Arthur Hayes: Can't always wait for the perfect setup, time to get in

Author: Arthur Hayes

textOriginal compilation: Ehan,

Wu said blockchain

first level title

Living in the moment

We moderns engage in many activities and are more present in the moment. In a global society addicted to endless internet-connected devices, mental clarity and inner peace have become extremely important.

One way I keep my mind clear and present is by skiing. As regular readers know, I'm an avid skier. In a dense forest, add a steeper slope with a few feet of fresh snow and I'm in heaven. While this setup brings me pure joy, it's not without risks.

Downhill fast in the woods requires 100% concentration. If your concentration is a little relaxed, you may find yourself playing the age-old game of man and tree. At my speed, the tree always wins - hitting my ass is the best outcome.

Last week, during a cat-ski, I learned a lesson. cat in the snow field means snow groomer, and snow cat skiing refers to riding a snow cat up the mountain. The resort I'm at can only be accessed by a snow cat. The resort features a snow bowl called the E Bowl. After reaching the top of the snow bowl, move for 5 to 10 minutes before dropping into deep snow. I chose my path, I threw myself into it, and I loved life.

The gullies in the snow bowl are full of wind-blown rolling slopes that are fun to jump off. As I skate to meet the rest of the group I'm skiing with, I take my mind off my current skiing assignment and start thinking about the cold beer and burger I'm having for lunch. As I approached what I thought was an ordinary mound of soft powder, I looked down and saw dirt. It was a crack in the snow. I jumped up quickly, then pushed my skis and legs forward like a long jump in order to grab the other side of the crack.boom. . . I slammed awkwardly into the opposite snowdrift, using my momentum to roll over my skis. I almost fell into the crack. If I fell into a crack, I could break my skis, I could sprain my knee, at best it would end my day, at worst it would end my season. All because I wasn't paying 100% attention to my current skiing mission.financial market forecasting

made a similar mistake in .

first level titleyou can sellin my last post

"Inflatable castle"

In , I set out my views on the scenarios the Fed might turn to. I fear the Fed will veer because of dysfunctional markets. If the Fed does decide to flip the "money printing machine" switch, there will be a nasty correction in the prices of all risky assets, including cryptocurrencies, before this action is taken.

One day last week, as I was relaxing in the cable car, I chatted with my wannabe K-pop star hedge fund bro. I asked him what he thought of the Fed's recent meetings and policy decisions. He thought it was super dovish and revealed he was fully invested in the market. In December, he decided to get out of T-bills and go long stocks.

