Returning to the encryption stage: From becoming famous to being arrested, what has BitMEX co-founder Arthur Hayes experienced?

Original compilation: angelilu, Foresight News

Original compilation: angelilu, Foresight News

One such story may sound familiar to you: a haughty young man with a higher education who spends a few years as a trader before starting a cryptocurrency exchange and quickly becoming a billionaire. He’s on TV, on Twitter, and as a face for the innovative industry of crypto, the kind of renegade entrepreneur you can’t help but pay attention to even if you don’t follow Bitcoin. This young man is the undisputed king of cryptocurrency. Then, perhaps out of arrogance, he started making mistakes. Even though he lived abroad, U.S. law enforcement had noticed him. After an indictment came down, he negotiated the terms of his return to the United States and surrendered to federal authorities, facing multiple felony charges.

This is not just the story of Sam Bankman-Fried, but of Arthur Hayes, who was on the crypto scene before SBF, was knocked out, and is now ready to return. While the stories are similar, they differ in many other ways in their lives: Bankman-Fried is a white kid from the social elite, while Hayes is a black kid from the Rust Belt; Like working 20-plus hours at a computer, Hayes is a burly, handsome man; Bankman-Fried has been labeled a success all his life, and Hayes created his fortune almost by will, except himself, everyone was surprised. In 2014, when Hayes was building the exchange known as BitMEX, no venture capitalist looked on him, and no one could have guessed that he would become history's first trillionaire. He even slept on a friend's couch at a friend's house for months when he wasn't successful.

The big difference is that Bankman-Fried (accused) stole billions of dollars from ordinary people around the world, while Hayes was never accused of taking something that didn't belong to him, or lying to his clients, or running a dishonest business. Nic Carter, co-founder of blockchain-focused investment firm Castle Island Ventures, said of him, "He's definitely one of the nicest guys in the cryptocurrency space, and BitMEX has never had their customers ripped off, nor been hacked." attack, never lost money.” Hayes has become something of a bitcoin martyr. “He’s not your typical bad actor who embezzles money or does something really nefarious,” said Daniel Bresler, a partner at the law firm Seward & Kissel that specializes in cryptocurrency and financial crime.

Hayes, 37, also has detractors. Economist Nouriel Roubini called Hayes the dirtiest player in a dirty business, even taking into account Bankman-Fried (who pleaded not guilty to SBF). Hayes accused of bribing government officials as a joke, inPosing next to a fleet of supercars on the streets of New YorkAnd making enemies by mocking the SEC on Twitter. These actions gave investigators an incentive to investigate him, gathering some evidence of his arrest.evidence, including Hayes knowingly violating banking laws by failing to prevent money laundering, accepting Iranian clients in violation of U.S. sanctions, and allowing Americans to trade on BitMEX without fulfilling various obligations.

Whether one chooses to view Hayes as a white-collar criminal or a scapegoat, his treatment is confusing, the only black entrepreneur at the top of the cryptocurrency game crucified for doing something not uncommon among his peers. Is it a coincidence? “The idea that one of the crypto figures they’re going to put in jail is black is terrible,” said a prominent industry figure who asked not to be named.

andTwitterandblogHe talked about cryptocurrencies online, but he was careful not to further anger the Justice Department and jeopardize lenient sentences. When his sentence ended in mid-January, he flew out of the US and eventually landed in Japan, where he skied six days a week and planned his next move.

Interview with Arthur Hayes

“I want to do my part to use Bitcoin to reach as many people as possible, and we will hopefully disrupt the TradFi system and give people another choice,” Hayes told me (he still has to work in a time of more scrutiny from the authorities). case through a two-year probationary period).

What's interesting is that the traditional financial industry that Hayes is committed to bringing down is the industry that got him started, an industry that allowed him to learn the technical knowledge of creating a cryptocurrency empire. He said, "You want to use your life to do something that you think can be real. Things that change the world, and hopefully I can be on the side of that change, both from the standpoint of me being right and the standpoint of me making some money out of it.”

