Learn about the cutting-edge investment institution Variant Fund and its investment portfolio in one article

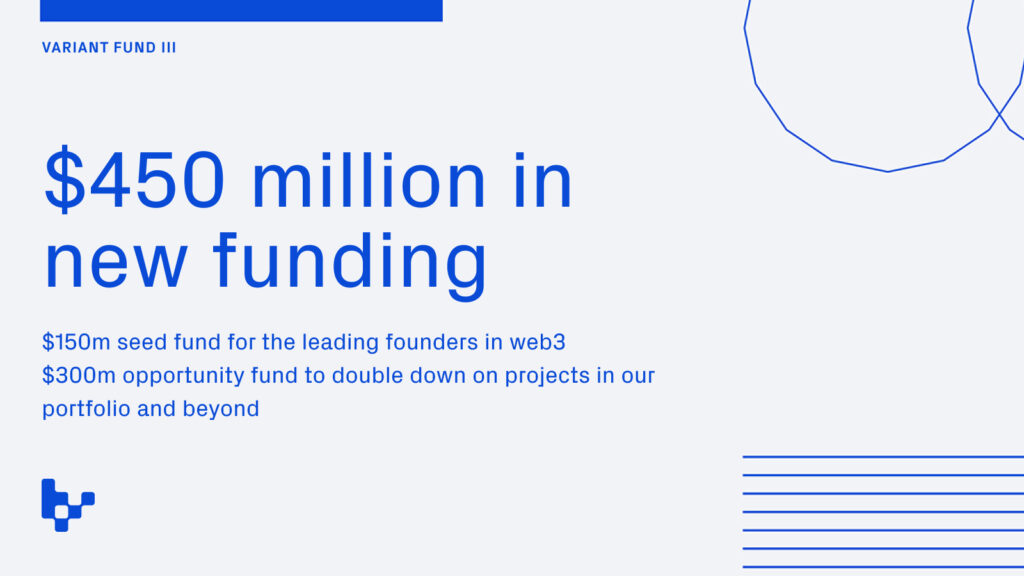

In July last year, when the encryption market was completely entering the cold winter, an encryption venture capital institution established less than three years ago announced the launch of a new fund with a capital scale of up to US$450 million, and this is the first fund it launched after its establishment in 2020. Three Funds - From the announcement of a US$22.5 million fund when it debuted, to the launch of an early-stage fund of US$110 million in October of the following year, this venture capital institution called Variant Fund has launched an encryption fund for three consecutive years, and each scale Both are more than 4 times that of the previous fund.

first level title

The founding team is a16z

Two of the three co-founders of Variant are from a16z (Andreessen Horowitz), and its core team generally has rich experience in the encryption industry. This is also an important reason why the institution has a relatively deep understanding of the industry and can often participate in the early financing of well-known projects.

Co-founder and general partner Jesse Walden was an investment partner in a16z's first crypto fund and later led a twelve-week accelerator launched by a16z crypto"a16z Crypto Startup SchoolBefore becoming an investor, Jesse was also a serial entrepreneur, having founded Cool Managers, an artist management company, in 2011; After the acquisition of the service platform Spotify, Jesse also led blockchain-related research and development as a product leader. It is understood that Jesse led Variant's investment in Uniswap, Phantom, Mirror, Flashbots, Foundation and other projects.

In 2018, Jesse, who was still at a16z, worked in the encryption investment team, and Li Jin, another joint venture of Variant, belonged to the consumer investment team. The two did not have much intersection except in terms of Internet creators and online platforms. In the summer of 2020, Li left a16z and founded Atelier Ventures, a company dedicated to the passion economy, and invested in encryption projects such as the game union Yield Guild Games and the DAO platform Syndicate. As she learned more about crypto, Li came to realize that an ownership economy, powered by cryptocurrencies, might be the way people could achieve a passion economy and consume technology more broadly. In October 2021, based on the belief that the future of consumer software lies in encryption, Atelier and Variant formally merged to jointly invest in applications that users can own and operate. Outside of work, Li is a content creator who enjoys blogging and is well known for it.

