Weekly Editors Picks Weekly Editors Picks (0819-0825)

Weekly Editors Picks is a functional column of Odaily. In addition to covering a large amount of real-time information every week, it also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news and pass you by.

Therefore, our editorial department will select some high-quality articles worth spending time to read and collect from the content published in the past 7 days every Saturday. From the perspectives of data analysis, industry judgment, opinion output, etc., we will provide those in the encryption world with You bring new inspiration.

Now, come and read with us:

Investment and Entrepreneurship

X-explore: In-depth study of the behavior patterns of airdrop masters. What can we learn from them?

The author has screened out 5 projects with received airdrop addresses exceeding 100,000 and total airdrop value exceeding US$140 million. They are Uniswap, ENS, Optimism, Blur and Arbitrum, in order to find airdrop masters and their subsequent targets. .

The trading volume of airdrop hunters on both DEX and NFT far exceeds that of ordinary users, and most of them are early users of Ethereum. And a good airdrop rule design can play a positive role in airdrop hunters. Most hunters tend to choose projects that have wide influence and popularity in their fields, with a clear preference for Layer 2 projects. Their next goals might be:

DeFi:Uniswap、 SushiSwap、0x、Metamask Swap、 Balancer、 1inch 、 Paraswap、 Aave、 Rarible、InstaDApp、dydx、 Compound;

NFT:Opensea、Blur、 LooksRare , X2Y2 ,Foundation;

Layer 2 solutions and cross-chain protocols: Arbitrum, Polygon, ZkSync lite, Optimism, HOP, ZkSync Era, Starknet;

DApp:DeBank。

If BNB holders do not participate in the Binance Launchpool every issue starting from 2021 and exchange the tokens they receive for BNB, the number of BNB will increase by approximately 13.87%. At the same time, one of Binances financial products, the BNB income pool, also has an annualized income of about 0.5%. It will help users automatically invest money into Launchpool. While enjoying 0.5% of the fixed income, there will also be additional launchpool income. The total over three years is 13.87% + 1.5% = 15.37%.

Compared with the Binance Launchpad project, there is no need to spend money to participate in the Binance Launchpool, so it is more preferable to users who already hold BNB and some stablecoins for various reasons. Buying at the close of the first day and selling on the next day may be the optimal solution for Binance Launchpool. The Binance Launchpool project may also need to judge the trend of BTC. Binance Launchpool is a stable financial lottery for BNB holders. Binance is leveraging its industry standing and influence to empower BNB holders.

Under the bear market, venture capitals interest in cryptocurrencies has slowed significantly. 10 T Holdings (10 T), a well-known crypto investment institution with three funds under its management, is currently out of ammunition and manages US$1.2 billion. Asset institutions can only wait for the next round of bull market or the further opening to the IPO of crypto institutions. The two founders behind them are raising funds for their newly launched funds, and both will continue to focus on the encryption industry.

Portfolio representative

The demographic dividend unleashes the growth potential of Vietnams encryption market, and the adoption rate of encryption has ranked first for two consecutive years. Vietnam has a high mobile Internet penetration rate, and the cost for users to learn Web3 is relatively low. At present, the Vietnamese government does not have a clear regulatory legal framework for cryptocurrencies, so the transaction of such assets is still in a gray area.

The mainstream international exchanges that have early deployed in Vietnam include: Binance’s C2C supports the use of Vietnamese Dong (VND) credit cards to buy and sell crypto assets, OKX supports Vietnamese users to trade with VND, MEXC is famous for its wide variety of assets in Vietnam, and Bybit’s Vietnam market transaction volume will grow in 2022 Huobi has quietly cultivated in the Vietnamese market, and BingX has gained a firm foothold locally through cooperation with Vietnamese community KOLs. Most of the Vietnamese local trading platforms are OTC, such as the peer-to-peer trading platform Remitano, and the Vietnamese OTC trading platform BitcoinVN. The crypto trading pattern in Vietnam is: Overseas platforms dominate, and users prefer large exchanges with high security. In Vietnam, Binance has the largest market share, followed by platforms such as Bybit, OKX, MEXC and local Remitano.

Entering Vietnam is still a good opportunity, and the operation strategy needs to be adapted to local conditions.

