Pantera's year-end letter: From the perspective of the FTX crash, the necessity of a decentralized system

The original text comes from Pantera Capital, the original title is "The Necessity of Trustless Systems", the authors DAN MOREHEAD, CHIA JENG YANG, JESUS ROBLES III, compiled by Baize Research Institute, slightly deleted.

Dear Investor,

After the high-profile explosion of the last DeFi Summer, we named our year-end letter:

DeFi works well

DeFi still works well. But this year's letter has become:

Regulated exchanges work well

Before we discuss regulated exchanges and other material, I want to share some thoughts on FTX fraud. Many media reports are this version:

"If you can't trust FTX, who else can you trust?!?!"

Usually followed by:

"Blockchain is a failure."

Yet the claims of blockchain skeptics, as well as some regulators and politicians, miss the point. The collapse of FTX has nothing to do with blockchain technology. It wasn't cryptocurrencies that failed. Bitcoin and all other protocols work just fine.

"It's really an old-fashioned embezzlement issue. It's just using the client's money for their own purposes, nothing complicated."

— FTX’s new CEO, John Ray

On December 12, Sam Bankman-Fried was arrested by Bahamian authorities representing the US Attorney's Office for the Southern District of New York (SDNY) after a month of uncertainty. Charges against him could include wire fraud, securities fraud, money laundering and conspiracy.

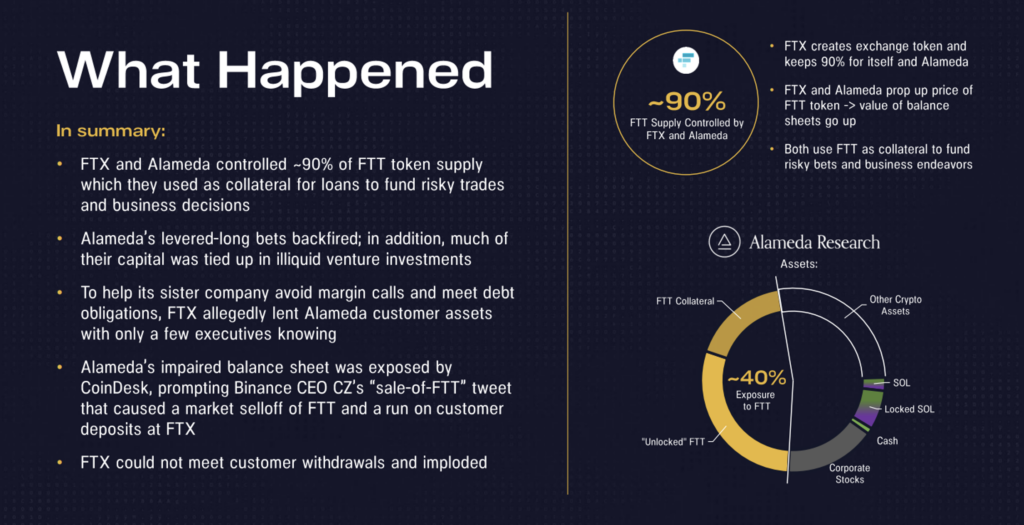

“Prosecutors say Mr. Bankman-Fried ‘participated in a scheme to defraud FTX clients by embezzling client deposits.’ The money was transferred to Alameda Research, SBF’s crypto hedge fund. The indictment alleges he also defrauded lenders, prosecutors said. Officials also cited campaign finance violations for making excessive political contributions "in the names of other people."

“The SEC complaint was even more eloquent. It said Bankman-Fried moved FTX clients’ funds to Alameda from the very beginning of FTX, so that “‘there is no meaningful distinction here. ’” Bankman-Fried then “used Alameda as his personal piggy bank, buying luxury condos, supporting political campaigns, and making private investments. ’ He took out huge loans, “on two occasions, Bankman-Fried was both a personal borrower and Alameda’s CEO. "

“Mr. Bankman-Fried claimed that Alameda had no privileges on the FTX platform. However, the SEC said his hedge fund had access to a “virtually unlimited” line of credit and was not subject to Bankman-Fried’s “automatic risk mitigation protocols to ensure FTX’s stability.” "Constraints. Customer funds were mixed up in internal accounts. The end came when cryptocurrency prices fell and "many lenders in Alameda demanded loan repayments."

