Under the bear market, cvxCRV has a negative premium, and Convex allocates more equity to cvxCRV to save the market

Curve's token model is very representative. Various aggregators and stablecoin project parties competitively lock CRV tokens into veCRV to ensure that mining pools related to their own interests receive higher CRV mining rewards, resulting in " Curve War".

However, locking CRV into veCRV is one-way, requiring a wait of up to four years before redemption. Recently, the pledged certificate cvxCRV issued by Convex, which holds the most veCRV, has also experienced a negative premium of about 10% under the imbalance between supply and demand in the bear market.

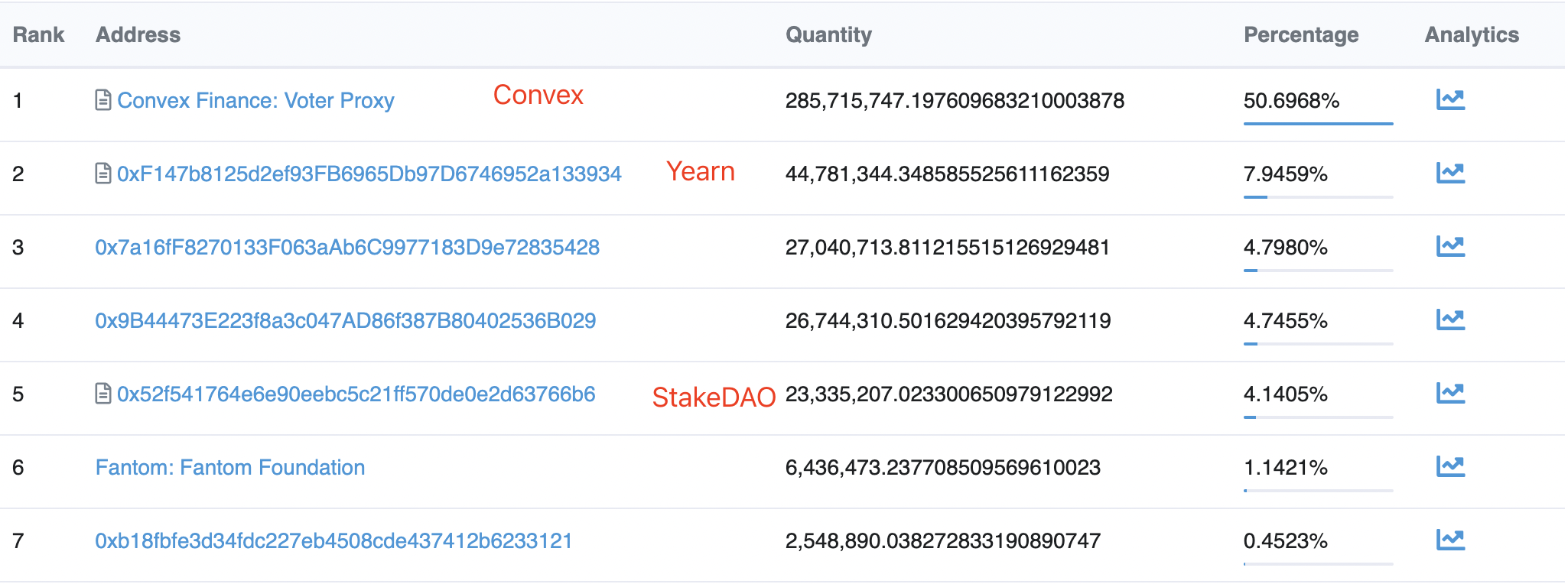

veCRV held by Convex accounts for 50.7% of the total, and cvxCRV has the highest negative premium

Curve's main purpose in designing the native token CRV is to incentivize liquidity on the Curve platform and allow as many users as possible to participate in protocol governance. Curve allows the native token CRV to be locked as Vote-Escrowed CRV (veCRV) for three benefits:

Share 50% of the transaction fee, which will be used to purchase 3 CRV, which is TriPool's LP token, and then distributed to veCRV holders.