In-depth Analysis: How the Blockchain Data Tool Dune Rise Rapidly

The amazing thing about Dune is that they dont use common methods in Web3, such as airdrops, pay to follow community growth, and using their own tokens for earning models (they dont issue coins). They resort to a lot of traditional PR and brand awareness tactics that make it easy to dominate search engine results pages, and it all stems from the way they build their product. Very little of their traffic comes from Google searches, most of it is direct visits.

Dune helps both the supply and demand side of blockchain data visualization - the demand side, it empowers content creators, drives PR and awareness. On the supply side, Dune lets data scientists create visualizations. Then, the blockchain data supply and demand parties freely marry. Dune helps data scientists get noticed and get paid work. Dune also helps those who need analysis (VCs and content creators) get detailed information across industries.

Dune makes money by offering paid plans.

The areas that the author thinks Dune missed are: high domain authority but very low organic traffic. For Dune to drive traffic, it should use the platform to create data outputs related to what people are searching for.

Dunes success really comes down to two key factors: having a great product that empowers multiple groups and letting people use their product for free, which promotes free public relations.

DeFi

New DeFi narrative? A New Model of Smart Contract Security Without the Oracle Protocol

The introduction of Oracle creates dependencies on external data, which pose potential risks. DeFi is built on non-upgradeable source code (Primitives). It cannot rely on any external factors except the contracts deployed on the blockchain, such as: no governance, contract upgradeability and oracles. There are very few DeFi protocols that meet this basic definition, the most representative of which is Uniswap V1, but from a security perspective, even Uniswap V2 and V3 are not eligible because they allow governance of certain functions, such as The closure of the agreement fee and the fee level introduced into the pool.

Recently we have discovered many oracle-less lending protocols, such as Ajna, Ethereum Credit Guild, MetaStreets Automated Tranche Maker, and the hybrid protocol Blend launched by Blur and Paradig.

FREI - PI pattern is: Function Requirements-Effects-Interactions + Protocol Invariants pattern. Take dYdXs SoloMargin contract (source code) as an example, which is a loan market and leveraged trading contract, which is an excellent example of the FREI-PI model. This is the only lending market in the early lending market that does not have any market-related vulnerabilities.

Shima Capital CTO: Reflecting on the Curve event, why do we need Runtime Protection?

Runtime Protection is a security technology that protects software applications from malicious attacks while they are running. Its principle is to perform real-time detection when the code is actually running, and analyze the actual behavior of the program to protect the program from malicious data and attacks.

One way is through Aspect programming, designed by the Artela blockchain network, which is able to switch execution contexts during the life cycle of any smart contract transaction to perform advanced inspections of the real-time status of the program. Artela provides a unique design of runtime protection through Aspect and EVM compatibility, and it has the opportunity to become the future foundation of encrypted smart contract security.

GameFi

The game project side has one and only three requirements: to attract new players, to promote activation, and to promote in-game consumption. Web3 players only have two requirements: to have a sense of companionship and to advance the principal.

Driven by the fact that every Ponzi cannot replicate the popularity of Axie, and the demand for companionship in every game cannot be strong enough to charge through live streaming and other methods (the source of income for traditional game guilds), the guild has shifted from serving players Transformation to a service project provider: On the one hand, the guild holds a large number of player resources. On the other hand, the guild still has a large amount of funds in its treasury, and can enjoy the growth dividends of the Web3 game track through investment.

Comparison of business data: YGG and MC are still active, while GF has fallen behind in terms of popularity; comparison of financial situation: MC has a balanced development of financial and business levels, YGG has strong business capabilities but lacks financial levels, and GF’s market value is less than the value of its blue chip + stable currency assets; Comparison of DAO construction and governance capabilities: Merit Circle is far stronger than its opponents.

Generally speaking, business capabilities: MC has more diversified business, YGG has a wider user base, and GF lags behind; external cooperation and investment capabilities: MC ranks first, followed by YGG in scale and profitability, and GF has the smallest scale and unknown profitability; Risk control capabilities: MC ranks first, followed by GF, and YGG performs poorly; valuation comparison: MC has reached a high level, YGG has fallen back normally, and GFs business weakness has resulted in market value < the total value of treasury stablecoins + blue chips.

