After the USDC crisis, what is the status of the stablecoin market?

Affected by the collapse of cooperative banks, the US dollar stablecoin USDC has recently faced a liquidity crisis. USDC fell as low as $0.8788 on March 11, a daily drop of more than 12%, according to data from CoinGecko. At the same time, USDC’s de-pegging also caused other stablecoins that accepted it as pledged assets, such as DAI and FRAX, to experience varying degrees of de-pegging.

Although the crisis of USDC has been resolved on March 13. However, as the most trusted stablecoin ever, USDC’s unanchoring still brought many changes and thoughts to the stablecoin market. Does the unanchoring of centralized fiat currency stablecoins give other types of stablecoins an "opportunity"? Has the liquidity of stablecoins in the market decreased or increased? Where do stablecoins mainly flow when a crisis occurs? PAData analyzed stablecoin fundamentals and market data (March 11-18) and found:

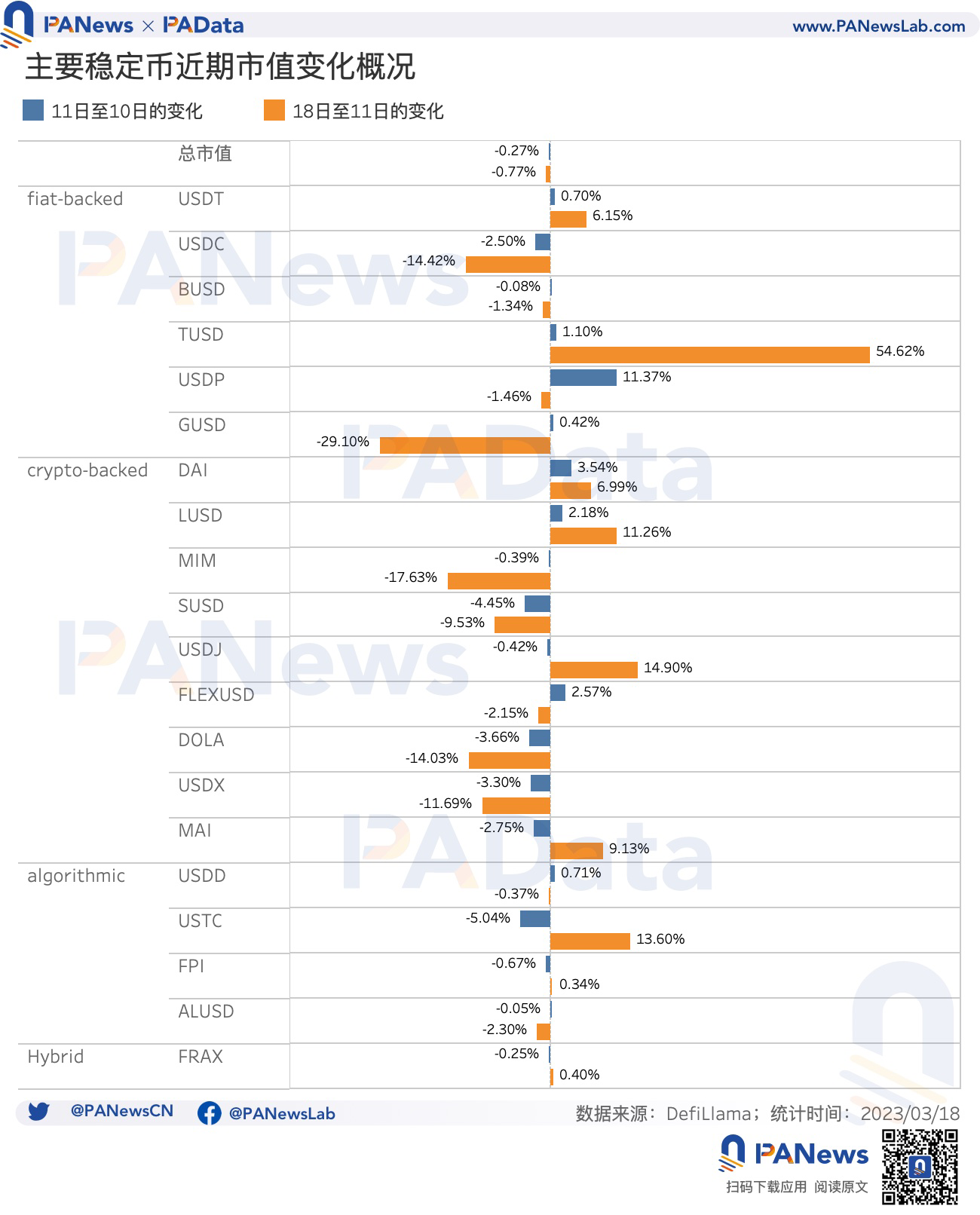

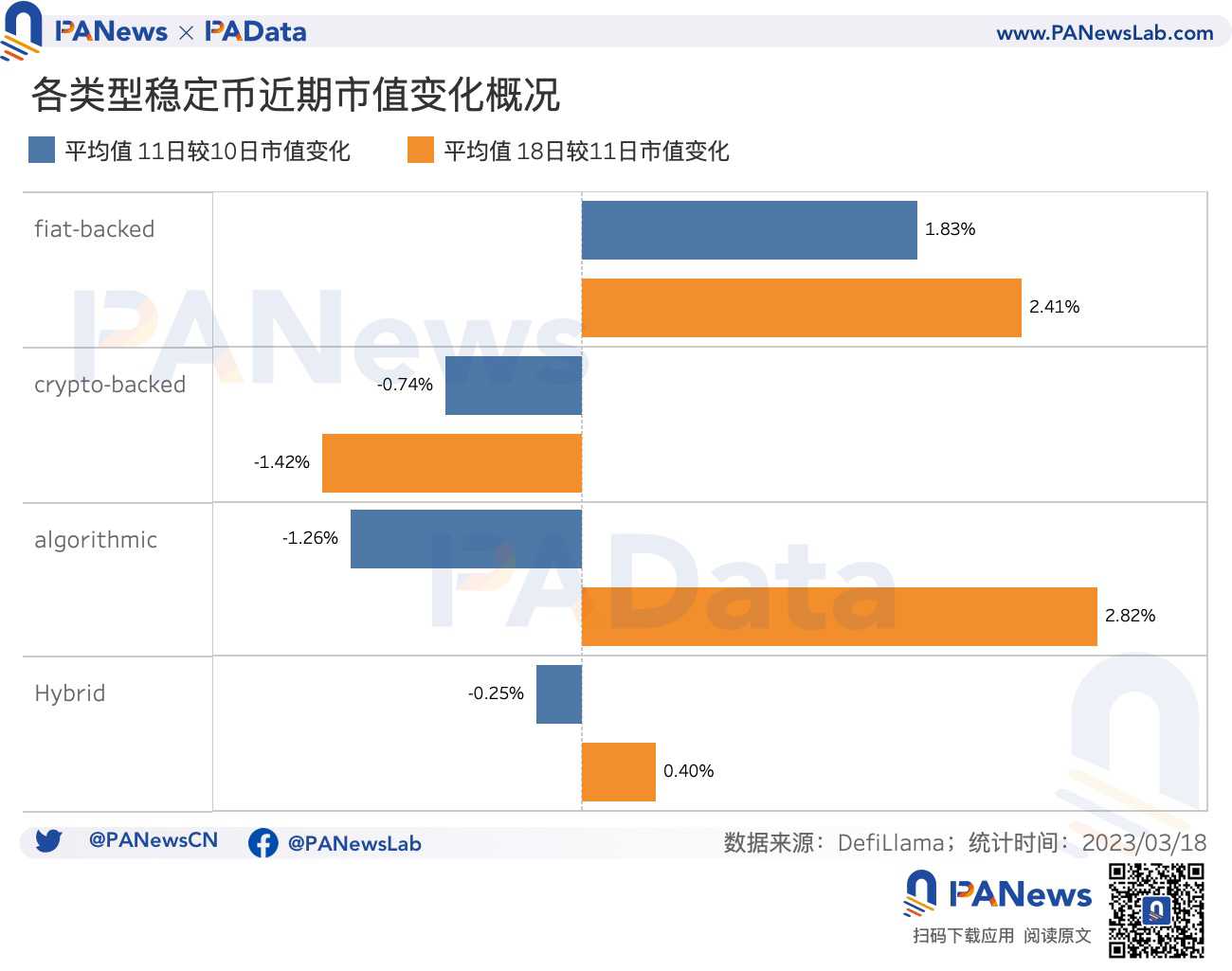

1) The average market value of the 6 fiat currency stablecoins all rose, and the average market capitalization of the 9 encrypted asset-based stablecoins all fell, which shows that the market’s confidence in the fiat currency stablecoins is still relatively strong, and the transmission of stablecoins based on encrypted assets is negative The impact is greater.

2) The current market value of USDC is about 47% of that of USDT, less than half. TUSD's market capitalization increased by more than 54%, the largest increase. The market capitalization of USDT, DAI, LUSD, USDP, GUSD, FLEXUSD, USDD, etc. also increased.

