JZL Capital Industry Weekly Report No. 51: FUD in the currency market continues, and the Federal Reserve meeting is hawk

1. Summary of Industry Dynamics

secondary title

1. Summary of Industry Dynamics

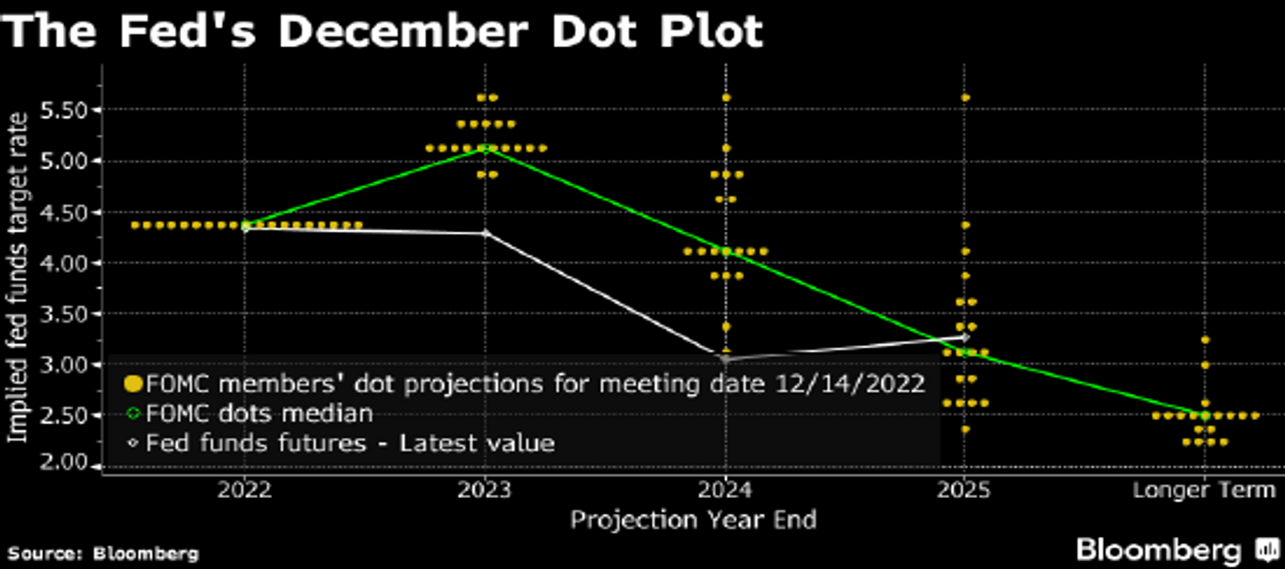

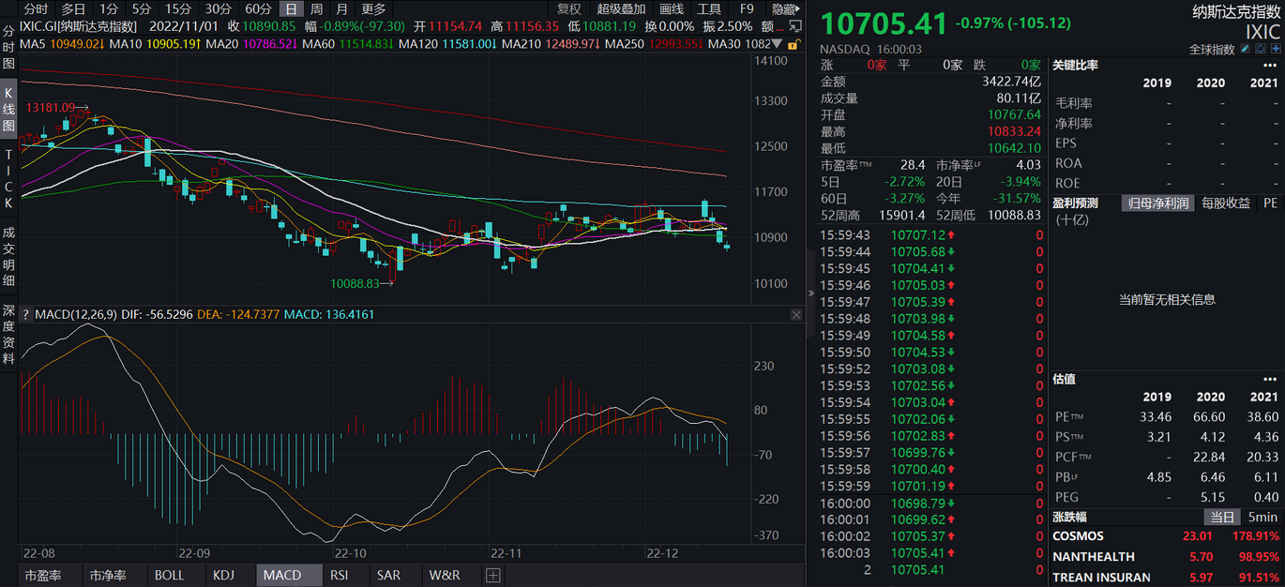

In contrast, U.S. stocks, the CPI data was released last Tuesday and the data is positive. The CPI annual rate in November was 7.1%, which was significantly lower than the 7.7% in October, and the month-on-month increase was only 0.1%, the lowest growth rate this year. The data looked very optimistic at first glance, but afterwards it turned into sadness. After a slight rise on Tuesday, US stocks started to fall for four consecutive days. The Nasdaq dipped to the bottom of the rectangular shock, with a drop of 7.5% from the highest to the lowest within the week. The S&P also terminated the upward trend of the previous few weeks. It dipped to the 60-day moving average and found support, and rebounded in late trading. The lower shadow line on the daily chart is formed. The end of the interest rate meeting on Wednesday and the speeches after Powell's meeting were the main driving force for this decline, and the market's outlook for the market outlook is still ominous. Powell first mentioned that it is impossible to predict the scale of the next interest rate hike. The extent of raising interest rates by 25 or 50 basis points in February next year depends on the data and the labor market. It will cut interest rates, which also led to most of the market's opinion that interest rate cuts will not be initiated in 2023. At the same time, the interest rate forecast dot plot also shows a higher peak interest rate than the September dot plot. Powell used the term restrictive monetary policy in his speech, which means tightening monetary policy. Powell does not seem to care that restrictive monetary policy will cause economic recession. He has also admitted that economic growth will be very slow, so 2023 It is very likely that under the guidance of the Federal Reserve and the self-fulfilling of investors' expectations, a real economic recession will be triggered. The impact of inflation and interest rate hikes on US stocks has come to an end, and the market may transition from macro policy guidance to the black swan risk of individual stocks. This week is the week before Christmas, and the market is preparing for a long holiday. Trading volume and volatility may both decline, and the market will most likely not break new lows before the end of the year.

2. Macro and technical analysis

secondary title

2. Macro and technical analysis

From a macro perspective, the U.S. stock market is digesting the FOMC meeting minutes and Powell’s speech. (1) In terms of recession, Powell said that the economic forecast given by the committee has met the criteria for a recession path, but the rate hike has restrictions on non-interest rate-sensitive industries The impact will still take time to emerge, especially as the labor market is currently very tight, and the U.S. economy is still likely to achieve a soft landing; (2) In terms of interest rate cuts, Powell said that the Fed will not cut interest rates until it is confident that inflation will fall back to 2%. A restrictive policy stance may be required for some time.

