YGG skyrocketed, comparing the treasuries and market values of three cryptocurrency guilds at a glance

Original author: 0 xscarlettw, Investment Manager @Mint Ventures

Summary:

YGG: Almost entirely YGG, with less than 4% in liquid assets;

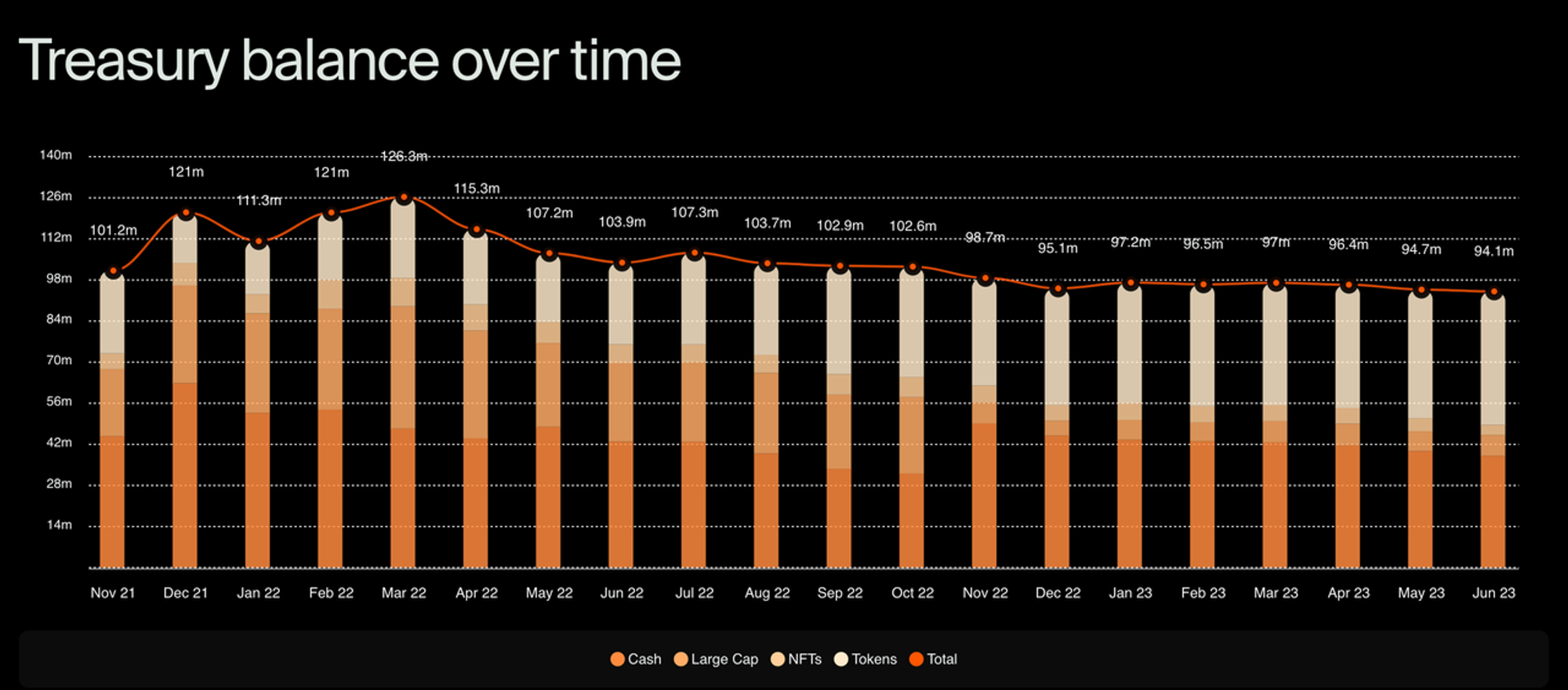

Merit Circle Treasury is balanced the best, with stablecoins + blue-chip, almost evenly split with NFT and other gaming assets;

GuildFi Treasury: Ethereum believers, 1/4 LSD stable income + 9% U+ almost half GF.

