This article sorts out the revenue opportunities of the four major cross-chain protocols: Hop, Synapse, Across, StarGate

Original author:Lucas Campbell

Compilation of the original text: BitpushNews Mary Liu

The future is multi-chain. Whether you think it will happen on multiple L1s like Ethereum, Cosmos, and Solana, or a roll-up-centric future, there is an opportunity to make money by driving these cross-chain transactions.

Chief among these is providing liquidity to top bridging aggregators - such as Hop, Synapse, and Across - and you'll get transaction fee income in return.

Even better, most cross-chain bridges today have launched tokens with liquidity mining plans, providing all liquidity providers (LP) with nice additional benefits.

Interested in taking advantage of this opportunity?

This article focuses on revenue opportunities for four cross-chain protocols: Hop, Synapse, Across, and StarGate.

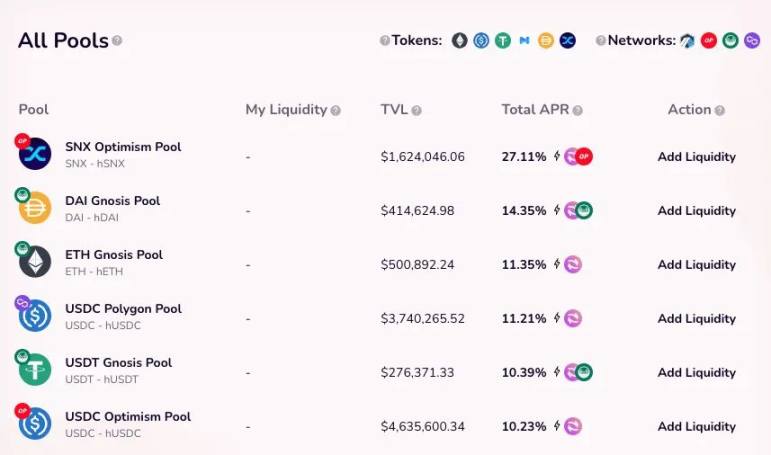

Hop Protocol

Networks: Ethereum, Arbitrum, Optimism, Gnosis Chain, Polygon

Assets: ETH, USDC, USDT, DAI, MATIC, SNX

Yield: 8 - 12% annualized yield

The first major cross-chain bridge is Hop.

Hop Exchange is built on a roll up token bridge that allows users to transfer assets across chains between the main Ethereum layer 2 and sidechains.

The protocol utilizes market makers called Bonders, who earn fees by fueling the liquidity behind these swaps. The bridge currently holds approximately $66 million in locked value and has facilitated billions of dollars in transfers.

After the launch of the HOP token, the protocol implemented a liquidity mining program, issuing 2.2 million HOP per month in the ETH, USDC, DAI, and USDT liquidity pools. The distribution of tokens is based on the transaction volume of each bridge and can be changed through governance.

Interestingly, Hop currently offers some mining pools with multi-asset rewards. The first is the SNX bridge, which is jointly incentivized by HOP and OP, providing LP with an annualized rate of return of 28%.

Two other notable pools are the DAI and USDT Gnosis pools, LPs of these stablecoin pools earn both HOP and GNO in the rewards program.

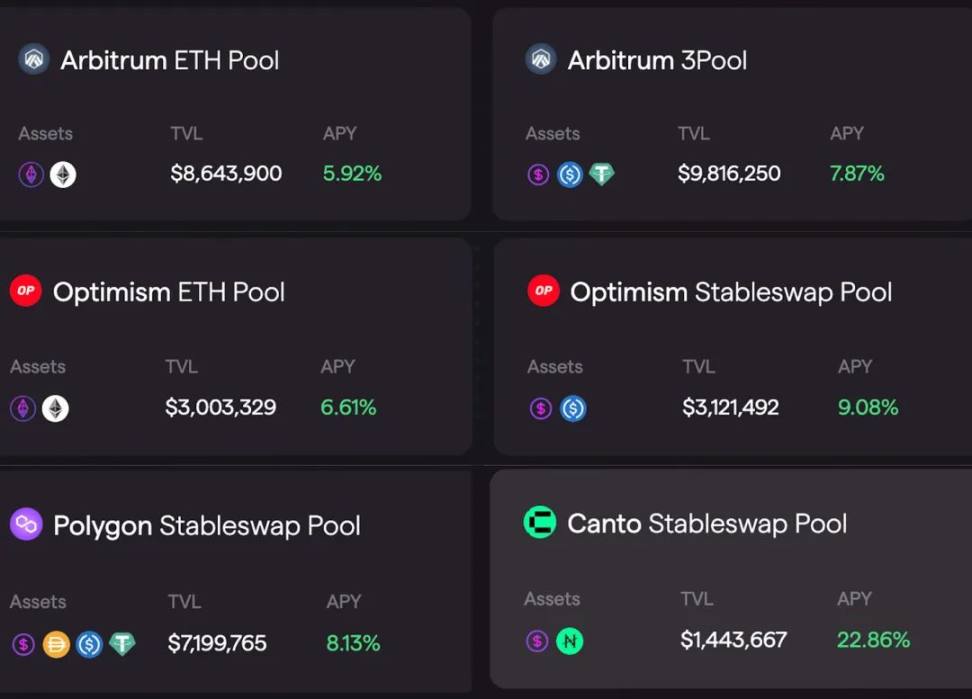

Synapse

Networks: Ethereum, Arbitrum, Optimism, Polygon, BNB Chain, Canto, Avalanche

Assets: ETH, USDC, USDT, DAI, BUSD, NOTE

Yield: 5 - 22% annualized rate of return

Synapse (SYN) is a cross-chain messaging protocol.

