13 Crypto Narratives to Watch in 2023

Original author:The DeFiedge

Compilation of the original text: The Way of DeFi

Original author:

Compilation of the original text: The Way of DeFi

If you get the right cryptocurrency narrative early on, you can create wealth.

Here are 13 narratives you should be paying attention to in 2023:

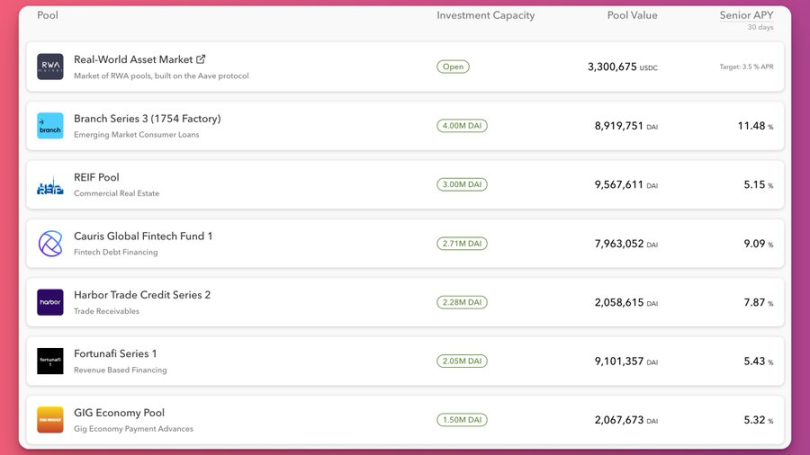

RWA protocol

RWA-related DeFi protocols are making progress.

Some highlights:

Maker Protocol has $600 million in real-world asset collateral.

GoldFinch / Maple Finance is processing loans.

Centrifuge's Tinlake has some diverse real-world assets

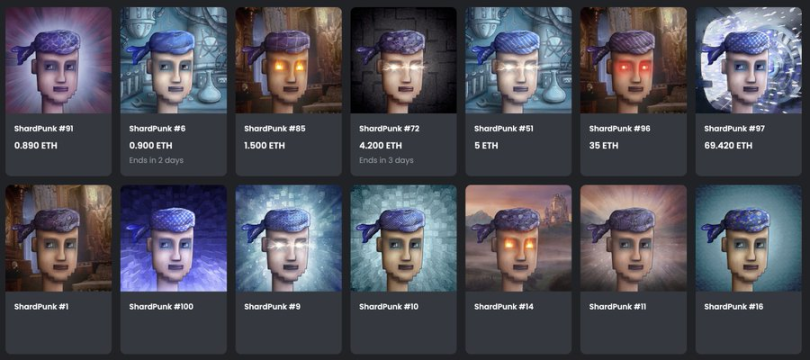

Financialization of NFTs

Those largest NFT projects already have value - the BAYC floor price is about 73 ETH.

DeFi x NFT aims to unlock the liquidity of NFTs and transform them into productive assets.

First wave of projects that allow you to use your NFT as collateral, such as NFTfi and BendDao

In the next wave, we will start to see the next generation of NFT financialization.

nftperp - short or long NFT/w leverage. It is in beta and has attracted over $21 million in transaction volume.

insrt finance - Shard Vault. They break down the NFT and you can earn the yield.

Cosmos chain

Cosmos is building a lot of new chains.

Berachain 🐻 ⛓️ - Proof of Liquidity Consensus.

Sei

Kujira 🉐 - An ecosystem built around real yield. They are constantly launching new products.

Canto - Cosmos compatible EVM. Liquidity as a public good.

Sei is a DeFi-specific L1 chain optimized for transactions.

CLOB (Central Limit Order Book) is standard on TradFi.

CLOB (Central Limit Order Book) is standard on TradFi.

In cryptocurrency? Only centralized exchanges can use them due to speed requirements. (They leverage fast Web2 technology)

We've always wanted CLOB due to tighter spreads and lower slippage.

Zk-rollups

Sei has figured out how to make it decentralized and fast. (600 ms deterministic, 22000 orders per second).

There will be a new generation of DeFi products built on Sei's technology.

Ethereum relies on Layer 2 solutions to scale.

Zk-rollups

There are two types of rollups:

Optimistic rollups, such as Arbitrum & Optimism

Optimistic rollups have an early mover advantage, but many consider zk-rollups to be a more advanced technique.

Scroll

zkSync

Starkware

Aztec Network

Polygon Miden & Hermez

In the future, zk-Rollups will take years to fully deploy due to complexity.