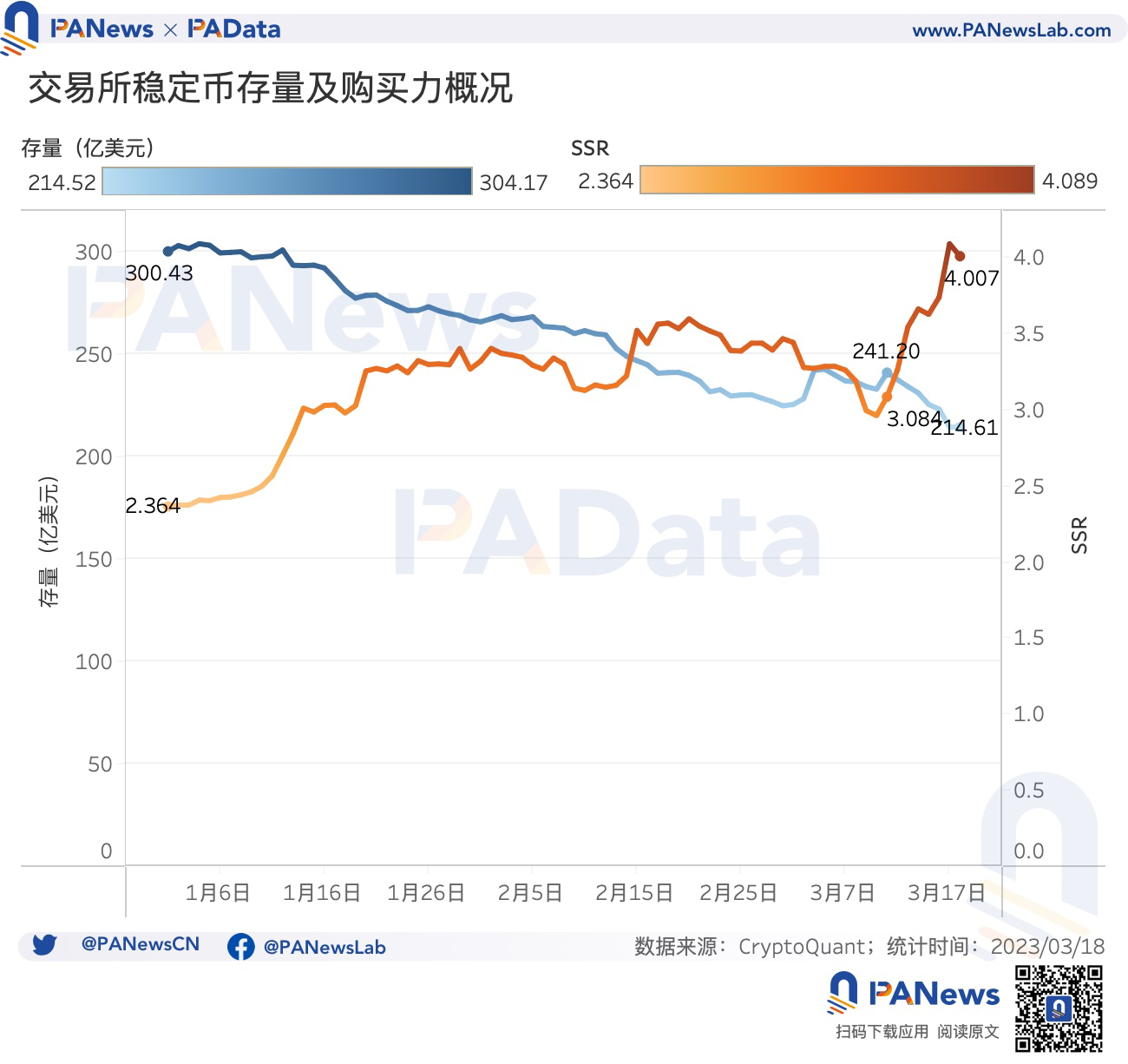

3) On the 18th, the stock of stable coins on the exchange was about 21.461 billion US dollars, down 11.02% from the 11th, and the outflow was faster.

