Three minutes to quickly understand how the Polygon zkEVM ecological development has been online for two months?

Compilation and arrangement: Baize Research Institute

Compilation and arrangement: Baize Research Institute

Have you heard about the development of Polygon zkEVM? Not a drop hunter, not an alpha hunter, but want to know what's going on on this L2?

Take you through everything you can do on Polygon zkEVM in 3 minutes. Is the ecological project an opportunity or pure airdrop hype?

zkEVM is considered the Holy Grail of Ethereum scalability. Polygon is one of the leading explorers in this field, and its Polygon zkEVM is the second zkEVM to go live on the mainnet after zkSync Era.

In this article we mainly discuss three things:

Opportunities on Polygon zkEVM

Overview of assets on the current Polygon zkEVM chain

All Dapps currently on Polygon zkEVM

Thinking and Summary

1. Opportunities on Polygon zkEVM

Let me show you some "temptation" - APR on Polygon zkEVM right now to see how profitable yield mining is.

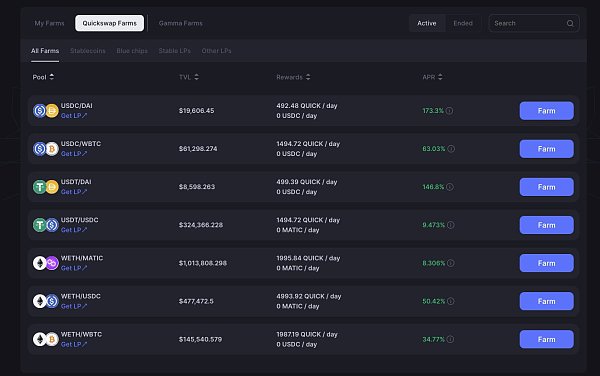

QuickSwap

The TVL of the zkEVM chain is about $7 million.

USDC/DAI - 173%

USDT/DAI - 146%

USDC/WBTC - 63%

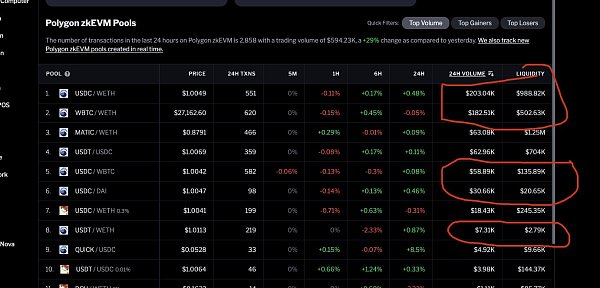

But it’s not just a high yield set to attract liquidity, if you check on CoinGecko, you can find that the actual volume/liquidity ratio is also high.