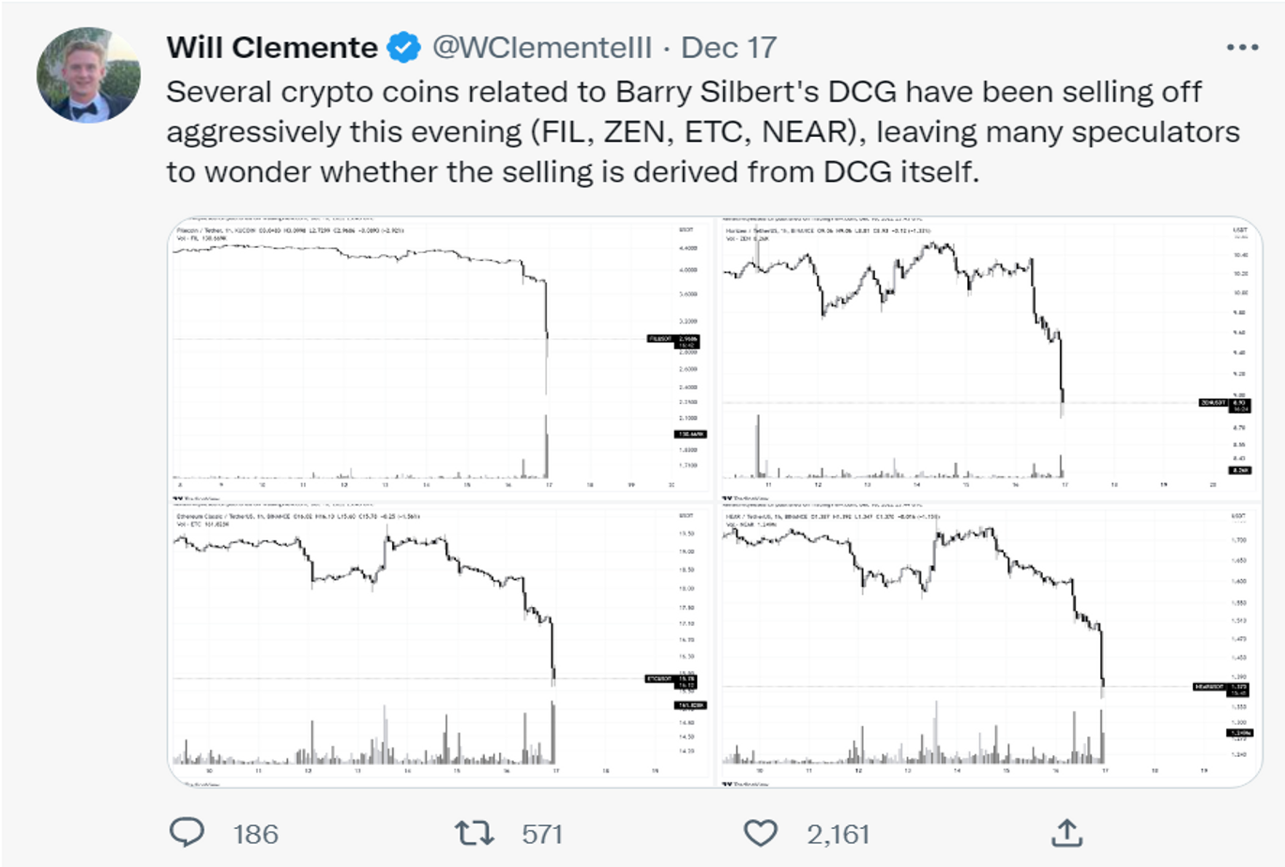

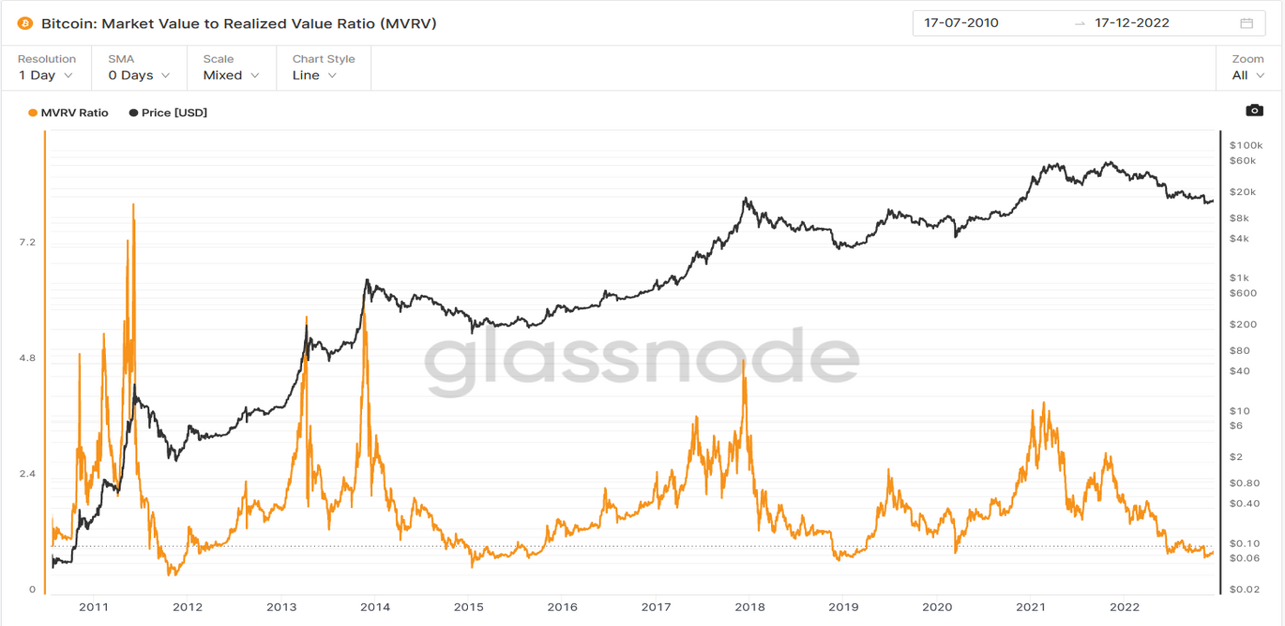

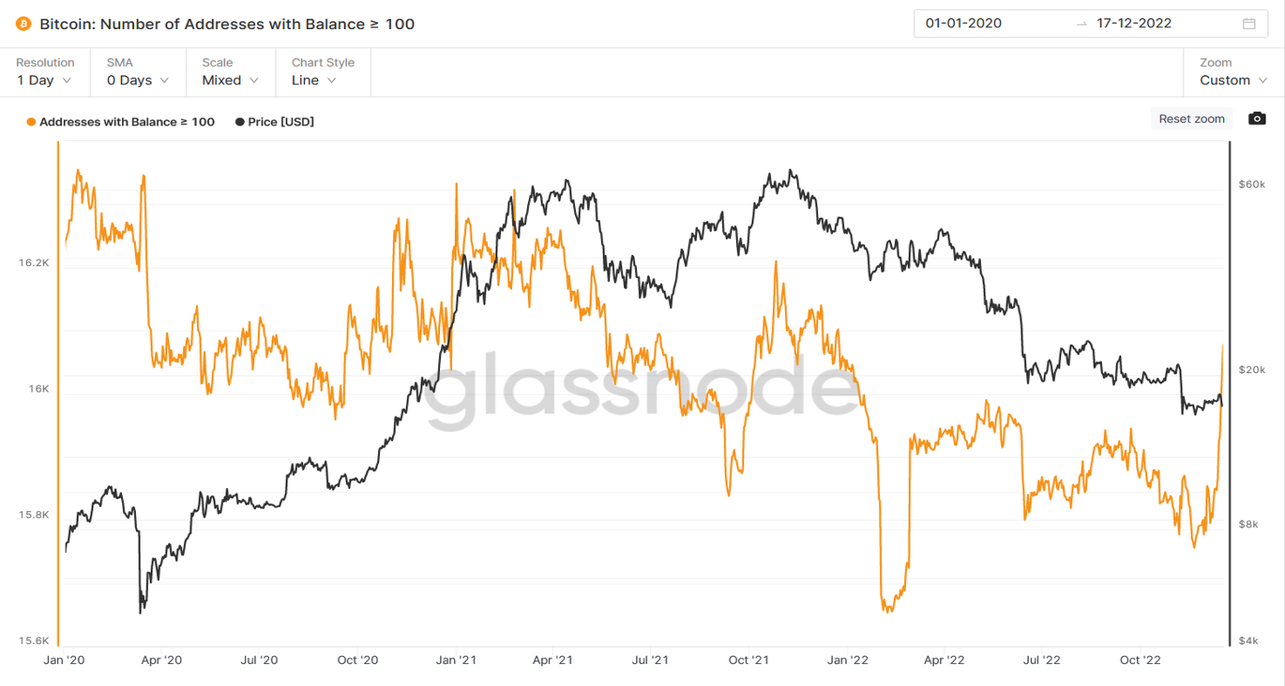

At present, BTC and ETH are affected by the macro level, and at the same time, the fermentation of the Binance incident in a short period of time has caused the market to start a sell-off mode, and the decline of altcoins is much greater than that of BTC and ETH.

