OP Research: The Future Pattern of the Game between Cryptocurrency Exchanges and Regulations

Original author: Jam, CloudY

Original editor: Vincero, YL

Introduction

The dual nature of regulation. Regulatory intervention can increase the hidden costs of trading and also attract more funds into the market by enhancing compliance. In addition, the strictness of the regulatory environment will also impact the free development of the Crypto Market, as a less strict regulatory environment is more conducive to the free development of the Crypto Market.

CEX+CeFi= Traditional Commercial Bank. CEX essentially follows the traditional commercial banking model, which earns interest spreads through deposits and loans. However, CEX currently lacks "The last buyer," which may be another important reason why CEX is subject to strong regulation. At the same time, some smart CEX are trying to implement forward hedging strategies to prepare for stronger regulation in the future.

CEX transitioning towards DEX. Although DEX is considered a possible alternative to CEX in the long term, there is still debate about whether it can ultimately replace CEX. We have observed that CEX continues to innovate to adapt to market demand and competitive pressures. At the same time, we cannot ignore the fact that DEX aligns more with the long-term principles of Crypto fundamentalism.

The Impact of Regulation on CEX Development

Regulation can cause trading costs to increase

The Increased Hidden Costs of Ease

Hidden costs are the costs that economic organizations (enterprises being one form of economic organization) frequently face in the process of operation, as opposed to explicit costs. Hidden costs refer to the future costs and transfer costs caused by enterprise or employee behavior that have a certain level of concealment. They are costs that are hidden within the total cost of the enterprise and are beyond the scope of financial audit and supervision.

Explicit costs can be directly linked to transaction quantities and records, but hidden costs tend to be concealed within the total cost, making them difficult to accurately measure and often overlooked. The characteristic of hidden costs lies in their lack of financial regulation. These costs may involve time costs, information asymmetry, errors, and incomplete compliance, thereby increasing the hidden costs embedded within the overall costs.

In the case of regulatory conditions in CEX, the increase in hidden costs of transactions is particularly significant. Regulatory agencies may require exchanges to adopt stricter Know Your Customer (KYC) procedures to prevent money laundering and misappropriation. This not only increases the exchange's additional human resources and technological input to ensure compliance of transactions but can also affect the speed and convenience of transactions, imposing external time costs and uncertainties on traders. Furthermore, regulatory compliance disclosures may cause asymmetry issues, exposing users to more trading risks and operational limitations, further increasing hidden costs. Ultimately, these hidden costs will be passed on to CEX users, possibly manifesting in increased transaction fees, withdrawal costs, and reduced financial returns.

Compliance May Drive Incremental Fund Inflows

However, compliance may drive incremental funds into the cryptocurrency market. With the optimization of regulatory environment and increased transparency, investors gain more confidence in the safety of funds and investment prospects of the cryptocurrency market, attracting more funds to enter the cryptocurrency realm. When CEX meets regulatory requirements and adopts compliance measures, investors will have more confidence in investing funds, increasing their investment positions in cryptocurrency assets.

These investors often have higher expectations for the safety and legitimacy of funds and believe that regulation can provide good protection. This increased confidence may prompt more funds to flow into the cryptocurrency market, providing a more stable investment environment. The influx of incremental funds can potentially provide more stable investment capital for the Crypto Market, thereby promoting its growth.

The translation of the given text would be:And to extend the holding period, further reducing the volatility of crypto asset prices.

At the macro level, compliance has two main effects on the cryptocurrency market. Firstly, the entry of traditional institutional funds means that traditional financial institutions are starting to participate in the cryptocurrency market, which will bring more funds into the market, increasing liquidity and scale. Secondly, the introduction of the traditional financial system means that cryptocurrencies are being recognized and accepted more widely, further increasing the market's size and participants.

At the micro level, a compliant framework involves fund transparency, rational leverage trading and clearing feasibility, and controllable market-making behavior. Fund transparency refers to the ability to trace and monitor the flow of funds and trading activities of exchanges and participants, helping to prevent money laundering and other illegal activities. Rational leverage trading and clearing feasibility mean that exchanges need to ensure appropriate margin rules and clearing mechanisms to protect the interests of participants and market stability. Controllable market-making indicates that exchanges need to manage and monitor market-making activities to avoid manipulation and improper behavior, while ensuring market liquidity and stability.

