Token Unlocks Report: What will be the impact of unlocking encrypted projects in 2023?

Original compilation: PANews

Original compilation: PANews

Recently, the encryption analysis company TokenUnlocks released the "2022 Annual Report", which reviewed the cryptocurrency industry in 2022 and analyzed the market in 2023. PANews compiled part of the content as follows:

Cryptocurrency Market Review 2022

According to CoinGecko statistics, the global cryptocurrency market value will drop sharply in 2022, plummeting from US$2.3 trillion in 2021 to only US$827 billion, a drop of as much as 64%. As the two largest cryptocurrencies by market capitalization-BTC and ETH have also shown a sharp decline in the past year, with a decline of 64% and 67% respectively. The reason is due to several major events in 2022:

First, the collapse of the Terra ecosystem, which led to the bankruptcy of several large crypto companies;

Secondly, the cryptocurrency exchange FTX ushered in a bankruptcy farce in the fourth quarter of 2022;

Finally, the most overlooked point is that some project tokens are due to be unlocked. After the unlocking, investors began to transfer tokens, which led to a surge in market liquidity.

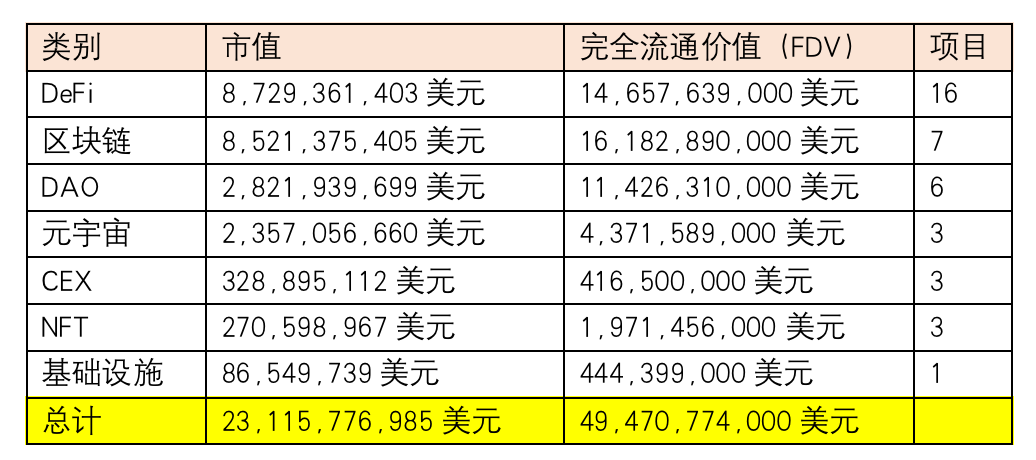

CoinGecko conducted tracking research on 143 protocols from July 4, 2022 to December 31, 2022, including DeFi, Blockchain, DAO, Metaverse, CEX, NFT, and infrastructure developers. The total market value of these projects has exceeded $23 billion, which is only 2.6% of the total market value of cryptocurrencies of $872 billion in early 2023.

Next, let's look at the token unlocking situation again.

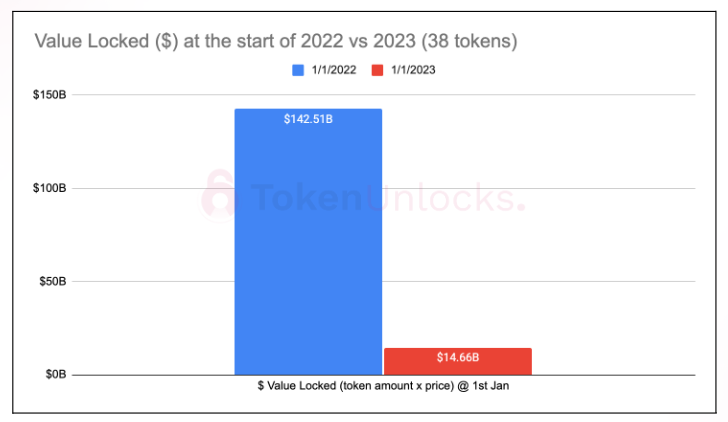

At the beginning of 2022, we tracked 38 tokens with a total locked value of about 142.51 billion US dollars (note: only allocated tokens, excluding pledges, liquidity mining, staking, etc.), surprisingly, 2023 At the beginning of the year this figure has dropped to $14.66 billion, which means that the locked value of tokens has dropped by 89.7%. There are two main reasons for this:

