The dark clouds will eventually clear, Krypital Group 2022 review and outlook

2022--the first year of the post-pandemic era, things are not going well.

text

The Russia-Ukraine war that started in February cast an uncertain shadow on the global political economy and continued until the end of the year. In response to the high inflation brought about by the flooding of the epidemic era to the US economy, the Federal Reserve raised interest rates unprecedentedly, making global capital The market is under pressure. In the severe macro environment, the encrypted economy is not immune, and "black swans" frequently burst out--DeFi has become a cash machine for hackers; the collapse of Luna-UST has caused a series of bankruptcies of institutions, and triggered a series of bankruptcies by the government. Regulation of the encrypted economy; the bankruptcy of FTX and Alameda has made people and institutions preparing to join the encryption industry pause and re-examine the transparency and maturity of the industry.

The nearly two-year bull market since DeFi Summer has brought not only a huge wealth effect, but also a series of innovations and encryption narratives such as DeFi, NFT, and Dao, which have made people see the new development direction of the Internet. In 2022, this Everything came to an abrupt end.

On the last day of 2022, we would like to chat with our friends who have been supporting us this year, what we have seen, what we have learned, and what we are looking forward to.

secondary title

The "Darkness" and "Lightness" of Part 1 2022

For the encrypted economy, the whole year of 2022 is full of various "black swan" events, but we can use three keywords to summarize: hackers, institutional failures and supervision.

hacker feast

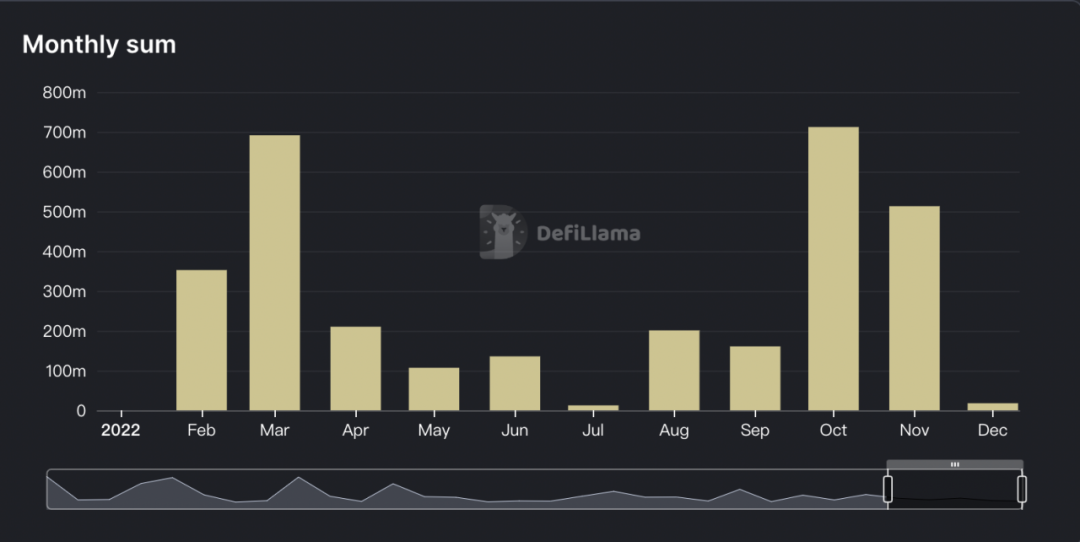

According to data from DeFi Llama, an encryption data statistics agency, more than $3.2 billion in assets were stolen in the hack. Among them, cross-chain bridges were the most stolen, accounting for 59% of the stolen amount. Notable ones include Ronin's $624 million, Wormhole's $321 million, and Nomad's $190 million.

In our opinion, security issues have become the biggest threat to the mass adoption of DeFi. In the bull market of the previous two years, DeFi has shown us their innovation and application potential. Even in this bear market, DeFi has shown better resistance to risk than CeFi, but while seeing innovation , More and more types of hacker attacks should arouse our attention. Whether it is wallet design, smart contract audit, insurance and asset custody, the improvement of security can ensure the development of the industry.

