Looking back at the ten-year history of the rise and fall of LocalBitcoins: the king of Bitcoin OTC is coming to an end

Originally written by Peng SUN, Foresight News

Originally written by Peng SUN, Foresight News

How would you buy cryptocurrency if there were no exchanges? If you wanted your cryptocurrency cash transactions to be untraceable, what would you do?

For the former, your choice must be OTC. If you combine the latter, you will definitely think of OTC for offline cash transactions. Of course, pure cash transactions are rare in contemporary society. Faced with the risk of freezing cards in OTC transactions on centralized exchanges, the safest way is to conduct P2P transactions with relatively trusted acquaintances around you.

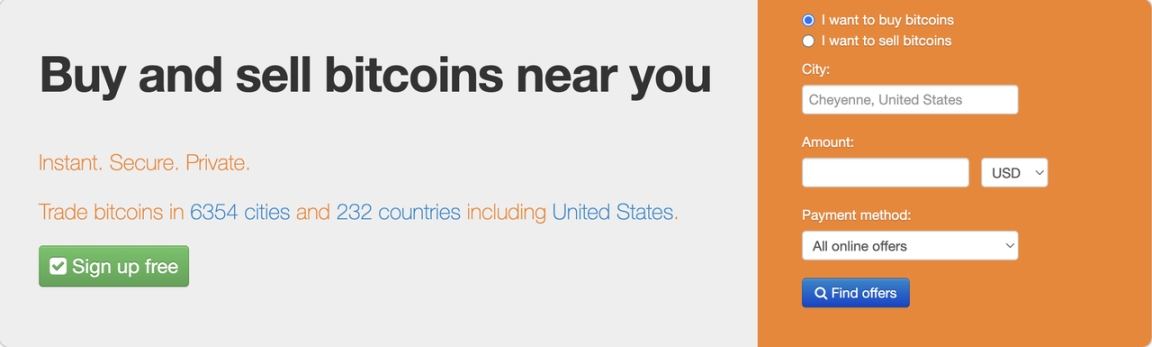

In the history of cryptocurrency trading, LocalBitcoins, a peer-to-peer bitcoin trading platform, should not be forgotten, the world's largest bitcoin over-the-counter trading platform, which has made an indelible contribution to the global adoption of bitcoin. LocalBitcoins is naturally loyal to the point-to-point decentralized spirit of Bitcoin. Although it is not a DEX, it is a trading platform that is different from centralized exchanges such as Coinbase, Circle, and Binance.Since its birth in 2012, LocalBitcoins has created its own brilliance, but was finally forced by reality and announced on February 9, 2023Out of service

LocalBitcoins.com official website

1. Local cash transactions: the birth and early development of LocalBitcoins

LocalBitcoins is a peer-to-peer Bitcoin over-the-counter trading platform located in Helsinki, Finland. It was founded by Finnish software developer Jeremias Kangas in June 2012. Its goal is to make Bitcoin ubiquitous and promote global financial inclusion.Jeremias Kangas