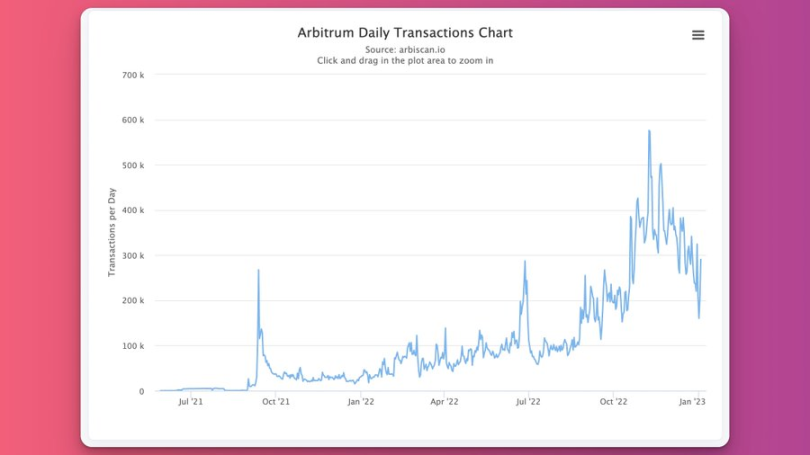

Arbitrum

Note the following items:

This year we will see more new dapps go live using zk-rollup technology.

Although zk-rollups are the future, Arbitrum (Optimistic rollup) is crushing it now.

Every new DeFi innovation I see is happening here, a lot of OG protocols are expanding to Arbitrum.

Many TVLs from Layer 1 chains are constantly migrating to Arbitrum.

There are two ways to play Arbitrum.

Use head dapps and hope to get an airdrop one day.

Celestia

Keep an eye out for new, interesting protocol releases.

I've been monitoring DeFiLlama to find dapps with fast growing TVL.

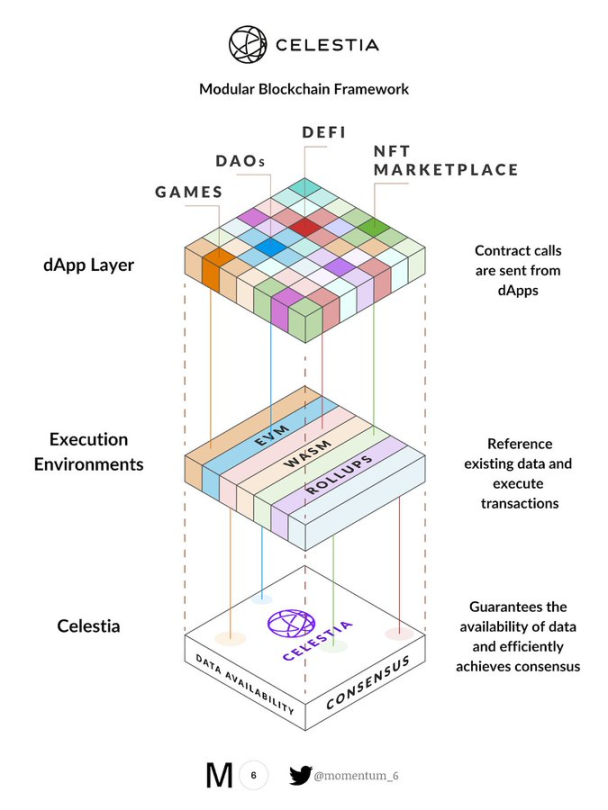

First generation blockchains are monolithic by design - a single blockchain does everything: consensus, execution, and data availability.

This leads to problems of scaling and decentralization.

Modular blockchains take a different approach by separating layers and responsibilities.

The value of Celestia. Think of Celestia as the Amazon Web Services of the blockchain.

It reduces security costs and makes launching a blockchain as easy as deploying a smart contract.

These blockchains will be customizable and sovereign.

Perpetual agreement (perps) war

Decentralized perpetual protocols found product/market fit last year. And the death of FTX gave it new life.

Despite feeling saturated as a DeFi degen, decentralized perps have barely penetrated the overall market.

Perpetual Protocol

GMX

dYdX

Gains Network

There is plenty of room to grow as they continue to innovate.

Main Perps protocols:

Kwenta by Synthetix

Countless GMX forks

I'll be watching how much traction GNS can gain on Arbitrum (the home of GMX) and how dydx integrates into its own Cosmos blockchain.