At the same time, although the cross-chain bridge has become the "hardest hit area" of hacker attacks and has become a topic of discussion in the encryption community, in the future of the multi-chain era, cross-chain will be one of the most important infrastructures, not only asset cross-chain, but also It is cross-chain interoperability between applications and more complex information transfer between chains. We continue to be optimistic about the development of this track. The DeBridge we invested in is also bringing cross-chain interoperability into DeFi, solving the liquidity problem of multiple chains, and bringing more composability to DeFi Lego. (If you have more ideas about cross-chain, look forward to communicating with you)

Institutional debacle with Luna and FTX

The bull market of the past two years has not only been a victory for cryptoists, but also for crypto speculators. Luna-UST's Ponzi game supports the highest market value of nearly 40 billion U.S. dollars; FTX-Alameda uses abnormal asset misappropriation to expand its trading market share while investing wildly in the primary market to expand its influence. They also all ended in this 2022.They have had a nasty effect on the crypto economy. Not only the market crash, the loss of user assets, the bankruptcy of a series of institutions such as 3AC, the confidence in the encrypted economy and the attention of supervision, these effects may last for two years or even longer, which makes the encryption institutions - which should have become the encryption market. A huge push in early development -- became a joke. After the Luna debacle, we once wrote aThoughts After the Luna Crash

. where we write:

"Frenzied joy will eventually have a violent ending." As an institution, we will continue to practice the strategy of "research-driven investment" to help early-stage projects grow.

Supervision

Supervision

The debacle of Luna and FTX, the arrest of the Tornado founder, and the potential OFAC censorship of Ethereum nodes have raised huge concerns about regulation among people in the crypto economy. However, we remain cautiously optimistic. We believe that the development of the encrypted economy is certainly related to the degree of freedom brought about by the lack of supervision, but it will not fail to develop because of supervision.

those good things

Although the crypto economy is in deep bearishness in 2022, we also see some good things happening.

The "merger" of Ethereum went smoothly beyond expectations and entered the era of POS. Under the POS consensus mechanism, waste of resources can no longer be a word for people to attack Ethereum. Under the POS consensus mechanism, Ethereum can upgrade the protocol more smoothly and have a healthier token economics. We are full of expectations for the future of Ethereum. In March of this year, Ethereum will usher in a "Shanghai upgrade", and the pledge of Ethereum will also usher in a healthier market. At present, the pledge rate of Ethereum is far lower than that of other POS public chains. We look forward to a further increase in the pledge rate, which will bring greater security to Ethereum.

Breaking away from the bull market narrative, infrastructure and middleware have paid more attention. Modular blockchain, Layer 2, ZKEVM, account abstraction...Although we do not bet blindly, we believe that the advancement of infrastructure facilitates more and better developers to enter the encryption economy and brings great benefits to the industry. More possibilities and a better future lead us into the next bull market earlier.

This is our summary of 2022: many "darks", but there is always "light".

secondary title

At the end of 2021, we were blindly optimisticpredictpredict

The development of the encryption economy in 2022, now, the "slap in the face" is quite serious. However, as a "five-year-old" organization, there is nothing wrong with frankly admitting mistakes, and we hope to bring our reflections to you.

1. Maintain control and awe of risks. We were lucky to survive the Luna and FTX incidents. Although our research and knowledge have helped us, if we are lucky, the outcome is still unknown.

2. Don't trust, veryfi, this sentence also extends to all industry practitioners.

3. Stay true to the original intention and continue to be the promoter of the industry.

Also, without further ado, let's get started and look to the future.

secondary title

Part 3 2023? No, in the next few years, those we are optimistic about

1. L2 will be the main battleground

Insufficient scalability has become the main pain point restricting the development of L1. At present, L2, which inherits the security of L1, will be the best solution to solve the scalability of L1. We expect several Rollups of Ethereum, Subnet of Avalanche, based on The application chain of the Cosmos SDK and several other ZKEVMs (several solutions of Polygon, Scroll, etc.) will become the main platform for carrying encrypted applications.

For DeFi, although the TVL of DeFi has dropped from a maximum of 200 billion U.S. dollars to less than 40 billion U.S. dollars, as the market recovers, more encrypted users and institutions enter the market, and most importantly-infrastructure improvements, we expect This data can be restored gradually. With the gradual improvement of L2 development, we expect that most L1 DeFi applications will gradually migrate to L2, and a large number of native DeFi applications will also be born on L2.

