Binance had a net outflow of US$1.8 billion in 3 days, where did all the inflows go?

Recently, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Binance. As the regulatory stick is swung down, the most influential exchange in the encryption world is facing a strong judicial crisis. And the SEC’s freezing order on Binance.us application brought another wave of FUD.

According to DeFiLlama data, the 24-hour net outflow of Binance was 660 million US dollars; since June 6, 1.82 billion US dollars have been outflowed.

From the perspective of net assets, Binance generated a net outflow of billions of dollars. Although this data seems huge, it is less than one-tenth of Binance’s total assets.

According to DeFiLlama data, Binance still has net assets of up to US$50.8 billion. Judging from the asset curve, the recent decline in assets has not been strong.

A Binance spokesperson told foreign media: "When such news spreads, the outflow of funds is expected to be higher than normal." But he does not think it is cause for concern. "The outflow of funds seems to have stabilized now."

secondary title

Where are the billions going?

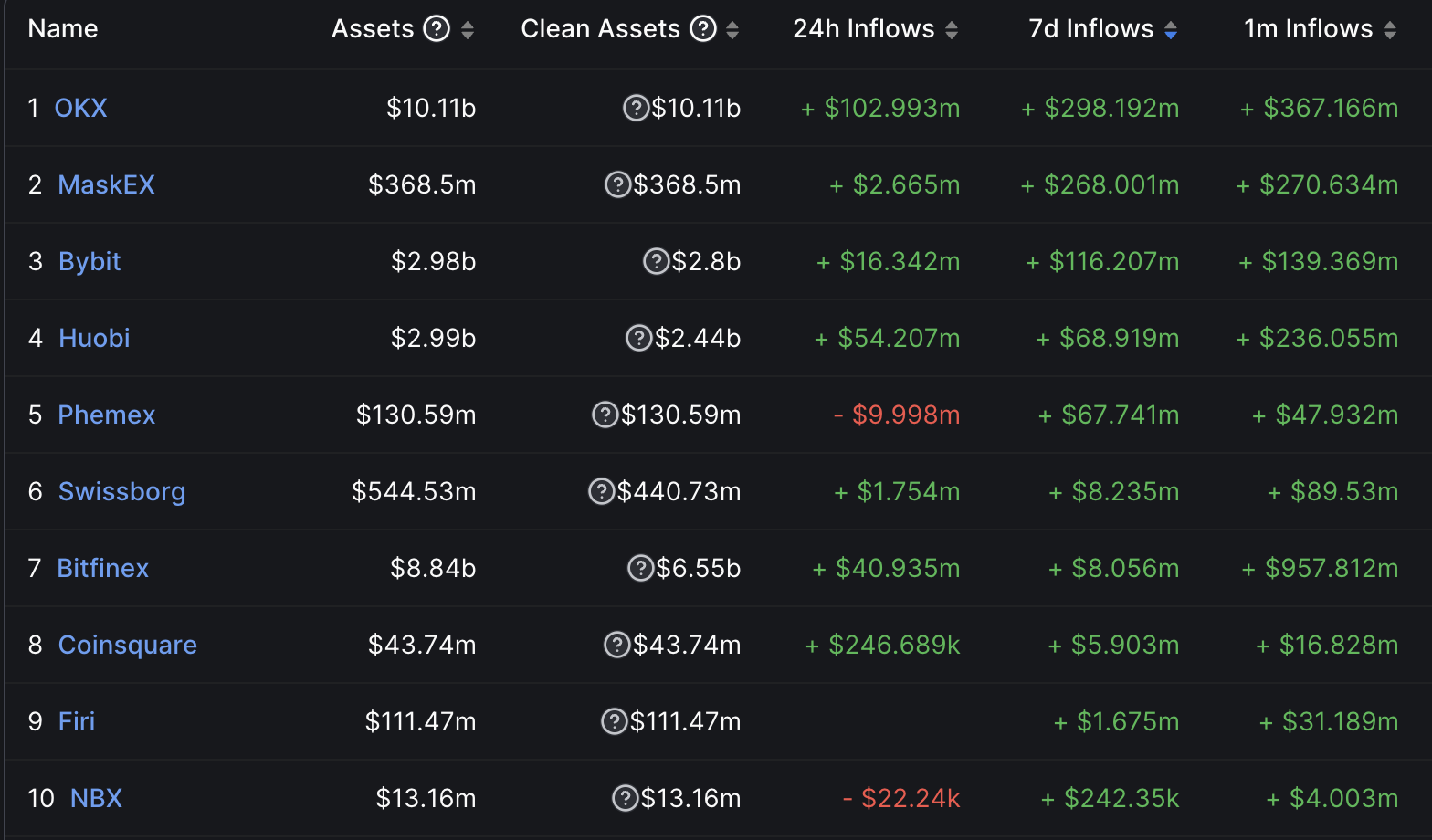

DeFiLlama data shows that in the past week, many exchanges have generated considerable net inflows.

