Explain in detail the new version of TNG launched by Curve: or promote the transaction volume to exceed Uniswap?

Original author:DeFi Cheetah,Crypto KOL

Original Compilation: Felix, PANews

Original author:

Crypto KOL

Original Compilation: Felix, PANews

Core point of view: One of the most important updates of Curve Finance in addition to crvUSD recently: Tricrypto New Generation (TNG) may enable Curve to surpass the trading volume of uniswap, because TNG provides a better execution price than Uni V3 by optimizing the Gas fee, A lot of volume can be captured from bots and aggregators.

This article will be divided into two parts:

How the new version of TNG can potentially promote Curve to surpass Uniswap in volatile asset trading by optimizing Gas fees

Review of Curve V2 mechanism and comparison with Uni V3's CLMM (Centralized Liquidity Market Making)

One of the main arguments of Uniswap proponents in previous debates with Curve was that the sheer volume of Uni V3 trading on volatile assets proved that Curve V2 was a total failure.

With TNG, that argument falls apart.

The significance of the TNG update is based on one point: Curve V2 Tricrypto pools (ETH, WBTC, and USDT) offer better quotes, but Gas is not included.

Across Uniswap’s 177,000 trades, the median value forfeited per trade was $6.22.

Method: Extract the data of each transaction of the ETH/USDT transaction pair on the Ethereum mainnet on June 22, 2022, respectively, on Curve Tricrypto and Uniswap V3, according to the quotation in the block before the transaction execution (that is, each transaction in the mempool Quotes from the time pool), simulating all these transactions on the counterparty’s exchange.

When factoring in the improved execution of Uni V3 trades, the Tricrypto pool offers a discount of $5.81 compared to Uni V3. So why does Uniswap still have an advantage in transaction volume? The answer is: Gas fee.