Two-year U.S. Treasuries move to 4.2

Nasdaq retreats below 11,000

Ahr 999: 0.34, you can make a fixed investment

secondary title

3. Summary of investment and financing

Investment and financing review

3. Summary of investment and financing

Investment and financing review

During the reporting period, the number of financing and projects "recovered slightly", and 17 investment and financing events were disclosed, with a cumulative financing amount of approximately US$4.76;

secondary title

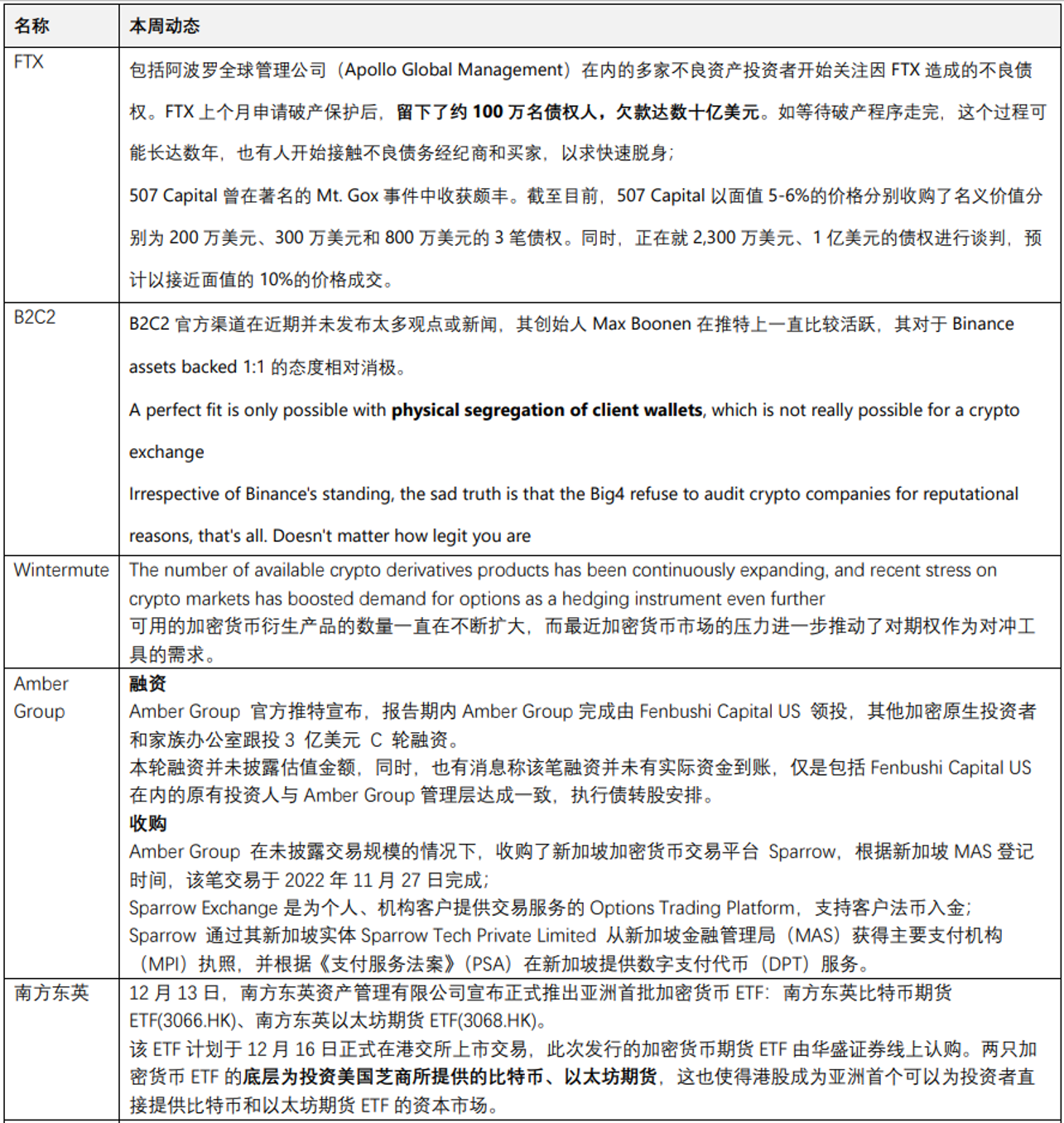

Institutional dynamics

4. Encrypted ecological tracking

1. NFTs

(1) NFT market this week

4. Encrypted ecological tracking

(1) NFT market this week

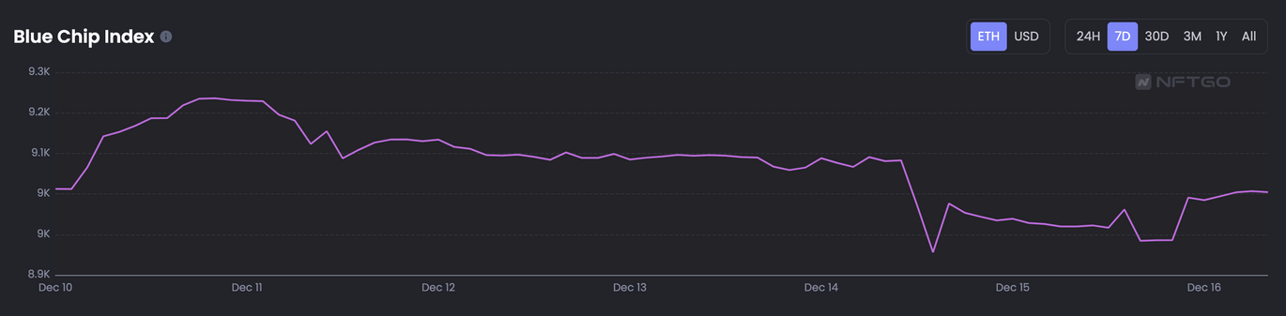

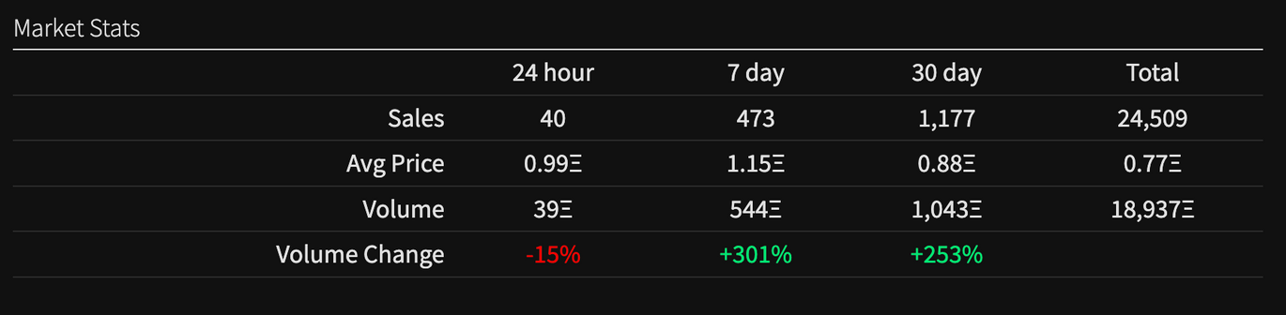

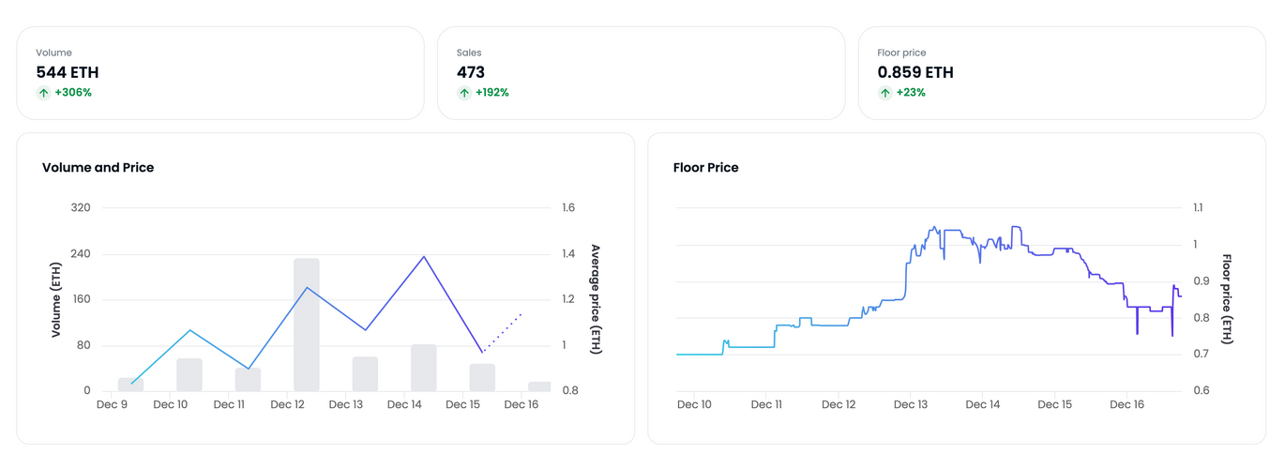

Market overview: The NFT blue-chip index has not improved significantly this week. As of December 16, the market has recovered compared to last month, but the NFT blue-chip market is still at the freezing point of a bear market. It has climbed, but there has been no significant change in general, and the market is still in the recovery period.