SocialFi

The article uses time as a line to string together the project history of SocialFi: from the early Roll+ social token platforms such as steemit, Peepeth, and Rally, to DeSo in 2021, to protocols such as Subreddit, Farcaster, Lens Protocol, and Cyber Connect in 2022, Then to the recent friend.tech.

wallet

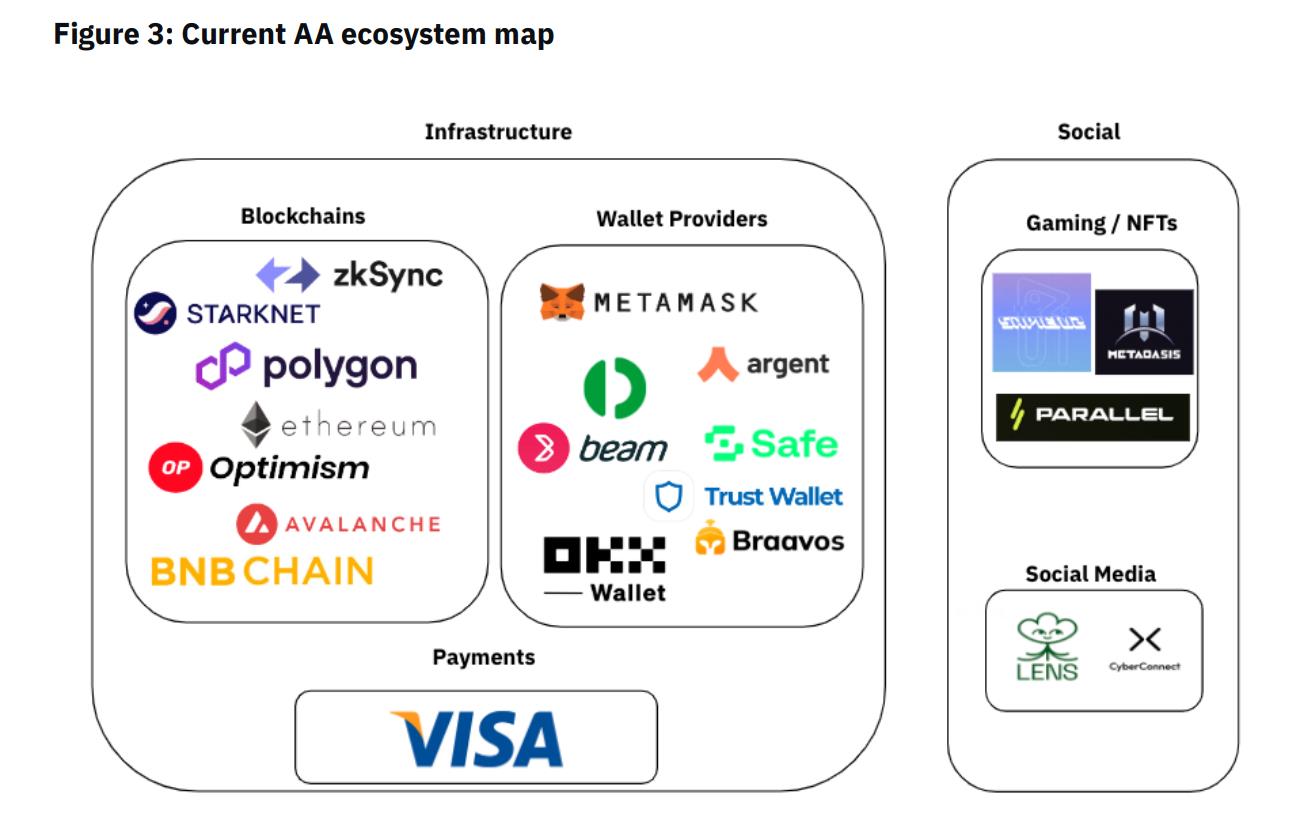

StarkNet and zkSync have launched native account abstraction solutions, and wallet providers such as Argent and Bravoos are also looking to provide these solutions.

Use cases such as traditional institutions Visa are also developing in this space, and Lens Protocol and CyberConnect also adopt account abstraction.

