开除Validium?从Danksharding提出者的视角重新理解Layer2

原文作者:Faust

原文来源:极客Web3

导语:近日,Danksharding 的提出者、以太坊基金会的研究员 Dankrad Feist 在推特上发表了一番颇具争议的言论。他明确指出,不采用 ETH 作 DA 层(数据可用性层)的模块化区块链不是 Rollup,同时也不是以太坊 Layer 2 。如果按照 Dankrad 的说法,Arbitrum Nova 和 Immutable X、ApeX 和 Metis 都要从 Layer 2 名单里「除名」,因为它们只在 ETH 之外(自己构建了名为 DAC 的链下 DA 网络)披露交易数据。

同时,Dankrad 还表示,像 Plasmas 和状态通道这种不需要链上数据可用性(Data Availability)来确保安全的方案仍算是 Layer 2 ,但 Validium(不用 ETH 作 DA 层的 ZKRollup)不算 Layer 2 。

Dankrad 此言一出,便引来了诸多 Rollup 领域的 Founder 或 Researcher 质疑。毕竟有许多「Layer 2 」项目为了节约成本,并没有采用 ETH 作为 DA( 数据可用性 ) 层,如果把这些项目踢出 L2 名单,必然波及到相当多的扩容网络;同时,如果 validium 不算 L2,Plasma 应该也没资格算作 L2。

对此,Dankrad 表示,Plasma 用户在 DA 不可用时(就是指链下的 DA 层网络搞数据扣留,不公开交易数据),仍然可以把自己的资产安全撤出至 L1;但相同的情况下,Validium(大多数采用 StarkEx 方案的项目都是 validium)却可以让用户无法撤资至 L1,把钱冻住。

显然,Dankrad 打算从「是否安全」来界定一个扩容项目是否为以太坊 Layer 2 。如果从「安全性」的角度来考量,Validium 在定序器故障 + DA 层发动数据扣留攻击 ( 隐瞒新数据 ) 的极端情况下,的确可以把用户资产冻结在 L2 无法提到 L1;Plasma 因在设计上与 Validium 不同,虽然多数时候安全保障不及 Validium,但在定序器故障 + DA 层发动数据扣留攻击 ( 隐瞒新数据 ) 时,却允许用户把资产安全撤离至 L1。所以 Dankrad 的说辞不无道理。

本文打算从 Dankrad 的视角出发,通过对 Layer 2 的细节作进一步分析,来深入理解为何 Validium 不是严格意义上的「Layer 2 」。

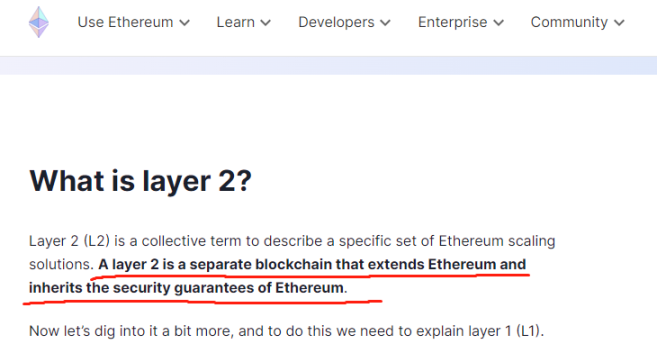

到底怎么定义 Layer 2 ?

按照 ethereum.org 网站和多数以太坊社区成员的定义,Layer 2 是「给以太坊扩容 + 继承以太坊安全性 的独立区块链」。首先,「给以太坊扩容」就是指分流以太坊无法承载的流量,分担 TPS 方面的压力。而「继承以太坊安全性」,其实可以转译为「借助以太坊保障自身安全性」。

比如,Layer 2 上所有的交易 Tx 都要在 ETH 上完成最终结算 Finalize,数据有错误的 Tx 不会被放行;如果要回滚 Layer 2 的区块,要先回滚以太坊区块,只要以太坊主网不发生类似 51% 攻击的区块回滚,L2 区块就不会回滚。

如果我们更进一步探讨 Layer 2 的安全性,其实还要考虑许多极端情况。比如,如果 L2 项目方跑路、定序器 Sequencer 故障、链下 DA 层挂掉,在这些极端事件发生时,用户能否把自己在 L2 上的资金安全撤出到 L1 上?