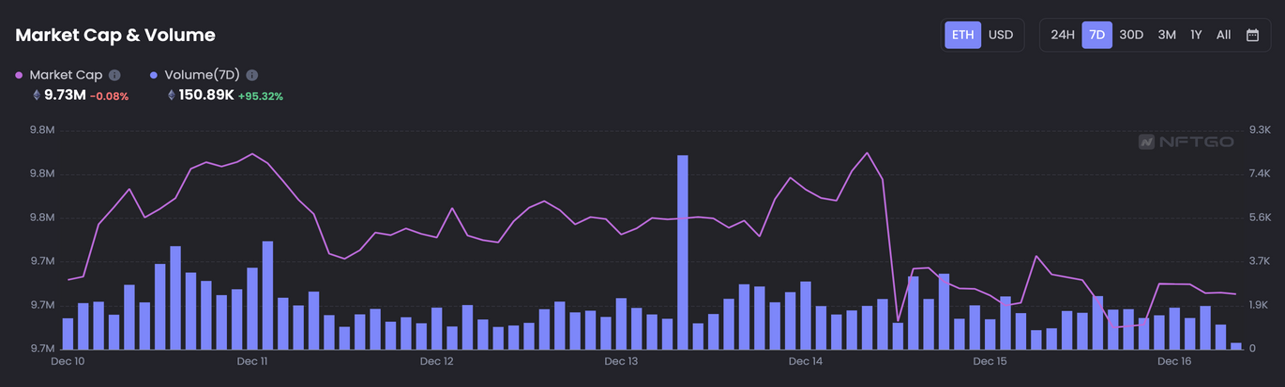

Although the total market capitalization of the NFT market this week basically changed little year-on-year, down only 0.08%, the total transaction volume has increased significantly, up 95.32% year-on-year within 7 days. The increase in the total market trading volume may represent a sign of improvement in the nft market.

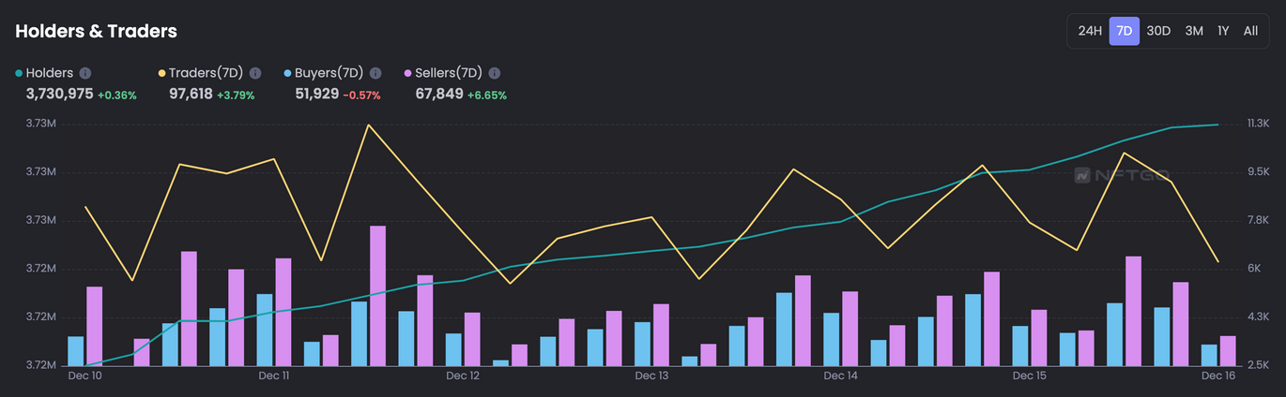

The holders of the NFT market have not changed much this week, and the activity of traders has increased to a certain extent compared with last week. Buyers have decreased by 0.57% compared to last week, and sellers have increased by 6.65% year-on-year. Overall, the market is currently not too There are many signs of bottoming out, and the market is still fluctuating at a low level.

The top three NFTs in terms of market trading volume this week are BAYC, MAYC, and Azuki. It is worth mentioning that the current market share of the artblocks platform dominated by generative art has already ranked fifth. The floor price of BAYC is currently maintained at around 67 ETH.

2) This week's dynamic focus:

Former U.S. President Trump (Donald Trump) announced on his social media website the launch of the Trump Digital Trading Card NFT. This series is issued on the Polygon chain, priced at $99, with a total of 45,000 pieces, which can be purchased using ETH and legal tender , the current Trump NFT has been sold out, the total transaction volume exceeds 2300 ETH, the floor price once reached 0.84 ETH, and the 24-hour transaction volume ranks first in OpenSea. This nft depicts some of his life's occupations and related interests in various forms, including superhero, astronaut, cowboy, and race car driver. Trump publicly stated that NFTs are very much like baseball cards, but hopefully more exciting, adding that they would make a great Christmas gift. Some of the buyer's benefits include participating in the platform's online lottery, and the prizes include:

Chance to win a dinner with Trump

Holders can invite their friends to play at Trump's golf course

online zoom call

Offline 1 on 1 meeting

Send out souvenirs related to him.

Racing game developer The Tiny Digital Factory has partnered with luxury sports car brand Aston Martin to launch the blockchain game Infinite Drive Racing, and will launch a limited-edition NFT series on Polygon. The first batch of 3,000 NFTs will be available on MagicEden on December 18th, whitelisted players will be able to purchase the collection on the first day, and the public sale will begin on December 19th. Buyers of an Aston Martin nft will be able to use their purchase to use and compete with fellow drivers in the Infinite Drive Metaverse game. All NFTs released will be restored 1:1 with real models, and collectors can view all parts of the car in their accounts.

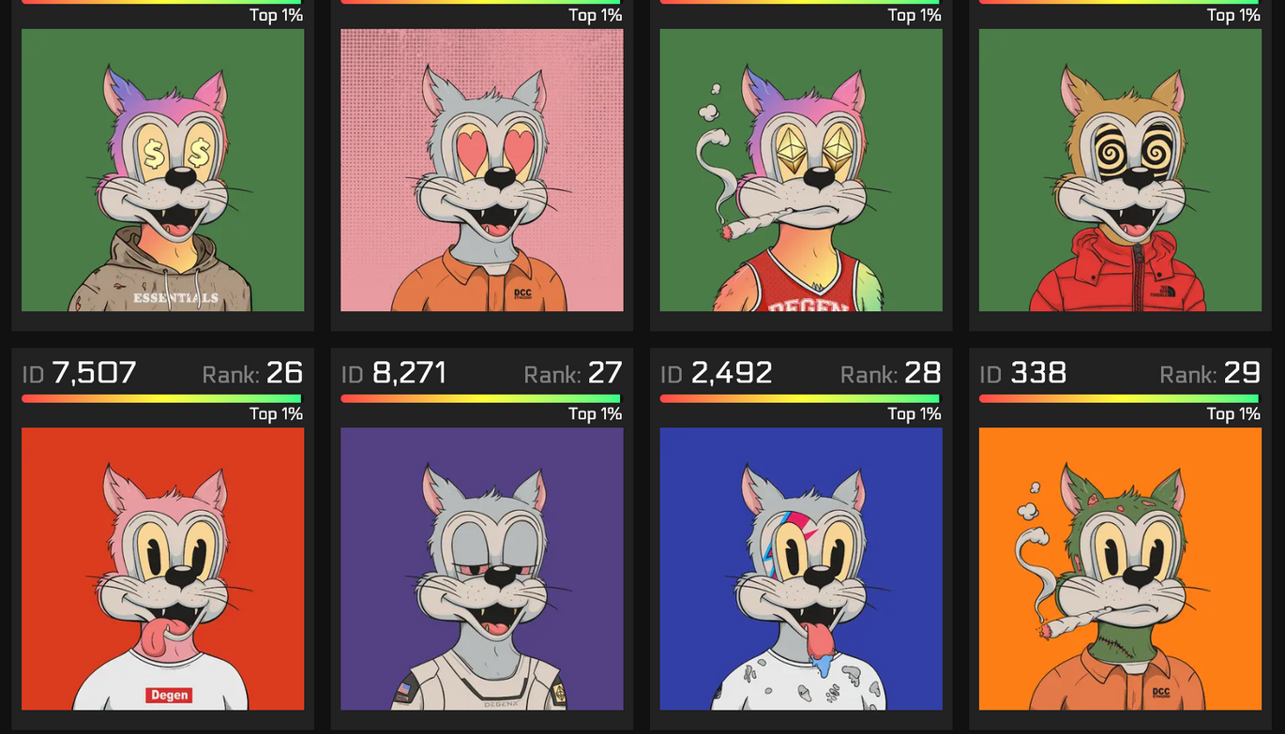

(3) Key project: DEGEN TOONZ

The background painting style is more retro, not delicate. It feels like a tribute to Tom & Jerry animation. The head-to-body ratio is relatively small, mainly highlighting the cat's eyes. The eyes and mouth account for a large proportion in the entire pfp picture, which is consistent with Tom cat.

It imitated the painting style of bayc and mayc, and the marketing was very successful. Many bayc and mayc users began to change to degen toonz's avatar. The promotion itself is also a kind of viral marketing practice, and it is very effective. From the perspective of users, the cross-holders with mayc are the most, and the bored ape family cross-holds Some accounted for 40%. Although degen's current blue-chip index is not high, he chose to break through the value of his own project from the blue-chip group of mayc. It may be because mayc is cheaper than bayc, so the starting point of this project is also very successful.