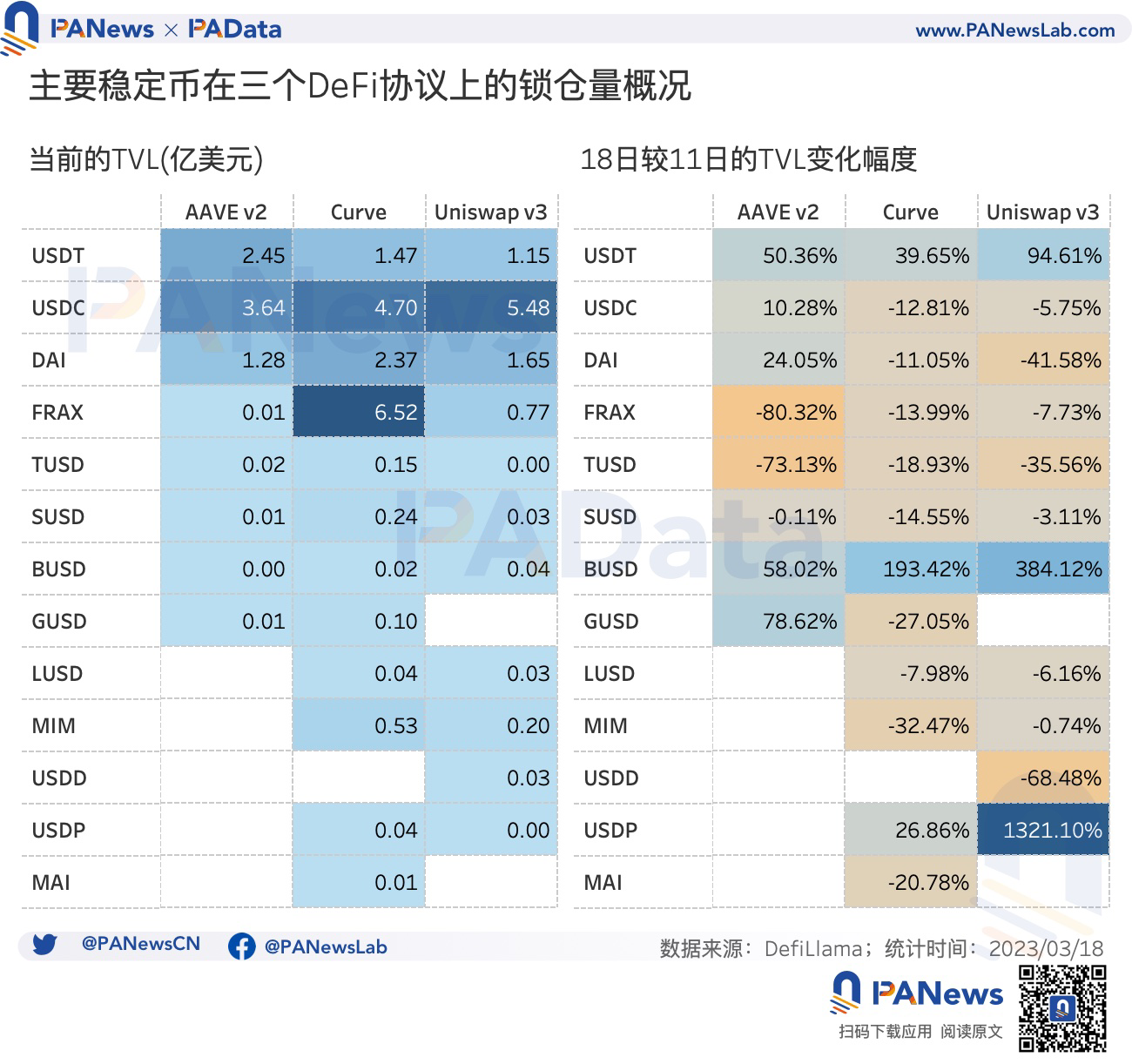

4) The total lock-up volume of 13 major stablecoins in 3 Uniswap v3, Curve and AAVE v2 dropped from $3.464 billion on the 11th to $3.297 billion on the 18th, a drop of about 4.83%.

first level title

01. The recent market value of TUSD has surged by more than 54%, and the USDC crisis is even more negative for stablecoins that use it as collateral

The de-pegging of USDC caused significant fluctuations in the market value of itself and other stablecoins. Just judging from the month-on-month changes in the market capitalization on the 11th compared to the 10th, it can be seen that the major stablecoins fell more than rose. The market value of USDC, the "first card" that fell in the dominoes this time, fell by 2.5%, but it was more affected by SUSD, DOLA, MAI and USTC, whose market value fell between 2.8% and 5.0%. The market capitalization of ALUSD, BUSD, FRAX, MIM, USDJ and FPI also fell, but not by much. The market value of the other 9 stablecoins increased on the day, of which USDP rose the most, with a month-on-month increase of more than 11%. Secondly, the increase of DAI, FLEXUSD, LUSD, and TUSD is between 1.0% and 3.5%.

The market capitalization changes on the 18th compared with the 11th mostly continued the month-on-month changes on the 11th. For example, the market capitalizations of the four stablecoins USDT, TUSD, DAI, and LUSD continued to rise on the 18th compared with the 11th, and the highest increase was TUSD, exceeding 54 %, USDT also rose by more than 6%. The market value of the seven stablecoins USDC, BUSD, MIM, SUSD, DOLA, USDX, and ALUSD continued to decline on the 18th compared with the 11th. Among them, MIM had the highest decline, exceeding 17%, and USDC also fell by more than 14%. In addition, there are some stablecoins whose market value turned from rising to falling after the crisis, such as USDP, GUSD, FLEXUSD, and USDD.