AA ecological map

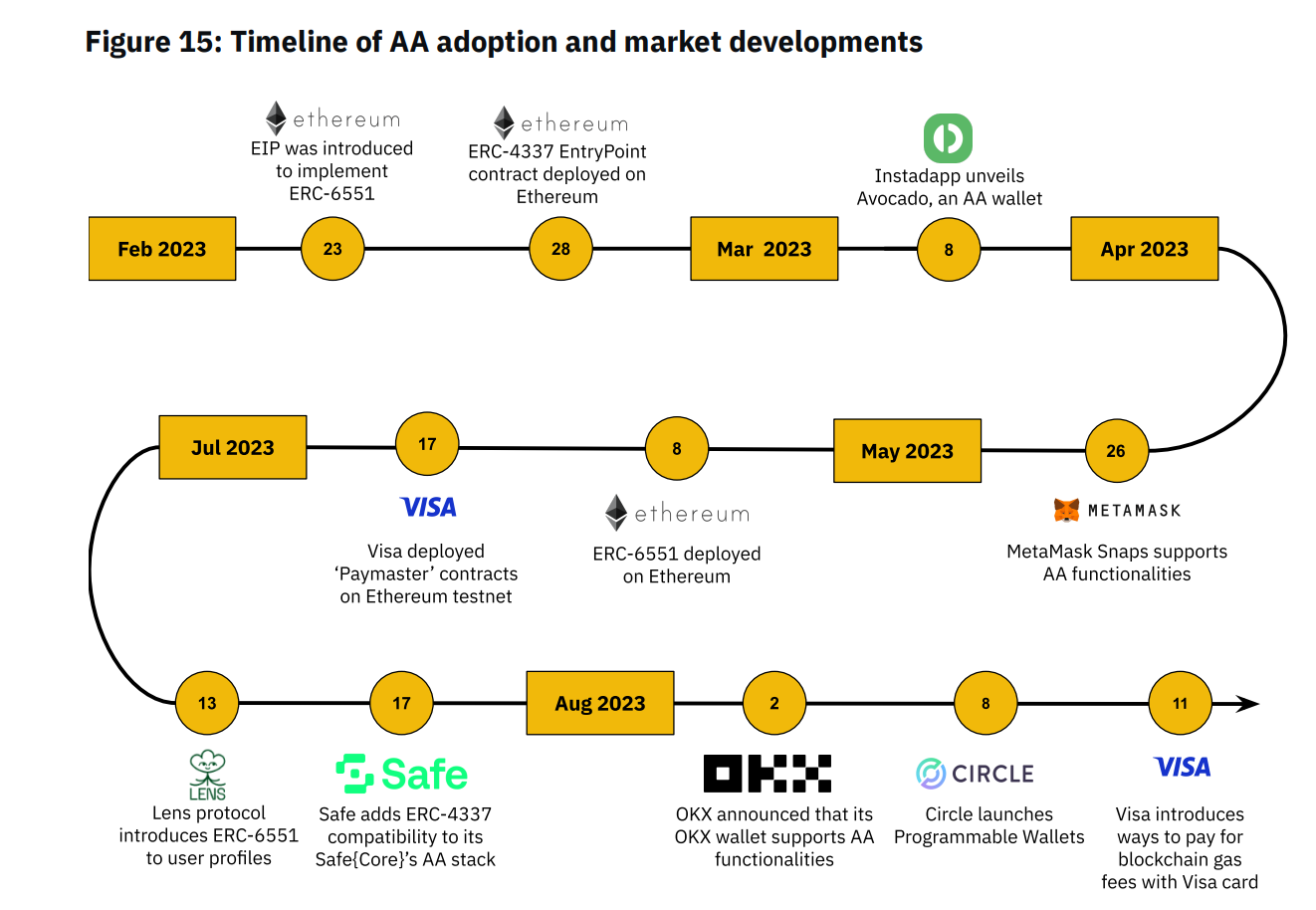

List of key events in the six months since AA was proposed to its current adoption

storage

EthStorage is the first layer-2 solution that provides programmable dynamic storage based on Ethereum data availability (*Data Availability), which can expand programmable storage at a cost of 1/100 to 1/1000 to hundreds of terabytes or even petabytes.

Its technical features include: highly integrated ETH, L2 decentralized solution based on DA layer, which can realize dynamic storage and create Ethereum network access protocol.

Through EthStorage, it will be possible to re-enable Internet applications with decentralized storage as the bottom layer (*currently many Dapps still use a centralized way to store data), such as dynamic NFT, music NFT on the chain, personal website, hostless wallet, Dapp, Deweb et al.