Photo: Mikaela Martin

Just before he left America (possibly for good), I visited Hayes in his incarcerated apartment, a gleaming white three-bedroom in South Beach with a wide balcony overlooking the Skan Bay, and a bougainvillea-covered wrap-around terrace with the Miami skyline in front and flocks of sailboats gliding on the water below. It was 81 degrees outside (the equivalent of 27.2 degrees Celsius in China), but in Hayes' home it felt 10 degrees hotter than that. After living in Southeast Asia for more than ten years, he would rather not use the air conditioner in this temperature.

Hayes, fresh out of a yoga class and not breaking a sweat, who spends most of his time lifting and stretching, has a muscular body and shoulders so defined and sculpted that it looks like he's wearing armor. Hayes was allowed a few hours a day to exercise outside. There are also tennis rackets and swimming goggles in the corners, and a bicycle helmet on the counter next to a random Amex Platinum card. He likes to shop for health food and juices at the Pura Vida cafe, where he is occasionally recognized by fans, and overall his house arrest at home doesn't feel particularly reclusive. Hayes has an office at nearby WeWork and occasionally gets permission to eat out, allowing him to mingle with Miami's burgeoning cryptocurrency community. In September, Hayes hosted an after-party for a conference in Singapore, offering drinks to people in the room remotely while sitting on South Beach. During the Christmas period, the government sent Hayes back home to Hong Kong.

While his life under house arrest looks good, Hayes can be uncharacteristically cautious and gloomy at times. He fears being kidnapped. He said, “I’m more worried about my safety in America because people here have guns.” He no longer considers America his home. He even thinks that the pool facing the sea on the ground floor of the building is a waste of space and attracts mosquitos instead. And midges, who lived in Singapore before he was placed under house arrest, said that there are not so many bugs in Singapore.

Hayes brought several stuffed animals from his collection of more than a hundred plush toys in Asia to keep him company in South Beach. He buys them to celebrate milestones, names them, and lines them up on his bed. At his house in Miami, I counted a chartreuse starfish, a fox, an armadillo, a giraffe, an elephant, an octopus, a snake, and an anthropomorphic cabbage. "Sometimes I do travel with a whole box of toys," he said.

Perhaps no one else in the cryptocurrency space has been quite like Arthur Hayes, as the big names in the industry are always in constant dramatic infighting. While Hayes was under house arrest, the company run by Su Zhu and Kyle Davies Three Arrows Capitaland FTX, led by Bankman-Fried, fell, and Hayes ended his house arrest at this time. But the demise of Three Arrows Capital and FTX has changed the cryptocurrency landscape, with mistrust brewing among the surviving players and regulators tightening their grip on the industry. Hayes said, “The archetypes of the crypto industry have been destroyed one after another, and the people who were held up as corporate role models have been proven to be either bad at business or outright liars, so I think we have almost hit bottom.”

Hayes said his return wasn't intended to fill a void in crypto leadership. “That’s not what cryptocurrency is about, it’s not supposed to be based on a very small number of people running a company.” He’s returning in another way, as a commentator and market mover with an influential blog and Twitter account, And these are must-reads for cryptocurrency believers. Hayes has written three articles onFTX downarticles, one of which is entitled "white boy” article about how SBF uses his innate advantages and super social intelligence to deceive everyone into thinking that he is a cryptocurrency wizard and the future of Western leading financial institutions. He continues on twittercondemn, with a picture that seems to be biting Bankman-Fried paper-cuts, mocking Bankman-Fried's vegetarian habit.

Hayes gloated over what happened to SBF with good reason, as BitMEX, at its peak in 2019 and worth billions of dollars, had a dominant market share in crypto derivatives trading at $1 trillion. But that was the year Bankman-Fried founded FTX, and his platform and others, which offered spot trading and add-on products, quickly swallowed Hayes' business. Eventually, FTX, Binance, etc. surpassed BitMEX in terms of amount, and Binance is now the undisputed leader. Today, BitMEX is barely in the top 10 derivatives exchanges, according to CoinMarketCap.