Judging from the average market value changes of various types of stablecoins in these two time periods, the USDC crisis did not cause a collective collapse of fiat currency stablecoins. In the daily market value changes, the average market value of the six fiat currency stablecoins all rose, with an average increase of 1.83% and 2.41% respectively. It can be seen that the market's confidence in the fiat currency stable currency is still relatively strong.

However, the crisis of USDC continues to be negative for stablecoins based on encrypted assets, especially stablecoins that include USDC as collateral, whether in the market value changes from the 11th to the 10th, or in the market value changes from the 18th to the 11th , the average market capitalization of the nine crypto-asset-based stablecoins all fell, with average losses of 0.74% and 1.42%, respectively.

first level title

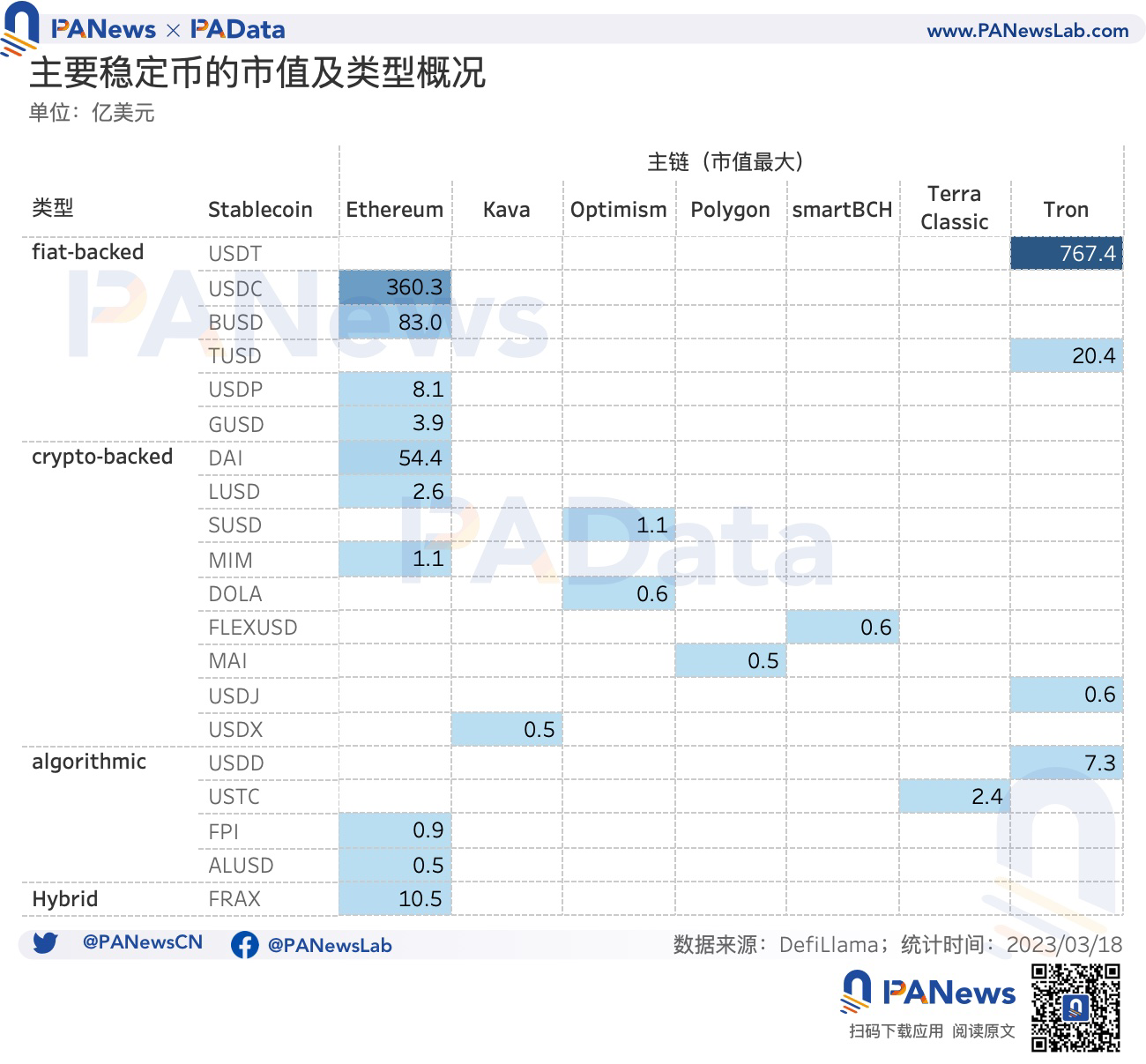

02. After the crisis, the market value of USDC is less than half of that of USDT. Among the over 100 stable currencies, the fiat currency stable currency is the absolute mainstream

According to data from DefiLlama, there are currently more than 100 stablecoins in the market, with a total market value of about 133.388 billion US dollars. As of March 18, USDT is still the "leader" of stablecoins, with a market capitalization of approximately $76.74 billion. This is followed by USDC with a market capitalization of approximately $36.03 billion. The total market value of the two is 112.764 billion US dollars, accounting for about 85% of the total market value of stablecoins. After this crisis, the current market value of USDC is about 47% of that of USDT, which is less than half.

