DODO Research: The ZK Rollup track is getting crowded, what is the first-mover advantage of zkSync Era?

Original source: DODO Research

Original author: dt

Original source: DODO Research

The second-layer expansion mechanism of Ethereum is the most prominent theory of today's blockchain, and it is also a battleground for military strategists.

first level title

I. Introduction to zkSync Era

zkSync is an Ethereum layer-2 expansion solution based on the zk-rollup architecture, designed to achieve high-performance, low-cost smart contracts and blockchain applications. It uses zk-rollup technology to achieve high-throughput expansion to reduce transaction costs and increase confirmation speed. zkSync Era is built on the basis of the zkSync protocol, featuring faster transaction speeds, higher scalability, and more cost-effectiveness. It is applied in many fields such as DeFi, cross-chain bridge, NFT and so on. Due to its high efficiency and low cost, zkSync has received extensive attention from the capital market and is developing rapidly.

Matter Labs, a zkSync development company, has completed a total of four rounds of financing, and the current total financing amount has reached 458 M US dollars. Well-known venture capital a16z, Dragonfly, 1KX, OKX Ventures, bybit, Blockchain Capital all participated in the investment. Looking at the past, whether it is in the field of WEB3 or WEB2, this amount of financing is an amount that cannot be ignored, and it is the leading unicorn project in the blockchain project.

secondary title

zkSync Era History

zkSync 1.0 - zkSync Lite was launched on the Ethereum mainnet on June 15, 2020, achieving a transaction throughput of about 300 TPS, but it is not compatible with EVM.

zkSync 2.0 - zkSync Era launched on March 24, 2023, supporting Solidity (via zkEVM) and Zinc (rollup's internal programming language) to implement arbitrary smart contract functions; secondly, via zkPorter - a combination of zk-rollup and sharding protocol, the throughput increases exponentially, reaching 20,000+ TPS.

secondary title

Rivals of zkSync

The opponents of zkSync are undoubtedly various public chains in the L2 track. In addition to the mature and leading Arbitrum One & Optimism, many latecomers who use zk-rollup are opponents of zkSync that need more attention:

Including Polygon zkEVM, which is currently online, Starkware, which is well-known and invested heavily by many capitals, Linea developed by Consensys, Scroll, which is also dedicated to the development of zkEVM, Aztec, which focuses on privacy, and two second-tier solutions funded by exchanges, OKX Invested in Taiko and bybit invested in Mantle. Even Optimistic Rollup Metis, which has already been launched, announced that it is actively developing Hybrid Rollup based on zk-rollup combined with the current Optimistic Rollup. Finally, there is Kakarot, which has attracted attention because of Vitalik's personal investment in the Pre-Seed round.