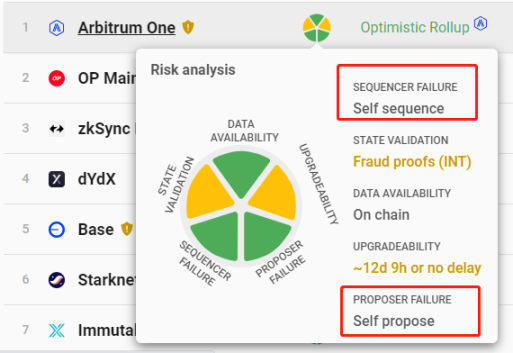

Layer 2 的「强制提款」机制

不考虑 L2 合约升级 / 多签隐患等因素,其实如 Arbitrum 或 StarkEx 都有为用户设置强制提款的出口。假设 L2 的定序器发动审查攻击,故意拒绝用户的交易 / 提款请求,或干脆永久宕机,Arbitrum 用户可以调用 L1 上 Sequencer Inbox 合约的 force Inclusion 函数,将交易数据直接提交至 L1;如果在 24 小时内,定序器没有处理这笔需要「强制包含」的交易 / 提款,该交易会被直接包含进 Rollup 账本的交易序列中,这就为 L2 用户创造了一个可强制提款的「安全出口」。

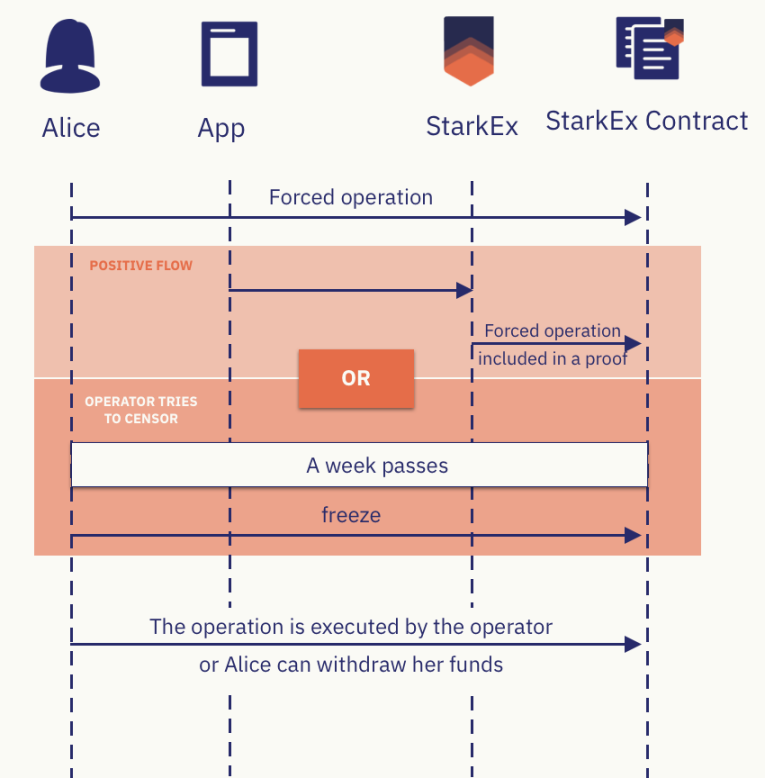

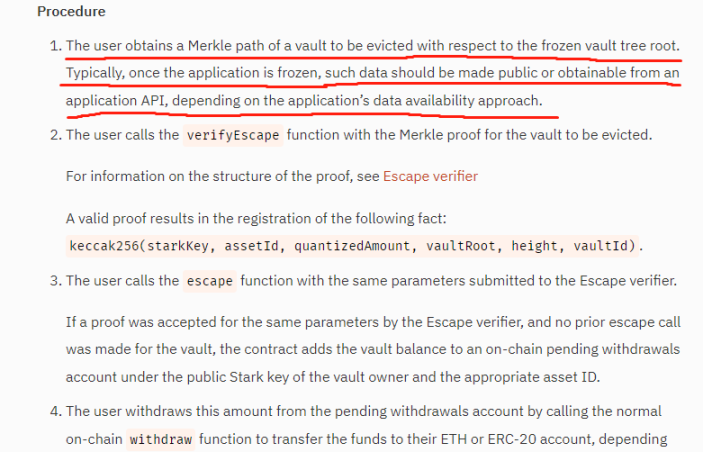

相比之下,有逃生舱 Escape Hetch 机制的 StarkEx 方案要有过之无不及。如果 L2 用户在 L1 提交的 Forced Withdrawal 请求在 7 天窗口期结束时,未得到定序器响应,则该用户可以调用 freeze Request 功能让 L2 进入冻结期。此时,L2 定序器将无法在 L1 上更新 L2 的状态,L2 状态冻结后要过 1 年才能解冻。