It can be seen that this is still a market with obvious "February 8 effect", so PAData will only focus on the 20 stablecoins with the highest current market capitalization for further analysis.

Among these major stablecoins, in addition to USDT and USDC, stablecoins with a current market capitalization of more than US$1 billion include BUSD, DAI, TUSD, DAI and FRAX, whose market capitalizations account for about 6.22%, 4.08%, and 1.53% and 0.78%. In addition, stablecoins with a market cap of more than $100 million include USDP, USDD, GUSD, LUSD, USTC, MIM, and SUSD, while other stablecoins have a market cap between $48 million and $88 million.

From the perspective of stablecoin types, these major stablecoins fall into four categories: fiat-backed, crypto-backed, algorithmic, and crypto-backed and algorithmic hybrid stablecoin (hybrid).

At present, the fiat currency stablecoins still have the highest market capitalization, but among the stablecoins with high market capitalization, the largest number are stablecoins based on encrypted asset mortgages, with a total of 9 types. However, stablecoins based on encrypted assets usually accept fiat currency stablecoins as collateral assets. In this sense, these two types of stablecoins are homologous.

first level title

03. The exchange stock fell to 21.4 billion US dollars, and the purchasing power of stablecoins fell to a short-term low

Blockchain analysis company Chainalysis published a blog post on the 16th that when the market is turbulent, the outflow of funds from centralized exchanges usually surges, because users may worry about not being able to access their funds in the event of an exchange failure. According to CryptoQuant's monitoring of the exchange's stablecoin stock, this statement is indeed confirmed.

According to statistics, on March 18, the stock of stable coins on the exchange was about 21.461 billion US dollars, which was 11.02% lower than the 24.120 billion US dollars on March 11, the day when USDC was unanchored, and the outflow speed was relatively fast. However, what is interesting is that on the 11th, the stock of stablecoins on the exchange rose by 3.49% compared with the 10th, which is an increase of 814 million US dollars. This may be related to the fact that users performed stable exchange on the exchange in order to avoid risks on the 11th.

In addition, the stablecoin crisis has also affected the purchasing power of stablecoins. Stablecoin Supply Ratio (SSR) is a commonly used indicator to measure the potential purchasing power of the market. It refers to the ratio of the market value of BTC to the total market value of all stablecoins. The lower the SSR, the more sufficient the supply of stablecoins and the greater the potential buying pressure. The stronger the price, the more likely the price will rise.

first level title

04. The transaction volume between stablecoins in DEX surged to 23.1 billion US dollars, and the current deposit and loan interest rates fell to the level at the beginning of the month

Under the crisis, not only a large number of stablecoins outflowed from exchanges, but also the three DeFi protocols closely related to stablecoin transactions, Uniswap v3, Curve and AAVE v2, the stablecoin lock-up volume also decreased, but the magnitude was much smaller. According to statistics, the total lock-up volume of 13 major stablecoins in 3 DeFi fell from $3.464 billion on the 11th to $3.297 billion on the 18th, a drop of about 4.83%.

Among them, the changes in the lock-up volume of some stablecoins on the 18th compared with the 11th are worthy of attention. For example, during this period, the USDT lock-up volume in the three DeFi protocols has increased significantly, with the highest increase of over 94% in Uniswap v3 and the lowest in Uniswap v3. The Curve is also up nearly 40%. On the other hand, the lock-up volume of USDC has decreased in both Uniswap v3 and Curve, and the decline is not small.

In addition, the locked positions of FRAX, TUSD, SUSD, LUSD, MIM, USDD, and MAI all fell in these three protocols, and the locked positions of FRAX and TUSD in AAVE v2 dropped by more than 70%. In contrast, fiat stablecoins BUSD and GUSD lock-ups are on the rise.

