veDAO Research Institute: The advantages, ecology, token model and investment value of the Sui public chain

On April 20, 2023, according to the official Twitter announcement, the public chain project Sui has been finalized to launch the main network on May 3, and the native token SUI sold through the cryptocurrency exchange in advance will also be unlocked during the main network launch . Regarding SUI tokens, the Sui project team has made it clear that SUI tokens will not be airdropped, and confirmed on April 15, 2023 that tokens will be sold in the form of IEO (Initial Exchange Offering).

In response to the IEO offering, KuCoin, Bybit, and OKX have also announced that they will sell SUI, and the subscription price for the public sale is 1 SUI = 0.1 US dollars. However, the community reacted fiercely to the behavior of [SUI tokens will not be airdropped]. Some netizens left a message under the tweet saying: NO AIRDROP = NO COMMUNITY (no airdrop, no community). It is indeed unWeb3 not to use airdrops to motivate active users in the community, but the Sui team also adds participants who have contributed to the public chain ecology to the purchase whitelist, so that they can buy SUI at a more favorable price ($0.03), And guarantee the amount of 1500 pieces.

So is the SUI token worth participating in? This article will analyze the Sui public chain from a multi-dimensional perspective, and take you to interpret the IEO information of the SUI token in all aspects.

Sui public chain features & advantages

Sui is the world's first permissionless Layer 1 blockchain designed entirely by ex-Facebook developers. As a decentralized PoS blockchain, Sui can achieve horizontal expansion in throughput and storage, and its goal is to become the first Internet-scale programmable blockchain platform. The Sui ecosystem adopts the Rust-based Move programming language and uses the same PoS consensus mechanism currently used in Ethereum. Its main features are as follows:

Strong scalability: The network is able to scale out throughput because it can agree on causally independent transactions in parallel. They do this through Byzantine Consensus Broadcasting, which removes the overhead caused by global consensus without sacrificing safety and liveness guarantees.

Secure Smart Contract Language: Move is a programming language, originally developed by Facebook, for writing secure smart contracts. Support for shared libraries, tools, and developer communities across blockchains.

Ability to define complex on-chain assets: Sui’s scalability is not limited to transaction processing. Its storage is also low cost and horizontally scalable. This enables developers to define complex assets with rich properties that live directly on-chain, rather than introducing a layer of indirection into off-chain storage to save gas costs.

Better Web3 User Experience: The Sui team wants to make it the most accessible smart contract platform, enabling developers to create great user experiences in Web3. To meet the next billion users, Sui will provide developers with various tools to leverage the power of the Sui blockchain. The Sui Development Kit (SDK) will enable developers to build without limits.

To sum up, Sui's architecture is known for its instant settlement and high throughput, rich on-chain assets and excellent Web3 experience. Its horizontally scalable throughput and storage can realize efficient DApp development at a lower cost.

Team situation

Sui's development team is Mysten Labs. The founders include Evan Cheng, Adeniyi Abiodun, Sam Blackshear, George Danezis, Kostas Kryptos, all of whom have participated in the Novi and Diem projects at Facebook.

In December 2021, the project announced the completion of a US$36 million Series A round of financing led by a16z, with participation from Coinbase Ventures, NFX, Slow Ventures, Scribble Ventures, Samsung NEXT, and Lux Capital. On September 8, 2022, it raised $300 million in Series B funding led by cryptocurrency exchange venture capital firm FTX Ventures, with other investors including Coinbase Ventures, Jump Crypto, a16z, Circle Ventures, Binance Labs and O 'Leary Ventures and other investment funds and partners.

This time, the IEO was carried out before the mainnet of the project was launched, and many netizens could not help but question whether the Sui project team was short of funds because of FTX’s thunderstorm last year. But it was also clarified that the Sui project team has already used up the $100 million invested in the FTX project, so there is no need to worry about it.

