Nasdaq: Revisiting Metaverse Venture Capital in 2022 and predicting the trend in 2023

Original source: Nasdaq

Original Compilation: Old Yuppie

The economic downturn and crypto bear market are a stage that causes headaches for all builders and VCs. In 2022, from the year of 2022, the venture capitalists are full of pride and spend a lot of money at the beginning of the year, and the venture capitalists are full of enthusiasm and dormant at the end of the year. Today, let’s take a look at a report from Nasdaq on Metaverse Venture Capital.

After a year of 2021 that saw the rise of platforms like The Sandbox and Decentraland, billion-dollar primary and secondary land sales, and soaring NFT prices, investor interest in the Metaverse has retreated somewhat. Ironically, at the same time, corporate and private equity money was pouring into the space. McKinsey reported in June that more than $120 billion had already been pumped into the Metaverse, which is more than double what it was in all of 2021.

This year's Enterprise Metaverse event confirmed that. Brands ranging from Nike and Gucci to Snoop Dogg and Time Magazine have invested heavily in Project Metaverse as a way to revolutionize experiential brand engagement, and Meta is doubling down on experiments with Horizon Worlds.

However, we have learned that there is more VC funding from web3-focused funds than mainstream VCs, corporates, and private equity in the consumer-focused space. We've seen this with OpenSea, Decentraland, Axie Infinity, Star Atlas, and The Sandbox.

With that in mind, let's take a look at the venture capital landscape in 2022 to get an idea of what 2023 might hold.

“Early in 2022, it became clear to us that it was the 'shovel-like' startups that would get the most investor attention. This metaphor is apt given the 'gold rush' mentality of many well-known consumer brands. "

who got the financing

As corporate money flows into the metaverse, three things happen. The first is a surge in demand for support services. In terms of building metaverse experiences, there is a rise in demand for digital architects, game designers, AI developers, content creators, and customized metaverse services, whether on open platforms or closed worlds.

The second thing that happens is fragmentation. The success of large Metaverse platforms has paved the way for purpose- and theme-specific platforms. Sports, arts, and consumer branding have been three of the most popular themes, while remote work collaboration and education emerged as viable candidates for building a particular world.

The third thing is the renewed focus on Web3 gaming. Given the contentious history of Web3 games, and the many brand initiatives surrounding gamification on the Metaverse platform, it is clear that a new economic model and gameplay innovation is needed. This year's crop of Web3 gaming startups are trying to do just that.