At the end of 2020, the current co-founder and general partner Spencer Noon announced that he was joining Variant. His entrepreneurial career in the crypto industry began in 2014 with the founding of BTCity, a Bitcoin ATM company. 4 years later, he founded DTC Capital, a cryptocurrency fund. In addition, he is the author of Our Network, an on-chain analytics community, which publishes a data-driven weekly newsletter covering hot projects in the industry. Before entering the encryption industry, Spencer was an early employee of the online ticketing platform SeatGeek and worked as an investment management analyst for UBS (UBS). At Variant, Spencer led the firm's investments in Morpho, Polygon, Canto, Turnkey, Perennial, and more.

Chief Marketing Officer Nina Suthers, formerly a16z's marketing partner, advises on marketing strategies for projects in the Variant portfolio. Prior to working at a16z, Nina was an Account Director at OutCast Agency, a PR firm specializing in communications, creative and digital marketing. Dan Roberts has been writing about encryption since 2011. Before joining Variant as editor-in-chief, he was editor-in-chief of crypto news site Decrypt, where he led the editorial team to develop the site's news strategy and planned and moderated live events.

Variant Fund's investment track and focus

In August 2022, Variant announced the launch of Variant Fund III, including a $300 million opportunity fund and a $150 million seed fund focused on investing in early-stage entrepreneurial projects. To support this effort, Variant doubled its size, growing the team to 15 professionals with deep expertise in DeFi, consumer and infrastructure, and building a portfolio support function to provide , token design, community building and other aspects of guidance.

Variant believes that cryptocurrencies will be the foundation of a user-owned network where products and services turn their users into owners. The key research directions of the investment team professionals it configures, on the other hand, also indicate the vertical segments they focus on in the encryption industry.

Variant values the potential of DeFi for financial empowerment, and its key directions on the track include:

Financial primitives that leverage user ownership to unlock network effects for sustainable liquidity

MEV Derivatives and Other Net Added Markets Related to Blockspace

Stablecoins that prioritize security, risk management, and mainstream consumer adoption

Financial primitives that leverage composability to create entirely new capabilities, such as loan optimizers and DEX aggregators

Financial products that connect the traditional financial system and DeFi, allowing new users and institutions to bridge the gap

In terms of infrastructure and tools:

L1, L2 and L3 so that developers can build new and increasingly complex on-chain applications

New computing primitives, from computing to storage, indexing, query, bandwidth, connection, etc.

New features such as applied cryptography, support for privacy, and privacy-based applications

Cross-chain interoperability, enabling applications to have a native full-chain product experience

Protocols and services that ease the burden of private key management and custody

Innovative and optimized Web3 security tools

Variant believes that Web3 has the potential to meet user needs in a new way, and believes that web3 applications will become mainstream. It focuses on this area:

Apps that leverage the unique capabilities of web3 to enable new user behaviors

Unlock web3 applications and infrastructure on mobile devices

A Web3 social network combining unique social and economic incentives

New token economic models that coordinate user behavior, such as X-to-earn

Vertical Market for Digital Goods

Networks that use financial incentives as a means to bootstrap and ultimately defeat traditional incumbents

Projects that address different issues in various forms of capital, from investment to creative projects to social impact and more

Tools to empower experimentation and make its governance more accessible, participatory and efficient

New forms of ownership of tokens and NFTs redefine user experience, which creates design space for new product features and experiences. In this regard, Variant focuses on:

Networking where UX ownership influences project strategy or direction

Networks where the user experience belongs to the community, such as a social club

Networks where users and services are economically aligned, such as shared revenue

first level title

Variant Founder Fellowship Accelerator Program

From June to August this year, Variant will launch the first accelerator program "Variant Founder Fellowship" for Web3 founders who are in the early stage of entrepreneurship, and select 20 founders or teams to provide them with support in the early stage.

