Detailed explanation of Opensea's new Deals feature: "Bartering" in the NFT world

Today, Opensea released a "Deals" feature that allows users to exchange a series of NFT combinations with other users' NFT combinations.

According to Odaily, in May of this year, Opensea introduced the "NFT combination trading model" with point-to-point capability when it launched the Seaport protocol. However, Opensea has not opened this feature on the frontend.

During the bear market, NFTs have been criticized for their lack of liquidity. NFTs held by collectors (especially non-blue-chip and non-utility NFTs) have little use other than self-appreciation or self-regret. As a result, various platforms have emerged to address the liquidity issues of NFTs, either by using borrowing or leasing models to release liquidity, or by further leveraging financial derivative instruments to "tokenize" them. However, fundamentally, non-fungible NFTs still have a single trading mode.

Opensea, as the former dominant NFT trading platform and now the second only to Blur, ignited hopes of solving the NFT liquidity problem when it launched the Seaport protocol. Now, the related "Deals" feature is finally live. Through experience, introduction, and analysis, Odaily will verify its working principles and effectiveness, and also share some thoughts on the competition in the NFT market.

Introduction to the Deals feature

The Deals feature is derived from the Seaport protocol, which is a decentralized smart contract protocol used to create and fulfill orders for ERC-721 and ERC-1155 tokens. Each order contains a token combination provided by the supplier and a token combination required by the receiver.

The Deals feature allows buyers on the same chain to apply to purchase a certain number of NFTs from sellers by bundling a certain quantity of NFTs and Tokens in an equivalent manner.

For example: User A wants to exchange 2 Azuki with a current value of 5 ETH for User B's Bored Ape, which has a value of 30 ETH. User A needs to search for User B's address through the Deals interface, select the Bored Ape from User B's wallet to generate a purchase order, and then select their own 2 Azuki. User A will use WETH to make up for the price difference based on the current market value and initiate a trade request to User B. Once User B agrees, the transaction is completed.

Through this example, we can see that this peer-to-peer bundled trading model is more suitable for swapping NFTs of equal value, such as Doodles and Azuki during a bull market. Of course, Opensea has also considered this and introduced WETH to fill the price difference, increasing the flexibility of "non-like-kind trades" and further enhancing the liquidity of NFTs.

(Attached: Opensea's Deals introduction video.)

Facing strong competitors, Opensea seeks change

Opensea's pace of updates has noticeably accelerated, from the introduction of the new Seaport protocol in May this year to the launch of the Deals feature today. The reasons behind this are not hard to understand:

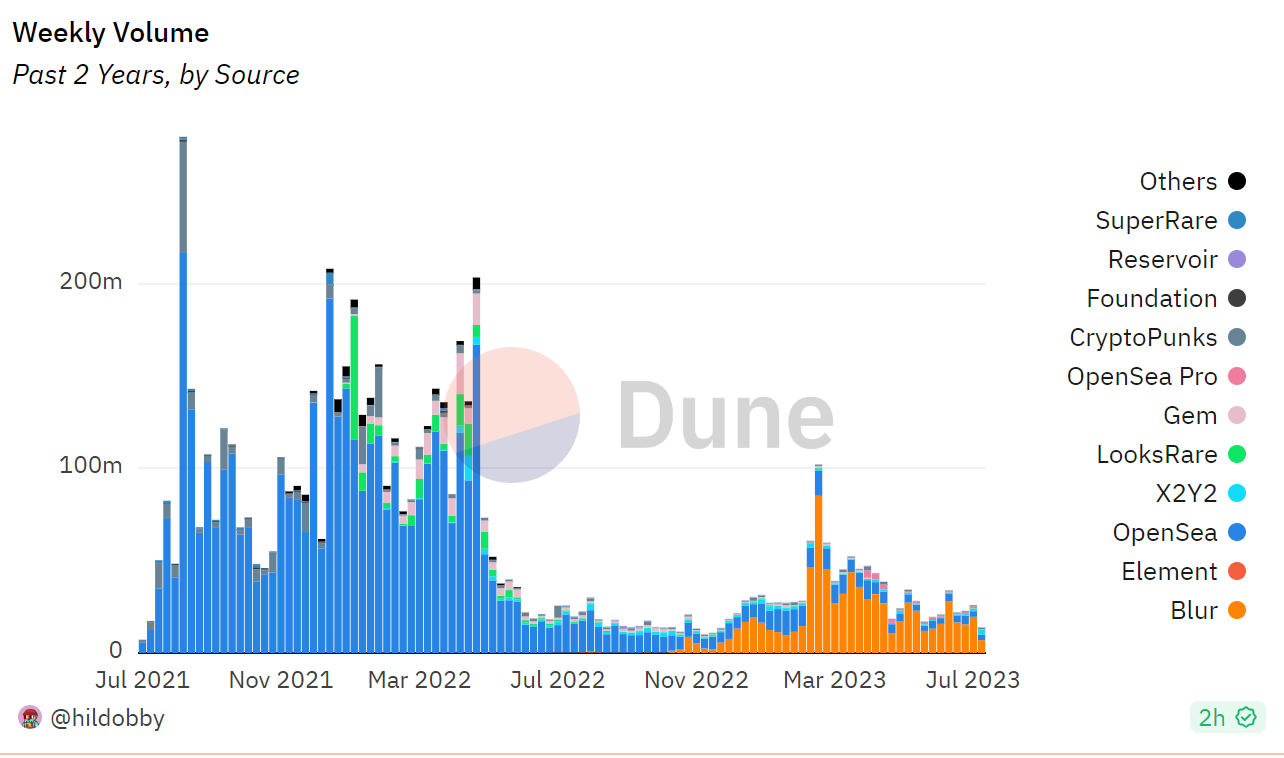

The above figure is a representation of the weekly trading volume of the main NFT trading platforms in the Dune panel over the past two years. It can be seen that from the end of last year to now, Opensea has been gradually losing market share to Blur, prompting Opensea to innovate and regain its market dominance.

Apart from token economics, Blur's rise to prominence is also due to its product model and supporting operations. Blur focuses on the model of batch sales and batch purchases, combined with the newly launched NFT lending platform Blend, forming an NFT transaction matrix to enhance NFT liquidity.

In contrast, Opensea's previous functionality was relatively limited, only allowing individuals to make single purchases through tokens, which was not conducive to large-scale transactions. This has led to a significant loss of market share. Can Opensea's new feature, Deals, reverse the situation and reclaim its former position?

Deals is a trading model that distinguishes itself from other platforms. It adopts an interactive combination trading model to simplify the transaction process and address the liquidity issue of NFTs through a barter-like mechanism. What advantages does this model have?

Taking Blur as an example, its trading model involves batch sales and batch purchases, which essentially follow the steps of traditional transactions - exchanging money for goods. However, from the user's perspective, it improves convenience without necessarily enhancing NFT liquidity. On the other hand, Opensea's Deals allows buyers to trade their own NFTs with tokens for the NFTs held by sellers, saving buyers the process of selling their own NFTs.

However, the Deals model also has its drawbacks - the lack of real-time interaction leading to inefficiencies. After a buyer applies, the transaction is not immediately finalized, which may affect the overall efficiency.

The steps are simple, you just have to wait for the seller's acceptance or rejection. This process also increases the time cost.Whether it's Blur's batch mode or Deals mode, they have different application scenarios. Blur is more suitable for periods with high NFT liquidity in a bull market, and Blur's usage is relatively more user-friendly. Deals is more suitable for the bear market phase, increasing the possibility of transactions in a period with poor market liquidity.

(By the way, I have a suggestion for Opensea, adding a chat window plugin for buyers and sellers may promote the success of Deals transactions.)

NFT projects cooling down while NFT platforms heat up

As many NFTs turn to dust, platforms primarily focused on NFT trading are also facing difficulties. Compared to 2021, the overall trading volume this year has significantly declined. The lack of NFT liquidity has become more evident.

However, there is hope with the emergence of ERC 6551, Blur's Blund lending, and Opensea's Deals feature.

These three provide new vitality to NFTs from different perspectives:

ERC 6551, as a new smart contract protocol, can enhance the composability of NFT, improve the operability and utility of NFT at the underlying level (NFT as a wallet, NFT as an identity), and is applicable to multiple fields. This reminds me of the possibility of combining NFT and FT into a whole for sale, such as the airdrop of a new project.

There are many NFT lending protocols, Blend integrates directly with Blur, which currently has the largest market share, and stimulates the release of NFT liquidity, increasing market activity.

The Deals feature of Opensea changes the existing NFT transaction process by skipping transaction steps. Will it be a powerful tool to stimulate the increase in NFT liquidity? Further observation is needed at the moment.

It is gratifying that practitioners still insist on innovation and have not been complacent. These small iterations during the bear market may become powerful weapons in the future bull market.