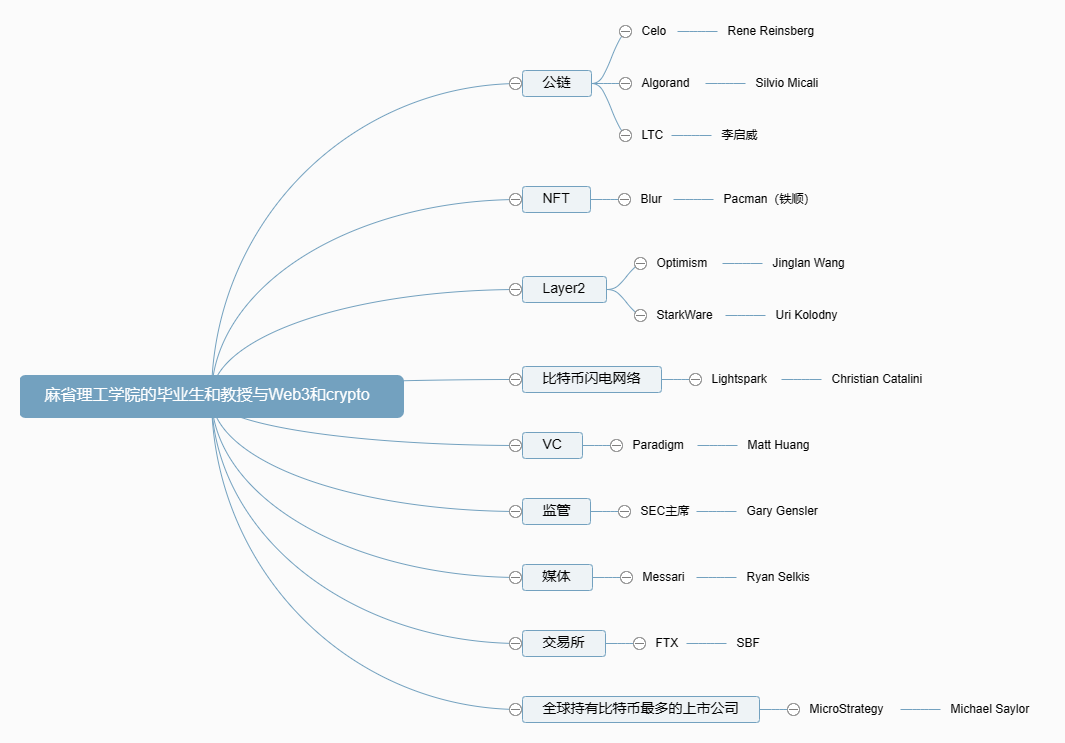

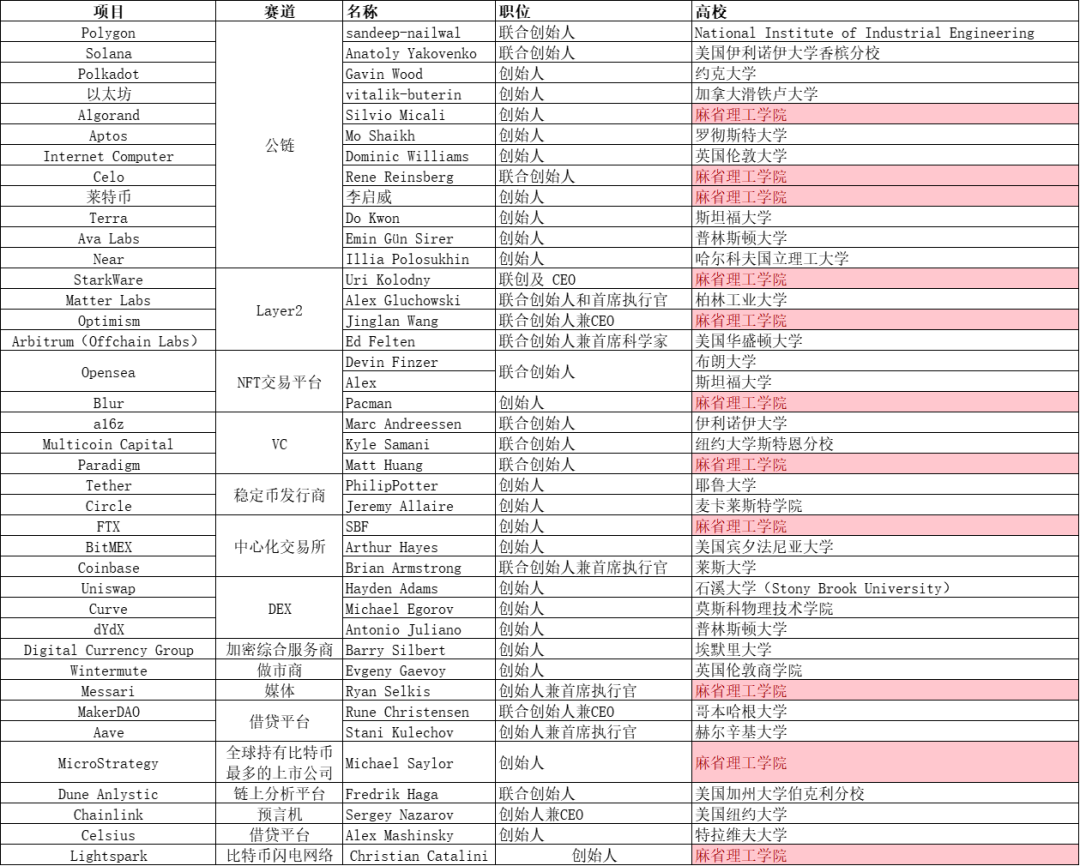

Inventory of 12 top Web3 talents from MIT

On February 22, the founder of the NFT trading platform Blur disclosed his identity and studied at the Department of Computer Science of the Massachusetts Institute of Technology.

In addition to the NFT trading platform, graduates and professors from the Massachusetts Institute of Technology (MIT) have a place in multiple tracks of Web3 and Crypto such as public chains, exchanges, VC, media, and Layer 2.

SEC Chairman Gary Gensler

Gary Gensler served as Chairman of the Commodity Futures Trading Commission (CFTC) from 2009 to 2014 and began teaching at the Massachusetts Institute of Technology in 2018. He is Professor of the Practice of Global Economics and Management at the MIT Sloan School of Management, including a Courses for Blockchain and Currencies. He is also a senior advisor to the Digital Currency Initiative at the MIT Media Lab.

In 2018, Gary Gensler introduced blockchain technology at MIT

On April 17, 2021, Gary Gensler was sworn in as SEC Chairman.

As the most cryptocurrency-savvy SEC chairman in history, Gary Gensler has high hopes for cryptocurrency people when he takes office. It is speculated that the Bitcoin ETF, which has been delayed before, will be passed soon, and the lengthy lawsuit between the SEC and Ripple will soon be settled. Finished.

Regrettably, the above expectations should appear to be in vain at present.