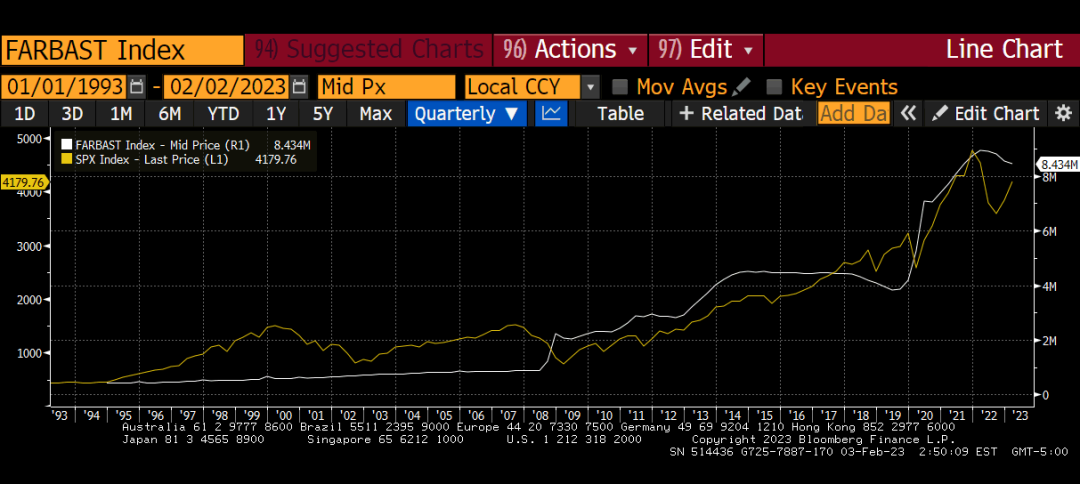

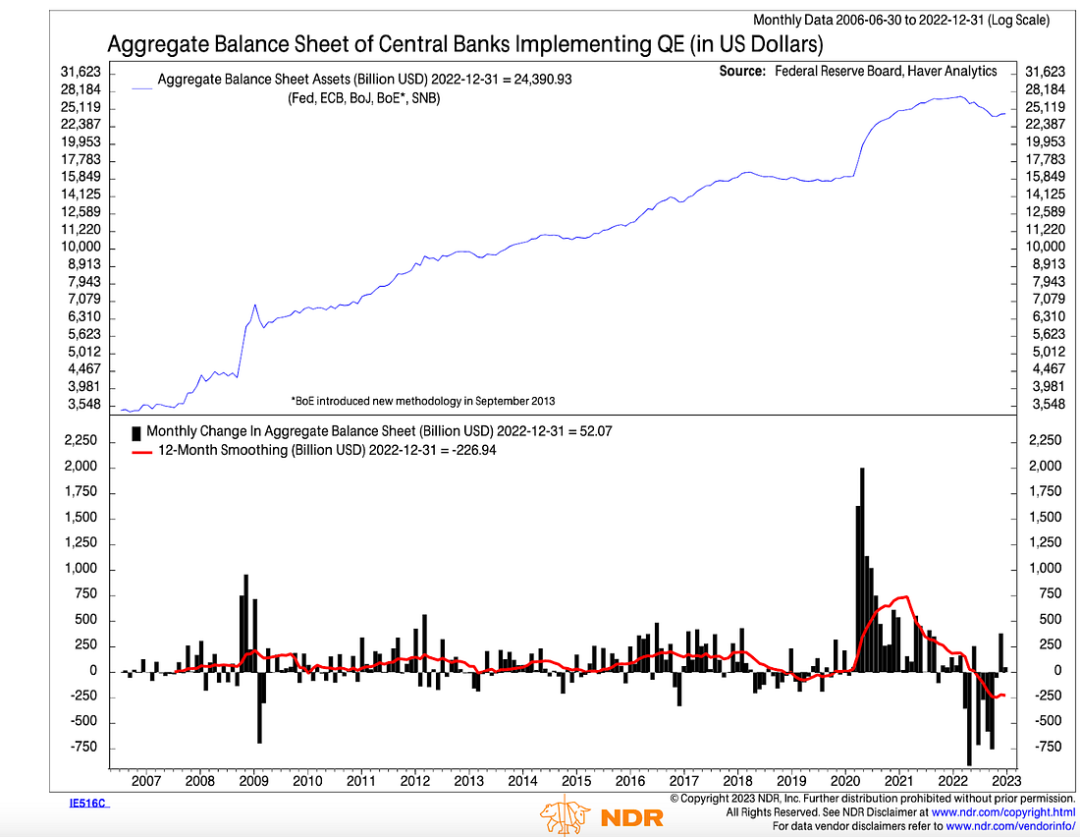

I asked him if he was afraid of the potential impact of quantitative tightening (or "QT" -- the Fed reducing the money supply and reducing its balance sheet by $100 billion a month). We all know that risk markets move in tandem with the balance sheets of central banks, especially the Federal Reserve.

image description

Fed Balance Sheet (white) vs S&P 500 (yellow)

He said he wasn't worried because he thought the U.S. government's debt ceiling hit would lead to a reduction in the Treasury's total account (TGA). TL;DR: The US Treasury has about $500 billion in the TGA (i.e. its checking account). The U.S. Treasury can roll over maturing debt, but it cannot issue new debt—that is, debt that would increase the total outstanding balance of U.S. Treasury bills, notes, and bonds. So if the Treasury wants to generate new spending, it has to pay for it out of pocket. This means that the Treasury could potentially pump the entire $500 billion of the TGA into the US economy, increasing liquidity in the system and driving up risky asset prices.