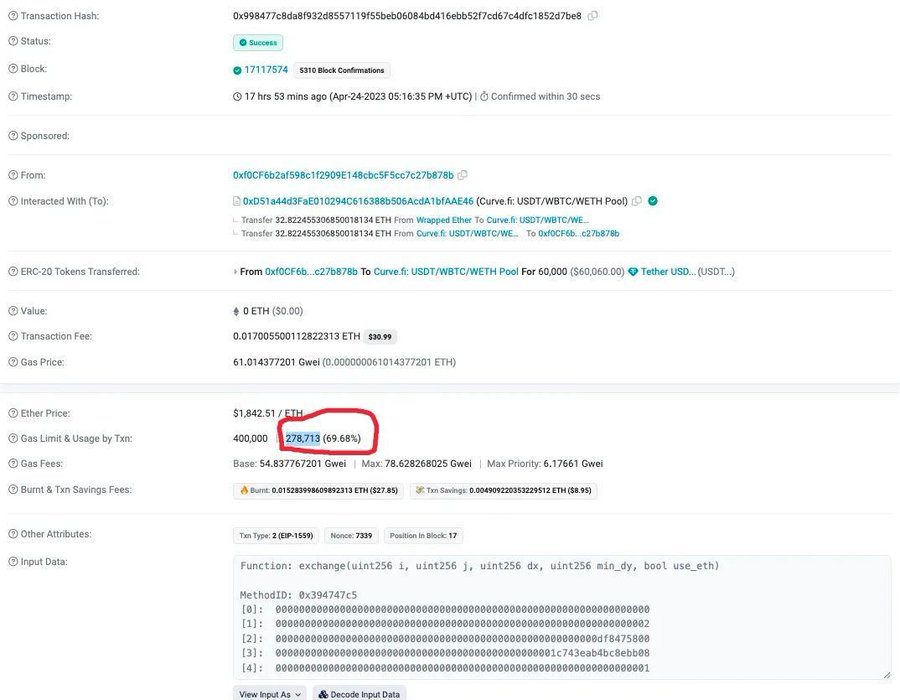

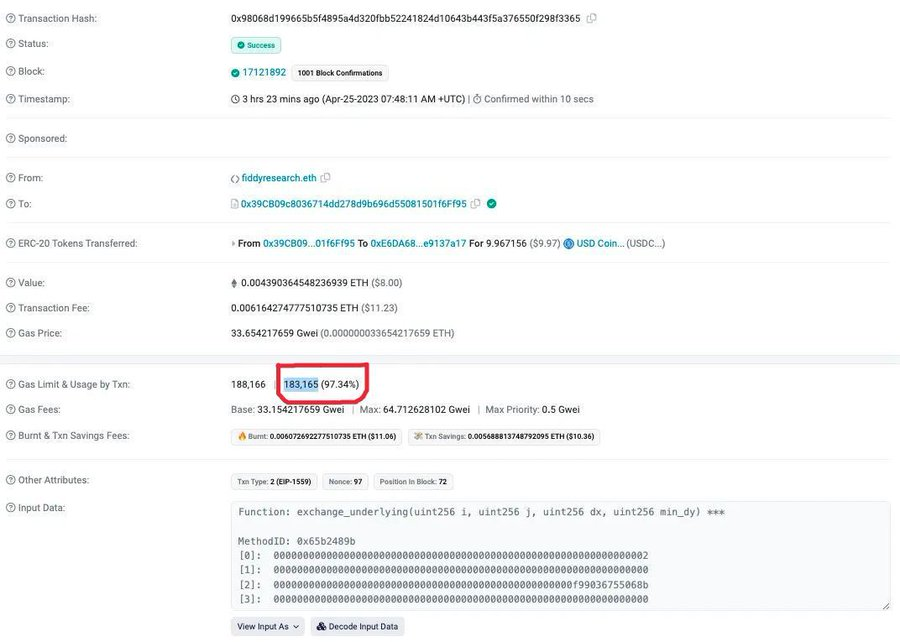

The Gas cost of Curve Tricrypto is about 2.5-300,000 Gwei, while the cost of Uni V3 is 1.25-175,000 Gwei. Here's how much marginal impact affects price execution: Curve's offer is $5-7 cheaper per trade than Uniswap, but gas fees per trade on Curve are at least $10 more expensive than Uni V3.

Let’s take a look at the performance of Curve V2 and Uniswap V3 in a low-gas environment: On Arbitrum, the ideal and actual transaction volume captured by the Tricrypto pool is greater than 80%. Due to the low gas fee on Arbitrum, Curve Tricrypto offers better execution prices than Uni V3, thus accounting for most of the transaction volume.

But on the Ethereum mainnet, there is a huge discrepancy between the ideal and actual transaction volume captured by Tricrypto pools. According to the above-mentioned Curve offer is better, but the gas fee is expensive, Curve can hardly surpass Uniswap.

Why does Curve Tricrypto cost more Gas than Uniswap?

Reason 1: The math involved in Tricrypto is more complex. To make it work properly in the first place, Tricrypto uses complex mathematical formulas that take very little time/effort to refactor these formulas into their most efficient form.

Reason 2: On Tricrypto, the liquidity rebalancing algorithm triggered when interacting with smart contracts is achieved by traders performing liquidity operations (trading, adding/removing liquidity) (traders undertake the rebalancing the cost of). On Uni V3, it is LPs who take the initiative to rebalance liquidity (LPs bear the cost of rebalancing).

Therefore, even comparing in silo (ETH-USDT pool) and no gas, Curve V2 cannot provide better execution than Uniswap V3, which is more gas efficient, and Uniswap has a better execution price overall.

In short, the gas fees of TNG and Uni V3 are now on the same starting line.

Why does the new version of TNG launched by Curve make the transaction volume exceed Uniswap?