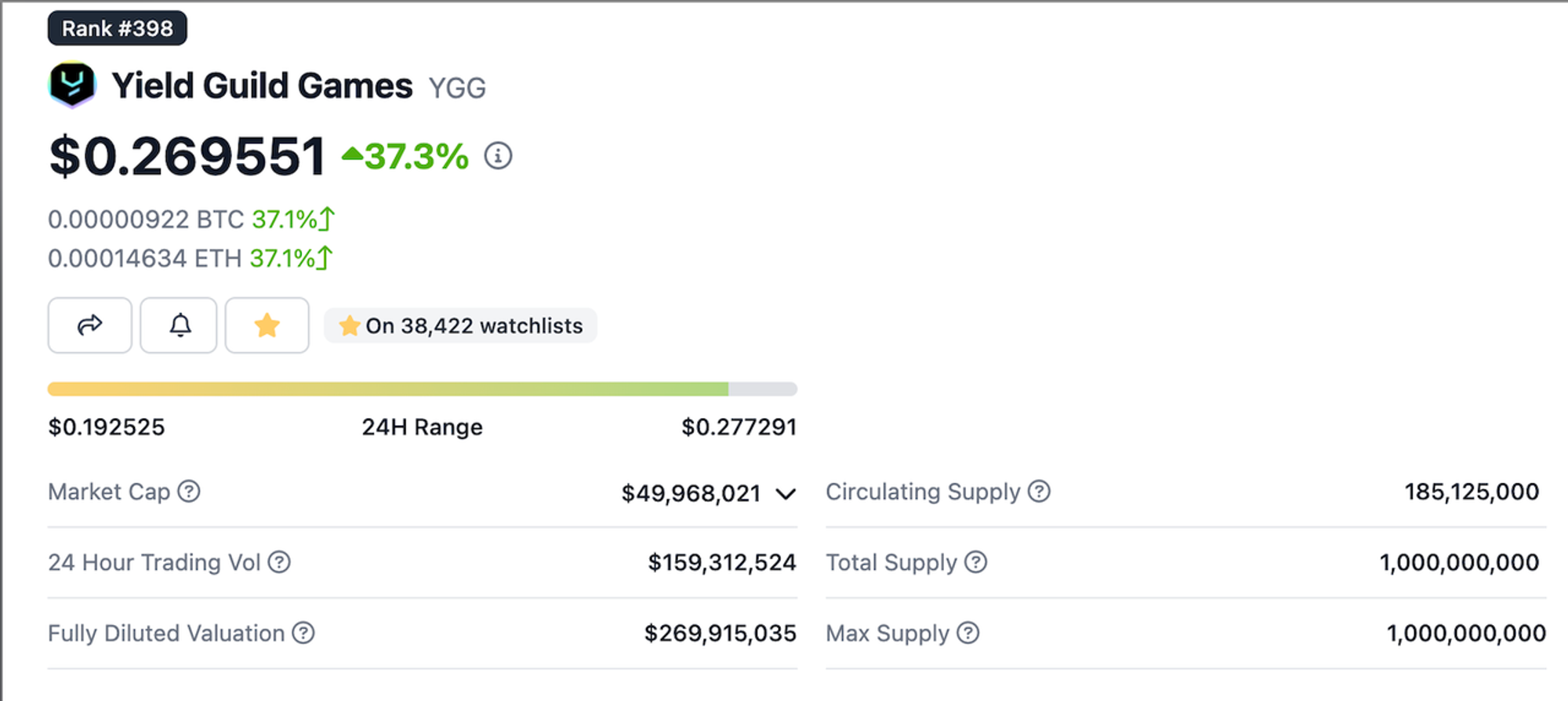

YGG: Almost entirely YGG, with less than 4% in liquid assets

FDV 269 M, mcap 49 M.

Treasury situation: 203 M YGG, 6.3 M USDT, the rest is negligible.