Ethereum and Scaling

Fire Validium? Re-understand Layer 2 from the perspective of the proposer of Danksharding

According to the definition of the ethereum.org website and most members of the Ethereum community, Layer 2 is an independent blockchain that expands the capacity of Ethereum + inherits the security of Ethereum. To further explore the security of Layer 2, many corner cases must be considered. For example, if the L2 project party runs away, the sequencer fails, and the off-chain DA layer hangs up, can users safely withdraw their funds on L2 to L1 when these extreme events occur?

Dankrad Feist, the proposer of Danksharding and a researcher of the Ethereum Foundation, pointed out that a modular blockchain that does not use ETH as the DA layer (data availability layer) is not Rollup, nor is it Ethereum Layer 2. According to Dankrad, Arbitrum Nova, Immutable X, and Mantle will all be removed from the Layer 2 list, because they only disclose transaction data outside of ETH (they built their own off-chain DA network called DAC).

The difference between Validium and Plasma in terms of security: After Validium’s sequencer releases Stateroot, as long as it immediately releases Validity Proof and DAC multi-signature, it can make it legal and become the latest legal Stateroot; if users and honest L2 nodes encounter data withholding Attack, the Merkle Proof corresponding to the current legal Stateroot cannot be constructed, and the withdrawal to L1 cannot be made. After Plasma submits a new Stateroot, it must wait until the window period ends before it becomes legal. The legal Stateroot at this time was submitted in the past. Because there is a window period (ARB is 3 days, OP is 7 days), even if the DA data of the newly submitted Stateroot is not available, the user still has the DA data of the current legal Stateroot (the legal root was submitted in the past), and there is enough time to force Withdraw money to L1.

Most Layer 2 projects will provide service ports to keep L2 nodes and sequencers in sync off-chain, so Dankrads concerns are often theoretical rather than real.

new ecology

friend.tech detonates the Base ecosystem, these ten projects deserve special attention

Overview of the Base Ecological Landscape: Traffic Fission Carnival and 100+ Project Inventory

Overview of the Scroll ecological landscape: looking for zkEVM vanguard

Hot Topics of the Week

In the past week, the popularity of friend.tech continued (Topic),Balancer:Multiple V2 pools have vulnerabilities, and users are advised to withdraw the affected LPs immediately,and thenAffects the Pendle pool,Exactly Protocol was attacked by a cross-chain bridge, with a loss of USD 12.04 million;

In addition, in terms of policy and macro market, the Hong Kong Monetary Authority:Will cooperate with the industry to promote tokenized bond issuance,Research is under way to establish a regulatory framework for digital Hong Kong dollars or stablecoins to promote the tokenization of bank deposits;

In terms of opinions and voices,SBF Denies Allegations of Fraud and Money Laundering Related to FTX Bankruptcy, founder of Curve:CRV OTC buyers who violate the cooperation agreement have no negative impact, but I believe they will abide by the half-year lock-up commitment;

Institutions, large companies and top projects,ARK Invest and 21 Shares Jointly File Two Ethereum Futures ETF Applications, Hong Kong listed companyVictory Securities launches virtual asset trading application,Coinbase Announces Bases Five Neutral Principles, including chain rules, user custody keys, free withdrawals, etc.,Base and Optimism Publish Governance and Revenue Sharing Framework, Base can obtain up to 118 million OPs within 6 years,MakerDAO passed the EDSR and stability fee adjustment proposal, DSR will be reduced from 8% to 5%,Aave:Due to technical issues with V3 GHO pool integration, GHO minting is suspended,Starknet version 0.12.1 is launched on the main network, and the quantum leap has ended;

NFT and GameFi space, Yuga Labs:Support for all upgradeable contracts and new series of OpenSea SeaPort will be phased out,Some blue-chip NFTs on multiple NFT lending platforms have entered liquidation, including BAYC, Azuki and other series,OpenSea Pro will charge a platform fee of 0.5% on all listings and offers from August 31,Rarible: Support royalties forever, no longer aggregate OpenSea, LooksRare and X2Y2 orders after September 30,Eric Wall:Willing to give double refunds to all users who purchased Taproot Wizards NFT...well, another week of ups and downs.

With Editors Picks of the Week seriesPortal。

See you next time~