L2 状态冻结后,用户可以构造与当前状态相关的 Merkle Proof,证明自己在 L2 上有 XX 数额的资金,通过 L1 上的逃生舱 Escape Hetch 相关合约来提款。这便是 StarkEx 方案所提供的「全额提款」服务。即便 L2 项目方没了,定序器永久故障了,用户还是有办法把资金撤出 L2。

但这里存在一个问题:用 StarkEx 方案的 L2 大多是 Validium(比如 Immutable X 和 ApeX),并不会把 DA 所需的数据发布到 ETH,构造当前 L2 状态树的信息都存在链下。如果用户无法在链下获取构造 Merkle Proof 的数据(比如链下 DA 层发动数据扣留攻击),是无法通过逃生舱来提款的。

至此,文章开头提到的 Dankrad 认为 Validium 不安全的原因,其实很明确了:因为 Validium 不像 Rollup 一样把 DA 的数据发到链上,所以用户可能无法构造出「强制提款」所需的 Merkle Proof。

Validium 和 Plasma 在发生数据扣留攻击时的区别

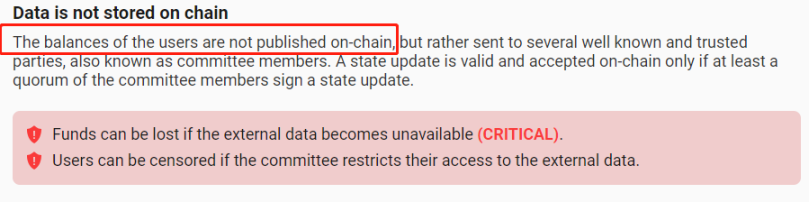

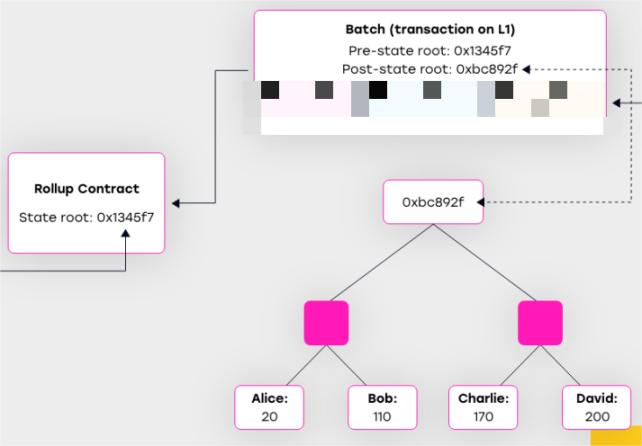

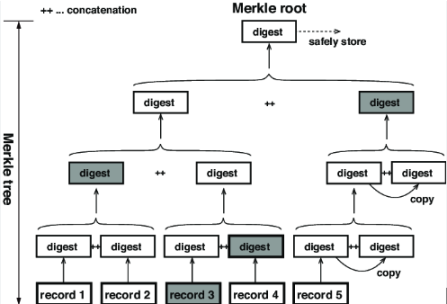

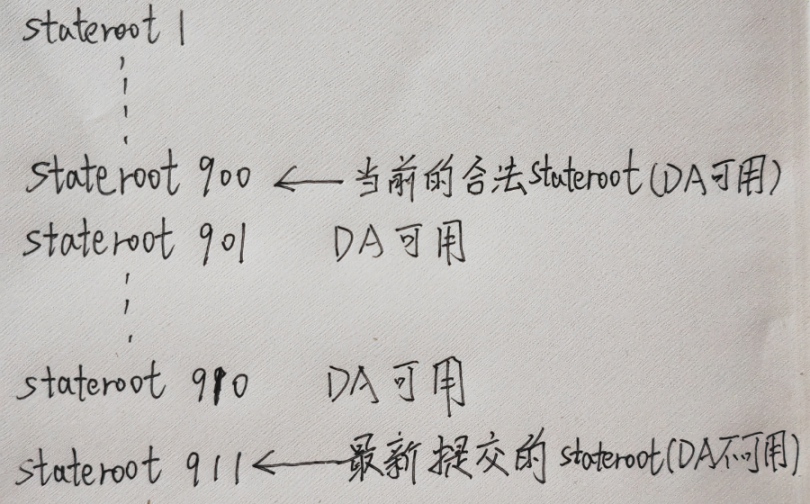

事实上,Validium 的定序器只在 L1 链上发布 L2 最新的 Stateroot(状态树的根),再提交一个 Validity Proof(ZK Proof),证明新的 Stateroot 生成过程涉及的状态转换(用户资金变化),都是正确的。