(Source: BTC volatility in the past 9 months)

Weak regulatory environment will enable freer development of the Crypto Market

In our observation, a strong regulatory environment has the following characteristics: licensing, securities definition, and asset categories.

Regulatory authorities can require CEX to obtain specific licenses or permits to operate. These licenses and permits need to comply with local regulations and compliance requirements, including but not limited to KYC and AML regulations. By issuing licenses and permits, regulatory authorities can have stricter supervision over CEX. Secondly, some cryptocurrencies may be deemed as securities. If a cryptocurrency meets the definition of a security, it needs to comply with securities regulations and be subject to supervision by securities regulatory authorities (according to CoinMarketCa).

^Data, currently determined by SEC as many as ^67 encrypted currencies). In addition, in a strong regulatory environment, encrypted currencies may be classified as specific asset types. For example, different countries may view encrypted currencies as financial assets, virtual assets, or digital assets. This classification may result in specific regulatory rules and tax requirements.

In the early stages of the appearance of encrypted currencies, especially after the appearance of Bitcoin, regulation agencies have not yet established clear regulatory frameworks and standards for the encrypted currency industry, especially important institutions like CEX, due to the fact that this field is a completely new internet innovation. However, with the popularization of encrypted currencies and the expansion of the market scale, "regulatory evasion" has gradually become a focus, leading to a series of regulatory measures and rule-making.

Initially, regulatory agencies only monitored and issued warnings about the encrypted currency market, reminding participants of the risks and challenges they may face, but did not formulate specific regulatory measures. Later, regulatory agencies began to pay attention to illegal activities related to encrypted currencies, including money laundering (but according to CZ's revelation in an interview, a report forwarded to CZ by an ambassador from a certain place mentioned that only 3% of Bitcoin transactions were related to illegal activities or problematic activities. This proportion is very small, in fact lower than that of fiat currency) and illegal financing. Now, regulatory agencies have formulated more comprehensive regulatory frameworks and more transparent regulatory standards, including but not limited to: information disclosure requirements, KYC and AML, licensing and registration requirements, framework and rule establishment, regulatory cooperation.

According to the laws of economic development and historical case studies, industries that are at the forefront of regulation can indeed gain better arbitrage space or development prospects.

Early participants in the industry can often establish strong brand influence and user bases. When regulation gradually strengthens, these companies may have already established sound compliance frameworks and reputations, making it more likely to obtain recognition and support from regulatory agencies. Such first-mover advantages can bring these companies better market positions and competitive advantages, allowing them to build deeper moats using external regulation.

Stricter regulatory requirements may cause some competitors to fail to meet compliance standards or be unable to bear the costs brought by regulation. As regulation strengthens, investors' confidence in compliant industry participants and projects may increase. They are more willing to invest in enterprises and projects that meet regulatory requirements, reducing investment risks.

Overall, a weak regulatory environment may bring greater freedom and flexibility to the crypto market.

(Dogecoin "To The Moon" Slogan)

Regulation is an important triggering factor for changes in the competition landscape of CEX

In the early development of the cryptocurrency market, especially with the emergence of BTC, the number of CEX was limited, and the main focus of competition was on providing secure, highly liquid, and diverse trading pairs. Early competitors included MT.GOX, BTC China (established in June 2011), Kraken (established in July 2011), Bitstamp (established in August 2011), Coinbase (though early Coinbase was a payment processor), and others. As the market grew and user demands changed, CEX began to expand their platform functionalities and services, such as adding derivatives trading, OTC trading, fiat trading pairs, lending, and insurance. A milestone event was the launch of perpetual contracts by Bitmex in 2016, with leverage reaching up to a maximum of 100x.

As the global cryptocurrency market developed, CEX started to compete in different niche areas. Some CEX focused on local markets, providing local fiat trading pairs and language support to meet the needs of local users. This led to the rise of regional exchanges, such as Huobi (formerly known as Huobi) and OKEx (formerly known as OKCoin), which focused on the Greater China market, as well as Upbit and Bithumb, which focused on the South Korean market. In addition, CEX focusing on derivative trading also emerged during this stage, such as early FTX and Bybit.