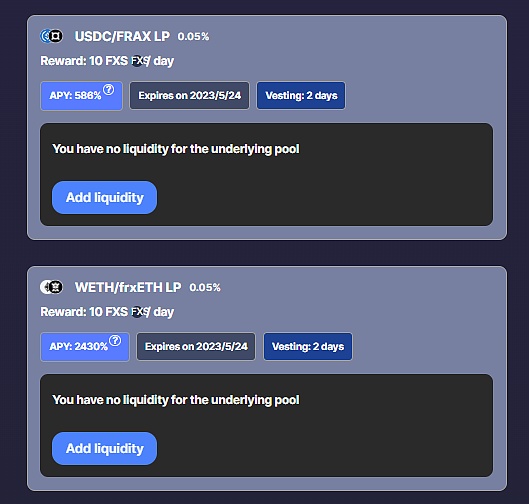

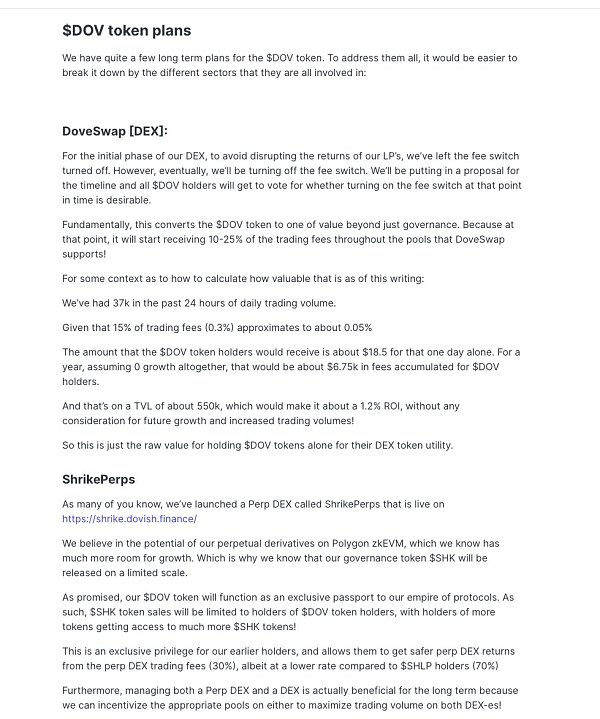

Dovish Finance

TVL is only $550,000.

The current TVL of the wETH/frxETH pool is 4.5 ETH, but the total daily income is only 10 FXS, which is obviously not attractive.

The same is true for USDC/FRAX, with a TVL of 18,000 US dollars and a total daily income of only 10 FXS. Assuming that the FXS price remains at 7 US dollars, the average daily income of providing 1 dollar of liquidity is only 0.003 US dollars (70/18000).

The project party also uses the platform currency $DOV as an incentive in some fund pools, but wETH/DOV LP is very thin, with only 24 wETH pairs, and the liquidity is very low. I'm not sure how $DOV will get it's value, can look at that later.

Mantis Swap

I did not find a stablecoin exchange AMM on Polygon zkEVM, so my friend recommended Mantis Swap to me:

🔹 Possibly the first stablecoin trading protocol

🔹 Single currency mining

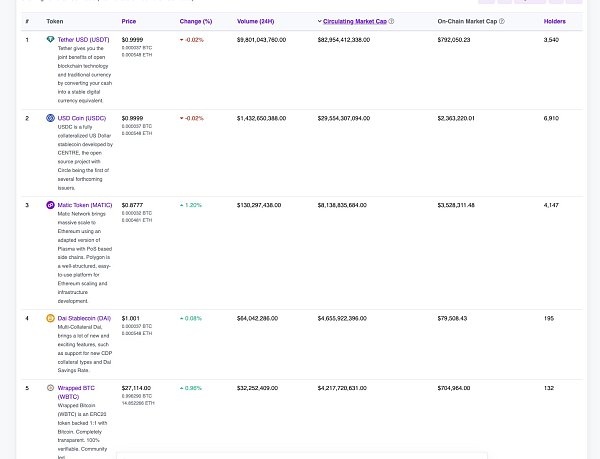

2. Overview of Polygon zkEVM’s on-chain assets

The Polygon zkEVM is just a "baby" right now, with a TVL of only about $10 million.

USDT - 700,000

USDC - 2.3 million

DAI - 80,000

BTC - 700,000

WETH - 2.3 million

Matic - 3.5 million

Interestingly, the Frax ecosystem existed very early:

sfrxETH - 475 thousand

frxETH - 455,000

FPIS - 469 thousand

FXS - 180,000

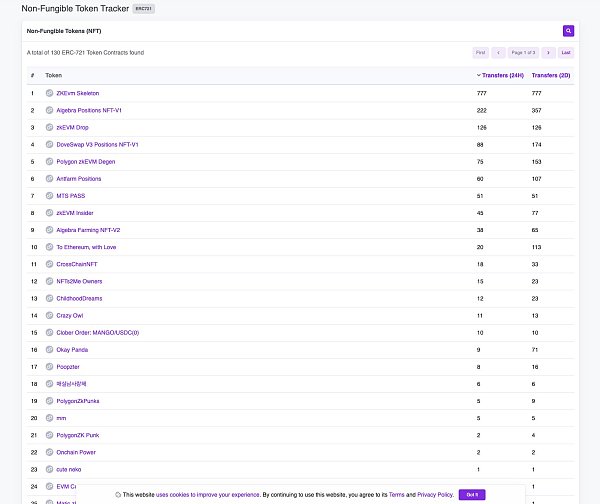

NFTs haven't been minted like crazy yet, but it looks like some projects are being laid out.