(图源:eckoDAO)

但单凭 stateroot 无法还原出此刻的状态树 world state trie,也就无法知晓每个 L2 账户的具体状态(包含资金余额),L2 用户就无法构造对应当前合法 Stateroot 的 Merkle Proof。这便是 Validium 不利的地方。

(Merkle Proof 其实就是 root 生成过程中所需的数据,也就是图中暗色的部分。要构造对应 Stateroot 的 Merkle Proof,必须要知道状态树的构造,需要有 DA 数据)

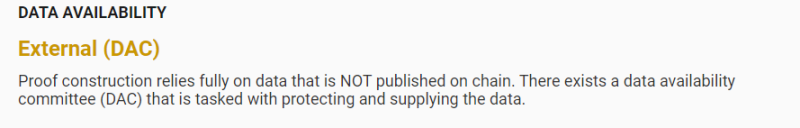

这里必须要强调下 DAC 这个东西。Validium 的 DA 所涉数据,比如定序器最新处理的一批交易,会同步给名为数据可用性委员会 DAC(Data Availability Committee)的 L2 专属 DA 网络,DAC 由多台节点服务器构成,一般由 L2 官方和社区成员或其他单位负责运行和监督(但这只是表面上的,实际上 DAC 成员都有谁,外界很难查证)。

有意思的地方在于,Validium 的 DAC 成员需要频繁在 L1 提交多签,证明 L2 定序器在 L1 提交的新 Stateroot 和 Validity Proof,与 DAC 同步到的 DA 数据能对上号。DAC 的多签提交后,新的 Stateroot 和 Validity Proof 才会被认为是合法的。

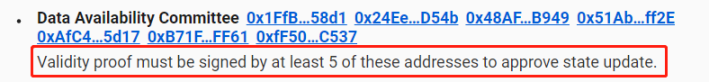

目前 Immutable X 的 DAC 采用 5/7 多签,dYdX 虽然是 ZKRollup,但也有 DAC,用的是 1/2 多签。(dYdX 只在 L1 发布 State diff 即状态变化,而非完整交易数据。但获取了历史记录里的 State diff,就可以还原全部 L2 地址的资产余额,此时就可以构造 Merkle Proof 来全额提款)。

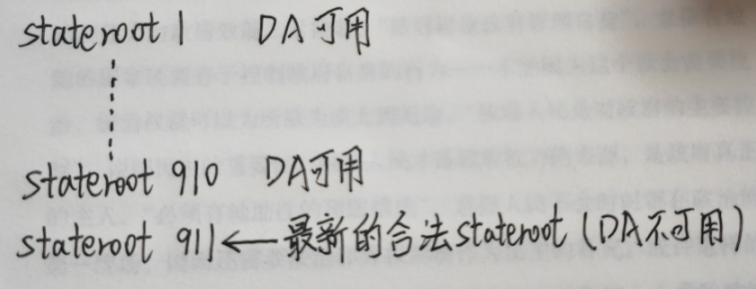

Dankrad 的观点不无道理。Validium 的 DAC 成员如果合谋,发起数据扣留攻击,不让其他 L2 节点同步此刻的最新数据,并且更新此刻 L2 的合法 Stateroot,用户无法构造此刻合法 root 对应的 Merkle Proof 来提款(因为此刻往后的 DA 数据不可用了,可用的是以前的 DA 数据)。

但 Dankrad 考虑的只是理论上的极端情况,现实中大多数 Validium 定序器都会实时的把新处理的交易数据广播给其他 L2 节点,其中不乏诚实节点。只要有 1 个诚实节点能够及时获取 DA 数据,用户就可以从 L2 全身而退。