Decentralized Sports Betting

Crypto degens and sports betting go together naturally.

I researched some projects:

Frontrunner(injective)

RektBets (Kujira)

decentralized social media

Betswap (powered by Wonderland)

decentralized social media

Twitter is going through a tumultuous time.

TikTok could be banned in US

People want to own their data and protect it from censorship.

2 headwinds:

1) UI/UX lags behind Web 2

2) Get Adopted

Farcaster

Orbis

DeSo

Some other interesting projects:

Decentralized stable currency

The main problem is getting network effects - people want to post where other people are already posting.

Decentralized stable currency

Stablecoins are the largest use case in DeFi, but there are issues surrounding centralization.

OFAC sanctions against Tornado Cash caused Circle to freeze USDC in the Tornado Cash protocol.

USDT has $435 million frozen.

Growing Demand for Decentralized Stablecoins

GHO(Aave)

crvUSD(Curve)

Which products are coming soon? Leading decentralized tokens now include Dai, LUSD, and Frax.

There are also some protocol stablecoins coming soon:

The industry has been weary of algorithmic stablecoins since the UST debacle.

Big brands join Web3

Thanks to Polygon, 2022 is a big year for big brands to join Web 3.

1) Let's see how Starbucks' Odyssey and Nike's Swoosh NFT scheme fared

Ethereum Liquidity Staking

2) Momentum - you can expect more big brands to join Web3

Ethereum Liquidity Staking

Ethereum’s Shanghai upgrade is expected to arrive in March — it will slowly unlock staked ETH. (about 15.9 million ETH are pledged now)

Once more ETH is unlocked, this will increase the demand for ETH liquidity collateral.

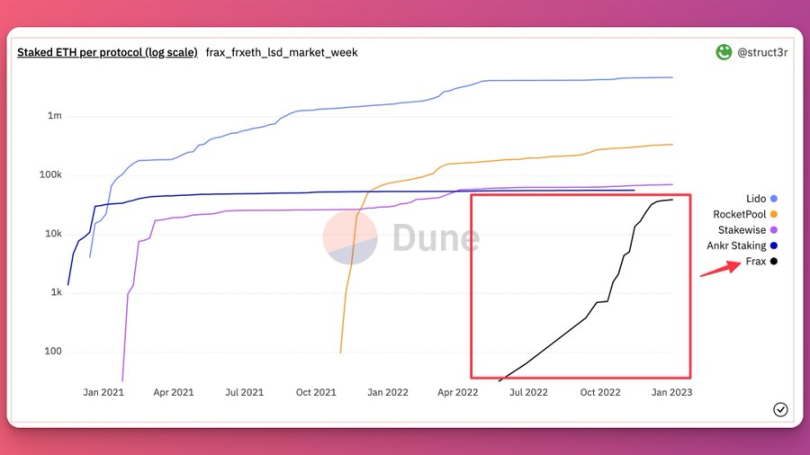

In the staking protocol market, Lido is dominating the market now, but a market share shift may occur.

Some other projects I'll be looking at:

RocketPool — focused on decentralized staking

FraxETH - Frax has an entire DeFi ecosystem to plug into and is gaining traction.

Other topics I follow:

A large number of tokens unlocked and shipped this year

Thorchain - Cross-chain swap

New Cosmos Proposals

FTM - AC background + FVM

Web 3 Wallet Wars

A bunch of other stuff just seems too low-level to mention.

some other bigger themes

I've listed several narratives, but I've noticed several larger themes that tie them all together.

1) Decentralize everything

2) Professional blockchain

3) Tokenize the real world

4) A new approach to solving the blockchain trilemma

In my opinion, the following topics are overrated:

GameFi - It's inevitable, but we're still years away from getting it right. Good games take a while to develop.

Crypto AI - I am bullish on AI in general, but anything related to Crypto AI right now is a money grab.

Solana - There were too many layers last year. This is a terrible choice.

How I see 2023

I am bearish on the situation this year.

The macro level sucks and it will take time for the stench of Luna/FTX to get out of the public mind.

2023 is all about staying engaged and planting the seeds for 2024/25.

Bear market position strategy

35% Low Risk Token/50% Stablecoin/15% Real Return Narrative.

Be prepared to deploy more funds if an echo bubble appears.

final thoughts

I'm not going to be actively trading - I'll probably stay away from the PVP market. keep patient.

final thoughts

A bear market is a psychological war of attrition.

We’ve been over a year since the last BTC top, and with so much disaster — the hard times are over.

survive.