— Wall Street Journal, "Sam Bankman-Fried's Cryptocurrency Crash"

In most respects, the FTX debacle is comparable to that of Three Arrows, Celsius, BlockFi, and Voyager. Concentrated, opaque, unaudited and offshore entities, and excessive leverage. With the crypto market down 70% and certain things like Grayscale's Bitcoin Trust (GBTC) trading at a 49% discount to the bitcoin in the trust, it's no surprise that highly leveraged entities would struggle.

Details are still emerging, but the FTX debacle involved massive conflicts of interest and apparently fraud. This pattern is as old as time. A trader, when faced with a small problem, tries to fix it and create a big one. When the forensic accountants are done, we may learn that FTX/Alameda went bankrupt earlier than the public knows. We estimate that if they had filed for Chapter 11 bankruptcy protection at that time, the damage would have been much smaller.

"If you can't trust FTX, who else can you trust?!?!"

The two-pronged answer is:

Regulated exchanges work well - such as Coinbase and Bitstamp

DeFi works well, especially DEXs - such as Uniswap, 0x, 1inch, Balancer and DODO

secondary title

Regulated exchanges work well

Regulated exchanges have been around for a long time, they are transparent, audited and regulated. The answer is already here. There are all sorts of crypto critics and skeptical regulators talking about the need for some entirely different future for blockchain transactions, but it is here, and has been for a long time. Exchanges like Coinbase, Kraken, and Bitstamp, when customers send money to them, they just deposit the money in the bank.

There's a lot of talk these days about high-tech "Proof of Reserves," but that's only part of the story. This just shows proof of some assets on the balance sheet, but no liabilities. The answer is simple: you hire a Big Four accounting firm, and you certify that you not only have assets, but that you have no liabilities that exceed your assets.

This is nothing new. Nine years ago, Pantera hired Ernst & Young to conduct its first audit of a crypto entity.

As a sign of how deep my understanding of blockchain is - I had to spend New Years Eve at the office with Wing in order to complete the audit. I have to prove how much bitcoin we hold. If I can transfer them at noon on a weekday before New Years - anyone on their team can confirm through a public blockchain explorer that those bitcoins are still in the same account after New Years weekend.

I was the chairman of Bitstamp for many years. Four years ago, EY was hired again to audit Bitstamp.

Deloitte audited Coinbase. If you store your cryptocurrencies on an exchange, be as cautious as your auditors.

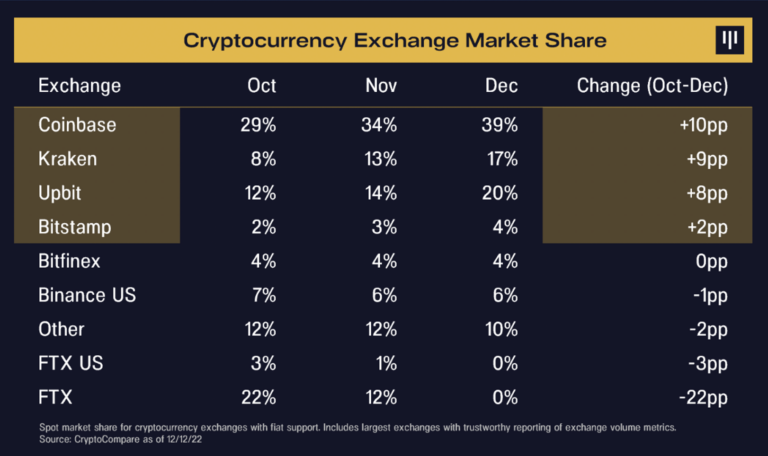

The market share of regulated, transparent and audited exchanges is increasing dramatically. This is essentially winning back customers who have fled to unsafe overseas exchanges in search of more trades, more leverage and lower fees. Since October, exchanges such as Coinbase, Kraken, Upbit, Bitstamp have increased their market share by 30 percentage points.

I think this trend is continuing. I hope it continues. That's great for our industry. It would be great if everyone was using such a regulated exchange for the past few years.

"Based on our review over the past week, we are pleased to learn that many of FTX's regulated or licensed subsidiaries, both inside and outside the United States, have solvent balance sheets, responsible management and valuable franchises."

— John Ray, new CEO of FTX

This is a very important point: Not even alleged perpetrators like Sam Bankman-Fried did (and don't appear to have, though details are still emerging), robbing regulated exchanges in the FTX empire. Even with all the craziness and alleged fraud going on at FTX, they didn't (or couldn't) rob US-regulated FTX subsidiary LedgerX. It's such a powerful symbol of why smart regulation is good for our industry - it protects investors, it has disclosure and transparency.