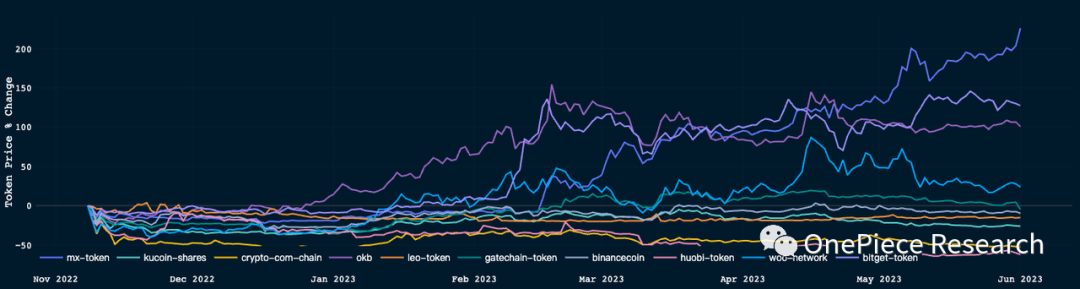

FTX and Binance are the stories that followed. In the early days, FTX focused on the derivatives track and quickly gained a leading position in the track. Binance, as an early playerInvestors seemed to have indirectly participated in the competition of the derivatives market. It wasn't until November 2022 that FTX's wrongdoing was exposed. The latest story is widely known, and we won't go into too much detail. (Source: YM Crypto) If the target of regulation is the object they aim at, then FTX has pulled the trigger on themselves. FTX's controversy undoubtedly accelerated regulatory actions against Binance, the largest CEX in the world, and Coinbase, known for its high compliance, also got caught up in it. From specific events, we can see that every change in regulatory policies has a significant impact on the entire CEX industry: On September 4, 2017, the Chinese government expressed a strong regulatory stance and jointly issued the "Announcement on Preventing Risks of Token Issuance Financing" with seven ministries, announcing that "ICO is an illegal public financing activity that should be stopped immediately." This announcement caused a dramatic shift in the market landscape: ICOs were classified as illegal fundraising, projects were forced to exit, and exchanges were forced to withdraw or go overseas. BTC China and Yunbi ceased cryptocurrency trading business, while OKCoin and Huobi shut down their RMB businesses and shifted overseas. On November 9, 2022, FTX's explosive incident led to increased regulatory efforts by the SEC: "In the six months after FTX's bankruptcy on November 11, 2022, the SEC conducted at least 17 enforcement actions related to cryptocurrencies, a 183% increase from the previous period." After FTX's compliance image collapsed, Krak was the first to be subject to stricter regulation by the SEC.en, Kraken's pledge business was sued by the SEC for not registering securities. In the end, Kraken immediately stopped providing on-chain pledge services to US customers and paid a $30 million fine to reach a settlement with the SEC. Coinbase naturally took over the market share of this part of Kraken's pledge business. Later, on June 5th and 6th, 2023, the SEC successively sued Binance.US and Coinbase. The SEC believes that both of them provide unregistered securities trading, and also claim that the profit and pledge services provided by these two exchanges violate securities laws. The accusations against Binance are even more serious, claiming that Binance engaged in liquidation transactions and mixed customer funds between its domestic and overseas entities. These two lawsuits resulted in a large amount of funds being withdrawn from the two exchanges and flowing into on-chain and other exchanges. The Financial Services and the Treasury Bureau of the Hong Kong Special Administrative Region Government issued the "Policy Statement on Hong Kong Virtual Asset Development" on October 31, 2022, indicating that Hong Kong is committed to promoting the development of NFTs, Web 3.0, and the metaverse market. The "Guidelines for Virtual Asset Trading Platform Operators" came into effect on June 1st, and virtual asset trading platform operators will be able to apply for licenses and allow retail investors to use licensed virtual asset trading platforms. This has led to a series of new and old exchanges announcing their entry into Hong Kong, including Xinhuo Technology, Tiger Securities, DBS Bank, OKX, Bitget, and others. It can be seen that the release of a policy can lead to the decline and rise of CEXes. Every major policy change reshapes the landscape of the CEX industry. (Source: The Block)

Hedging Strategies for CEXs' Business Risks

CEX + Cefi = Traditional Commercial Bank

Abstract Understanding: Although CEXs primarily operate as exchanges, their underlying model is similar to that of traditional commercial banks.