1. The price of tokens dropped sharply

2. Too many tokens issued in 2022

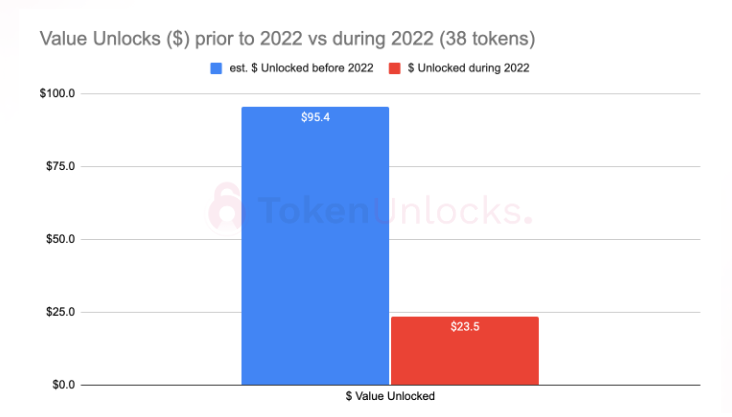

The total value of the 38 tokens unlocked during 2022 is approximately $95.4 billion (in prices as of December 31, 2021), while the value of tokens unlocked during 2022 is $23.5 billion. This means that the value of tokens unlocked in just one year, 2022, represents 24.6% of the total value of tokens unlocked in all previous years. When we compare the year-over-year decline in value locked to the value unlocked in 2022, another interesting phenomenon emerges:

The drop in token locked value is: $142.5 billion – $14.7 billion = $127.8 billion, while the unlocked value is $23.5 billion.

Imagine if investors had sold all their positions on the unlock date throughout the year, they might have received an average of only $235/$1278 in value, or 18.4% of the original locked value, while the other 71.6% might have been absorbed by the public market . Of course, this is only a rough estimate. In fact, the rate of return will also involve various other factors such as liquidity, macro effects, and token returns at that time.

Not only that, but we also focused on tracking two unlocking mechanisms, namely:

1. Cliff unlock (cliffunlock)

2. Linear unlock

The following table lists the value of cliff unlocking and linear unlocking in 2022. The data shows that the value of tokens unlocked by the cliff accounts for about 61% ($14.4 billion/$235), and the value of tokens unlocked linearly accounts for about 39%. At the same time, we can also see that the total value of unlocked tokens in 2022 will reach 23.5 billion US dollars, and the unlocked value in the first half of the year is more than twice that of the second half.

price impact

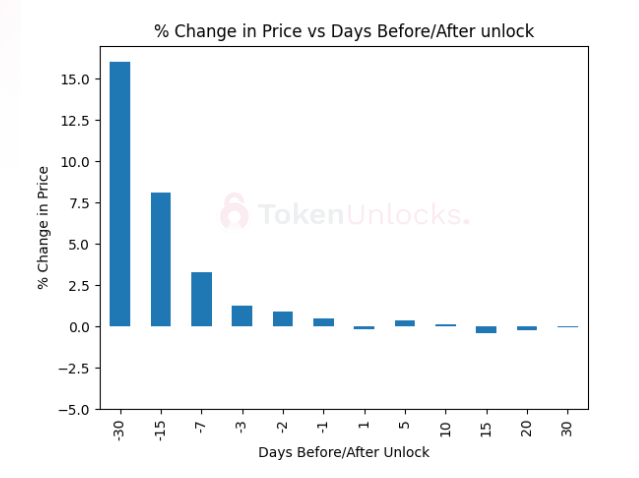

For investors, as more and more tokens are unlocked from smart contracts or wallets and circulated in the market, if the demand remains constant, it is not difficult to expect that the price of these tokens will fall.