first level title

II. zkSync Era Data Overview

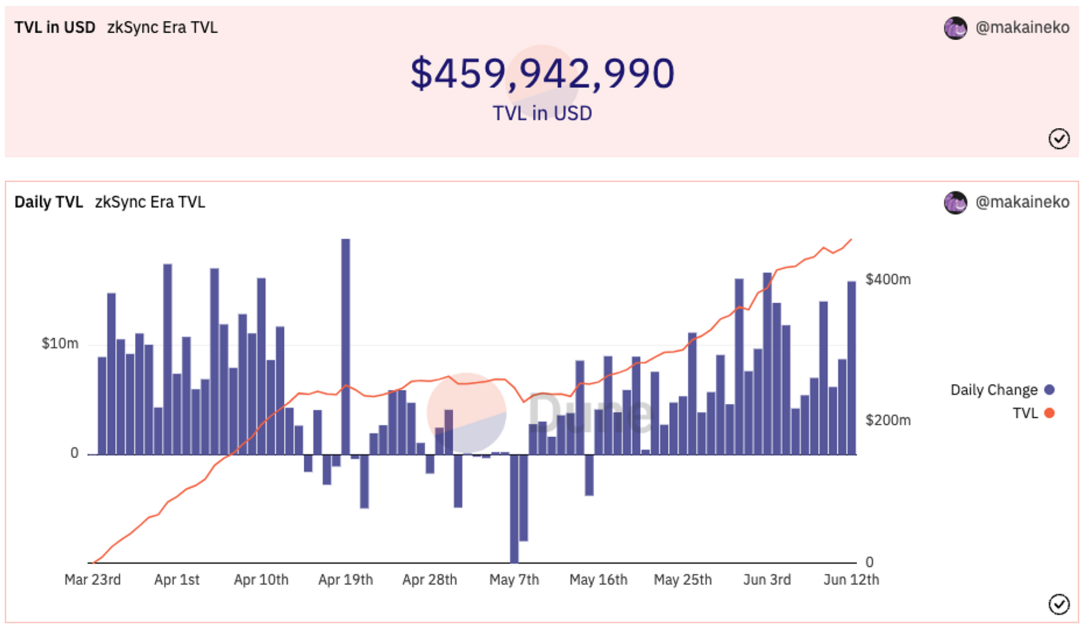

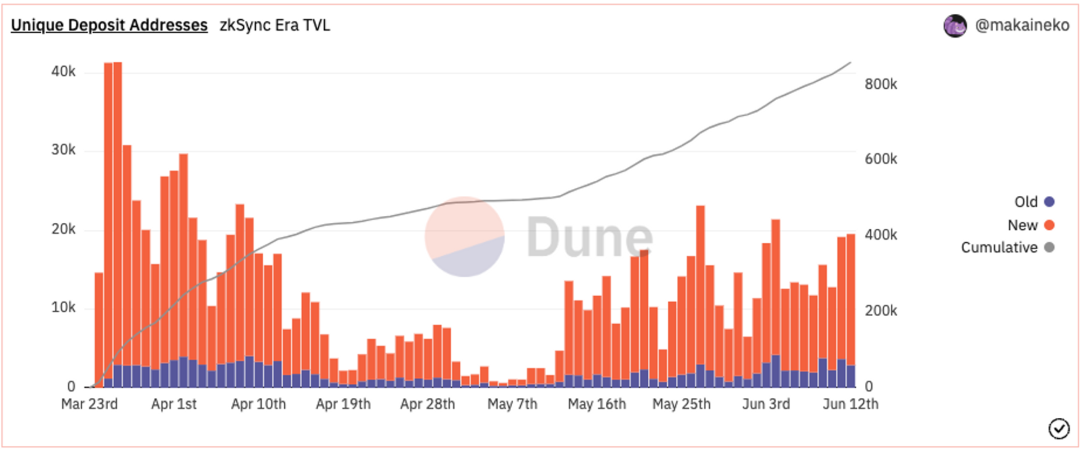

Before introducing the ecological projects in detail, let us first understand the current status of the zkSync Era ecosystem from the data such as TVL, official bridge entry and exit, and daily on-chain transactions.

image description

source: l 2b eat.com/scaling/tvl

source: dune.com/makaineko/zksync-era-airdrop-criterion

The zkSync Era official bridge data is also in line with the rising trend of its ecology. The accumulated deposit addresses have reached 800K, and the average daily new deposit addresses since June are about 10K.

source: dune.com/makaineko/zksync-era-airdrop-criterion

image description

source: dune.com/sixdegree/zksync-airdrop-simulation-ranking

first level title

secondary title

Veteran Items

When zkSync Era was not launched, many project parties promised to deploy it, including Balancer, Uniswap, Frax, OHM, LayerZero and other well-known old protocols on the main network, but not many have completed the deployment so far. 1inch and iZUMi Finance are the largest established agreements that have been officially launched.

1inch Network

The 1inch aggregator is one of the cornerstones of the Defi project. It officially landed on zkSync Era on 4/20 and became the 11th public chain deployed. With 1inch, it means that the split liquidity on the chain has a good entrance, and users can exchange tokens It is no longer necessary to think about which DEX operation to go to, effectively promoting ecological development.

iZUMi Finance

secondary title

image description

source : https://defillama.com/chain/zkSync Era? tvl=true

secondary title

DEX decentralized exchange

SyncSwap

SyncSwap is a decentralized exchange built on zkSync Era. It has the characteristics of low fee cost, and at the same time inherits the complete security of zkSync.

Features of SyncSwap include support for pool gauges, custom fee structures, advanced routers, voting escrow token models, governance, and more.

