Understanding Pacman in one article: a decentralized leveraged mining protocol on Arbitrum

Pacman is a decentralized leveraged mining protocol deployed on Arbitrum. When it comes to leveraged mining, the first thing many people think of is Alpaca Finance. Alpaca Finance is a leveraged mining protocol built on the BNB Chain, which maximizes capital efficiency by giving lenders high interest rates and borrowers high leverage (borrowing to increase positions) mining income (cover high borrowing interest).

Pacman is the same, but with some extensions.

The principle of leveraged mining is to borrow funds for mining on the basis of your original mining position, increase your income, and use your mining income to cover the loan interest.

Let's see what extensions Pacman has made?

1. Centralized liquidity mining: Leverage will bring liquidation, and liquidity mining concentrated in a certain price range will reduce the risk of being liquidated, thereby avoiding the liquidation problem caused by the rapid market decline.

2. Pacman added veToken economics (providing veNFT and veNFT combined) and xPAC, oPAC economics. veToken governance to adjust the emission of tokens in different Leverage Farm Lps. Therefore, veToken also has bribe income, and at the same time captures agreement income.

oPAC is a call option on PAC Token, allowing people to buy PAC at a discounted price. The form is oPAC with no expiration date. oPAC is part of the reward medium that Pacman gives to users. The other part is the PAC.

How does oPAC implement call options?

The official example is: PAC Price: $ 0.78 ETH Price: $ 1600/ Strike Price: $ 0.39/ Discount: 30% + 20%

1 oPAC + 0.00024375 ETH = 1 PAC;After selling PAC, the user can get $ 0.78

Treasury Income: 1 oPAC + 0.00024375 wETH (wETH is treasury income)

In short, the free oPAC+wETH can be exchanged for PAC, and then sold to get a discount rate% profit. This discount rate depends on B(x)+L(x), B(x) is determined by the price change of PAC, the higher the price, the higher B(x); L(x) is determined by the agreement TVL, also That is to say, the more LP, the higher the locking time, and the higher the L(x). That is to say, the growth of the currency price and LP will increase the profit of oPAC, which will also increase the expectations of oPAC holders for the higher price of PAC currency.

oPACs are directly convertible to vePACs, which means you can get vePACs at a discounted price in the marketplace.

first level title

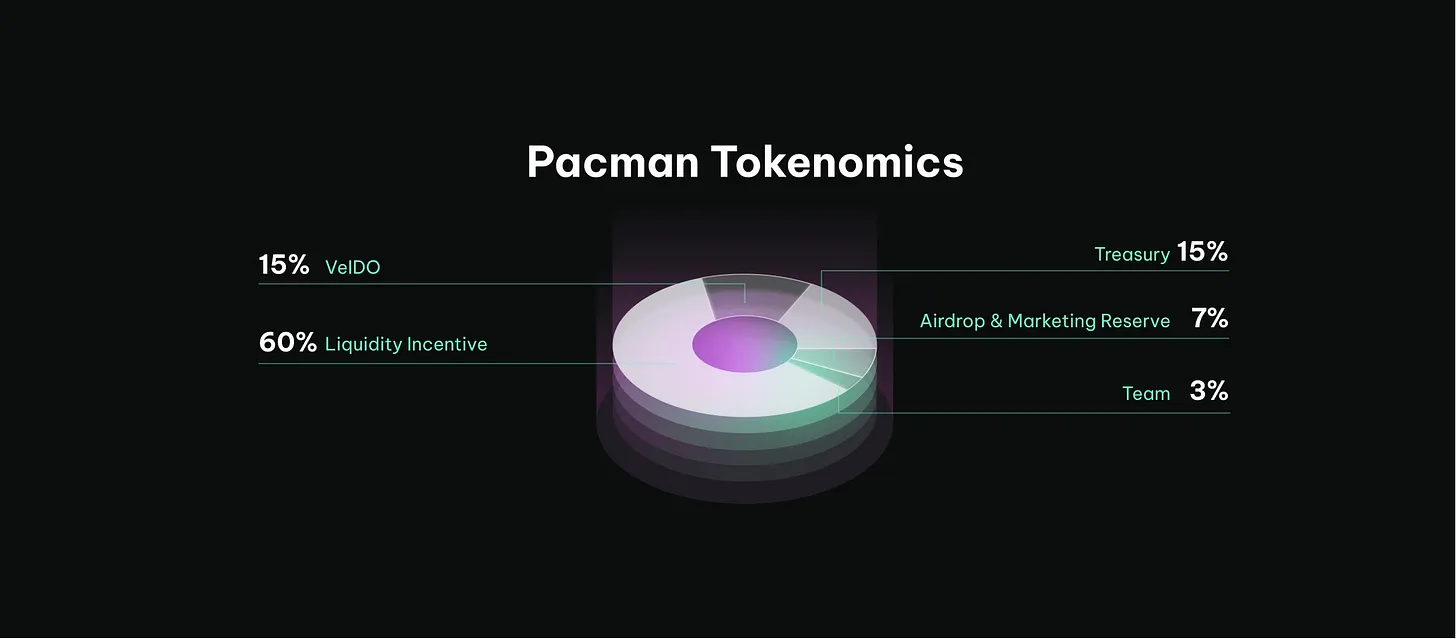

PAC Token Economics

Total PAC Supply: 30,000,000

PAC's veIDO is different from the usual IDO. The longer the lock-up time, the higher the discount you can get. The upper limit of the non-locked part of the first round of veIDO is 300 E, and the locked upper limit is 300 E. The total upper limit of the non-staking part of the three veIDO rounds is 600 E, and the total upper limit of the locked part is 300 E. Three rounds of veIDO will issue 15% of the tokens.

In order to attract locked funds, Pacman has taken some measures:

1. Token purchase discount;

2. Higher voting rights;

3. Lower oPAC exercise price;

4. Priority to enjoy xPAC repurchase rights;

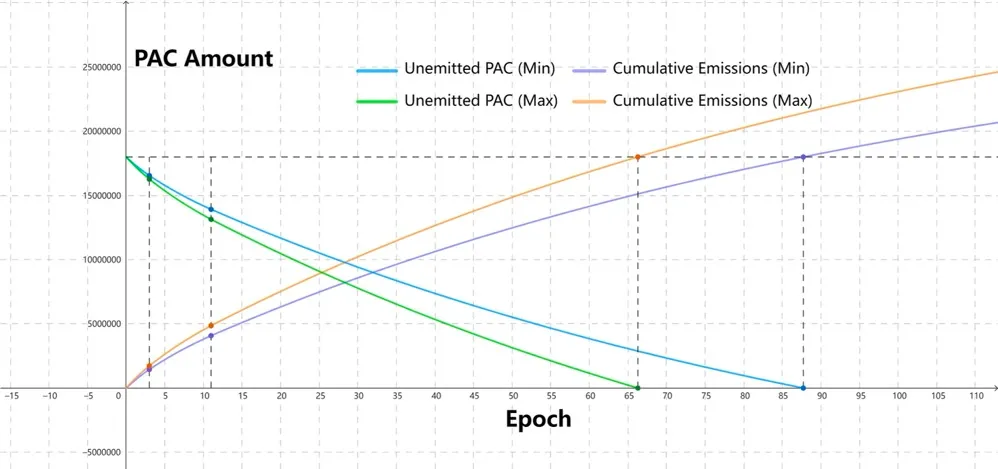

Emission schedule