A crypto exchange remains a profitable business, collecting transaction fees from every trade it processes. "In the history of finance, you don't have a lot of opportunities to own an exchange, they're like a money printing machine," said Hayes, whose fortunes range from hundreds of millions of dollars to billions of dollars, depending on price, and he's working on various ways to invest. his family office MaelstromHas made 10 to 20 investments in private companies, including a robotic sex doll startup. "I really like what these guys are doing," he said.

He is also actively participating in the market. “I’m a trader, and if it’s moving, I’m going to trade it,” he said. Hayes predicts a bull market through most of 2026, followed by an economy not seen since the 1930s disaster. “I think every central bank will fix the price of their government bonds for the next 12 to 18 months, and that will lead to the next giant upcycle in all risk assets, and then we’ll have a generational crash. That’s what I point of view.” Hayes burst into a laugh that sounded like it was coming from a loudspeaker.

His market judgment also applies to cryptocurrencies, which are recovering from the negativity wrought by FTX, which has rallied about 50 percent since the company went bankrupt. Hayes said, "We will have different cycles, sometimes it is a cycle of deep value tokens rising, sometimes it is a cycle of shit coins, any shit coin can go up 50 times, of course you don't want to. Miss those cycles. So yeah, I'd invest in deep tech and cryptocurrencies that decentralize and really realize the vision of Satoshi Nakamoto's white paper, and I'd invest in shitcoins because I think I can time the market and buy into a narrative and sell when that narrative peaks. We’ll see if that actually happens in practice.”

Photo: Mikaela Martin

Past Arthur Hayes

In August 2004, at the start of his freshman year at the University of Pennsylvania, Hayes started hitting the gym with a new friend at 5:30 every morning. As black students in Wharton's undergraduate program, they used their dawn training hours to dream about their futures. "Becoming rich is our specific goal," said the friend, Justin Anderson, who is now a venture capitalist. For Hayes, who grew up in Buffalo and Detroit, the child of auto workers whose parents divorced when he was 11, becoming rich was a largely unimaginable goal at the time. But one morning that month, as he and Anderson were waiting for the elevator, he felt the foreboding particularly strong, “I remember pressing that button, being silent for a while, and then saying, we’re going to be billionaires. ’” Anderson said, “I think he sees himself as some kind of financial wizard, more Gordon Gekko than Mark Zuckerberg.”

Hayes surprised and inspired some of his black peers by passing the toughest challenge at Penn. Anderson said, "As a black man, if you don't have confidence in yourself, it is impossible to reach this level. He became the president of the Black Student Association of Wharton Business School. In Arthur's world, there are actually no obstacles. He just does this Arthur obviously knew he was a black man in a predominantly white environment in Pennsylvania, but he never found it a challenge.” Hayes took a place in the school’s bodybuilding competition “Mr. The development direction of Asian financial industry.

“The people in Buffalo stay in Buffalo, but I don’t want to stay in Buffalo,” Hayes told me. He didn’t want to go to Manhattan like the rest of the class, and he thought he would get the same results as everyone else. In the summer of his junior year in 2007, he won an internship at Deutsche Bank in Hong Kong. Hayes described his feeling about Hong Kong as "love at first sight", from the moment he left the airport in a taxi, past palm trees and endless shipping containers and verdant hills overlooking the city's iridescent skyline. He said, "Hong Kong feels so good to me, and I am looking forward to the stories that happen in China."

At Deutsche Bank, he worked in the equity derivatives sales department, and one of the more junior jobs was delivering meals to his superiors. He later wrote on his blog: "It's all very common, but as an enterprising poor intern, I struggled to profit from my role of buying meals. I charged a fairly high price per order. The difference, so I can make hundreds of dollars a week. Lest you think I'm doing something out of character, everyone in the office knows what I'm doing and acquiesces, respect the rules of the game."

Hayes was also a clubber, which helped him land his first full-time job after returning to Philadelphia his senior year. As he recounted in another blog post, Deutsche Bank sent recruiters to Penn. Hayes writes: "During my interview, I expressed my love for partying in Hong Kong. As a test, one of the senior recruiters asked me to recommend some local nightclubs. We ended up getting drunk at the Philly Family Club downtown. It’s a mess.” After graduation, he formally joined Deutsche Bank in Hong Kong as a trader.

