SignalPlus Daily Morning News (20230317)

Dear friends, welcome to SignalPlus Daily Morning News. SignalPlus Morning News updates macro market information for you every day, and shares our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

Dear friends, welcome to SignalPlus Daily Morning News. SignalPlus Morning News updates macro market information for you every day, and shares our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

After a week of investor angst and wild volatility, markets finally calmed down yesterday. The key points are summarized as follows:

- Credit Suisse (CS) obtained a loan line from the Swiss National Bank. CS plans to repurchase some senior bonds. Its stock price stabilized, but bonds remained weak.

- UBS and CS oppose forced merger despite government pressure on strategic partnership.

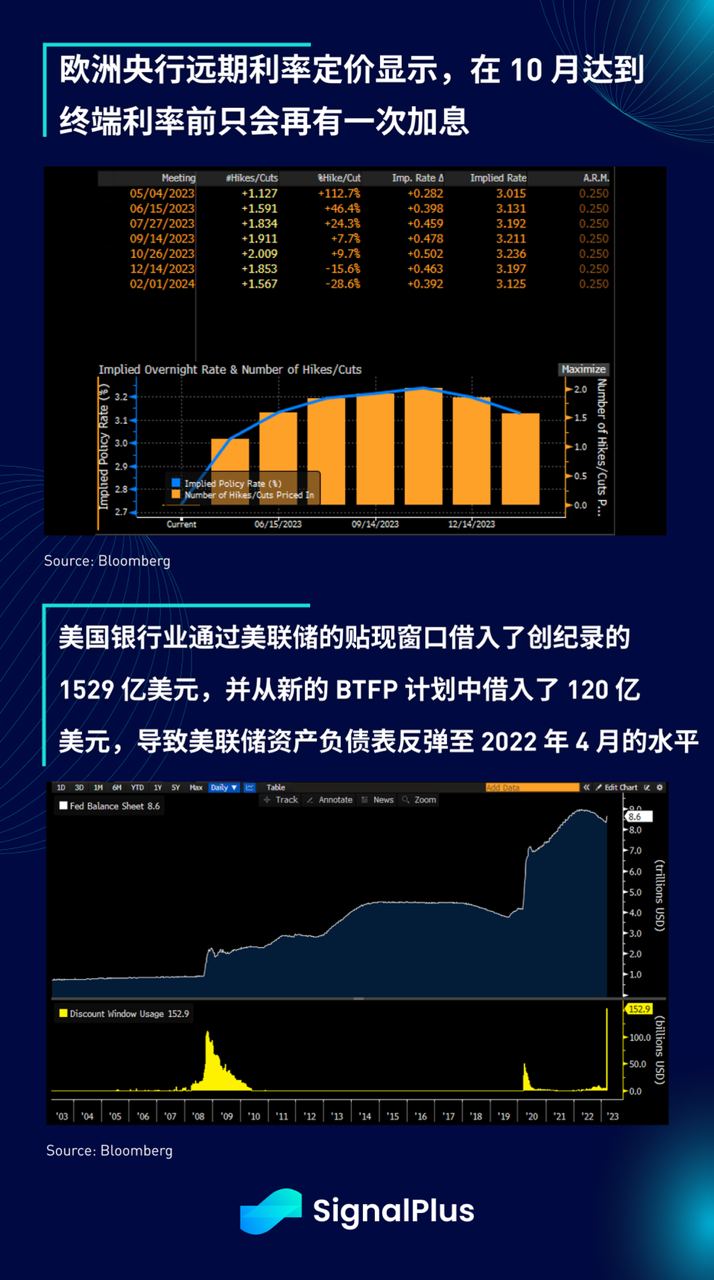

- ECB "dovish" to raise interest rates by 50 basis points, while the market expected only 25 basis points, however, due to the current "uncertainty", the ECB did not give any forward guidance on the next move, compared with its recent meeting This is seen as leaning towards the dovish side.

- With the Fed in a period of communication silence, Secretary Yellen took over the task, telling Congress that the U.S. banking system remains sound and that regulators will "scrutinize" after the SVB collapse, while denying that last weekend's actions amounted to a bailout; moreover, Like the ECB, Yellen emphasized that "addressing inflation is critical for the Fed" and that "high inflation is the number one economic problem" and President Biden's "top priority."

- The U.S. banking industry collectively agreed to deposit $30 billion with First Republic to help stem the latest turmoil, with Bank of America, Citi, JPMorgan and Wells Fargo each offering $5 billion in uninsured deposits, while Goldman Sachs and Morgan Stanley Lee will provide $2.5 billion each. Shares of First Republic rallied nearly 40% on the news, though its shares weakened again after hours, as the bank reported that its liquidity position had fallen from $70 billion over the weekend to just $34 billion on Wednesday.

