Understand the difference between market manipulation and oracle manipulation in one article

first level title

This article will discuss the difference between market manipulation and oracle manipulation, how Chainlink Price Feeds can fully cover the market price of assets, and how developers can improve the security of applications.

What is market manipulation?

secondary title

Illiquid assets are more likely to be manipulated

An attacker's ability to manipulate prices depends on the liquidity of the asset itself. Liquidity refers to the ease with which an asset can be traded without affecting its price. The more liquid an asset is, the more money it will take to manipulate its price. Conversely, the less liquid an asset is, the lower the cost of manipulating prices. Therefore, illiquid assets are more likely to lead to market manipulation, and therefore also bring greater risks to related financial products.

The liquidity of an asset depends on its trading volume, trading depth and trading market. Let's talk about the definition of each indicator and its importance:

Trading volume--Trading volume refers to the number of transactions of an asset in a certain period of time. High trading volume indicates high market liquidity. However, some assets lack trading depth despite their high trading volume.

Transaction Depth——Trading depth refers to the number of buy orders and sell orders placed at each price level. This represents the market's ability to absorb large orders without generating large price swings.

market place--Assets are traded on multiple platforms at the same time, including centralized trading platforms,Decentralized Exchange Platform (DEX)secondary title

Market manipulation to guard against

There are many ways to manipulate the market, the following are some ways to manipulate the traditional financial and DeFi markets:

spoofing——Post a transaction but don't execute it. Use bots to post large numbers of trades to influence the behavior of buyers and sellers, and then reverse trades before execution.

hype (ramping) -Artificially increase the market price of assets to stimulate the demand of real buyers, and then ship to these buyers.

Bear raid -Artificially lowering asset prices by smashing or short selling.

Cross-market manipulation——Initiate a transaction in one market to manipulate the price of another market, and ultimately make a profit through arbitrage.

Wash trading——Acting as both a buyer and a seller, creating false volumes to attract real traders into the market.

Frontrunning——Initiate trades based on inside information, before the market knows or reacts to the news. In the crypto industry, frontrunning deals are alsoMEVa part of.

secondary title

Market Manipulation Risks of DeFi Protocols

Over the past few years, market manipulation has caused DeFi to lose a lot of value in various ways. Even if the price feed oracle machine integrated in the DeFi protocol is operating normally, if the market connected to the oracle machine is manipulated, the agreement still has risks.

DeFi platforms with market manipulation risks include:

currency market--Lending protocols that do not liquidate low-collateralized loans in a timely and efficient manner could experience bad debts or even dry up liquidity. Manipulating prices can also cause user funds to be misliquidated and cause losses.

Options Market——Like currency markets, options markets must trigger liquidations efficiently in order to remain liquid. These liquidations may be mandatory.

Synthetic assets -Paying a position based on the wrong price or creating a bad debt can result in a loss of funds for the liquidity provider.

Algorithmic stablecoin——If the stablecoin's stability mechanism and implicit incentive mechanism are destroyed due to price manipulation, then the stablecoin may experience unanchoring.

Automated asset management——first level title

Oracle

Oraclesmart contractblockchainandsmart contractInput external data such as digital asset prices, sports results, and weather data.

secondary title

Oracle manipulation due to misreporting

The error report refers to the discrepancy between the price feed uploaded by the oracle and the real price feed. Whether an oracle causes a false report intentionally or unintentionally, there is a risk of manipulation for the protocol that accesses the oracle.

