Demystifying the first digital asset "killing pig" sued by CFTC

case overview

For the first time in a recent case, the U.S. Commodity Futures Trading Commission (CFTC) dabbled in"romance scam"(Romance Scam) field. The CFTC reportedly sued Justby International Auctions and its CEO Cunwen Zhu on Friday, alleging that the company misappropriated $1.3 million in client funds that were supposed to be used to trade digital assets.

The CFTC lawsuit was filed in the U.S. District Court for the Middle District of California. According to the CFTC's allegations, Cunwen Zhu, through his company, Justby International Auctions, defrauded at least 29 clients and defrauded them of more than $1.3 million between April 2021 and March 2022.

Originally, these client funds were supposed to be used for digital asset commodity and foreign exchange transactions, and Justby was supposed to manage the funds and generate income, but Cunwen Zhu used these funds for personal consumption and transferred most of the funds to the scheme involved in the case. Bank accounts, digital wallets, and digital asset trading platforms controlled by employees in China.

What is the specific method of "killing the pig"?

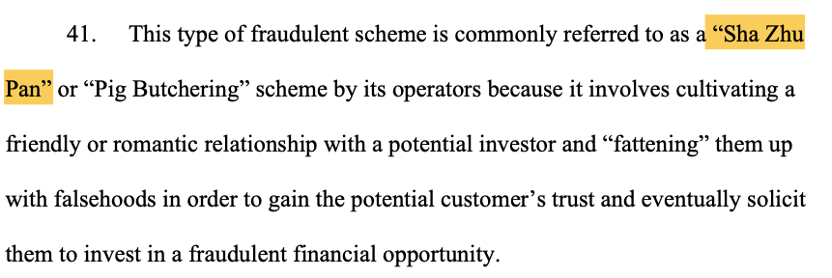

According to the CFTC,The scammers use social media to get in touch with customers and"Pretending to be friends or in a relationship with a client", so as to induce them to open an account.CFTC mentioned in the lawsuit documents that three types of people played a role in it: (1)"solicitor"Contact scheme clients via social media and pretend to be friends or romantically involved with them in order to induce them to open and fund trading accounts; (2)"trading company", which purports to establish a trading account on behalf of a program client; (3)"shell company"image description

Interestingly, CFTC mentioned the pinyin of "killing pig dish" in the lawsuit documents

The CFTC mentioned the method of killing pigs in very detail in the lawsuit documents. According to the documents, the "solicitor" spent more than a year with a client to establish a romantic relationship, and then persuaded the client to open an investment trading account with his company and invest funds. To achieve this goal, solicitors often share expensive-looking photos of their lives, driving records of luxury cars, and screenshots of super-high-yielding fake accounts. These solicitors usually claim to be very successful traders and often attribute their success to an "uncle" or "insider" who provided the inside information.

Once cheated, they will then introduce customers to trading companies, open trading accounts and send money. These trading companies themselves are legitimate, but the trading software downloaded by instigated customers is not real trading software, and various false information will be provided. Often, the trading software will show considerable profits if the client follows the investment advice of the solicitors and trades on the software. According to the CFTC lawsuit, one of the defrauded customers' accounts showed false profits of more than $2 million.

Responses and Recommendations from the CFTC

The U.S. Commodity Futures Trading Commission (CFTC) has issued several customer protection fraud alerts and articles, including "Avoiding Romantic Scams in Forex, Precious Metals, and Digital Assets," warning users of a recent increase in scams on online dating and social media platforms , these scams trick victims into sending money to fraudulent websites claiming to trade forex, precious metals or digital assets.

In the ongoing lawsuit against Zhu and Justby,The CFTC seeks compensation for defrauded customers, disgorgement of disgorged proceeds, civil monetary penalties, trade bans, and permanent injunctions for further violations of the Commodity Exchange Act (CEA) and CFTC regulations.The incident shows that regulators are increasingly concerned and taking action to crack down on scams in the cryptocurrency space. It is foreseeable that because digital currency-related financial cases are more difficult to trace the whereabouts of money, the relevant supervision will be more intense.

Ian McKinley, the CFTC’s director of enforcement, said in a statement:"As people try to escape isolation during the pandemic and connect with others online, scammers see a new opportunity to take advantage of the public and commit fraud. Today's action, the first of its kind by the CFTC, demonstrates that the CFTC will hold accountable unscrupulous individuals who defraud customers and protect the public from Internet scams. "