Introduction to RoadMap

In mid-February this year, 8888 DEGEN TOONZ NFTs have been released, and the Discord community and official website have been established. With the development of the community, ETH and NFT airdrops will be rewarded to outstanding participants in the community, and special identities will be granted to the community (enjoying unique benefits, such as Other NFT project whitelist, etc.).

Phase 2: Establish a community DAO, DEGEN TOONZ holders can have voting rights for all major decisions of the NFT project through snapshots. The project party will use additional NFT and ETH to reward current Holders (a total of 10,000 usd).

Start to synthesize the second generation of DegenToonz to control inflation.

Phase 3: The DegenToonz metaverse operation officially begins, and the project party will begin to build an exclusive event land for TOON TOWN in the metaverse. DegenToonz will issue metaverse airdrops to all holders.

Phase 4: Issue the second airdrop of Degen Toonz to the holders, establish the foundation for the P2E game, and introduce the development and deployment of the next stage of the project.

Summary of the development path:

As a 2D PFP NFT project, DegenToonz did not fall down after encountering the dilemma of endless MINT in the early stage of the project and the breakout of the secondary market. Instead, it continued to unite the community, summarize and analyze the source of the problem, and actively discuss solution. In the later stage, the project has also been recognized by the market and players, and the floor price and transaction volume have been steadily rising. The project party has also been preparing offline activities to build a communication platform for the community. It can be said that the project party and the community support each other. If the status quo can be maintained stably and a highly united community atmosphere is maintained, DegenToonz will become mainstream in the future The potential of blue chips is enormous.

2. GameFi blockchain games

overall review

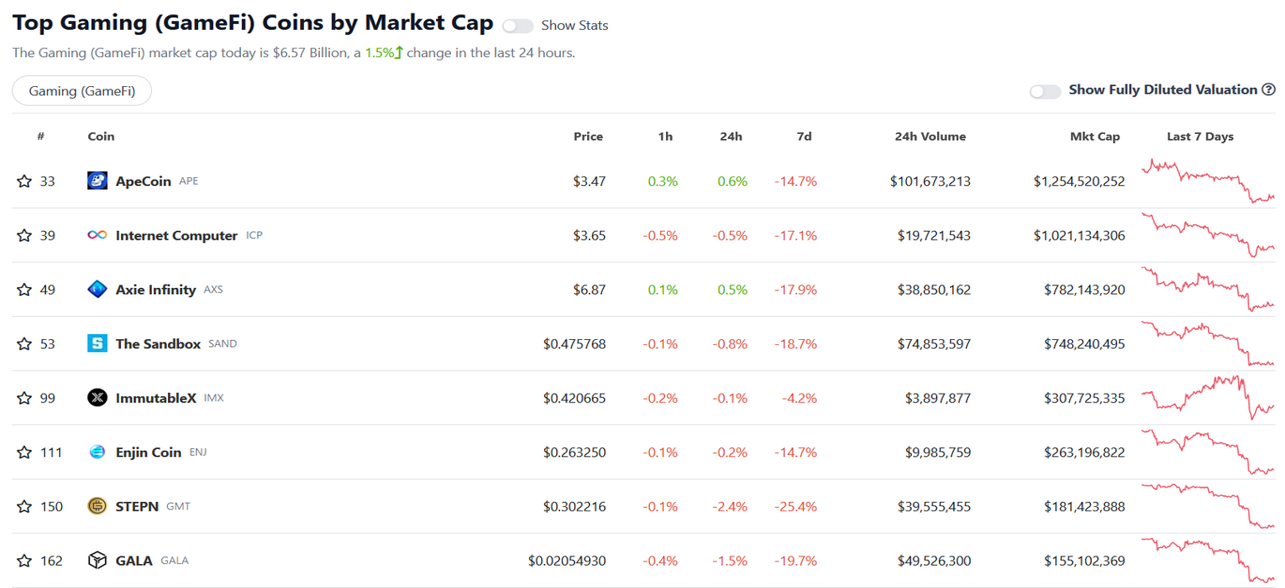

This week, mainstream tokens on the GameFi track continued to fall, generally falling by more than 10%. Affected by recession expectations, insufficient market liquidity, and FUD sentiment, only BTC and ETH struggled to maintain prices with only a small drop, and the rest of the Altcoins performed poorly.

Project of the week—Grand Cross: Metaworld

Mysten Labs, the development company of the new public chain Sui Network, announced that it has reached a strategic cooperation with Metaverse World, a subsidiary of the Korean game company Netmarble (Netmarble Games). Metaverse World will develop and build its Metaverse game based on the Sui blockchain.

Netmarble (Netmarble Games) is a well-known game development and distribution company in South Korea. Its games include "The Age of Voyage OL" and the mobile game "Lineage 2: Revolution", etc. The company's market value is 4.32 trillion won (about 3.3 billion U.S. dollars). Its subsidiary Metaverse World was established in 2021 and mainly develops metaverse virtual idols, VR game avatars and other businesses.

The game jointly developed by the two parties is called Grand Cross: Metaworld, which focuses on the concept of an open world community, adopts 3D animation style, and uses Unreal 5 engine to produce. Judging from the promotional video (real scene of the game), the production is quite sophisticated. Grand Cross: Metaworld allows players to customize their personal space, while allowing players to use cameras to render virtual avatars (V-Tubers, 4K anime style). Judging from the promotional video, the game will also include elements such as NFT props. The game is expected to be in closed beta in the first half of 2023.

3. Infrastructure & Web3 infrastructure

1) Market Overview - Public Chain & TVL

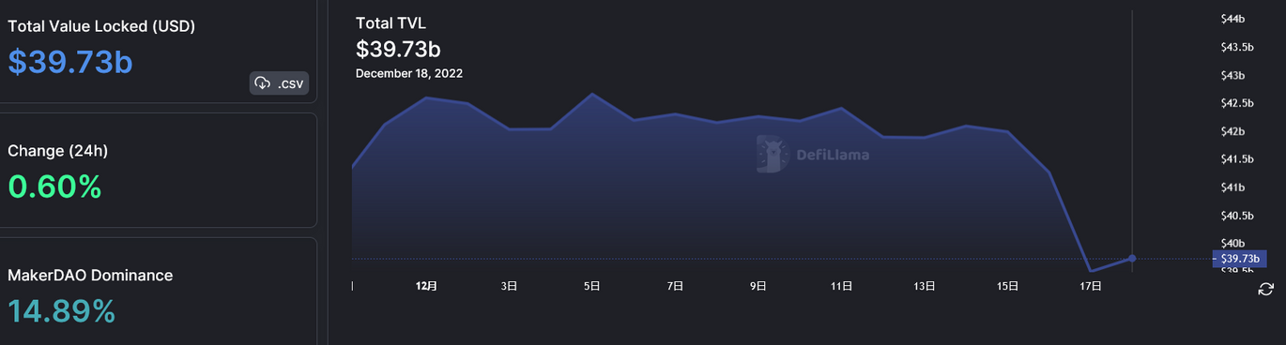

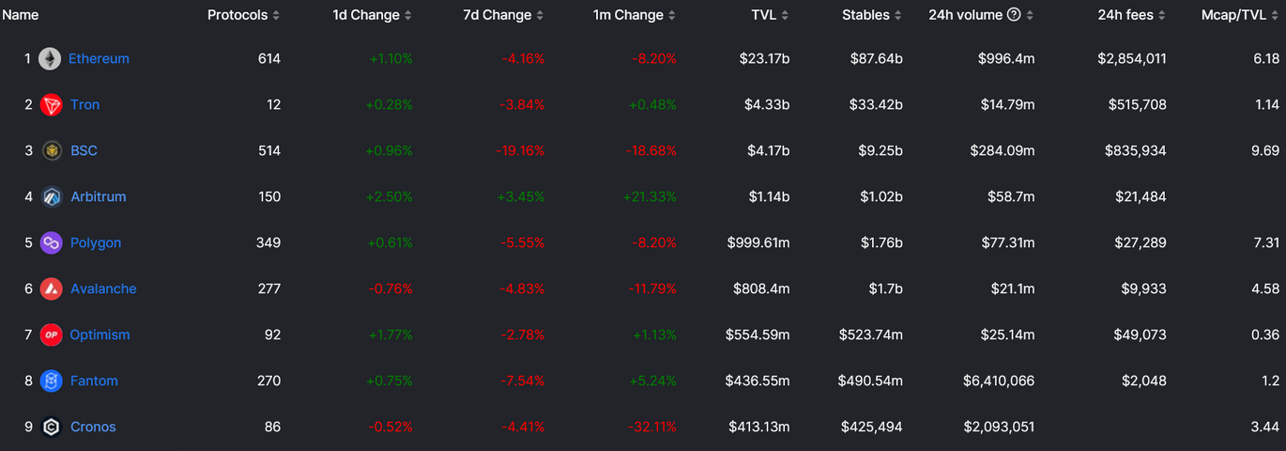

As of December 18, the overall lock-up volume (including staking) of all public chains denominated in US dollars has fallen sharply, from 48.46 B last week to 39.73 B, a drop of 18%.