Founder of LocalBitcoins

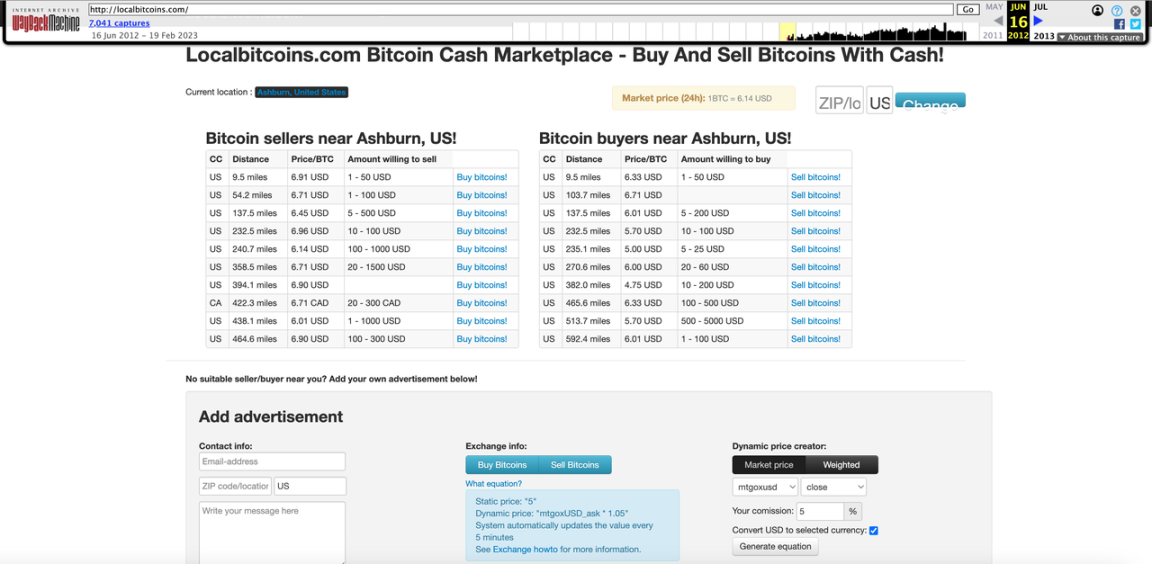

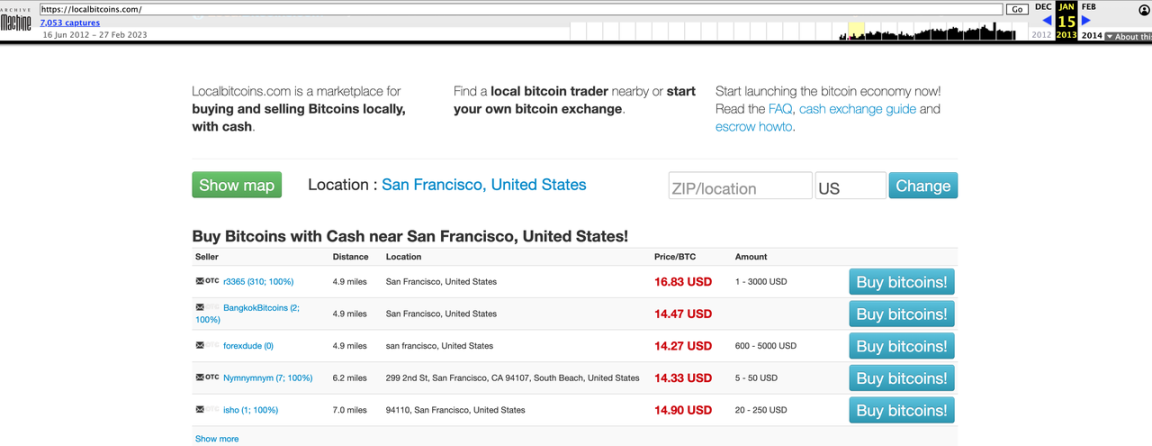

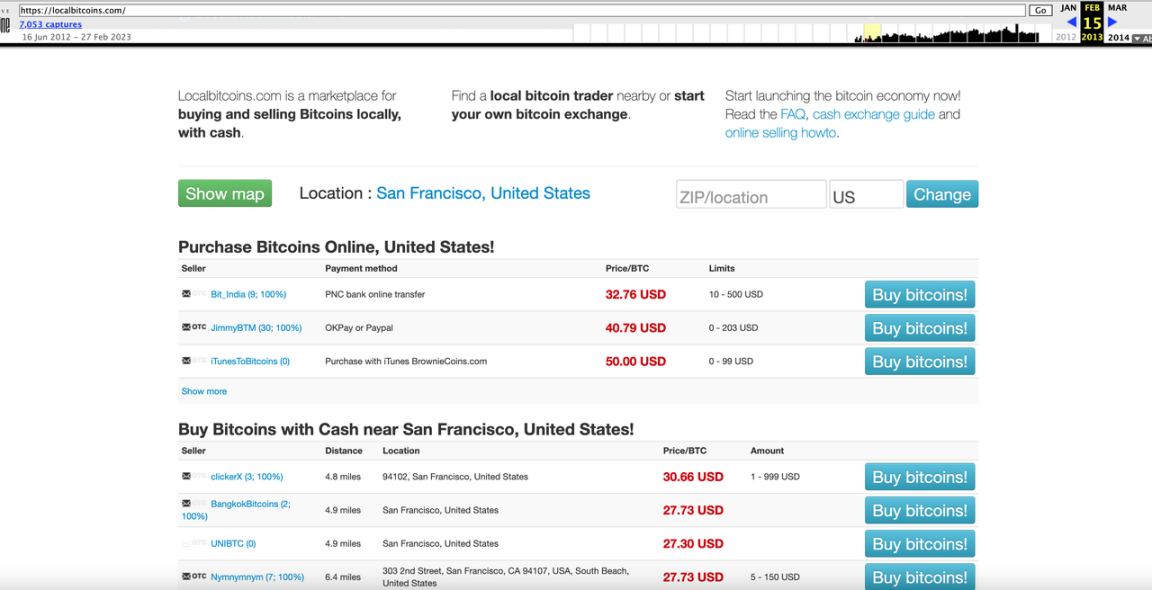

LocalBitcoins.com official website, 1 BTC = 6.14 USD

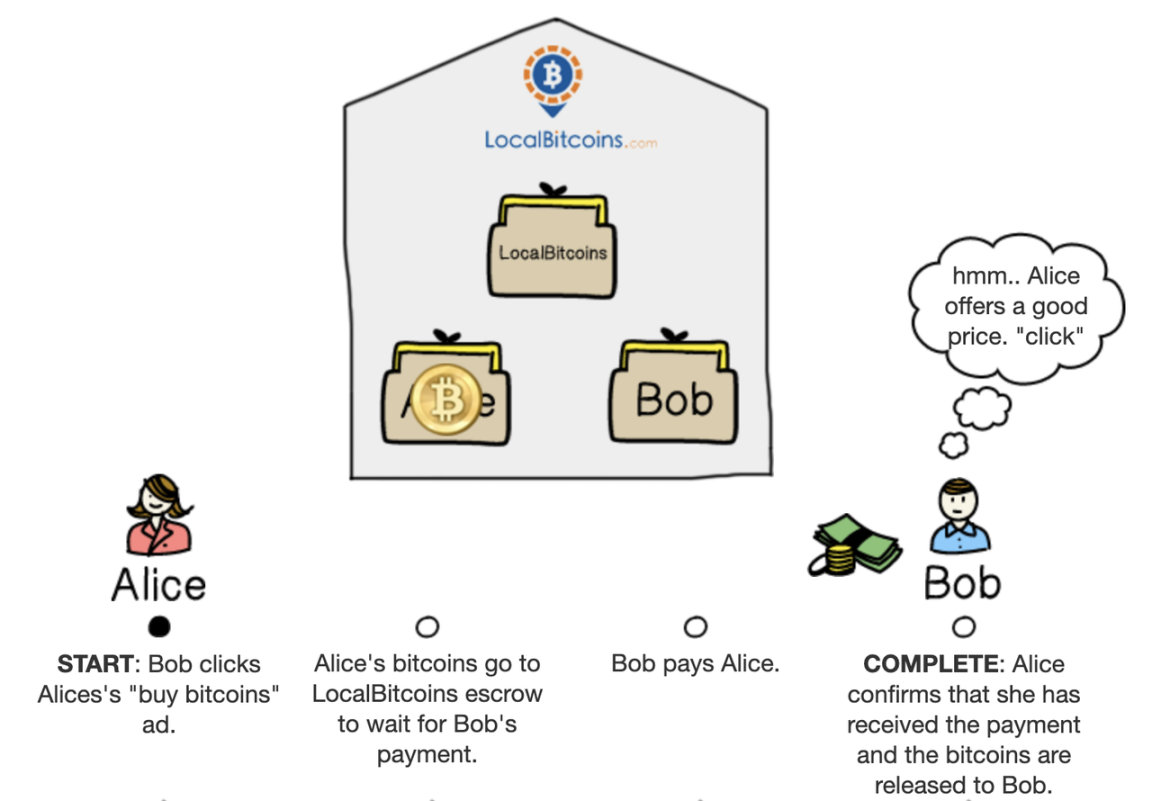

means of transaction

On June 14, 2013, when LocalBitcoins was founded for one year, it had 44,000 users, spread over 142 countries and 1,700 cities, with an average of about 250 new registered users per day, and a daily transaction volume of about 400-900 BTC. Users can price BTC in XAU (gold ounces) and XAG (silver ounces) on Localbitcoins. In November 2014, Simon Hamblin, CEO of the British bitcoin exchange Netagio, stated that the trading volume of British exchanges in the pound and bitcoin markets lagged behind OTC platforms such as LocalBitcoins.

