After 10 months, BTC has returned to $30,000. Is the bull market about to start?

After falling below the $30,000 mark on June 10 last year, Bitcoin regained its lost ground for the first time in 10 months. OKX Ouyi market shows that this morning, Bitcoin rose to a maximum of 30,500 US dollars, temporarily reported at 30,200 US dollars, an increase of 6.3% in 24 hours, and an increase of 82% within the year.

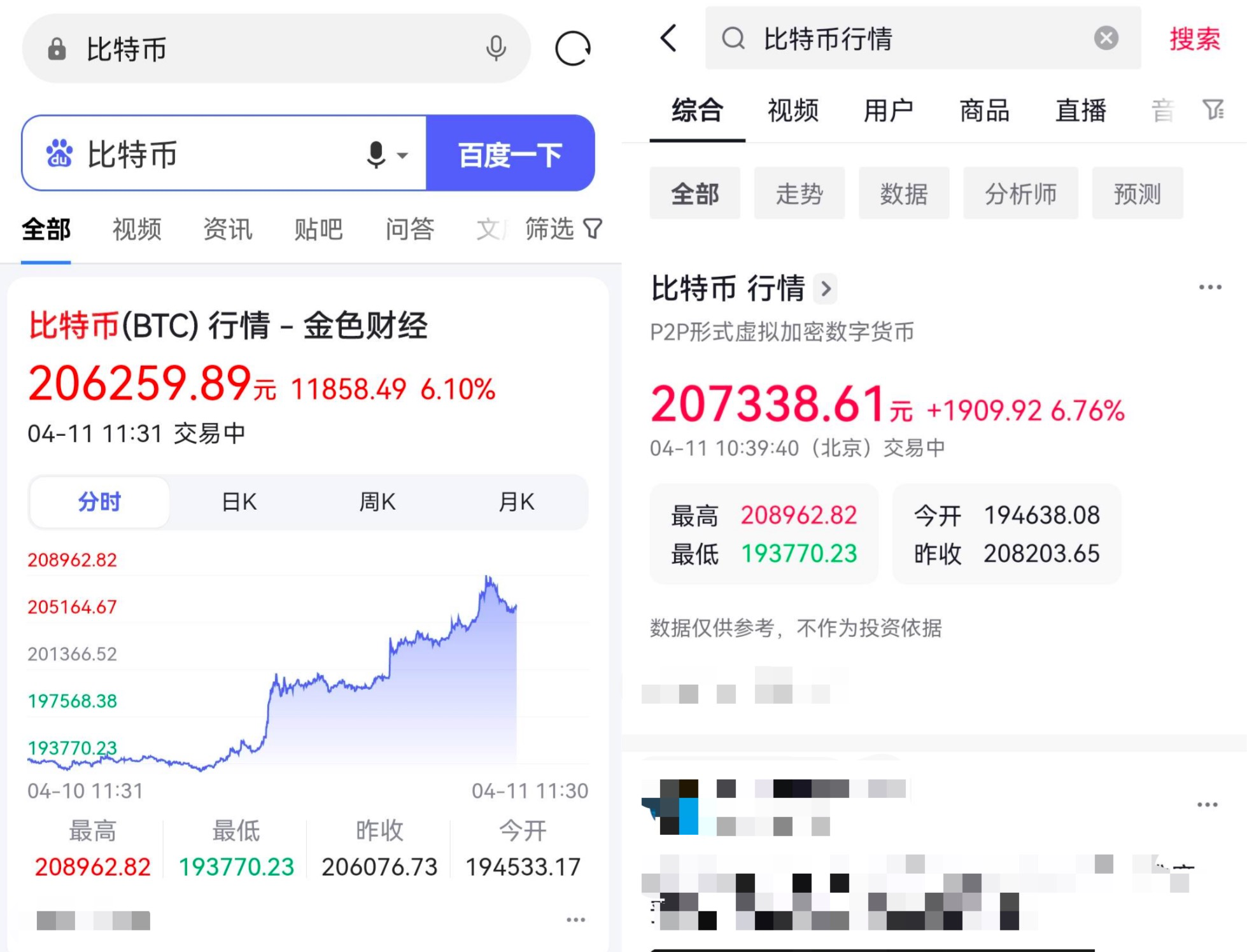

On the news side, Baidu and Douyin App launched bitcoin market data queries last night, which was also interpreted as a major driver of this rise, and the market called it "CN Power" (China Power). Interestingly, this week coincides with the Web3 Hong Kong Blockchain Week, and the curse of "every meeting must fall" seems to be broken.

secondary title

1. The blood-sucking market, Bitcoin is thriving

After breaking through to $28,000 in mid-March, Bitcoin has been consolidating around that point for three weeks.

