Detailed explanation of Spark Protocol: a man named Sam wants to help MakerDAO do things

On February 9th, two things worth noting happened in the DeFi market.

First, the development team Phoenix Labs initiated a proposal at the MakerDAO Governance Forum, suggesting to build a new project Spark Protocol around MakerDAO. The first product will be Spark Lend, a decentralized lending market centered on DAI.

The second is that Aave's over-collateralized stablecoin GHO has finally launched the Goerli test network, which will allow developers and potential adopters to access the code base and test how GHO works.

As a leading project in the two major DeFi segments such as stable currency and lending,MakerDAO and Aave "coincidentally" chose to expand to each other's firmly controlled positions on the same day, which added some smoke to the DeFi market, which has been busy competing with each other recently.(Speaking of which, DeFi leaders have recently engaged in a "one-to-one collaboration", and it feels better to pull Uniswap and Curve to engage in a "1 vs 1 battle".)

Regarding the details of Aave GHO, there have been many interpretations on the market, so I won’t repeat the wheel here. Interested readers can directly search for keywords in the Odaily site to read.

In today’s article, I mainly want to talk to you about Spark Protocol, a new MakerDAO ecological project disclosed to the outside world for the first time.

What exactly is the Spark Protocol trying to do? What are the advantages of its products compared with mainstream lending agreements such as Aave on the market? How does this project relate to MakerDAO? What benefits can it bring to the MakerDAO ecology? We will attempt to answer these questions in turn below.

Endgame Plan, Maker's Expansion Dream

Before explaining Spark Protocol, we need to look back to June 2022. At that time, MakerDAO co-founder Rune Christensen released a landmark proposal in the community, the so-called "Endgame Plan" (The Endgame Plan, see "The largest reorganization in the history of Maker, DAI may decouple from the US dollar in the future》)。

