The Shanghai upgrade is completed, how much selling pressure will the unlocked ETH bring?

This article comes from GlassnodeThis article comes from

, original author: Alice Kohn, compiled by Odaily translator Katie Kohn.

The highly anticipated Shanghai/Capella hard fork was scheduled to take place this morning, allowing staked ETH to be withdrawn.This article assesses the potential sell pressure that unlocking could generate from a staker perspective, and discusses the estimated amount of staked ETH that could be withdrawn and sold immediately following the Shanghai upgrade. After researching different staking groups and their motivations for selling to unlock ETH,

We estimate a total of 170,000 ETH will be sold after the Shanghai upgrade.

Looking at staked ETH from the perspective of depositors and dividing it into different categories, we identified the groups most likely to generate sell-side pressure. It is expected that a major portion of unlocked staking rewards will come from users redeploying to liquid staking providers, which are less likely to sell since selling is a loss. Currently, there are only 253 depositors waiting to exit their stake, which is a very small number. Most of them are individual stakers, or early stakers on the Beacon Chain. We believe they are most likely to have a high level of conviction and withdrawals are most likely related to changes in their technical setup rather than exiting their positions.

We expect only 100,000 ETH ($190 million) of the total accumulated rewards will be withdrawn and sold. Additionally, we expect twice as many validators to exit, but only a limited amount of stake will be released each day. We believe only a fraction of that, ~70,000 ETH ($133 million), will be truly liquid.The economic impact of this situation will be felt for days to weeks. According to our analysis,Arguably, upgraded technical delivery is more likely to support a growing staking industry that seeks to better serve Ethereum holders in the long run.

first level title

Shanghai upgrade

The highly anticipated Shanghai/Capella hard fork is scheduled to begin on April 12, 2023, and will allow withdrawals of ETH funds from Ethereum’s new PoS consensus mechanism. The earliest deposits were made in November 2020, before the launch of Beacon Chain, and so far, stakers have not been able to claim their staked ETH or accumulated rewards.

Some stakers have been active since Beacon Chain, and their rewards have been accumulated for over two years, following the market through a full bull/bear cycle. This sparked speculation about the underlying market, with supply impacted as roughly 18 million ETH ($33.92 billion, or 15% of the total circulating supply of ETH) were unlocked. People worry about whether these will flood the market after unlocking and temporarily put a lot of sell pressure on ETH.

The purpose of this paper is to assess the staking landscape of ETH, develop a framework for staking groups, and assess the potential impact of the Shanghai hard fork. We ran several simulations to answer the following questions:

Who is most likely to withdraw staked ETH?

How much pressure do we expect these withdrawals to put on sellers?

first level title

Ethereum Staking Landscape

To gain a comprehensive understanding of the current staking landscape, we will provide a brief technical overview of the existing players in Ethereum’s Proof of Stake (PoS) consensus mechanism:

A depositor is a private individual, or an entity that sends 32 ETH to an Ethereum smart contract to activate a validator. A depositor can have multiple validators stake 32 ETH for it.

Nodes are physical hardware that run validator software. Each node can accommodate many validators. Nodes can be operated by depositors themselves, or entrusted to third-party pledge service providers.

secondary title

depositors are major players

A lot of research has been done on Ethereum's staking economy, most of which focus on validators as the main players in the staking economy. For our analysis, we believe it makes more sense to focus on depositors, since depositors can have multiple validators, and decisions about withdrawals and use of funds are ultimately made at the depositor level.

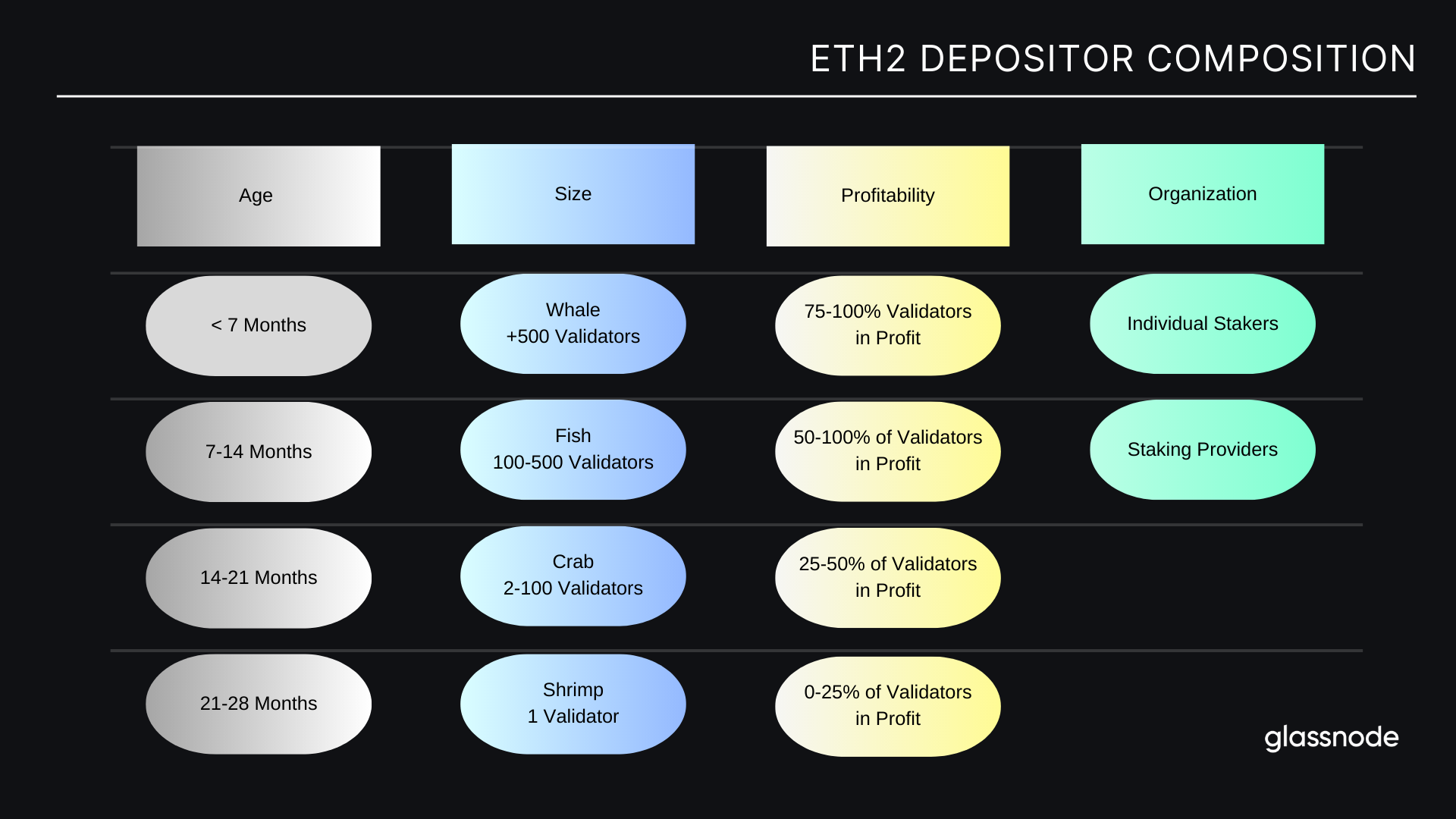

To understand the Shanghai/Capella upgrade, we will divide depositors into different cohorts based on expected demand for ETH and motivation for staking or non-staking. The following figure is the segmentation we chose, mainly considering four factors:

Depositor participation time: the length of time the depositor is active.

Depositor size: The number of validators you have.

Depositor Profitability: Unrealized profit/loss among owned validators.

PLEASE NOTE: We understand that private individuals or entities may deploy staking into the network using different depositor wallet addresses. This often happens with providers of staking services. Therefore, we separated depositor addresses belonging to these providers from the dataset and analyzed them separately. This is to prevent errors in the predictive signals we attempt to obtain through the following analysis.