What should we do now?

Before the FTX crash, my hunch was that the worst was over for cryptocurrency prices. Excessive leverage, which centralized lenders could not sustain, exploded in May and June.

There seems to be no way for other entities with similarly high leverage to avoid bankruptcy six months later. When the dust settles, we will likely find that FTX/Alameda went bankrupt months before public knowledge. If so, everything from then on is just criminal.

Sam Bankman-Fried admitted in an interview a few weeks ago that they went bankrupt during the Terra-LUNA crash in May.

"After the LUNA crash, FTX's chaotic accounting + margin trading positions built up over time, but I didn't realize the full scale of it until a few weeks ago."

— Vox's Kelsey Piper interview with Sam Bankman-Fried, November 16, 2022

He will testify -- under oath -- before the U.S. House of Representatives next week.

“In FTX’s bankruptcy filing, they published a list of their top 50 creditors who owe $3.1 billion. The filing also shows that FTX and Alameda Research lost $3.7 billion between 2019 and 2021. So, even In a bull market, they're actually losing a lot of money as well. It's unclear exactly when the fraud and theft happened, but it seems like it may be earlier than people previously thought."

— Joey Krug, Co-CIO, Pantera, December 9, 2022

If Sam Bankman-Fried knew he was bankrupt back in May (as SBF hinted at in the Vox interview) and kept advertising for customer deposits, raising money, stealing customers' money...and continuing to be on TV , podcasting and lobbying the US Congress. It's unbelievable, unreasonable.

Kelsey: “So, there’s no point in saying things like ‘let’s lend out customer deposits,’ it’s just that various financial instruments end up adding up, and you don’t even see them add up?”

SBF: "Yeah. . . Like, oh, FTX doesn't have a bank account, I think people can wire money to Alameda's to make money on FTX . . . three years later. . "Oh fuck, it looks like people wire money $8 billion, gosh, we basically forgot the stub account that corresponded to it, so it was never delivered to FTX. "

— Vox's Kelsey Piper interview with Sam Bankman-Fried, November 16, 2022

Jesse Powell said it well:

"I'm really struggling to control my anger. It's not about aiming high and getting lost. It's about the recklessness, greed, self-interest, arrogance, anti-social behavior that leads one to risk the industry for personal gain years of hard-won progress at risk."

— Jesse Powell, Co-Founder, Kraken, November 10, 2022

US: Crypto Regulation VS Internet Regulation

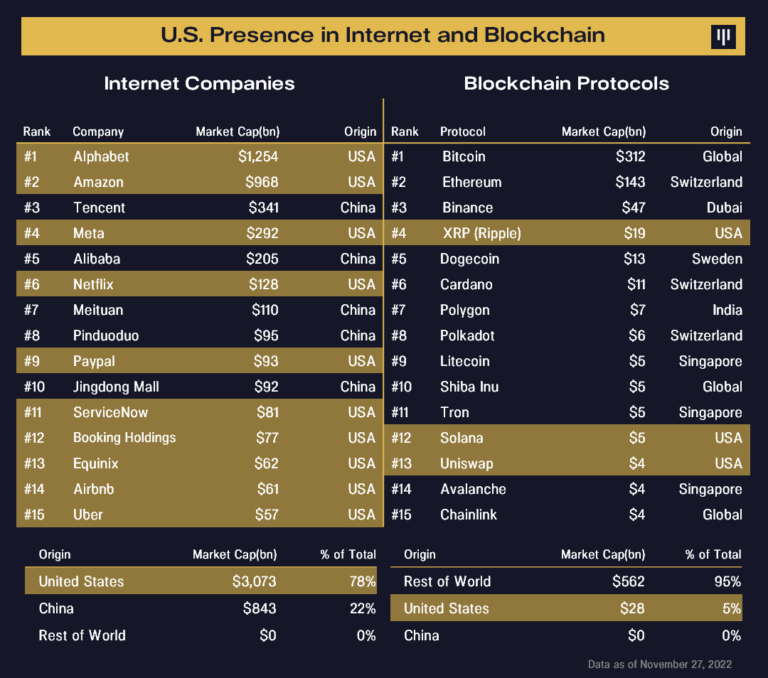

The state of crypto asset regulation is diametrically opposed to the rest of the internet.