Andrew Goodwin, Hayes’ roommate at the time, said, “He’s always been the kind of person who takes challenges bigger than life, even as an intern, always pushes the limits, and you should see his yoga pants.” On a Friday At work, a department executive walks past Hayes' desk and says, "Who the fuck is that?" because he's wearing a skintight pink polo shirt, a pair of jeans, and bright yellow sneakers. Casual Fridays are canceled.

The market crash of 2008 took some of the fun out of the high-paid expat lifestyle, and as the recession loomed, Hayes began converting his funds into gold. It is both an investment and a kind of insurance in case of social unrest. “The boatmen only take gold coins,” a friend remembers Hayes telling him.

Hong Kong is full of expatriate financiers who seek something more exotic than Wall Street and tend to share an ideology — yearning for a return to the gold standard, hating capital gains taxes, and believing that central banks will be the downfall of Western economies. "Hong Kong attracts a lot of hardcore liberals because it has low taxes and little regulation," Hayes' friends put Hayes into this group.

exposure to bitcoin

It’s no surprise that Hayes got an early exposure to Bitcoin, in the spring of 2013, after Hayes, who had found a new job at Citigroup, was fired, saying “I’ve always wanted to find the next thing,” His first trade quickly netted him several thousand dollars. Hayes remembers having a sense of being at the birth of a technology as revolutionary as the printing press or the telegraph. He spent the next year and a half sleeping on friends' couches while experimenting with cryptocurrencies, finding arbitrage like the ones he'd learned in banking.

One day in 2013, bitcoin prices in the mainland surged relative to those in Hong Kong due to China's tight controls on the movement of money. Hayes began buying bitcoin at lower prices and selling it on exchanges in China, withdrawing the profits to a mainland bank account he opened with a fake address. He then drove across the border from Hong Kong to Shenzhen, took the money, and returned with the money in his backpack. During one border crossing, Hong Kong authorities detained him, believing he was involved in suspicious bitcoin transactions. Hayes finally managed to convince officials that he too was a victim in the deal, and they let him go.

Talking crypto on CNBC in 2018. Photo: CNBC/YouTube

Slowly becoming something of a legend, Hayes is already a star in Hong Kong, and not just because of his looks. Goodwin once wrote that Hayes' almost mythical heroism circulates in cryptocurrency circles. Strangers and friends alike sometimes referred to Hayes as a "nigger," a Cantonese slur. But Hayes is happy to be different. He laughed and told me, “When you come to Asia you want to stand out, because if you come to a region that spans half the world and you just want to fit in, why did you leave in the first place?”

Hayes appreciates the concept of a trustless currency. He said that "cryptocurrency is the only asset that is truly yours," and on the other hand he reverently referred to Bitcoin as "pure energy in digital form." But unlike many other early believers, he never kept much of his assets. “It would be very stressful to put your entire fortune into this very volatile asset and you can’t control the outcome, and I don’t have that power. I’d rather have a business whose success or failure I’m directly responsible for. "

Create BitMEX

At the time, startups like Coinbase were opening exchanges in an attempt to make digital currencies accessible to everyone. Hayes saw an opportunity for a more unique adventure. One of his specialties at Deutsche Bank and Citibank was trading futures contracts. “Derivatives are like breathing for my life,” said Hayes, who envisions creating a niche exchange for established traders who want to bring Wall Street-style operations to bitcoin. The platform does not accept other cryptocurrencies or fiat currencies, and it looks and feels like a Bloomberg terminal. Hayes teamed up with Ben Delo and Sam Reed, both cryptocurrency enthusiasts who know how to code. In 2014, they founded BitMEX, short for Bitcoin Mercantile Exchange—the name is a nod to the iconic Chicago Mercantile Exchange, the derivatives market. They were incorporated in Seychelles, which has low disclosure requirements for financial companies, and Hayes is the CEO.