secondary title

Private Pledgers vs. Institutional Pledgers

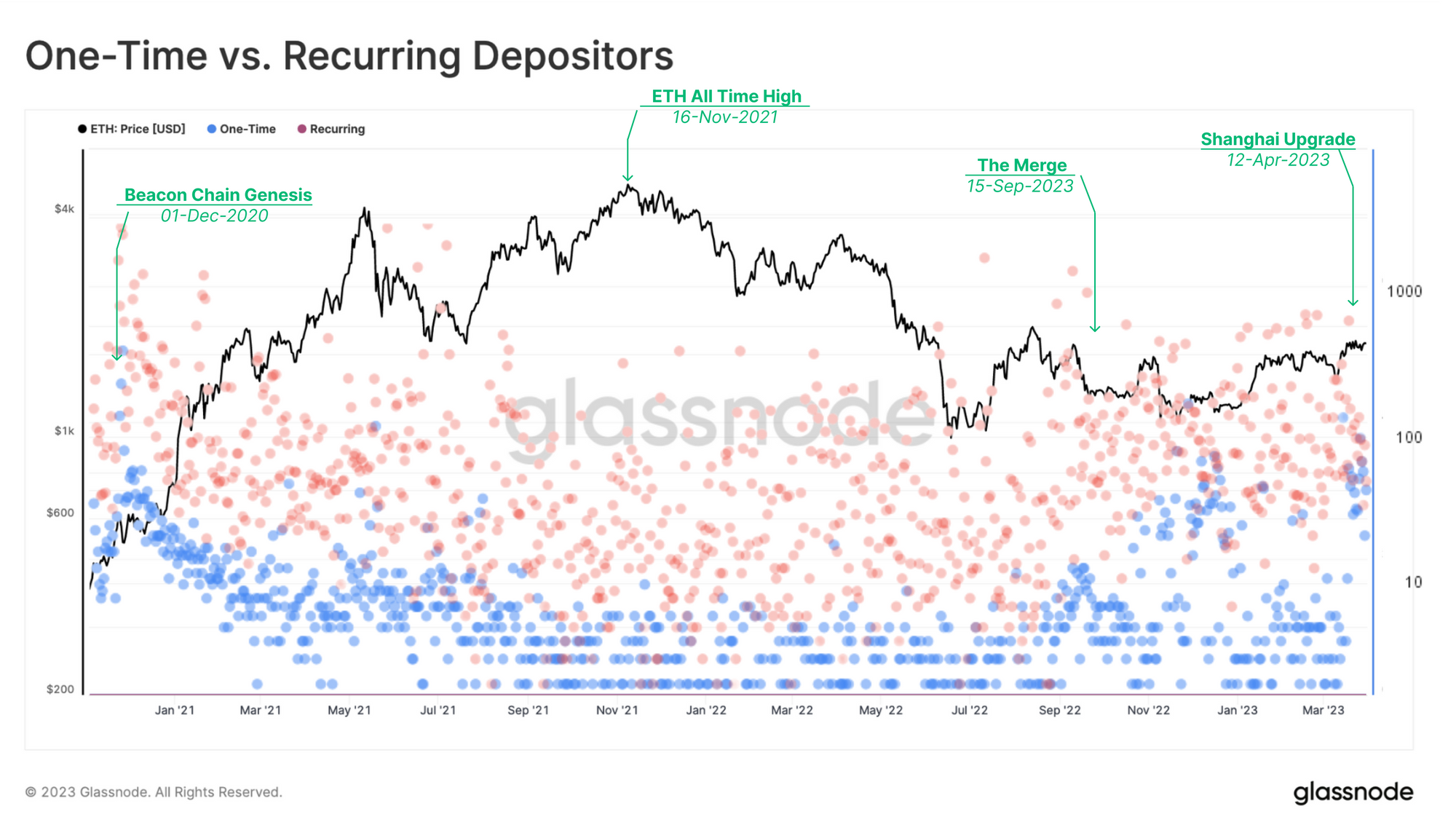

When untangling the staking landscape, it is important to distinguish between private stakers and institutional/staking provider depositors, the former having their own technical setup. In the charts below, we exclude staking providers because many of these entities use one-time addresses for deposits, which would distort the real data.

We also note that the staking pool is mostly composed of depositors who stake multiple times and thus hold multiple validators. We can see that some of these recurring savers have over 1000 deposits per day. Interestingly, in the 2021 bull market, there has been a relative "off-season" for these new deposits on the Beacon Chain.

secondary title

pledge provider

Staking providers are larger entities that allow users to delegate their ETH to the provider's validator nodes. By delegating ETH to these nodes, users can earn rewards for supporting the network without having to run their own validator nodes and provide the full 32 ETH.