The essence of a commercial bank is to create credit currency through the process of accepting deposits and granting loans. By accepting deposits, banks obtain funds to support their subsequent business activities. Then, based on the deposits they have acquired, banks generate profits by providing loans to individuals, households, and businesses. When a bank grants a loan to a borrower, the borrower deposits the loan amount into their bank account. This creates new deposits, enabling the bank to have more funds available for lending and investment.

Initially, CEXs only offered basic spot trading (e.g., spot exchanges primarily designed for BTC). Later, they expanded to offer derivative trading, such as perpetual contracts. However, the current operation of CEXs is still in the "black box" stage, as exchanges have not clearly stated how their leverage funding operates for providing contract trading. Leverage funding for perpetual contracts typically comes from two sources: own funds and user funds.

Based on this, it can be reasonably speculated:

1) Spot has become the gateway for CEX to absorb funds, and the contract has evolved into a direct application scenario for lending. The ultimate result is the creation of credit currency, but this form of credit currency can only be used within the created CEX.

2) The use of user funds takes priority over proprietary funds. After all, the ultimate goal of CEX is to maximize the profit from transaction fees while ensuring the safety of proprietary funds.

However, traditional commercial banks are generally required to practice separation of businesses, such as separating securities investment from other operations. On the other hand, CEX "part-time" as an investment bank, nominally, CEX only issues platform coins; in reality, some projects do rely on the support of CEX. By issuing platform coins, exchanges can increase their control over the platform ecosystem. Users holding platform coins may benefit from various discounts, promotions, or rewards. In addition, platform coins can bring additional revenue and profit opportunities to exchanges. Platform coins are usually designed to have a certain level of scarcity, with their supply being fixed or subject to mechanisms that lead to long-term deflation. As the platform develops and the number of holders increases, platform coins have the potential to appreciate, thus bringing more benefits to CEX.

However, traditional commercial banks have reserve requirements and capital requirements, making their risk exposures public and transparent. Additionally, even if an individual bank experiences a liquidity crisis or a financial crisis, the central bank can act as the "last buyer" under certain conditions. Therefore, in the traditional financial paradigm, commercial banks are often considered "too big to fail."

Unfortunately, CEX, this giant in the world of cryptocurrencies, currently lacks a transparent financial system and lacks the "last buyer." This may also be a significant reason why CEX is subject to strong regulation.

(Lehman moment)

Insight: Mainstream CEXs are preparing in advance for stricter regulation

Larger exchanges must move towards compliance and facilitate legal deposits.

; ">Smart CEXs are evolving towards a more decentralized path to adapt to future stringent regulatory environments. Coinbase not only provides custody wallet services but also plans to launch Layer 2 solutions based on OP Stack. Binance has already successfully launched the OP BNB testnet, while Bybit has also announced the launch of its Layer 2 solution. In addition, Bitget has introduced MegaSwap, offering users convenient token aggregation and swap services, with a model leaning towards DEX. On the other hand, OKX is relatively aggressive by directly integrating its Web 3 wallet with the CEX App, enabling the conversion of on-chain and off-chain assets."

Binance

Despite frequent regulatory lawsuits in the United States, Binance is still widely recognized as the largest CEX in the market. Its Launchpad, IEO, and Listing have significant influence and wealth effects. With regulatory measures gradually strengthening, Binance's CEX business is facing challenges. To ensure compliance, Binance has made efforts, though the impact is not significant. This will inevitably drive Binance to further develop its on-chain business. BAS Application Chain and BNB Greenfield Storage Chain are empowered by BNB, constructing the on-chain ecosystem for BNB.