Gary Gensler's view on cryptocurrencies is: BTC is a commodity and should be regulated by CFTC. Most of the remaining crypto assets are securities, crypto exchanges are stock exchanges, and both the issuer and the exchange are obliged to register with the SEC. This makes the legal basis for the SEC to regulate cryptocurrencies to follow the securities law, but there is currently no precise definition of which cryptocurrencies are securities.

How effective is Gary Gensler's regulation of cryptocurrencies?

During Gary Gensler’s tenure, there were many incidents such as the thunderstorm of Luna, the bankruptcy of Three Arrows Capital, the bankruptcy of Celsius, Voyager and other lending platforms, and the bankruptcy of FTX. These incidents caused unprecedented harm to investors.

Gary Gensler's work has also caused dissatisfaction with some people. For example, U.S. Congressman Tom Emmer accused Gary Gensler of collecting encryption company information as random and unfocused, and refused to provide Congress with the requested information, causing Congress to miss events such as Terra and FTX. investigation.

On February 10, the SEC ordered the encryption exchange Kraken to "immediately" end the encryption pledge-as-a-service provided to US customers, and will pay a $30 million fine to the SEC. Prior to this, the SEC had ordered the encrypted lending platform Nexo to stop providing financial services to all U.S. customers, including citizens and residents.

Gary Gensler’s explanation: Whether through staking as a service, lending, or otherwise, cryptocurrency intermediaries are required to provide appropriate disclosures and protections required by securities laws when offering investment contracts in exchange for investors’ tokens.