Last night, Bitcoin broke through $29,000 in one go, and this morning it successfully broke through and stood firm at $30,000, setting a new high since June 10 last year. At present, Bitcoin is temporarily reported at $30,200, a 24-hour increase of 6.3%. Since the beginning of the year, Bitcoin has recorded a cumulative increase of 80%.

However, in this round of market last night, other mainstream currencies did not follow the pace of Bitcoin, and the increase was far less than that of BTC, and there was a blood-sucking market. The top 20 currencies by market capitalization have basically increased between 2% and 4%. Among the top 50 currencies by market capitalization, only STX (10.5%), FIL (6.7%), LDO (6.5%) and RPL (6.3%) % ) comparable to the rise of BTC; ETH, in particular, failed to break through the resistance of $2,000 for many times.

In fact, since the thunder of traditional banks such as SVB in March, the ALT/BTC exchange rate has continued to fall, and the trend of Bitcoin has been stronger than other mainstream currencies. From the perspective of market share, the current proportion of BTC has risen from 41% in March to 48%, while ETH has been hovering around 18%. One possible explanation is that Bitcoin has become a safe-haven channel for funds.

Affected by the upward trend of the overall market, the current total market value of encryption has risen to US$1,235.4 billion, an increase of 4.5% in 24 hours; since the beginning of the year, the total market value of encryption has increased by US$406.9 billion, a cumulative increase of 49.1%. Encryption users' enthusiasm for trading has increased significantly. Today's panic and greed index is 68 (62 yesterday), and the level of greed is higher than yesterday, and the level is still greedy.

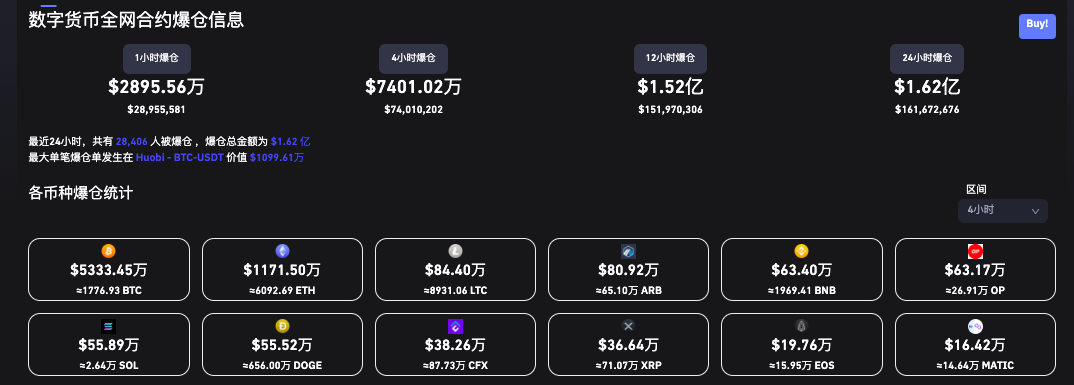

In derivatives trading,Coinglass dataIt shows that in the past 24 hours, the entire network has lost 162 million US dollars, of which ETH has lost 11.17 million US dollars and BTC has lost 53.33 million US dollars. A total of 28,404 people have become victims of liquidation. According to Glassnode data, Bitcoin options open interest ($10.3 billion) exceeded futures open interest ($10 billion) for the first time on April 9, mainly due to a large number of call option buying, which also means that traders Betting that the price of BTC will be higher.