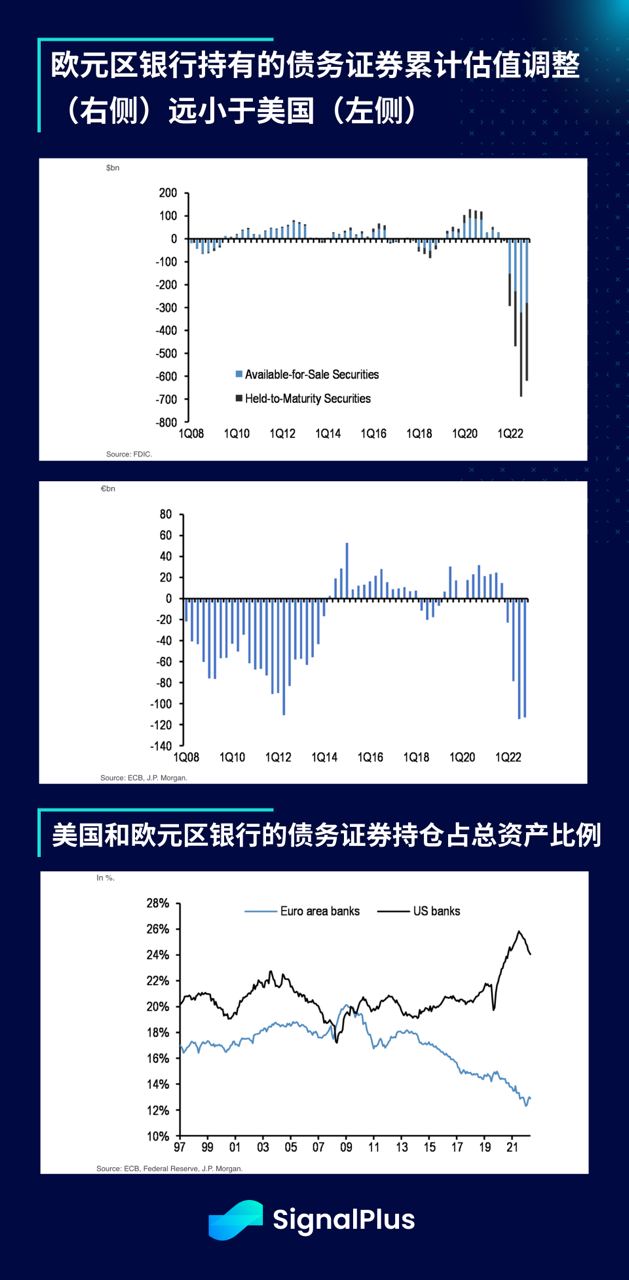

- US banks borrowed a record $152.85 billion from the Federal Reserve through the regular discount window over the past week (ended Wednesday), well ahead of the GFC-era peak of $111 billion. In addition, the new BTFP tool was used by $12 billion, resulting in an increase in Fed reserves of more than $440 billion, offsetting the 70% reduction in quantitative tightening to date, and the balance sheet is back to the highest level since April 2022.

Yesterday's main event was the European Central Bank's interest rate decision, which was the market's first acceptance of how the central bank will balance anti-inflation targets and maintain system stability amid a liquidity crisis. The ECB's actions were largely in line with our expectations, namely raising rates at least as much or slightly more than market expectations (50 bps), while limiting damage by lowering terminal rate expectations (the ECB opted to skip forward guidance directly ), and assured the market that it would "stand ready" to act if the risk contagion. We have always advocated that under the current situation, the regulatory authorities should show a firm stance and not overreact to the short-term expectations of the market. Otherwise, this will cause the market to start worrying about whether the current crisis is serious, which will have counterproductive effects, and will also violate the Their assurances to lawmakers and the public that the situation is under control will not repeat the bailouts of the global financial crisis.

In effect, the ECB is attempting to accomplish this daunting task by doing all of the above, showing that the lack of interest rate guidance does not mean that their resolve to fight inflation has faltered, but that market tensions are still being closely monitored and if financial stability requires Maintaining that they will be "ready to respond at any time", Lagarde also expressed confidence in the euro area banks, while clearly stating that "inflation remains too high". Following the ECB meeting, Yellen ran a similar script on the soundness of the US banking system and that inflation remains enemy number one, with the regulator to do a post-mortem analysis of the SVB situation. We expect the Fed to adopt a similar strategy next week, but it may be more "hawkish" to raise interest rates by 25 basis points compared to the market's current expectations.

In terms of cryptocurrency, the most important news is that Ethereum announced that the Shanghai upgrade will be carried out around April 12, and the withdrawal of pledged ETH will be opened. At present, about 17.5 million ETH are mortgaged, and the value is about 2.9 billion according to the spot price. A potential supply shock has been anticipated, but it will still be a significant event, and it will come at an interesting time, with spot prices rising sharply but mainstream participation hampered by unfriendly U.S. regulatory policies. Meanwhile, in the absence of new DeFi and industry innovation, BTC dominance has quietly rebounded to near a 1-year high of 45.8%, and the trend appears to be on track until the next compelling new technology or narrative emerges. It won't stop anytime soon.

If you want to receive our updates immediately, welcome to follow our Twitter account @SignalPlus_Web 3 , or join our WeChat group (add a small assistant WeChat: chillywzq), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Links

Website:https://www.signalplus.com/