Algorithmic Stablecoin Year-End Review: It’s been a tough year as UST collapses

Image credit: by

Compilation of the original text: The Way of DeFi

Image credit: bytool generationtool generation

2022 is going to be a tough year for algorithmic stablecoins due to the collapse of UST.

According to DefiLlama data, as of today, the stable market value is only 2.36 billion US dollars, accounting for only 1.6% of the total market value of stablecoins.

First, a brief explanation of what an algorithmic stablecoin is. Suanwen issues $1 worth of stablecoins by depositing $1 worth of volatile assets.

For Terra, it mints 1 UST with 1 USD of LUNA. If the UST price is less than $1, anyone can buy UST for $1 to mint LUNA, and then sell LUNA for a profit.

This model is capital efficient: when demand for UST increases, it boosts LUNA buying pressure and price.

When the price of LUNA increases, the amount of LUNA required to mint 1 UST will decrease.

And during a drop in demand, the process is reversed, which eventually leads to the collapse of the UST peg.

Currently, Defillama lists a total of 20 algorithmic stablecoins.

Terra's UST Classic is still the third largest stablecoin with a market cap of $202 million and the 136th largest coin of all coins!

Despite trading below the peg at $0.02, USTC is still listed on Binance, OKx, Kraken, and other exchanges.

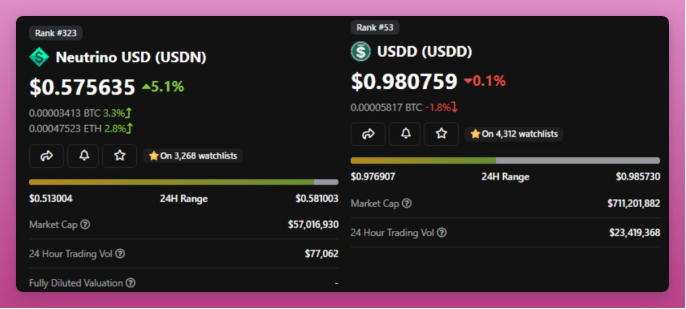

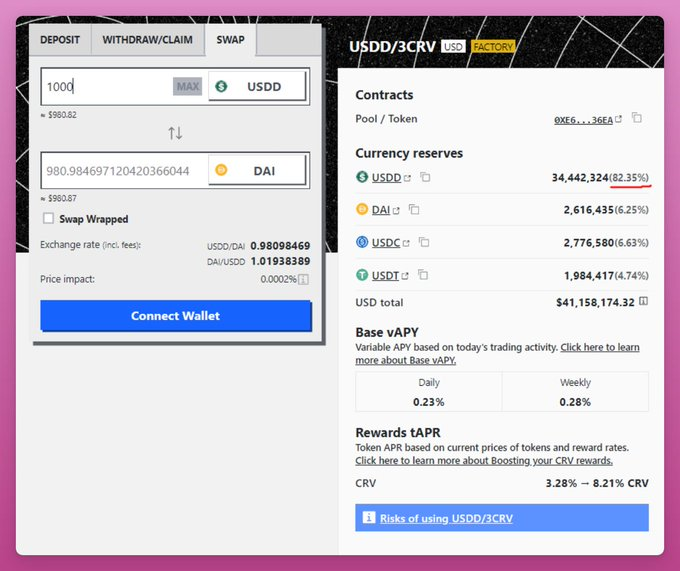

Tron’s USDD and Wave’s USDN are the only two UST stablecoins that have their native tokens as collateral. Although both are below pegged trades and are not (and no longer are) pure calculations.

Tron claims that USDD is mortgaged by TRX, BTC, USDT and USDC, with a mortgage rate of 201%.

However, USDT is only minted with TRX, and only by 8 Tron DAO members (Alameda is one of them).

USDD was last issued on July 17, and its market cap has not changed since then.

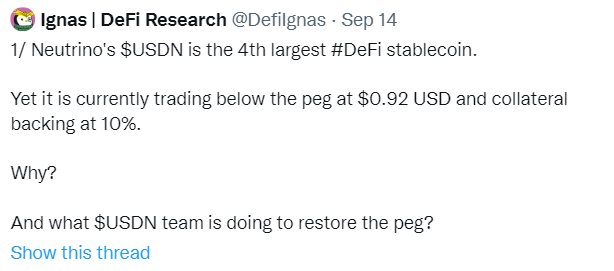

Wave's USDN has gone through 4 major decouplings, the worst of which is happening now.

