Inventory of the top ten annual moments in 2022: there is still a warm dawn under the thrilling

Compilation of the original text: Bai Ze Research Institute

Compilation of the original text: Bai Ze Research Institute

first level title

Crypto Moment of the Year

If you ask a passerby to summarize the cryptocurrency market in 2022, there is a good chance they will tell you that 2022 is the year of the death of blockchain technology.

In the Twitter Crypto space, thousands of investors who came for last year's bull run vowed to leave the market for good in 2022 as they "woke up."

But, it hasn't been a quiet year for those who choose to stay. Sure, all tokens plummeted in value as the crypto market lost $2 trillion in market cap, but there were still plenty of major events to keep us entertained, or, at least, having something to do.

As with previous bear markets, some of this year's landmark events have turned out to be some of the most disastrous. Few would argue that 2022 isn't one of the rockiest years for the cryptocurrency industry. We have seen Terra, Three Arrows Capital, and FTX, which are worth tens of billions of dollars, fall one after another just a few months apart. Investors suffered staggering losses, and it felt like the industry was set back years.

Still, 2022 has given us some positive developments. While ETH’s price has been underperforming, Ethereum has done well this year as the “consolidation” is finally complete. We’ve also seen countries acknowledging the potential of cryptocurrencies against the backdrop of war, sanctions, and soaring fiat inflation.

2022 was one of the most volatile years ever for cryptocurrencies, but the industry survived. During this doomed bear market, whether the ecosystem can survive has become the biggest question.

For now, though, 2022 will be a memorable, if difficult, year for the crypto ecosystem.

secondary title

Canada Freezes Liberty Team Funding

The first major crypto event of 2022 didn’t happen on-chain, or even online, but in Ottawa, Canada’s capital. On January 22, hundreds of Canadian truck drivers set off from all over the country and began to gather on Capitol Hill to protest the government's new crown vaccination mandate. The government refused to negotiate with them, so so-called "freedom convoys" took control of the streets. The size of the convoy made it difficult for law enforcement to disperse the protesters.

On Feb. 14, in response to the protests and lockdowns, Prime Minister Justin Trudeau activated the Emergency Act, which briefly gave the government additional powers, ordering Canadian financial institutions to freeze protesters and any supporters through donations. their bank accounts - to cut their money. Undeterred, however, protesters turned to cryptocurrencies, leading Canadian authorities to blacklist at least 34 cryptocurrency wallet addresses associated with the Liberty Convoy. Shortly thereafter, a combined police force forced the truck driver off the streets, and by February 20, downtown Ottawa had been completely cleared.

secondary title

Ukraine Starts Accepting Cryptocurrency Donations

The Russia-Ukraine conflict has had a major impact on global markets this year, including cryptocurrencies. In this battle, cryptocurrencies have taken center stage.

Within days of the conflict erupting, the Ukrainian government’s official Twitter account posted a post that included bitcoin and ethereum wallet addresses, hoping donors would donate BTC and ETH. The tweet sparked immediate confusion, with ethereum co-founder Vitalik Buterin warning people that the Twitter account may have been hacked.

However, the Ukrainian government’s Ministry of Digital Transformation then confirmed that Twitter had not been stolen and the post was correct as they did want to fund war relief efforts by accepting cryptocurrency donations.

A flood of donations followed, with the Ukrainian government raising more than $30 million worth of BTC, ETH, DOT, and other digital assets in three days. Someone even donated a CryptoPunk NFT.

