The Expectation of the Airdrop Volume King: The Summer of Layer 2

Summary

Summary

This hot report mainly reviews the status quo of the entire Layer 2 ecology after Arbitrum one issued tokens, and draws the following conclusions:

Arbitrum’s airdrop brought a wealth-creating effect and triggered a wave of Layer 2 interactions, especially zkSync and StarkNet. ZkSync gas consumption has increased by 82% in the past week. Goerli ETH test coin price rises.

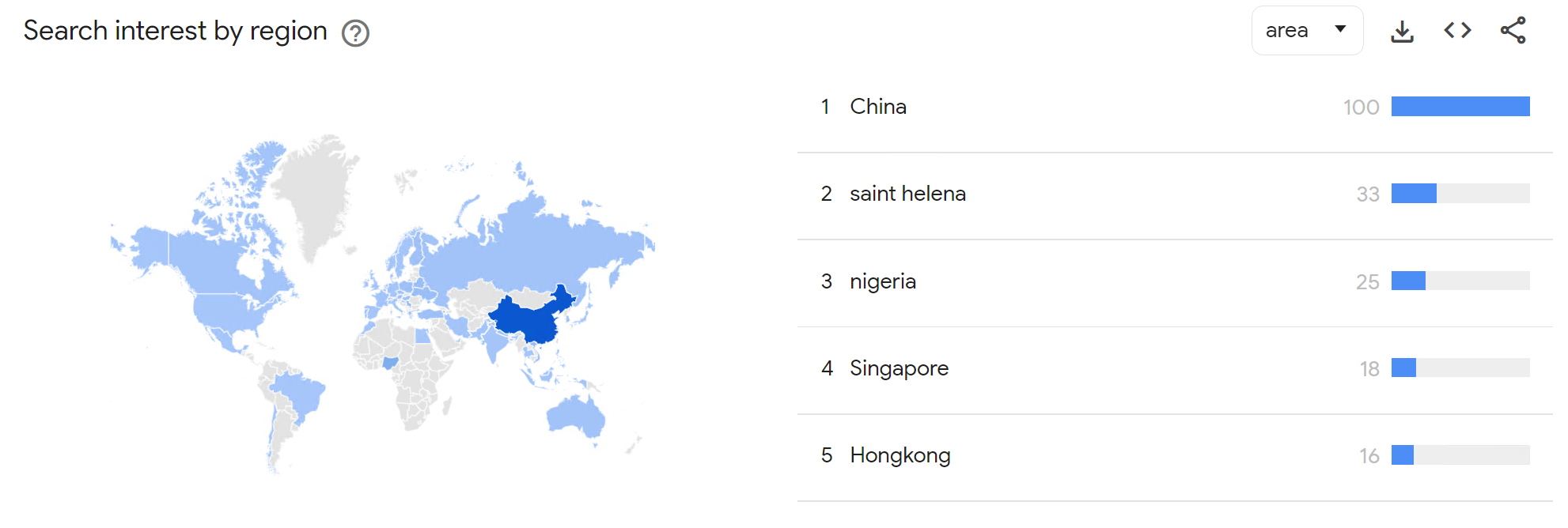

Chinese users have a soft spot for airdrops. In the past month, google trends ranked first.

Other Layer 2 testnet projects, including Scroll, Base, and Linea, will become rising stars.

Due to the popularity of the BTC NFT of the Ordinal protocol, the BTC second-tier ecology has begun to attract attention, and the second-tier projects led by Stacks have begun to gather strength.

Layer 2 technology and ecology still need to be continuously improved, and the real Summer of Layer 2 will not be until 2024.

