Extraction of 12 main points of the SBF lawsuit

This article comes fromTwitter, original author: @Compound 248

Odaily Translator |

On December 22, former FTX CEO Sam Bankman-Fried (SBF) was extradited from the Bahamas to New York, the United States, and detained by the FBI. New York federal prosecutors released an indictment involving eight counts last week. Convicted, he could face decades in prison, whileFormer Alameda Research CEO Caroline Ellison has pleaded guilty to seven counts of conspiracy to commit wire fraud against FTX clients, wire fraud against Alameda Research lenders, commodity fraud, securities fraud, and money laundering, with a maximum penalty of 110 years in prison; FTX co-founder Gary Wang He pleaded guilty to four counts of conspiracy to commit wire fraud, commodity fraud, and securities fraud against FTX customers, and could face up to 50 years in prison.According to a legal document filed by the U.S. Securities and Exchange Commission in the Southern District Court of New York, we have sorted out 12 main points of this case:

1. SBF told a big lie, Gary Wang established the "FTX back door" for Alameda Research and used it for money laundering, and Caroline Ellison turned Alameda Research into SBF's personal fund, and SBF began to buy real estate, venture capital, and donate to American politicians like crazy .

2. Caroline has admitted that SBF asked him to do many things, including instructing her to take client funds from FTX in exchange for FTT tokens, which contradicts SBF’s repeated testimony that she did not know FTX took client funds. Clearly, Caroline doesn't want to hang out with SBF anymore, and now she's going to drag SBF down.

3. In May 2022, Alameda Research discovered that something was wrong. At that time, the fund had already "borrowed" billions of dollars in FTX client assets, but the violent volatility of the encryption market made Alameda Research (including SBF) unable to fulfill the borrower's obligations. As a result, SBF became more and more crazy, allowing Caroline to take more FTX customer money.

4. SBF has planned for a long time. In fact, a large number of brazen breaches have been carried out in the dark for a long time, only to peak in 2022. As early as a few years ago, SBF started doing this, so the problem with FTX is not a recent "accident", but a "fraud that has been planned for many years".

5. SBF and Gary Wang own 100% of the shares of Alameda Research. If you mention Alameda Research, you can almost use "SBF" instead, because SBF owns 90% of the shares of the fund, and Gary Wang owns the remaining 10% — —Alameda Research has no clients and all the money is stolen from clients by SBF and Gary Wang.

6. SBF has absolute control over Alameda Research from beginning to end. Even with the appointment of Caroline and Sam Trabucco as co-CEOs of Alameda Research in 2021, SBF has always maintained control of the fund, frequently communicates with fund staff, and has full access to fund books and transaction records - "Alameda Belongs to SBF alone", there is absolutely truth to this statement.

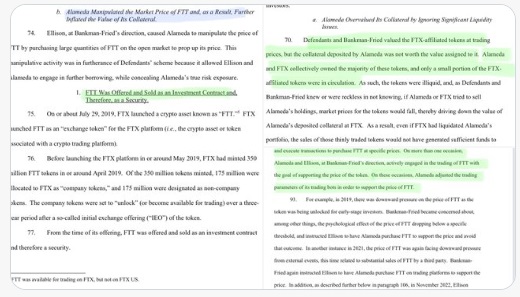

7. Alameda (SBF) is "excluded" from the FTX risk management process. As many people know, as a cryptocurrency exchange, FTX does have a good set of risk engines, but it does not include SBF and Alameda Research, because SBF can easily launch FTT, a "garbage currency" as collateral.

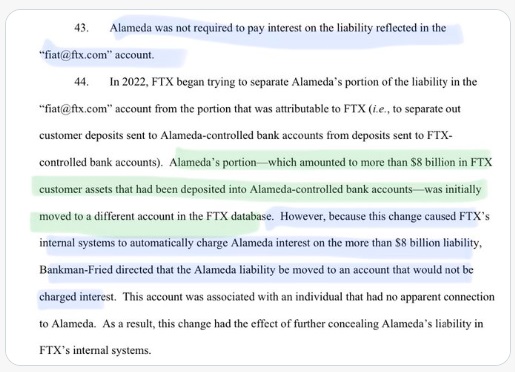

8. SBF is the culprit for the loss of up to $8 billion in FTX customer funds. SBF asked Alameda Research to perform a series of illegal operations, directly remitting $8 billion of FTX customer funds into Alameda accounts. These funds are essentially "loans", and SBF even made Alameda (in fact, SBF itself) not have to pay Interest.

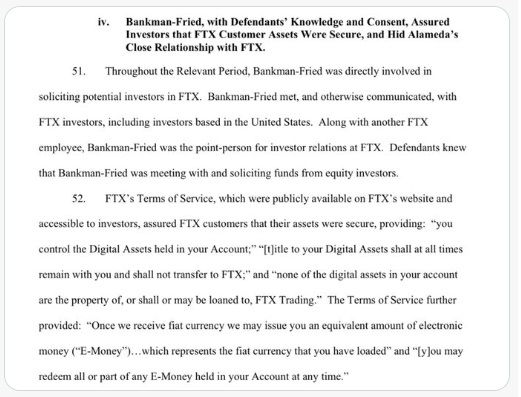

9. SBF has committed securities fraud. Among the many frauds committed by SBF et al. was securities fraud. The US Securities and Exchange Commission has already filed a lawsuit against SBF, and imagining how SBF lied to potential investors to raise new funds will undoubtedly be "more guilty".

10. FTT is a "securities". SamCoins, ShitCoins, Web3 "Token", or even "Magic Beans", no matter what you call it, the token FTT is definitely different from the cryptocurrency you imagined. SBF lied to every investor and also manipulated the price of FTT. Now, the US Securities and Exchange Commission has also made it clear: FTT is a "securities."

11. SBF is not engaged in encrypted lending business at all, what he is doing is "money laundering". If your fund "borrows" client assets and then "lends" those funds to yourself, and none of the transactions are even recorded, is that a "lending business"? Isn't this blatant money laundering? !

12. FTX customers withdrew $5 billion in one day, and the funding gap was as high as $8 billion.

Summary: The above are the 12 main points of the SBF lawsuit. It is expected that there will be more lawsuits against him and his accomplices in the future, and will push SBF to his final outcome.