This explanation is not satisfactory. SEC Commissioner Hester Peirce said that the SEC's punishment of Kraken is a "lazy" regulatory approach, and pledge guidelines should be issued to guide registration. Nansen founder Alex Svanevik said it would be easy for exchanges to be transparent about their ETH staking without “help” from the SEC.

On February 13, the SEC issued a notice to the encryption company Paxos, saying that the digital asset Binance USD (BUSD) issued and listed by Paxos is an unregistered security that violates investor protection laws. The SEC plans to sue the company.

The SEC's regulatory approach has angered the big guys of cryptocurrency. Ryan Selkis, founder of Messari, said that sensible regulation is very important, and the de facto ban will be ruthlessly attacked. I will spend every ounce of energy and political capital fighting the enemies of cryptocurrency.

Founder of FTX: SBF

Full name is Sam Bankman-Fried. From 2010 to 2014, he studied physics at the Massachusetts Institute of Technology.

After graduating from MIT with a physics degree, SBF worked for 3 years at Jane Street, a quantitative trading firm on Wall Street. In 2017, he started Alameda Research out of a rented house in Berkeley, California. In May 2019, FTX, an exchange focusing on the derivatives trading market, was established in Hong Kong.

The success of FTX is inseparable from the right time, place and people.

Timing: At the end of the year after the establishment of FTX, the global outbreak of the new crown epidemic. In March 2020, the spread of the epidemic caused the financial market to collapse, and the Federal Reserve opened the floodgates. In the ensuing two years, the total amount of money printed in the United States was almost equal to that in the past 40 years. Under the flood, the encryption market ushered in a violent bull market, and FTX skyrocketed.

Geographical advantages: After the "94" supervision in 2017, mainland China has completely prohibited entities operating virtual currencies. Singapore and Hong Kong have emerged as gathering places for cryptocurrency players.

Renhe: The narrative of FTX and the image of white Wall Street elites created by SBF are very pleasing among elites, from BlackRock, the world's largest asset management company, Ontario Teachers' Pension Fund, the third largest pension fund in Canada, and Singapore's state-owned investment institution Temasek, Sequoia Capital, Softbank, Tiger Global Fund, Multicoin, Paradigm, Coinbase Ventures and other institutions have raised more than US$3.2 billion in financing, with a valuation of US$32 billion, making it the fastest growing cryptocurrency company in history.

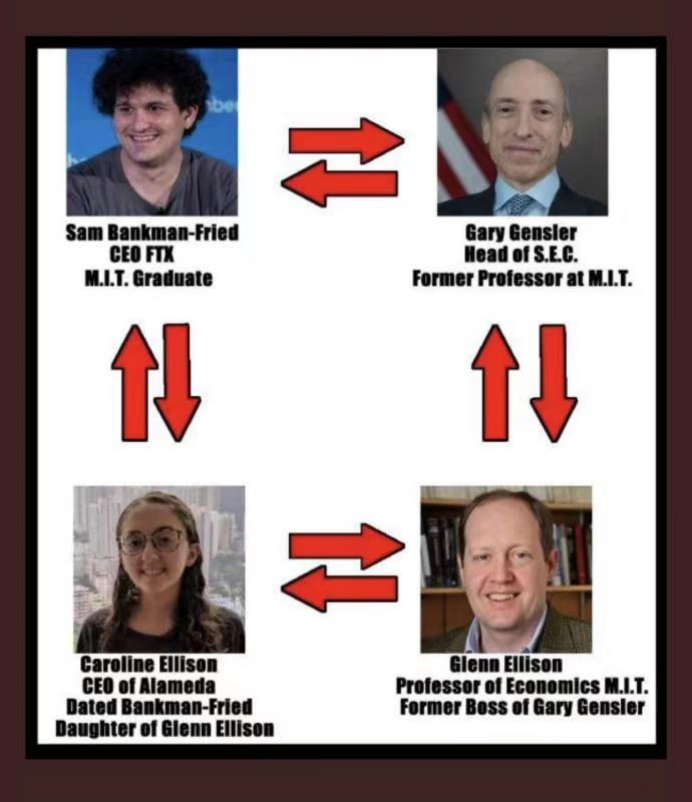

Of all the “harmony,” however, the relationship between SBF and SEC Chairman Gary Gensler has been on the nerves of melon eaters since the FTX bankruptcy. To put it simply, both SBF and Gary Gensler are from MIT, one graduated from MIT, and the other taught at MIT. Caroline is the CEO of another SBF company, Alameda. Her father, Glenn Ellison, is a professor and director of the MIT School of Economics and Gary Gensler's immediate supervisor at MIT.