The figure below shows some findings after analyzing the collected data: where the x-axis represents the number of days before and after unlocking, negative values represent before unlocking, positive values represent after unlocking, and the y-axis represents the percentage change compared to the price on the day of unlocking. As the trend chart shows, the price typically drops by 15% as the unlock date approaches, and flattens out once the unlock is complete. It’s worth noting that this analysis is relatively accurate as it references Bitcoin prices.

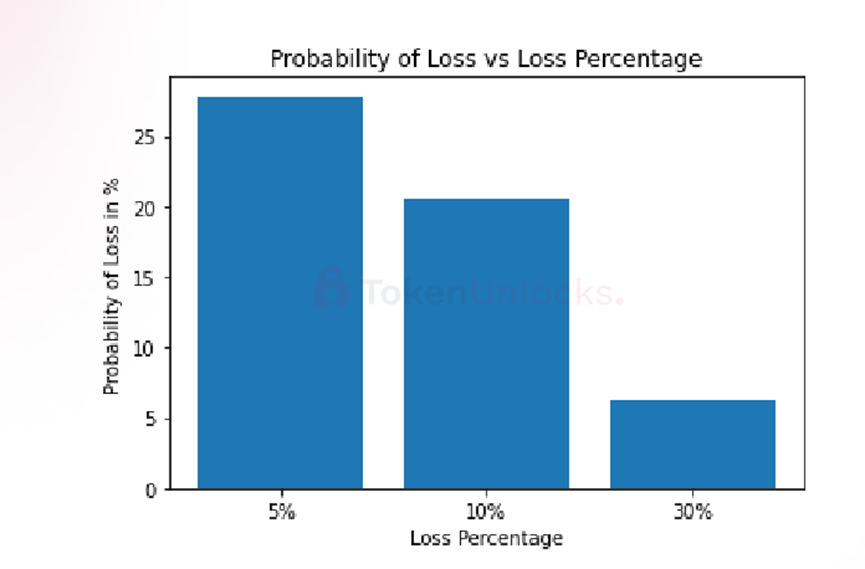

As you can see from the graph above, the token price tends to drop on unlock days compared to the days before unlock, so we want to find the probability of losing a position when shorting 30, 15, and 7 days before unlock.

The research data shows that the probability of losing 5% of the token value is 27%, the probability of losing 10% is 20%, and the probability of losing 30% is 6% (note that this analysis takes into account the price of Bitcoin in the short term Behavior).

Outlook for 2023

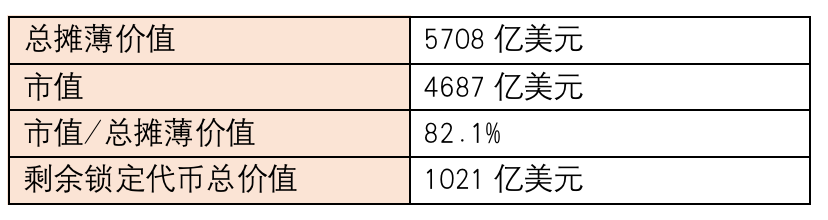

The report also provides forecasts for the crypto market to 2023, including token unlocking forecasts for the top 300 crypto projects using residual market capitalization and FDV to understand potential unlocked value over the next few years. For simplicity, this analysis takes the statistics of the top 300 tokens (fixed supply) on December 31, 2022, and excludes tokens with unlimited supply.

Overall, 82.1% of the tokens with a fixed total supply are already in circulation, while the remaining unlocked tokens are worth approximately $102.1 billion.