Sui Ecological Project Inventory

So far, the Sui ecology has attracted many teams to build projects, and many early high-quality projects have obtained Sui's grant, which are distributed in cross-chain, SocialFi, traffic, DeFi and other tracks. The following is an inventory of four projects that have received grants from the Sui project team:

SUIA: The first POAP application on Sui, it is a social dApp built on the Sui network, the project aims to create an open, powerful and community-driven social network. SUIA has carried out four innovations: personalized NFT recommendation, information flow based on on-chain activities, NFT-based brand club, and composable personal space. In terms of data, SUIA currently has more than 200,000 users, 50 core brands, and more than 300,000 community members. Supported by Sui Grant, Sui Builder Heroes from Sui Foundation. Its next step plan is to enable users to have more social functions, such as community games and social transactions.

ComingChat: ComingChat is a SocialFi product, which aims to solve the problem of fragmented Web3 product experience. This product also embeds some things related to ChatGPT, which is a Web3 portal application that supports multiple public chains and provides DeFi and GameFi functions for users. From the perspective of the application layer, ComingChat includes DID, wallet, encrypted communication, social network, DeFi, GameFi and other functions. At the protocol layer, ComingChat aims to support a multi-chain ecosystem

MovEX: MovEX is the first AMM+order book hybrid liquidity DEX on Sui, which combines the advantages of AMM and order book to provide everyone with a liquidity trading experience by creating a hybrid liquidity pool. Internally, MovEX has a settlement engine that distributes orders between AMMs and order books, which guarantees both minimal slippage for traders and fairness for liquidity providers. Liquidity providers can also customize the price range to provide one-sided liquidity, which can effectively manage impermanent losses.

Movernance: Movernance is the first fully functional on-chain governance platform for the Sui ecosystem. It provides projects with the necessary decentralized governance by integrating governance forums and on-chain voting capabilities. And Movernance innovatively proposed the authority governance framework and the governance right market (bribery platform), which improved the overall efficiency of decentralized governance and provided a solid foundation for the large-scale application of the project.

Token Economic Model

Token Economic Model

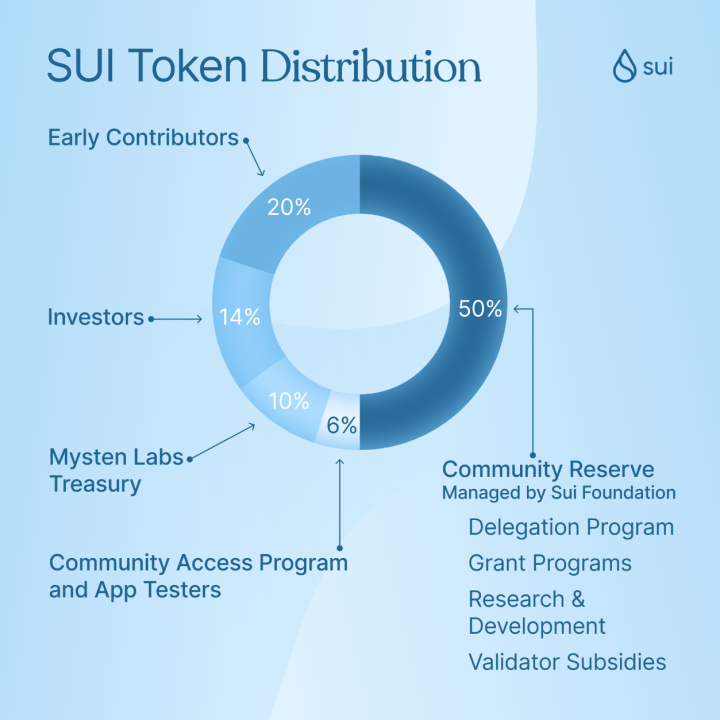

The total supply of SUI tokens is 10 billion, which will be allocated to 50% Community Reserve, 20% Early Contributors, 14% Investors, 10% Mysten Labs Vault, 6% Community Access Program IEO and Application Testers. There are four main application scenarios for tokens: network pledge, transaction fees, storage fees, governance voting, and SUI native asset trading tools.