After FTX went bankrupt, thousands of people petitioned the US Congress to investigate the relationship between Gary Gensler and FTX founder SBF. Gensler met with SBF before FTX went bankrupt. Gensler may have helped SBF and FTX gain regulatory monopoly status through a legal loophole, the whistleblower said.

Founder of Blur: Pacman (Tie Shun)

Pacman is the pseudonym of Tieshun Roquerre.

From 2016-2018, Pacman majored in mathematics and computer science at MIT.

In 2022, Pacman anonymously founded the NFT trading platform Blur. In March 2022, Blur completed an $11 million seed round of financing, led by Paradigm.

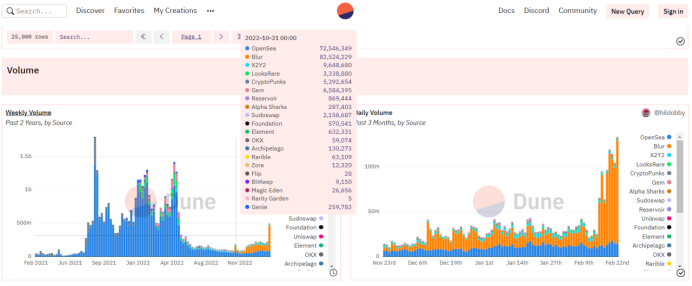

Before the emergence of Blur, Opensea's absolute dominance over the NFT trading market was unshakable. Although x2y2 and LooksRare attempted to stage Sushiswap's "vampire attack" on Uniswap by issuing coins, they all failed.

On October 20, 2022, Blur will be officially launched. According to Dune Analytics data, on October 31, Blur's weekly transactions have surpassed Opensea. Prior to this, no trading platform's weekly trading volume had reached 1/2 that of Opensea. On February 22, Blur had a daily trading volume of $115 million, while Opensea had less than $15 million.

Pacman's ability to execute has been amazing, taking himself and Blur from nothing to hero in just 3 months.

However, just like the "DeFi god mines" that have sprung up with token rewards after the previous DeFi summer, what will happen when Blur's token rewards are reduced or exhausted? This analysis by Delphi Digital researcher Teng Yan is worth reading.

Founder of Optimism: Jinglan Wang

Jinglan Wang is currently the only female founder behind a project with a market value of tens of billions of dollars in the Web3 field.

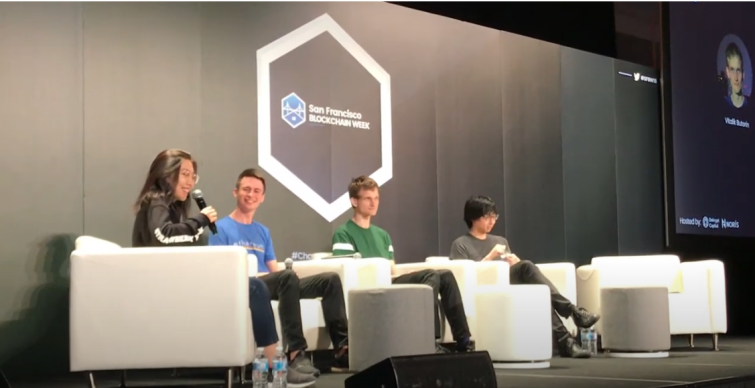

2018 San Francisco Blockchain Week Jinglan Wang moderated the conversation

The MIT Bitcoin Club is where Jinglan Wang started his career in cryptocurrency.

Jinglan Wang has served as the chairman of the Wellesley (Wellesley College) Bitcoin Club and the director of the MIT Bitcoin Expo.

Jinglan Wang's obsession with cryptocurrencies is so extraordinary that she even changed her major to study computer science at university in order to better understand cryptocurrencies.

From March 2017 to August 2018, Jinglan Wang served as the executive director of the Blockchain Education Network (BEN), which was founded in 2014 by crypto tycoon Jeremy Gardner and the Bitcoin clubs of colleges and universities across the United States. A non-profit organization for blockchain education.