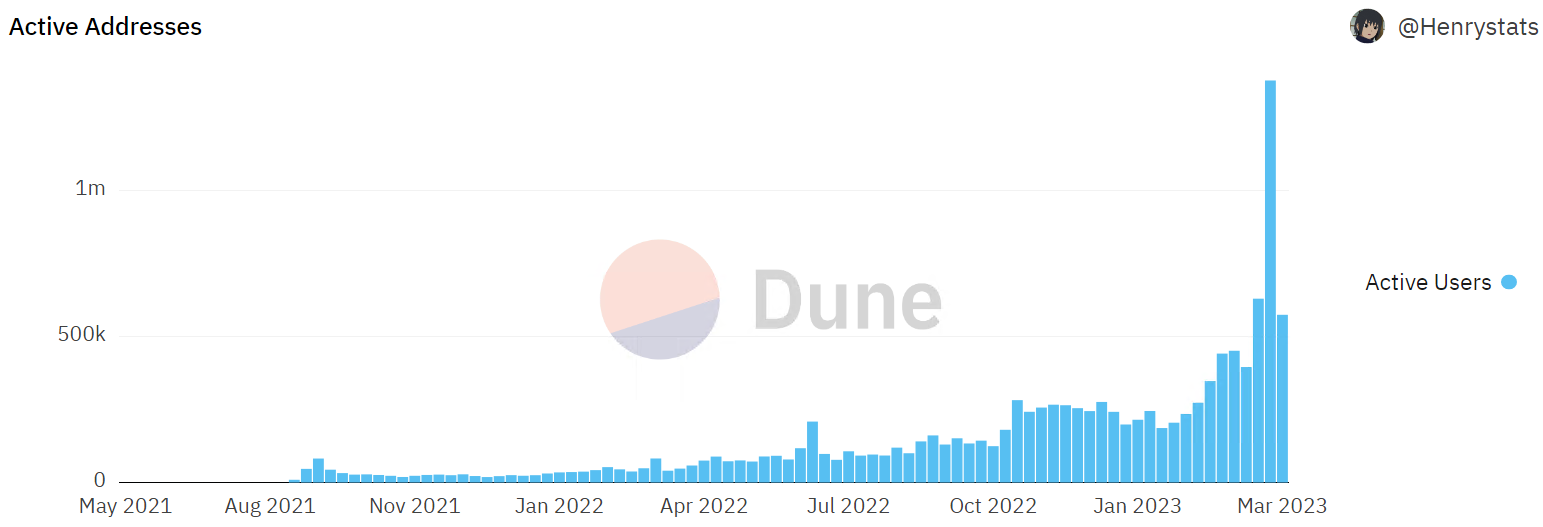

The most exciting thing in March 2022 is undoubtedly the airdrop of Arbitrum, and the price of $ARB is also in line with everyone's expectations, stabilizing around $1~$1.5. According to the official airdrop rules, 625,143 addresses are eligible for airinvestment, and the airdrop supply exceeds 1 b, and each address receives an average of 1,859 $ARB, with a value of about $24,167, which undoubtedly brings a large wave of wealth effects , and the interaction cost will not exceed $10. Since the release of the airdrop rules, Arbitrum One's TVL has risen all the way to $2.25 b, accounting for 66.86% of the entire layer 2 ecosystem. The number of unique addresses has exceeded 4 million, and the number of active users in the week of the airdrop reached 1.38 m. Even after the airdrop and token issuance, Arbitrum’s on-chain activity is higher than other public chains and the Ethereum mainnet.

image description

Figure 1. Arbitrum Weekly Active Addresses (Source: dune, @Henrystats)

The airdrop of Arbitrum brought about some interesting phenomena:

(1) Arbitrum's airdrop rules do not effectively shield Sybil addresses. This has resulted in certain individuals and groups gaining huge wealth, and 1007 contract addresses have also received airdrops, with a total of about 1 million, and the airdrop rules cannot effectively prevent the following four types of witches:

Witches with less than 20 addresses;

A witch who deposits and withdraws through exchanges, cross-chain bridges, and smart contracts;

Sybils with obvious NFT or fund-sweeping behavior after the snapshot;

(2) Due to the wealth effect, a large number of users have poured into other Layer 2 projects that have not issued coins to interact, especially zkSync and StarkNet, the remaining four kings of Layer 2 projects, and even the Goerli testnet project has also attracted users. The Goerli ETH test coin is starting to have a price.

image description

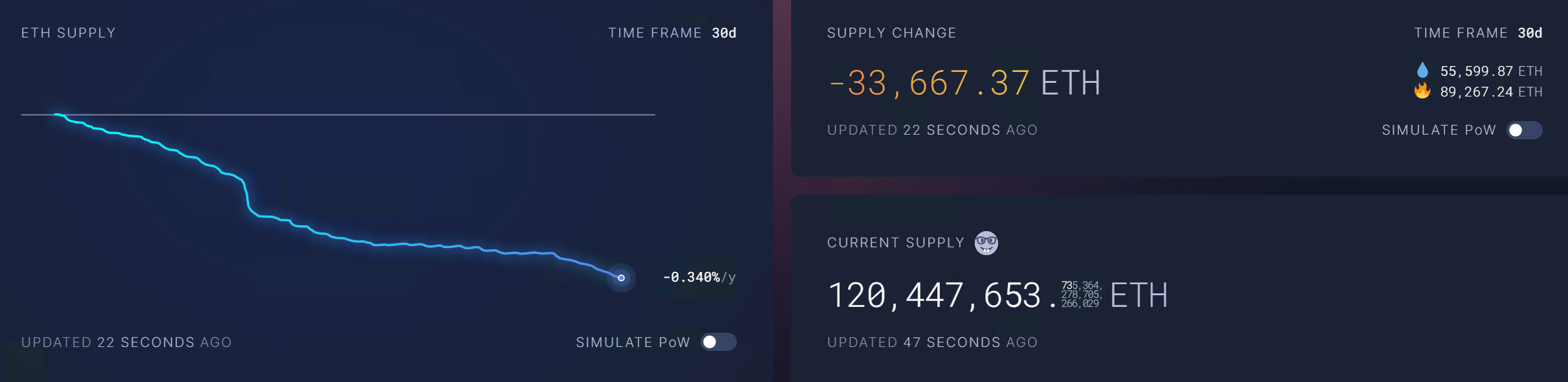

(3) Layer 2 interacts frequently, ETH gas is burned, and ETH is stable and deflationary. ZkSync’s gas consumption has increased by 82% in the past week, reaching 1003 ETH.

image description

(4) Chinese users have a soft spot for airdrops. According to Google trends, the search volume of zkSync in China ranked first in the world in the past month.

image description

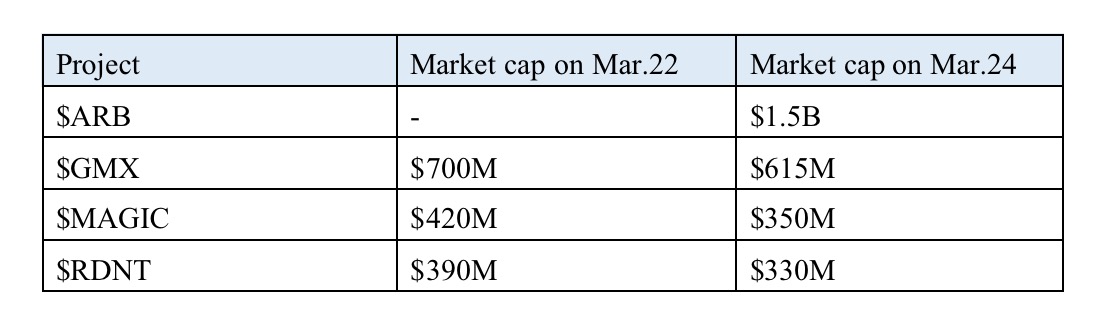

(5) After the issuance of $ARB tokens, FDV reached $1.5 B, the market value of Arbitrum's mainstream ecology declined, and the activities on the chain also returned to the state before the issuance of tokens this week. At this stage, the industry is still in a bear market, and after the benefits of issuing currency are exhausted, it may be a negative. On-chain funds quickly shifted to new narratives.