His answer hit the point. He sees it as a future issue and he can sell it anytime. But right now - and I totally agree with him - the dollar and global central bank liquidity conditions are in favor of risk assets. So he said he planned to live in the moment and ride this potential wave of short-term monetary easing.

I mulled over what he had said and emailed my banker to start withdrawing money from my money market fund and US Treasury portfolio. All bets on Bitcoin, head to the last port of call in Shitcoin City.

first level title

Is it too late?

It is dangerous to buy Bitcoin when it is already up 50% from its lows. Have markets priced in all the easing for the next few months?

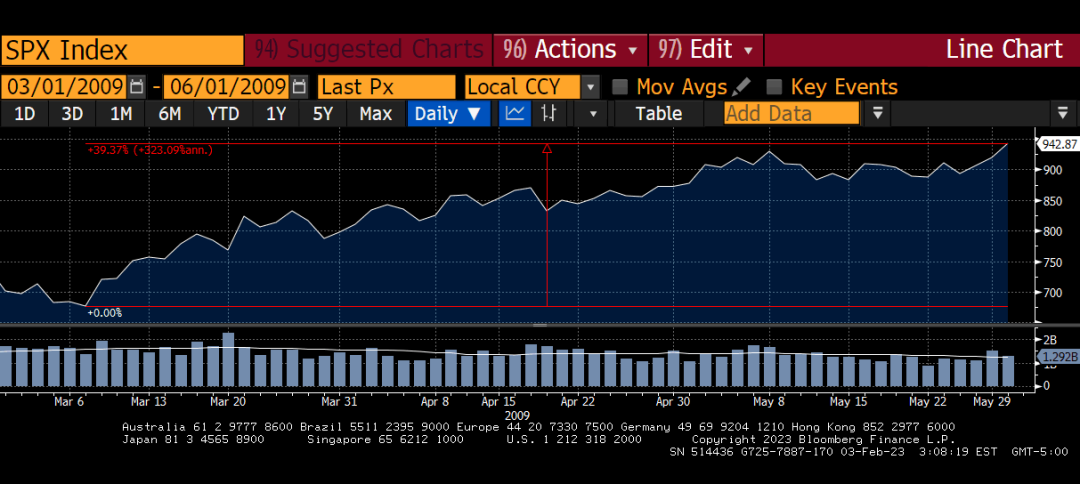

Remember in March 2009, when the Fed started buying bonds as part of its quantitative easing (QE) money-printing operation?

The S&P 500 rebounded 40% from its lows. That's a huge move in just 3 months for the world's most traded stock index. The market is pumping because it expects policy easing to come. If you declined to participate after June 2009 because you thought everything was settled... well, I'm sorry for your loss.