According to Variant's official website, its team has successively supported dozens of leading projects in the industry, and these projects have now constituted their Variant Network, a network composed of founders and leaders in its investment portfolio that enables A professional community where they build and learn together. Variant believes that the network-based peer learning model is the most effective way to illustrate the "good examples" that emerge in the process of building Web3. In a new and fast-growing industry like crypto, domain experts are often the builders at the forefront of innovation. So far, Variant Network has effectively facilitated its learning on topics such as product design, token strategy, regulatory issues, and more.

Building on this e-learning model, the Variant Founder Fellowship aims to co-catalyze more innovation in the cryptocurrency space by inviting a cohort of emerging founders to build and learn alongside Variant's portfolio founders. Connecting entrepreneurs who are tackling similar challenges is one of the best ways to support crypto startup teams.

first level title

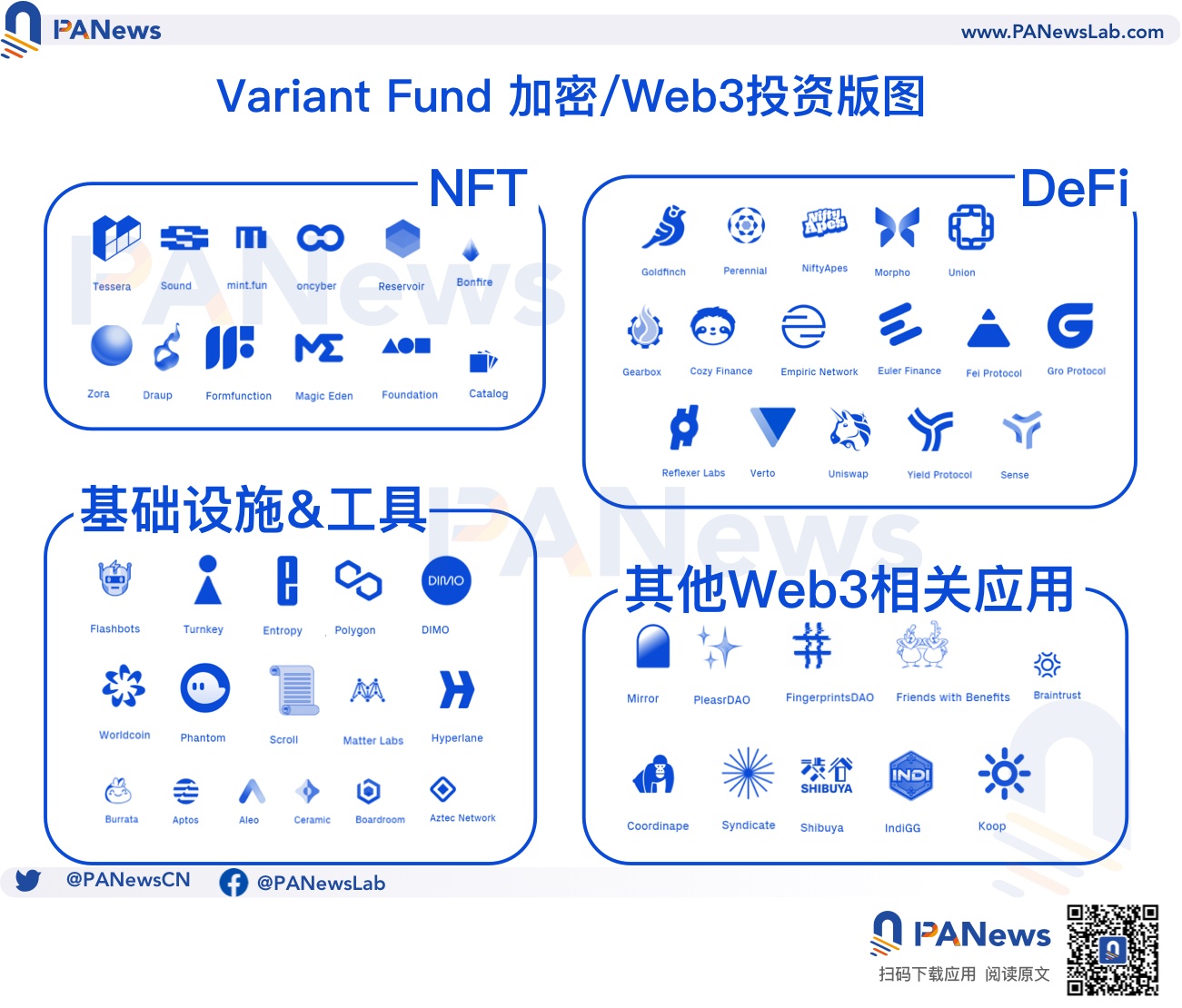

Portfolio: Focus on DeFi, infrastructure and consumer applications

According to Variant’s official website, Variant has invested in 54 encryption projects, which are basically evenly distributed in infrastructure, DeFi, NFT and other fields, including many well-known projects in multiple vertical fields such as Aptos, Polygon, zkSync, Uniswap, and Magic Eden. The following will follow PANews"Financing Weekly"The classification method of the column classifies these projects, briefly introduces them and lists relevant financing information. (Note: According to public disclosure information, in the following summary list of investment portfolios in various fields, all projects Variant have participated in investment, but only when they are the lead investor or only participate in one of the rounds of financing of the project. list.)

DeFi

Uniswap:Decentralized cryptocurrency exchange. In August 2020, a $11 million Series A round of financing was completed, led by a16z, with participation from Paradigm and Variant; in October 2022, Uniswap completed a $165 million Series B round of financing, with a16z, Paradigm, and Variant participating again.