Obtaining Curve's governance voting rights can determine the distribution of CRV liquidity mining rewards among different mining pools.

Increase your own CRV mining rewards on Curve up to 2.5 times.

Because mining rewards can be increased, users who perform liquidity mining on Curve need to pledge CRV to increase their mining rewards. However, veCRV cannot be transferred, and the needs of users may change, which creates a market for aggregator projects that help users mine. Liquidity providers do not need to pledge CRV tokens themselves, and can obtain higher rewards than directly mining in Curve.

As of the afternoon of January 6, 2023, it can be seen from the blockchain browser that the contract addresses currently holding the most veCRV are Convex, Yearn, and Stake DAO, which hold 50.7% and 7.9% of the total veCRV respectively. %, 4.1%, and a total of 62.7% of the total holdings. Convex holds more than 50% of veCRV, which also shows that it is now in an absolute leading position in the "Curve War".

When users pledge CRV tokens through these projects, although they cannot be redeemed, these projects issue liquid pledge certificates for users, namely cvxCRV of Convex, yCRV of Yearn, and sdCRV of Stake DAO, which can be sold in the secondary market on the deal.

Currently, the conversion ratios of cvxCRV/CRV, yCRV/CRV, and sdCRV/CRV are 0.917, 0.973, and 0.992, respectively. Convex, which has a larger market share, has a higher negative premium for cvxCRV issued. It should be noted that the bottom layer of these liquid mortgage certificates is pledged with 1: 1 CRV tokens, and there is no under-collateralization, but because of liquidity and supply and demand, there is a negative premium.

