A debate triggered by a number, who will be the king between Curve and Uniswap?

Original source:

Original source:Twitter

Compilation of the original text: JamesX,MarsBit

@DeFi_Cheetahis one of my most respected DeFi analysts. But in the spirit of a productive discussion, I respectfully disagree with his@CurveFinanceV2 with@UniswapSome points in the analysis of V3.

See:Why is CurveFinance a better DeFi core protocol than Uniswap?

secondary title

Viewpoint Summary Pt.1

(1) Curve's Ponzi token economics is unsustainable

- Curve's ve-tokenomics postponement and mitigated token sell pressure does not solve this problem.

- CRV token release value > Curve's revenue + bribes

- Curve+ protocol leases liquidity with released tokens

secondary title

Viewpoint Summary Pt.2

( 2) Uniswap has a better business model

- Lower liquidity costs

- Protocol ecosystem provides more flexibility and innovation

- The Uniswap ecological project creates new products based on the Uniswap mechanism

- Curve ecological project aims to expand CRV's Ponzi economics

Curve’s utility and value proposition is undeniable for Ethereum and cryptocurrencies, and the protocol is often praised. And the innovation of ve-tokenomics has given birth to brand new DeFi mechanisms such as gauges, bribes, and curve wars.

But Curve’s ve-tokenomics is ultimately a ponzinomics to incentivize liquidity, by delaying selling pressure (lock-in) or offloading selling pressure to symbiotic protocol tokens (such as Convex, Yearn).

This approach to generating liquidity has been successful in attracting profit-seeking capital and temporary inflows, but does not suggest sustainability or recoverability of TVL.

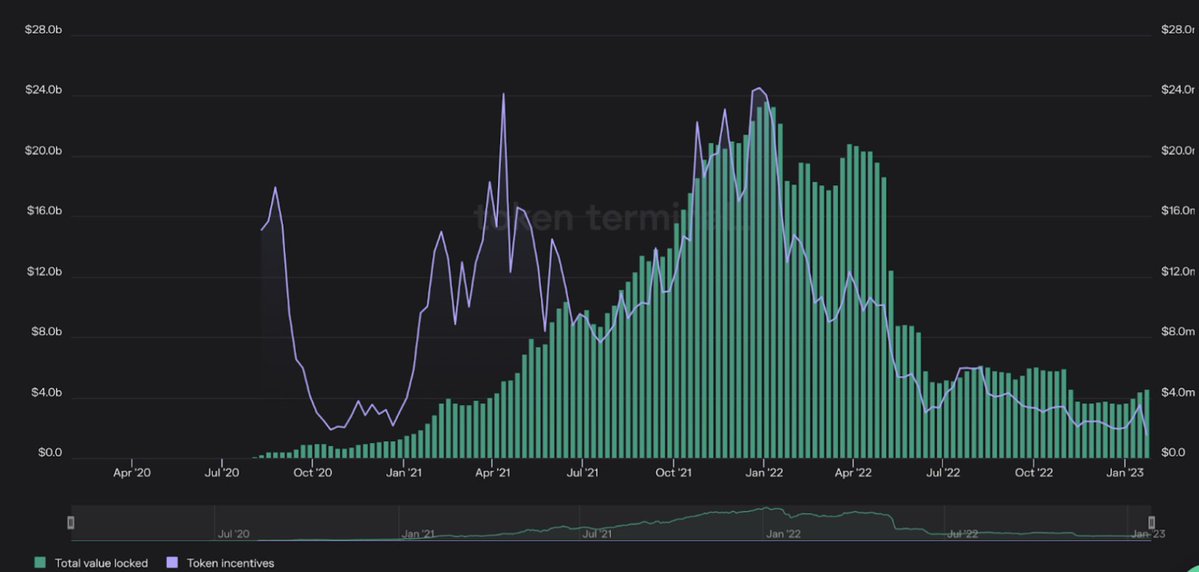

Below is a graph of Curve’s TVL (green) and its token release (lavender).

Aside from the initial spike in emissions to channel liquidity, Curve's release line graph closely follows its TVL.

Why is this?

Simply put, liquidity mining = renting liquidity with tokens to unlock value. It was initially cost-effective and efficient, however, if rent payments stopped or decreased and liquidity was no longer fully incentivized, it would go away. (As shown in FIG)

The same applies to $CRV. When releases get too low (or depleted), only transaction fees remain as an incentive. Thus, the benefits of LPs continuing to provide liquidity, and the protocol's benefit of competing in Curve's ecosystem are diminished.