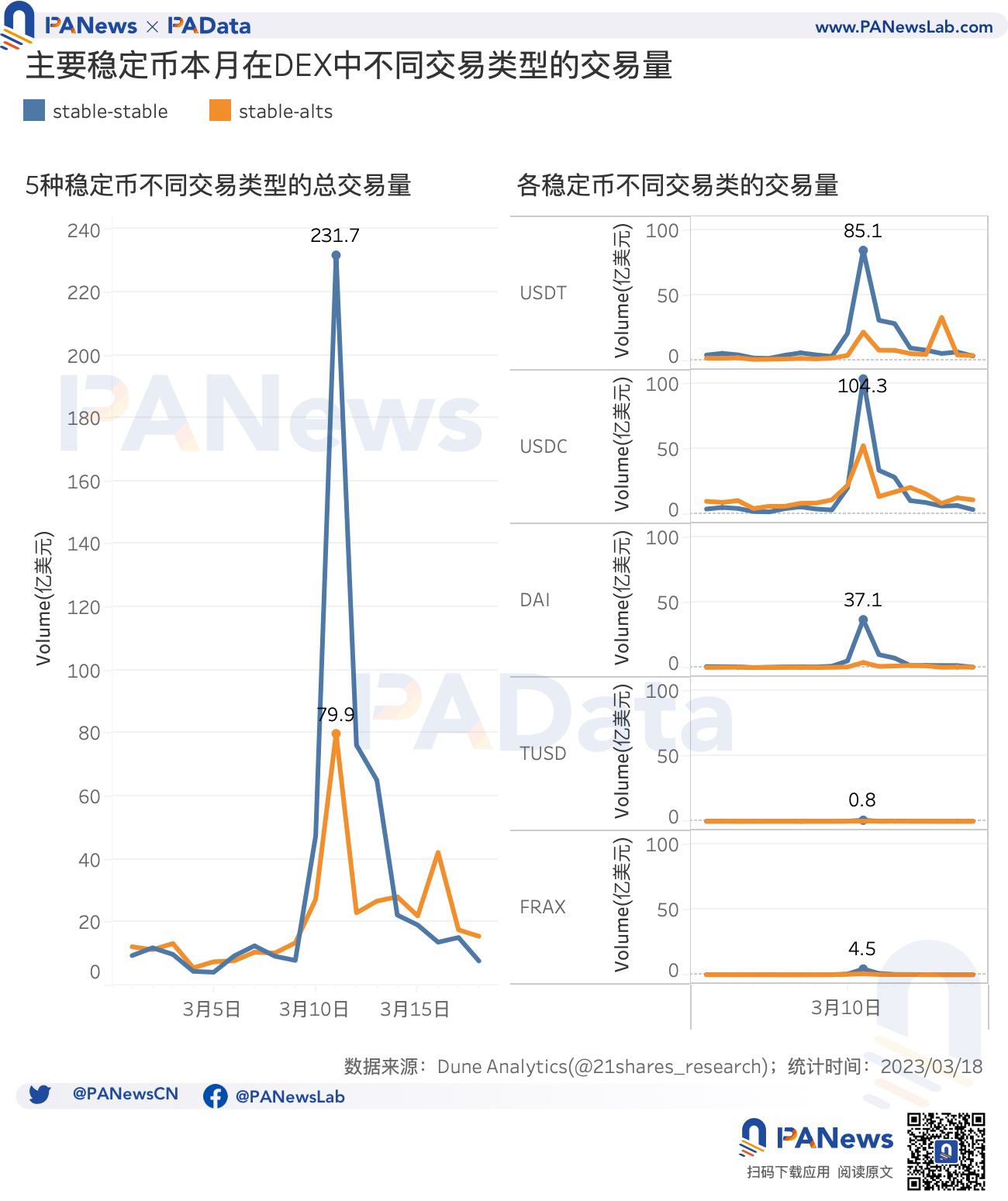

The types of stablecoin trading pairs in DEX can more accurately capture the recent flow of stablecoins in DeFi. On March 11, the total transaction volume of stablecoin trading pairs (stable-stable) in DEX reached 23.17 billion U.S. dollars, far exceeding the daily average of about 1 billion U.S. dollars at the beginning of this month. Moreover, the total transaction volume of stablecoins and other token trading pairs (stable-alts) reached 7.99 billion U.S. dollars that day, which also created a small peak.

In general, after USDC is unanchored, transactions between stablecoins have become extremely active. If we further observe the trading volume of stablecoin trading pairs of major stablecoins, we can see that on the 11th, the trading volume of USDC stablecoin trading pairs reached 10.43 billion US dollars, while USDT reached 8.51 billion US dollars, and DAI was about 3.71 billion US dollars. It is reasonable to speculate that the transactions between these 3 stablecoins constitute the main flow path of stablecoins in DeFi under the crisis.

This is in line with Chainalysis’s earlier statement that the surge in USDC purchases on DEXs was due to confidence in fiat stablecoins, with some users buying USDC when it was relatively cheap and betting it would re-peg to the U.S. dollar.