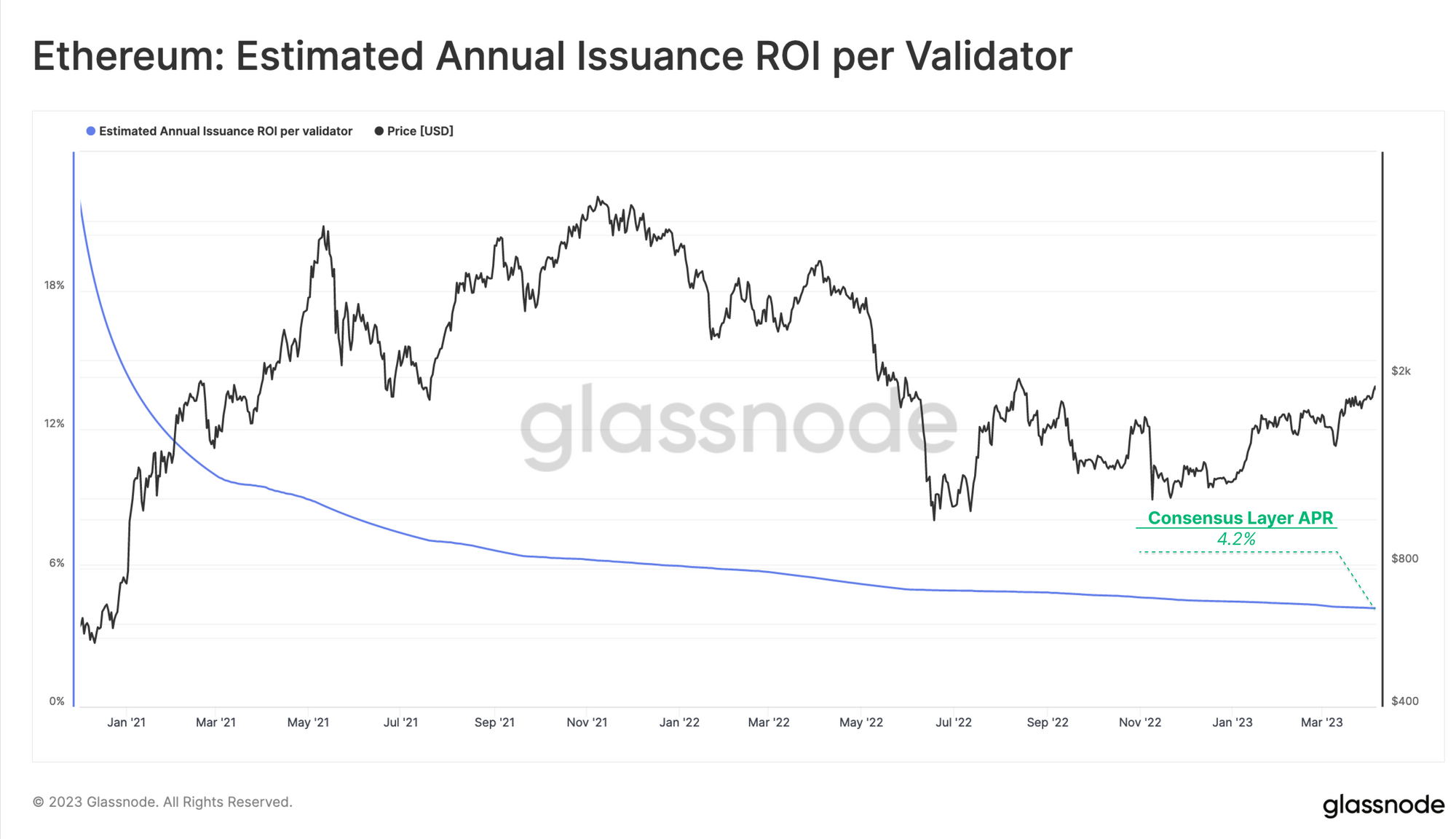

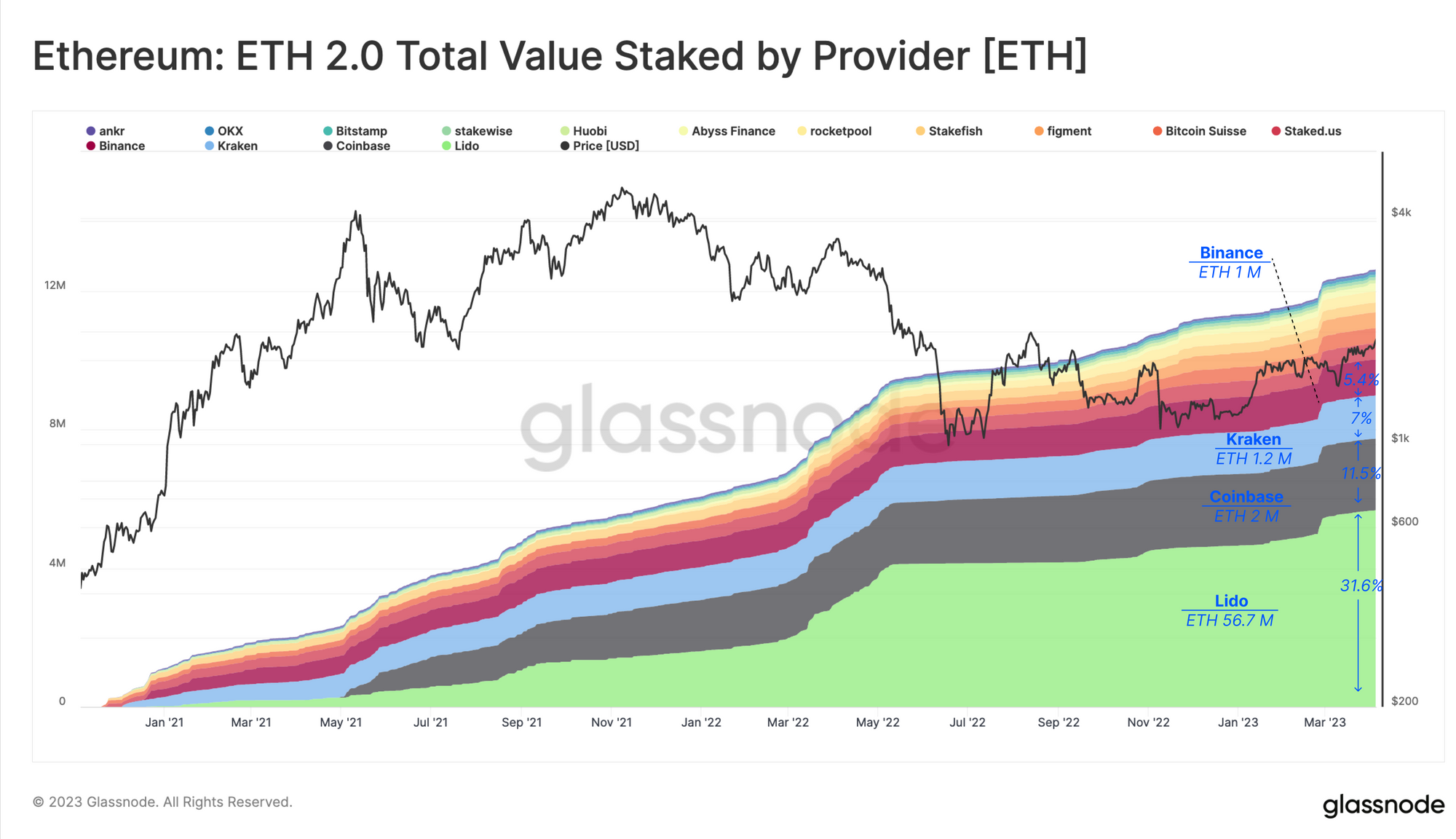

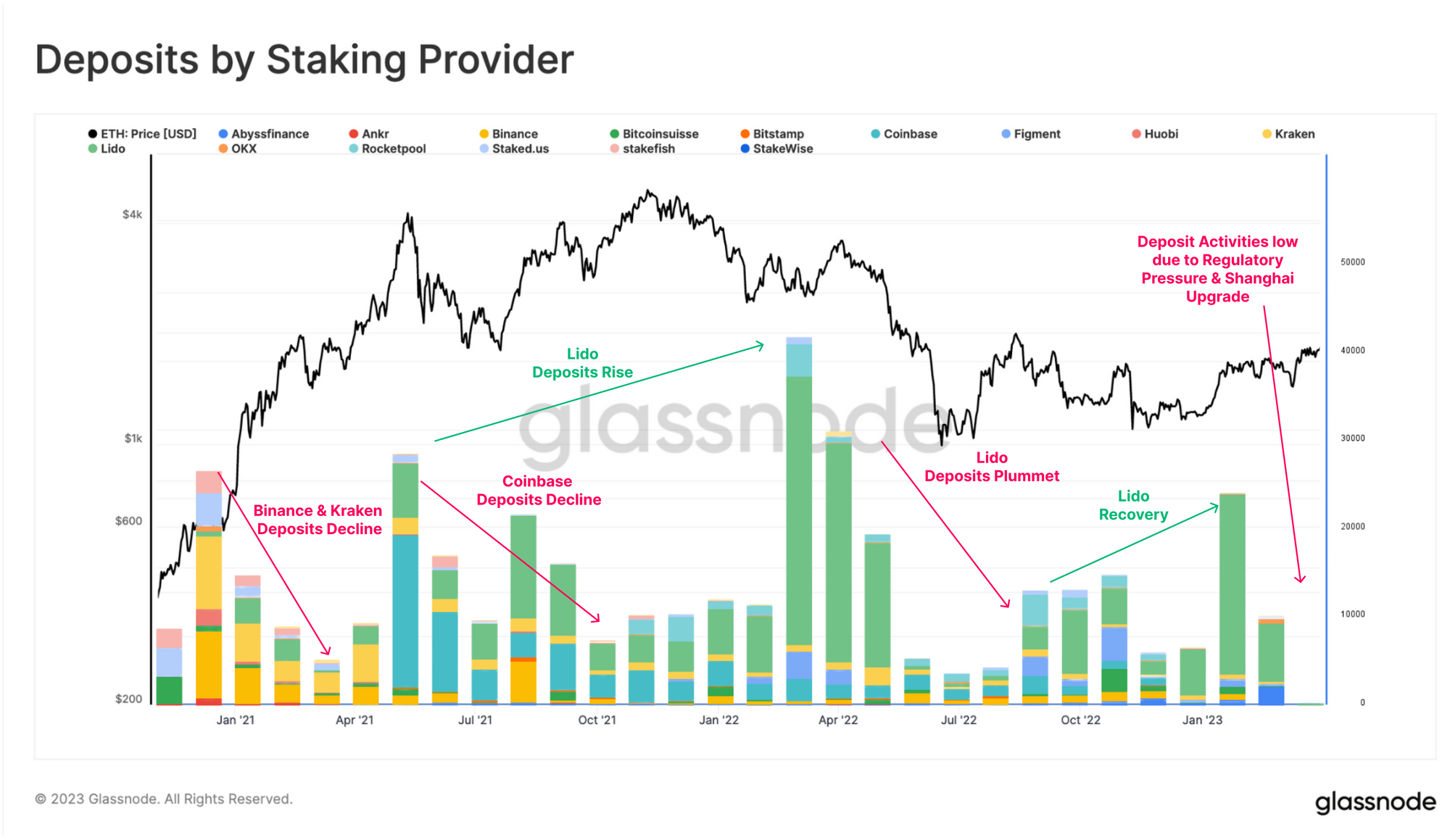

Over the past two years, liquidity staking providers have gained huge market share by returning tradable token derivatives to users. Currently, Lido is the market leader with over 30% market share of the entire network staking. Centralized exchanges such as Coinbase, Kraken, and Binance followed with market shares of 11.5%, 7.0%, and 5.4%, respectively.

Looking closely at the number of deposits by various staking providers over time, we can clearly see a shift in dominance:

In the first half year after the birth of Beacon Chain, Kraken and Binance were the main depositors. However, they were eventually overtaken by Coinbase and Lido.

As a result, deposit activity from all staking providers, especially Lido, drops sharply in mid-2022 and slowly "recovers" towards the end of the year. Additionally, we have observed a massive drawdown in staking activity on centralized exchanges due to increasing pressure on these institutions from U.S. regulators. Kraken finally ended its staking service in the U.S. in February 2023 after being fined by the U.S. Securities and Exchange Commission (SEC), while Coinbase received a notice in March 2023 that its staking service violated anti-securities laws.

secondary title

depositor participation time

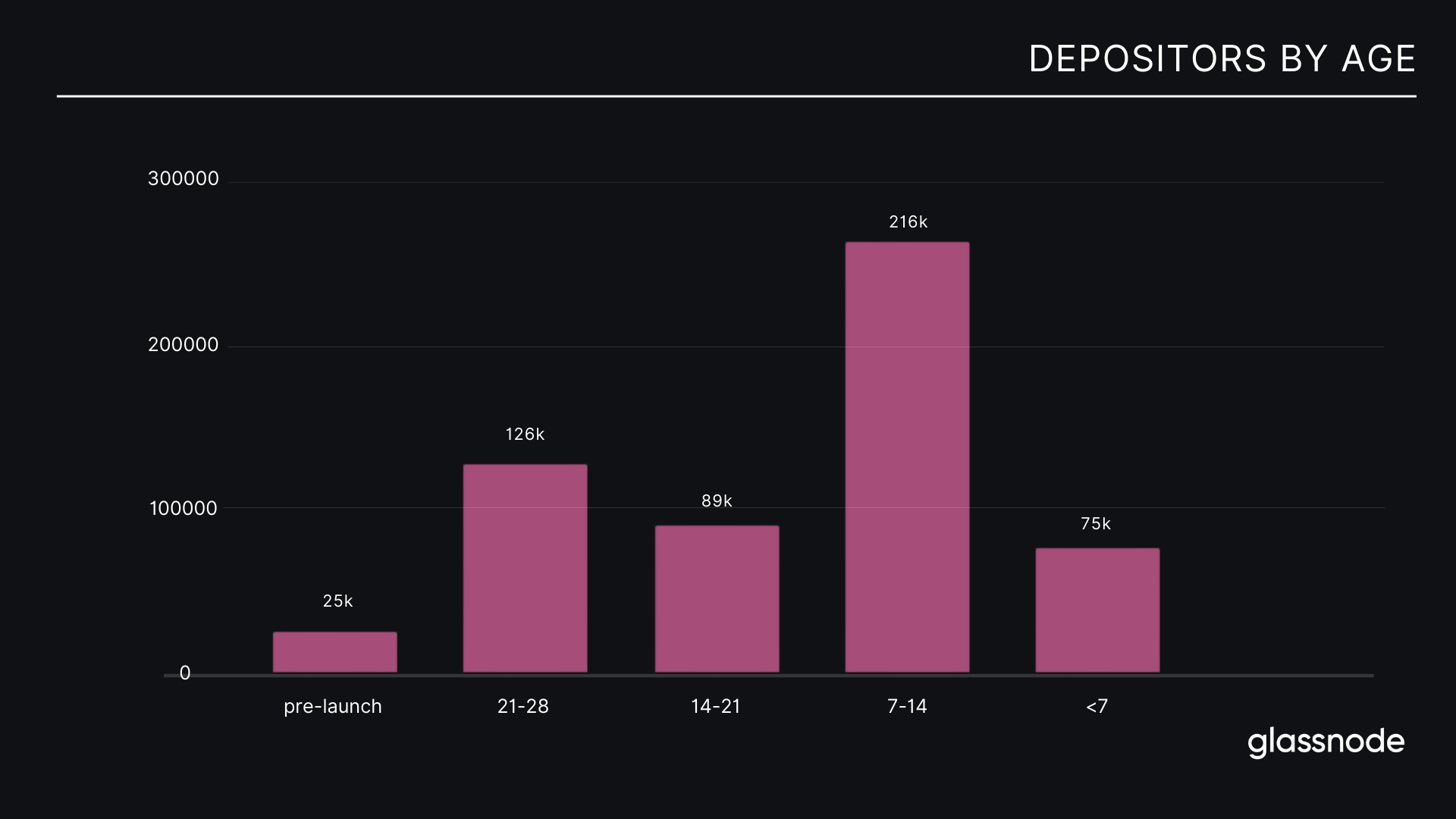

Depositor Engagement Time uses the deployment date of the validator to calculate the average time for depositors to participate in the staking economy. This includes one-time and recurring depositors, but again excludes collateral providers.