OKX

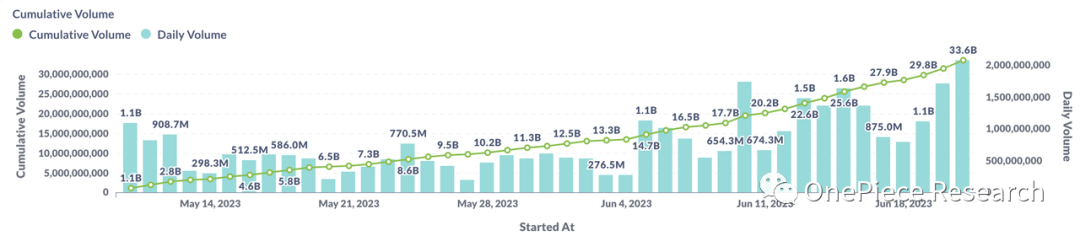

Unlike Binance, OKX chooses to hedge regulatory risks using Web 3 Wallet and OKBChain. The user experience of Web 3 Wallet itself is among the best in similar wallets. What's crucial is that OKX's Web 3 Wallet is embedded in the OKX App, enabling seamless conversion between on-chain and off-chain transactions. This will help OKX evade regulation while converting CEX users to OKB Chain, empowering OKB. With the policy launch in Hong Kong and the support from users of OKX Web Wallet, OKB Chain seizes the opportunity and has achieved phased success in coping with strict regulations.

Bitget

As a second-tier CEX, Bitget still focuses on leveraging hotspots and IEOs to build its brand and empower its platform coin BGB, in order to attract more users. Therefore, there is still a certain gap in terms of product and marketing capabilities compared to larger exchanges. However, outside of the CEX realm, leveraging the matrix established by Foresight News and Ventures, Bitget continues to attract users from other second-tier CEXs and potential incremental users, which has proven to be effective. Furthermore, Bitget claims to be planning to establish a compliant exchange in Hong Kong. From this, it can be seen that second-tier CEXs are still struggling in terms of user base and brand, and are still far from considering strong regulation, and can only embrace regulation-friendly crypto regions.

Open Exchange OPNX

Unlike other CEX, OPNX chooses to hedge regulatory risks in an on-chain manner. Its plan is to separate the trading collateral from the matching engine: 1. User collateral, whether native assets or RWA, is transparent on-chain; 2. Customer positions require credit limits for the collateral as margin, and the collateral parameters must be determined by the DAO to which the on-chain assets belong, with funds and liquidation being isolated from each other. OPNX focuses on RWA and debt trading, which can largely avoid the impact of securitization, and debt trading similar to Celsius and FTX can also open up a large incremental market for it. As for regulation, OPNX chooses to establish itself in Hong Kong, which embraces a crypto-friendly environment.

(Source: Nansen)

Dark Horse: Perpetual Contract Business Won't Be Easily Abandoned

For CEX, perpetual contracts are currently the largest source of revenue. The development of perpetual contracts can be traced back to 2016, when BitMEX introduced this innovative derivative contract. Its leverage can go up to 100x, earning BitMEX founder Hayes the title of "King of Leverage." Over time, other exchanges have also launched their own perpetual contract products, such as OKEx's perpetual contracts and Bitfinex's perpetual contracts. Perpetual contracts feature leverage trading, margin mechanism, and diverse underlying assets, allowing traders to engage in more diversified trading strategies and profit from market volatility.

For users, what really gets them addicted is not just the novelty of being able to leverage up to hundreds of times but also the easy access to hundreds of times their net assets, whichFeeling dizzy. High leverage can make users feel the potential huge profits and stimulate their greed. Fast profits can bring excitement and satisfaction, and increase users' desire for speculation. The uncertainty of asset price fluctuations also brings stimulation and excitement to users, thereby further encouraging them to try high leverage trading.

Therefore, the supply and demand sides of perpetual contracts have formed a certain business understanding. "CEXs tap on the shoulder of perpetual contracts: if the market likes it, we provide it."