Five core components of the economic model:

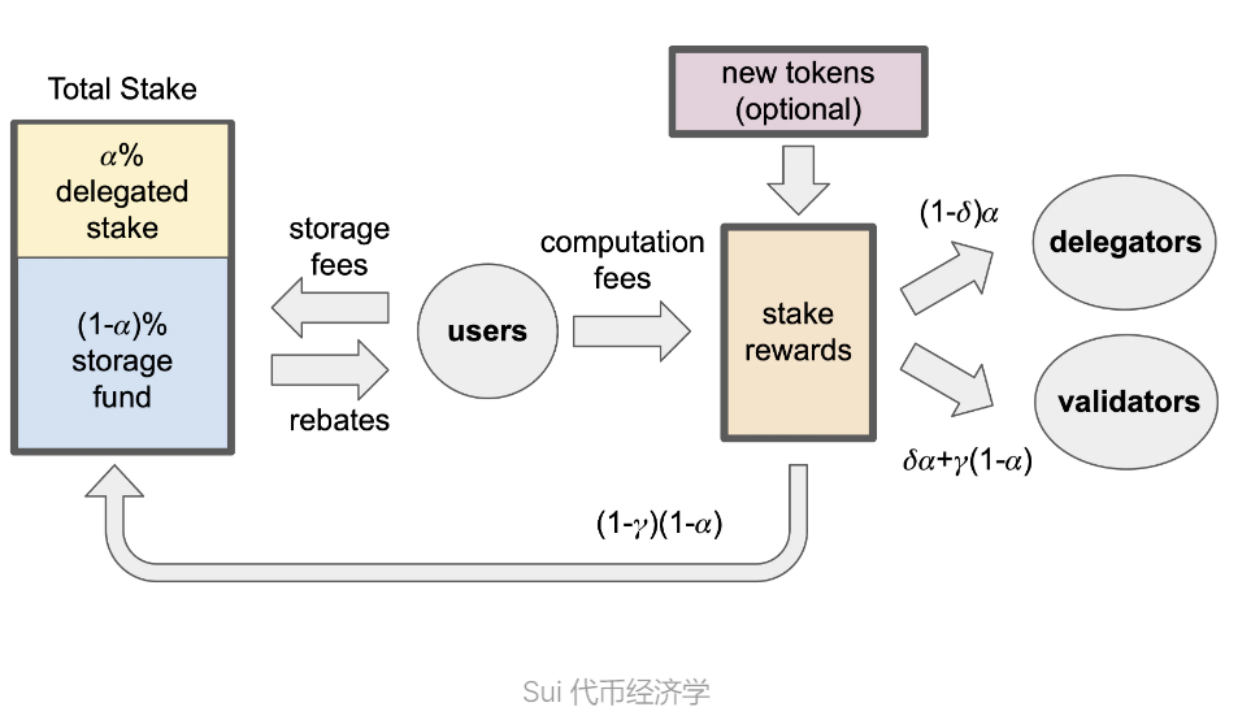

The proof-of-stake mechanism PoS is used to select, motivate and reward the actions of Sui platform operators (ie validators and SUI delegators).

All network operations charge Gas fees, which are used to reward participants in the proof-of-stake mechanism and prevent spam and denial-of-service attacks.

Sui’s storage fund is used to transfer staking rewards across time and compensate future validators for storage costs of previously stored on-chain data.

On-chain voting is used for governance and protocol upgrades.

The SUI token is the native asset of the Sui platform.

Different from the token economics model of traditional proof-of-stake chains, Sui's token economics model adds the function of storage funds. Since the blockchain is a data structure that only increases but does not decrease, more and more data needs to be maintained on the chain as time goes by, and the cost will increase accordingly. Higher fees for users, the storage fund was born to solve this problem, let early users pay more fees, so that all users can use the network based on similar fee levels.

In addition, Sui's storage fund also pays out validators in the system, or people who actually store blockchain data and complete data maintenance work. As maintenance increases, payouts to validators also increase, which incentivizes more people to become validators in the system, and as more people become validators, the total amount of storage space available increases. will increase, which further leads to a reduction in gas costs for writing to the blockchain. Sui's token economics model is typical of a highly scalable chain economics model, using game theory to ensure that gas fees remain relatively constant over the lifetime of the blockchain.