(1) Crossing Africa: "Motorcycle Journey"On October 8, 2013, Kangas was published on BitcoinTalkA "motorcycle tour" across Africa

Event, Sponsor Borja and Elvis to ride motorcycles through Morocco, Western Sahara, Mauritania, Senegal, Mali, Burkina Faso, Togo, Benin, Cameroon, Nigeria, Republic of Congo, Democratic Republic of Congo, Angola, Namibia, Boswana, South Africa 16 countries. The campaign went off without a hitch, and Borja found residents in every country/city he visited during his travels who were willing to exchange bitcoins for their local currency. This move undoubtedly expanded the global adoption of LocalBitcoins and the popularity of Bitcoin, and they proved that Bitcoin can be traded.LocalBitcoins sponsored Borja in 2013Across Africa "motorcycle tour"

Activity"

(2) The Mt.Gox crisis and the choice of the Bitcoin community

In July 2013, Jeremias Kangas and LocalBitcoins.com were invited to participate in a panel discussion on "Rising Stars of the Bitcoin Startup Ecosystem" at the inaugural London Bitcoin Conference 2013. It can be seen that the influence of LocalBitcoins in the Bitcoin community has been initially established. On January 18, 2014, the inaugural Satoshi Square event was held at Bishops Square on the edge of the City of London, allowing people to trade bitcoins face-to-face. It was an "informal networking event" focused on educating those new to bitcoin about the digital currency. It's also where Bitcoin enthusiasts discuss cryptocurrencies, the latest mining technology, and Bitcoin trading. In addition, users can also use LocalBitcoins to conduct offline Bitcoin transactions in the real world.

The early audience growth of LocalBitcoins also benefited from Mt.Gox. From June 25, 2013 to 2014, the Mt.Gox crisis also promoted the rapid expansion of LocalBitcoins market share. For example, on December 10, 2013, Mt.Gox and AstroPay cooperated to provide USD and Bitcoin deposit and withdrawal for users in Latin America (Argentina, Brazil, Chile, Colombia, Mexico, Peru, Uruguay). But the banking option in Argentina disappeared after a few days and is no longer available to the Bitcoin community in Argentina. “In Argentina, Bitcoin users have become accustomed to buying and selling Bitcoin locally using sites such as Conectabitcoin, LatinCoin, LocalBitcoins and even Facebook groups.”By the end of 2013, the only bitcoin exchange in Taiwan was LocalBitcoins, which is also a popular choice for bitcoin enthusiasts in Egypt, Japan, Albania, and Indonesia. March 31, 2014Venezuela

After hyperinflation and bank failures, LocalBitcoins, Bitcoin Venezuela have informal meetups, conferences and exchanges all over the country.

On May 2, 2015, a Bitcoin buyer who traded offline on LocalBitcoins said, "In cities like New York, London, Los Angeles, and Tokyo, you can buy them on the street, at almost any time of the day. Meet someone in their apartment, or in my case, in a brightly lit, busy Starbucks, and give them some cash in exchange for digital currency.”

(3) Fund circulation needs

In November 2013, after the violent anti-government protests in Ukraine, Ukrainian protesters raised funds through Bitcoin. Since it needs to be converted into Ukrainian hryvnia (hryvnia) to be used in Ukraine, the only available Bitcoin exchange is BTC. -e, so P2P trading platforms like LocalBitcoins are the best choice for protesters in Ukraine.

Likewise, LocalBitcoins and Bitcoin have come to be seen as money flow conduits in Latin America due to lack of access to fully functioning online exchanges. On Dec. 19, bitcoin remittance startup Coincove used the LocalBitcoins platform to allow its customers to bring fiat currency in person to a local bitcoin dealer. The service provided by Coincove is to exchange their cryptocurrencies into US dollars so that customers can transfer money to different countries around the world. Coincove uses Bitcoin as a conduit for money flow. Four countries were initially chosen for operations: Argentina, Mexico, Spain and Chile, the latter three countries having significant Argentine communities and needing to be economically connected to their home country.year 2013,

Ukraine Protesters Raise Funds Using Bitcoin

(4) Functions and services: ATM, Invoice and online payment

(1 )LocalBitcoins ATM

Updates to LocalBitcoins' own features and services also facilitated early development.

As more people and businesses use bitcoin, easy and convenient exchange services are in increasing demand. To make up for the lack of a more direct connection with customers, LocalBitcoins decided to launch ATMs to automate their bitcoin trading operations. The Bitcoin ATM was originally developed by bitcoinkiosk.com, and LocalBitcoins.com acquired the entire product in December 2013. On February 17, 2014, LocalBitcoins announced the production of LocalBitcoins ATM, through which users can buy and sell BTC. It uses a new technology that allows ATMs to work without an internet connection, while transactions happen on the LocalBitcoins website.At the Helsinki Bitcoin Conference,

Buy Beer Using a Bitcoin ATMThe First Bitcoin ATM

, can be carried on the subway

LocalBitcoins ATM at 24 hour kiosk Delish

(2 )Invoice

Aamulehti News Go to Kynsilaukan restaurant to visit second ATM

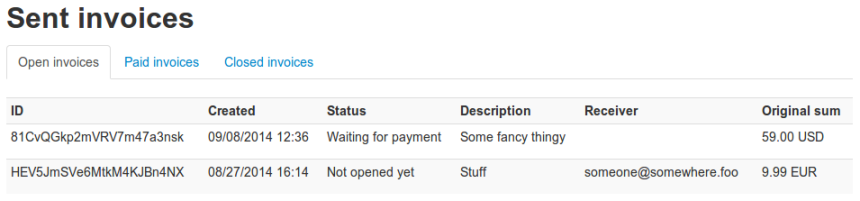

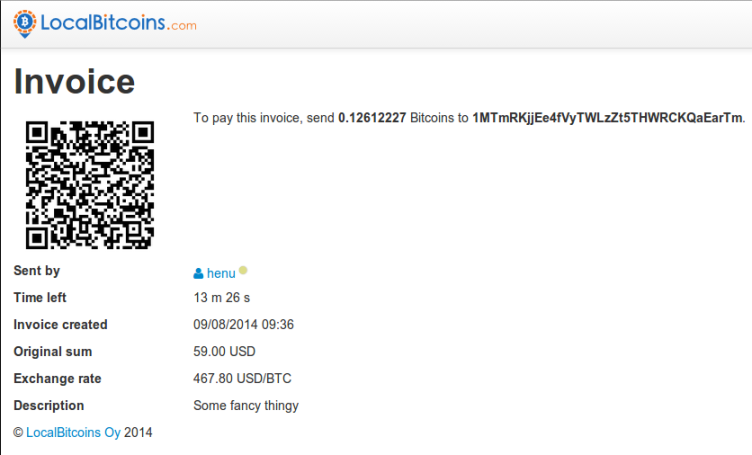

LocalBitcoins official website homepageInvoice

On September 8, 2014, LocalBitcoins launched its first merchant tool

(3) Online payment

, the "Cash" trade ad listing on LocalBitcoins.comFebruary 15, 2013

, LocalBitcoins.com Adds "Online" Trading Ad ListingSupported by the official website on February 29, 2016