The US government did build the Internet (ARPANET, which will celebrate TCP/IP's 50th anniversary next year). Subsequently, the U.S. government gave early Internet companies numerous advantages. In particular, the US offers them an unregulated safe harbor and an 8.25% discount over brick-and-mortar competitors through no sales tax. As a result, all of the largest Internet companies in the world are based in the United States.

So far, the U.S. approach to regulation has been counterproductive in the blockchain age. It encourages 95% of blockchain entities to move overseas. Likewise, 95% of the market capitalization of the crypto market is in projects outside of the US.

regulatory black hole

CFTC Chairman Rostin Behnam pointed out something absolutely fascinating. There is a regulatory black hole in spot bitcoin exchanges. This is a very strange question in the US regulatory system, where the CFTC has very clear jurisdiction over any derivatives or futures. If it detects a problem, it has the ability to take enforcement action in the underlying physical commodity market. But it does not have the ability to regulate the bitcoin spot market.

What about the SEC? Apparently, the "S" in the SEC is "securities," so it can only regulate things that are securities. Although the SEC has not stated what is and is not a security, it is widely believed that Bitcoin is not a security. If it's not a security, then it must be a commodity. So leaving this very strange black hole in crypto regulation without an agency mandated by Congress to oversee bitcoin spot trading.

"Since 2014, we've handled more than 60 encryption cases. However, since we don't have direct oversight, we have to wait for individuals to come to us and say, 'Hey, you should check this issue we've identified' or 'I 'Get scammed'. Every single case we deal with is because we have received information that is not the traditional information you would expect or expect from a market regulator. The regulator monitors the market in real-time and identifies unusual trades, Are there registered entities, making sure they don’t have consolidated related funds, don’t have conflicts of interest, they have books and records you can check, they have financial resources, etc. All of these are core elements of financial market structure.”

— Rostin Behnam Chairman, CFTC, DeCenter Inaugural Summit in Princeton, November 30, 2022

“There is growing demand for cryptocurrencies, but there are major gaps in regulation. I have been outspoken in my warning that the crypto market is largely unregulated and that we need a sweeping regulatory overhaul of the crypto market.”

— Rostin Behnam Chairman, CFTC, DeCenter Inaugural Summit in Princeton, November 30, 2022

"The collapse of all crypto entities is a real, tangible event, and voters, customers, investors, and Americans are being hurt. We cannot stand by and watch."

“Blockchain lending, custody, markets, tax policy, etc. are core issues that the new Congress will have to address. It will be an uphill battle, but Congress will be determined to get something done.”

"What has happened in the past few weeks is obviously very unfortunate. (Referring to FTX) I hope to use these events as a springboard for swift and comprehensive action. If we don't act quickly, I fear this will happen again. I will continue to advocate- Timely action must be taken because we cannot risk another entity going bankrupt in the near future."

— Rostin Behnam Chairman, CFTC, DeCenter Inaugural Summit in Princeton, November 30, 2022

FTX, encryption winter will pass

Pantera has invested in four similar "crypto winters." While the FTX debacle is incredibly frustrating, I'm sure...

"This too shall pass."——Ancient Persian proverb

Encryption Not a Problem: Lessons from Centralization and Weak Regulation

This paragraph was written by Jesus Robles III, Content Assistant and Chia Jeng Yang, Investment Assistant

In its heyday, FTX was the second largest centralized cryptocurrency exchange by trading volume and trusted by many. Over the course of two weeks, the company went bankrupt, lost billions of dollars, and created a huge ripple effect that caused serious problems for many major cryptocurrency institutions and led to several corporate bankruptcy.

Naturally one would ask, if you can't trust one of the largest players on the exchange, one with all the advantages of being successful, and trusted by a whole host of industry players including institutional players, then who can we trust?

Since the inception of Bitcoin, the wisdom of the encryption industry has been "don't believe it, verify it".

While critics in our industry lash out at FTX for its failures, they say little about the overall promise of blockchain.

At this point, it is important to step back, put aside any emotional or knee-jerk reactions, and soberly assess the potential impact. A centralized financial institution that happened to deal in cryptocurrencies — not held to the same regulatory standards as non-crypto traditional financial institutions — mishandled funds so much that it collapsed.

There has been much speculation in the industry about the cause of the crash. However, due to the nature of the cryptocurrencies held by the exchanges or the technologies, protocols and projects (excluding FTT) associated with these cryptocurrencies, the collapse is anything but imagined.