Jinglan Wang has been studying the scalability of Ethereum since 2015.

In 2019, Jinglan Wang founded the non-profit research organization Plasma Group with Benjamin Jones, Karl Floersch and Kevin Ho. Plasma is the second-layer extension technology of Ethereum, which was proposed by Vitalik and Joseph Poon in 2017.

In January 2020, the Plasma Group announced its transition from a research collective to a for-profit startup called Optimism, backed by $3.5 million from Paradigm and IDEO CoLab Ventures.

This shift to a for-profit startup was initially questioned by outsiders, such as Dragonfly Capital partner Ashwin Ramachandran, who described the shift as "the death of Plasma."

In March 2022, Optimism completed a financing of US$150 million at a valuation of US$1.65 billion. Became a crypto unicorn in 2 years. On June 1 of the same year, Optimism officially launched its governance token OP, and launched an airdrop, and the whole crypto was boiling.

Just yesterday, Coinbase built a new L2 blockchain Base based on OP Stack, and the Optimism token OP bucked the trend and surged, with a market value of more than 10 billion US dollars in full circulation.

Paradigm founder Matt Huang

Matt Huang (Huang Gongyu) studied mathematics at the Massachusetts Institute of Technology from 2006 to 2010.

Matt Huang is best known for investing in Toutiao (later renamed Bytedance) founded by Zhang Yiming at the age of 24. According to an article in 2019 by the public account "Landian Book", Huang Gongyu's return on investment was about 2,000 times, and ByteDance was valued at about 75 billion U.S. dollars at that time.

In June 2018, after resigning from Sequoia Capital, Matt Huang and Coinbase co-founder Fred Ehrsam co-founded crypto venture capital Paradigm.

Matt Huang (right) and Fred Ehrsam

Since the establishment of Paradigm, it has been the head project of almost all subdivided tracks in the Web3 field. Including Blur, the NFT trading platform with the largest trading volume, uniswap, the largest DEX, Optimism, the Layer 2 network with the highest market value, etc. Of course, there are also times when you miss, such as investing in FTX.

Compared with successful investment cases, the most impressive thing about Paradigm is that it will soon be able to implement research capabilities and lead the industry trend.

For example, the NFT artwork Art Gobblers, which became popular in November last year, and the green paper were written by Paradigm researchers, and adopted the Goo token distribution mechanism proposed by Paradigm in September 2022. In May 2021, Paradigm proposed the concept of "perpetual option". Since then, Opyn's research team has launched a perpetual cooperation option product.

Founder of Lightspark: Christian Catalini

From 2014 to 2021, Christian Catalini served as assistant professor and associate professor at the MIT Sloan School of Management, and is the founder of the MIT Encryption Economics Laboratory.

2018 - 2022 Christian Catalini serves as co-founder of Diem/Libra and Chief Economist of Meta FinTech.

During this period, there was also a small story in which MIT researchers accused Facebook of plagiarizing the results of a paper published in July 2018 on the design of Libra.

In February 2022, Diem was sold for approximately $200 million, and Meta's cryptocurrency dreams were shattered.

In May 2022, served as co-founder and chief strategy officer of Lightspark.

Additionally, he currently serves part-time as an economic advisor for Algorand, a technical advisor for Chainlink Labs, and an advisory board for Coinbase Research.

Messari founder Ryan Selkis

Ryan Selkis attended the MIT Sloan School of Management in 2013-2014, earning an MBA.

In January 2018, Ryan Selkis founded Messari to build research tools for crypto businesses and professionals.

In September 2022, Messari received $35 million at a valuation of $300 million.

MicroStrategy founderMichael Saylor

Michael Saylor studied aeronautics and aerospace at the Massachusetts Institute of Technology from 1983 to 1987, and founded the business intelligence company MicroStrategy after graduation. In 1998, MicroStrategy went public on Nasdaq.