Market liquidity: The liquidity is particularly good today, with trading volume in the hundreds of millions, but a few months ago it had already shrunk to a few million.

Review: A large part of the market value of YGG should be attributed to its brand value, primary investment, and user base. If we look at the treasury, the funds are quite imbalanced... (6.3 M stable coins, YGG worth 203 M, FDV 270 M, and mCap 49 M). It's possible that Arkham hasn't labeled some of the wallets.

I haven't seen a good summary of YGG's primary investment, but I'll work on it when I have time.

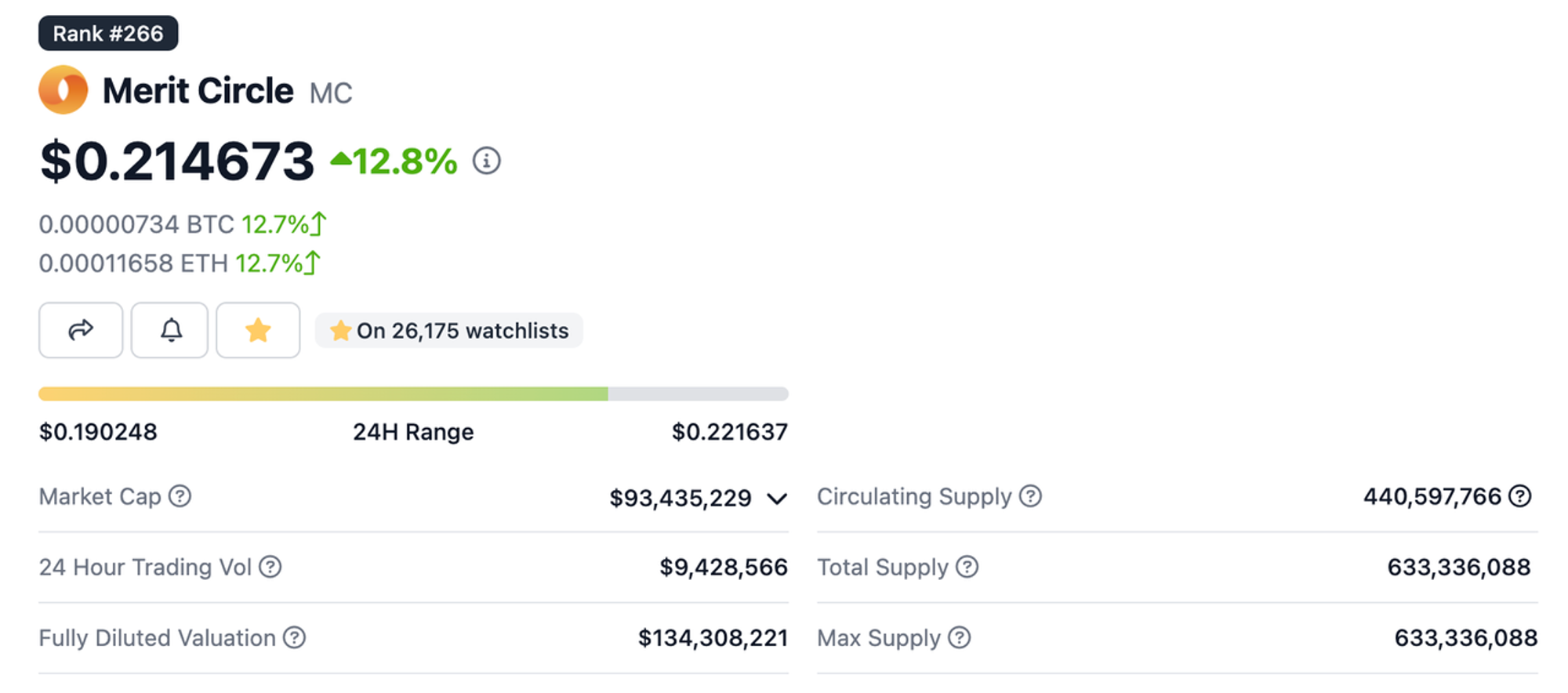

Merit Circle has the best-balanced treasury, with stable coins and blue-chip assets making up almost half of it, along with NFTs and other gaming assets.