Synapse Bridge enables users to exchange between a range of L1 and L2 assets using AMM. Unlike Hop Protocol, Synapse extends beyond Ethereum and the chains it contains, and supports swapping between Layer 1s like Canto, Avalanche, and Harmony, and well-known Ethereum L2s like Arbitrum and Optimism.

That said, similar to Hop, Synapse also features SYN tokens that are distributed across most pools through a massive liquidity mining program.

As you can see below, there are plenty of opportunities to capitalize on, with the hottest new L1 -- the Canto -- yielding as much as 22%.

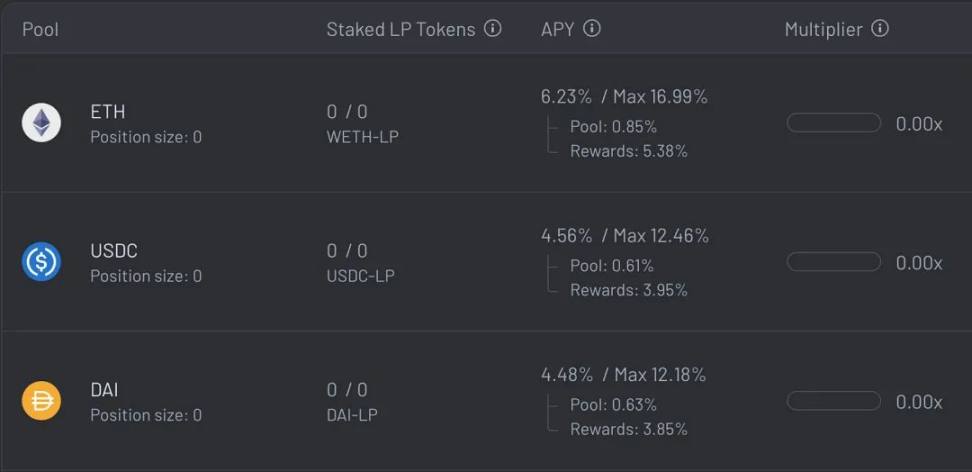

Across Protocol

Networks: Ethereum, Arbitrum, Optimism, Gnosis Chain, Polygon

Assets: ETH, USDC, USDT, DAI, WBTC

Yield: 4.5 - 17% annualized yield

Across Protocol has become a fair contender in the cross-chain space, with more than $1.3 billion in total value transferred recently.

Built by the team at UMA Protocol, the bridge works by providing incentives for LPs to provide short-term loans to users on another chain, which are repaid after two hours from the L1 liquidity pool.

Following the token launch in November, the protocol now offers several yield farming opportunities for ACX tokens. Across' liquidity program stands out because it rewards LPs with multiple rewards based on how long users provide liquidity.

Users can reach the maximum APY listed in the chart below by providing liquidity on the protocol for more than 100 days.

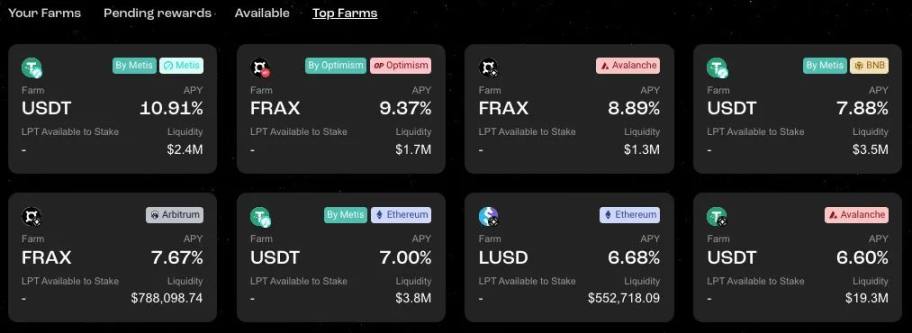

Stargate

Networks: Ethereum, Avalanche, BNB Chain, Polygon, Arbitrum, Optimism, Metis

Assets: ETH, USDC, USDT, DAI, FRAX, LUSD

Yield: 3-10% annualized yield

The last cross-chain bridge we want to discuss is Stargate, which is built on Layer 0's omnichain technology.

The protocol currently has a TVL of $381 million, its token STG has a market cap of $83 million and an FDV of $600 million. Similar to the aforementioned cross-chain projects, the protocol leverages its native tokens to increase the yield of potential LPs.

in conclusion

in conclusion

There are many opportunities to earn high-yield APY in the crypto market by providing liquidity for cross-chain swaps. People are building bridges between blockchains all the time, and this guide is your starting point to start earning.

Original link