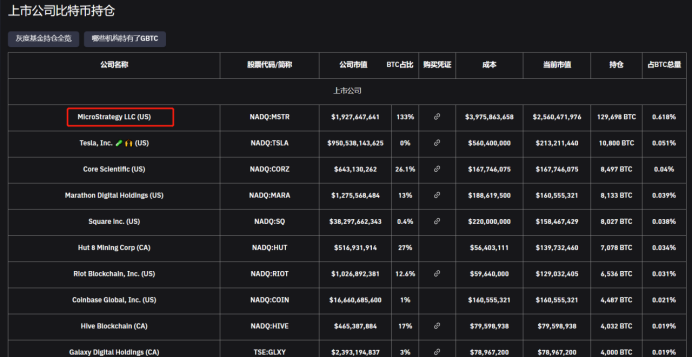

In July 2020, MicroStrategy made its first Bitcoin purchase. According to coinglass data, MicroStrategy currently holds 129,600 BTCs, making it the listed company with the most BTCs.

Tesla followed closely behind. Tesla's purchase of Bitcoin has something to do with Michael Saylor. In December 2020, Musk tweeted about the feasibility of buying bitcoin in large quantities. Michael Saylor suggested that Tesla convert its balance sheet from USD to BTC.

In February 2021, Tesla submitted an announcement to the SEC that Tesla had purchased $1.5 billion worth of Bitcoin.

Uri Kolodny, Co-Founder and CEO, StarkWare

From 1998-2000, Uri Kolodny was an MBA student at the MIT Sloan School of Management.

From November 2017 to present, Uri Kolodny is the co-founder and CEO of StarkWare.

In May 2022, Starkware announced that it had raised $100 million at a valuation of $8 billion. Investors include institutions such as Paradigm, Sequoia Capital and Pantera Capital, as well as Vitalik.

Rene Reinsberg, founder of Celo

Rene Reinsberg studied for an MBA at the Massachusetts Institute of Technology from 2009 to 2011 and is the founder of the MIT Entrepreneurship Center.

Since 2020, Rene Reinsberg has served as the chairman of the Celo Foundation.

Litecoin founder Li Qiwei

In 1999, Li Qiwei graduated from the Massachusetts Institute of Technology.

In 2011, Li Qiwei created Litecoin after modifying the Bitcoin code.

The encrypted world will never lack the pursuit of meme. Under the marketing slogan of "Bit Gold, Lite Silver", Litecoin has gained a firm foothold in the encrypted world. Thousands of altcoins that appeared during the same period faded away in subsequent waves, while Litecoin miraculously weathered every trough.

In 2018, Li Qiwei liquidated Litecoin at the high price of Litecoin, and part of the funds obtained were donated to the Litecoin Foundation and MIT's digital currency program.

Algorand founder Silvio Micali

Since 1983, Silvio Micali is a professor at MIT's Computer Science and Artificial Intelligence Laboratory (CSAIL).

In 2012, Silvio Micali won the Turing Award, the highest award in the computer industry, together with Berkeley alumnus and MIT colleague Shafi Goldwasser.

first level title

Why MIT?

According to incomplete statistics, among the leading Web3 projects, entrepreneurs from MIT account for the largest proportion among all universities.

first level title

Massachusetts Institute of Technology (MIT) Digital Currency Initiative

Launched in 2015, the program was initiated by the MIT Media Lab with the participation of MIT faculty and students. Members include the MIT Bitcoin Club, the MIT Bitcoin Project, and Bitcoin Expo.

The group's hires include former White House senior adviser on mobile and data innovation Brian Forde and current SEC chairman Gary Gensler.

secondary title

secondary title

Official website:

https://sloangroups.mit.edu/blockchain/home/

MIT Bitcoin Club

A student organization at MIT, one of the earliest blockchain clubs in the world, organizes weekly meetings for mutual education and discussion, hosts hackathons and co-organizes the annual MIT Bitcoin Expo.

secondary title

Official website:

https://bitcoin.mit.edu/

MIT Bitcoin Expo

Founded in 2014 and hosted by the MIT Bitcoin Club, the MIT Bitcoin Expo is the earliest blockchain-related conference among all universities. It started with discussing Bitcoin, and later expanded to include L1 and L2 infrastructure, privacy, regulation and governance, and decentralized applications as the industry developed.

This year's MIT Bitcoin Expo will be held on April 22-23. Speakers include Litecoin founder Li Qiwei, Nym CEO Harry Halpin, Lit Protocol founder David Sneider, etc.

secondary title

https://www.mitbitcoinexpo.org/

Blockchain Course

MIT is one of the first universities in the world to offer blockchain courses.

In 2015, the MIT Media Lab announced that it would create a digital currency course to inspire the next generation of bitcoin talent.