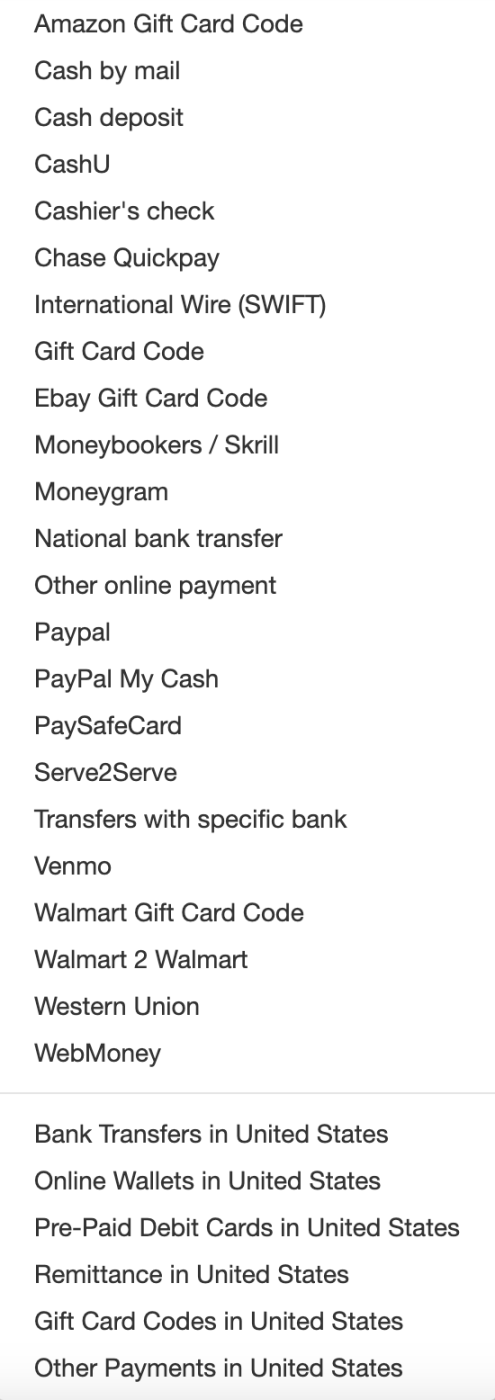

payment method

2. Between regulation and censorship resistance: the "golden age" of LocalBitcoins

Big Brother is watching you. —George OrwellBack in 2013, regulatory questions were on people’s minds, “Would Bitcoin be shut down by an unfriendly regulator or government?” “How could the Cuban or North Korean government stop me from buying and selling Bitcoin?” system?" Jeremias Kangas gave the answer, "Bitcoin will not be shut down", but "services like LocalBitcoins.com will be shut down". At the first Bitcoin Conference held in London in July of the same year, "Regulatory and Legal Challenges

” has become an important topic in the development of Bitcoin.Frankie BishopFor example, in August 2013, Bitcoin Co LTD, a Bitcoin exchange in Thailand, was shut down due to regulatory reasons, and representatives of the Facebook Thailand Bitcoin group

During the exchange’s shutdown, “the local community used things like OKPAY and LocalBitcoins.com for bitcoin transactions,” he said, adding that trading platforms like LocalBitcoins “have never been blocked” despite the Thai government’s sometimes draconian internet controls. In December 2014, LocalBitcoins founder Kangas claimed that German financial regulator BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht) contacted LocalBitcoins to require some sort of license to operate in the country. However, LocalBitcoins did not have the license at the time, so it decided to suspend its business in Germany. Kangas pointed out that LocalBitcoins serves 8,000 active users in Germany and that “parts of the service actually originated in Germany, so it’s a bit ironic and sad that we can no longer offer this service there”.

LocalBitcoins has faced political pressure over the years, in part because of its lax identification procedures. Buyers and sellers do not need to use real names, offline P2P transactions will not leave any transaction records, and as long as the transaction size is kept small, LocalBitcoins has become a natural choice for incremental money laundering. Because of this, Silk Road's dark web transactions have achieved a blowout of profits through LocalBitcoins. Due to the rampant illegal activities on the dark web, US Secret Service agents went undercover on the exchange and successively arrested many users who laundered money through LocalBitcoins. In 2015, LocalBitcoins withdrew from New York after failing to obtain a New York State BitLicense.

(1) Legal risks of US undercover agents and P2P transactions

Since no digital transaction records are left, peer-to-peer bitcoin transactions in the United States began to be criminalized in 2014. Between 2014 and 2022, there have been multiple arrests of Americans using LocalBitcoins for operating unlicensed money transfer services (MSBs) and money laundering, whether simply conducting Bitcoin Cash transactions or engaging in criminal activity.

(1) 2014

On February 8, 2014, the U.S. Secret Service indicted two Florida men, Michell Abner Espinoza and Pascal Reid, under anti-money laundering laws for using LocalBitcoins.com to transfer large amounts of Bitcoin.

In late 2013, a task force formed by the Miami Police Department and the U.S. Secret Service began investigating bitcoin trading activity in the area. Detective Ricardo Arias and Agent Gregory Ponzi contacted Michell Abner Espinoza through LocalBitcoins and arranged several meetings between January and February 2014. During several meetings where the undercover agents said they intended to buy stolen credit card numbers with digital currency, Espinoza sold the agents $1,500 in bitcoin and was arrested when he planned to sell $30,000 in bitcoin.

Their second count is operating an unlicensed money transmission service, and statute 560.125 prohibits people from frequently conducting unlicensed money transmission services in Florida in excess of $300 but less than $20,000 in any 12-month period. Depending on the amount involved, it can be classified as a third-degree, second-degree, or first-degree felony. Exchanging more than $100,000 of funds in any 12-month period is considered a first-degree felony, punishable by a fine of twice the value of the currency, up to a maximum of $250,000. Espinoza, who trades under the name MichaelHack on LocalBitcoins.com, has traded more than 150 bitcoins in the past six months. This is the first time states have decided to bring money laundering charges in a case involving bitcoin.