This is the same as the handful of other crypto asset projects that have ultimately succumbed to mismanagement or deliberately implemented centralization risks. We think it's clear that the exchange's crash has nothing to do with the blockchain.

“I have over 40 years of restructuring experience. I have served as chief restructuring officer or CEO in some of the largest corporate failures in history. I have overseen cases involving criminal activity and allegations of malfeasance (Enron). I have overseen cases involving Cases of novel financial structures (Enron and Residential Capital) and cross-border asset recovery and maximization (Nortel and Overseas Shipholding). Almost all cases I cover are in terms of internal controls, compliance, human resources and system integrity characterized by some kind of defect."

“Never in my career have I seen a company of this size (FTX) have control failures and such a complete lack of trustworthy financial information. From compromised system integrity and faulty foreign regulation, to concentration of control This is unprecedented in the hands of a very small number of inexperienced, unsophisticated and potentially compromised individuals."

— FTX’s new CEO, John Ray

The FTX debacle comes down to the fact that it was run by a poor organization with malicious and unqualified actors - centralization risk.

We believe this is also due in part to regulators not having the proper powers or tools to guard the bottom line — mandated by Congress to enforce enforcement only after damage has occurred, rather than having the ability to preemptively protect users and funds.

Another major factor that led to FTX’s collapse was regulatory uncertainty in the U.S. driving crypto institutions and users out of the U.S., like the “Wild West,” where it’s so easy to start a company and operate — regulatory woes.

We believe there are two ways to avoid this crisis:

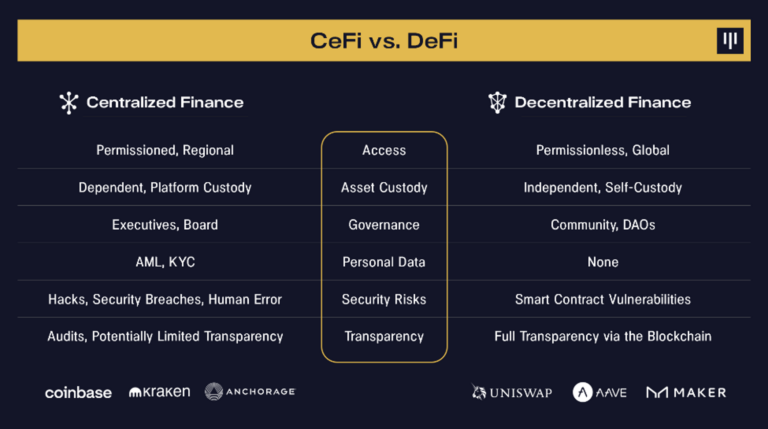

1. Decentralization: If FTX were a decentralized exchange made up of smart contract protocols, like DeFi, then the activities of the exchange might already be fully transparent, auditable, and verifiable. Additionally, user funds could have been kept in their own custody. Some DeFi protocols with these characteristics exclude many potential frauds, mismanagement of funds, suspension of withdrawals, etc. - that is, centralization risk. DeFi and blockchains are the solution to many of these classic centralization risks. Transparency, auditability, verifiability, self-custody, etc. are inherent characteristics of some DeFi protocol architectures.

2. Regulation/Transparency: While we wait for widespread adoption of DeFi, a robust, comprehensive regulatory framework for crypto will provide us with better assurance of institutional integrity (e.g., regulated traditional finance). A comprehensive regulatory framework would require transparency, auditing, reporting, regular review, segregation of exchanges with potential conflicts of interest, etc., should be broad enough to protect all users, regardless of whether transactions are overseas, and give regulators the appropriate authority and tools to Spot any issues ahead of time.

We believe in transparent, audited, regulated exchanges — companies like our portfolio companies Coinbase, Bitstamp, and Circle are good examples of institutional integrity. These centralized crypto finance companies have embraced and continue to support regulation, security, It is running successfully and is embracing DeFi technology.

“Cryptocurrency regulation in the United States has been difficult to navigate, and regulators have so far failed to provide a workable framework for how to provide cryptocurrency-related services in a safe and transparent manner. This means that a large number of cryptocurrency-based financial products, including lending, Margin trading and other instruments that are perfectly legal and regulated in traditional financial markets are almost always illegal in the US. The US is afraid of lawsuits. They don’t want to break the rules, and now they don’t know what the rules are.”

“As a result, U.S. consumers and advanced traders have been trading on high-risk overseas platforms outside the jurisdiction and protection of U.S. regulators. Today, more than 95% of cryptocurrency trading activity occurs on overseas exchanges.”