And as we mentioned in the previous section, "regulation will increase the hidden costs of trading", but transaction fees are unlikely to increase significantly, because the current total transaction fees (Maker fee + Taker fee) are mostly between 0.01% and 0.1%. (Transaction fee data Source: CoinmarketCap.com) If the marginal transaction fee is increased, a considerable number of investors will be lost. Therefore, perpetual contracts, as the most profitable business of CEXs, will become the object of marginal substitution. In other words, the perpetual contract business segment may have more innovations to compensate for the loss of income caused by the increase in hidden costs.

Summary

In summary, as a derivative model of the traditional commercial banking model, CEXs will consider compliance, decentralized development, and continuous development of innovative perpetual contract business strategies in risk hedging. This is to ensure the stability of income and adapt to the challenges of future strict regulatory environments.

Can DEX replace CEX?

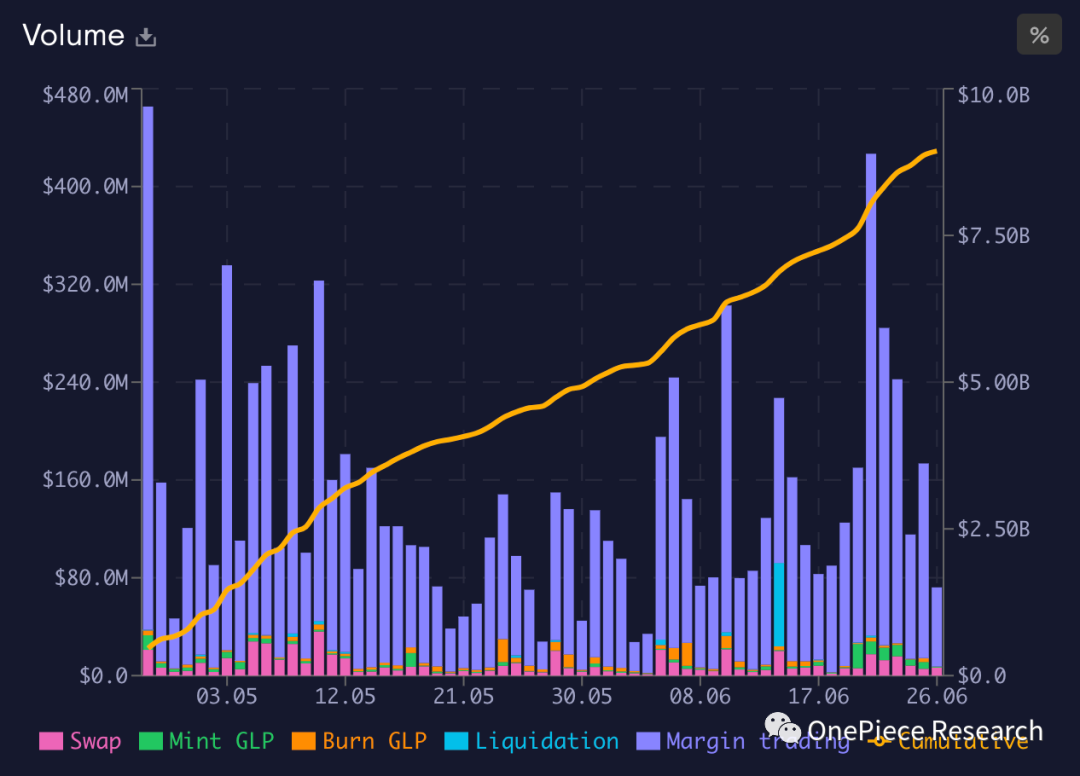

Facing attacks on both the front and back, DEX may usher in a good development opportunity. The U.S. Securities and Exchange Commission (SEC) has filed lawsuits against the world's largest cryptocurrency exchange, Binance (and its founder Changpeng Zhao, accusing them of operating a securities exchange illegally), and against Coinbase Inc., the largest cryptocurrency exchange in the United States (accusing them of operating a securities exchange illegally). CEX is currently in the midst of legal compliance risks. In addition, the listing effect has overdrafted the future growth space of some tokens. The poor performance of newly listed tokens in leading CEX platforms, such as Binance, is a major reason for this. According to research by @Loki, based on Binance's listing announcements, during the 13-month period from April 29, 2022, to June 4, 2023, Binance has listed a total of 20 new tokens and 14 old coins for spot trading. Among them, the average return on holding the 20 new coins until June 4, 2023, is -22.3%, while the average return on BTC during the same period is 7.9%, indicating significantly worse price performance compared to BTC. Regarding the listing effect, we believe that the poor performance of newly listed tokens is also due to the following reasons: insufficient incremental funds in the market, the listing of new coins will cause a diversion of existing funds, and the probability of new coins experiencing a sharp decline will increase correspondingly in a bad market environment. 1) Insufficient incremental funds: When there is overall market liquidity insufficiency, newly listed tokens may fail to attract enough incremental funds to support their price increase. In this case, investors may prefer to allocate limited funds to existing mainstream tokens or assets with more stable returns, and adopt a wait-and-see approach towards newly listed tokens. 