The TVL of all public chains has declined to varying degrees this week, and the ranking has not changed much, but the TVL of Arbitrum has maintained a growth momentum.

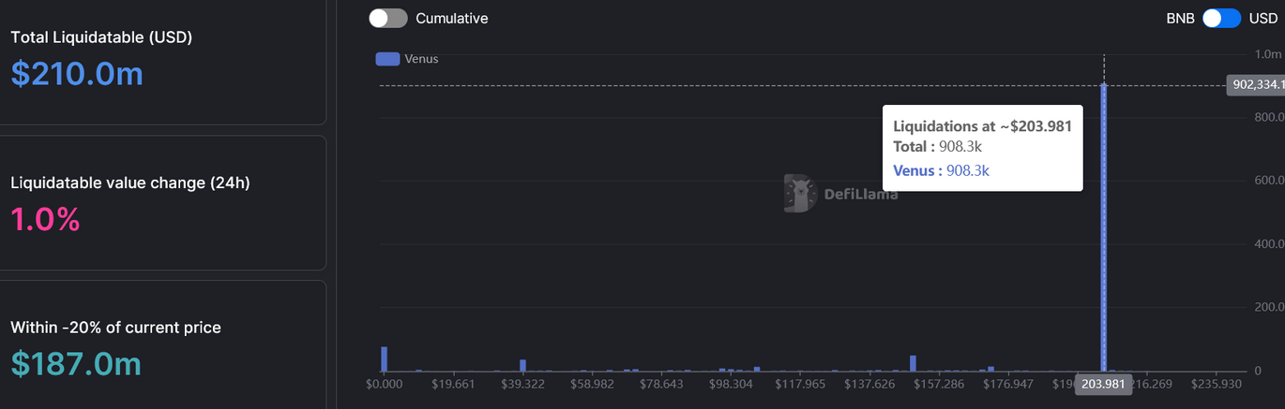

Among the rest of the public chains, BSC has continued to fall sharply, mainly due to the impact of the Binance FUD incident, BNB fell by more than 13% this week. In addition, affected by the continuous decline in the price of BNB, the market is worried that about 900,000 BNB (about 216 million U.S. dollars) will be liquidated in the lending agreement Venus. According to DeFiLlama data, the liquidation price is about 204 U.S. dollars. The 900,000 BNBs were stolen from a hacker attack on the BNB Chain cross-chain bridge in October this year, and were deposited in Venus as collateral to lend out stablecoins.

We believe there is no need to panic over this liquidation. Previously, the Venus community had published a proposal VIP-79, in which the BNB Chain core team became its sole liquidator, and cooperated with Binance and other parties to jointly repay debts when the liquidation price was reached, so as to avoid market turmoil caused by automatic liquidation.

2) Market Overview - Stablecoin Supply

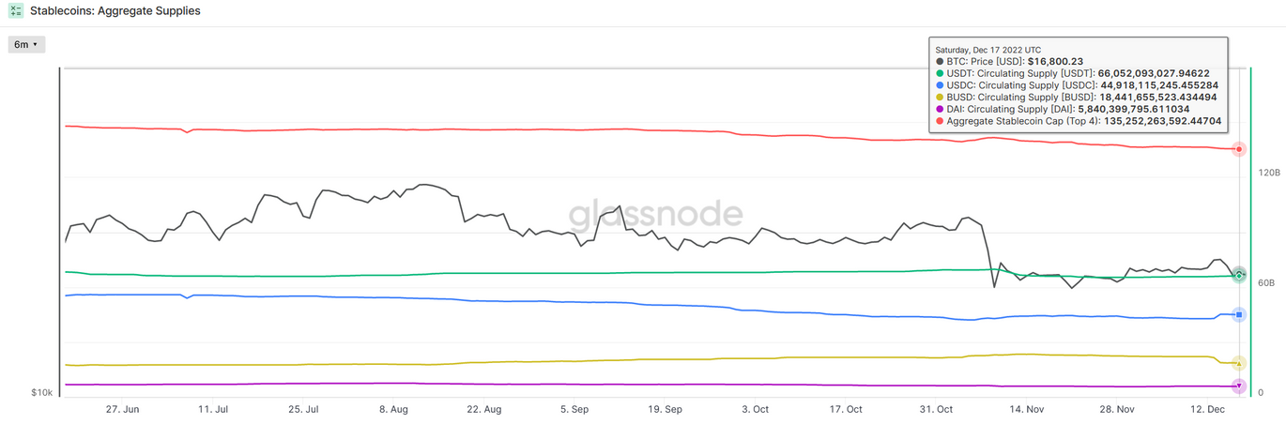

As of December 17, the total supply of the top four stablecoins (USDT, USDC, BUSD, DAI) was about 135.252 billion, a sharp decrease of about 1.154 billion (-0.85%) from 136.4 billion a week ago. The supply of stablecoins has fallen for five consecutive weeks, and funds have shown a continuous outflow trend, and the decline has accelerated this week.

Among the three major legal currency stablecoins this week, the supply of USDT rose slightly by about 344 million pieces this week, and the downward trend rebounded; the supply of USDC increased by about 2.2 billion pieces this week, while the supply of BUSD decreased by 3.658 billion pieces this week. Possibly due to the influence of Binance FUD, the user chose to convert a large amount of BUSD into USDC for withdrawal and escape.

After a short-term rise in DAI, which is the leverage of ETH, it fell again this week, and the bottom-hunting funds gradually realized their profits.

On the whole, the market liquidity is still in short supply, lacking the promotion of incremental funds, the short-term rebound may have ended, and the market will fluctuate and bottom out again.3) Market overview—Binance FUDOn December 16, accounting firm Mazars Group announced that it would suspend services for cryptocurrency-related clients.

Including Crypto.com

, KuCoin, and Binance. Previously, Mazars became Binance’s proof of reserve audit. According to CoinDesk, Mazars has suspended work with cryptocurrency companies on the Proof of Reserves report, citing “concerns about the way the public interprets the report.” The relevant reporting link on the Mazars website is currently no longer valid.

Mazars Group is a global accounting firm headquartered in France. It is the 11th largest accounting firm in the world and has member institutions in 91 countries around the world (the domestic member institutions are named Zhongshen Zhonghuan).

Since the FTX incident, the transparency of centralized exchanges has been questioned. In addition to announcing the reserve addresses on the chain, Binance has chosen audit institutions to provide reports to improve trust. However, Binance did not choose the "big four" accounting firms as auditors like Coinbase, but chose a relatively small auditing institution, and the market has doubts about this. In traditional industries, the replacement of auditors or the resignation of auditors by listed companies is usually interpreted as negative. If the audit is temporarily changed near the reporting date, the risk of financial fraud is usually higher. Therefore, the news was interpreted by the market as a major negative. After the announcement of the news, BNB fell by at least 15%, and has recovered part of the decline.

4 Social&DAO&DID

However, in the crypto industry, traditional auditors are usually not competent for relevant audit work. As far as accounting firms are concerned, due to the consideration of ability, reputation and professional ethics, they may not necessarily accept business from emerging industries. CZ also stated on Twitter that the blockchain itself is a public and permanent ledger that has been audited the most times. Therefore, we believe that there is no need to over-interpret this event.