USDN has struggled to maintain its peg to $1 as it is no longer backed by 100% WAVES collateral.

As for why it's struggling? Please see belowThread, and follow @YouAreMyYield for more updates.

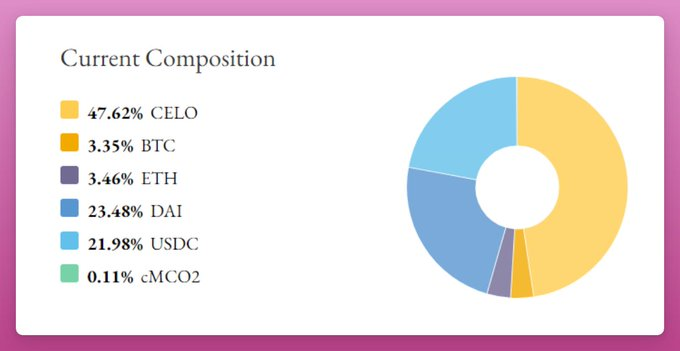

Compared with the stability introduced above, Celo's CUSD is pretty good.

The CUSD collateral ratio is 50% of CELO, and the rest are carbon credits of BTC, ETH, stable currency and MCO 2 Token. CUSD has stable collateral, but low market capitalization and trading volume: $42 million and $1.2 million, respectively.

Looking at market cap again, FRAX is the true leader in the category with its $1 billion market cap.

FRAX is distinguished by some of its algorithmic models (see belowThread):

capital efficient coinage

Support Curve, Convex, etc.

Built-in Fraxlend and Fraxswap

Automated market operations facilitate supply

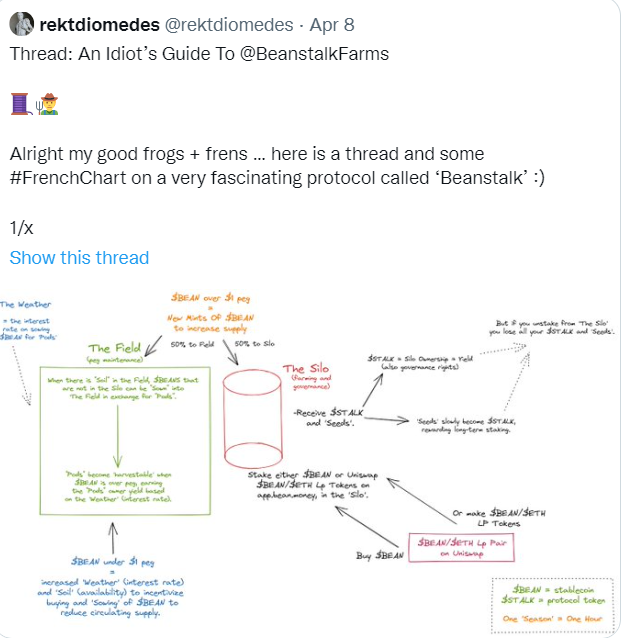

More innovation and experimentation in this area is brought about by UXD, BEAN, and DEI.

UXD uses delta-neutral position derivatives to maintain the peg. For example, when $1 of SOL is deposited, the protocol opens a short position to earn a funding rate and distributes it to UXD holders.

tweetstweets)

DEI is a fractional reserve stablecoin used within the DEUS Finance DAO's derivatives ecosystem. Its market cap is only $22 million, which is small, but it's interesting. like@rektdiomedesAs he put it, “Think of it as TERRA/LUNA + synthetic assets + oracles, all supraphysiological doses of DeFi testosterone.”

Two algorithmic stablecoins decided to voluntarily shut down this year.

FEI raised $1.3 billion in 2021 to build a decentralized stablecoin.

tweetstweets)

The second is Near's USN.

USN was launched just 8 months ago as an algorithmic stablecoin.

After UST collapsed, USN v2 transitioned to minting USN with USDT. But due to double minting, there was a '$40 million collateral gap' and the project was shut down.

In general:

Algorithmic Stablecoin Market Cap Drops 90%

Algorithmic stablecoins of pure UST type no longer exist in the market

Most of the current stable projects are niche products with low market capitalization

At least two projects (USDN, USDD) are working to keep the peg

Two programs (USN, FEI) were closed.

At this stage, algorithmic stablecoins pose no threat to any of the major fiat-backed stablecoins, or even to over-collateralized stablecoins.