“Part of the reason FTX has been able to get big and strong is because it operates in the Bahamas, which is a small country with little capacity to regulate and oversee financial services businesses. Are regulators forcing FTX to behave the way it has done in the past? No, but They really created a situation where FTX could risk it without any repercussions."

secondary title

CeFi VS DeFi: FTX is a failure of centralization

This paragraph was written by Jesus Robles, III, Content Assistant

In our industry, the distinction between "centralized" and "decentralized" entities, systems, companies, etc. is important.

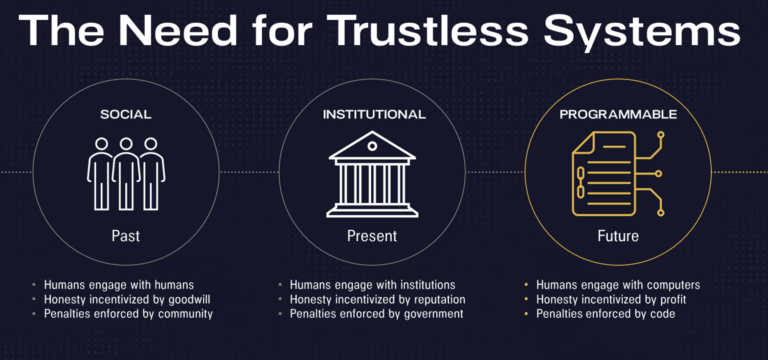

Long story short: centralized organizations like traditional financial institutions, corporations, etc. face some obvious risks - for example, management chooses to commit fraud, mismanage user funds, etc., leading to the demise of the company. Other members of the organization, users, etc. have no say in these wrong decisions, but still bear the full consequences.

For a decentralized system, the "complete failure of corporate control and total lack of trustworthy financial information" (in the case of FTX), is inherently more difficult to achieve, because in a decentralized system like DeFi, transparency and self-custody are Basic features, which are strictly enforced by transparent and fair smart contracts and codes.

While its business involves decentralized projects, tokens, and more, FTX is fundamentally a centralized institution. Its demise must have been due to the risk of centralization chosen by its small group of decision makers through fraud, mismanagement of funds, etc. For DeFi services, products and tools, or DAOs (Decentralized Autonomous Organizations), decisions need to be made democratically by all involved participants and in full view of all participants. Most rational participants would not agree to fraudulent, poorly managed funds. Through democratization and transparency, we believe DeFi will make it harder for things like FTX to happen.

A centralized entity or system is opaque - since there is no way to peer into its inner workings, it is impossible to assess any potential problems from the outside. Recently released filings from FTX's bankruptcy proceedings show that the company's problems had been worsening in the months leading up to bankruptcy. This crisis could have been detected early and ultimately avoided if companies had developed transparency, conducted comprehensive audits, etc. For DeFi services, products, and tools, this kind of transparency is often native, making it difficult to let things go sour in the long run as they did in FTX's case.

In the case of fintech, a centralized entity or system typically holds assets for users. While this does have some benefits, if an entity or system fails, then those assets also suffer. In fact, this is the case with FTX. Hundreds of thousands or even millions of users who have lost billions of dollars in crypto assets will be "lucky" to get a few cents in compensation once the bankruptcy process is completed. For example, the Mt. Gox bankruptcy proceedings remain unresolved after a nine-year time span. But for decentralized financial services, products, and tools, users can keep their own assets according to a specific agreement or system architecture, so even if the project fails, they can still withdraw funds from the service, product, or tool to avoid losses .

The failure of centralization led to the downfall of centralized FTX. Blockchain — and how it can be decentralized — is the solution, not the problem.

DeFi is great: code is law

This paragraph was written by Jesus Robles, III, Content Assistant

DeFi is different from opaque centralized finance, its foundation is rock solid, rooted in immutable code, and completely transparent. In some cases, DeFi completely removes human subjectivity, such as funding decisions. With DeFi, participants can transact openly and transparently on the blockchain — rather than behind the scenes through opaque, human (i.e. fallible), potentially conflicting financial actors. So DeFi is the vision we should strive to achieve, instead of insisting on using an inefficient centralized financial system.

DeFi has never "sinned". Rules are encoded into smart contracts. Users do not need to trust counterparties, nor do they need to trust the platform to conduct financial transactions. DeFi's code is simply executing what both parties agree to.