Immutable and Sorare are building a low-threshold, zero-gas NFT trading platform, which is expected to become an important infrastructure for future gamefi and NFT transactions.

Judging from the current L2 development, Arbitrum will take the lead in the next two to three years. Without issuing Token, Arbitrum's TVL has surpassed Polygon, Avalanche and other L1. Arbitrum's ecology has also developed relatively well. In addition to Uniswap, Curve, Sushiswap, Aave and other old-fashioned DeFi products, GMX has grown into the most recognized and popular perpetual Dex in the market. Rage Trade, which is based on Layer 0 to open up inter-chain liquidity, is being adopted More discussions in the encryption community, Dopex is building some of the simplest option products for users to use, Capdot V 4 intends to launch a global commodity trading market on Arbitrum; Treasure Dao is building a Gamefi game platform... We expect Arbitrum to launch its own next year After Token, its ecology will be further improved.

Other L2s are not without opportunities. Optimism plans to launch OP Stack, intending to build an L2 as a service platform; Cosmos' application chain can support more complex applications.

In the short term, we are not optimistic about ZK Rollup and various ZK EVMs, and their technical progress may be lower than market expectations. However, driven by capital and the further maturity of ZKP technology, the L2 market may face a reshuffle in the future.

In addition, it is expected that "EIP-4844" will be launched in the next upgrade after the "Shanghai Upgrade" of Ethereum, which will greatly reduce the gas cost of Rollup and is expected to enhance the competitiveness of Rollup.

2. Development of DeFi derivatives

In the bear market in 2022, most DeFi tokens have fallen by nearly 90% from their highs, but the price of the perpetual contract agreement GMX token has doubled against the trend.

Although GMX has outstanding design in terms of product and token economics, and its trading volume has also developed against the trend, becoming the perpetual Dex with trading volume second only to Dydx, it also reflects the market's optimism towards DeFi derivatives.

Aside from the fact that the number of real DeFi users is not large, an important reason that restricted the development of DeFi derivatives in the past was infrastructure constraints. For example for perpetual products:

1) The oracle on the chain has the risk of being manipulated;

2) Order book is better than AMM, but the confirmation on the chain is slow, and the storage on the chain is expensive, resulting in poor product experience;

3) Liquidity is too dependent on centralized market makers;

However, with the development of application chains such as L2 and Sei, it is expected to solve this problem for perpetual products and attract more users to use DeFi for perpetual transactions. The ZKX on Starknet we invested in is based on Starknet's high TPS, low latency, low cost, and strong scalability to create a truly decentralized order book derivatives trading platform.

We are also optimistic about the development of derivatives such as options and structured products. In the traditional financial market, the threshold for users of such products is high, and the product is complicated to understand, but DeFi can be pushed to users in a very simple way.

However, we believe that DeFi needs better token economics. It is difficult to support the long-term development of the project simply by the narrative of governance tokens or liquidity incentives. For example, we recently discussed whether tokens should be separated from the agreement, and empower tokens through "real income". We are also very willing to communicate with relevant project parties or investors and participate in discussions and designs related to token economics.

3. Application chain or new narrative and development direction of Dapp

On June 22, dydx announced that it would break away from Starkware and would choose to develop a dydx chain based on the Cosmos SDK, which triggered heated discussions on the application chain in the market; Sei Network, led by MULTICOIN CAPITAL, is also committed to creating a high-speed chain dedicated to user transactions ;Cross-chain bridge Synapse is about to launch its own chain to better provide cross-chain services...Our articles in August"Krypital Group: dYdX "betrayed" Ethereum, will the application chain become the mainstream narrative of Dapp? "

, we started from the reasons why dydx "betrayed" Ethereum, and analyzed the reasons for the success of the application chain from the technical and user levels. In addition, we believe that for some specific applications, such as derivatives fees that require higher TPS and lower Gas fees; applications such as Gamefi that require high-frequency interaction with smart contracts, the application chain is a very good choice. For some general-purpose applications, such as Uniswap, Maker Dao and other DeFi underlying products, the composability of the application chains of these products needs to be further verified by the market.

Overall, we agree with Lisk's narrative, but Lisk is still in its early stages. At present, there are not many applications that require application chains in the market, and there is even a strange phenomenon of "more chains than applications", which is very magical.