For the first six months, almost no one traded on BitMEX. By the spring of 2015, Hayes was ready to give up. He sent an email to the other two co-founders with another idea, saying "Hong Kong is the go-to place for second-hand electronics, what if their website changed to trading second-hand iPhones?" Delo And Reed turned him down. Ultimately, they decided to attract customers to BitMEX by allowing them to take more risks. The big money in derivatives trading comes from the use of leverage -- borrowing money to make bigger bets, multiplying profits but also amplifying losses. Hayes, Delo, and Reed increased BitMEX's leverage limit to 50x, more than double that of its competitors, and then they increased it to 100x. This makes BitMEX the most daring exchange in cryptocurrency, or perhaps the most reckless. “We were profitable in no time, and hyperleverage became so core to the BitMEX brand that the company’s parent company changed its name to 10 0x Group,” Delo said.

saidsaid: “There are some people who offer similar products, but they focus on the depraved gambler, the retail trader of Bitcoin, so why don’t we do the same thing? The problem is, retail investors are not used to trading derivatives. They will Messaged Hayes complaining that their contract suddenly disappeared (because it had expired), and clients often called the founders liars.”

At this time, Delo had a new idea, which has become the iconic innovation of BitMEX. What if it made a futures contract that never expired? In May 2016, BitMEX launched what it called a perpetual contract — a 24/7-traded, constantly updated derivative that would simplify betting on the future price of bitcoin. Darius Sit, founder of Singapore-based cryptocurrency trading firm QCP Capital, said: “This is proving to be revolutionary for liquidity in the cryptocurrency market. As an exchange, more liquidity means more liquidity for BitMEX. More profits. Whether the price of Bitcoin goes up or down, as long as people keep trading, Hayes makes money."

About a month after the perpetual contract debuted, he ran into a colleague holding a newspaper at a dim sum shop in Hong Kong. The UK has voted to leave the European Union, and the market is in an uproar. "We're going to get rich!" he howled.

after becoming famous

By 2017, with BitMEX so rich that Hayes and his co-founders turned down an investment offer from a venture fund that valued the company at $600 million at the time, Hayes and his co-founders retained nearly all of their equity. The trio had struggled to raise capital when BitMEX was first born. The Bitcoin bear market came the following year, but it just got people trading on their platform more often. That summer, BitMEX peaked at $8 billion in daily trading volume, and Hayes, Delo, and Reed took a cut of $4 million—a ridiculously high amount.

In their 45th-floor office in Hong Kong's financial district, they have laid out leisure spaces for billiards, poker and mahjong, as well as a huge bar and a Lamborghini-branded sound system. Two stone temple lions were installed at the entrance of the office. Even more egregious is a tank containing three blacktip reef sharks, which costs more than $100,000 a year to maintain and, according to Delo, is so heavy that it requires additional support columns to strengthen the building.

According to Hayes, who isn't in the office much, some of the excess is driven by other people. “I came back from a vacation somewhere and saw this and I was like, well, whatever,” he said of sharks. He was social president of a fraternity at the University of Pennsylvania, where he encouraged the fraternity culture at work. , sponsoring parties and stunts such as the Big Eater Competition. “He shows up with a wad of cash and a bunch of Big Macs and says who wants to try it? To the outside world, Hayes acts as an ambassador — representing the rebellious spirit of BitMEX and crypto in general,” Reed said. "There's always a joke that he wants to be a trader, but he's going to be an amazing salesman," he said.

In May 2018, Hayes traveled to New York to attend the Consensus cryptocurrency conference and stole the show before he even got inside. BitMEX parked three Lamborghinis outside its downtown venue. Hayes called it "a guerrilla marketing tactic," acknowledging that it might seem "a little crude." The supercars were rented from a man who wouldn't even let the BitMEX staff drive them, and they got a ticket for about $1,000. "Looking back now, I wish we hadn't done the Lamborghini thing because no one got the joke," Reed said.