The initial donation drive is just one of a historic move by the government to embrace cryptocurrencies in times of crisis. On March 26, the Ministry of Digital Transformation of Ukraine also launched an NFT museum to sell NFTs recording war events in order to raise more funds.

secondary title

text

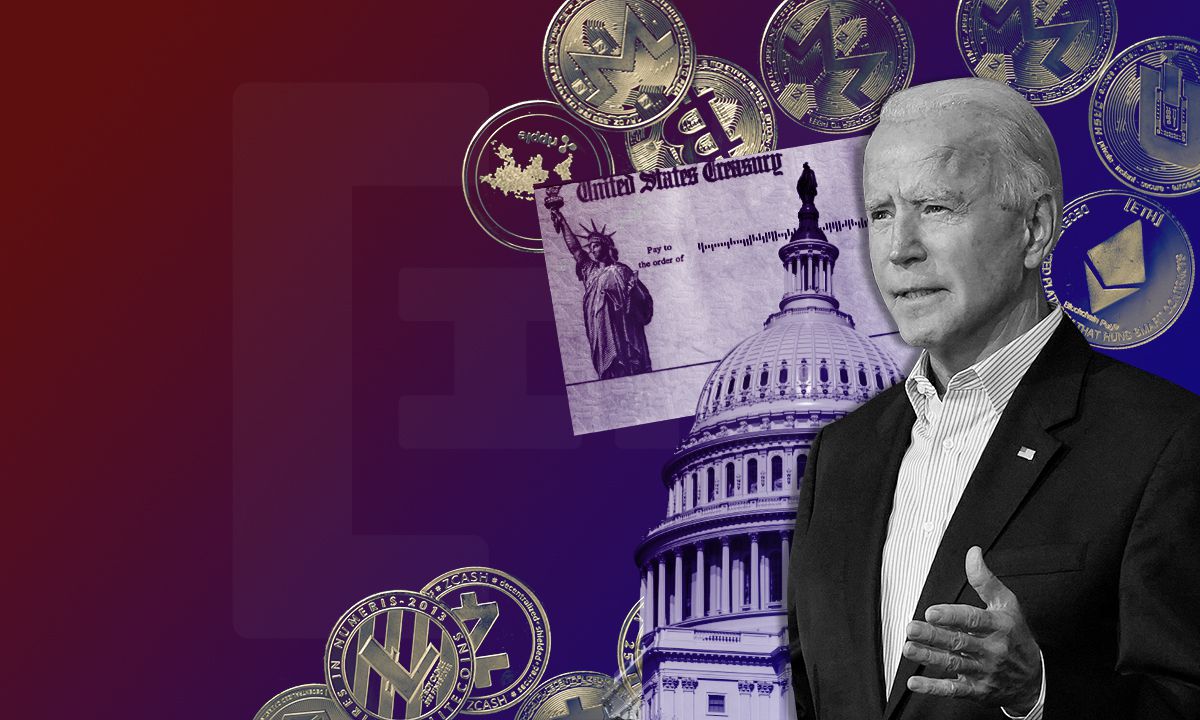

This year, the U.S. took their regulation of cryptocurrencies to a whole new level. Let’s be honest, the way the U.S. government regulates cryptocurrencies has been piecemeal even in the best of times for the crypto market, but it’s hard to imagine an industry now begging the government for a clearer set of rules.

Apparently, the executive branch is still still figuring out what “digital assets really are,” let alone how to regulate them. Are they securities? Or a commodity? Maybe they resemble securities in some ways but not in others. Maybe some of them are commodities, others are securities, and still others are currencies...but by what criteria do we make these distinctions?

Is Congress working on this? Who is making the rules?

That person is-President Biden.

Thirteen years after Bitcoin was born, and three administrations in the United States, President Biden issued an executive order directing nearly all federal agencies, including Cabinet departments, to finally come up with a comprehensive plan for U.S. cryptocurrency regulation and enforcement. When Biden's order was finally signed in March, it was widely seen as a boon for the crypto industry. Far from the draconian approach many had feared, Biden's executive order is simply a research directive requiring each agency to develop a plan once and for all and present it to the White House.

secondary title

Hackers Steal $550 Million From Ronin Network

The crypto industry has suffered several high-profile hacks in 2022, but the attack on Ronin, a cross-chain bridge for the popular blockchain game Axie Infinity, is by some means the biggest.

The attackers, later identified by U.S. law enforcement as the North Korean government-sponsored Lazarus Group, used phishing emails to obtain five of the nine Ronin validators. This allowed the attackers to steal funds, including 173,600 ETH and $25.5 million in USDC, for a total value of approximately $551.8 million.