Table 1. Changes in the ecological market value of Arbitrum after the issuance of tokens

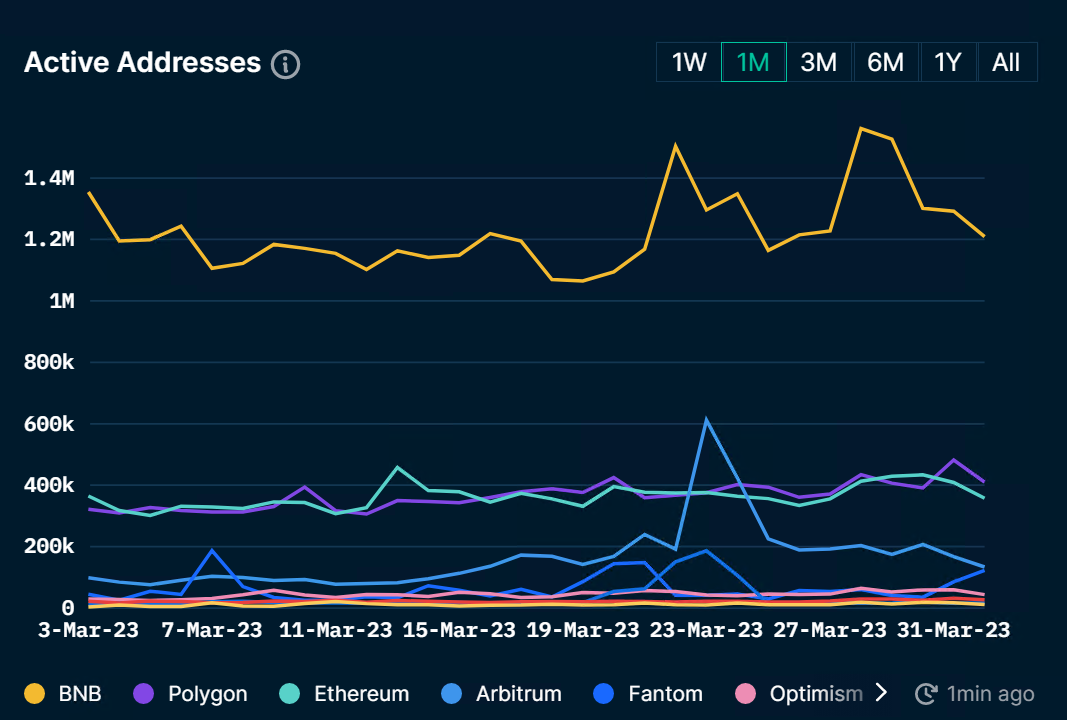

Figure 5. The number of active addresses of each public chain in March (source: nansen.ai)

first level title

2. Airdrop opportunities on the second layer of Ethereum

Regardless of whether the underlying technology of the OP system is really decentralized and high-performance (such as node downtime, sorter problems), users still care about the wealth effect. Optimism and Arbitrum have gained a good market share in the Layer 2 ecosystem through ecological accumulation and airdrops to grab users. Moreover, as the Layer 2 ecology becomes more mature, and EIP-4844 will greatly reduce Layer 2 fees, Layer 2 has a great advantage compared with other public chains. The bull market in the encryption industry in 2021 is a big explosion of new public chains, and the summer of Layer 2 is also the expectation of all users.

2.1 zkSync era

Under the premise of the success of Optimism and Arbitrum, the remaining two king projects of Layer 2, zkSync and StarkNet, need to show more sincerity if they want to seize the market. The competition among projects and the wealth effect brought about by users' fomo have made Layer 2 Summer ready to emerge. Below, we sort out the progress and ecological development of the Ethereum Layer 2 project to provide reference for airdrop users.

Developed by Matter Labs, zkSync leverages zero-knowledge proofs, specifically zk-Rollups, to bundle multiple transactions into a single proof, which can then be verified on the Ethereum blockchain. zkSync is a promising scaling solution in the blockchain ecosystem designed to solve the challenges of high fees and network congestion on Ethereum. It enables more practical and efficient use of decentralized applications and digital assets by providing a secure, scalable, and low-cost alternative.