In addition, the interest of mainstream institutions in Grayscale products has begun to decrease. ARK Fund has reduced its holdings of more than 100,000 GBTC shares in March; according to The Block Pro data, the average daily trading volume of GBTC increased by 67.6% in March to US$55 million, a record high A new high since December 2022. At present, the discount rate of GBTC's net asset value has dropped from 49% at the beginning of the year to 36.83%; the net value discount rate of the Grayscale Ethereum Trust Fund (ETHE) has dropped from 59.3% at the beginning of the year to 52.63% . currentGrayscale FundThe total holdings are 25.219 billion US dollars, and the trust discount rates of other mainstream currencies are as follows: ETC (-62%), LTC (-43.55%), BCH (-25.86%), ZEC (-27.15%), MANA (-7.25%), ZEN (-25.26%), LPT (-27.27%), BAT (-40.93%), the three products with positive premiums are XLM (10.73%), LINK (22.78%) and FIL (103.79%).

secondary title

2. The reason: China's power to drive the market up?

Regarding the current round of rising market prices, market analysis believes that there are two main direct drivers: one is the Hong Kong conference, and the other is the launch of the three major domestic application companies in the Bitcoin market.

Last night, TikTok and Baidu APP launched Bitcoin market search one after another. Users directly input "Bitcoin" in the search box, and the first result directly displays the latest current market price, and uses RMB "Yuan" as the pricing unit (Note: TikTok currently A-share market query is not open). This morning, Weibo also joined the ranks, supporting Bitcoin market data.

This news was interpreted by foreign media and Western encryption community KOL as a favorable market for policy opening. In addition, this week coincides with the 2023 Web3 Hong Kong Blockchain Week, and many Chinese gathered in Hong Kong, breaking the curse of "every meeting must fall". The encryption community dubbed it the title of "China Power" to highlight the important position of the East in the encryption market.

From the perspective of macroeconomic conditions, the Fed’s interest rate hike may slow down in the second half of the year, and the market is more optimistic about the market outlook.

After raising interest rates by 25 basis points in March this year, the US federal funds rate has reached the highest level since October 2007. Asked in a private meeting with U.S. lawmakers in a private meeting with U.S. lawmakers, Fed Chairman Jerome Powell said he expected one more rate hike this year, according to an interview with U.S. Republican Rep. Kevin Hearn.

secondary title

3. Future: The market bottomed out and the halving market started

Bitcoin stands at the $30,000 mark, does it open the door to a new round of bull market? Regarding the future trend of Bitcoin, there are several favorable factors as follows.

One is the halving market. Every time the Bitcoin blockchain produces 210,000 blocks, the block reward for miners is halved; this halving occurs approximately every four years and slows down the rate at which Bitcoins are issued. The next Bitcoin halving will take place on May 9, 2024.

The multiple halvings in history are closely related to the bull market cycle of the entire encryption market. According to past data statistics, Bitcoin will peak around 368-550 days after halving, and then bottom out 779-914 days after halving; in other words, since the halving in May 2020, the lowest Bitcoin price Points should appear in the period June-December 2022 - the location of the previous cycle occurred in November 2022 ($15476). The crypto market has passed its darkest hour, and the probability of returning to this price again is very low.

Philip Swift, co-founder of the trading suite Decentrader, said that according to calculations, Bitcoin will experience a "double top" in 2025, reaching peaks above $200,000 twice in 2025; the specific point It may be slightly lower than the data calculation expectation, which is about 180,000 US dollars; in the following year, the bear market low will be around 50,000 US dollars.

Second, judging from the data on the chain, the vast majority of bitcoins are in a dormant state, and the selling pressure is relatively small. According to Glassnode data, in the past two years, 53% of the bitcoin circulation supply has been inactive; nearly 29% of the bitcoin circulation supply has not been transferred in the past five years, about 5.6 million (worth about 158 billion U.S. dollars); 15% of bitcoins have not been moved in ten years, about 2.7 million (worth $76 billion).

In addition, from the perspective of technical indicators, a number of data show long-term bullishness. In early March this year, the 100-day moving average and the 200-day moving average formed a bullish "golden cross"; last week, the 60-week and 200-week moving average formed a bullish "golden cross".

It should be noted that while Bitcoin is bullish in the long term, another pressure it may face in the short term is the sell-off of the US government. according tocourt documentsIt shows that the U.S. government confiscated 50,000 BTCs related to the dark web Silk Road, and sold 9,800 BTCs on March 14 this year. It plans to sell the remaining 41,500 BTCs (worth about $1.25 billion) in four batches this year. For the market, this will be no small selling pressure.