2) Diversion of existing funds: The introduction of new tokens may cause investors to transfer some funds from other tokens or assets to participate in the trading of the new token. This could affect the liquidity and price of some existing tokens, especially in a market that is overall weak, this impact may be more significant. Therefore, in an unstable market environment or when investor confidence is low, the probability of new tokens experiencing a breakage may increase. Currently, with CEX facing challenges on multiple fronts, could DEX enter a golden period of development? Uniswap's AMM mechanism, which was established to eliminate market makers, has achieved spot trading that aligns with on-chain logic. However, the issues with AMM are also evident. When there is not enough LP depth, the slippage in trading can be significant. Even with average LP depth, compared to CEX trading, the slippage is still high, especially for assets with large trading volumes and good liquidity. Therefore, we can see many large holders transferring funds to CEX for trading and then transferring them back to the chain. For a long time after the DeFi Summer, DEX did not make any breakthrough progress. However, recently, there have been some signs of a resurgence in DeFi. As the Uniswap v3 patent expired, an AMM mechanism called Liquidity Book, led by Trader Joe, emerged. Liquidity Book draws on the ticks of Uniswap v3 and establishes smaller price ranges called Bins. Trades within each Bin can be executed with zero slippage, and different strategies can be developed based on the number of Bins and changes in fund distribution, optimizing the user experience for traders and liquidity providers. Additionally, centralized liquidity solutions have also appeared in projects such as ve(3,3) to promote depth of prices and increase LP income. Furthermore, the custom LP incentive led by Camelot has also been well-received in the market, with Maverick and Uniswap v4 launching similar offerings. Taking the perpetual contract DEX-DYDX as an example, which is most similar to CEX, DYDX uses an order book model, where user assets are held in a non-custodial manner and trades and settlements are conducted in a trustless manner. Prices for positions and settlements are obtained through oracles, off-chain engines match orders, and a liquidation engine automatically closes positions. The oracle price is the median of prices reported by 15 independent Chainlink nodes. During settlement, positions are closed at the closing price, and the profits or losses from the settlement are covered by the insurance fund. DYDX v4 will be integrated into the Cosmos ecosystem to achieve lower latency and reduced slippage. However, one issue with DYDX replacing CEX is that the index prices for fees and limit orders still come from CEX. As of June 21st, DYDX has a 24-hour trading volume of $2.08 billion, which is still significantly lower compared to top CEXes. (Source: DYDX.exchange) (Source: Coinmarketcap) Unlike DYDX's order book model, GMX uses an LP model, where traders become counterparts to LPs, achieving zero slippage and avoiding the need for market makers to provide liquidity. This is similar to the advantage of the spot AMM model. Additionally, the fees for GMX are...