IEO and Whitelist Purchase Details

The IEO is carried out on the three major exchanges, and the details of the latest sale are as follows:

KuCoin: 2.25 E SUIs (does not support mainland users)

Group A general public sale will be held from 08:00 on April 15th to 24:00 on April 22nd (UTC+8). Users can eventually get the number of lottery tickets, and after the predetermined period ends, the winners will be selected by lottery.

The group B identification sale will be held from 09:30 on April 20 to 24:00 on April 22 (UTC+8), and all whitelist users need to complete all subscription processes. This round is only available to early contributors to Sui, who must be Sui whitelisted users. You can click on the link to view eligibility:https://verifysupporters.sui.io/, Sui has contacted the whitelisted users via email, and users can participate in KuCoin using the email address of the assigned account.

Bybit: 9.4 E SUIs (does not support mainland users)

Subscribe on Bybit’s Token Sale Platform ByStarter

Subscription period: 12:00, April 21st to 08:59, April 24th (UTC+8)

Distribution Period: April 24th 09:00 to April 24th 13:59(UTC+8)

Result Announcement: 14:00, April 24 (UTC+8)

OKX: 2.25 E pieces of SUI (support mainland users)

Subscribe on JumpStart, a token sale platform owned by OKX

Subscription period: 10:00, April 23rd to 10:00, April 24th (UTC+8)

Statistics of winning lottery: 10:00, April 24 (UTC+ 8)

Token distribution starts: 18:00, April 24 (UTC+8)

Whitelist Eligibility:

Early participants who joined the Sui Discord community before February 1, 2023 made important contributions to the development of the Sui ecosystem by providing advice, participating in discussions, interacting with ecosystem projects, and advocating technological innovation. (Drawing probability is about 20%)

In the Capy Holidays competition of Testnet Wave 1, the winner selected through social media voting will be rewarded with SUI according to the stipulated competition terms.

Members who participate in the organization and operation of Builder Houses and other important activities, they show their love for Sui and devote a lot of time and energy, will be rewarded with SUI after the mainnet goes live.

Discussion on investment value

Sui is often compared to Aptos because both projects were started by ex-Facebook employees, and while Aptos definitely deserves credit, Sui is seen as the premium version, with more solid technical aspects and a better look. Aptos's current full-circulation valuation is US$13 billion, and its circulation market value is US$2.3 billion. Since the market has given Aptos such a high valuation, Sui will also have an extremely high valuation.

Sui's IEO public sale plan this time has indeed chilled the hearts of many community users, and it is also detrimental to the construction of the future community, causing many active participants to lose confidence. Objectively speaking, although the Sui project team is not good at marketing, this IEO of Sui has accumulated a lot of discussions and attention in the community, and the technicality and stability of the Sui public chain are worthy of recognition.

In general, with a strong team background, referring to APT, Sui may have a very high valuation. The current IEO has caused a lot of hype and attention for SUI in the market, which may bring strong fomo sentiment. However, the shortcomings of the Sui team’s market operations also make people worry, and there is no way to fully clarify the FTX funding issue.

The veDAO research team hereby reminds that there is no airdrop of SUI tokens, and beware of fraud during IEO. If you are interested in SUI's IEO this time, the link below can send you quickly:

SUI details:https://app.vedao.com/projects/

SUI official website:https://sui.io/

SUI official twitter:https://twitter.com/SuiNetwork

🔴Investment is risky, the project is for reference only, please bear the risk by yourself🔴

Link:https://github.com/MystenLabs/sui/blob/main/doc/paper/tokenomics.pdf

Follow us

veDAO is a decentralized investment and financing platform led by DAO. It will be committed to discovering the most valuable information in the industry. It is keen on digging the underlying logic and cutting-edge tracks in the field of digital encryption, so that every role in the organization can fulfill its responsibilities and get paid off.

Website: http://www.vedao.com/

🔴Investment is risky, the project is for reference only, please bear the risk by yourself🔴