Also, we can see that most depositors deposit between 6 months and 1 year. This shows growing confidence in Ethereum’s staking economics over the past year, especially after the successful execution of the merger and the recent enablement of withdrawals.

secondary title

depositor size

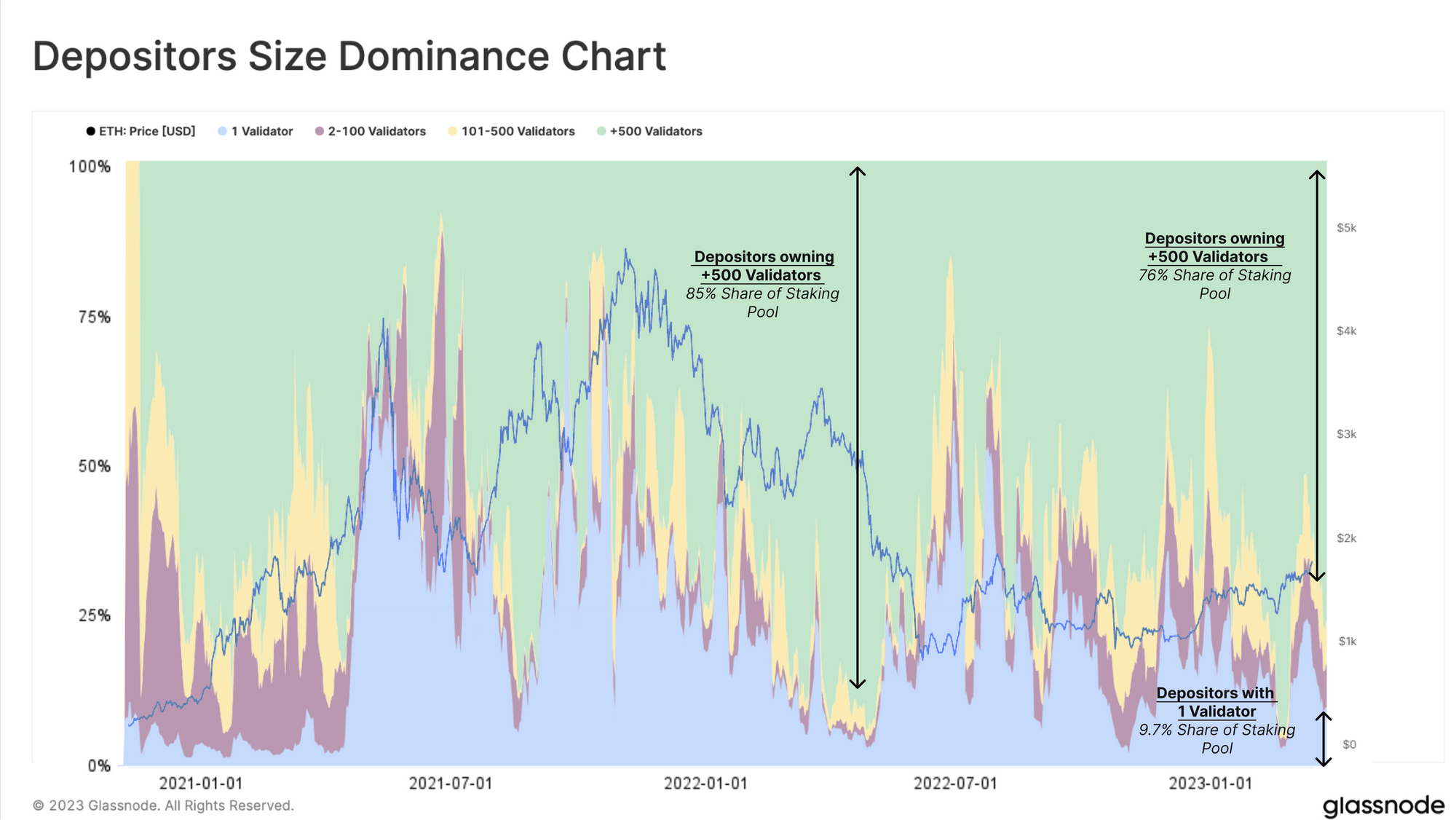

The next step is to examine the size of individual depositors, again excluding staking providers from our dataset. Unlike the graph above, which counts a single deposit event, here we count the total number of validators a depositor’s wallet address has accumulated over time. We then categorized these into data bars of different sizes.

The dominance of "crab" and "fish" (users with small holdings relative to whales) entities with between 2 and 500 validators is surprisingly small at only 13.5% of the total.

secondary title

Depositor Profitability

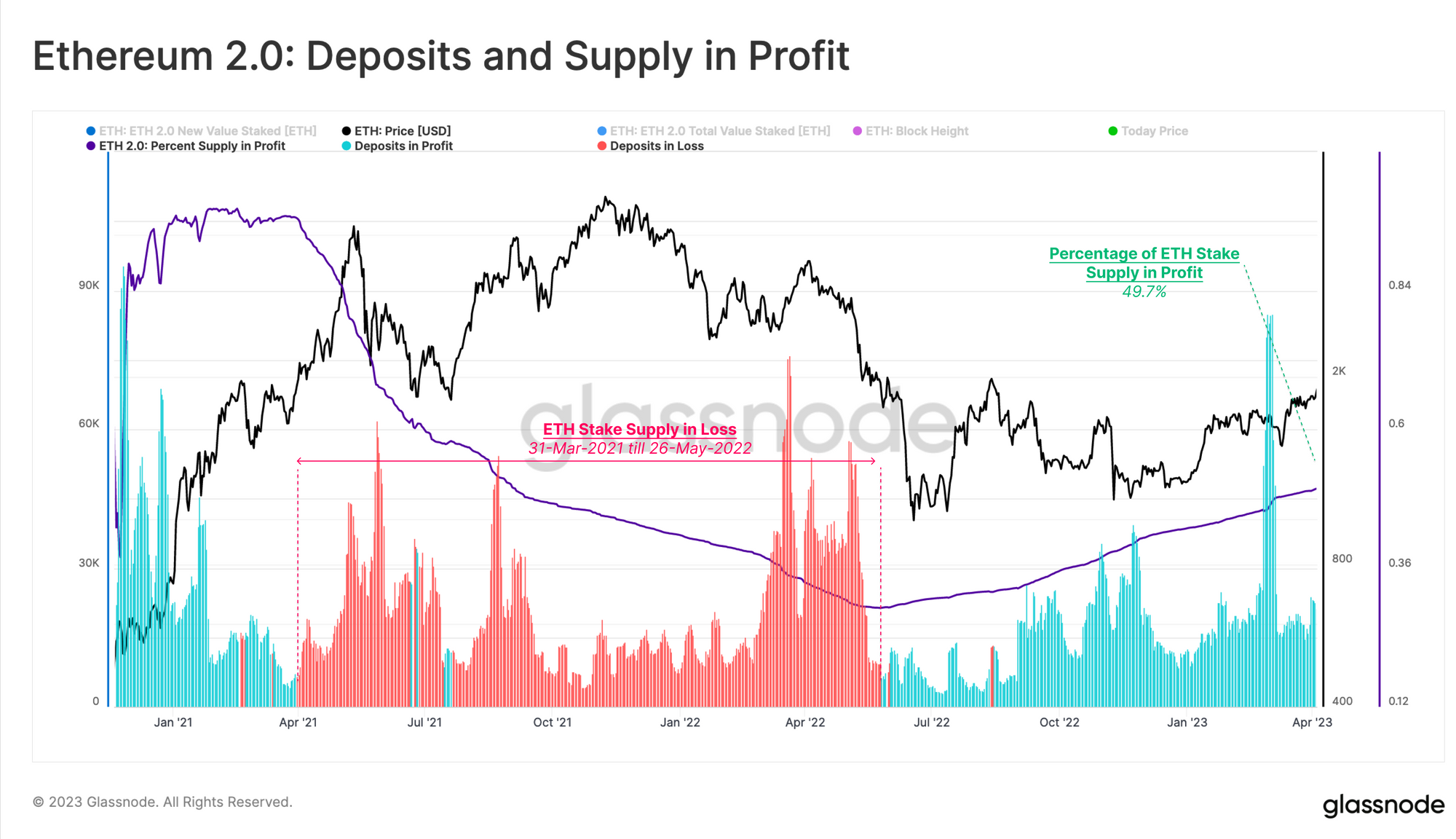

To assess the profitability of depositors, we calculate the realized price of their pledge, which is the value of ETH at the time of deposit compared to the current spot price. This provides a measure of the average unrealized profit/loss held by each depositor.

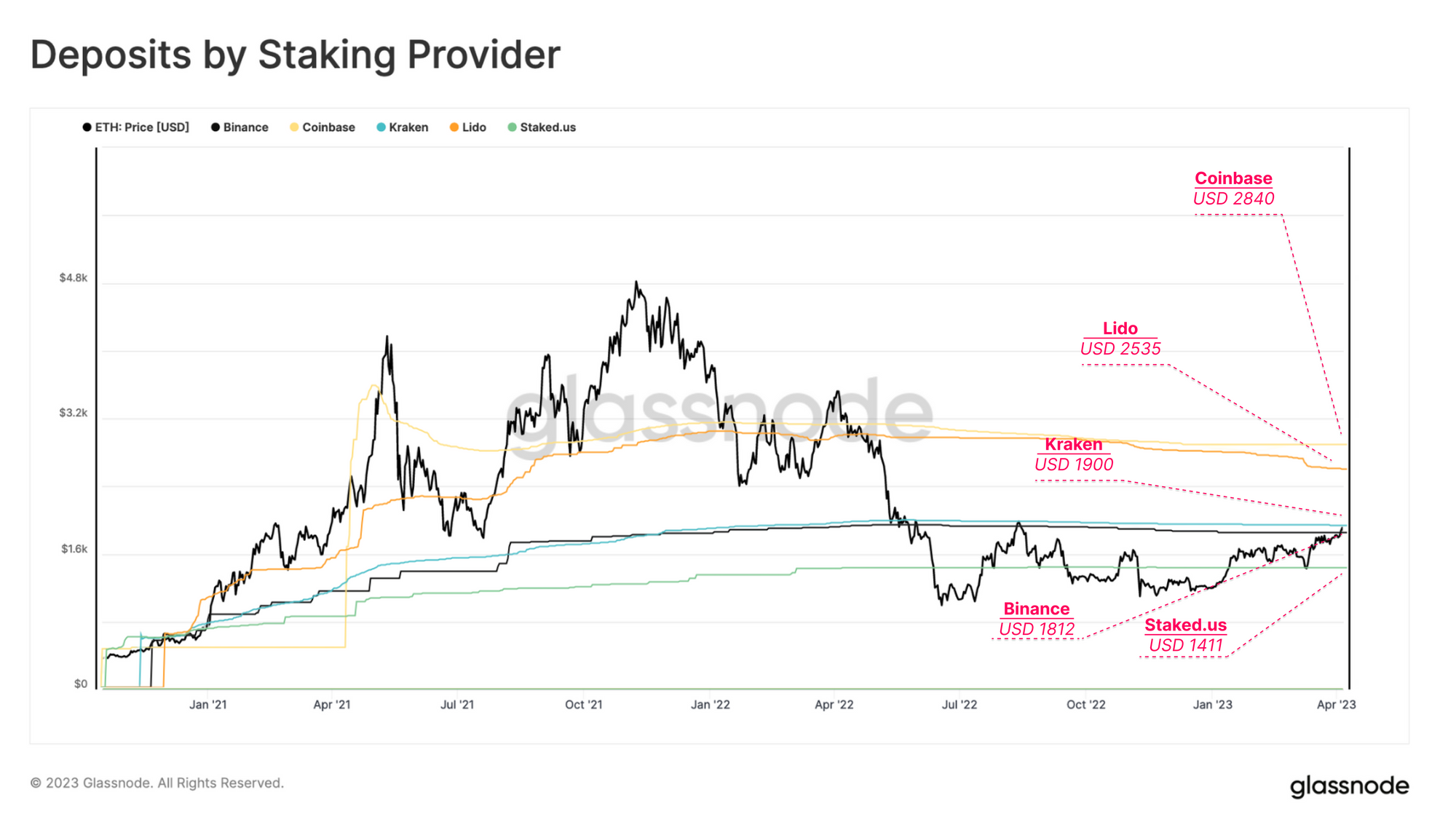

Currently, the average deposit price across all staked ETH is $2,136, suggesting an average unrealized loss of -13% at current spot prices. This compares to an unrealized profit of +36% for the realized price of $1403 on the Ethereum network, which captures the average price at which the entire ETH supply last moved on-chain.