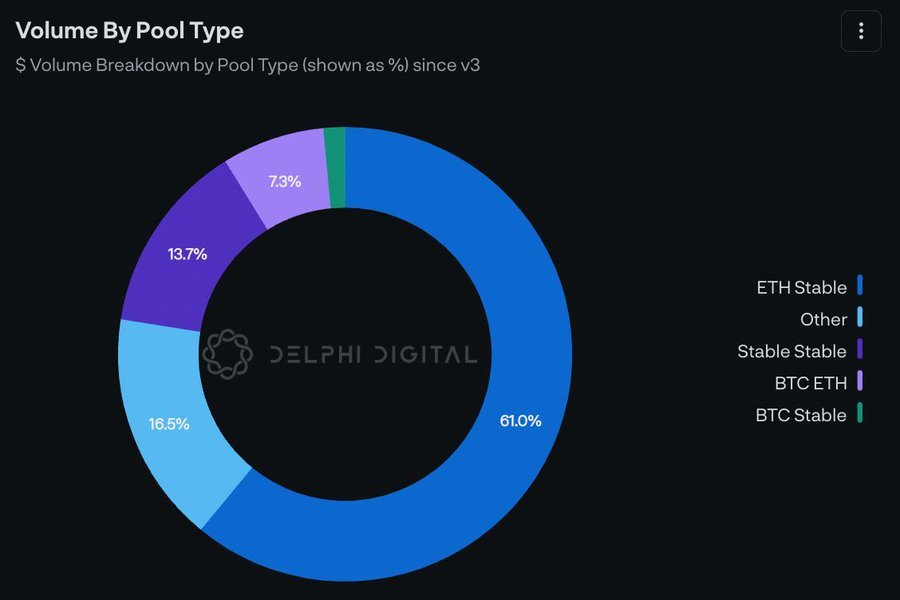

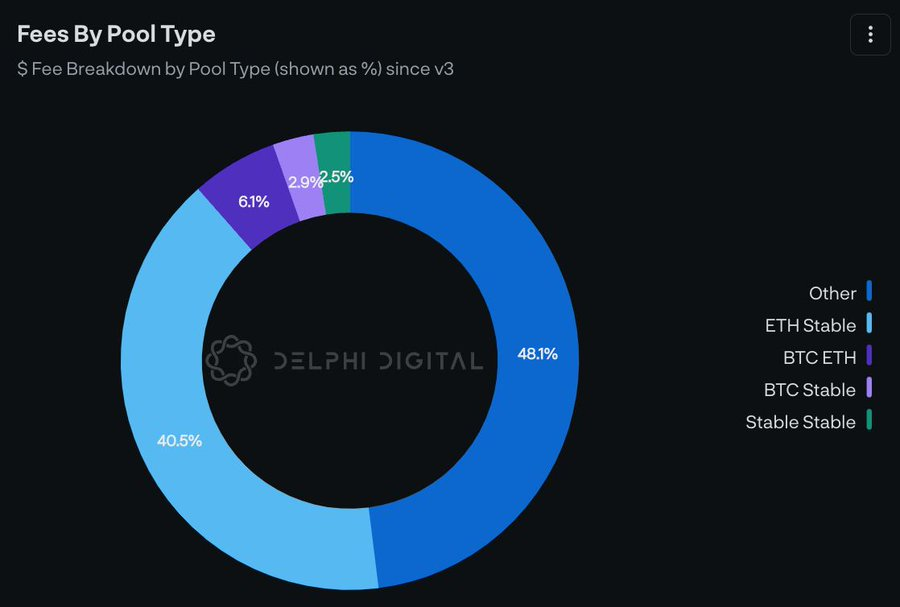

In short, since TNG optimizes the Gas fee of the Curve Tricrypto pool to be comparable to Uni V3, plus Tricrypto's algorithm essentially ensures higher capital efficiency and lower transaction slippage, Curve can benefit from bots Capture more volume and aggregators. Trirypto will threaten 61% of Uniswap’s trading volume and 40.5% of LP fees.

Why does the new version of TNG launched by Curve make the transaction volume exceed Uniswap?

Why does the new version of TNG launched by Curve make the transaction volume exceed Uniswap?