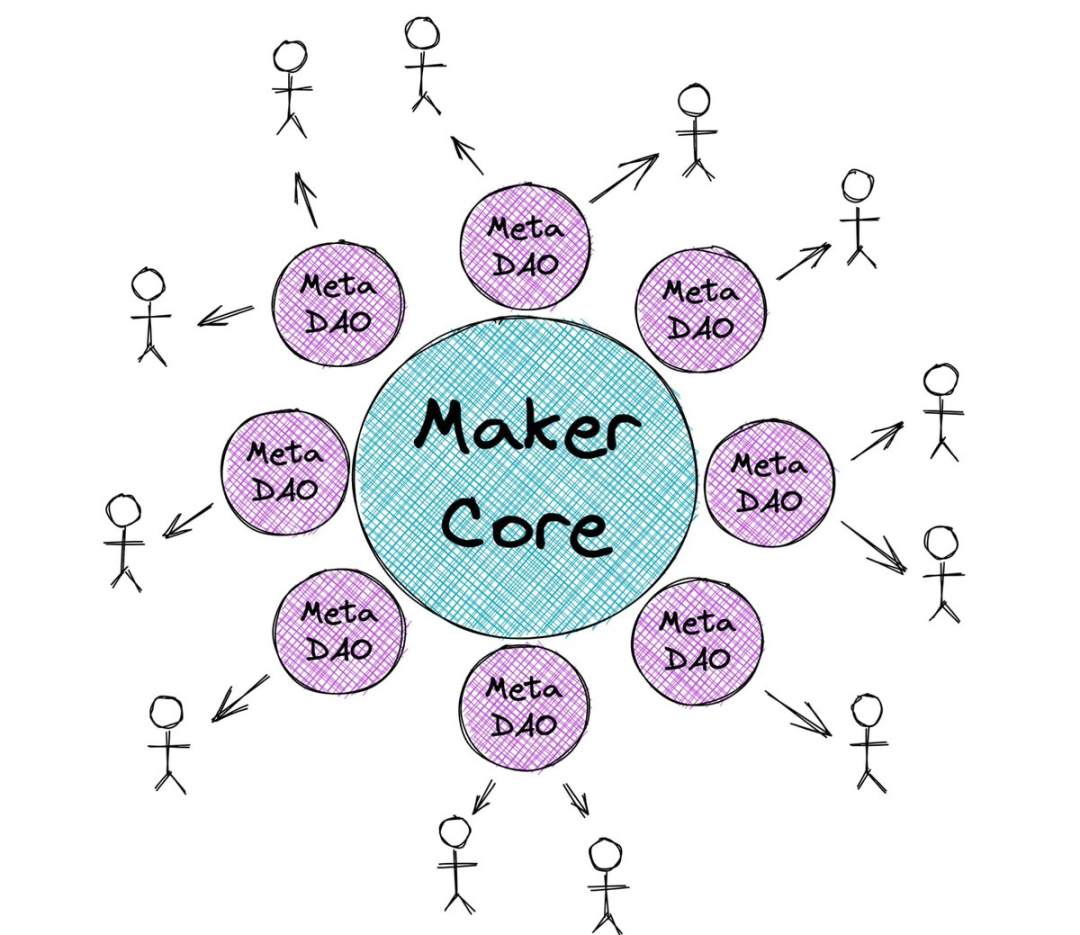

The main content of the Endgame Plan is,It is recommended that MakerDAO create multiple sub-governance modules called MetaDAO (the two words look a bit similar, so you have to look carefully) under Maker Core, so as to reduce the complexity of the entire MakerDAO governance system and completely solve the "governance" that plagues the project. Deadlock" problem.

As a pioneer of the decentralized financial revolution, MakerDAO has gone through multiple rounds of market ups and downs with a steady pace, and has gradually grown into a cornerstone project of the DeFi "tower". In order to maintain the stable operation of the project, MakerDAO has formulated a large and complex governance system, but in turn, this somewhat "cumbersome" system limits the pace of MakerDAO's outward expansion.

A typical example is MakerDAO's struggle in the direction of real world assets (RWA). Rune believes that MakerDAO's existing governance system simply cannot meet the needs for efficient processing of real-world assets, let alone compete with those top traditional financial institutions.

When the time comes to 2023, almost all major DeFi leaders have embarked on the road of business expansion, Aave and Curve pointed their finger at MakerDAO’s stronghold stable currency, Uniswap also started NFT, even SushiSwap, whose money bag has been deflated, has explored lending business (now cut off), but MakerDAO has been trapped in its own One-third of an acre of land. Although the stablecoin business is indeed profitable, being too Buddhist often means being forced into a defensive position, which is not conducive to the long-term development of the protocol.

The MetaDAO proposed by Rune aims to solve this problem.Under the vision of the Endgame Plan, in the future MakerDAO will touch different business areas through multiple sub-communities MetaDAO. Each MetaDAO will have its own tokens, treasury (which will still be controlled by Maker Core) and governance system, and will Only focus on the direction of your business without being distracted by other responsibilities.

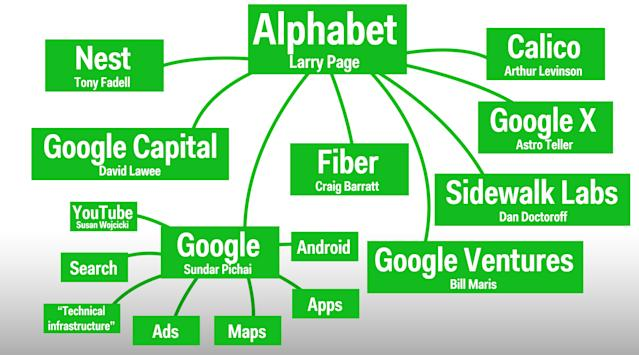

This is like the structure of traditional Web2 such as Google, Alphabet (similar to MakerDAO) plays an overall role, and specific businesses are executed by different subsidiaries (similar to MetaDAO) such as YouTube, Maps, and Android.

Reflected in MakerDAO's vision, all major businesses under its umbrella will operate independently for MetaDAO in the future, such as the RWA mentioned above,The Spark Protocol proposed by Phoenix Labs this time is a MetaDAO that focuses on lending.

Spark Lend, build a killer app with interest rate advantage

The predecessor of Phoenix Labs was Crimson Cluster. The development team first posted on the MakerDAO governance forum in October last year, a few months after Rune proposed the Endgame Plan.

The founder of the development team is Sam MacPherson, who previously worked on MakerDAO's engineering team. (SBF and OpenAI founder Sam Altman have smashed the technology circle one after another, this name always makes me feel a little magical now...)