Verto:Decentralized exchange based on Arweave. February 2021; Pre-Seed financing completed, the amount is undisclosed, 1kx, Variant, etc. participated in the investment.

Yield Protocol:Fixed rate lending agreement. In June 2021, $10 million in Series A financing was completed, with participation from Framework Ventures, Paradigm, and Variant.

Cozy Finance:DeFi risk management company developing open-source protocols for automated and trust-minimized protection markets. In September 2020, Cozy Finance completed a US$2 million seed round of financing, led by Electric Capital, and participated by Variant and Dragonfly Capital.

Empiric Network:A new decentralized blockchain oracle on StarkNet. In July 2022, $7 million in financing will be completed, led by Variant and participated by Flow Traders.

Euler Finance:Ethereum-based lending protocol. In June 2022, $32 million in financing was completed, led by Haun Ventures, with participation from Variant, Jump Crypto, etc.

Fei Protocol:Decentralized, scalable and DeFi native stablecoin protocol. In March 2021, $19 million in financing was completed, with participation from a16z, Framework Ventures and others.

Gearbox:On-chain composable leverage protocol. In August 2022, $4 million in financing will be completed, with participation from Placeholder and Ledger Prime.

Goldfinch:A DeFi lending protocol that lets people borrow cryptocurrencies without collateral. In February 2021, Goldfinch completed a financing of US$1 million, with participation from Coinbase and Variant; in May of the same year, it raised US$11 million in funding from institutions such as a16z crypto; in January 2022, it completed a round of financing of US$25 million, a16z crypto, Y Combinator and others participated in the investment.

Gro Protocol:DeFi yield and savings protocol. In March 2021, a US$7.1 million seed round of financing was completed, led by Galaxy Digital and Framework Ventures, with participation from Variant and others.

Morpho Labs:Peer-to-peer (P2P) layer on top of lending pools like Compound or Aave. In July 2022, Morpho completed $18 million in financing, led by a16z and Variant

NiftyApes:A decentralized protocol that enables loans on NFTs and collectibles. In November 2022, $4.2 million in seed round financing was completed, led by Variant and FinTech Collective.