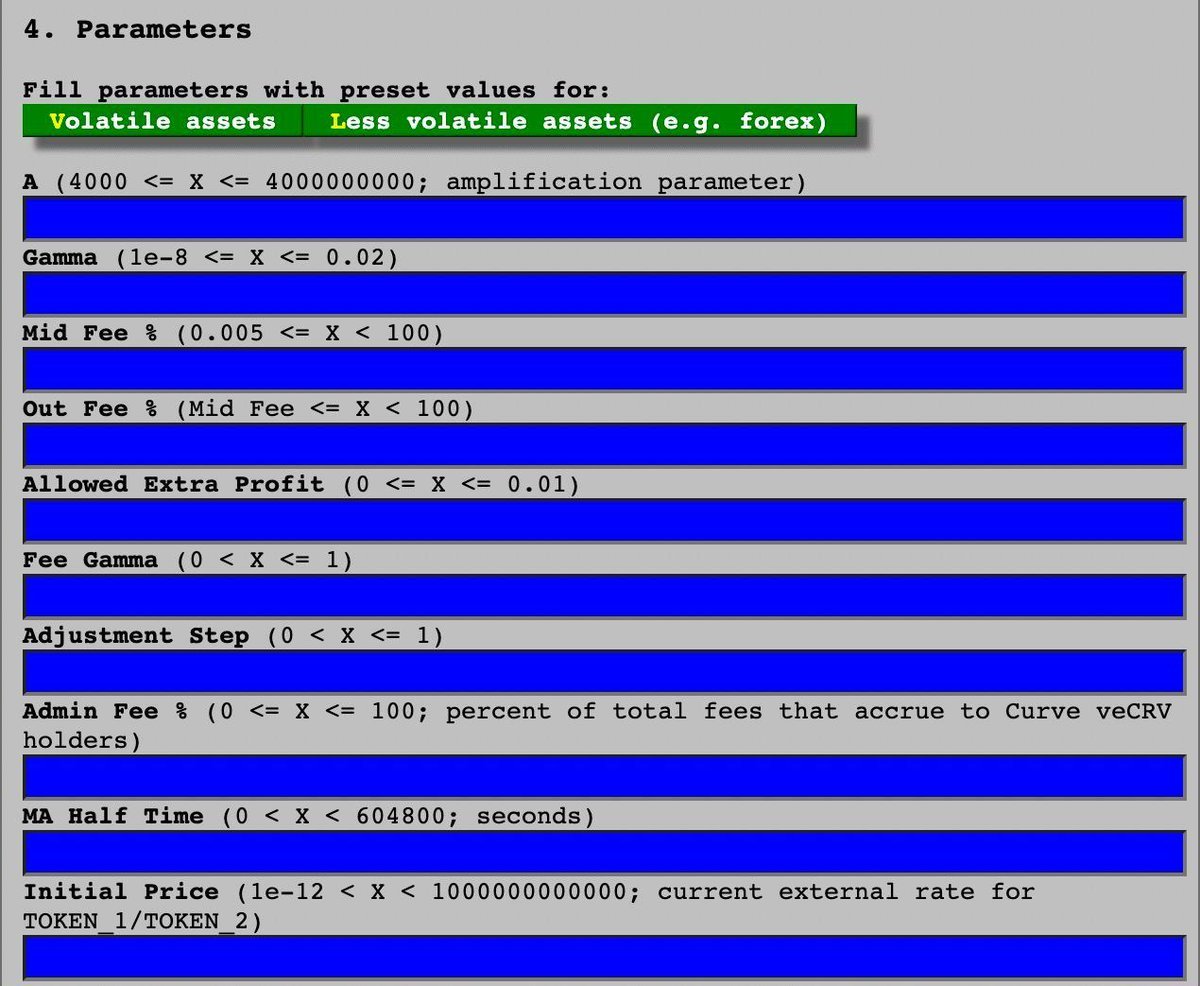

Here is a review of the mechanics of the Curve V2 Tricrypto pool for trading volatile assets. As CLMM (Centralized Liquidity Market Making), it was launched on June 9, 2021. However, unlike Uni V3, Tricrypto uses an internal oracle repeating mechanism. When the price range (Price scale) deviates from the internal prediction, it will re- Concentrate liquidity.

The price range is where the liquidity is most concentrated, and the internal oracle is the exponential moving average of the price of the currency pair. As the gap between the price range and the internal oracle widens and market volatility increases, Tricrypto pools increase their dynamic fees accordingly.

The dynamic fee is to compensate for the higher impermanent loss (IL) incurred by LPs, just like traditional market makers (MMs) increase bid-ask spreads during volatile times. When the market fluctuates greatly, Tricrypto will rebalance frequently, and the transaction volume will increase to generate more transaction fees, thereby offsetting some impermanent losses caused by rebalancing. The bonding curve is very capital efficient when the spot price is close to the price range, and as the price moves away from the price range, the bonding curve behaves like X*Y=K. If the spot price drifts too far out of the price range without enough fees being collected, the pool will offer slightly worse execution than Uni V2 until enough fees are collected.