According to Phoenix Labs' proposal, the first product of Spark Protocol will be Spark Lend.Spark Lend is a decentralized lending market built on the open source code of Aave v3—— In order to express its contribution to Aave's open source work, Spark Lend has proposed in the Aave community to share 10% of the net profit in the first two years with the community (if the behavior of donating money fails, there will be ghosts).

Regarding Spark Lend, its general operating mode is the same as that of lending markets such as Aave and Compound, but there are several key differences in details.

One is that Spark Lend will focus on DAI, which means that the market will most likely only serve DAI in terms of stablecoins in the future, thereby improving the market competitiveness of DAI at the scene level.

The second is that Spark Lend will only support five high-value, high-liquidity assets such as DAI, ETH, wstETH, WBTC, and Savings DAI (DAI in the DSR) as collateral, giving up support for some relatively long-tail assets ( This may be a lesson learned from the Aave CRV bad debt incident). In addition, in order to further consolidate security, Spark Lend will initially set a debt limit of US$200 million.

Thirdly, and most importantly,Spark Lend will support users to lend DAI at the deposit rate of DAI in the DSR contract. Since this figure is currently 1%, it means that if Spark Lend can be launched immediately, the borrowing rate of DAI in its market will be only 1%.

Odaily Note: For the operation mechanism of DSR, you can read this articleMakerDAO Multi-Collateral Dai (MCD) System White Paper: Functionality and GovernanceThe "DAI Savings Rate (DSR)" section in .

That's a pretty scary number,The 1% borrowing rate means that Spark Lend can provide the highest borrowing efficiency on the market.In contrast, the current USDC borrowing rate of Aave v3 on Ethereum is 2.2%; the USDC borrowing rate of Compound v3 is 4.18%. Even after subtracting the 2.48% liquidity mining income that can be used as a hedge, the final calculated interest rate is 1.7%.

The advantage of capital efficiency is not only a sharp tool for Spark Lend to accumulate liquidity, but also will greatly stimulate the market demand for DAI, which will not only help Spark Lend challenge the existing lending giants, but also promote the pace of MakerDAO's business expansion.

