On How the Rise of Legal Status Leads DAO Out of Utopian Dilemma

image description

first level title

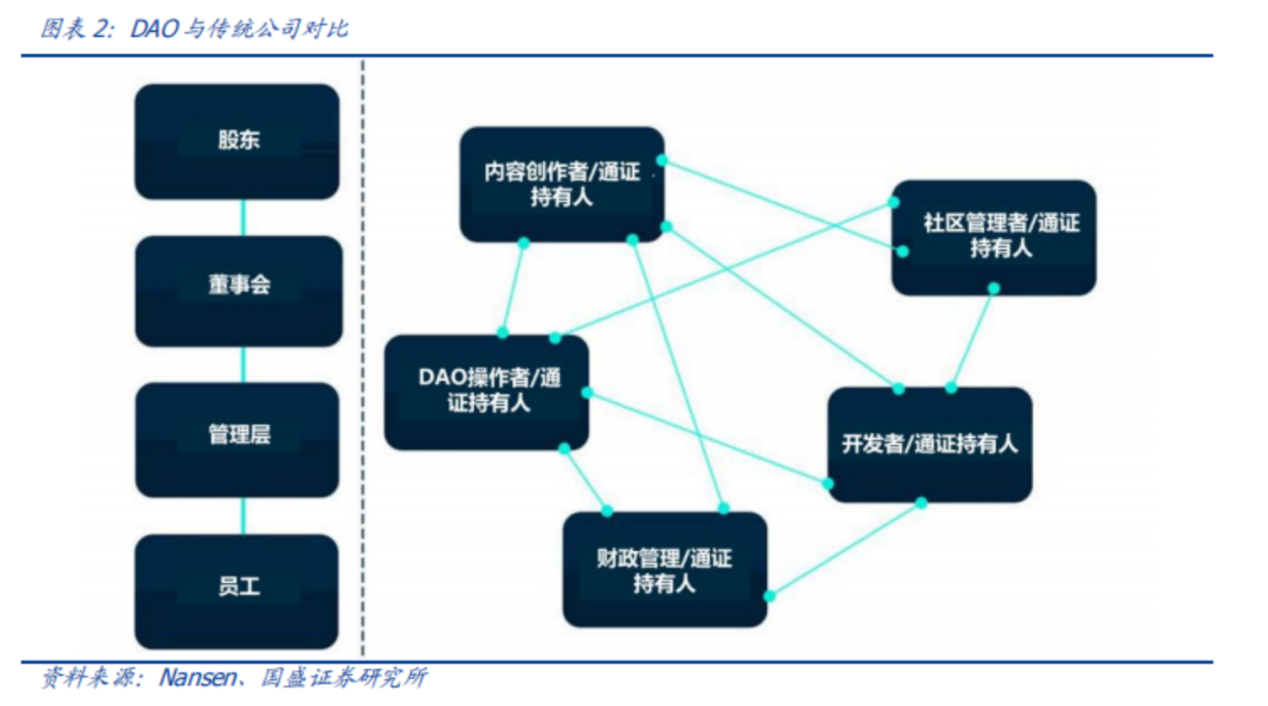

DAOs have no clear legal entity until 2021

Before 2021, DAO organizations do not even have any particularly good options and space to establish legal companies. Even if individual states or countries allow DAOs to register as legal entities, they will require DAOs to make too many compromises. For example, they would require the DAO to keep a list of members' full names and addresses, elect a board or trustees with authority over the organization, and keep written records of meeting decisions.

First of all, we need to know that if an organization is not registered as a legal entity in the United States, it will basically not be recognized by the government. Much of the modern economy depends on organizations gaining legal status. For a traditional business or organization, whether large or small, for-profit or not-for-profit, one of the first things to do is create a legal entity for the organization, usually in the form of a corporation, foundation, or limited liability company (LLC). form. A problem here is that if a group of people engage in a joint business without a legal entity, US law regards them as a general partnership system.What are the problems with a DAO considered a general partnership regime?

In a general partnership, the participating individuals are individually responsible for the actions of the organization and the actions of the other participating individuals. Therefore, when a DAO suffers from fraud, hacking, or accidents, innocent individuals involved are vulnerable.

Legally, a general partnership does not have the status of a legal person. While most DAOs at least want to own the intellectual property of their logos and trademarks, that means it can't sign contracts to do things like open bank accounts, buy and own property, sue and be sued, or hire staff.

first level title

After 2021, the DAO is included in the limited liability company system

On April 21, 2021, the Governor of Wyoming signed DAO-focused Bill 38, making Wyoming the first state ever to recognize DAOs as LLCs (effective July 1, 2021).