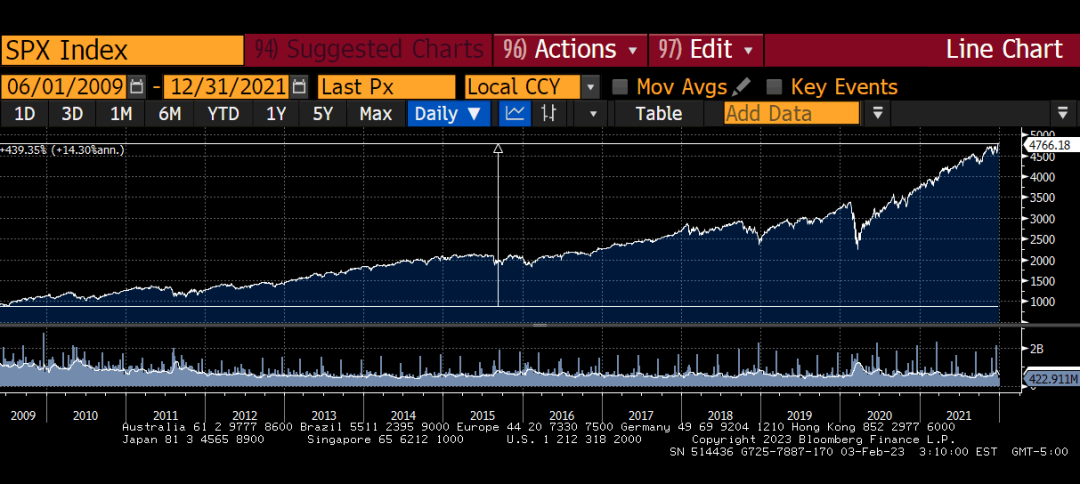

The S&P 500 continued to rise 440% from June 2009 to December 2021. It continues to rally as the Fed continues to provide free money to the market (through quantitative easing).

Likewise, part of my portfolio missed the early innings of Bitcoin's recent rally -- which was also driven by expectations of upcoming monetary easing -- but that doesn't mean I should be stubborn and refuse to participate in the next part of the rally, which Driven by reverse repurchase agreement inflows and (as mentioned earlier) TGA payouts. let me explain.

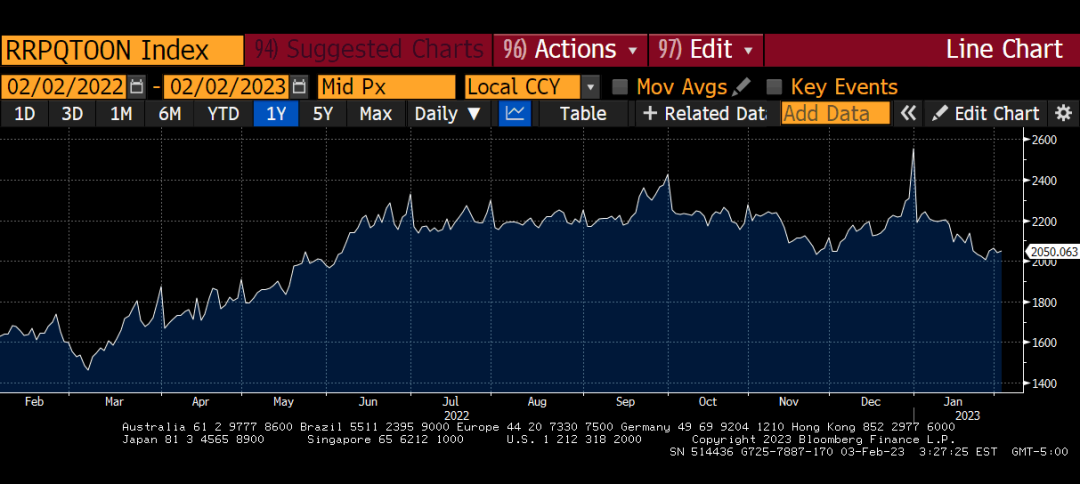

My USD Liquidity Index has three main components: the size of the Fed's balance sheet; the size of the Fed's TGA holdings; and the size of the Fed's reverse repurchase (RRP) facility.

We know that the Fed's balance sheet will shrink by $100 billion a month, which is bad for risk. But at the same time, the Treasury will reduce the TGA to zero as the debt ceiling is hit. TGA is currently about $500 billion. This means that downside in Fed QT over the next 5 months may be offset by TGA spending in the US economy.