After examining the realized prices of each staking provider, we observed that the average cost basis of Coinbase and Lido was approximately 50% higher than the current ETH spot price. Binance and Kraken, which saw major deposit activity at the start of the bull market, are currently trading at approximate breakeven levels between $1,812 and $1,900, respectively.

The high realized prices on Coinbase and Lido are an interesting dynamic, as both offer a liquid collateralized derivative for their staked ETH, allowing holders to sell, or better hedge risk, with depositors potentially at level 2 The market gets a better realized price.

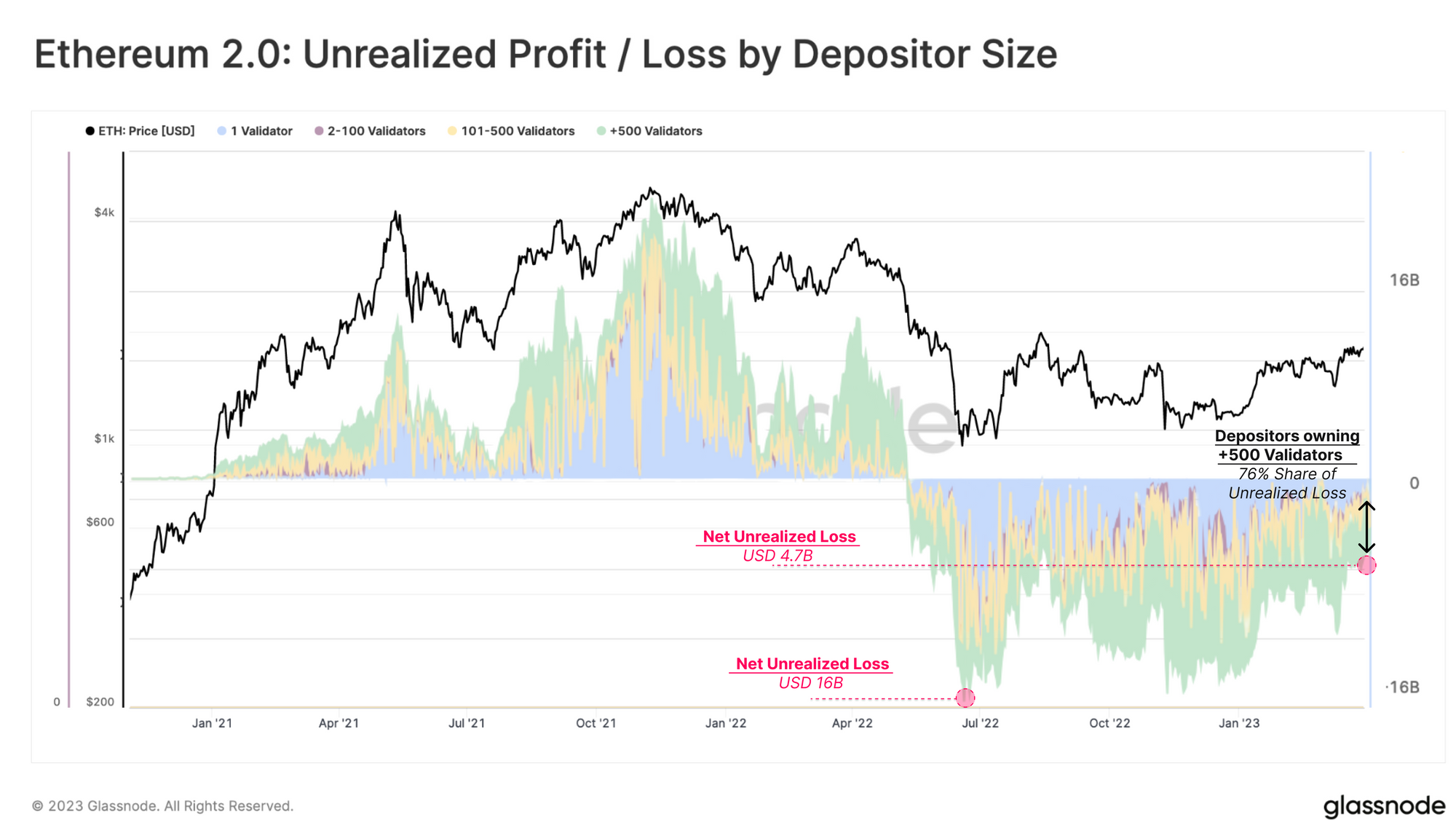

Using the difference between the ETH spot price and the realized price of ETH deposits, we derive the total dollar value of unrealized profits or losses held by depositors. Combined with our division of depositor size, we can begin to classify according to unrealized profit or loss between depositor types. After peaking at $16 billion in July 2022, net unrealized losses are now $4.7 billion. It was largely borne by whale savers, who accounted for 76% of unrealized losses.

first level title

Simulate the withdrawal situation after the Shanghai upgrade

Next, we estimated the amount of staked ETH that might be withdrawn immediately following the Shanghai upgrade.

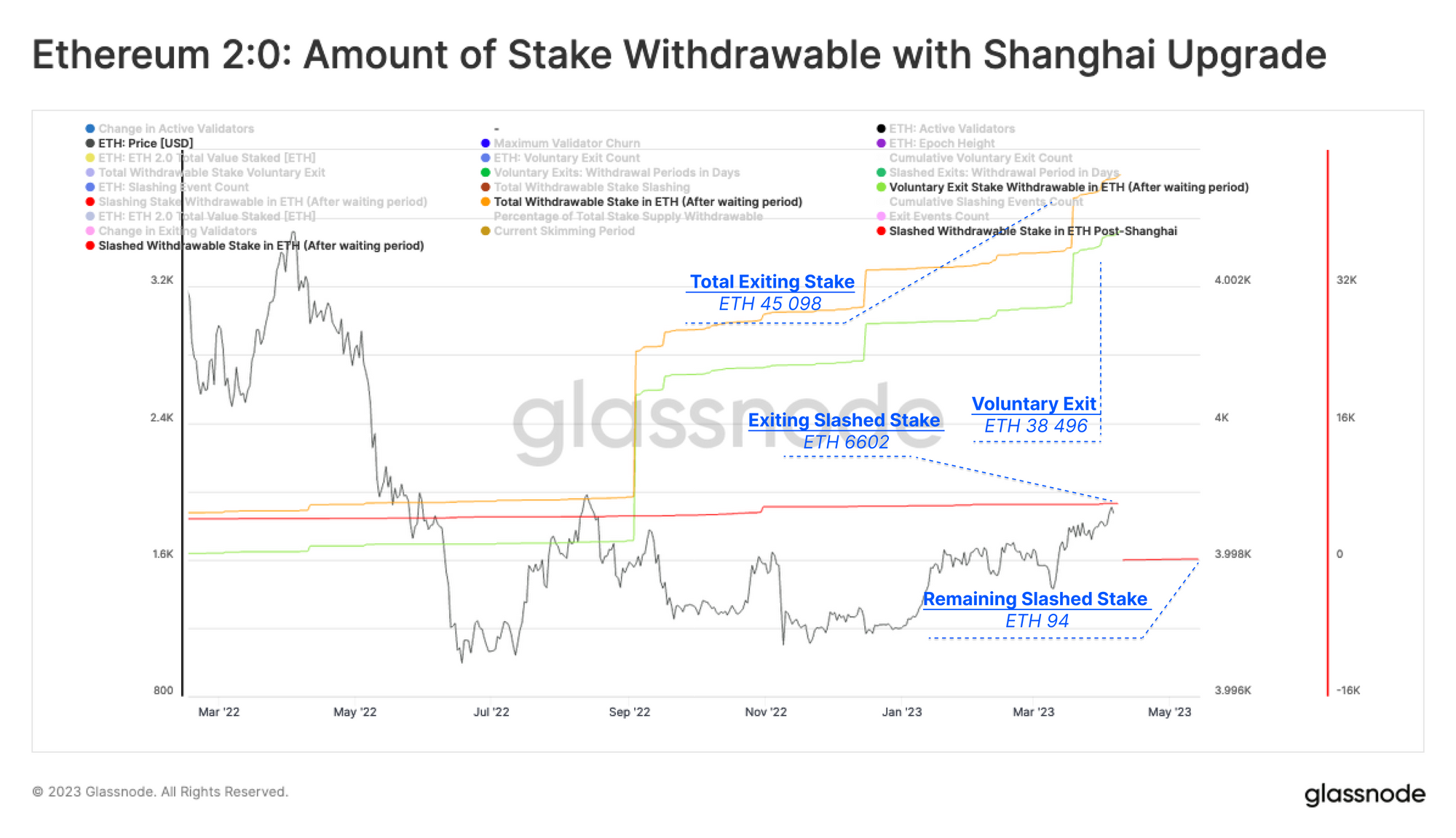

While depositors cannot withdraw their staking funds, they can still sign a voluntary exit message stating that they wish to withdraw from the staking pool. There are currently 1,229 validators waiting to exit, and 214 "killed" validators who will be forced to withdraw once withdrawals are enabled (a total of 46,176 ETH, $85.7 million).