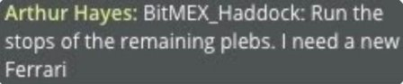

But the behavior was in keeping with Hayes' personality, exuding heroism and showing that he didn't take orders from anyone. A myth began to circulate: Hayes always made money, even when no one else was making money. A meme also began to circulate, albeit a fabricated one, of a screen allegedly showing Hayes instructing a staff member to "get the rest of us off, I need a new Ferrari"screenshot。

The remarks seemed to support a common (and unsubstantiated) belief at the time that Hayes was manipulating the market and trading with clients. He didn't deliberately shy away from the car thing. In late 2018, he posted a photo on an ambulance that BitMEX donated to Seychellesbumper sticker. His other car is a Lamborghini. He also purchased a yellow Ferrari Portofino. Fans saw the model as a sports car for those who didn't actually understand cars, and some in Hayes' inner circle dubbed it "the Ferrari of a sissy." Hayes also hated driving it. "I'm not a car person, I hit two cars in the parking lot," he said.

A global mogul, Hayes took his antics globally. Even though BitMEX can’t legally do business in the US, he held a robe-themed charity event on New York’s Cipriani Wall Street that included food stalls, lobster, and a Rick Ross performance. Another time, Hayes flew one of his favorite DJs, Christian Smith, from Europe to a club in Asia because he wanted to dance to the music he loved.

Hayes kept some parts of his life extremely private. Many of his closest colleagues were unaware that he had an intellectually disabled brother until the relationship was brought up in court. Hayes, who avoided several topics during our interview, had a firm condition that I not name his wife, whom he married in 2018. A colleague said, “We like to joke that there is an Arthur Hayes, and there is a @CryptoHayes (his Twitter handle), they are different people.” Delo said, “Arthur is a front man, a performer, A P. T. Barnum."

Debate with Roubini (left) in Taipei in 2019, photo: BitMEX/YouTube

Hayes had a circus-like act in the summer of 2019, when he boarded the so-called "Tangle in Taipei’ stage – a debate with Roubini, a prominent economist and strong critic of cryptocurrencies. Roubini wore a suit, while Hayes wore skinny jeans with holes at the knees. In less than ten minutes, he revealed himself. When the moderator asked why BitMEX was based in Seychelles, Hayes said the company didn’t need to “bow down and accept regulation from the U.S. government.” He continued, “I really don’t want to be at the bottom with my brother all day. So I get rid of The only difference between regulators in the US and Seychelles? It costs more to bribe them. How much does it cost on this island? A coconut."

Hayes insisted he was only joking, and Roubini was appalled by the remark, "I mean, they're all liars, but at least they're pretending they're not, and he told me this guy, he said, he could do whatever he wanted. .It's a statement that admits he's a liar. I've never seen anything like it, even in this place, they're all criminals."

By asserting that he operates outside of U.S. jurisdiction when, in fact, any entity that interacts with the U.S. financial system is subject to U.S. law, Hayes is doing worse than directly asking regulators to target him. In a way, BitMEX did just that. Shortly after the Roubini clash, when asked for information about the company’s operations, someone on the exchange responded with a meme featuring a Hayes smiley face and the text “Register in Seychelles bro come to me.”

BitMEX Investigated, Hayes Arrested

When news of the federal investigation broke, customers were said to have withdrawn $500 million from the platform at the time. The Justice Department indicted Hayes, Delo, Reed and their first employee, Gregory Dwyer, in October 2020. "The thing regulators in D.C. hate most is embarrassment." “The reason they were charged was because what they did was blatant,” said a former CFTC official who also charged Hayes, Delo, Reed (BitMEX settled with the CFTC for $100 million) , but will decrease later). “The Department of Justice has strong evidence that Arthur Hayes communicated directly with customers in Iran. Arthur Hayes drove a Lamborghini in New York, demonstrating that they knew what the law was, that they willfully ignored it, and that they were brazenly engaging in illegal behavior.”