This practice of selling tokens at a discount in exchange for volatile liquidity is not sustainable or an efficient use of capital, a situation Curve is well aware of.

and@ConvexFinanceand@yearnfinance, so as to support the value of $CRV with its native tokens.

Even so, emitting CRVs with"rent"The cost of liquidity on Curve far outweighs the value of the revenue and bribes associated with rented liquidity, leading to a massive operating deficit for the protocol.

@DeFi_CheetahConsider $CRV emission, while often thought of as a cost to the protocol, is actually a fee projects pay Curve for liquidity.

In other words, the emission of $CRV has been agreed"prepaid", to ensure on-chain liquidity, thereby offsetting inflationary pressure on $CRV.

Let's assume this is true.

Then, Curve's total operating profit/deficit = (total expenses + total bribes) - total emissions

($101 million + $234 million) - $1.2 billion = -$865 million

This deficit is extremely damaging to $CRV and its holders.

Furthermore, according to LlamaAirforce, every $1 spent on bribes yields $1.42 to CVX holders, meaning the protocol pays $1 for more than $1 in CRV, thus refuting the argument that bribes are sufficient as an offset CRV inflationary pressure"Prepayments"the opinion of.

In effect, all of Curve's liquidity is rented.

Its ve-model is a "house of cards".

( 1) The protocol leases liquidity from Curve (bribes in exchange for CRV).

(2) Curve leases liquidity from LP (exchange CRV for liquidity).

(3) LP casts liquidity from Protocols (liquidity for CRV).

Curve bears the brunt of operating costs in this model and employs Ponzi economics to postpone the inevitable impact of ongoing deficit $CRV emissions, but this is not sustainable.

It is also important to note that Curve's ve-tokenomics disproportionately favors first movers and deters new entrants. Neither bribery nor $CRV accumulation is a viable liquidity strategy for new protocols that are often capital and resource constrained.

It will only become increasingly difficult for any new (potentially game-changing) protocol to build deep liquidity on Curve as first movers extend their CRV leads on the platform.

Now, talk about the advantages of Uniswap.

I'll start by pointing out that DeFi protocols operate like early tech startups. They burn cash to acquire users, drive top-line growth, and achieve critical mass upon which they can be self-sustaining.

Cost-effective customer acquisition + retention is a must for long-term sustainability and growth. In the context of DeFi, this means acquiring + retaining liquidity at the lowest possible cost.

Uniswap relies entirely on fees generated by transactions, yet still manages to attract and maintain liquidity on its platform.

This points to a self-sustaining low-cost business model that will have explosive growth and success once DeFi reaches mass adoption.

Uniswap also has a growing ecosystem of innovative symbiotic projects driving V3 adoption by improving user experience and optionality.

@izumi_FinanceLiquidBox provides three Uni V3 LP NFT liquidity mining models suitable for different similar assets for projects that want to accumulate deep liquidity on Uniswap V3 through liquidity mining. Compared with the liquidity mining of V2 and Curve ecology Both cost and effectiveness have been greatly improved.

@xtokenterminalEliminates the need for manual entry and active management of LP key parameters, addressing one of the most critical pain points of Uni V3.

@ArrakisFinance provides a trustless algorithmic market-making strategy, creating deep liquidity on Uni V3 through automated strategies.

@Panoptic_xyz and @GammaSwapLabs labs are innovative examples of #OpFisymbiotes expanding Uni V3 use cases by fundamentally changing the mechanism of providing liquidity as DeFi infrastructure.

@Panoptic_xyz provides trustless, permissionless options trading with instant settlement by enabling execution on any underlying asset pool within the @Uniswap v3 ecosystem. A post by @Slappjakke digs into the protocol's architecture.

Innovation by @GammaSwapLabs enables gamma long shorts to use LP tokens as assets representing volatility. Gammaswap Uni V3 LPs (shorts) receive an upfront premium from traders for pledged base token (longs) volatility.

You can refer to my research report for a deeper understanding of Gammaswap.

The point is, Uniswap's symbionts are more complex because their strengths come not from $UNI, but enhancements to the V3 mechanism that provide a more convincingly useful product than the protocol built to scale the $CRV behemoth.

Innovation is what drives DeFi forward, and sustainability is what keeps DeFi going. In my opinion, in the long run, Uniswap is more suitable as the driving foundation for the two.