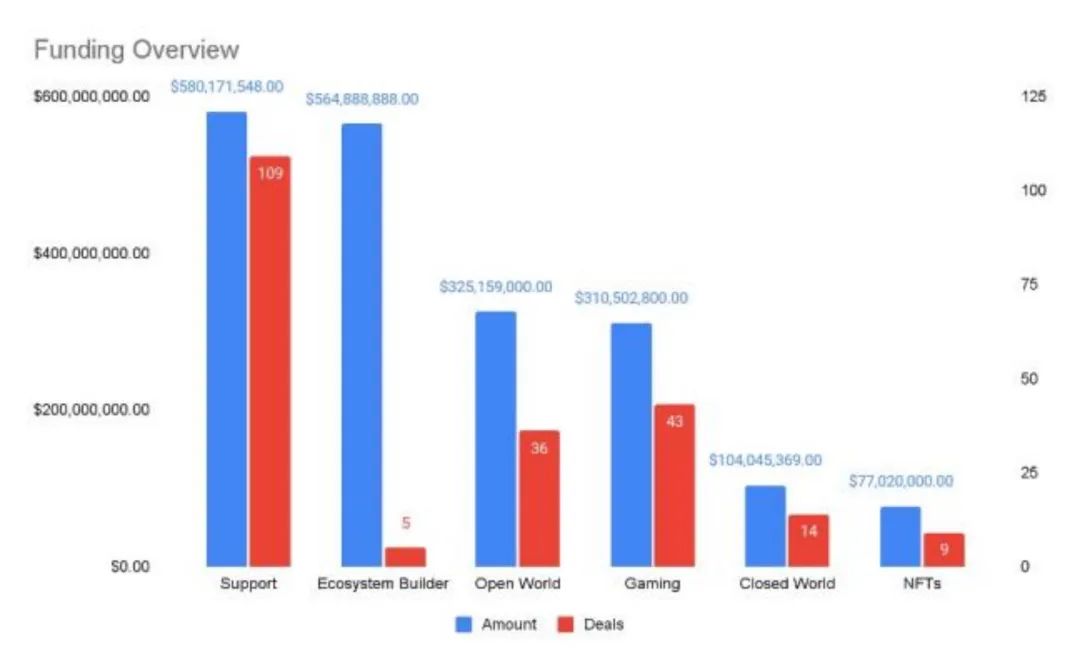

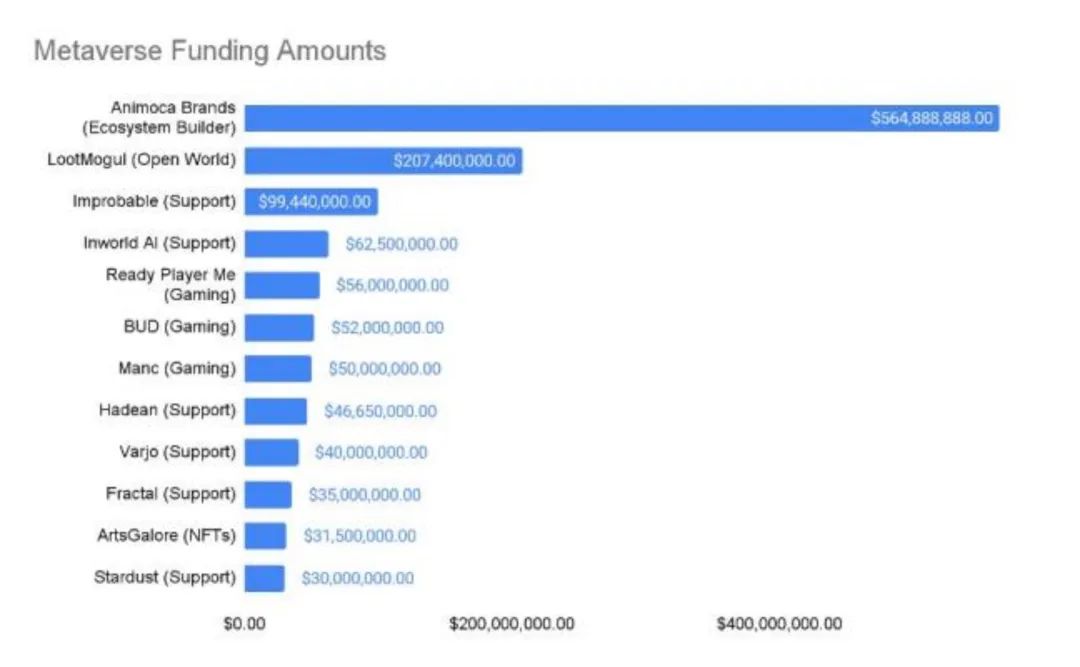

Venture capitalists have been quick to capture these trends. Startups backing the Metaverse are the main beneficiaries. Gaming startups are not far behind, especially those in the extended reality (XR) space. But the one receiving the most funding is Web3 giant Animoca Brands. This follows a pattern in recent years of investors funding late-stage ecosystems, which then fund early-stage startups. We’ve seen this trend across all major blockchain ecosystems, and now we’re seeing it with the ecosystem-agnostic Animoca Brands.

who is investing

From the first quarter to the fourth quarter of this year, financing transactions have dropped significantly. This coincides with the onset of the current cryptocurrency winter. We also see that investors have moved away from the hype-driven, more speculative investments that will characterize Q4 2021 and Q1 2022. The focus now is to focus on those builders who provide real value to their customers. One such area is startups that make it easier for brands and businesses to gain a foothold in the Metaverse.