3. All Dapps currently on Polygon zkEVM

QuickSwap

Currently the largest DEX on Polygon zkEVM.

Dovish Finance

Swap, the perpetual contract function will be launched soon.

However, current liquidity mining is not very attractive.

Uniswap

The on-chain vote for "Launch Uniswap V3 on Polygon zkEVM" has passed and should be coming soon.

LeetSwap

At the same time, the Swap built on Canto + Polygon zkEVM, the UI cannot connect to zkEVM yet.

Antfarm Finance

Antfarm is a Swap that prioritizes liquidity providers and aims to use market price changes to provide liquidity providers with more profits and security. The current TVL is $1.07 million, which looks good.

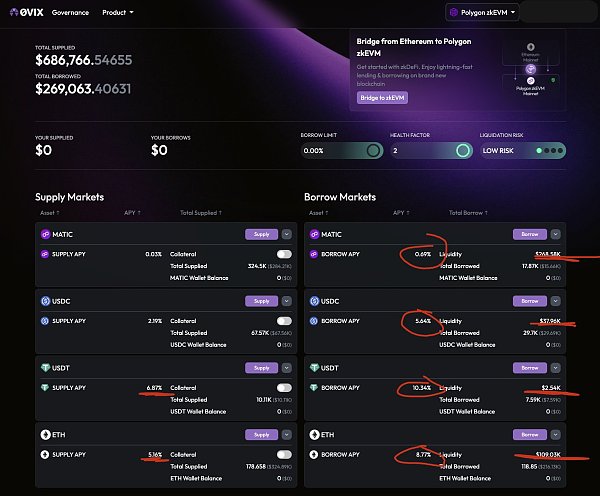

0 VIX

A lending protocol, but currently there is not much liquidity to lend out.

But now it’s really not worth borrowing money on Polygon zkEVM. If you cross-chain all the way to zkEVM just to borrow money, it’s better to do something through those platforms that provide high APY.

But if you're an airdrop hunter, give it a try.

D8X

The upcoming institutional-grade perpetual DEX.

Satori Finance

A perpetual DEX invested by PolyChain and Coinbase.

zkEVM Swap

A small Swap, not very popular on Twitter, and no more information.

zkDeFi

A less popular Swap, which also has liquidity mining and Launchpad functions, is built on zkSync and will soon come to Polygon zkEVM.

4. Thinking and conclusion

Polygon zkEVM is not only backed by an experienced Polygon development team, but also has a "baby" L2 with airdrop expectations.

As Sandeep Nailwal, the founder of Polygon, whom I have always respected, put it:

“The Polygon zkEVM ecosystem is poised for a massive boost with key infrastructure deployments like Safe, the arrival of oracles like Chainlink, improved user experience based on early developer feedback, cost optimization using data compression, and more. Additionally, There is no rule that existing tokens (MATIC) cannot be mass airdropped.”

The advantages of Polygon zkEVM are:

🔹 Backed by Polygon, it is easy to attract more protocols to develop

🔹 The team has strong business development skills and can invite more protocols to migrate over

🔹 Has an active community

Even so, Polygon zkEVM also faces some challenges:

🔹 Polygon is trying to do many things, DeFi, Web3 games, Web2 adoption

🔹 Their DeFi has slowed down a lot and they think the "king" is QuickSwap

🔹 Zero-knowledge proof technology is cool, but how many people really care about it?

If you want to try Polygon zkEVM, you may find that most cross-chain bridges are not very liquid. You can basically only cross-chain ETH from the Ethereum mainnet to this point. So, the user experience with Polygon zkEVM has not been great so far (but it's early days).

I love mining in DeFi, and the high APY offered by existing DeFi Dapps is good for me.

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.