Money market funds make up the majority of participants in RRP schemes because it offers a risk-free way to earn income. It's even less risky than holding short-term Treasury bills. That's because the Fed pays interest on RRP balances daily, and T-bills are zero-coupon fixed-income instruments -- and there's always the risk that the U.S. government decides to default. And, given that the difference in yield between the two options isn't huge, the prevailing sentiment is "why take more risk than you need to?" Hence the influx of money market funds into RRP -- when someone like me When people withdraw money from money market funds to invest in the asset market, this causes the RRP balance to decrease, which increases market liquidity and prices naturally rise.

image description

New York Fed overnight reverse repurchase agreement

first level title

party starts

I'm writing an article on how the Bank of Japan (BOJ) is taking money printing to the next level. But for now, all you need to know is that the Bank of Japan seems determined to ensure that hyperinflation takes hold where the sun has set.

As this shift unfolds across the globe, all signs point to "Go Go Go!" - but like everything in the universe, this is a temporary phenomenon.

first level title

scary future

TGA will run out sometime in the middle of the year. Immediately after it runs out, the US will engage in a political circus around raising the debt ceiling. Given that the Western-dominated fiat financial system would collapse overnight if the US government decided to forego raising the debt ceiling and instead default on the assets that underpin it, it is safe to assume that the debt ceiling will be raised. And once the debt ceiling is raised, the US Treasury will have some work to do.

The Congressional Budget Office (CBO) estimates the 2023 US federal deficit will be between $1.1 and $1.2 trillion. The U.S. Treasury must issue bonds to cover the deficit. Given that it can't do so in the first half of the year, that means it has to sell its massive fiscal 2023 debt in half the time.

While the Treasury is busy selling bonds, the Fed's current policy is to continue to reduce its holdings of US Treasuries by $100 billion per month. This is double trouble for risk assets. This would mean that a lot of liquidity is being withdrawn from the market. The question then becomes - if inflation, the US labor market and the US economy in general weaken in the second half of 2023, will the Fed pause rate hikes (or even cut rates) while continuing to tighten monetary conditions through QT?

I also asked my macro dad Felix Zulauf the same question. He acknowledged that financial conditions are loosening and will continue to loosen due to the reduction in TGA. In his view, if Powell is really a follower of Paul Walker and he wants to continue to tighten financial conditions, he should speed up the pace of QT to offset the decline in TGA and RRP. However, he did not change the pace of the Fed's QT, nor did he indicate any change in the pace of QT. (However, if Powell decides to ease financial conditions and accelerate the pace of QT at the next Fed meeting, my optimism will evaporate.)

Regardless, with the Treasury flooding the market with debt and the Fed talking both ways, I'd say this future is negative for risk assets. This means that if you are going to buy risky assets now, you need to be prepared to watch the market closely and be ready to hit the sell button immediately before the TGA drops completely to zero but the debt ceiling.

first level title

next steps

1. Think right

I can't always wait for the perfect setup. It's time to move in.

2. Raise cash

I move some of the liquid fiat I'm willing to risk out of money market funds/short term US Treasuries into USD cash, which I can then quickly deploy into risky assets of my choice.

3. Buy Bitcoin

I will be deploying in the next few days. I hope the size of my bet really matters, it doesn't - so please don't think it will have any noticeable effect on the price of Bitcoin when this happens.

4. Shitcoining together

I believe there's a narrative that's motivating a lot of shitty projects right now. I'll give you guys an update once I've done more research on the shitcoin space - but if bitcoin and ethereum continue to rise, there's sure to be a shitcoin vertical going wild in the next few months.

The key to shitcoining is understanding how they move in waves. First up is the rally in cryptocurrency reserve assets — namely bitcoin and ethereum. The gains from these stalwarts eventually stalled, and prices then edged lower. Meanwhile, the trashcoin complex staged an aggressive rally. Then the shitcoin trend went to zero and interest returned to bitcoin and ethereum. This step-wise process continues until the end of the secular bull market.

5. Relax

Of course, there may be some global political events that trigger a risk-off movement. I have a few in mind and am currently considering how much they would affect the price of Bitcoin if they were bearable. Looking forward to a detailed article conveying my findings as I've been thinking about these questions.