On April 10, 2014, Espinoza and Reid cited the US Internal Revenue Service (IRS) that Bitcoin is not a currency but a "property" (property)guideguide

Application to dismiss money laundering charges. On August 2, 2014, the Bitcoin Foundation submitted a document titled "Amicus Curiae" to the court, trying to dismiss the accusation against Pascal Reid of operating an unlicensed money transfer service under Florida statute 560.125. Its core position is that "the state prosecutor will Florida's regulations governing <money services businesses> are inappropriately applied to individuals conducting peer-to-peer sales of bitcoin." However, a Bitcoin Foundation spokesperson said Michell Abner Espinoza's case is separate from Reid's. On December 13, 2014, a Florida Circuit Court judge ruled, suggesting that individual bitcoin traders could be considered remitters under state statutes, and Reid lost the case.

In 2015, a judge sentenced Pascal Reid to 90 days in prison. Reid pleaded guilty to operating an unlicensed money transmitter, was sentenced to five years of probation, and must provide law enforcement and financial entities with information assistance about Bitcoin and digital currencies. Reid was required to complete "no less than 20 training sessions on digital currency and cybercrime," and provided assistance to the Miami Beach Police Department, the U.S. Secret Service, and the Miami Electronic Crime Task Force.

In 2016, Miami Judge Teresa Mary Pooler ruled that Michell Abner Espinoza did not qualify as a money transmitter as prosecutors said, but the ruling did not set a precedent for similar cases since then.

(2) 2017

On May 2, 2017, LocalBitcoins user Jason R. Klein of Nixar, Missouri, pleaded guilty in federal court to conducting an unlicensed money transfer business by exchanging bitcoins for cash. Klein admitted to meeting with and selling bitcoins to two undercover federal agents on five occasions between February 6, 2015, and July 27, 2016. In total, Klein sold about 98 BTC to the agent for $30,000 in cash and an additional 10% commission. Klein has been selling bitcoins on LocalBitcoins since 2013, and most of the ads for the exchange are from 2013.

On May 17, 2017, LocalBitcoins user Sal Mansy of Detroit, Michigan pleaded guilty in United States District Court to operating an unlicensed money services business in violation of Title 18, United States Code, Section 1960. Between August 2013 and June 2015, Mansy sold approximately $2.4 million worth of bitcoin on LocalBitcoins after purchasing bitcoin at Coinbase and Bitstamp, and deposited the proceeds into a business bank account at his personal company, TV TOYZ. The undercover agent made two transactions with Mansy between December 2014 and March 2015 for a total of 6.32 BTC (price was less than $1900 at the time). Coinbase also shut down Mansy's account for not registering with the U.S. Financial Crimes Enforcement Network (FinCEN) as a money transmitter. In June 2015, prosecutors raided his Detroit home and seized three bank accounts totaling approximately $120,000. Meanwhile, Mansy was sentenced to up to five years in prison and a $250,000 fine.

On May 25, 2017, LocalBitcoins trader and Shreveport masseuse Randall Bryan Lord and his son, Michael Aaron Lord, were sentenced for transferring funds through an illegal Bitcoin financial scheme. Father and son pleaded guilty to conspiracy on April 13, 2016 Operating an unlicensed money service business. Micheal Lord also pleaded guilty to conspiracy to traffic drugs, which he traded through the "dark web" and exchanged funds for bitcoin. His account on LocalBitcoins.com is called "Internet 151" and has since 2012 completed more than 3,000 transactions.

On October 25, 2017, Bradley, Michigan, Anthony Stetkiw was charged with operating an unlicensed money transmitter business for trading and brokering bitcoins on LocalBitcoins under the name "SaltandPepper." Stetkiw, who usually meets with clients at Tim Hortons restaurants, has engaged in bitcoin transactions worth hundreds of thousands of dollars, and the undercover agents have purchased bitcoins worth more than $55,000 from Stetkiw on six occasions.

(3) 2018-2022

On July 9, 2018, LocalBitcoins user "Bitcoin Maven" Theresa Lynn Tetley pleaded guilty to operating an unlicensed remittance business and money laundering. Tetley worked as a trader on LocalBitcoins.com, exchanging between $6 and $9.5 million for clients across the country. Tetley began an in-depth investigation in 2016, when an undercover DEA agent met and introduced her to her "boyfriend," who was also an undercover agent. Since then, the bitcoin cash transactions conducted by the two parties have involved dark web and drug smuggling.

In 2019, a U.S. district judge sentenced Jacob Burrell Campos for operating an unlicensed money transmission business. Burrell sold hundreds of thousands of dollars in bitcoin to more than 1,000 customers on LocalBitcoins.com, while charging a 5% commission. From late 2016 to early 2018, there were almost daily transactions of more than $1 million. He admitted there was no anti-money laundering or know-your-client program, and he did not do due diligence on the source of client funds. Burrell provides its clients with anonymity and privacy and exchanges over $1 million in unregulated cash.

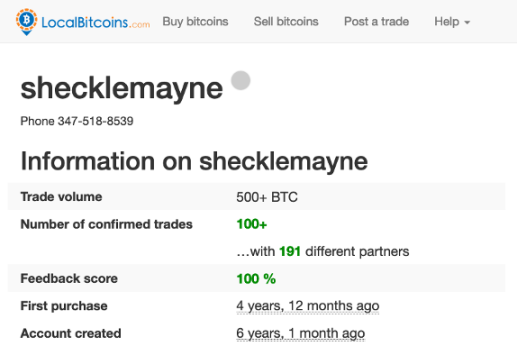

In August 2019, Knal Kalra, also known as Scheklemaayne, pleaded guilty to U.S. federal criminal charges for owning and operating an unlicensed money transfer service that exchanged nearly $25 million through his LocalBitcoins account and Bitcoin ATMs.

Unregistered US MSB Ads on LocalBitcoins in 2020

In 2020, Washington state resident Kenneth Warren Rhule was charged with operating an unlicensed money transfer service and laundering more than $140,000 in BTC after agents from the Homeland Security Investigations (HSI) conducted eight cash-for-cryptocurrency transactions with LocalBitcoins seller Rhule.

2022 Early Bitcoin pioneer and libertarian Ian Freeman and his associates (collectively known as "Crypto 6") helped scammers and other criminals launder over $10 million in BTC through Bitcoin AMM networks as well as P2P and virtual cash, facing tax evasion and Federal charges related to operating an unlicensed money transmission service.