The Shanghai upgrade allows two withdrawal methods: partial withdrawal and full withdrawal. Partial withdrawals (commonly known as skimming) automatically withdraw each validator's accumulated staking rewards, reducing their validator balance to 32 ETH. A full withdrawal involves quitting the validator completely and getting back the entire staked balance.

The validator performs the same automatic withdrawal process for partial withdrawals and full withdrawals. Automatically scan the entire validator set, starting at index 0 and scanning linearly. If a validator does not sign the exit message or is axed, the excess ETH balance will be withdrawn and automatically sent to the enforcement layer. A successful exit if the validator has signed the voluntary exit and passed the waiting period. 12 seconds per slot for a total of 16 validators scanned and processed. With the current number of validators, this process can take up to 4.5 days.Up to 2 days depending on the actual number of validators who are eligible for partial withdrawals after the Shanghai upgrade.

secondary title

Predictions for Partial Withdrawals

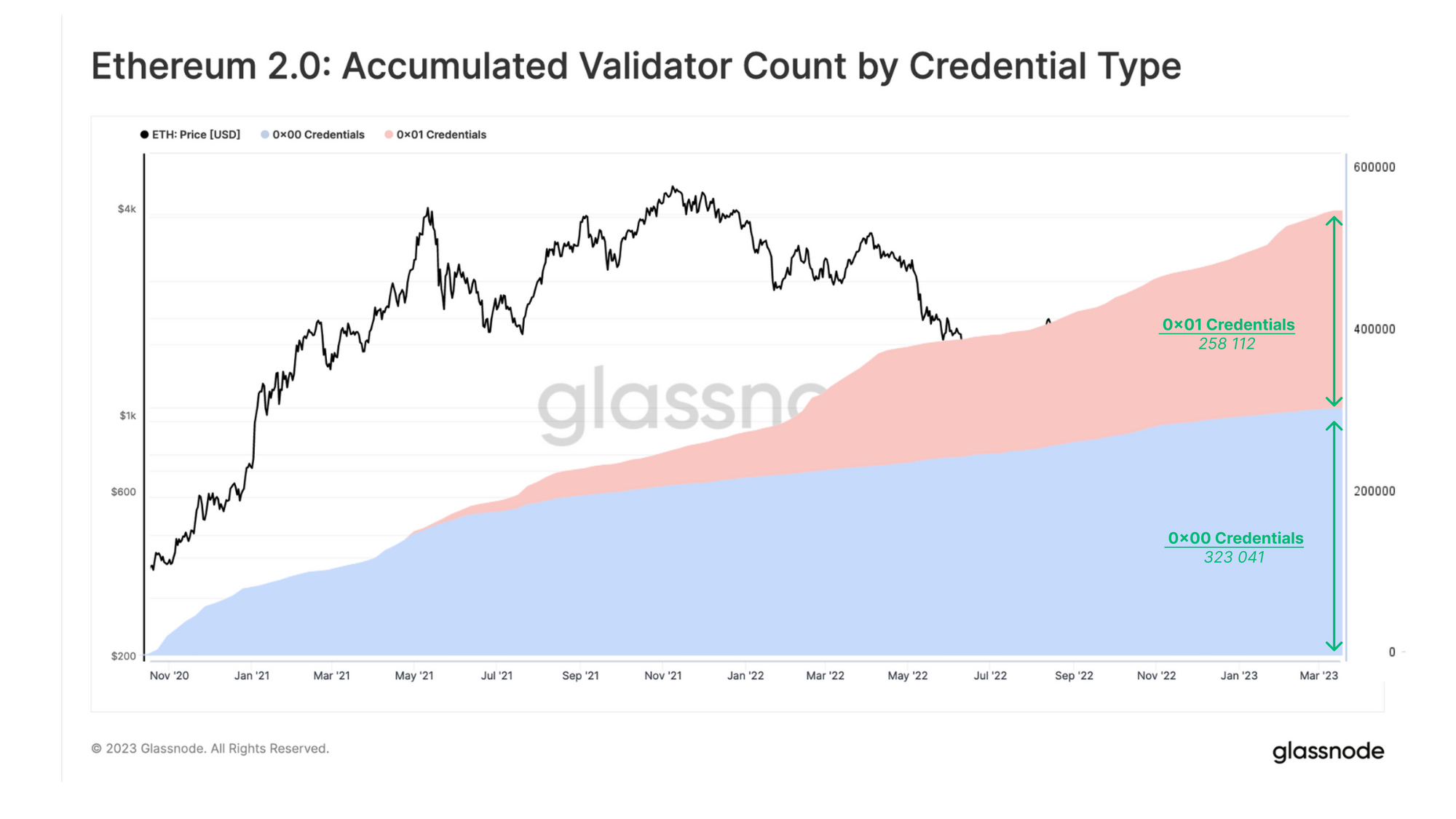

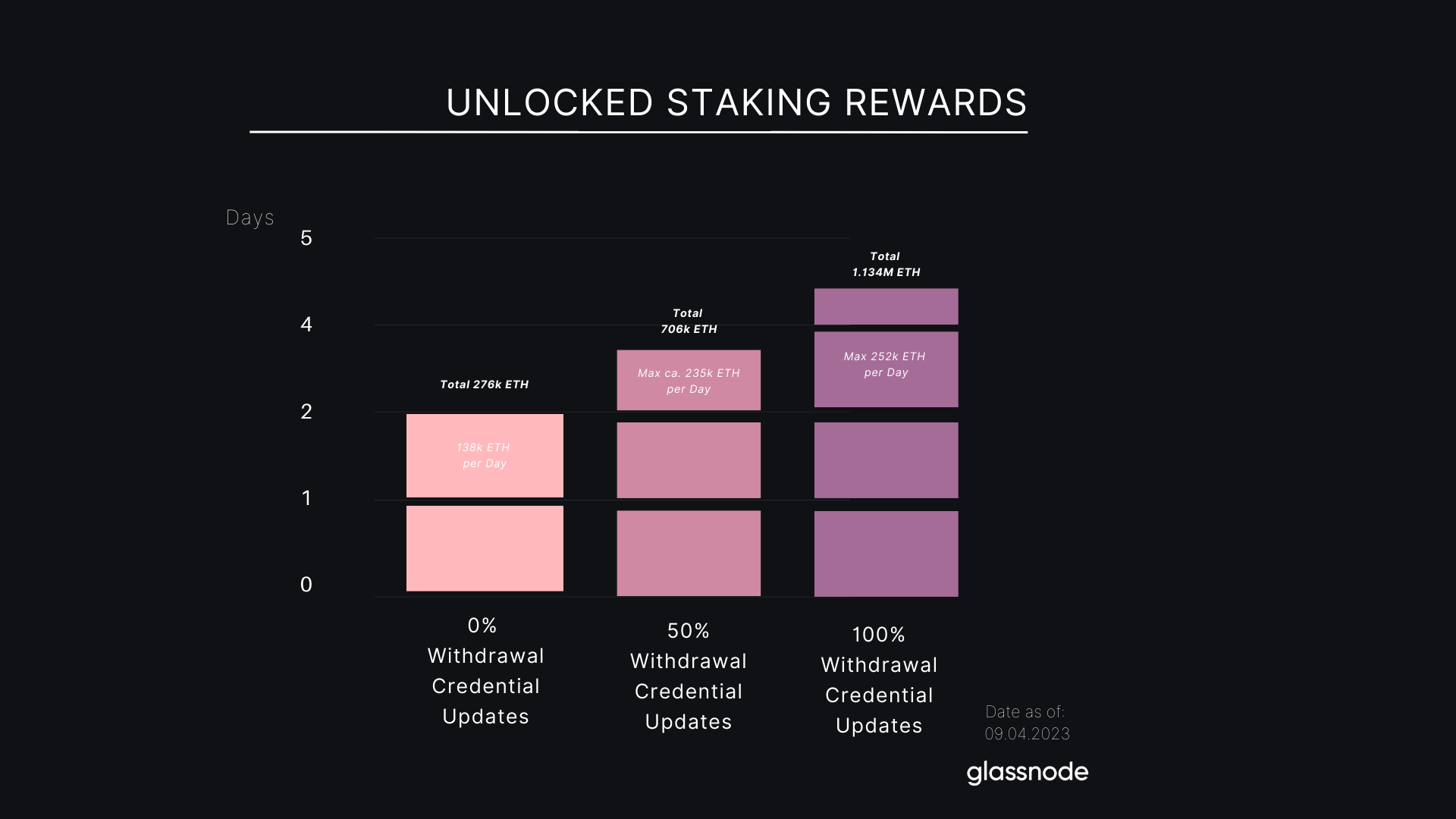

As mentioned above, only validators with 0x01 withdrawal tokens will participate in the automatic withdrawal process. Currently, about 44% of validators have the correct withdrawal credentials. However, there are still many validators who need to update their withdrawal credentials, many of which were deployed in the early days of Beacon Chain and thus accumulated a large amount of staking rewards. Data Always analyzed this in detail, and we reproduced the graph below to show how the number of validators for these two sets of credentials has evolved.