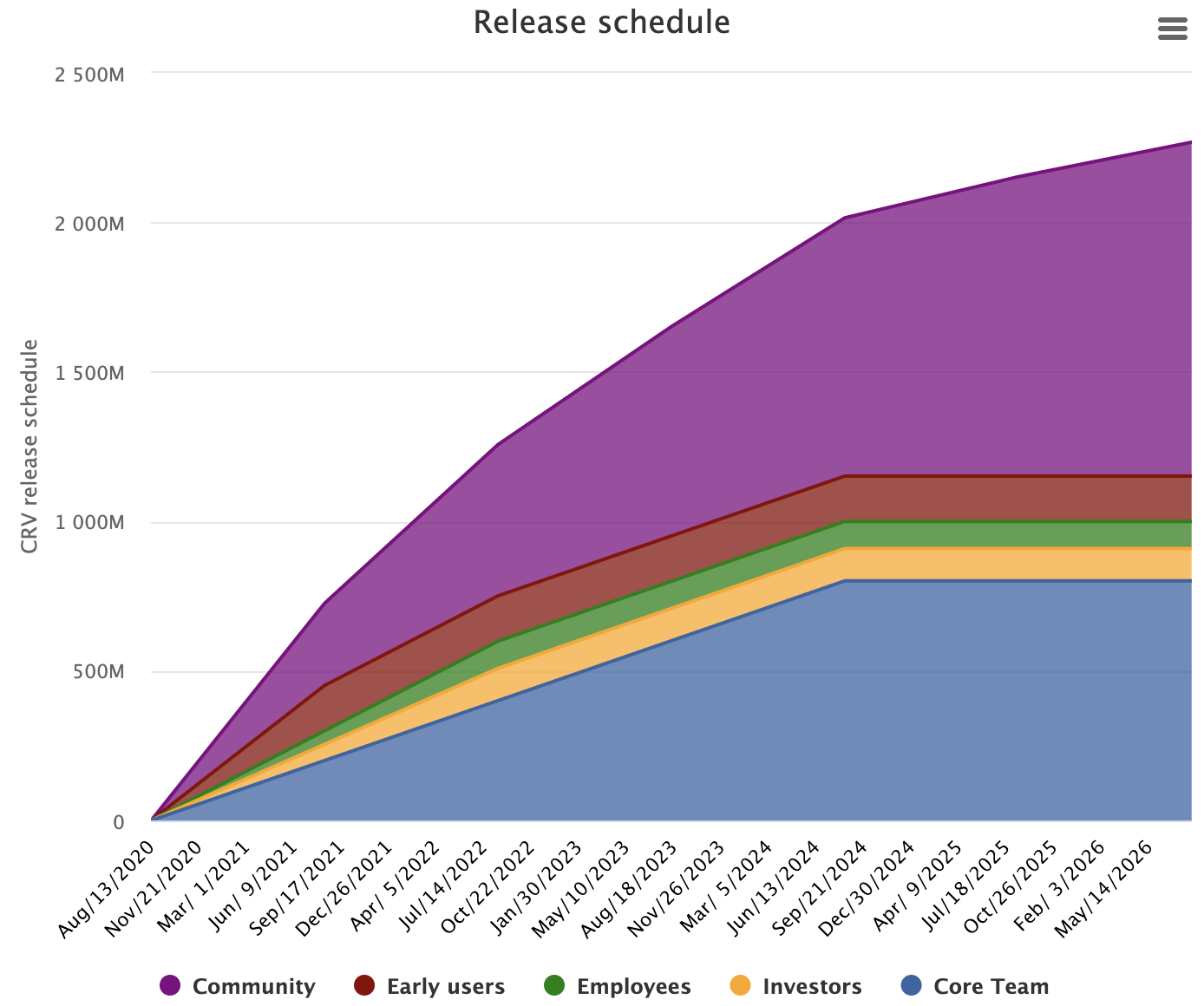

CRV has been criticized for high inflation and low income

according to

according toCurve's official unlocking plan, currently due to the unlocking of core team and community tokens, CRV tokens will still maintain a high inflation rate until August 2024 when the core team tokens are released. Inflation through 2023 is about 27.2%.

Curve has the highest liquidity among DEXs, but the trading volume is not high, so the income of CRV is not high. Taking the Ethereum mainnet as an example, the liquidity of Curve is US$3.45 billion, and the transaction volume in the past 24 hours is US$257 million; the liquidity of Uniswap V3 is US$2.98 billion, and the transaction volume in the past 24 hours is US$420 million. In the case of lower liquidity, the transaction volume of Uniswap is higher, and Uniswap is mostly non-stable currency transactions, and the transaction fees are higher.

Some of Curve’s commonly used valuation metrics also underperformed, with a P/S of 1,286.7 and a P/F of 643.4, according to Token Terminal.

Convex's response: will use 2% of proceeds to buy back cvxCRV

According to the design of Convex, liquidity providers do not need to pledge CRV and can obtain higher returns; CVX pledgers can obtain 5% of the agreement fee income, and the accumulated veCRV will gradually increase, which is conducive to the long-term development of the agreement; users who pledge CRV through Convex , on the basis of the existing rights of veCRV, you can also get 10% of Convex's fee income, and you can sell cvxCRV in the secondary market at any time. This mechanism can achieve a win-win situation for liquidity providers, CVX pledgers, and CRV pledgers.

However, the exchange ratio of cvxCRV/CRV has a negative premium of more than 10% in extreme cases, indicating that the current demand for cvxCRV is insufficient.

Convex announced on January 2 that it will introduce a series of measures through governance voting to increase the stake of cvxCRV.