Specifically, OKX has seen a net inflow of about $300 million in recent days. MaskEX ranked second on the 7th inflow data, with a net inflow of about 270 million US dollars. ByBit received a net inflow of $120 million.

Only the above three exchanges have received net inflows of US$100 million. There are two exchanges with a net inflow of tens of millions of dollars, namely Huobi and Phemex. In addition, Bitfinex also received tens of millions of net inflows after the incident, but due to the large net outflows in the previous few days, it did not perform well on the 7-day data.

It should be noted that DeFiLlama does not include data from platforms such as Coinbase, MEXC, Kraken, Bithumb, etc., so its data only represents one aspect of the market.

Overall, the CEX data collected by the DeFiLlama platform has generated a total net inflow of approximately US$860 million in the past 7 days.

Binance, on the other hand, generated a net outflow of $1.8 billion in the past 7 days. According to Fortune data, Coinbase also generated billion-dollar net outflows. Other CEXs cannot fully undertake the net outflow of about US$3 billion. We speculate that more funds flowed to decentralized wallets and unsigned addresses.

Odaily learned that, taking OneKey's hardware wallet as an example, its sales data this week has increased by at least 300% compared with usual days. KeyStone, also a hardware wallet brand, also recorded a three-fold increase in sales.

Traders are migrating to DEX?