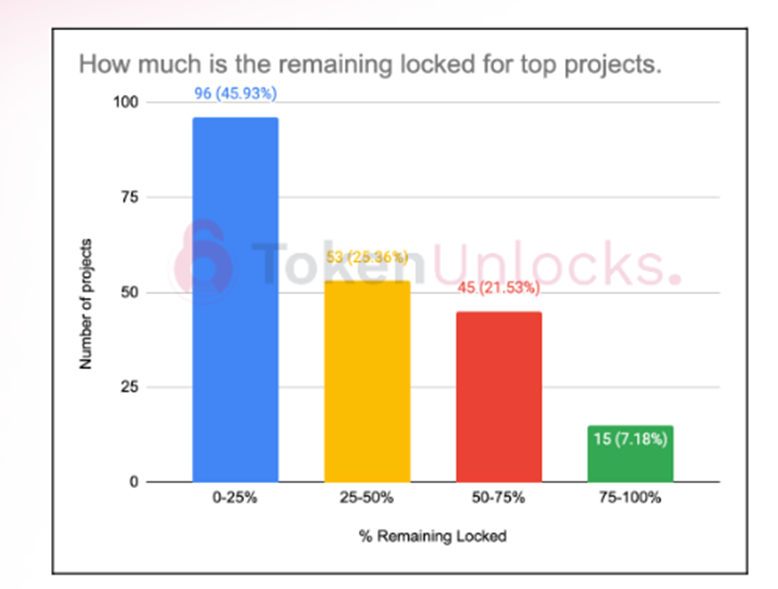

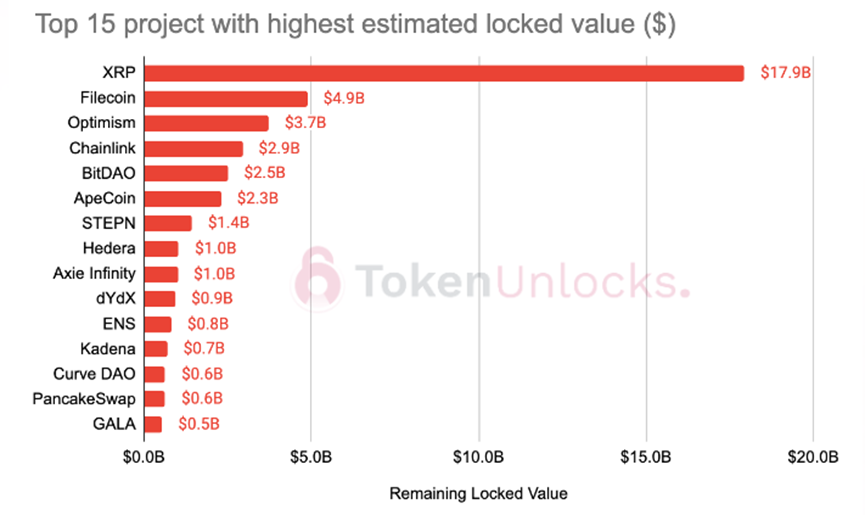

Next, let’s look at the remaining lockup percentage (will be circulated in the market in the future). The chart below shows that 96 encrypted projects have locked up less than 25% of the total supply of tokens, of which 15 projects include More than 75% of illiquid tokens. On average, a crypto project has about 38.6% of its total supply to unlock. The last graph lists the top 15 projects with the highest estimated remaining locked value, with XRP at the top of the list with a token value of $18 billion.

For the crypto industry, 2023 is destined to be a very "interesting" year, because many projects that received financing in 2021 may need to support operations by cashing out their tokens. Although most users may choose to leave the market, and the income generated by the agreement may plummet, it is believed that with the release of more and more analytical data, the transparency of the encryption industry is increasing day by day, and participants can thus gain a deeper understanding The way tokens are allocated for each project and get incentivized through token economics and protocol design.

I believe that in the new year, the entire encryption industry can continue to move forward with confidence and create new miracles.