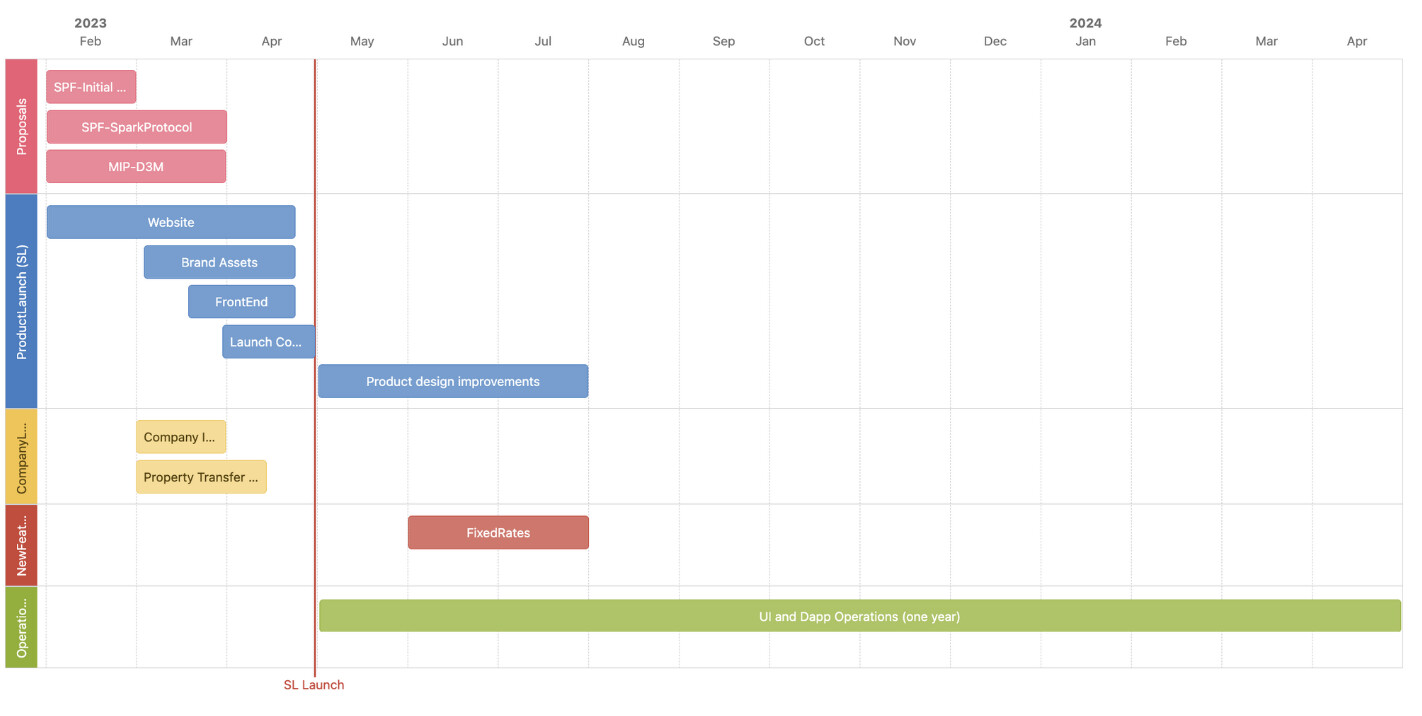

According to the roadmap given in the Phoenix Labs proposal, Spark Protocol will have four major upgrade directions in the coming year.

One is to provide fixed-rate services with the help of protocols such as Deco, Sense Finance, and Element Finance, which are expected to be released in the second half of this year.

The second is to explore a multi-oracle support solution. Spark Lend will support Chainlink in the initial stage of launch, but will add support for Chronicle (formerly Maker Oracles) through an upgrade later this year to prevent a single oracle due to violent market fluctuations. A brief failure condition occurs.

The third is cross-chain deployment. In the future, Spark Lend will deploy its products on major Layer 2 and side chains, and use MakerDAO's DAI cross-chain transmission infrastructure Maker Teleport to meet users' cross-chain needs.

Fourth, and most importantly, Spark Lend will add support for EtherDAI, MakerDAO's ecological liquidity pledge token, in the future. Regarding EtherDAI, when Rune proposed the Endgame Plan, he emphasized that this will be an important part of MakerDAO's future business. Phoenix Labs also believes that with the upcoming upgrade of Ethereum Shanghai, the best time to support EtherDAI has come, which will greatly enrich the usage scenarios of EtherDAI.

Combined with the content of the Phoenix Labs proposal,secondary title

What does this mean for MakerDAO?

As mentioned earlier, Spark Protocol will operate as one of the MetaDAO under Maker Core in the future, so it is bound to be firmly bound with the entire MakerDAO ecosystem, and then help the latter capture more value.

First of all, purely from the perspective of the composability of DeFi, the interest rate advantage of Spark Lend can greatly stimulate the market demand for DAI, which will help the latter's circulating supply increase.