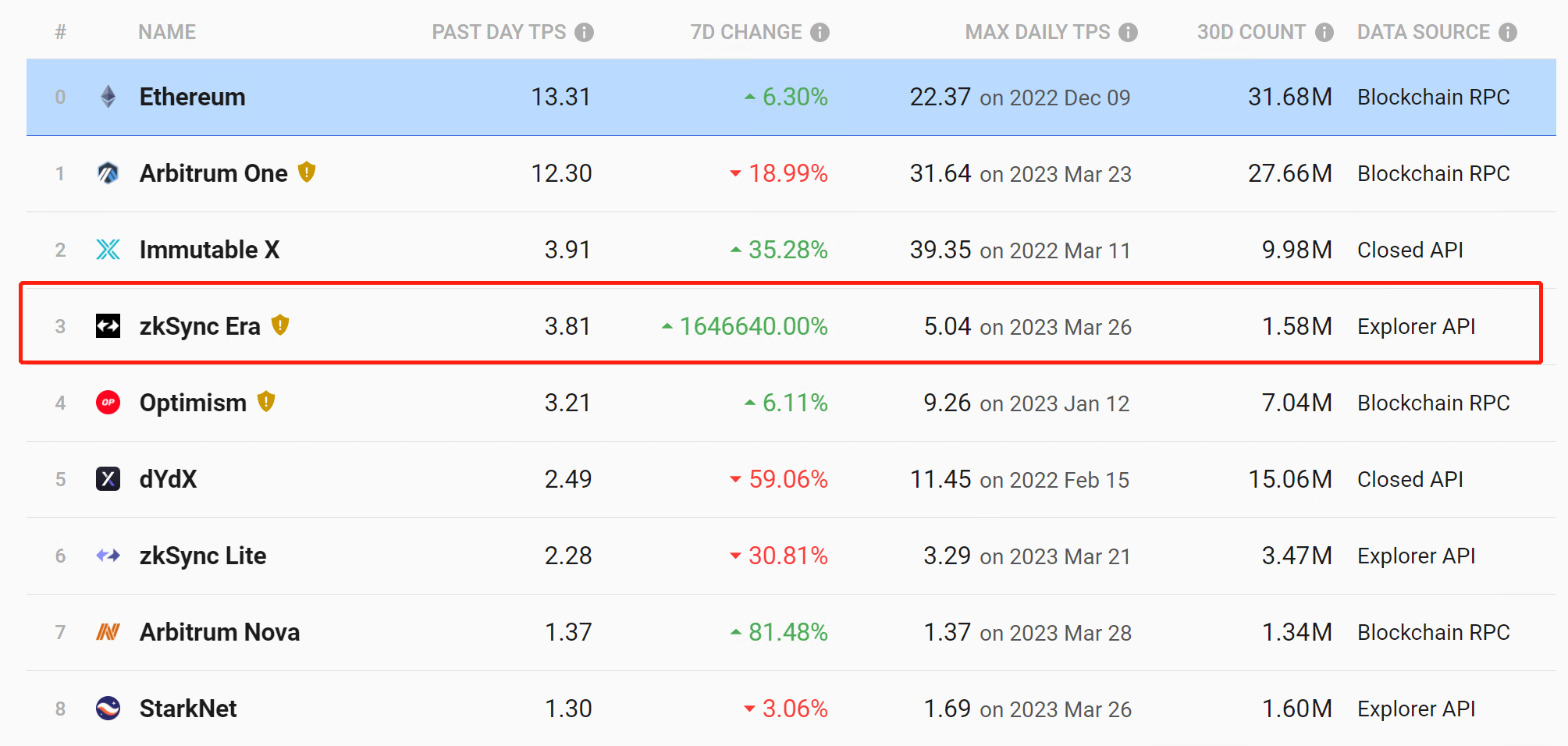

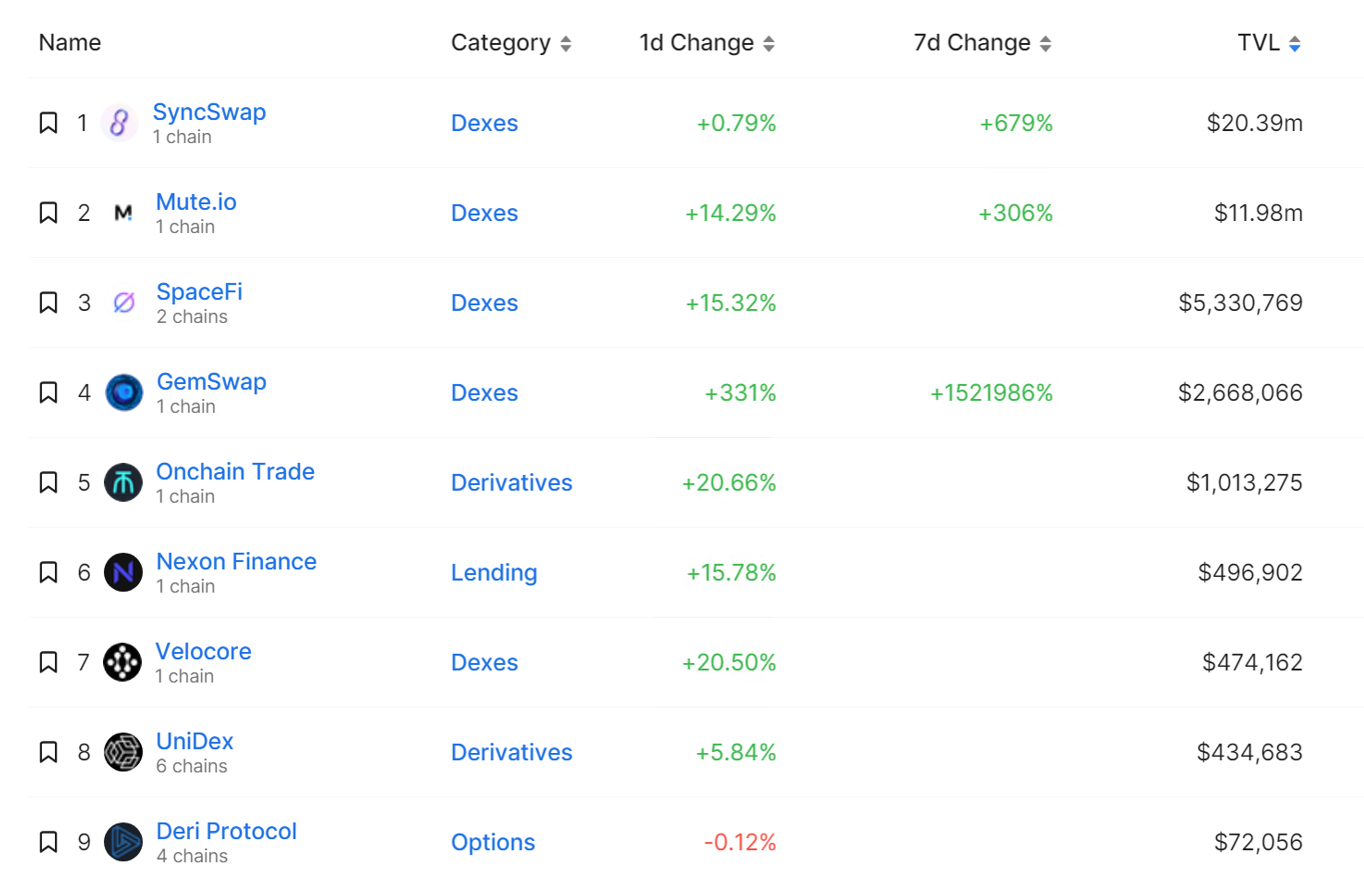

Currently, zkSync Era network TVL reaches $42.86 M, and zkSync Era has increased by 47,000% in the past week. , according to Dune Analytics data, the number of zkSync Era single addresses has reached 241,765, and 58,554 ETHs have cross-chained into the zkSync Era network. According to Defillama data, there are 9 DeFi projects included, mainly DEX projects. There are already 34 projects that have been officially launched, including wallets, cross-chains, NFTs, etc., but there are fewer innovative projects, and there is still a certain gap from the OP ecosystem. User interaction can choose: (1) Use the official cross-chain bridge; (2) Interact with DEX, exchange tokens or become LP; (3) Participate in lending projects; (4) Participate in domain name or NFT casting.