Coingecko: FDV 134 M, mCap 93 M (mCap is almost equal to the treasury amount).

Treasury breakdown: 38 M USDT/USDC, 7 M blue-chip assets (wBTC, uni, weth, etc.), 3 M NFTs, 45 M other gaming tokens.

Review: MC seems to have the most stable distribution of treasury funds, with the highest proportion of stable coins (40%), evenly distributed blue-chip assets, NFTs, primaries (45%), and tradable gaming tokens (3.9%). Most importantly, its MC/FDV is about 60%, without significant selling pressure like YGG (which is less than 20%).

The MC value within the treasury is 0.3 M (0.31%), making it one of the least concentrated tokens in terms of selling pressure.

The current market valuation (mCap) is in line with MC's own valuation of its treasury. However, due to the discounted prices of primary games in the current market, the actual value may be slightly lower.

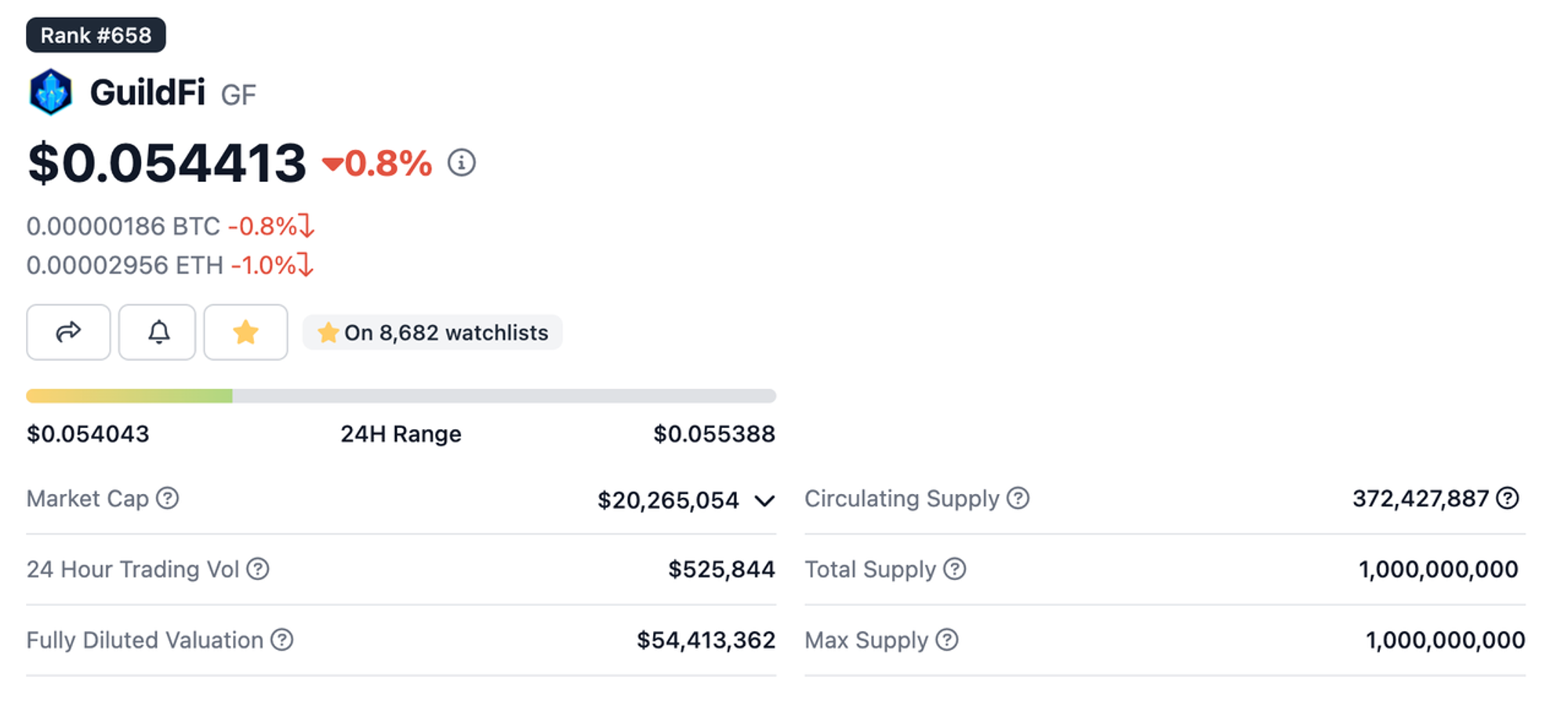

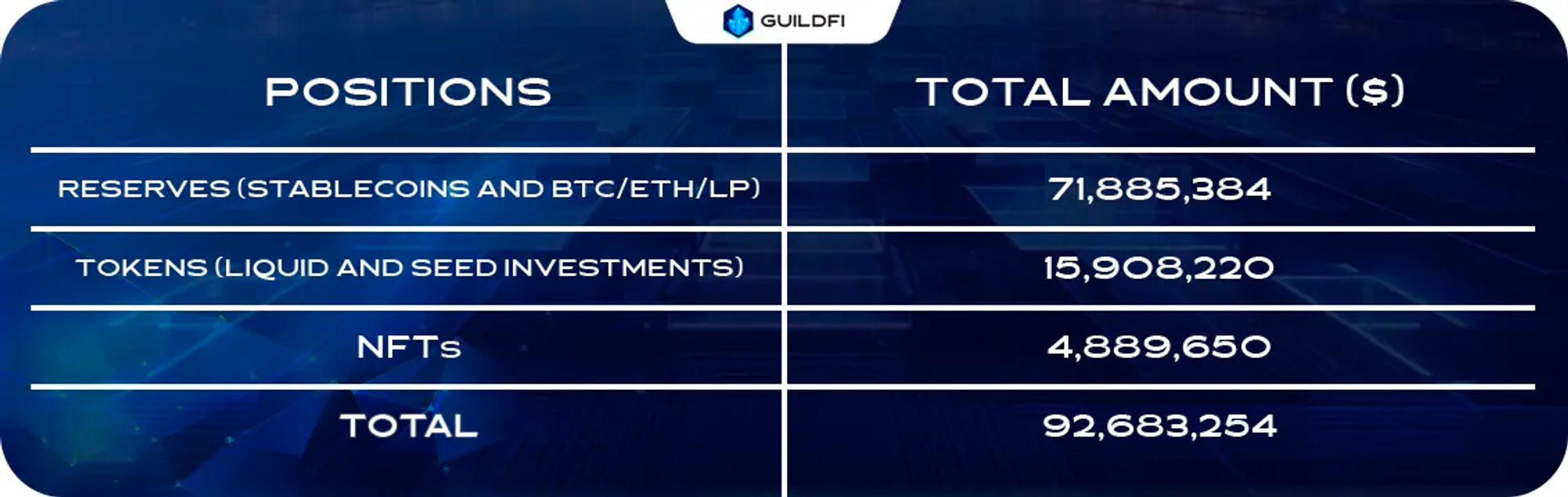

GuildFi Treasury: Ethereum believers, 1/4 LSD steady income + 9% U+ most of GF

Treasury status (on-chain) (public medium): 41 M GF, 23 M stETH, 8.7 M USDT/USDC

Review: 1/4 to LSD is quite interesting, Ethereum believers.jpg

Medium doesn't talk much about most of its liquid assets, which are its GF, lmao, but the market cap also shows that the market still values it to some extent. However, the market cap is still a bit underestimated compared to stables+stETH.