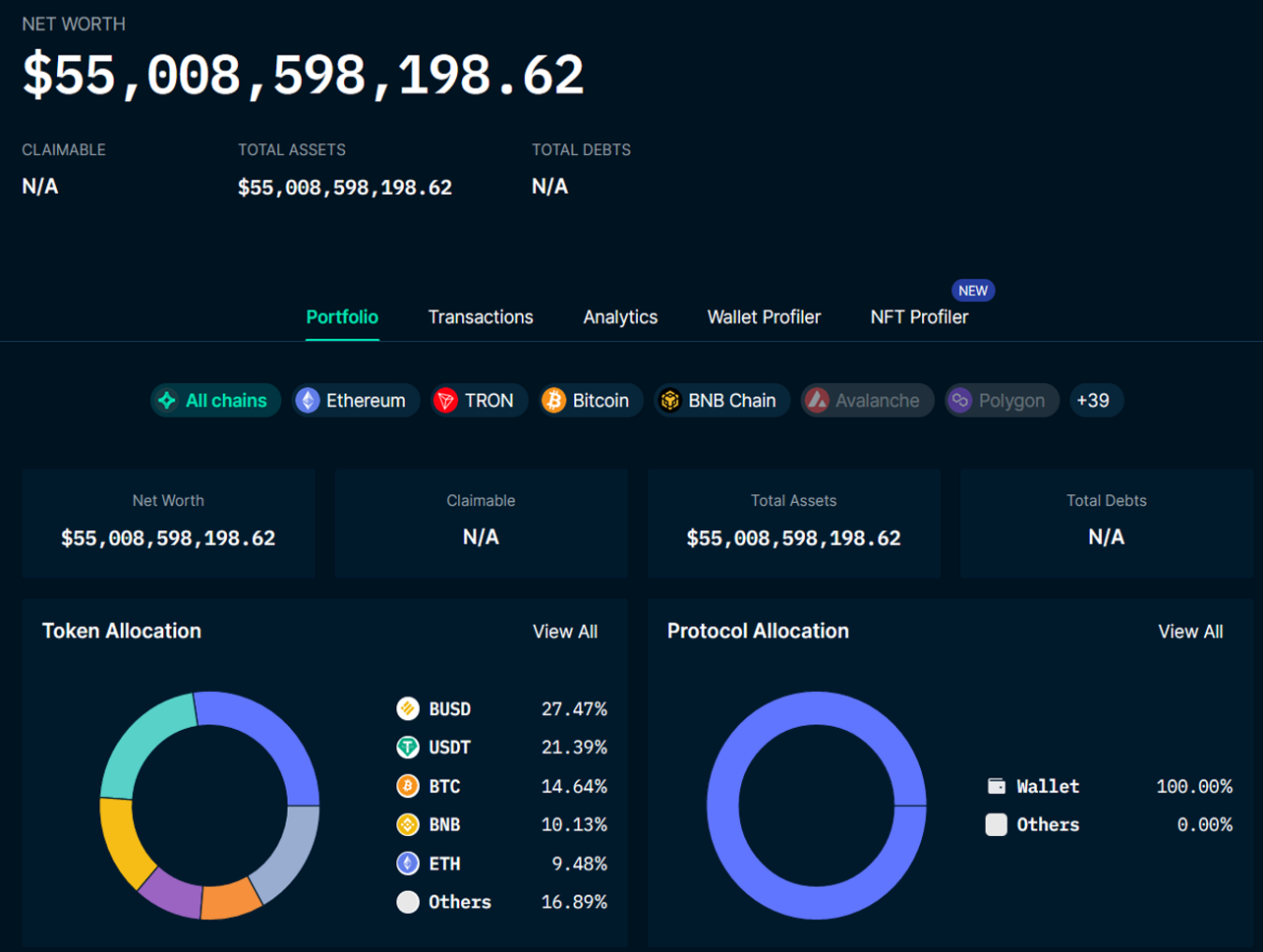

According to Nansen data, Binance’s reserves have fallen to $55 billion (from 70.5 billion in November), but the ratio of asset reserves remains healthy. In addition to market declines, Binance experienced a wave of withdrawals of about $6 billion this week. If Binance survives this stress test, it will undoubtedly gain more trust and market share in the future.