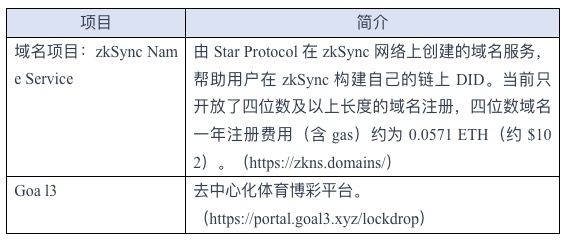

Figure 6. Activity of Layer 2 projects over the past 7 days (Source: L 2b eat.com)

Figure 7. zkSync ecological project (source: defillama)

secondary title

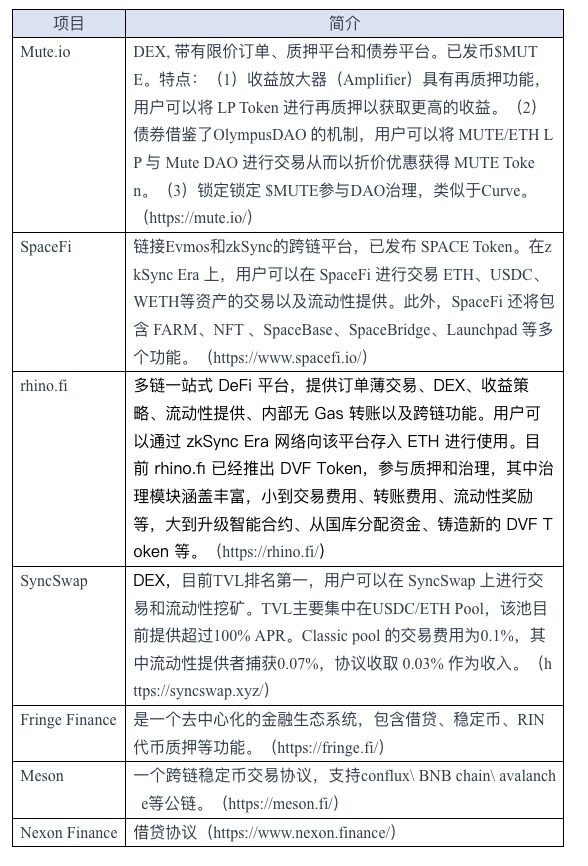

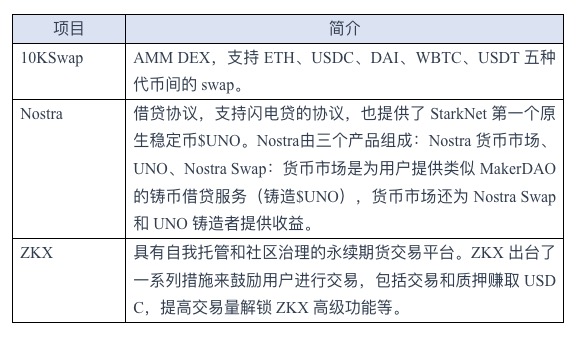

(1 )DeFi

(2 )NFT Marketplace & Projects

(2 )NFT Marketplace & Projects

2.1.1 Inventory of some zkSync ecological projects

2.2 Starknet

(3) Others

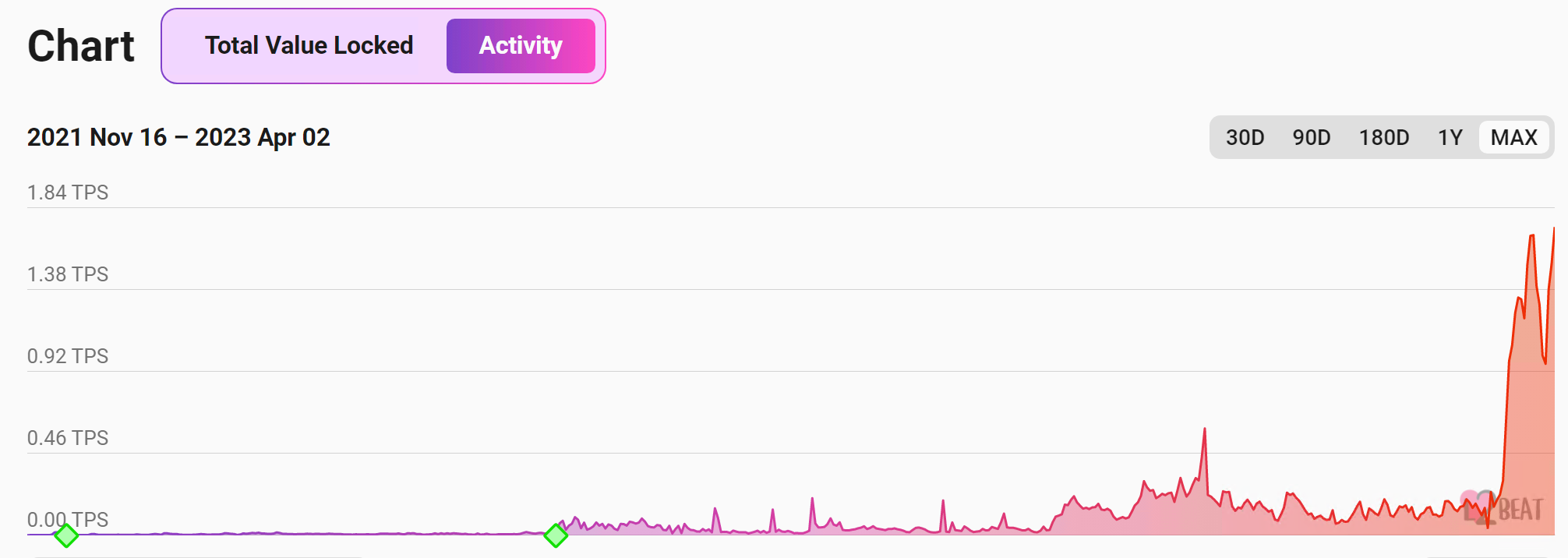

Given that StarkWare is currently valued at US$8 billion, it goes without saying that the StarkNet ecological project has a lot of gold. StarkNet has announced on November 16, 2022 that its native token $STRK has been deployed on the Ethereum mainnet for voting, staking and payment of fees, and the distribution of tokens is still to be determined.