Recently, SyncSwap launched Move, a cross-chain bridge based on the official zkSync Era bridge, which allows transfers between Ethereum and zkSync Era, and supports USDC, ETH, USDT, WBTC, LUSD, LSD, MUTE and other assets. In fact, Move can be understood as the third-party front-end of the zkSync Era official bridge, which has the same gas cost as the zkSync official bridge, and the bridge token is 100% zkSync native assets, with no third-party risk. When users approve or transfer funds with Move, they interact directly with the official zkSync smart contract.

iZUMi Finance

iZiSwap is an on-chain order book DEX launched by iZUMi Finance, a one-stop liquidity-as-a-service DeFi protocol, on zkSync Era. It adopts iZUMi's discrete liquidity AMM (DL-AMM), similar to Uniswap V3 centralized liquidity, DL-AMM Liquidity can be allocated at any fixed price, improving capital efficiency.

iZiSwap is the continuation of the automatic market maker (AMM) DEX represented by Uniswap. Its innovative design not only improves the efficiency of liquidity supply, but also greatly enriches the user's trading experience, making iZiSwap stand out in the competition of decentralized trading platforms.

It is worth mentioning that iZiSwap has launched a fully decentralized limit order book model. During the trading process, all limit orders on a single point are treated as a whole. This method can greatly improve the efficiency of the transaction and ensure that the transaction is completed in O(1) time. Second, whenever the price crosses a price point, the filled order volume is transferred to a separate storage space called legacy. This design enables the system to clearly distinguish the sequence of orders, thereby ensuring the correctness of transactions.

Finally, the user needs to claim the transaction assets by himself. This is a necessary restriction as it ensures that users have full control over their assets and avoids security issues that may arise due to automatic asset transfers.

Such a design brings a series of good properties. First of all, since the limit order on a single point as a whole can complete the transaction in O(1) time, this greatly improves the efficiency of the transaction. Secondly, when the price passes through the target price (time point A) and then falls back (or crosses) the target price (time point B), the limit order after time point B will not be recorded as a transaction status, This guarantees the correctness of the transaction. Finally, when the price is at the target price, the part of the transaction will be obtained by the user who initiated the claim operation first, which ensures fairness in the sense of first-come-first-served.

In general, iZiSwap's innovative limit order management method has brought significant improvements in terms of security, efficiency, and fairness, providing users with a better trading environment.

Maverick Protocol

Maverick Protocol is a DeFi liquidity infrastructure designed to provide a liquid market for traders, liquidity providers, DAO funds, and developers, powered by Maverick AMM.

Users can trade and provide liquidity on Maverick AMM. There are 4 different types of liquidity modes: Mode Right, Mode Left, Mode Both and Mode Static, after choosing a mode, the AMM will automatically move its liquidity to follow the price according to a specific set of rules. Maverick Protocol allows LPs to open Boosted positions, use incentive rewards to accurately attract liquidity, and other users can add liquidity to Boosted positions to purchase shares. LP can obtain income from transaction fees and LP incentives.

Mute

Mute.io is a zkRollup-based DEX on zkSync Era. It includes modules such as limit orders, pledge platforms, and bond platforms. It supports wallets, transactions, LP pools, Amplifiers, bonds, and DAO governance functions. It allows ETH, USDC, MUTE, WISP, ZKINA, MVX, IDO, WETH, USD+, ZKDOGE, DOF, BOLT, ZKFLOKI and other assets for trading and liquidity supply. Users can obtain LP tokens after providing liquidity in the LP pool, and pledge them into Amplifier to obtain income.

Bonds are an innovation of Mute. Users can use their LP tokens to purchase MUTE from Mute DAO at a lower price (bond). After buying a bond, MUTE will be released after 7 days. If the ROI is positive, the user can earn Take more MUTE than LP tokens. Through bonds, Mute DAO can increase the liquidity owned by the agreement, increase treasury revenue and the long-term liquidity of the agreement. dMute is the DAO token of the Mute.io ecosystem. Users need to lock MUTE for 7 to 364 days, and get dMUTE in return. After the lock-up period, users can redeem MUTE.

SpaceFi

SpaceFi is a Web3 platform that connects the Cosmos ecosystem and Ethereum Layer 2. Its products include DEX, NFT, Starter, Spacebase, and there will be new products such as Game and Social Network in the future.

SpaceFi supports ETH, USDC, SPACE, WETH tokens for trading and adding liquidity. Users can pledge single currency such as xSPACE and LP tokens such as SPACE-USDC to participate in mining in the Space Farm to obtain xSPACE rewards. Starter is Space's incubation and fundraising platform. Users can pledge LP tokens such as USDT, ETH, or SPACE-USDC to obtain a share of project tokens at the initial issue price. Spacebase is an on-chain community of Space. By creating or joining Spacebase, users can get more mining rewards. Planet NFT is minted by SPACE tokens, NFT holders can issue on-chain proposals, and both Planet NFT holders and xSPACE holders can participate in governance voting.