In February 2022, the Republic of the Marshall Islands passed a law "The DAO Act 2022". The DAO Act of 2022 will allow DAOs to be established as limited liability companies (LLCs.) to enable them to be recognized as DAOs limited liability company. The bill also intends to allow for-profit DAOs and non-profit DAOs to register, while providing definitions and regulations for the formation of DAOs, agreements, and the use of smart contracts. And enable legal entities registered in the country to formally adopt DAO structures and governance tools.

On April 6, 2022, Tennessee also passed legislation to recognize and allow limited liability companies (LLCs) to register as "DAOs," in an effort to make "Tennessee the Delaware of DAOs." According to state House Rep. Jason Powell, “With this new business structure, Tennessee will become a beacon for blockchain investment and new jobs...just as Delaware became the beacon for traditional LLCs. Center or credit card companies in South Dakota.”

Therefore, since 2021, DAO organizations have been included in the limited liability company system, and DAO organizations can choose to engage with the authorities and the legal system. The U.S. states of Wyoming and Tennessee, as well as the Republic of the Marshall Islands, have both passed laws allowing DAO LLCs, highly flexible and robust legal entities custom-made for DAOs, with all the benefits of a traditional LLC.

Additionally, some DAOs take the form of Colorado limited cooperative associations (LCAs), unincorporated nonprofit associations (UNAs), or choose to create foundations in Switzerland, the Cayman Islands, or the British Virgin Islands. Since 2021, hundreds of DAOs have incorporated companies in these jurisdictions, which allows these DAOs to enter the banking business, protects their members from personal liability, and even ensures that the DAOs can solve their own tax problems.

first level title

In 2023, grant the DAO organization an independent legal entity

On March 1 this year, Utah passed its DAO bill, recognizing centralized autonomous organizations as legal persons, and all these blockchain-native organizations called DAOs will not need to wrap themselves in the existing corporate structure, that is, they can Benefit from legal personality. The Utah DAO Act grants legal recognition and limited liability protection to DAO organizations, addressing the limitations of the previous "limited liability company wrapper" approach.

It means that DAO no longer needs to be packaged as a variant entity of a limited liability company, and the DAO organizational form itself has become an independent legal entity recognized by Utah law. According to the research of R 3 P 0, the following content in this bill deserves attention:

The DAO organization has legal personality, but the DAO has limited liability, and its liability is limited to all the assets of the DAO. Among them, the individual members do not bear the responsibility, and in special cases, the responsibility is divided according to the size of the voting rights.

Created a clearer and more nuanced tax treatment consistent with current DAO functionality. Propose new tax language. Compliant with the tax complexities of a DAO(Section 48-5-406 of the Act (1) If a DAO recognized under this Act is eligible to elect to be classified as a corporation for federal tax purposes, and the DAO makes that election, the DAO shall Organizations shall comply with Chapter 7 of Title 59 of the Corporate Franchise and Income Tax Act.(2) (a) Unless a DAO makes the election described in subsection (1), a DAO recognized by this Act DAOs shall be classified as partnerships for tax purposes and are subject to Part 14 of Part 10 of Section 59 of the Pass-Through Entities and Pass-Through Entity Taxpayer Act. Provided that constraint (b) for taxation purposes, the DAO shall distribute to each member of the DAO an allocated share of the income, gains, losses, deductions, and credits arising from the activities of the DAO, in accordance with proportionally distributes the member's membership interest in the entity.)

Provides that DAO participants have no implied fiduciary responsibilities unless those responsibilities are expressly stated as applicable.

use"rules"(rather than the operating agreement) to protect DAO ownership/anonymous editing and safeguards for participants.

A technical gatekeeping feature was incorporated to ensure that the DAO is indeed a DAO.

DAO has no administrator, and all members are regarded as joint administrators. And all governance token holders will be considered DAO members (which regulates the division rules)

first level title

secondary title

Will DAO's formal integration into the legal system make it lose its "centralization"?

A common concern for many DAO organizations when considering forming a company is whether legal compliance will make their DAO less decentralized and thus go against the core values of Web3. But in fact, without legal compliance, people often use "decentralization" to make DAO a tool for people to do evil.