(2) Anti-censorship: Bull Market, Regulation and Politics

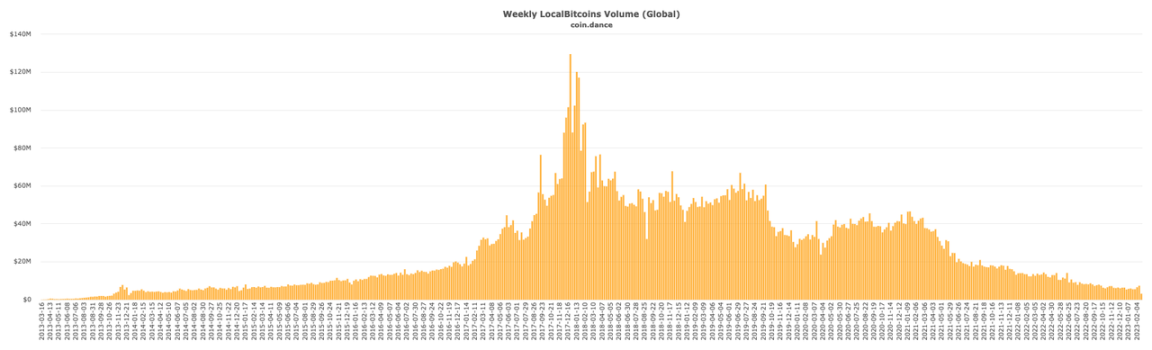

As of 2017, LocalBitcoins.com has provided services for buying bitcoins for users in more than 14,000 cities in 248 countries. At the same time, the end of 2017 ushered in a big bull market in the history of Bitcoin, and LocalBitcoins also reached the "golden age" in the ten-year development process in the same year. According to Coin Dance data, the trading volume of LocalBitcoins in most countries peaked between late 2017 and early 2018. Since the centralized exchanges in the more developed regions are relatively complete, the spot price of the P2P trading platform is much higher than that of the exchange. Therefore, developing countries have become the main force for the growth of LocalBitcoins.

Coin DanceIn addition to the big bull market, factors such as government regulation, geopolitics, economic turmoil, imperfect exchange infrastructure, and the lack of popularization of bank accounts are the main driving forces of the golden age. Considering the above factors, this section will select several representative countries and regions for introduction.

: LocalBitcoins BTC volume from March 16, 2013 to February 18, 2023

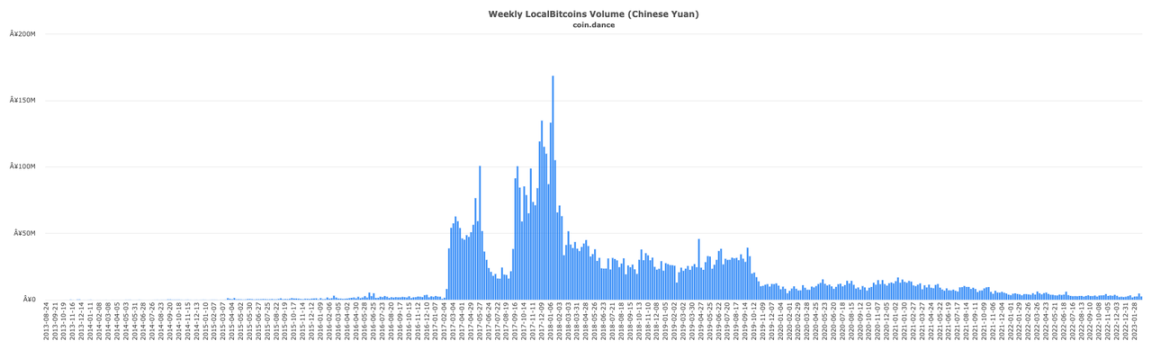

(1) Government supervision in China, India, Colombia and other countries

As early as December 5, 2013, the "People's Bank of China and other five ministries and commissions issued a notice on preventing Bitcoin risks" has clarified the official attitude of Bitcoin supervision, that is, "Bitcoin transactions are a kind of commodity buying and selling behavior on the Internet. Ordinary people have the freedom to participate at their own risk." From January 2017, the People's Bank of China began to interview the heads of the three major bitcoin exchanges, and entered the three major exchanges to conduct on-site inspections. The three major exchanges then stopped financing and financing. On February 9, a number of exchanges announced to upgrade their anti-money laundering systems and suspend Bitcoin withdrawal services. Under the regulation, Chinese cryptocurrency traders flooded LocalBitcoins, and its trading volume surged 3742% in one month (February 4th to March 4th). On September 4th, the "Notice on the Clean-up and Rectification of Token Issuance and Financing" came to the ground. It coincided with the bull market in December 2017. The weekly trading volume of Chinese users on LocalBitcoins reached the peak on January 13, 2018 Zhou reached an all-time high of approximately RMB 169 million (approximately US$25 million). At the same time, the total global trading volume of LocalBitcoins reached its peak in December 2017, about $129 million.

Coin Dance:LocalBitcoins ChinaChina

BTC trading volume

BTC trading volume

BTC trading volume

(2) Argentina and Hong Kong in political and economic turmoil

BTC trading volume

BTC trading volume

(3) Venezuela, Iran and Russia under US sanctions

Venezuela is the main force of LocalBitcoins trading volume. Ernesto Contreras, director of business development at Dash and co-founder of the Caracas Blockchain Summit, once said that "LocalBitcoins was the main reason for the massive use of Bitcoin in Venezuela in 2017-2019 after being sanctioned by the US government."

Since 2017, the United States has imposed oil sanctions on Venezuela and imposed sanctions on people and companies pro-Maduro, making it difficult for individuals to send money to Venezuela from abroad, and international banks cannot conduct normal business with Venezuelan banks. Businesses such as MoneyGram and Transferwise stopped serving the country. With regulated centralized exchanges also banned from serving Venezuela, where there are a limited number of crypto platforms, poor infrastructure, and unreliability, LocalBitcoins is extremely attractive to Venezuelans facing economic instability, political sanctions, and financial isolation They are also trying to use Bitcoin as a tool to fight inflation.

BTC trading volume

BTC trading volume

BTC trading volume

2019 Financial Report

(3) The road to compliance: KYC and the cancellation of cash transactions

In July 2018, the European Commission implemented the 5th Anti-Money Laundering Directive (EU Directive 2018/843, also known as 5 AMLD), which for the first time takes virtual currencies into consideration, including virtual currency exchange services and custodial wallet providers. Although the directive was not implemented until January 2020, the Finnish Parliament voted on March 13, 2019 to approve a new bill proposal on virtual currency service providers, as well as amendments to the Anti-Money Laundering Act under 5 AMLD. LocalBitcoins is a Finnish company that proactively claims to be "a pioneer in adapting new compliance standards for the cryptocurrency industry" and "by becoming the compliance standard, aims to promote trust, legitimacy and maturity in the Bitcoin ecosystem, paves the way for a more viable, broader currency and combats the criminal use of Bitcoin and its network.” On March 18, LocalBitcoins launched a new account registration process. Users can verify basic information when registering, increase the number of customers of suitable advertisers, and prohibit the creation of illegal accounts.