image description

Figure 8. Starknet network activity (source: L 2b eat)

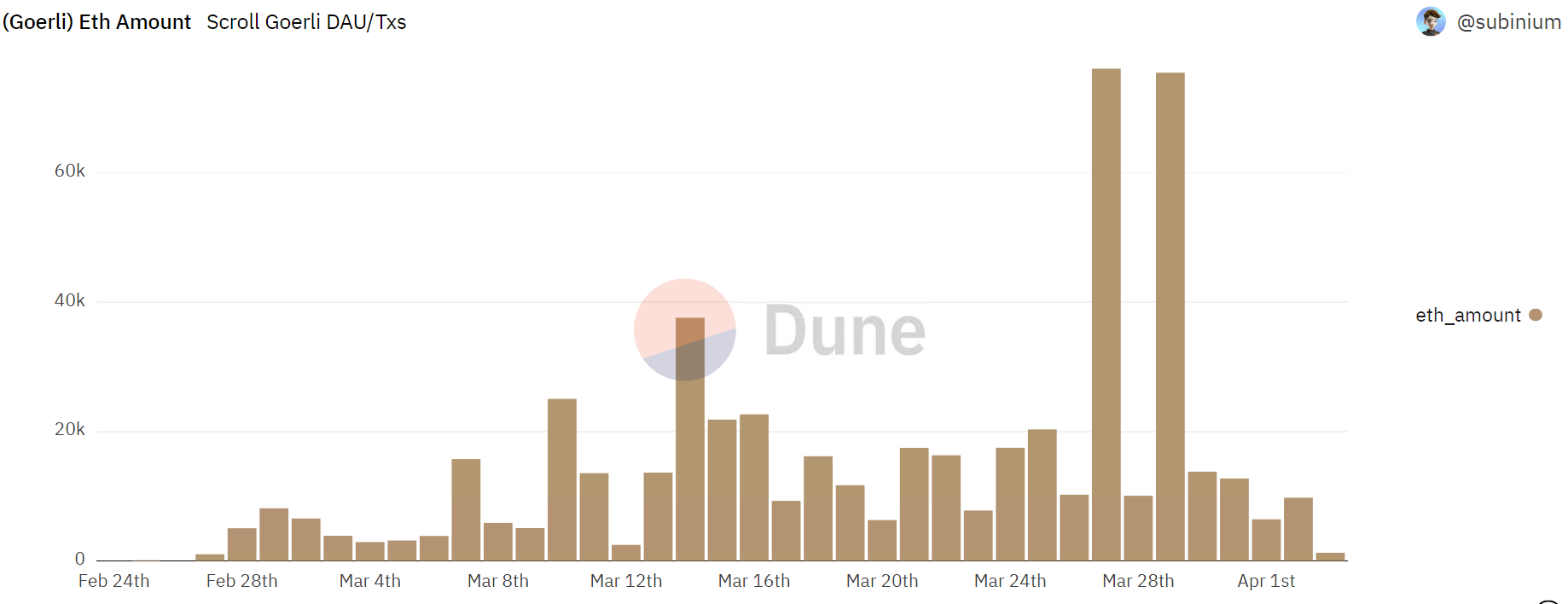

(1 )DeFi

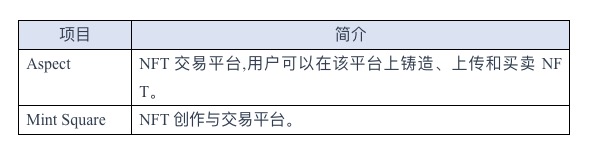

(2 )NFT Marketplace & Projects

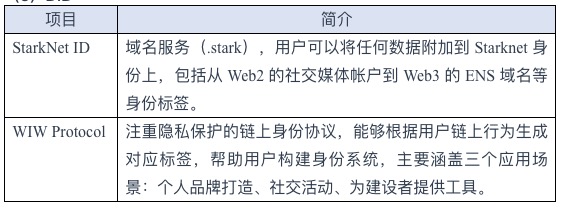

(3 )DID

(4 )Game

(4 )Game

2.2.1 Inventory of some Starknet ecological projects

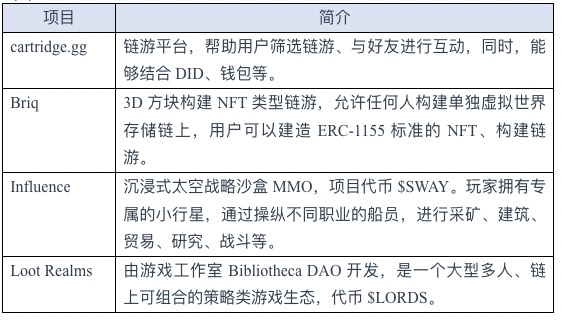

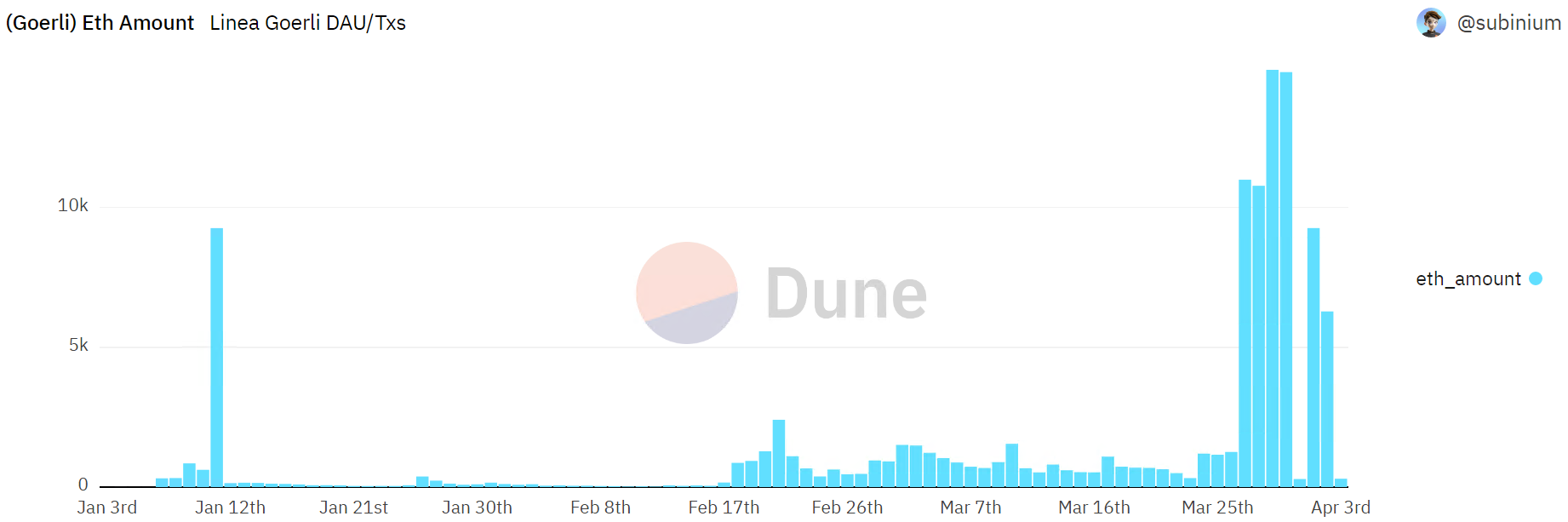

Among the Layer 2 projects that are closely following the four kings, Scroll is currently second only to zkSync and Starnet. Scroll received $30 million in Series A funding in April 2022 and $50 million in July 2023. Scroll's goal is to build an EVM-compatible zk-Rollup, and the team is mainly Chinese. Currently, the Scroll project is progressing smoothly, and the alpha testnet phase is underway. During the pre-alpha version, 1 million unique addresses and 16 million transactions have been achieved. Recently, the total amount of ETH in the testnet is also increasing. The Scroll ecology has not yet been fully formed, and there are few projects that users can participate in, such as Uniswap. Users with strong coding skills can deploy smart contracts, but they all need to obtain Goerli test coins.

image description

Figure 9. Scroll Goerli ETH amount (Source: dune, @subinium)

Coinbase announced the four major directions supported by the Base Ecological Fund: 1. Stable coins (flatcoins) that can track inflation rates; 2. On-chain reputation platform; 3. On-chain capped order book (LOB) trading platform; 4. More secure For DeFi, this includes tools that can protect against smart contract code vulnerabilities or protocol logic errors, and ultimately on-chain insurance and insurance agreements, or any other product that can provide users with critical support in the event of smart contract failure.