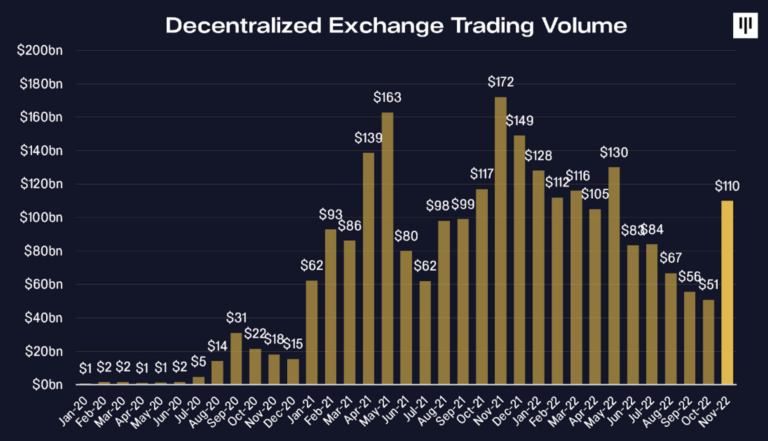

Trading volumes on decentralized exchanges (DEXs) spiked in November following the FTX crash.

The best proof that DeFi is superior to centralized finance is head-on competition.

“Additionally, while news of the FTX debacle gave crypto skeptics a lot of heart, we want to point out that all of the recent crashes in the crypto ecosystem have come from centralized players, not decentralized protocols.”

— Steven Alexopoulos, Cryptocurrency Analyst, JP Morgan, November 10, 2022

Defunct centralized finance firms like Celsius and BlockFi did business with counterparties and then invested those funds in DeFi protocols. What happened next was far-reaching: these centralized financial companies were forced by smart contracts to pay back the DeFi protocol. Celsius was forced to prioritize repayments of its $400 million in loans on Maker, Aave, and Compound to prevent its collateral from being liquidated. It has no ability to "restructure"/violate smart contracts. In DeFi, "a transaction is a transaction" - you can't get out. All centralized financial companies are forced by smart contracts to repay DeFi agreements.

On the other hand, centralized financial firms like FTX can lie and cheat to their own clients. Unfortunately, their customers are unlikely to get their money back.

With DeFi, the result is different. Clients can monitor the agreement on the blockchain and be sure that the code will execute their transactions.

Part of the reason FTX failed was that Alameda allegedly had a premium account. Additionally, Alameda is allowed to trade without an automatic liquidation mechanism when over-leveraged. However, there are no backdoors or concessions in DeFi, these are not allowed in DeFi. In DeFi, the same rules apply to everyone, and protocols cannot structurally deviate from them.

We believe that DeFi is the future of finance, and while it has some unique early issues, it is certainly the solution to the risks and limitations of centralized finance, such as lack of transparency, backdoor trading risk, insolvency, mismanagement of funds, fraud wait. This is part of the reason we invest in some DeFi protocols.

We believe that the crypto industry will continue to drive the development of DeFi protocols.

Structurally Safer Finance: Regulated Exchanges

This paragraph was written by Jesus Robles, III, Content Assistant and Chia Jeng Yang, Investment Associate

While DeFi is inconsistent with CeFi in some ways, the coexistence of these two fintechs will become the norm, rather than DeFi "completely replacing" CeFi.

That said, CeFi can and must improve as it relates to cryptocurrencies and needs better regulation. Regulated entities are generally safer, and we believe that regulation creates structurally safer financial institutions with better net worth, and they should be accepted.

Regulated CeFi exchanges can and do very well. We have something to say about well-regulated, fully transparent, and strictly run centralized cryptocurrency exchanges — like Coinbase, Bitstamp, and Circle, which Pantera invested in.

1. Coinbase

Coinbase is a publicly traded company subject to strict regulation and in 2017 became one of the first entities to receive a BitLicense for crypto business licenses from the New York Department of Financial Services (NYDFS). Coinbase also holds licenses in virtually every state in the United States and continues to seek and obtain approvals from international regulators to support the growth and expansion of the platform.

In June 2021, the German Federal Financial Supervisory Authority (BaFin) granted Coinbase Germany GmbH a cryptocurrency custody and trading license under the new licensing regime introduced in January 2020. The BaFin licensing framework is the first of its kind in the EU, with Coinbase Germany being the first company to receive such a license.

