Is CZ funded next week? Interpretation of the CFTC Binance Indictment

This article comes fromTwitter, Original Author: Adam Cochran, Partner, Cinneamhain Ventures

Odaily Translator |

Odaily Translator |

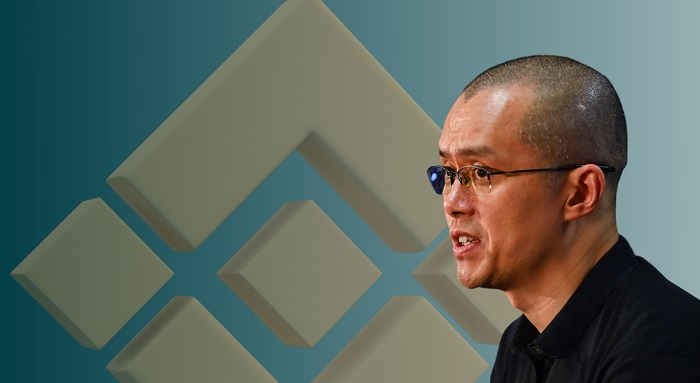

Just after TikTok CEO Zhou was funded to end the "soul torture" of the US Congress, on the evening of March 27, Bloomberg disclosed that the US Commodity Futures Trading Commission (CFTC) charged the cryptocurrency trading platform Binance and its CEO in Chicago federal court. CZ, the first chief operating officer, Samuel Lim filed the lawsuit.

Cinneamhain Ventures partner Adam Cochran analyzed and interpreted the US Commodity Futures Trading Commission’s 74-page indictment on social media, and Odaily compiled it as follows:

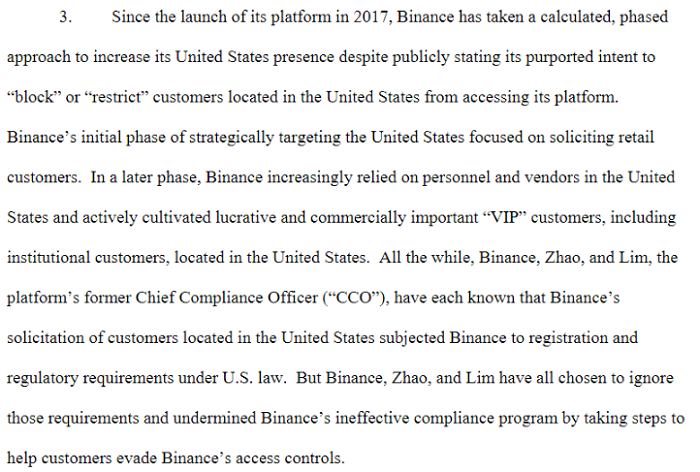

1. The U.S. Commodity Futures Trading Commission is trying to deal a "fatal" blow to Binance, and may even overthrow the Binance Empire. First, and most critically, the CFTC believes that since the launch of the platform in 2017, Binance has taken a deliberate, A phased approach to increasing its presence in the US. Initially, Binance strategically targeted retail customers in the United States. In the later period, Binance increasingly relied on personnel and suppliers in the United States, and actively cultivated lucrative and commercially important "VIP" customers, including institutional customers located in the United States.

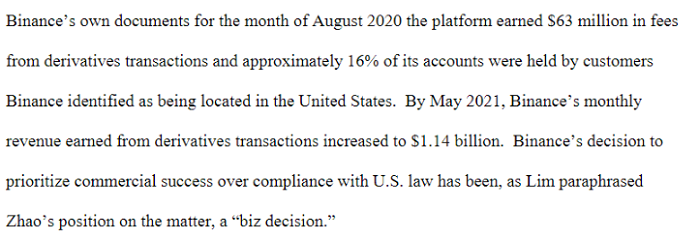

2. The CFTC pointed out that Binance cultivates the US customer base because it is profitable for them to do so, and Binance's internal report also revealed that its product revenue comes from "they know" US customers.

2. The CFTC pointed out that Binance cultivates the US customer base because it is profitable for them to do so, and Binance's internal report also revealed that its product revenue comes from "they know" US customers.

3. Binance, CZ and Samuel Lim are all listed in 7 violations of CEA/CFC/USC. CFTC also implies that all Binance entities are under the control of "CZ". Architectural mystery, especially with Binance-specific U.S. exchanges Merit Peak and BAM (Binance.US).

4. The CFTC even obtained CZ chat logs and other documents on these issues.

5. The CFTC also tracked Binance’s suspected manipulation and self-trading, claiming that more than 300 “internal accounts” owned by CZ, Merit Peak, and Sigma were used for self-trading, and pointed out that Binance did not take reasonable anti-fraud or anti-manipulation measure.

5. The CFTC also tracked Binance’s suspected manipulation and self-trading, claiming that more than 300 “internal accounts” owned by CZ, Merit Peak, and Sigma were used for self-trading, and pointed out that Binance did not take reasonable anti-fraud or anti-manipulation measure.

6. The CFTC is also specifically associated with Trust-Wallet, Binance Labs (due to its presence in the United States), and many Binance employees with operations in the United States, including volunteers "Binance Angels", as a basis for filing in the United States .

7. The CFTC believes that Binance and its affiliated entities will designate the ultimate beneficiary (UBO), and in this way will directly return control to CZ.

8. The CFTC stated that it has obtained a large number of chat records and documents from insiders, indicating that CZ knew about US customers and took steps to hide them in internal documents.

8. The CFTC stated that it has obtained a large number of chat records and documents from insiders, indicating that CZ knew about US customers and took steps to hide them in internal documents.

9. The CFTC will attempt to ban Binance, CZ and Lim and all of their related affiliates from the activities of:

- engage in any of the acts described in this case

- Transactions from registered entities

- holds any commodity interest

- Guide any digital asset transaction

- Accept any funds from anyone for the purpose of buying or selling digital assets

-Registered or exempted from CFTC

- Be a principal, officer or employee of a registered entity

and request Binance

- Hand over (repay in the form of a penalty) trading profits, income, salaries, commissions, loans, or fees from U.S. persons

- Make all customers affected by these violations

- Pay the civil penalty assessed by the court

- a jury trial in this matter

10. This means:

-Binance US will take a huge hit

- The market maker who is the ultimate beneficiary in the US market will leave Binance

- Binance International payment rails in the US or partner countries are "dead forever"

- Technically speaking, the CFTC may consider it illegal for Binance international to provide any trading services outside the United States

- CZ, Lim and Binance employees will not be able to work in regulated businesses

- Binance will not be funded by any bank with ties to the US that trades in USD

-Binance Labs will be liquidated

-Binance could face multi-billion dollar fines

The Binance team will never legally hold US goods or access US securities

11. If CZ, Lim and Binance fail to engage with the US courts and fail to defend themselves at trial, the CFTC will likely win outright and add some contempt/obstruction criminal charges which will push the issue expand to other countries. If CZ, Lim, and Binance get involved, then find out they have to disclose everything to US regulators during the trial, which could lead to more problems.

12. For Binance, a relatively safe solution may be to pay the CFTC a multi-billion dollar fine, which may allow CZ et al. to avoid pleading guilty.