At the end of last year, in the case of CFTC suing Ooki DAO, the purpose of bZeroX to transfer the control of bZx protocol (now Ooki protocol) to bZx DAO (now Ooki DAO) is to try to make bZx DAO not be recognized due to its decentralized nature. implement. The founders of bZx tried to use the decentralized nature of DAO to evade legal sanctions.

secondary title

The DAO revival is imminent

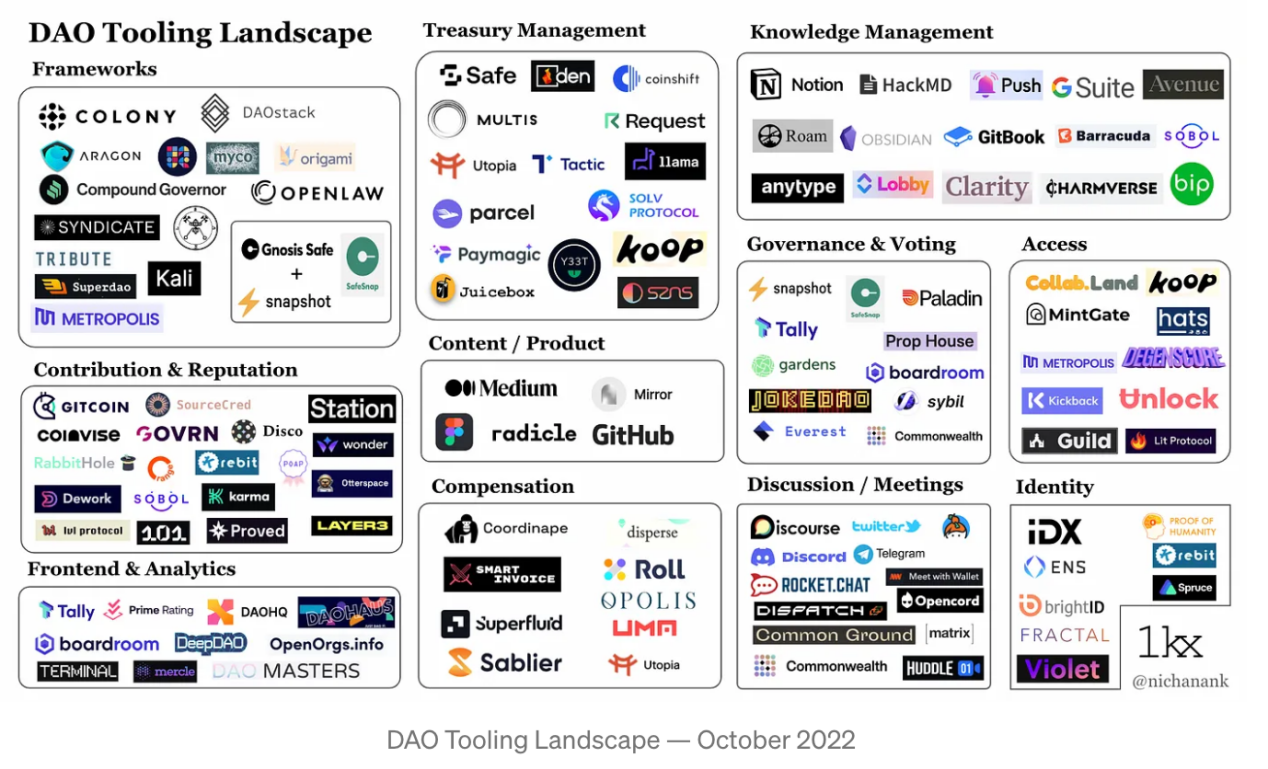

The past year — from Celsius Network to the FTX storm — has been a wake-up call for the need for decentralization of assets and decision-making, which will surely lead to a DAO renaissance. With the continuous innovation of blockchain technology, DAO tools will make the future application of DAO more streamlined and more efficient. For example, governance, proposals, and voting are important parts of DAO. With nearly a million active voters and proposers, you need the right tools to ensure fairness and efficiency. Second, the DAO Treasury is the lifeblood of every DAO, giving it the fuel it needs to achieve its goals. Therefore, to ensure efficient and secure governance, you must use high-quality tools to prevent hacks and errors - especially when you interact with DeFi protocols.

Disclaimer: There are risks in the market, and investment needs to be cautious. Readers are requested to strictly abide by local laws and regulations when considering any opinions, viewpoints or conclusions in this article. The above content does not constitute any investment advice.

Copyright statement: If you need to reprint, please add the assistant WeChat to communicate. If you reprint or wash the manuscript without permission, we will reserve the right to pursue legal responsibility.

Disclaimer: There are risks in the market, and investment needs to be cautious. Readers are requested to strictly abide by local laws and regulations when considering any opinions, viewpoints or conclusions in this article. The above content does not constitute any investment advice.