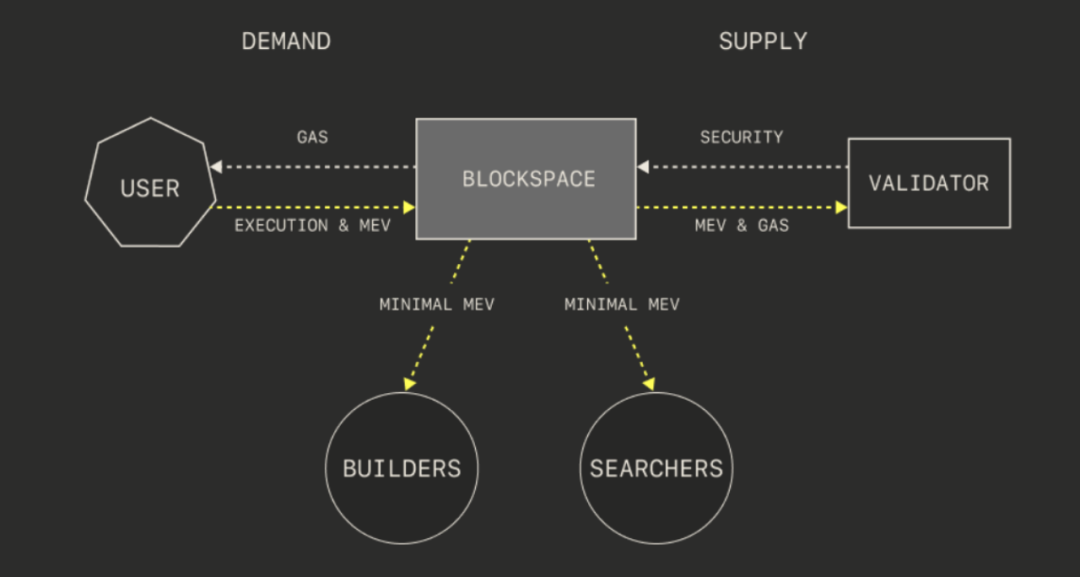

4. Increasing focus on MEVsWith Ethereum “merging” into Pos, MEV has become a major source of income for network builders. Articles in September"Should We Be 'Warning' About MEVs?"

, we have conducted relevant science popularization on the concept of MEV and current solutions, and interested friends can check it out by themselves.

Although institutions such as Flashbots continue to optimize this market, we are pessimistic about the short-term resolution of MEV. This is a market where only a few can participate, but they are the most important players in this decentralized platform. If they only form for their own benefit, the hidden consequences will be disastrous

5. The entry of Web2 users into Web3 may bring the next tipping point

We often think, what is the next tipping point in the market?

DeFi can become a tipping point, and the huge market participation and wealth effect brought by liquidity mining is its biggest boost. As DeFi matures, Ponzi such as "liquidity mining" declines. Although we are optimistic about the continued development of DeFi, under the conditions of macro liquidity shortage, it is difficult for DeFi to become the tipping point of the next cycle again.

Looking back on last year, a hot word that was frequently mentioned was Web3. Although there are many definitions of web3, there is no doubt that the encryption economy will be an important part of Web3. Just imagine, if even a small part of the billions of users in Web2 flood into Web3, what will it bring to the encryption economy? How should a Dapp that can attract tens of millions or even billions of users without relying on Ponzi be valued by the market?

In the past few years, on the one hand, security issues and lack of infrastructure have restricted Web2 users from entering Web3. With the gradual improvement of the overall infrastructure (the development of L2, the launch of low-threshold wallets, the realization of cross-chain interoperability, and the reduction of gas costs), more and more developers will bring more and more richness to the Web3 market. application, the threshold for users to enter Web3 will also be greatly reduced. In the next two years, it is not impossible to create a super super large Dapp. On the other hand, the predicament of the past Web3 project was that it was impossible to find a suitable economic model, and the project tokens, NFT, products, etc. did not find a suitable combination point, because they had to wear the Web3 cloak and act as a Ponzi, the last place chicken feathers.

So which track will this tipping point be born on? Socialfi, Gamefi or Web2.5 application? We dare not draw conclusions easily and wait for the birth of explosive applications.

Summarize

Summarize