Thanks to its regulation, Coinbase is currently the second largest cryptocurrency exchange by trading volume and one of the most successful and prominent companies in the crypto industry. Regulated CeFi works great!

2. Bitstamp

We believe that Bitstamp, the longest-standing cryptocurrency exchange, is one of the industry leaders in terms of compliance and regulation. reason:

1:1 custody of assets with licensed trust company BitGo and other regulated banking institutions.

There is crime insurance.

We are currently cooperating with BitGo and Ernst & Young to release a report on the transparency of reserve certificates as of the FTX event.

It is the first cryptocurrency exchange to obtain a license in Europe: In 2016, it obtained an EBA payment agency license in Luxembourg.

It is one of the few companies with NYDFS BitLicense to operate in New York State.

Audited by Ernst & Young in each of the past four years.

Hold capital reserves as required by NYDFS.

Bitstamp, currently the fifth-largest cryptocurrency exchange by trading volume, has seen its market share surge as users flee dangerous overseas exchanges for safer, regulated ones.

Regulated CeFi works great!

3. Circle

Circle issued USDC, which is a stable currency, which is more like an entrance to the encrypted world than an exchange. Every USDC on the internet is 100% backed by cash and short-term U.S. Treasury bills, so it's always convertible 1:1 to USD. (A stablecoin is a reserve-backed cryptocurrency designed to take advantage of the decentralization benefits of blockchains while mitigating the risk of price volatility typical of crypto markets.)

Circle USDC reserves are held and managed by leading U.S. financial institutions, including BlackRock and BNY Mellon. Every month, Grant Thornton LLP (one of the largest auditing, tax and consulting firms in the US) provides a report on the size of USDC reserves.

Circle, like PayPal, Stripe and Apple Pay, is licensed to transmit money under US state laws. Circle's financial statements are audited annually and subject to SEC review.

In the US, Circle is also regulated as a money services business by the Financial Crimes Enforcement Network (FinCEN), part of the US Department of the Treasury.

Outside the US, Circle is regulated by the UK's Financial Conduct Authority as an Electronic Money Institution (EMI), under the responsibility of the UK Treasury and Parliament.

Recently, Circle also received approval-in-principle from the Monetary Authority of Singapore (MAS) as a major payment institution licensee. This enables Circle to provide digital payment products, cross-border and domestic money transfer services in Singapore, thus becoming a new generation of financial services and business applications.

Circle closely monitors the actions of the aforementioned governments to ensure that they meet any future obligations.

With a cautious approach to regulation, Circle has become one of the longest-running and most trusted portals to the crypto world, leading the adoption of stablecoins and often advocating for more appropriate industry regulation.

Regulation and DeFi

This paragraph was written by Jesus Robles, III, Content Assistant and Chia Jeng Yang, Investment Associate

Regulated entities are generally safer, and we believe that regulation creates structurally safer financial institutions with better net worth, and they should be accepted. Regulation is one of many tools to strengthen security structures and help catch malicious actors — but it has limitations. Legal structures and regulation should be seen as good but incomplete means of security, merely a means to the end of "structurally safer finance".

In the more open global environment created by cryptocurrencies, DeFi must protect its users through code, and for trustless purposes, there is nothing more mechanical, structured, or more reliable than code.

While the FTX debacle is still ongoing, many DeFi protocols are functioning as before, many of which have been strengthened by the many bankruptcies that have occurred this year.

“We should be talking about the decentralized nature of DeFi because it raises a whole different set of problems, especially for regulators. We’re used to being hands-on. Bank examiners, for example, are embedded in banks, their office is theirs. Regulated banks. DeFi and DAOs raise a lot of very difficult questions about the role of regulators."

— Rostin Behnam Chairman, CFTC, DeCenter Inaugural Summit in Princeton, November 30, 2022

Regulatory Outlook: Future Industry and Technology Legalization

“While this is certainly a major short-term setback, we believe the well-publicized FTX debacle could significantly speed up the timeline for the introduction of cryptocurrency-related regulation (similar to new banking regulation following the GFC (Global Financial Crisis)).”

“As such, we view the FTX debacle as a step backwards for the industry, but it could prove to be a catalyst for the crypto industry to take two steps forward (further unlocking blockchain’s utility value). In fact, we believe the regulatory framework The establishment of cryptocurrencies is a necessary catalyst to drive institutional adoption of cryptocurrencies at scale."

— Steven Alexopoulos, Cryptocurrency Analyst, JP Morgan, November 10, 2022

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.