secondary title

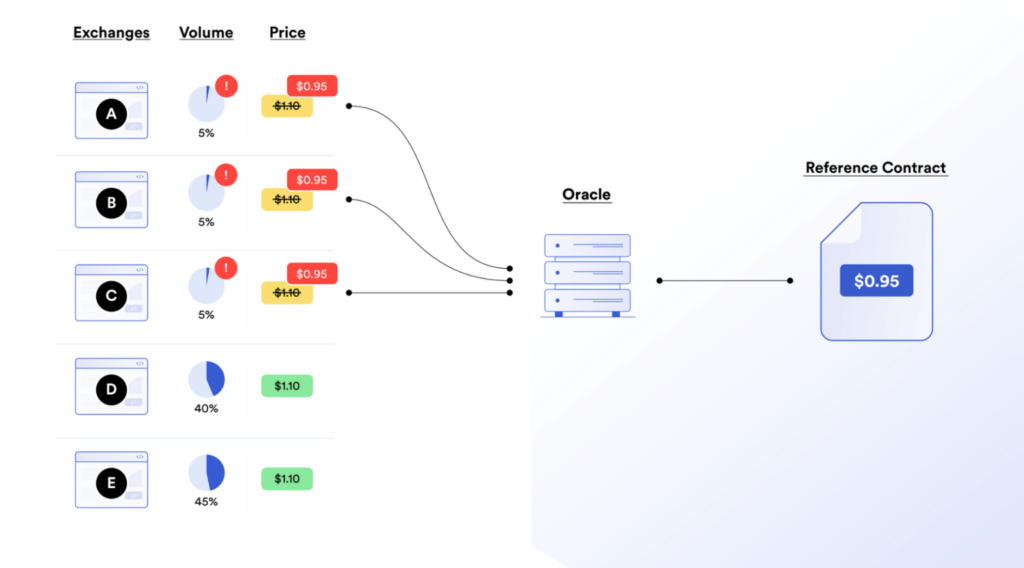

Oracle manipulation due to insufficient market coverage

Insufficient market coverage may cause oracles to misreport asset prices. If the oracle only covers a small number of trading markets, it is more likely to be manipulated, because the attacker can manipulate the price of these few trading markets without affecting the overall market price.

image description

secondary title

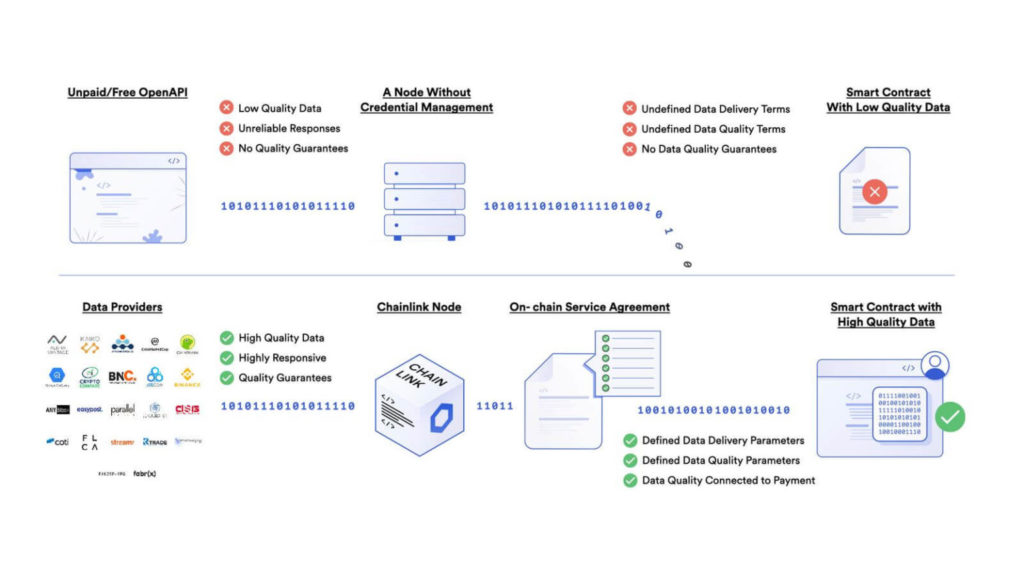

Highly secure oracle

Improving the security of oracle design can effectively eliminate the risk of oracle manipulation. The security of the oracle machine includes the following links: 1) Obtain price feeds from all trading environments to achieve coverage; 2) Prevent external parties from tampering with data through decentralization, eliminating single points of failure; 3) Establish an economic incentive mechanism to Ensure the accuracy of oracle reports.

image description

first level title

Oracle Manipulation Risks for DeFi Protocols

Currency markets, options markets, synthetic assets, algorithmic stablecoins and automated asset management, etc.DeFiOnce the protocol is manipulated by the oracle machine, it will cause a series of negative consequences, such as stablecoin de-anchoring, malicious arbitrage transactions, forced liquidation, and protocol liquidity drying up. While the risks of oracle manipulation are similar to those of market manipulation, the roots of the two types of behavior are different.

first level title

What is the essential difference between market manipulation and oracle manipulation?