The strangest detail in the whole affair is that the hack happened six days before the news broke, and for almost a week, no one managed the cross-chain bridge until the funds ran out. While this suggests a lack of focus on cross-chain bridges from Sky Mavis, the developer of Axie Infinity, and its partners, the slow response could also be partly due to the lack of mass adoption of cross-chain bridges due to deteriorating market conditions.

The Ronin incident marked the beginning of a series of attacks by the Lazarus Group on the encryption industry. In June, Layer-1 network Harmony lost about $100 million in a similar attack, while DeFiance Capital founder Arthur Cheong also fell victim to a targeted attack by the Lazarus Group — losing a bunch of high-value Azuki NFTs.

secondary title

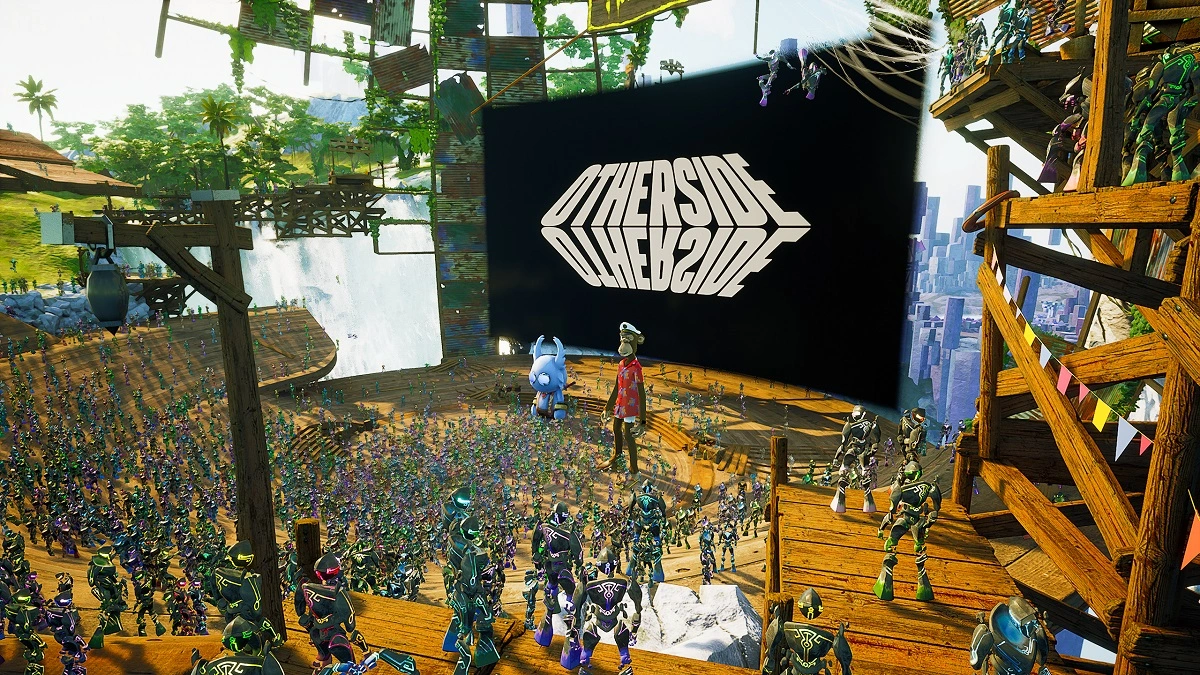

Yuga Labs Introduces Otherside

The Bored Ape Yacht Club (Bored Ape Yacht Club), an NFT series created by Yuga Labs, won the 2021 NFT competition and became the most popular NFT collection in 2021, but Yuga Labs is not slowing down its streak going into 2022. winning momentum.

The company acquired Larva Labs' CryptoPunks and Meebits lines in March 2022, making Yuga the world's top NFT company and helping Bored Apes take off. The company also received a massive funding round led by a16z as it shifted its focus to the Metaverse.