image description

Data source: Data Always

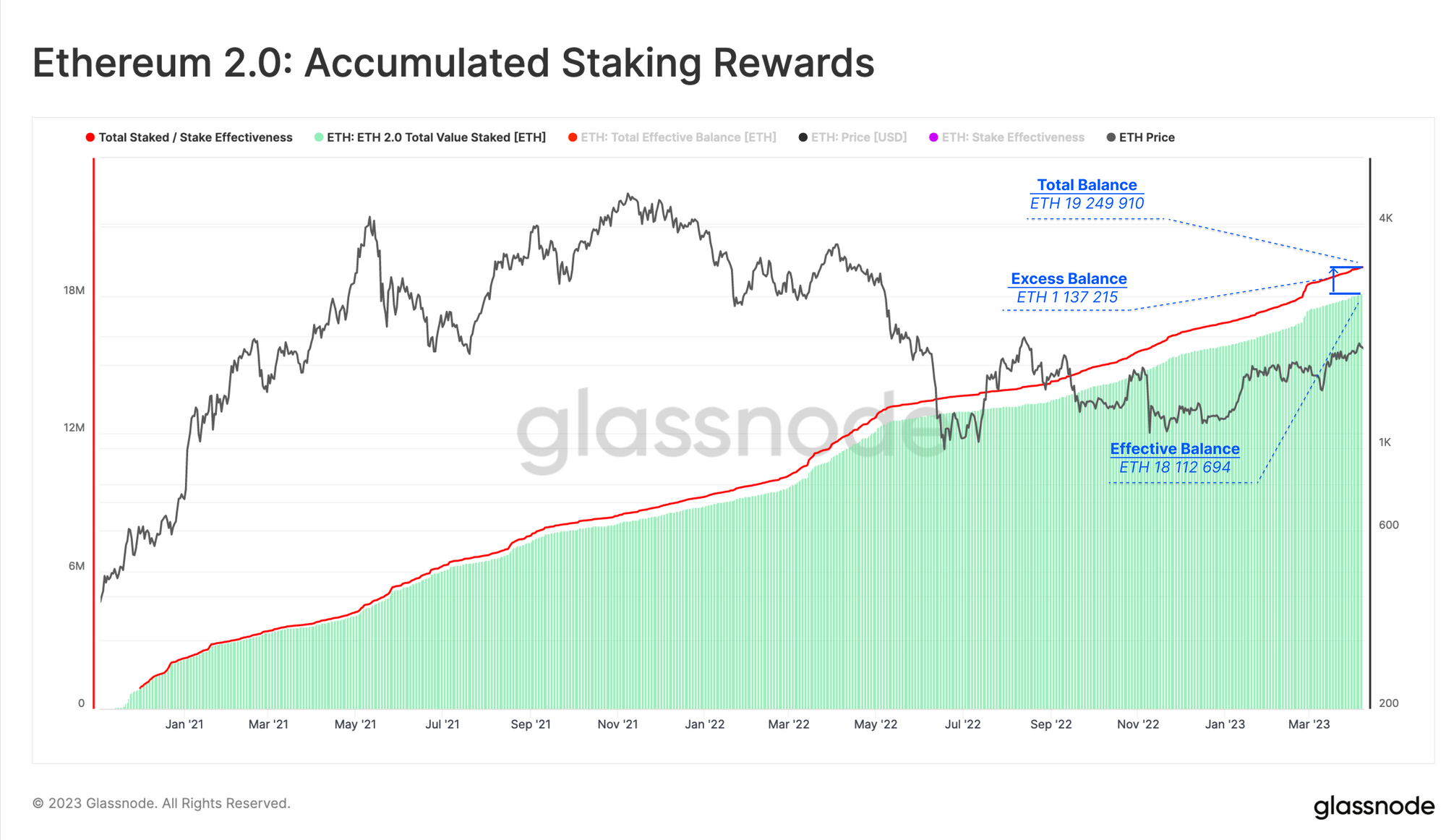

According to the ratio determined in the analysis, validators with 0x00 credentials own nearly 75% of the total accumulated rewards. Therefore, validators with 0x01 credentials will get the remaining 25%, which is equivalent to withdrawing 276 k ETH in two days.In an extreme case, all remaining validators updated their withdrawal credentials after the Shanghai upgrade, which would happen at a rate of 16 validators per block,

We will finally see the entire 1.137 million ETH withdraw from the Beacon Chain within 4.5 days.

The graph below shows the minimum and maximum amounts for reward payouts, including the maximum daily ETH amount unlocked in each case. Actual figures may vary between these extremes. We believe that many depositors may wait until the successful implementation of Shanghai to unlock their accumulated rewards and then upgrade their withdrawal credentials, so we use a 50% withdrawal as a benchmark. We expect the actual number of accumulated rewards unlocked to be closer to the bottom line of 706 k ETH ($1.31 billion).To estimate how much of the accumulated rewards will be sold, we break down the depositor segment above. Since Lido holds a sizable share of the jackpot and has committed to restaking the main prize,

We believe other staking providers will follow suit, which will result in a significant portion of staking rewards being re-locked.We can also rule out high levels of sell-side pressure from the rest of the group.

This leaves us with a likely range of 76k ETH ($141m), possibly up to 162k ETH ($300m), a measure of potential seller pressure for partial withdrawals after the Shanghai upgrade.

secondary title

Forecast of full withdrawal

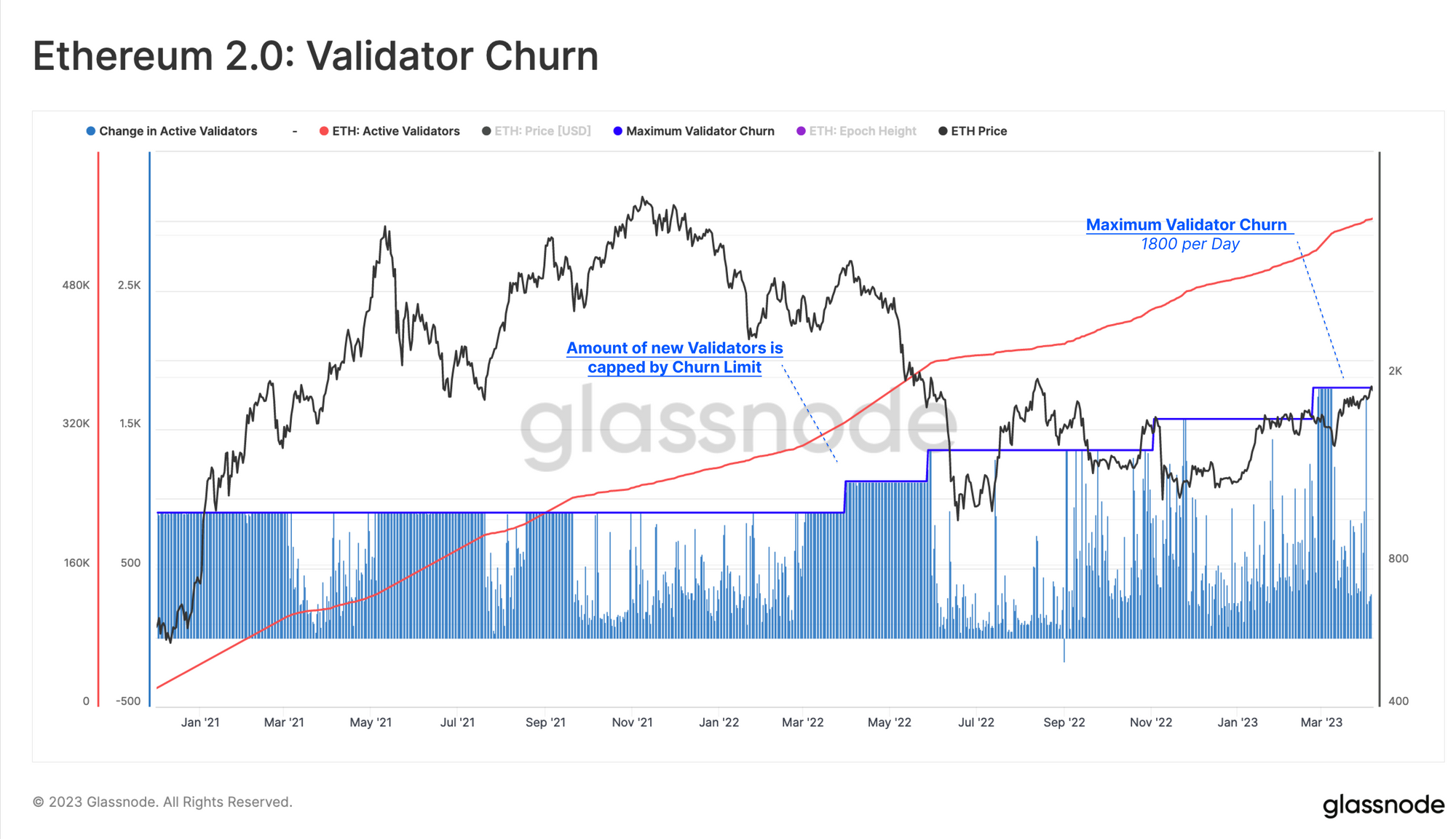

Looking at full withdrawals, it's important to note that only a limited number of validators can withdraw each day. Since the security of the Ethereum network depends on a stable set of validators, there are various mechanisms to prevent large fluctuations in validators and rapid depletion of stake. This daily amount is defined by volatility, which determines the number of validators allowed in and validators out. The volatility limit itself is tied to the number of active validators in the staking pool.

With the current fluctuation limit of 8 verifiers per epoch and 225 epochs per day, a maximum of 800 verifiers will withdraw every day, which is equivalent to 57.6 k ETH. From our historical data, we can see how the volatility limit works with new incoming validators.

In addition to the exit period determined by the volatility limit, validators must also pass an exit capacity delay. For validators who quit voluntarily, this waiting period is 256 epochs, or about 27 hours. For axed validators, that's 8192 epochs, or about 36 days. Then, we add the time for the automatic withdrawal process again, as described above.

Taking into account our data on exited and axed validators, and varying waiting periods, we simulated the cumulative amount of ETH accessible after the Shanghai upgrade. After three major spikes in the number of validators signing voluntary exit agreements (one after the merger in September 2022 and another this year), we now see a cumulative total of 45,098 ETH (equivalent to 83.3 million USD) will be available to stakers.

As mentioned above, the staking exit process will take two days for the total amount to exit the Beacon Chain, meaning we will see at least 45,098 ETH ($83.3 million) between April 12th and April 14th Exit the Beacon Chain.Reviewing our depositor breakdown table, we can now identify the composition of depositors who are likely to initiate full withdrawals. We see that the validators who have exited belong to a total of 253 depositors.

Notably, very few staking providers have withdrawn their validators. Of the largest staking providers so far, only Coinbase has announced that it will allow withdrawals immediately following the Shanghai upgrade. It is said that Lido will not enable withdrawals until May, and Kraken and Binance have not yet announced a date.