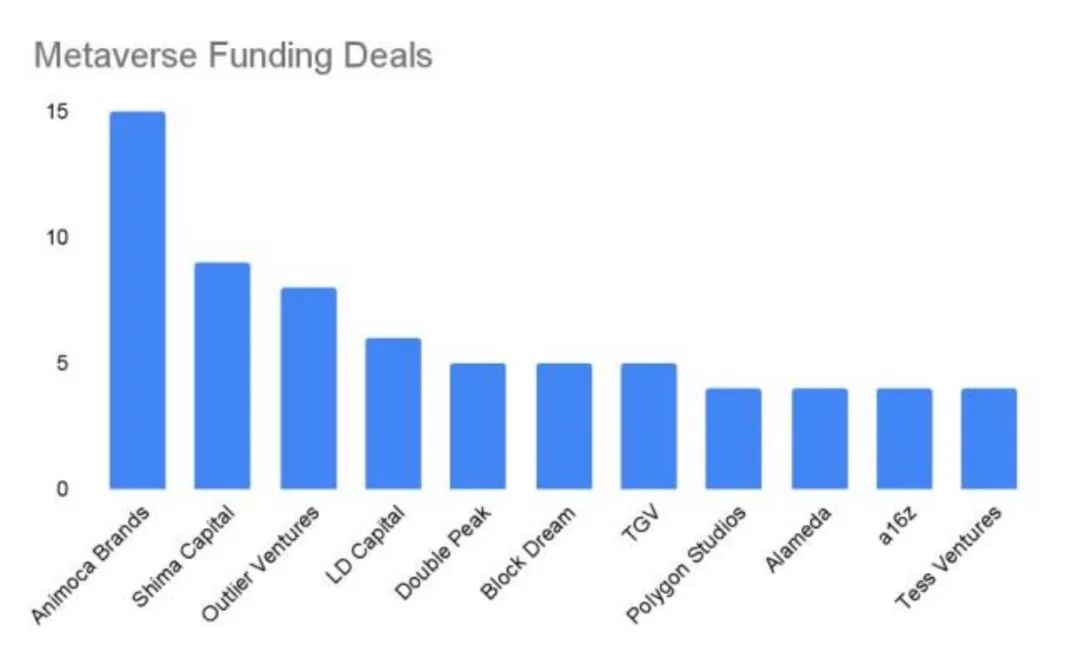

Another thing we’ve seen this year is that metaverse investments represent a relatively small portion of total blockchain investment. Take Shima Capital as an example. So far, the company has completed 102 transactions in 2022, 52 of which are in the blockchain field. However, only 17% of these deals could be described as Metaverse investments. Outlier Ventures and LD Capital had even higher proportions, at 50% and 30%, respectively. This shows that the entire industry is gearing up for growth. Given the inherent interoperability of Web3 technologies, investments that benefit one sector will also indirectly benefit others.

Animoca Brands closed the most Metaverse deals in 2022 so far. This is in line with the company's mission to contribute to building an open Metaverse. Its deals span Open Metaverse platforms, supporting companies and Web3 game developers. Another ecosystem builder, Polygon Studios, is also actively bringing more Metaverse companies onto the Polygon blockchain. Interestingly, Alameda Research also showed a clear interest in the Metaverse prior to its collapse.

Looking ahead to 2023

If there’s one lesson learned from this year’s Metaverse Investing event, it’s that the future of the open Metaverse concept is bright. While the crypto winter continues, builders will keep building and innovators will keep innovating. Now is the time to look for investment opportunities, to find startups hard at work now that will help grow the industry of tomorrow.

In stark contrast, Meta's Horizon Worlds adventure hits a pretty big speed bump in 2022. After an ambitious start, the company had to revise its monthly active user goal by nearly 50%, not to mention having to lay off thousands of employees. On the face of it, Meta's troubles are an indictment of the closed Metaverse. Accessing it requires expensive VR equipment, the actual utility of which is unclear. What's clear, however, is that the success of Horizon Worlds shouldn't be considered a barometer of the metaverse concept as a whole.

Here are some trends to watch in 2023:

Supporting services such as architecture, artificial intelligence and avatars will continue to account for a large share of investment

The metaverse is not going away. Open and closed platforms will continue to emerge. Businesses will find new ways to take advantage of the technology, and our lives will move more into the virtual world. We'll start to see innovations like AI avatar representation, virtual robot training, and a new wave of fun Web3 games based on a stable economic model.

The Open Metaverse Platform will invest heavily in expanding its own ecosystem

This is already happening to some extent, but we expect to see more of it in 2023, especially as the Metaverse platform launched this year seeks additional funding next year. If we do come out of the crypto winter in the first half of 2023, we should also be able to see established Metaverse platforms complete funding rounds planned for this year.

Web3 Gaming Set to Get Stronger With Improved Economic Models and Usability After a Tough Year

Web3 game developers may be the ones most affected by the current crypto winter. As token prices plummeted, so did the number of users playing their games. This sends a clear message that GameFi's economic model needs to be more robust and gameplay needs to get better. To that end, in 2023 and beyond, we'll likely see more games combining a "free to play" model with a new "play and earn" model.

A series of new industries will bring more traffic to the open metaverse

Concerts and other live events are prime examples. Well-known brands and celebrities are only scratching the surface of merging physical and digital experiences. We expect to see more innovations in this area, especially as XR technology improves and becomes ubiquitous.

methodology

We want to pay special attention to companies that are building the Metaverse platform or building tools and services that support the Metaverse platform. Using Crunchbase data, we set the description keywords to "metaverse" and "virtual world" in the search filter. We then categorized each company based on its description as "ecosystem builder", "open world", "closed world", "gaming", "NFT", or "support". For the “NFT” category, we only considered companies that showed a clear connection between their NFT creations and the Metaverse.

Other reports and articles on financing tend to cover online gaming, virtual and augmented reality. We believe this is a sweeping approach that greatly exaggerates the amount of money spent on Metaverse development. Simply put, not all MMOs and XR experiences should be considered relevant to the Metaverse concept.

Original link