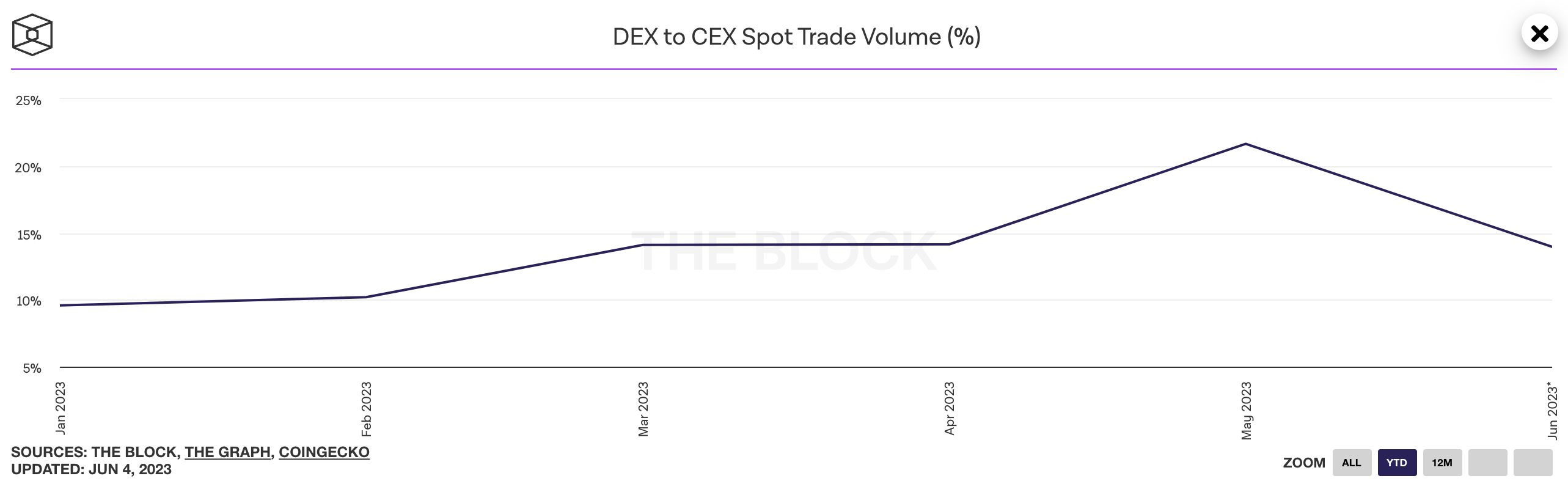

Due to the drastic changes in the regulatory environment, some traders have also begun to migrate to DEX. CoinGecko data shows that between June 5 and June 7, the trading volume of the top three DEXs surged by 444%. Uniswap V3, Uniswap V3 (Arbitrum), and Pancakeswap V3 accounted for 53% of the total DEX trading volume in the past 24 hours, adding more than $792 million. Additionally, trading volume on DEX Curve, which supports stablecoin trading, soared 328%.

The comparison with DEX is more obvious. Let's take the transaction volume data of the past 24 hours as an example. The "regulatory market" has gradually come to an end, and the crypto market trading sentiment has declined in the past 24 hours. According to CoinGecko data, the 24-hour trading volume of CEX dropped by 20.92%. The decline in trading volume of DEX was significantly lower, only 13.11%.

secondary title

Institutions and projects have mixed responses to FUD

After the SEC sued, as the news continued to ferment, the encryption industry also expressed its support or concerns through practical actions. The most direct way is the flow of real money.

Despite massive outflows from both Binance and Coinbase, people are still bucking the trend and depositing into them.

Following the reports of the SEC suing Binance, FalconX received 37 million USDC from Circle and deposited 29.5 million USDC into Binance. Jump Trading transferred about $50 million in ETH and stablecoins to Binance.

Before the lawsuit, FBG Capital had withdrawn a total of 44 million USDT from the two exchanges. After this incident, FBG Capital deposited all the previously withdrawn 44 million USDT into Binance.

The mysterious giant whale on the chain also began to use CEX to express support. The whale address beginning with “0x 3356 ” deposited 100 million USDT to Binance through multiple operations in just 12 hours.

According to 0xScope monitoring, even under the pressure of the SEC, assets worth $915 million have flowed into Binance in the past 24 hours.

Of course, there are also institutions that are withdrawing assets. For example, the investment institution Arca has withdrawn approximately US$1.68 million and over 1.48 million ARB from Binance.

Cumberland, an encrypted market maker, is unpredictable-withdrawing 67.9 million USDC from Circle, depositing 67.1 million of them in Coinbase, and conducting a large number of withdrawals from Coinbase and Binance, with a total of 37,600 USDC withdrawn ETH and varying amounts of AXS, SHIB, COMP, LINK, CRV, AAVE and RNDR tokens.

Going back to this lawsuit, although the flow of funds is quite strong, compared with the huge stock of assets of major firms, the amount of outflow is still only a very small part. And this strong FUD emotion is more or less filled with some over-rendering.

From the perspective of the whole industry, no matter which direction the situation itself will develop, the contradictions surrounding supervision will inevitably promote the improvement of supervision itself. Looking at the longer-term future, the current disputes may be just the pains leading to a new stage.

Jake Chervinsky, chief policy officer of the Blockchain Association, had the most interesting feelings about this incident, "Relief, the SEC finally took action, and the result is not so bad, isn't it? Life and business continue." As far as investors are concerned, the future prospects of the encryption industry are still promising.