The January 26, 2019 phishing attack also prompted LocalBitcoins to take quick compliance measures. LocalBitcoins announced on Reddit at 18:00 on the same day that there was a security breach. The attack lasted for 5 hours, after which LocalBitcoins intervened and prevented the attack. During this period, when users visit LocalBitcoins, they will be redirected to a login page that mimics LocalBitcoins. After collecting the user's login credentials, hackers try to log in to the user's account. If the account is protected with two-factor authentication (2 FA), the hacker is asking for a one-time code for 2 FA. Subsequently, LocalBitcoins shut down the forum and temporarily disabled transactions on its platform to prevent the attack. LocalBitcoins said that as of press time, only six compromised accounts could be identified, and hackers stole $28,200 worth of bitcoins from users' LocalBitcoins accounts. On the same day, LocalBitcoins shared that "LocalBitcoins accounts are safe to use" and emphasized the importance of two-factor authentication.

On June 18, 2019, LocalBitcoins announced the launch of a new identity verification system, constructing four account hierarchy structures of T 0, T 1, T 2, and T 3. Accounts of different levels have different verification requirements and transaction volumes, and a gradual A formal verification system where users gradually verify their accounts as activity on the platform increases.June 18, 2019

new authentication system

In November 2019, CipherTrace released a report stating that “LocalBitcoins is the top choice for direct criminal funding for the third year in a row.” Among them, the "Finland" exchange received the highest proportion of criminal BTC, receiving more than 99% of criminal funds. In the same month, following the release of Finland’s Act on Virtual Currency Service Providers, the Finnish Financial Supervisory Authority (FIN-FSA) registered LocalBitcoins as an official virtual currency provider, “determining that LocalBitcoins has adequate procedures in place to prevent money laundering and terrorist financing, and that customer assets are protected.” fully protected."

In July 2020, LocalBitcoins announced that it was using Elliptic's Navigator risk analysis tool and Lens wallet screener to combat illicit cryptocurrencies. Elliptic Chief Scientist Tom Robinson said that LocalBitcoins' policy shift will lead to a 50% drop in darknet cryptocurrency inflows in 2020.

LocalBitcoins official website snapshotRedditIt sounds a bit ironic that a bitcoin trading platform based on "native" cash transactions has finally canceled the cash exchange! It is the non-traceability of cash that enables LocalBitoins to have the spiritual core of encryption such as anonymity, peer-to-peer, decentralization, and privacy. It is also the many international actions of early cash payments that made LocalBitcoins a giant in cryptocurrency transactions.

A LocalBitcoins user on Twitter said:

"It kind of defeats the purpose of the 'local' in the name"

“Localbitcoins used to work fine, but now the sheer amount of requirements and verifications to comply with money laundering laws make it a rubbish experience. I got banned twice before I stopped using their service entirely. Also, privacy and service Terms change every month"

"Big Brother is watching you. -George Orwell".

Before taking compliance measures, LocalBitcoins is a tool for people to enhance their privacy and resist the censorship of centralized power. Its existence and large-scale adoption around the world promote the native Bitcoin economy. Users can rely on the Bitcoin architecture to build mutual trust , to interact anonymously. As Satoshi Nakamoto pointed out when he designed Bitcoin: "What we need is an electronic payment system based on cryptography rather than trust, which allows any two parties willing to trade to trade directly without the need for a trusted Third parties.” However, from this moment on, LocalBitcoins’ peer-to-peer differentiated features and ideals that are different from centralized exchanges are completely obliterated. Without the core of decentralization and anti-censorship, LocalBitcoins is just enjoying the last vanity of the prosperous age. The power of global regulation created the golden age of LocalBitcoins, but it was destined to be the gravedigger of LocalBitcoins from the beginning.

3. Who killed LocalBitcoins: the failure of business and the continuation of the encrypted economy

LocalBitcoins’ announcement cited “decreasing trading volumes” and a “long crypto winter” as reasons for its closure. However, why did transaction volume drop? In fact, there are many factors that kill LocalBitcoins, such as "Bitcoin cash transactions only", "outdated interface", "excessive spot prices", "expansion of P2P platforms", "centralized exchange P2P services". expansion" etc.

(1) The Last Dance: 2020-2021

In June 2019, LocalBitcoins introduced KYC and eliminated cash payments, but this did not seem to have an impact on LocalBitcoins transaction volume. As can be seen from Coin Dance's LocalBitcoins weekly trading volume data, from June 2019 to May 2020, weekly trading volume fell by about 32.5%. At the same time, the trading volume of OKEx and Coinbase also decreased by 30% and 45% from June 2019 to May 2020, respectively. Since January 2020, LocalBitcoins has grown by about 40% in half a year, while OKEx and Coinbase have also increased by 2500% and 800% respectively. Perhaps as the LocalBitcoins spokesperson put it: "Cash transactions used to account for less than 0.5% of all transactions" and "removing it has had no impact on our trade volume."

June 2020 to May 2021 is the last dance for LocalBitcoins, which coincides with the first climax of Bitcoin's 2020 bull market, which peaked at $64,918. According to the LocalBitcoins quarterly financial report, the total transaction volume of LocalBitcoins in the third quarter of 2020 was US$580 million, the total transaction volume in the fourth quarter was US$612 million, and the total transaction volume in the first quarter of 2021 was US$596 million. During this period, the main markets of LocalBitcoins included Russia, Venezuela, Colombia, the United Kingdom, the United States, Nigeria, China, South Africa, India, Spain, Argentina, Peru, Chile, etc. Volumes in Latin America largely drove the total volume for the period.

After May 2021, the weekly trading volume of LocalBitcoins fell sharply with the plunge of Bitcoin. Since then, the weekly trading volume has failed to exceed 20 million US dollars, and the official LocalBitcoins blog has not updated the financial report after the first quarter of 2021. As mentioned earlier, in 2018, there were 2,400 BTC transactions per week, but by 2021, this data will drop below 1,000. In early February 2023, only 283 BTC were traded.