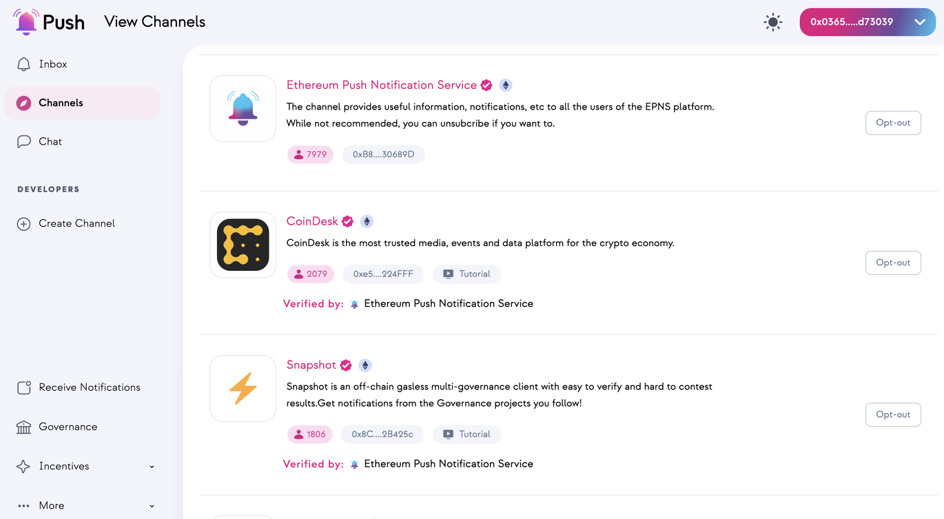

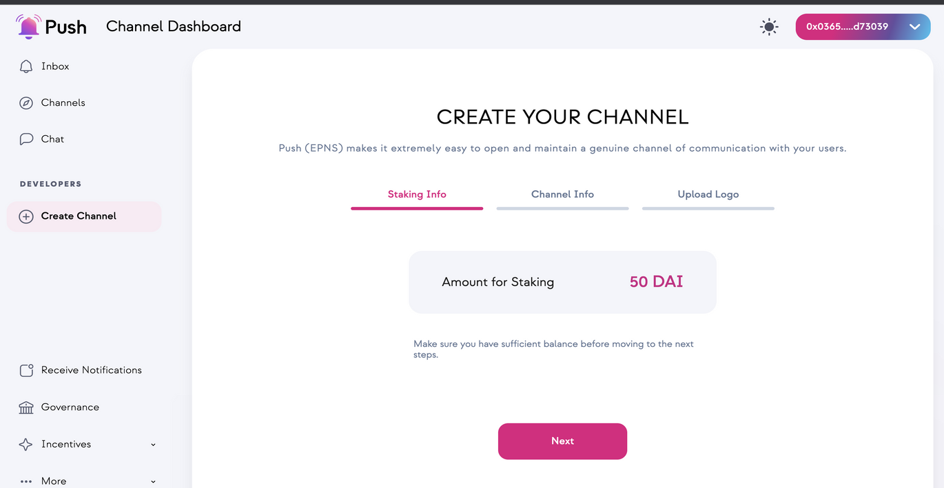

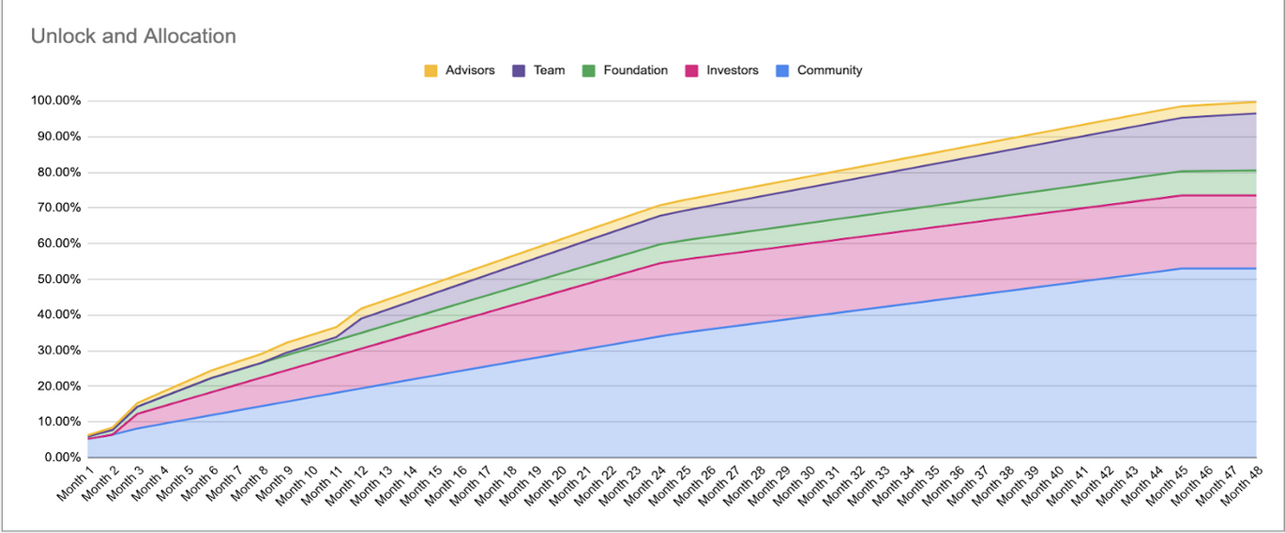

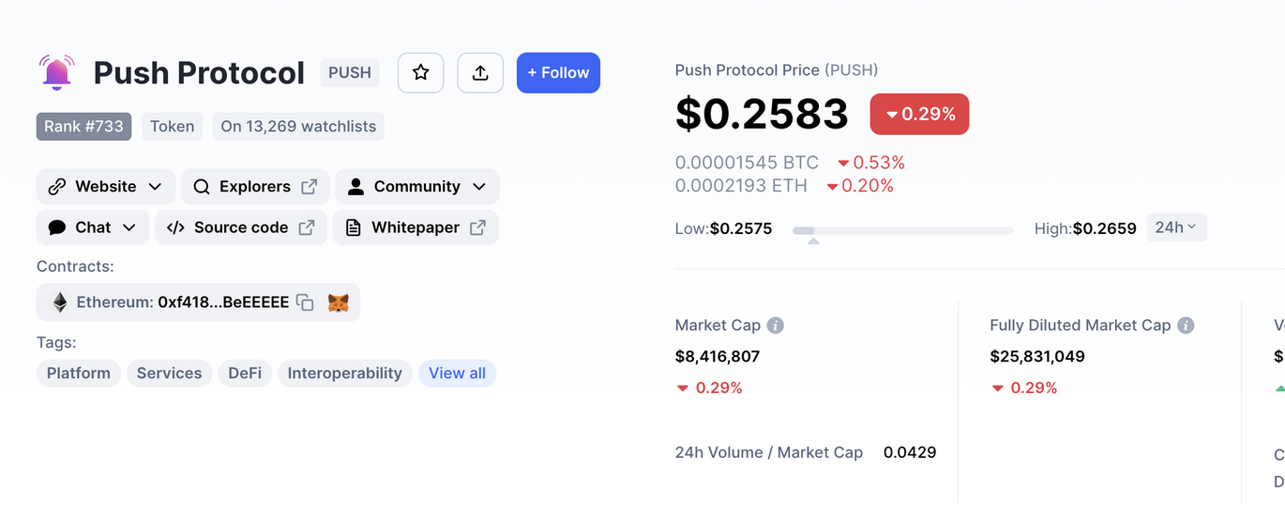

Project Introduction: PUSH Protocol

The PUSH protocol aims to build the first open communication layer in Web3; this protocol can push relevant information notifications of smart contracts, dApps or traditional servers to user wallet addresses for each public chain.

Previously called EPNS (Ethereum Push Notification Service), it was renamed PUSH in September this year. The main reason for the name change is because it is now supporting multiple chains, and continuing to call it EPNS will bind itself to the Ethereum brand.

Product logic:

The message push of Web2 is an extremely important link. Chat, news, and important notifications need to be used in various scenarios, but in fact, it is difficult to think of any Dapp that has used message push in Web3.

The main reasons are: 1. At present, most web3 applications are presented in the form of websites, and the development of the mobile terminal is extremely slow, because the message push is instant, and web2 is widely used after the emergence of the mobile Internet; 2. The infrastructure layer Lack of a mature solution for message push.

But in fact, Web3’s message push scenario has more rigid needs than Web2, such as defi price changes, ENS domain name expiration, loan liquidation warnings, gas abnormal warnings, and whether transactions on the chain are completed.

Function introduction:

Feature push

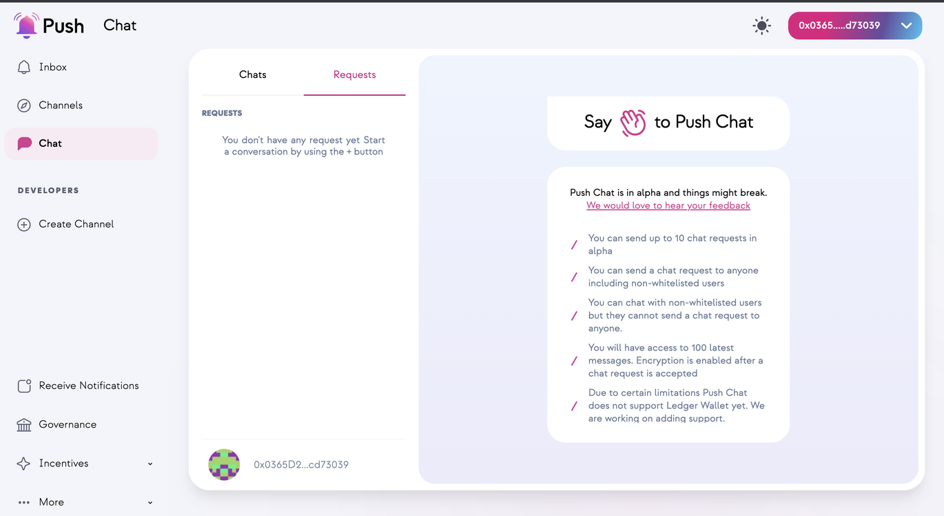

chat

broadcast

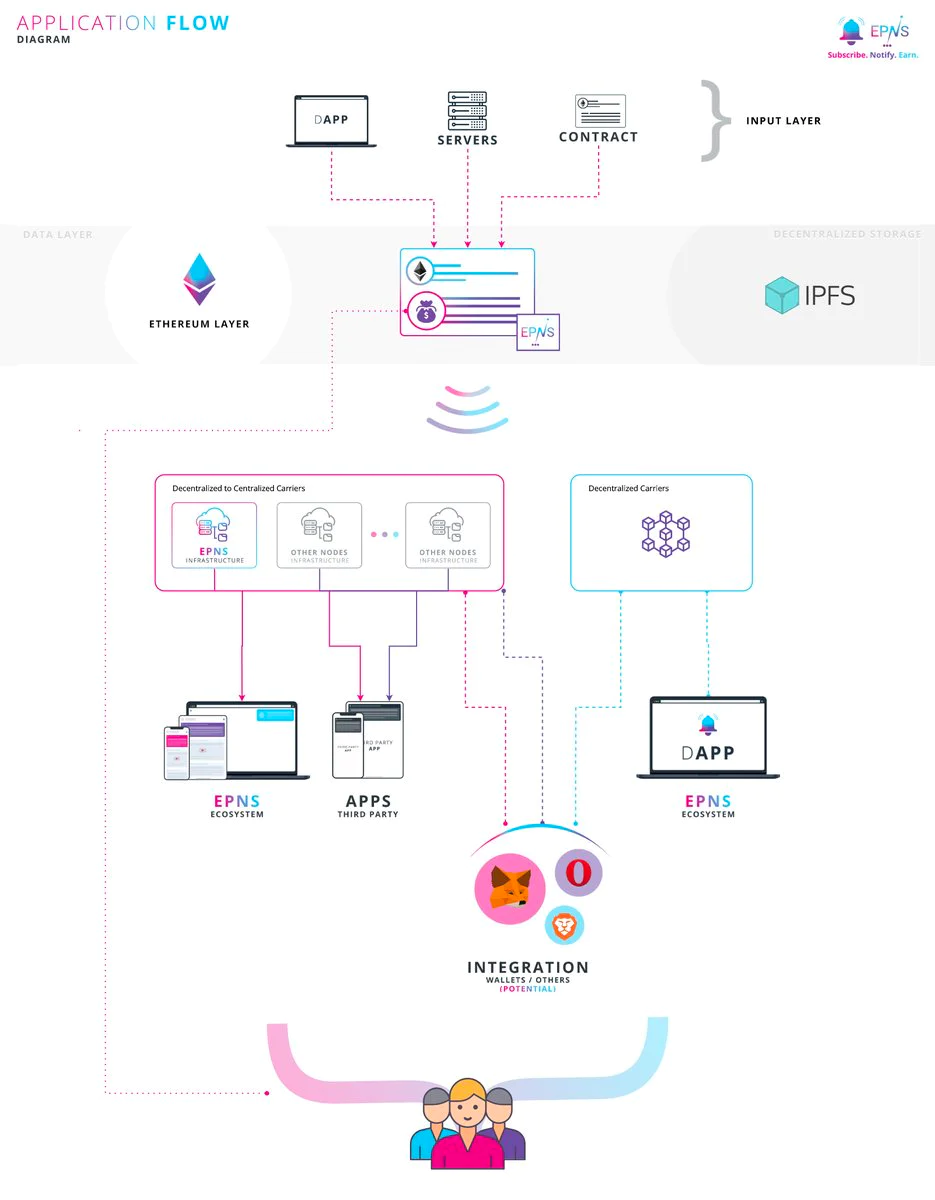

Technical principle:

The upstream DAPP, service, contract and other input layers will send the information to be pushed and the receiving address to EPNS, which will distribute and transfer them out. Third-party products can use the message capture interface of EPNS to obtain and display the corresponding messages.

To put it simply, it can be understood that the contract, back-end service and other upstreams can bury a piece of EPNS code where the message needs to be pushed, and pass in the corresponding message content, and EPNS will help you broadcast the message to the corresponding address. There must be a front end downstream that is responsible for receiving messages and displaying them.

At present, EPNS has made a front-end of its own message box plug-in to receive messages. Of course, any other third-party products can use the EPNS interface to display the messages received by users.

Financing status:

In April of this year, a $10.1 million Series A round of financing was completed at an average valuation of $131 million, led by Jump Crypto.

It completed a $660,000 seed round last year at a valuation of $12 million, led by Binance lab.

secondary title

5. Team news

JZL Garden Progress

5. Team news

In the past two weeks, JZL Garden has launched the Garden project's first NFT series "Dandelion" to the Upstairs platform, and it was completely sold out within one hour of the public sale. This is an important milestone moment for JZL Garden, thank you for your witness.

about Us

Last week, the Liuye and BAUBAU projects were also in full swing. We welcome your continued attention. In addition, the 7-labs built by our Sandbox continue to enrich elements such as "penguins" and "polar bears".