Additionally, we saw exiting depositors primarily those with only one validator and those deploying their stake during the pre-launch phase or the first quarter of the Beacon chain cycle. This time frame coincides with the start of a bull market, which is why we see large numbers of exited savers holding unrealized losses.

We generally expect little price pressure from these saver groups. The staking environment has changed dramatically since staking, and these early solo stakers may be inclined to exit and then redeploy with new staking provider setups to reduce the risk and overhead of maintaining staking setups. They may also want to benefit from new or Liquid Staking Derivatives (LSDs), allowing them to keep their ETH liquid and use it as collateral in DeFi while still earning Ethereum staking rewards.

Kraken is expected to shut down a large number of validators after the U.S. Securities and Exchange Commission (SEC) questioned Kraken’s U.S. staking service. Another potential mass exit could come from Celsius Network, as it will reportedly sell its staked ETH as part of bankruptcy proceedings, although the two institutions are unlikely to exit immediately after the escalation.

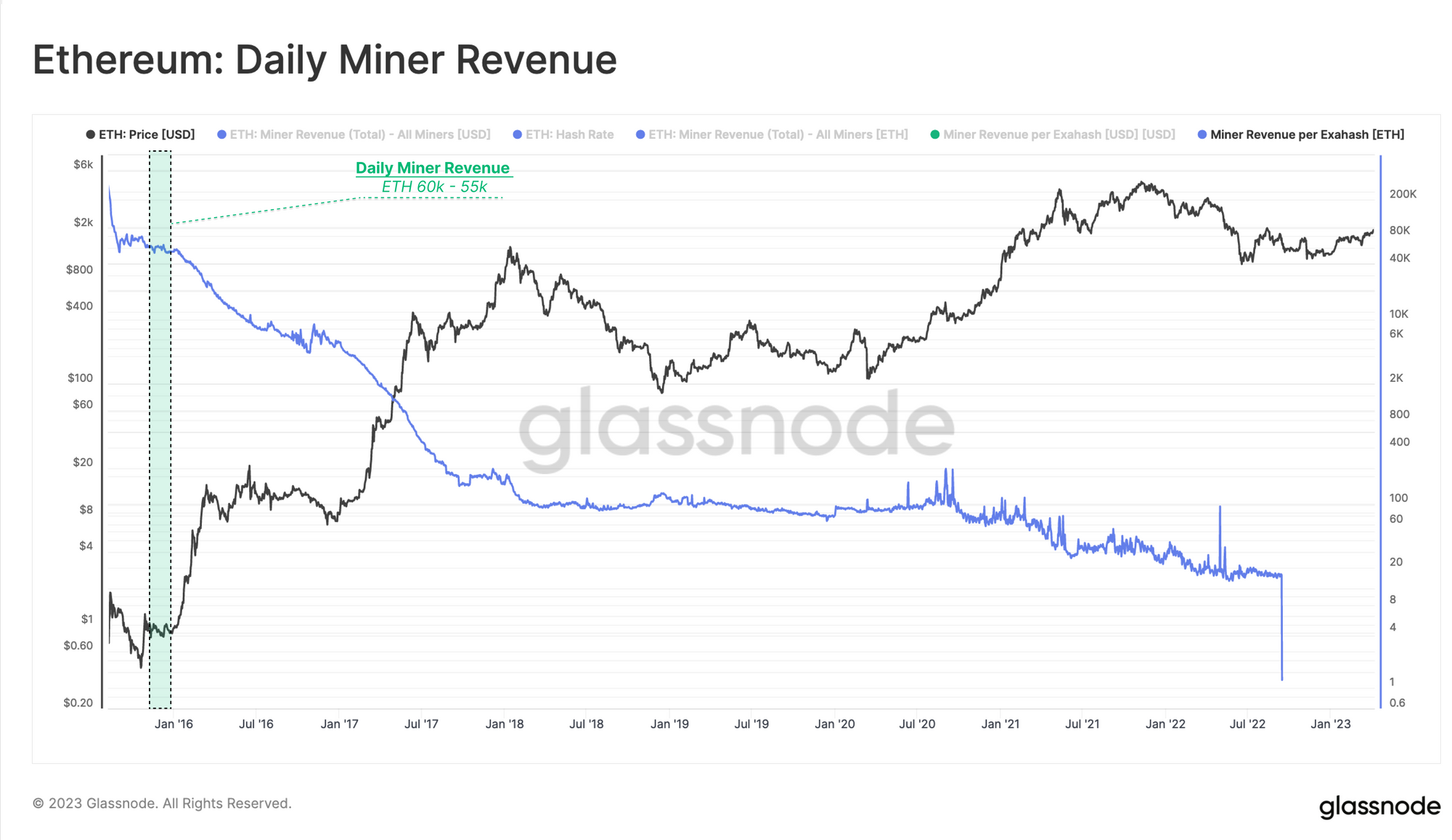

In this context, a withdrawal of this amount would result in a dynamic similar to the early days of PoW, when miner revenues oscillated in this range (albeit with ETH price below $1).

secondary title

Forecasting the impact on total supply

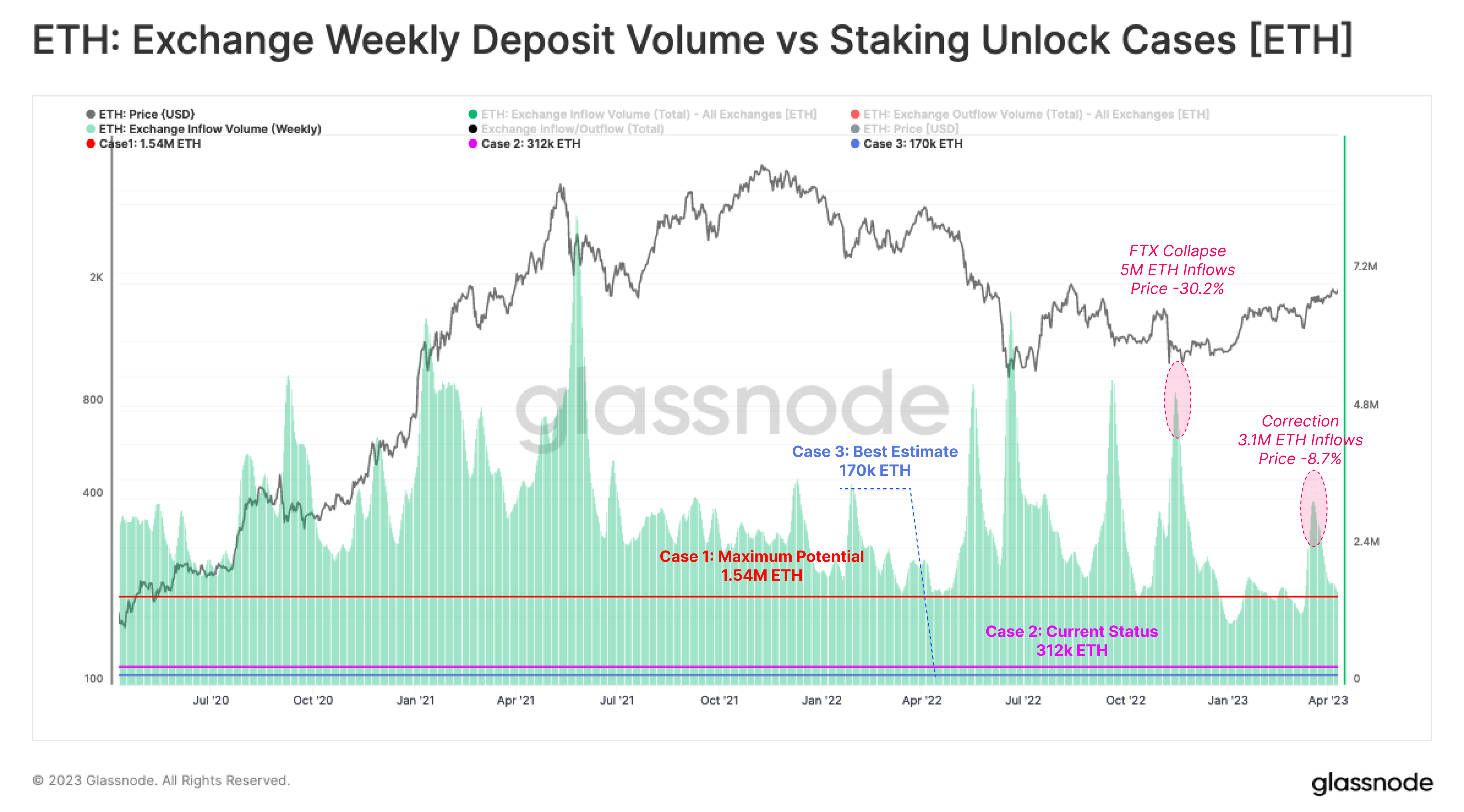

Considering partial withdrawals and full withdrawals, we can simulate the potential supply pressure in the first week after the Shanghai upgrade. We have three scenarios where stakes are unlocked and dumped:

Case 1: In the most extreme case where the total accumulated rewards and the maximum amount of stake allowed per week are withdrawn and sold, we can see a total of 1.54 million ETH ($2.93 billion) becoming liquid assets.

Case 2: In the current status quo, only 00x0 tokens are staking rewards, 45 k ETH will be withdrawn and sold, and the first week will see ~312 k ETH ($592 million) become liquid assets.

Case 3: Our best estimate based on the 50% withdrawal voucher update, our segment of depositors, and assumptions about investor confidence and profitability. Also assuming that the current number of validators exiting will double before and after the Shanghai upgrade, we estimate a total of 170,000 ETH ($323 million) was sold.

secondary title

Summarize

Summarize

While it is impossible to fully predict the outcome of the Shanghai upgrade, the analysis in this article attempts to ease market anxiety about the economic impact of the supply unlocking event.

Even in extreme cases where the largest amount of rewards and stakes are withdrawn and sold, sell-side volumes are within the range of average weekly FX inflows. Therefore, we conclude that even in the most extreme case, the impact of the upgrade on the price of ETH is acceptable to users.