(Source: Stats.gmx.io)

Long-termism: DEX aligns more with Crypto fundamentalism and blockchain justice principles

From the above DEX mechanisms and data, we can see that the current DEX market share in the entire exchange market is still relatively low compared to CEX, and perpetual contract DEX even heavily relies on CEX for pricing. However, all of this is due to the low entry barriers of CEX, which results in CEX having more liquidity and user activity than DEX. More users and the introduction of market makers. The security of DEX's non-custodial model and the transparency of margin and liquidation mechanisms naturally align with crypto fundamentalism and blockchain justice. Therefore, with the development of technology, when on-chain interactions and Web 3 wallets are no longer barriers for users to enter DEX, what may finally emerge is an on-chain DEX based on off-chain technology, and CEX will only be a place like most brokerages that fully comply with regulations and cater to large institutions for large-scale trading and retail customers for deposits and withdrawals. The exchange that best fits our description is the Open Exchange we mentioned earlier, which takes a more CEX-oriented approach to decentralizing CEX. So, in the short term, what DEXes may need to do is sacrifice to some extent decentralization in order to achieve a better user experience. To achieve widespread adoption of DEX, we still need to wait for the landing and popularization of the following key technologies:

Account abstraction is an important step in blockchain to introduce incremental users. The current EOA address is not actually a user-friendly account form, but rather a primitive account form given to developers, as there is currently no better solution. Similar to Web 2.0 account, which allows logging in and calling various program functions freely, and establishing complex instructions with just one click, account abstraction can achieve a similar interactive experience as Web 2.0 accounts, without the need for repetitive signing and authorization, ensuring both security and convenience. This will greatly reduce the interaction barrier between DEX and CEX.

Ethereum login is the opposite path to account abstraction, which expands the application of blockchain accounts, making Web 3 compatible with Web 2. Users can use Ethereum accounts to register and login to Web 2 platforms, which will change the situation where CEXs divert traffic to Web 3, and instead, make on-chain accounts the entrance to Web 2.

Based on account abstraction and Ethereum login, DEXs use AppChain and off-chain computing to achieve a trading experience with low barriers, low friction, and high performance comparable to current CEXs, while guaranteeing fund security and operational transparency. Additionally, due to on-chain composability, DeFis will no longer face just a "Summer" but rather sustainable development. The development of decentralized storage, computing power, Oracle, and indexing will bring back the sacrificed decentralization.

Conclusion: If CEXs' ultimate destination is decentralization, are DEXs' advantages still valid?

We are optimistic about the future of CEXs and commend the industry positioning of DEXs. However, when CEXs move towards decentralization, the fate of DEXs is yet to be determined. When CEXs transition to decentralization, it will inevitably threaten the industry status and competitive advantages of DEXs. DEXs, as a decentralized trading paradigm, have unique advantages. First, their core feature is decentralization. Second, DEXs offer a wider range of asset choices.

However, as CEXs embrace and integrate some decentralized features and technologies, this evolution may weaken the advantages of DEXs to some extent. CEXs' decentralization transformation can provide higher transaction speed and liquidity, as well as interoperability with the traditional financial system, which could pose challenges to DEXs.

In the development of the cryptocurrency industry, CEXs and DEXs can complement each other and provide users with different options.Transaction choices and experiences. With the advancement of technology and market development, the competition and cooperation between CEX and DEX will continue to evolve, and the final outcome remains to be seen. In summary, the CEX market is gradually being influenced by regulations, but at the same time, it is constantly innovating to adapt to market demands. DEX, as a potential alternative to CEX, aligns more with the principles of Crypto fundamentalism. CEX and DEX each have their advantages and limitations in the cryptocurrency field, and the future development path still holds uncertainty. Regardless, both CEX and DEX aim to provide users with better trading experiences and development opportunities. Reference: [1] https://www.techflowpost.com/article/detail_12078.html [2] https://www.theblockbeats.info/news/28714?search=1 [3] https://foresightnews.pro/article/detail/35891 [4] https://dydxprotocol.github.io/v3-teacher/#/perpetual-guide [5] https://docs.traderjoexyz.com/ [6] https://news.marsbit.co/20230114221554647070.html [7] https://gmxio.gitbook.io/gmx/ [8] https://gmx-io.notion.site/gmx-io/GMX-Technical-Overview-47fc5ed832e243afb9e97e8a4a036353gn: left;">[9]https://foresightnews.pro/article/detail/35891

[ 10 ]https://foresightnews.pro/article/detail/21548

[ 11 ]https://academy.binance.com/en/articles/what-is-erc-4337-or-account-abstraction-for-ethereum