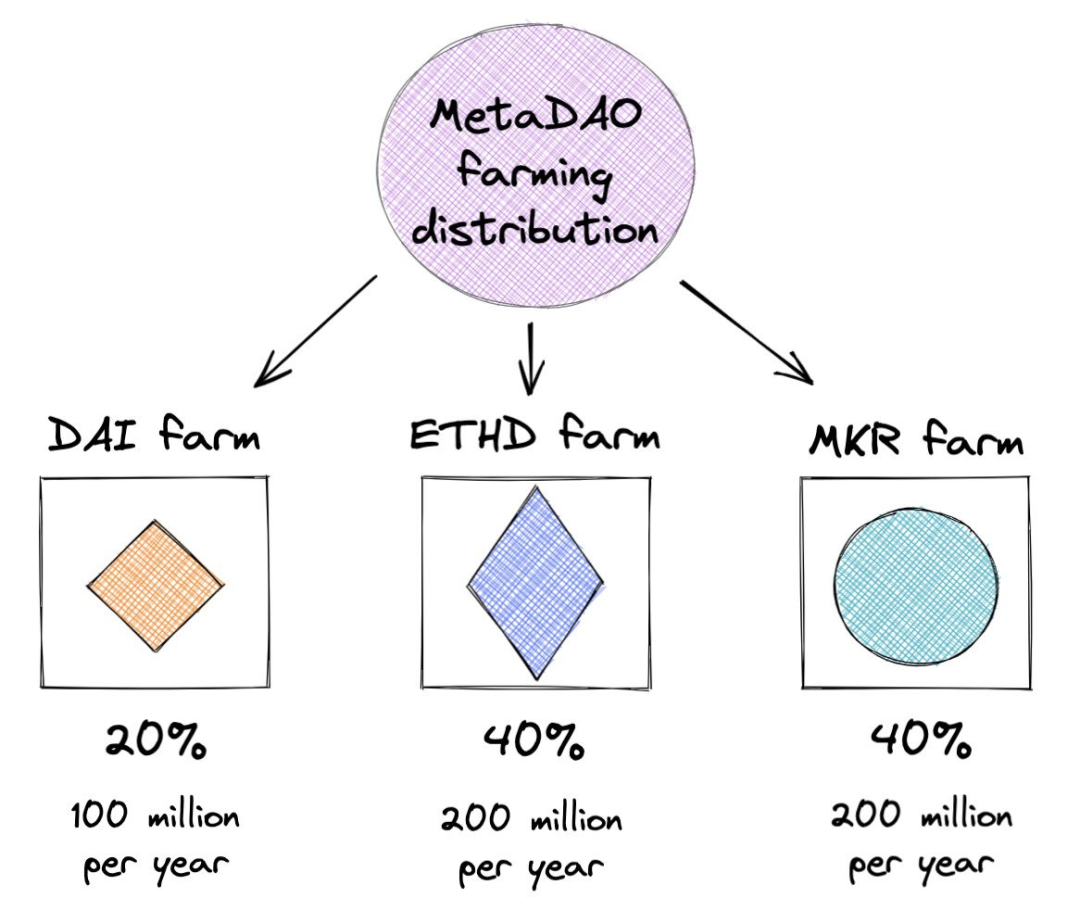

Secondly, from the perspective of tokens, Spark Protocol, as MetaDAO, will also issue its own tokens. According to the planning of Endgame Plan,Each MetaDAO token will be gradually distributed to the MakerDAO community through liquidity mining, of which 20% will be allocated to the DAI pool, 40% will be allocated to the ETHD (ie EtherDAI) pool, and 40% will be allocated to the MKR pool.

this means,The MakerDAO community will benefit from the release of the Spark Protocol, and ecological tokens such as MKR, ETHD, and DAI will also receive new empowerment. In the foreseeable future, with the launch of more MetaDAOs, tokens such as MKR are even expected to become necessary "shovels" for mining new potential projects.

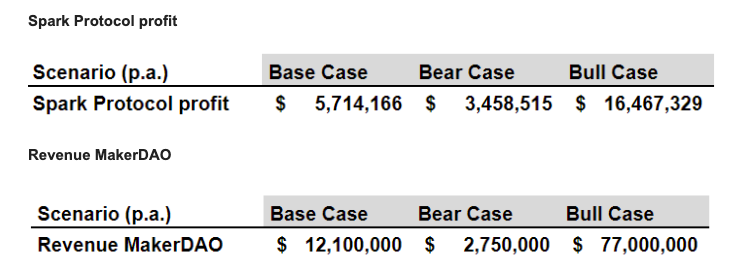

Finally, and most directly,Since the treasury of each MetaDAO is controlled by Maker Core, Spark Protocol's protocol revenue will also directly become MakerDAO's protocol revenue.Phoenix Labs imagined three different market environments in the proposal, and evaluated the annual income level that Spark Protocol can bring to MakerDAO under different conditions.

When the protocol TVL and utilization rate are both in the middle of the market (Base Case), the profit of Spark Protocol is about 5.71 million US dollars, and the income returned to MakerDAO is about 12.1 million US dollars;

When the protocol TVL and utilization rate are both in a poor state (Bear Case), Spark Protocol's profit is about 3.46 million US dollars, and the income returned to MakerDAO is about 2.75 million US dollars;

secondary title

DeFi old king to new narrative

From Rune's Endgame Plan to Phoenix Labs' proposal to create Spark Protocol, in less than a year, MakerDAO's narrative is quietly undergoing earth-shaking changes.

With the landing of MetaDAO one after another, such as Spark Protocol, the MakerDAO ecosystem will gradually transition from a "single-layer dual-token system" to a "two-layer multi-token system" in the future.This will also gradually break the market's current cognitive limitations on MakerDAO and bring greater room for imagination. After all, nothing in this industry can be more exciting than increasing the "market dream rate".

The old king of DeFi is embarking on a new journey.