche) can be mapped to 1 unit of AVAX/USDC LP liquid collateral assets (LSDs) on the Ethereum chain through Entangle.

Entangle’s core architecture

Let’s not talk about the technical implementation principles for now. Let’s first clarify why it is designed like this? To put it another way, why do LP holders bother so much with the liquidity of their own group? The reason has been mentioned above, through Entangle, one more layer of income can be obtained, that is, the income generated by LP LSD.

Let’s look at 2 examples more concretely:

Example 1:

1) Xiao Ming provides stETH/ETH liquidity on Curve Finance and obtains corresponding LP tokens;

2) Xiao Ming pledges LP through Entangle;

3) Entangle automatically puts LP tokens on Convex for pledge compound interest;

4) Entangle issues LPs LSD certificate to Xiaoming;

5) Xiao Ming deposits LP-LSD in Curvance as collateral to obtain loan income.

Example 2:

1) Xiaohong provides AVAX-USDC liquidity to TraderJoe and obtains corresponding LP tokens;

2) Xiaohong pledges LP through Entangle;

3) Entangle automatically deposits LP into TraderJoes Yield Farm Compounding;

4) Entangle issues LP-LSD on the Polygon chain to Xiaohong;

5) Xiaohong deposits LP-LSD in AAVE as collateral to obtain loan income (only assuming that AAVE does not support Entangles LP-LSD).

Through the above-mentioned method of multiple defi Lego of LSD assets, the liquidity of assets has been greatly improved, and at the same time, sticky liquidity has been brought to the agreement (to be discussed later).

1.1 Implementation mechanism

The above scenario is not difficult to understand, but the technical implementation is not so easy, involving complex issues such as price feeding of full-chain assets and anchoring of full-chain assets. How does Entangle realize the application scenario of the full chain LSD?

The core of the Entangle technology implementation mechanism is the liquid vault LV (Liquid Vaults), which deploys LVs on different chains it supports through the underlying native oracle network and the internal DEX deployed in multiple chains.

Entangle supports the casting of LSD in the LV of the B chain based on the liquidity of the A chain LV at a ratio of 1: 1. The supported basic assets include 3 major categories: LPs of mainstream DEXs (such as AVAX/ USDC LP pairs on TraderJoe), lending Assets (such as the USDC lending pool on AAVE) and liquid pledge tokens (such as stETH). The essence of the liquidity vault is to encapsulate LP and map it to other chains.

Entangle’s liquidity vault operation process

With the underlying native distributed oracle solution E-DOS (Entangle Distributed Oracle Solution), Entangle provides lower-cost full-chain asset price feeds for full-chain dApps without relying on third-party oracles.

Entangle native oracle E-DOS architecture

1.2 Viscous fluidity

The realization of LP-LSD application scenarios has brought more capital gains to users, standing on the protocol side, and also brought sticky liquidity to the protocol.

In order to attract users to provide liquidity in the initial stage of launch, many Defi projects usually adopt an aggressive token economic model (high inflation rate/fast release speed). This incentive method is unsustainable. While rapidly diluting chips, it also reduces the income of the protocol. Once LP income is lower than expected, users will withdraw liquidity, which is not sticky.

Entangles full-chain LSD infrastructure provides users with cross-chain LP empowerment, improves liquidity incentives, and increases the stickiness of liquidity to a certain extent.

2. Tenet Protocol

Entangle provides full-chain application scenarios for LP-LSD, while Tenet provides specific application scenarios for full-chain LSD (Tenet chain pledge). The former is approximately a network-like structure, while the latter is more like a convergence-like structure.

Tenet is also an EVM-compatible application chain based on the Cosmos SDK, which deeply integrates LayerZeros full-chain interoperability infrastructure to enable LSD assets to achieve chain-level empowerment.

The core of the Tenet full-chain LSD implementation is based on its innovative consensus mechanism - DiPoS (Diversified Proof of Stake). Simply put, users will no longer be limited to protecting the network by pledging the native token $TENET as a verifier/delegator, Applicable to LSD assets across the entire chain.

2.1 Supported LSD asset classes

Tenet supports a basket of assets as pledge assets for its DiPoS consensus, such as stETH and rETH issued by liquid pledge agreements such as Lido and RocketPool; it also supports LSD issued by CEX, such as cbETH and wBETH issued by Coinbase and Binance.

In addition, users can directly pledge PoS assets through Tenets internal liquid pledge module without paying any management fees (Note: Lido, etc. charge a 10% management fee). The first batch of PoS tokens that support liquid pledge include ETH, ATOM, BNB, MATIC, ADA and DOT, and more PoS assets will be gradually supported in the future.

In this way, PoS asset pledgers can obtain Tenets block rewards and transaction fees while obtaining native network consensus rewards. This method of cross-chain staking of assets makes the connection between different chains closer, and realizes the positive effect of mutual benefit and win-win - LSD pledgers obtain higher returns, and Tenet obtains higher network security based on DiPoS.

3. Dream linkage

Although Entangle and Tenet both belong to the full-chain LSD application chain and are both rooted in the Cosmos ecosystem, the relationship between the two seems to be more of cooperation than competition.

The core focus of Entangle is LP-LSD, which is to provide cross-chain LSD services for LP assets; the focus of Tenet is DiPoS, which supports diversified LSD assets to participate in the pledge consensus. Just imagine, if Tenet can support Entangles LP-LSD as the pledge asset of the DiPoS consensus in the future, LP-LSD will receive additional rewards from Tenet, and Tenet will obtain the security guarantee of LP-LSD pledge. This is a real dream linkage.

4. Postscript

LSD Summer brought several waves of craze to defi, while full-chain LSD didn’t get much attention from the market. As a brand new track, full chain LSD is brewing before the explosion or dies in the cradle, time will tell everything.

For Cosmos, the most powerful response to Cosmos is dead is the truly phenomenal Cosmos sub-chain. The full-chain LSD track seems to have a chance to become this breakthrough.