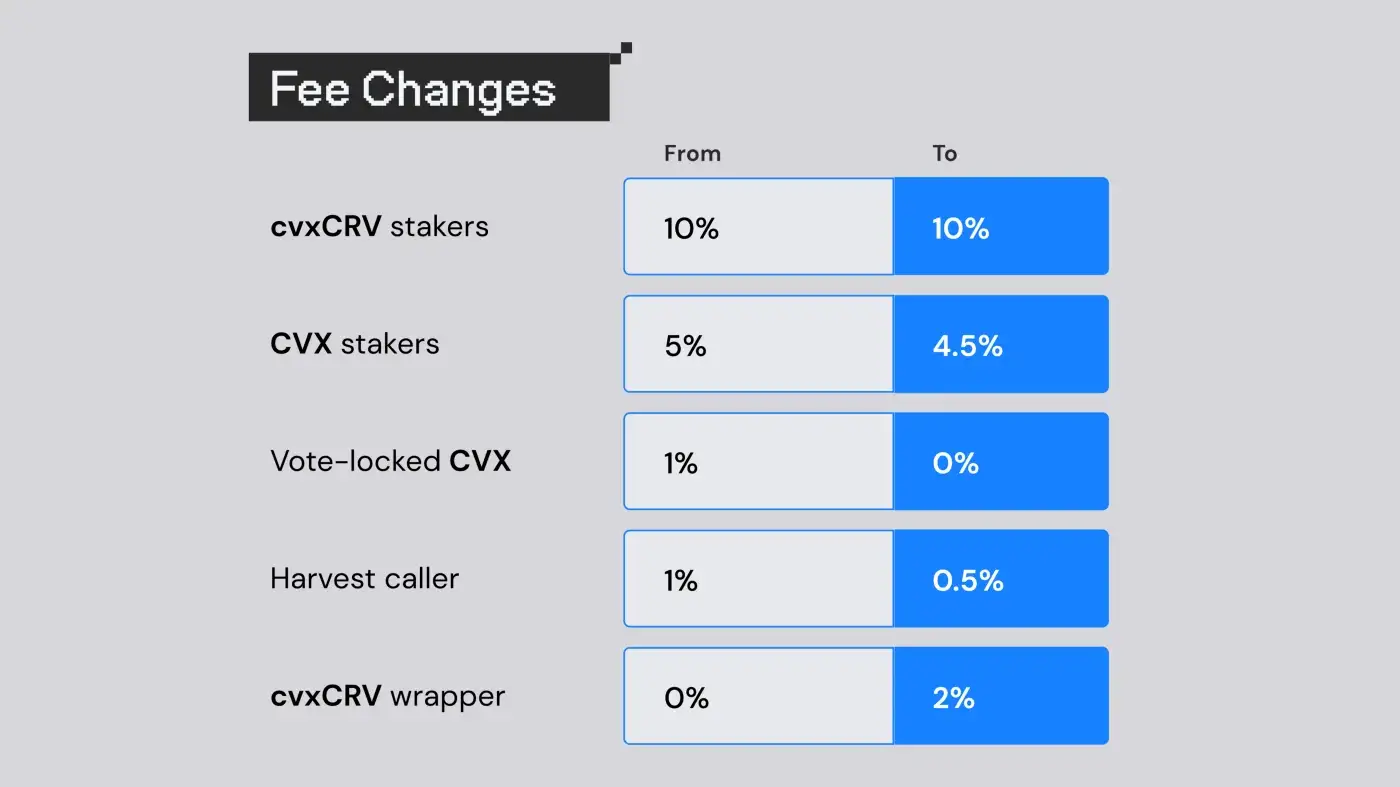

1. Modify the fee structure and increase the cvxCRV wrapper fee by 2%, which is used to buy back cvxCRV from the open market.

2. To incentivize cvxCRV stakers, Convex will transfer a portion of the existing CVX release to cvxCRV stakers.

3. Update the cvxCRV/CRV liquidity pool, start some new functions through the latest version of the factory pool (using internal price oracles), and the rewards of the existing cvxCRV/CRV pool will also be redirected to the new liquidity pool.

4. Update the wrapper contract, and the pledged cvxCRV will be transferable, which means that it may be used as collateral in other projects. Making adjustments to how rewards are earned, cvxCRV stakers can choose to receive only CRV, CVX, or 3 CRV.

In terms of the distribution of protocol revenue, the new distribution method mainly distributes part of the rewards originally allocated to CVX pledgers of the Convex governance token to CRV stakeholders.

summary

summary

The cvxCRV issued by Convex has a negative premium of more than 10%. Convex will be more biased towards cvxCRV pledgers in the distribution of future income, and will repurchase cvxCRV and allocate more CVX tokens to cvxCRV pledgers.

In addition to the reasons for liquidity, the high inflation and low income of CRV may also be the reason for the loss of confidence of cvxCRV holders. The inflation rate of CRV in 2023 is about 27.2%. At current data, Curve has a P/S of 1286.7.