Perennial:DeFi derivatives agreement. In December 2022, a $12 million seed round of financing was completed, led by Polychain Capital and Variant.

Reflexer Labs:Algorithmic stablecoin RAI development team. In February 2021, $4.4 million in financing was completed, led by Pantera and Lemniscap.

Sense Finance:A decentralized fixed income protocol on Ethereum. In August 2021, $5.2 million in financing was completed, led by Dragonfly and participated by Variant and others.

UnionFinance:secondary title

Infrastructure and Tools

Aleo:Data privacy platform, whose new computing system Zexe helps off-chain computing with on-chain verification for scalability and privacy. In April 2021, the US$28 million Series A financing was completed, led by a16z, and Galaxy Digital, Variant, etc. participated in the investment; in February 2022, the US$200 million Series B financing led by SoftBank and Kora Management was completed.

Aptos:A layer 1 public chain project, its main network will be launched in October 2022. In March 2022, a $200 million seed round of financing will be completed, with participation from a16z and Variant.

Aztec Network:Based on ZK Rollup's privacy and capacity expansion solution, in December 2021, completed the $17 million A round of financing Paradigm led the investment, Variant, Vitalik Buterin and others participated in the investment; in December 2022, completed the $100 million B round led by a16z financing.

Matter Labs:Parent company of the Ethereum scaling protocol zkSync. In November 2021, $50 million in Series B financing will be completed, led by a16z; in December 2022, $200 million in Series C financing will be completed. Blockchain Capital and Dragonfly led the round, with participation from Variant and a16z.

Polygon:Ethereum scaling solution. In February 2022, $450 million in financing will be completed, with participation from Sequoia India, Tiger Global, Variant, etc.

Scroll:Ethereum native zkEVM layer 2 solution. In March 2023, $50 million in financing was completed, with participation from Polychain Capital, Sequoia China, Variant, etc.

Burrata:A compliance-focused crypto startup that aims to check all of its compliance without setting up a PII server by creating the necessary tools and infrastructure. In December 2021, $7.75 million in financing will be completed, with Stripe, Variant and others participating.

Ceramic:Decentralized network storage protocol. In February 2022, $30 million in Series A financing was completed, led by Multicoin Capital and Union Square Ventures, with participation from Variant and Jump Crypto.

DIMO:A blockchain-based automotive platform that allows drivers to share vehicle data in exchange for tokens. In February 2022, a $9 million seed round of financing was completed, with participation from CoinFund and Variant.

Entropy:Decentralized and trustless custody solution. In June 2022, a US$25 million seed round of financing will be completed, with participation from Dragonfly Capital, Variant and others.

Flashbots:Ethereum research and development company aiming to enable a permissionless, transparent and fair ecosystem for MEV extraction. According to The Block, it plans to raise $30 million to $50 million, and Paradigm has committed to lead the investment. Variant is also an investor. The financing details have not been disclosed.

Hyperlane:Cross-chain application construction platform. In September 2022, $18.5 million in financing will be completed, led by Variant, with participation from Galaxy Digital and CoinFund.

Turnkey:Solutions for private key management and security protection. In March 2023, a US$7.5 million seed round of financing will be completed, with participation from Sequoia and Variant.

Worldcoin:Crypto company founded by OpenAI CEO Sam Altman. In June 2021, a financing of 25 million US dollars was completed, and a16z participated in the investment. According to The Block, Worldcoin plans to raise up to $120 million at a $3 billion valuation.

Boardroom:Governance and management platform designed to improve distributed decision-making across crypto networks. In October 2020, $2.2 million in financing was completed, led by Standard Crypto, with participation from Variant, CoinFund, Framework and Slow Ventures.

Phantom:secondary title

NFT

Bonfire:NFT infrastructure platform that allows its partners to create custom NFT-integrated Web3 websites. In December 2022, a $6.2 million seed round of financing will be completed, with participation from NEA, Variant, etc.