Velocore

Velocore is the first ve( 3, 3) DEX based on Velodrome Finance and Solidly codebase in zkSync Era.

The core function of Velocore is to allow users to trade digital assets at low cost and low slippage. Users can add liquidity to the LP pool (divided into Stable Pool and Volatile Pool), and use LP tokens to obtain VC token incentives. VC is the native token of Velocore. VC holders can vote for escrow tokens and exchange for the governance token veVC (veNFT). veVC can be transferred, merged and split. The VC lock-up period can be up to 4 years. The longer the release time, the higher the voting weight and rewards veVC holders will receive. veVC holders can also obtain agreement fees, bribes and kickbacks. Bribes can be used to encourage other users to vote for LP pool rewards. Velocore also has Launchpad and launched memecoin WAIFU.

veSync

veSync is also the ve( 3, 3) DEX on zkSync Era and a fork of Velodrome Finance. veSync's TVL on the zkSync Era is approximately US$4.85 million, ranking seventh, with an increase of nearly 20% in the past 7 days.

The native token of veSync is VS, and the governance token is veVS (veNFT). veVS can be transferred, merged and split. veSync leverages the ve(3, 3) incentive model, token holders can vote to escrow their tokens to receive veNFTs, longer vesting periods lead to greater voting rights and rewards. There are two types of veSync liquidity pools, Stable Pools and Volatile Pools, with transaction fees ranging from 0.02% to 0.05%. In the future, veSync will launch Concentrated Pools, allowing users to customize the range of liquidity provided. Users choose specific pools to vote and receive bribes.

eZKalibur

secondary title

Lending lending market

Borrowing has always been the most important infrastructure in all public chains except DEX. However, because chainlink has not yet connected to zkSync Era, and currently uses the oracle machine provided by Redstone Finance, giant whale users dare not use it, and in zkSync Era There are only two large assets of ETH & USDC, and there are not many real usage scenarios, so the lending field is a tepid existence in the zkSync Era, and most users may be short hunters or DEFI farmers.

Eralend

Eralend, formerly known as nexon finance, is a compound fork protocol like ReactorFusion. There is not much innovation in terms of mechanism. This project was once mentioned in the zkSync Era official Twitter tweet introducing the ecological project, and the protocol has not yet issued governance tokens. This may have attracted a large number of short hunters to participate. At present, TVL and ReactorFusion are evenly matched at $5 M, which is the top lending market on the zkSync Era.

ReactorFusion

secondary title

CDP Overcollateralized Stablecoin

Overnight USD+

secondary title

Derivatives Derivatives

Unidex

secondary title

other projects

Kreatorland

Kreatorland is a one-stop NFT project provided by Opensea Fork on the zkSync Era chain. It is one of the projects mentioned in zkSync Era’s official Twitter tweet. It provides users with the service of minting and issuing NFT. Launched an NFT Poop Genesis.

Goa l3

Summarize

Summarize

zkSync has a rich history and a promising future. With the continuous advancement of Ethereum technology, the competition in the field of zk-rollup or zk-EVM is also intensifying. zkSync Era occupies the pioneer position to give priority to the establishment of ecology. At present, it has been proved from the ecological system on the data surface that the overall public chain of zkSync Era is currently in a stable upward stage.

From the number of protocols, it can be seen that the most mature development in the zkSync ecosystem is the DEX track. Whether it is the traditional Uni v2 fork, ve(3, 3) solidly fork, or DEX with concentrated liquidity, all have achieved good results. On the contrary, the track of lending, derivatives, NFT, or GameFi currently does not have obvious innovation capabilities. With the emergence of applications that attract users, it can be expected that with the deployment of more infrastructure projects including cross-chain protocols, oracles, and stable coins, more interesting Defi Lego projects will emerge.

references

references

https://foresightnews.pro/article/detail/33720

https://www.odaily.news/post/5187161

https://www.crunchbase.com/organization/matter-labs

https://www.alchemy.com/overviews/zkevm

https://l 2b eat.com/scaling/tvl

https://dune.com/makaineko/zksync-era-airdrop-criterion

https://dune.com/sixdegree/zksync-airdrop-simulation-ranking

https://defillama.com/chain/zkSync Era? tvl=true

https://ecosystem.zksync.io/