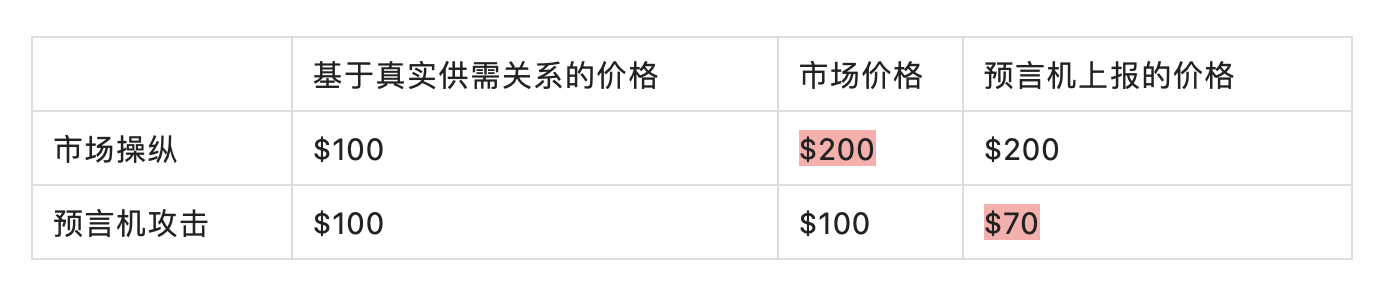

Market manipulation changes asset prices, while oracle manipulation uploads wrong or invalid price feeds to the chain, which do not reflect the true price of the asset. These two issues have been conflated for a long time due to the loss of funds that appear to be at first glance distorted asset prices.

The essence of market manipulation is to change the underlying supply and demand relationship of an asset so that its price deviates from normal levels. Under normal circumstances, the oracle will report the price of the asset truthfully based on the actual situation. If the market-wide price of an asset is manipulated, the oracle will still report that price - which is what the oracle is supposed to be used for.

secondary title

Examples of points of failure

As mentioned in the above table, the failure points of market manipulation and oracle manipulation are different. Suppose there is an asset that should trade at $100 based on true supply and demand. When the market is manipulated, the real price of $100 is artificially manipulated into $200, and that's the point of failure. And the oracle just accurately reported the market price of $200. And when the oracle is manipulated, the market price remains at $100. The oracle incorrectly reported the price as $70, which was the point of failure.

secondary title

Chainlink Price Feeds Can Protect dApps From Oracle Attacks

To eliminate the risk of oracle attacks, applications can integrate Chainlink Price Feeds to accessHigh-quality and tamper-proof market data。

Chainlink Price Feeds has a variety of security features, including:

Achieving decentralization on multiple levels -infrastructure inData Sources, Node Operators, and Oracle NetworksDecentralization at the level can avoid the risk of single point failure and ensure that the oracle report can reflect the real market price.

Highly reliable oracle node operator——node operatorDistributed in all corners of the world, they are not only experienced, have passed security assessments, and can also resist Sybil attacks. These nodes are responsible for transmitting price data for the Web3 network.

Defense in depth strategy -On-chain transparency, active monitoring, failover, disaster recovery, and backup oracle network, etc., jointly build asecondary title。

How Chainlink Price Feeds Responds to Market Manipulation

If the market-wide price of an asset is being manipulated, Price Feeds will report that price because the oracle will accurately reflect the current state of the market. But if only a small portion of the market is manipulated (such as a few low-liquidity markets), then Chainlink Price Feeds will still report the price of the entire market to defend against manipulation attacks.

secondary title

Explore Chainlink Price Feeds

first level titlehttps://youtu.be/-pJqlI 61 ZKc

How DeFi developers can ensure the security of dApps

To ensure the security of dApps, the first step for DeFi developers is to integrate Chainlink Price Feeds to obtain accurate, tamper-proof and reliable price data. Second, developers must assess the quality of assets in the protocol.

Assets with low liquidity are more vulnerable to attacks as collateral, because it is easier for attackers to manipulate these assets. Therefore, a specific analysis of market risk should be carried out to clarify how to set the loan-to-value ratio (loan-to-value ratio) to best protect the liquidity of the agreement and avoid risks.

Further enhance the security of dApps:

Fuse mechanism——In case of extreme price fluctuations, the smart contract will be suspended.

Delay contract upgrade——The contract will not be updated until the protocol receives the latest data feed.

Manual emergency stop switch——If a vulnerability is found in the upstream smart contract, the user can manually suspend the operation and temporarily cut off the data feed.

monitor--Some users will create their own monitoring and alarm mechanism to send an alarm when the data feed deviation exceeds a certain threshold.

first level title

Improve the security of dApp and promote the mainstream application of DeFi

If DeFi applications are to be popularized in daily life, the security of DeFi must be watertight. This means we must address the issues of market manipulation and oracle manipulation. While oracle manipulation can be effectively avoided using Chainlink, developers must take security precautions and users must do their own research before depositing funds into a protocol. In the final analysis, to ensure the security of Web3 assets, a multi-pronged approach must be taken. We need to work together to ensure the safety of user funds.

If you are a DeFi developer looking to integrate Chainlink Price Feeds, check out ourdeveloper documentation,existDiscord groupAsk a question, or chat with a Chainlink experttelephone communication。