Draup:A digital fashion platform where users can buy, display and earn money from digital fashion brands. In July 2022, a $1.5 million Pre-Seed round of financing was completed, led by Variant.

Formfunction:Solana ecological NFT market. In March 2022, one month after its launch, it announced the completion of a $4.7 million seed round of financing, led by Variant and participated by OpenSea Ventures and others. It officially closed on March 29, 2023.

Foundation:The Ethereum-based NFT platform aims to create a new creative economy. In February 2021, a $200,000 seed round of financing was completed, and the investors were a 16 and Variant.

Magic Eden:NFT trading platform. In March 2022, $27 million in Series A financing was completed, led by Paradigm, with participation from Sequoia, Variant, etc.; in June 2022, $130 million in Series B financing was completed, co-led by Electric Capital and Greylock.

mint.fun:Foundry aggregator, launched by Web3 tracker Context. In April 2022, Context completed a $19.5 million seed round led by Variant Fund and OpenAI CEO Sam Altman.

Oncyber:NFT immersive 3D gallery. In January 2022, a $6.7 million seed round of financing was completed, led by Variant.

Sound.xyz:NFT music startup. In December 2021, announced the completion of a $5 million seed round of financing. a16z led the round, and Variant and others participated.

Tessera:Fragmented NFT ownership platform, formerly Fractional. In August 2021, a US$7.9 million seed round of financing was completed, led by Paradigm and participated by Variant.

Zora:Establish an open source protocol for the NFT market. In October 2020, a $2 million seed round of financing was completed, led by Kindred Ventures; in May 2022, a $50 million seed round of financing was completed, led by Haun Ventures founded by former a16z investor Kathryn Haun. cast. Variant's participation in the investment was not disclosed.

Reservoir:Open source NFT aggregator, undisclosed financing information.

Catalog:secondary title

Others (DAO, Web3 related applications)

FingerprintsDAO:Collector organization, dedicated to curating and collecting artworks created using smart contracts, and generating corresponding blockchain fingerprints. In September 2021, it was announced that the financing was completed. The amount has not been disclosed yet. Participating parties include a16z, Variant, etc.

Braintrust:Web3 talent recruitment platform. In October 2020, $18 million in financing was completed, led by ACME and Blockchange, and participated by Variant and others. In December 2021, it raised US$100 million through the sale of private tokens. This round of financing was led by Coatue and participated by Tiger Global and others.

Coordinape:A platform for DAOs to easily and fairly allocate resources to contributors. It allows its DAO members to reward each other and makes community payments more fair and transparent by incentivizing participation.

Friends with Benefits:A new kind of DAO and social club. In October 2021, a16z announced an investment and guidance for an undisclosed amount, and Variant is also an investor.

IndiGG:The Indian subDAO under the gaming guild YGG. In January 2022, a $6 million seed round of financing was completed, with participation from Sequoia India, Jump Capital, and Variant.

Mirror:A decentralized content publishing platform that supports embedding and displaying NFTs of PFP, art and music types in article content. It is the official investment portfolio announced by Variant, but no specific financing information has been found.

PleasrDAO:A decentralized autonomous organization around encrypted art collections. In December 2021, it received investment from a16z, which is also the official investment portfolio of Variant, but the specific amount was not disclosed; in January 2022, The Block reported that it planned to raise $69 million;

Shibuya:Web3 video platform by digital artist Emily Yang. In December 2022, $6.9 million in financing will be completed, led by a16z Crypto and Variant, with participation by Tsai Chongxin and others.

Syndicate:Decentralized investment platform. In August 2021, a US$20 million Series A financing led by a16z was completed, and Variant participated in the investment; in May 2022, a US$6 million financing was completed, and a16z, OpenSea, etc. participated in the investment.

Koop:A Web3 protocol focused on the creator economy. In August 2022, $5 million in financing was completed, led by 1confirmation and Variant Fund.