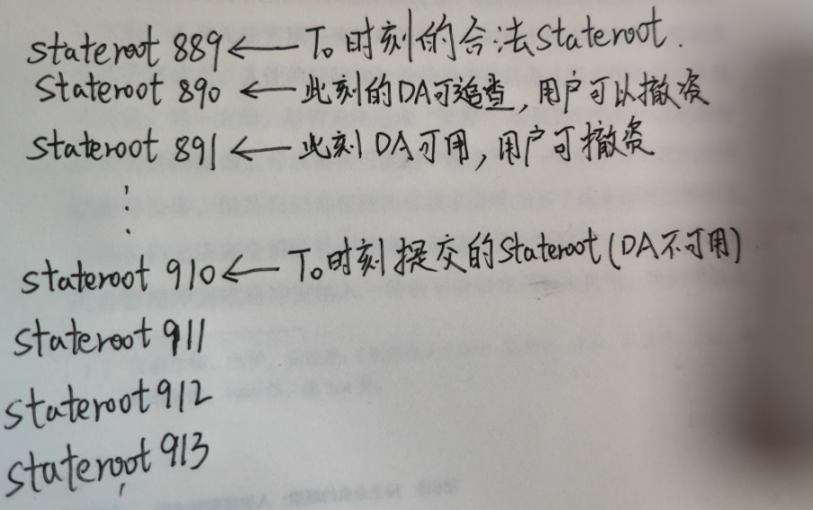

可理论上存在于 Validium 身上的问题,为何不存在于 Plasma 身上?这是因为 Plasma 判定合法 Stateroot 的方式,和 Validium 不同,有欺诈证明窗口期的缘故。Plasma 是 OPRollup 之前的 L2 扩容方案,与 OPR 一样靠欺诈证明保证 L2 的安全。

Plasma 与 OPR 一样有窗口期的设定,定序器发布的新 stateroot 不会立刻判定为合法,要等窗口期 close 且没有 L2 节点发布欺诈证明。所以 Plasma 和 OPR 的当前合法 Stateroot,都是几天以前提交的(这就好比我们看到的星光,其实都是很久以前发出的),而用户往往可以获取过去时刻的 DA 数据。

同时,欺诈证明机制能在此刻生效的前提,是此刻 L2 的 DA 可用,也即 Plasma 的 Verifier 节点可以获取此刻的 DA 所涉数据,这样才能生成此刻的欺诈证明 ( 如果有必要的话)。

那么一切都很简单了:Plasma 正常工作的前提是此刻 L2 的 DA 数据可用。如果从此刻开始,L2 的 DA 不可用了,用户能安全撤资吗?

这个问题不难分析,假设 Plasma 的窗口期是 7 天,如果从某个时间点 T 0 开始,新的 DA 数据就不可用(DAC 发动数据扣留攻击,不让诚实的 L2 节点获取 T 0 往后的数据)。因为 T 0 及此后一段时间内的合法 Stateroot,是 T 0 时刻前提交的,而 T 0 时刻前的历史数据可追溯,所以用户可以构造 Merkle Proof 来强制提款。

即便很多人无法立刻察觉异常,但因为有窗口期存在(OP 是 7 天),只要 T 0 时刻提交的 Stateroot 还未合法化,且 T 0 之前的 DA 数据可追溯,用户就可以把钱安全撤出 L2。

总结

至此我们大致可以理清楚 Validium 和 Plasma 在安全性上的区别:

Validium 的定序器发布 Stateroot 后,只要立刻发布 Validity Proof 和 DAC 多签,就可以使其合法,成为最新的合法 Stateroot;如果用户和诚实 L2 节点遭遇数据扣留攻击,无法构造当前合法 Stateroot 对应的 Merkle Proof,就无法提款到 L1。

而 Plasma 提交新的 Stateroot 后,要等窗口期结束才能合法,此时的合法 Stateroot 是过去提交的。因为有窗口期(ARB 是 3 天,OP 是 7 天)存在,即便新提交的 Stateroot 的 DA 数据不可用,用户也有当前合法 Stateroot 的 DA 数据(合法 root 是过去提交的),有足够的时间强制提款到 L1。

所以,Dankrad 说的话有道理。当发生数据扣留攻击时,Validium 存在把用户资产困在 L2 的可能,但 Plasma 并不存在这个问题。

(下图中 Dankrad 说的有一点不对,Plasma 应该不允许构造过时的合法 Stateroot 对应的默克尔证明来提款,因为这会导致双重支付)

所以,链下 DA 层的数据扣留攻击会造成许多安全隐患,但 Celestia 尝试解决的正是这个问题。此外,因为大多数 Layer 2 项目都会提供让 L2 节点与定序器保持链下同步的服务端口,所以 Dankrad 的忧虑其实往往只是理论上的,而不是现实中的。

如果我们用鸡蛋里挑骨头的态度,再提出更极端的假设:所有的 Plasma 链下节点都不可用了,那么那些没跑过 L2 节点的普通用户都无法强制提款到 L1。但这种事情发生的概率,等价于一条公链的所有节点集体永久性宕机的概率,可能永远不会发生。

所以,很多时候,大家只是在谈论一些根本就不会发生的事情。正如美剧《切尔诺贝利》里克格勃副主席对主角说的那段金句:「为何要担心根本就不会发生的事情呢?」