(2) Out of Blue: Expansion of LocalBitcoins Alternatives

There are two types of alternatives to LocalBitcoins, one is the P2P Bitcoin over-the-counter trading platform, and the other is the P2P service of the centralized exchange. They began to develop after 2018 and gradually eroded the market share of LocalBitcoins.

(1) P2P OTC trading platform

P2P Bitcoin OTC platforms like LocalBitcoins also include Hodl Hodl, Pawful, Bsiq and LocalCoinSwap.

Hodl Hodl is a P2P Bitcoin over-the-counter trading platform launched in February 2018. There is no KYC, and the transaction fee is up to 0.6%. It uses multi-signature smart contracts to host funds instead of hosting funds on the platform like LocalBitcoins. In May 2019, LocalBitcoins suspended services in Iran, and Hodl Hodl became an alternative for Iranian users. At the same time, Hodl Hodl also issued an article inviting the Iranian community to go to hodlhodl.com for transactions.

Since Russia is the largest revenue market for LocalBitcoins, in the spring of 2019, Paxful, an over-the-counter bitcoin trading platform, began to enter Russia in an attempt to encroach on LocalBitcoins' market share in Russia. Anton Kozlov, Paxful Russia manager, said that Paxful is working together to challenge the dominance of LocalBitcoins in Russia by adding support staff, partnering with local KOLs, and building a 10-person expert team. By the spring of 2020, usage of Paxful's Russian site has grown by 350%, the number of new users has surged by 364%, and the average monthly transaction volume is about 4 million US dollars. Kozlov said that Paxful’s Russian user base is on the rise, while LocalBitcoins has stagnated after launching KYC in 2019. While LocalBitcoins trades around $30 million in rubles per month, Kozlov said Paxful will continue to eat away at it.

(2) The victory of centralized exchanges

In the golden age of LocalBitcoins, one of the reasons why the United States was not the main force for its growth was that the spot price of Bitcoin offered by exchanges such as Coinbase in the United States was lower than the OTC price of LocalBitcoins, and the platform hosting of LocalBitcoins required service fees, so users No need to go through over-the-counter transactions between more convenient options. Since then, many exchanges have successively launched P2P OTC transactions, represented by Binance, and began to seize the global P2P market.

In December 2019, Huobi Indonesia decided to establish a legal gateway to allow users to exchange Indonesian rupiah (IDR) for USDT, which can be traded on the exchange. Previously, LocalBitcoins was the route that was often used in Indonesia. Huobi hopes to take a dominant position in the Indonesian crypto trading market.

In terms of exchange P2P services, Binance should be the most handy. In 2019, Binance P2P was officially launched, with growth in all regions of the world, but the fastest growth in regions where traditional cryptocurrency exchanges are difficult to operate, such as China, India and Southeast Asia. Binance P2P implements zero transaction fees, zero custody fees, and zero advertising publishing fees. "No matter what price the buyer and seller agree on, they can trade directly." At the same time, Binance also launched functions on LocalBitcoins such as advertisement posts, cash transactions, and transaction reviews. This move can be called a heavy blow to LocalBitcoins, which declared the commercial death of LocalBitcoins. After catering to supervision, implementing KYC, and canceling cash payments, all the advantages of LocalBitcoins in terms of anonymity, privacy, and resistance to censorship have been lost. Under the same conditions, users will naturally choose cheaper channels for cryptocurrency and fiat currency transactions. And Binance has enough confidence to implement this model, because unlike platforms that specialize in P2P, Binance has strong exchange profitability to support its P2P business.

As of September 30, 2021, Binance P2P supports buying and selling six cryptocurrencies, BTC, ETH, BNB, BUSD, DAI, and USDT, using 55 local fiat currencies through more than 150 payment channels around the world. Supporting multiple cryptocurrencies is clearly an advantage over LocalBitcoins' "Bitcoin only". In 2020, Binance P2P processed transactions worth $7 billion through 3.8 million orders, with a daily trading volume of up to $54 million. Compared to 2019, Binance P2P users grew 7 times.

As the main trading volume country of LocalBitcoins, Venezuela has already accepted Binance. When LocalBitcoins announced its closure, Venezuelan cryptocurrency advocate Aníbal Garrido said it "wouldn't have much impact on the Venezuelan ecosystem," as LocalBitcoins had fallen sharply since its peak in 2018. Ernesto Contreras also believes that "today, its closure will not have much impact on the Venezuelan market, because very few people are currently using LocalBitcoins." This is partly due to "an outdated and unintuitive interface" and "needs in 2023 are different than in 2012". The most used P2P platform by Venezuelans in recent years is Binance, and the adoption rate of Hodl Hodl and Bisq is very low.

It can be seen that Binance P2P basically has the functions of LocalBitcoins, and it does it better.

(3) The King of Bitcoin OTC: Brewing a Global Market for the Encrypted Economy

LocalBitcoins was born due to local cash transactions, and naturally has the characteristics of Bitcoin's native decentralization. It is committed to making Bitcoin a global financial inclusion and personal economic autonomy. What is embarrassing is that LocalBitcoins catered to the supervision, implemented KYC, canceled cash transactions, and was besieged by similar P2P platforms and centralized exchanges in the market, so that it was closed due to lack of transaction volume. It appears that the origin and destination of LocalBitcoins have diverged dramatically.

However, is LocalBitcoins really doing something wrong? It has made great contributions to global financial inclusion and promoted the adoption of Bitcoin in countries in Asia, Africa and Latin America. Did it do AML wrong? If illegal activities abuse Bitcoin, it will hurt their own users and stigmatize the cryptocurrency even more. Did it do something wrong by canceling cash transactions? There are very few cash transactions, and users themselves choose online transactions on their own initiative. Is it "Bitcoin only" wrong? Its goal is to make Bitcoin a global financial inclusion, fully in line with the spirit of Bitcoin, and other cryptocurrencies are not consistent with the goal.

The closure of LocalBitcoins is a natural choice for the global encryption economy. The market and users will always prefer low-cost, high-efficiency, beautiful, simple, safe and practical channels. It is difficult to distinguish which is right and which is wrong. Regrettably, encryption-native cores such as privacy and anti-censorship have once again failed in modern nation-states, capital and markets. Perhaps, it itself is only suitable for living in the edge of the "other". However, as a bridge between the physical world and the encrypted world, the just-needed P2P transactions are still continued by centralized exchanges and other off-exchange platforms. Bitcoin is the cornerstone of today's crypto economy, and LocalBitcoins has brewed a broad global market for the crypto economy through Bitcoin.