Hayes resigned as CEO, and a few months later, he chartered a private jet, flew to Hawaii, and was arrested while wearing a T-shirt. Marshals boarded the plane, fingerprinted him and examined his cheeks. Hayes was then handcuffed by two FBI agents in body armor and taken to court, where he pleaded not guilty. After a 10-day quarantine, he was flown back to Singapore, where he has been spending the duration of the COVID-19 outbreak. In contrast, Reed's experience was even worse. Reed, a JavaScript programmer from Wisconsin, was at his home in the southern suburbs of Boston with his 3-month-old baby, wife and parents-in-law. At 6 a.m., a dozen FBI agents and police officers knocked on the door with guns drawn and handcuffed him to a chair in the living room. Reed was taken to a federal building downtown and spent about 10 hours alone in a dank basement cell with his ankles handcuffed.

In February 2022, Hayes changed his plea, most likely because of the threat of prison. U.S. Attorneys for the Southern District of New York told the court that BitMEX was a “tool for money laundering and criminal activity” that conducted more than $200 million in suspicious transactions; it failed to report any of the transactions to the government as required. In one case, Hayes unfrozen the account of a suspected hacker, allowing them to withdraw potentially stolen bitcoin, the government said. Prosecutors wrote that because the company did not ask traders for identity details, "there is a risk that criminal activity on BitMEX will never be discovered."

Prosecutors asked the court to impose a "significant prison sentence" on top of the six months to one year suggested by the sentencing guidelines, Hayes told the court in a contrived tone: "While I have a lot to be proud of in terms of my achievements at BitMEX, I I deeply regret my involvement in this criminal activity." Hayes' attorney submitted testimony from friend, family dentist and former Goldman Sachs partner and hedge fund manager Mike Novogratz, who is now a partner at Galaxy Investment. Mike Novogratz wrote: "No one should ever forget that Arthur was a young, successful black man, and this country and industry need more of them." In May, the judge upheld the lower limit of the sentencing guidelines, allowing Arthur to escape entirely past the prison term.

How Hayes felt after his arrest

When I asked him why he was prepared to tell his story, Hayes said, "Even if the blow happens, keep going." When I asked him to talk about his regrets, he refused: "If you sit here and dwell on the past, you're going to be miserable. And I mean, I'm still here. I won't go anywhere."

“Obviously there are a lot of limits to what I can say,” Hayes added, adding that in order to prevent him from further irritating the government, Hayes hired a lot of expensive legal and PR consultants, one of whom monitored all our conversations via Zoom, whenever my questions approached When in "dangerous" territory, he would interrupt. Finally, when you ask Hayes to talk about a low point in his life? "Probably the most unpleasant thing to do is sit in a management meeting and deal with other people's problems," he says. "When I come into the office sometimes, I leave the door open, but I don't want to do that." Temperamentally, he's better suited to be a Writer, not a CEO.

Hayes said that when he left the United States, he may never return. “I hardly ever plan to go back to America,” he says. He only makes complaints about jet lag, American food, etc., but there is a sense that he has come to despise his home country on a deeper cultural level.

He has spent the past six weeks in Hokkaido. He prefers to ski alone, in neon-colored gear, and enjoy the tranquility of a solitary gondola. "I don't know if I have a general vision for the future, but it's about surviving and not losing people's bitcoins," he said one morning. Hayes insisted he didn't like the FTX debacle and what it gave to all crypto The shadow cast by money. “I don’t want that to happen, it’s not an ideal situation for us,” he said. He also cautioned that FTX overtook BitMEX because of Bankman-Fried’s alleged fraud. “We let someone come into our house and take the money we were supposed to be making, and if Sam was a backstabber, that’s why they beat us — it wasn’t. We beat ourselves.”

Reed is more explicitly bullish on the possibility of BitMEX regaining some market share. "Let's call it a comeback," he said. Hayes has publicly resigned from the company amid his legal battle, saying he is now just a board member with no plans to retake the CEO job (according to people familiar with his actions). , who still controls BitMEX behind the scenes). “When they pleaded guilty, Arthur acted very aggressively, and it was clear that he just wanted BitMEX back — back to the way it was before,” one of the people said.

However, at present, BitMEX is still going downhill. It has undergone two rounds of layoffs in the past year. The chief executive appointed to replace Hayes, who was fired in October and is now suing the company in Singapore for wrongful dismissal, is now chief financial officer Stephan Lutz.

Original link