image description

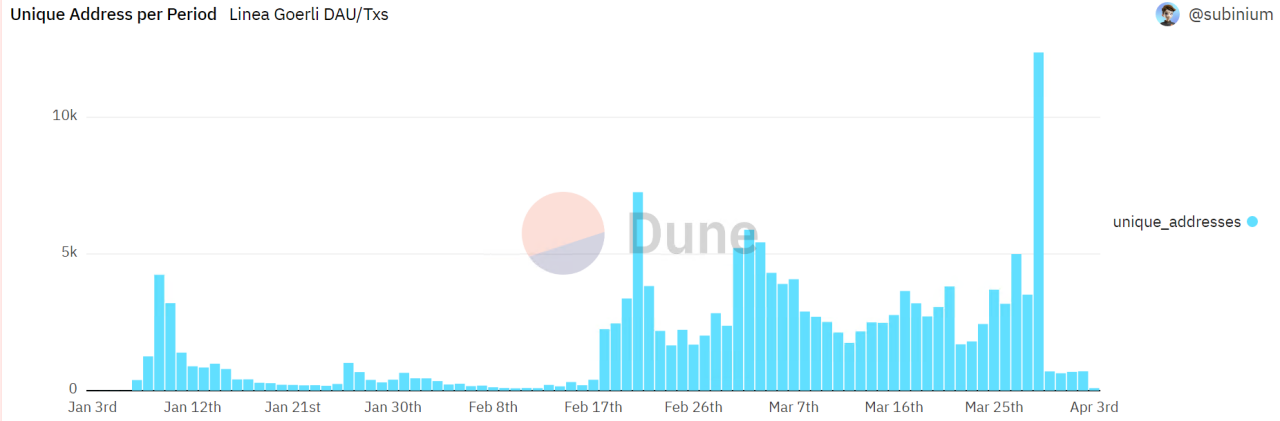

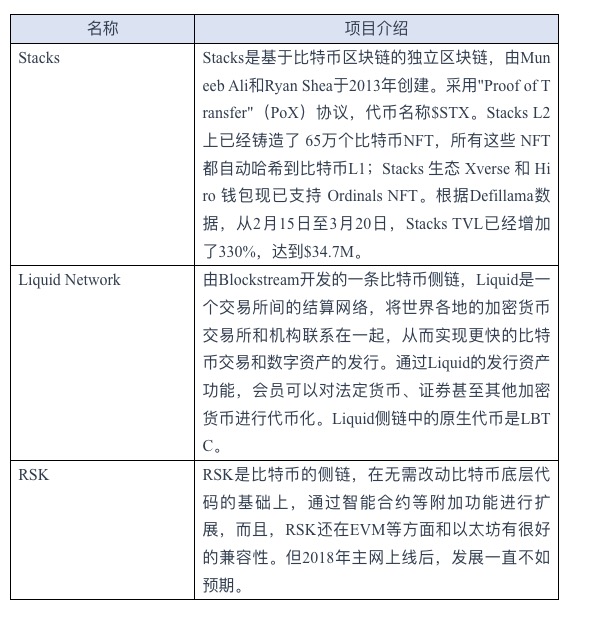

Recently, in addition to the high popularity of the Polygon zkEVM mainnet launch, Consensys also opened the testnet of its zkEVM project Linea. Last week, Linea had an inflow of more than 10,000 Goerli ETH in a single day, setting a new high. At present, there are more than 110,000 addresses on the Linea chain, about 115,000 Goerli ETHs have been deposited, and more than 590,000 transactions have been completed. Linea's interaction is similar to Scroll, and you need to get Goerli's test currency. At present, the applications that users can interact with are relatively limited, including cross-chain bridge hop, DEX: Uniswap, MES protocol, NFT: ghostNFT.

Figure 11. Linea Goerli ETH inflows per day (Source: Dune, @subinium)

Figure 12. Linea Goerli Daily Unique Addresses (Source: Dune, @subinium)

first level title

3. BTC Layer 2 network development and status quo

However, the Lightning Network cannot carry diverse ecological applications similar to Ethereum. Since the BTC taproot upgrade, developers can embed asset metadata, making BTC possible to become a data platform. The concept of the second layer of BTC stands out. In February, the BTC NFT based on the Ordinal protocol brought the BTC native ecology and the concept of ordinal NFT to the market, and the BTC ecology once again attracted attention. Here are 3 well-known second-tier BTC projects.

image description

At present, the BTC ecology is still far away from Ethereum. Many people are optimistic about BitcoinFi for the following two reasons: (1) The decentralization of the BTC network, almost all the POS nodes of the Ethereum mainnet are in Amazon and Microsoft Google Cloud; (2) The Ethereum ecology has been over-developed, while the BTC ecology is still a blue ocean.

first level title

4. Conclusion and reflection

Arbtrum's airdrop triggered a Layer 2 craze. Behind the fomo, it also caused a series of problems: 1. Speculators are too enthusiastic, but ignore the development of the project itself. Compared with AI, the technological progress of the blockchain itself creates The rich effect is too obvious, so that users do not enjoy the technological advancement brought by the product, which is actually very unfavorable to the development of the industry; 2. Although it is a bear market, the capital game and mutual cuts in the market are becoming more and more intense; 3. Everyone is very interested in Layer 2 The expectation is much higher than that of the public chain. The Ethereum ecology carries too much money, but the development of zk technology, especially zkvm, is slow; 4. The airdrop is too expensive, but it is not profitable. More powerful projects may choose the IDO method, such as the public chain Sui, which may be objective and fair.

Other Ethereum Layer 2 projects, such as Starknet, have a richer ecology than zkSync, but they are not in a hurry to issue coins, and the service fees charged by Starkware are fully capable of making them profitable. On the contrary, the author is more optimistic about Layer 2 projects with zkevm as the core technology, such as Scroll and Linea. However, the interaction of these projects is slightly complicated and requires the purchase of ETH test coins.

About Huobi Research Institute

References

2. https://consensys.net/blog/research-development/consensys-zkevm-is-ready-for-public-testnet/

3. https://Goerli.linea.build/

4. https://www.odaily.news/post/5186161

5. https://www.wu-talk.com/index.php? m=content&c=index&a=show&catid= 38&id= 12865

6. https://www.fx 168 news.com/article/150875

7. https://www.panewslab.com/zh/articledetails/ws 25 r 0 c 3.html

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as "Huobi Research Institute") was established in April 2016. Since March 2018, it has been committed to comprehensively expanding research and exploration in various fields of blockchain, with a view to pan-blockchain As a research object, the research objectives are to accelerate the research and development of blockchain technology, promote the implementation of blockchain industry applications, and promote the ecological optimization of the blockchain industry. The main research contents include industry trends, technical paths, application innovations, Pattern Exploration, etc. In line with the principles of public welfare, rigor, and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms, and build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical foundation and trend judgment to promote the healthy and sustainable development of the entire blockchain industry.

4. The information, opinions and speculations contained in this report only reflect the judgment of researchers on the date of finalizing this report. In the future, based on industry changes and updates of data information, there is a possibility of updating opinions and judgments.

https://research.huobi.com/

disclaimer

1. Huobi Blockchain Research Institute does not have any relationship with the projects or other third parties involved in this report that affect the objectivity, independence, and impartiality of the report.

2. The materials and data cited in this report come from compliant channels, and the sources of the materials and data are considered reliable by Huobi Blockchain Research Institute, and necessary verifications have been carried out for their authenticity, accuracy and completeness , but Huobi Blockchain Research Institute does not make any guarantees about its authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the conclusions and opinions in the report do not constitute any investment advice on relevant digital assets. Huobi Blockchain Research Institute is not responsible for any losses caused by the use of the content of this report, unless it is clearly stipulated by laws and regulations. Readers should not make investment decisions solely based on this report, nor should they lose the ability to make independent judgments based on this report.

4. The information, opinions and speculations contained in this report only reflect the judgment of researchers on the date of finalizing this report. In the future, based on industry changes and updates of data information, there is a possibility of updating opinions and judgments.

5. The copyright of this report is only owned by Huobi Blockchain Research Institute. If you want to quote the content of this report, please indicate the source. Please let me know in advance if you need to quote a lot, and use it within the scope of permission. Under no circumstances shall any quotation, abridgement and modification contrary to the original intention be made to this report.