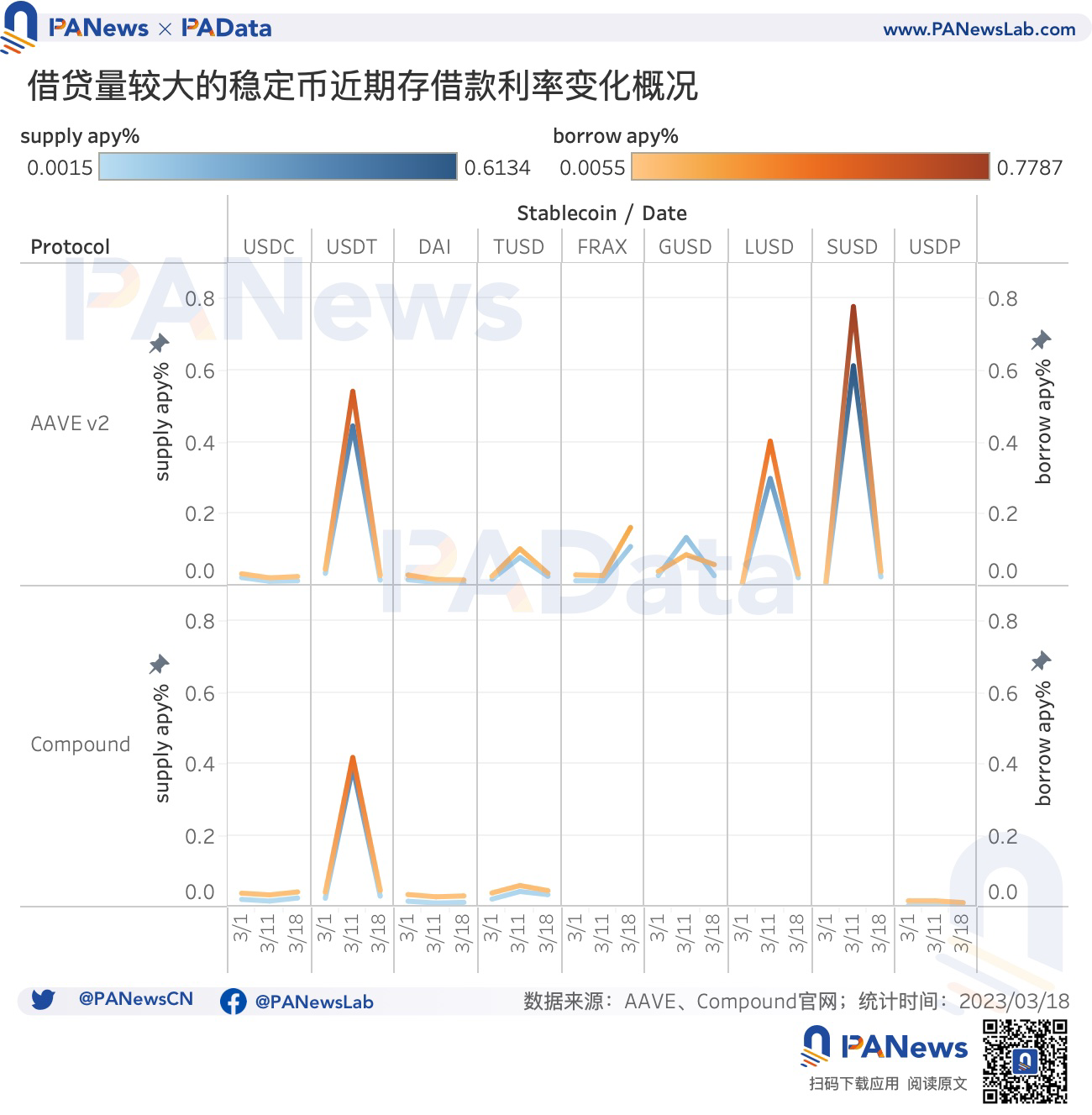

After USDC is unanchored, it will also have a great impact on the deposit and loan interest rates in the lending market. Among them, the trend of deposit and loan interest rates of USDC and DAI is basically similar to a "V" shape, that is, the borrowing demand is equal to or smaller than the change in the deposit scale, but relatively Words fluctuate little. The trend of deposit and loan interest rates of USDT, TUSD, GUSD, LUSD, and SUSD is basically similar to the "Λ" shape, that is, when a crisis occurs, the change in borrowing demand is greater than the change in deposit scale, and the liquidity is relatively insufficient. However, the current deposit and borrowing rates in the lending market have returned to the level at the beginning of the month.

Stablecoins are the most important "bridge" between the encrypted world and fiat currencies, and the closer the "components" to the real world, such as the regulated US dollar stablecoin, the more likely they will become a vulnerable point in the system. However, because of this, its ability to resist risks is stronger than that of upper-level assets purely built in the encrypted world, because centralized management can more effectively contain this risk, just like USDC saved the day because SVB accepted multi-party capital injection , which is the source of users' confidence in regulated fiat currency stablecoins, and it is also the reason why stablecoins are getting more and more attention from regulatory authorities.