Meme players must see: four steps to help you quickly find the next PEPE

Original compilation: Biteye core contributor Crush

Original compilation: Biteye core contributor Crush

After a 375,000x increase in just 21 days, $PEPE has changed many lives. Others can, and I believe you can too! Here's my complete guide to finding early potential meme tokens (and trading them for insane rewards).

In this article, I will introduce:

The Basics of Meme Coin Investing

How to Find and Research Powerful Meme Coins

Best Meme Coin Buying Strategies

first level title

01 Basic knowledge

When you buy any token, you buy it on the condition that it can be sold at a higher price in the future.

This is even more true for meme coins as they rely more on psychological drivers than fundamentals.

This is called "castle in the air theory" in economics (promoted by economist Keynes), that is, "investors try to build a castle in the air, and believe that its price will rise in the future, and it will exceed its inherent estimated value." .”

Our goal is to be one step ahead of others, enter the market faster, and buy the tokens we need. Of course, this has far fewer fundamental drivers for meme coins than your usual investment projects. Therefore, you must consider investing in meme coins as a gamble!

You can think of meme currency as a game in a casino. L1 and exchanges are like casino houses. Users invest in this house, but the casino always wins.

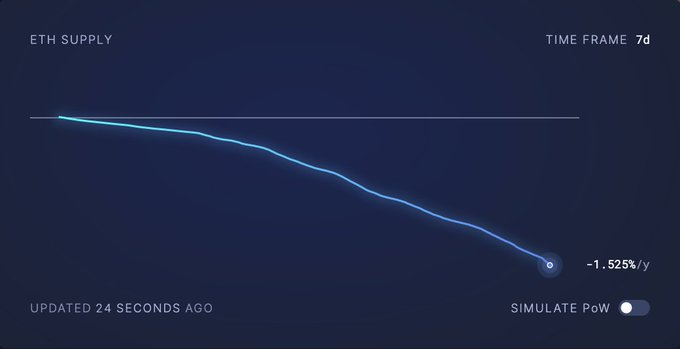

Last week’s ETH consumption also increased, i.e. more on-chain activity means more ETH burned.

But compared to real casino games, the probability of success in investing in meme coins is actually greater.

first level title

02 How to Find and Research Meme

secondary title

1. Monitoring Tokens

secondary title

2. Verify the meme culture of tokens

Memecoins can only succeed if they have a strong community, and of all the success factors, community trumps all other variables.

Memes have to be fun and easy to understand, there are many ways we can analyze the sociality of tokens:

Monitoring social metrics on @LunarCrush

Determine if the token is being talked about in social platforms: Twitter, Telegram, Discord, etc.

secondary title

3. Research fundamentals

Ask yourself the following questions:

Who are the team members? Are they real names? If not, are they doing a good job at hype operations?

What does token economics look like? Is there a dilution/burn mechanism?

To be honest, these questions may not matter as much when it comes to meme coins, but we still need to put in some effort to help ourselves understand the project and create an advantage.

At the same time, one of the biggest obstacles in this industry is constant rugs and exploitation. Although these cannot be completely avoided, learning the following methods may greatly reduce your risk of being rugged.

1. Quick review of tokens through @Token_Sniffer;

2. Assess the wallet distribution of tokens via @bubblemaps;

3. Figure out whether you want to follow the leader, or change places with one shot.

Leaders are usually the first tokens to appear in a class of play, they have a higher market cap and are less risky, for example, $DOGE is the leader of the "Inu" class of tokens, as now, $PEPE is the "frog" coin The leader of the same.

@_FabianHD asserted in a recent post, “The best play is usually long the leader token.”

For details, please read the following tweets:https://twitter.com/_FabianHD/status/1654286501725741057? s= 20

New users are first attracted by the leader, and then slowly enter various imitation markets with smaller market capitalization. When liquidity flows back and forth within a specific type of token, the profits of the imitation usually flow back to the leader token, so these leader tokens often have a high risk-reward ratio.

The second option is to look for imitations, which may bring some good returns in the short term, but for the reasons I mentioned above, the risk-reward ratio of these imitations is usually not high.

4. Follow Smart Money

When we don't know what to buy, we can look at what some whales or other successful meme coin traders are buying.

The specific process is as follows:

1. Go to Etherscan and see successful early buyers of meme coins like $PEPE

2. Look for additional "Smart Money" wallets on @lookonchain

3. Track their wallets on DeBank to see what they are buying

first level title

03 Purchase strategy

Now assuming you've done the research above and have settled on the tokens you plan to buy, how do we go about the transaction itself? (From purchase to pocket of profit)

secondary title

1. Treat it like a casino

secondary title

2. Use a single wallet to buy Meme

secondary title

3. Use technical analysis to help you enter the market

Accurate technical analysis is difficult due to liquidity constraints and lack of historical price data. But I've found that having a plan with charts can help you avoid investing blindly.

One of the ways that works well is to wait for a major pullback, then go long and wait for the next breakout (this worked well on $PEPE), which reduces the chance of getting caught in the highs.

There is no problem with increasing positions in batches within a specific period of time, and there is no need to rush in all at once.

first level title

04 Selling strategy

Assuming that you have made money now, how should you sell it and what is the strategy?

Memes can change your life quickly, but make sure you actually use the money to change your life and don't spit out the profits.

A simple rule is to double your stake so that you can use the profits to continue participating without any psychological burden.

Although technically speaking, the profit is also your own money, but this operation will at least reduce the probability of zeroing.

After each doubling, we can withdraw a part of the profit. Of course, if you think the token will rise sharply, you can also leave more principal to continue participating.

This strategy works well until a top occurs, after which you can experience severe profit drawdowns. With these indicators below, you can tell if a coin top is forming and reduce your risk accordingly.

These indicators include:

• 24-hour trading volume exceeds market cap

• Lower and lower price highs

• A decrease in the number of holders, or a significant slowdown in the growth of holders

• Whales start selling chips

• Funding rate turned from negative to positive

We cannot guarantee 100% prediction of when the top will appear, but we still hope that the combination of these indicators above can help you find the top and reduce risk, and also hope this article is useful to you and help you become a better meme coin investor.