Yuga Labs kicked off the Metaverse chapter with the sale of virtual land NFTs, offering community members the opportunity to own a piece of land in the Metaverse known as the "Otherside." Existing community members will receive a virtual land NFT for free as a reward for their loyalty, while others will need to purchase it.

As the popularity of Bored Apes NFT continues to soar, the Otherside virtual land has also become the most anticipated NFT sale of the year. As expected, a gas war ensued, with only those willing to spend thousands of dollars in fees on transactions able to successfully purchase. Yuga Labs blamed the launch on ethereum's congestion issues and hinted that it may leave the ethereum network, although such a planned proposal did not go through. All told, the company made about $310 million from the sale, making it the largest NFT sale in history. Prices on the secondary market spiked at one point and have since plummeted due to overall market weakness, but it's safe to say that once the Metaverse hype heats up, all eyes will be on Otherside.

secondary title

Terra crashes

At its peak, Terra was one of the largest cryptocurrencies in the world by market capitalization, and the Terra ecosystem was worth over $40 billion.

Terra is seeing phenomenal growth in late 2021 and early 2022, largely due to the success of its native stablecoin, UST. Contrary to most stablecoins, UST is not fully collateralized: it relies on an algorithmic mechanism to maintain a peg to the U.S. dollar. The algorithmic system allows users to mint new UST tokens by burning LUNA tokens, or burn UST to exchange for new LUNA tokens.

UST’s mechanics helped the Terra network expand at the start of a bear market, as many investors swapped volatile cryptocurrencies for stablecoins to “shelter” from price crashes. At this time, UST is a particularly attractive option because Anchor Protocol, a lending platform on Terra, offers a 20% yield on UST loans. As market participants flock to UST to earn yield, they increasingly burn LUNA, driving up the price of LUNA.

The rise of Terra — combined with the outpouring of support from Terra founder Do Kwon on social media — seems to have given investors a sense that Terra isn’t immune to the crypto market downtrend at all. In turn, UST seems more attractive.

On May 7, 2022, a series of huge sell-offs challenged the peg of UST, which sounded the alarm for Terra, and UST briefly recovered after decoupling. Two days later, UST lost its peg again, triggering a full-blown "bank run". The rush of UST holders to redeem their UST for LUNA tokens greatly increased the supply of LUNA, resulting in a depreciation of LUNA, which in turn led to more redemptions by UST holders. By May 12, UST was trading as low as $0.36, while LUNA was down to a fraction of a cent.

secondary title

Celsius and Three Arrows Capital are in a liquidity crisis

When the Terra ecosystem collapses, we know the consequences will be bad, but we don't yet know who it will affect and for how long. Terra crashed in May, wiping out tens of billions of dollars in value. But by mid-June, the fruits of Do Kwon’s “labor” had found their way into the centralized crypto market, and that’s when things really went sour.

On the evening of June 12, Celsius, a leading centralized crypto lending platform, reminded its customers that it was temporarily suspending withdrawals. Everyone immediately understood that this was not good. Celsius invested in Terra, and when the project hit rock bottom, it fanned the flames lit by CEO Alex Mashinsky’s unauthorized use of transactions on the company’s books. As its investments became insolvent, it set off a chain reaction among a familiar cast of characters. Celsius lends money on decentralized platforms like Maker, Compound, and Aave, but also lends heavily to centralized crypto entities like Genesis, Galaxy Digital, and Three Arrows Capital. Some crypto entities (with the creditable exception of Galaxy) turn around and lend out the loan again, and so on. It may be years before we see the full chain of custody surrounding all of the assets being moved, but there are signs that these companies, despite their multi-billion dollar valuations, may simply be moving the same funds over and over again.

The next one is Three Arrows Capital. Within days of Celsius declaring bankruptcy, rumors of Three Arrows' bankruptcy began to circulate, and its co-founders Su Zhu and Kyle Davies have not responded publicly. Today, they are thought to owe about $3.5 billion in debt after defaulting on a string of loans. Others such as Babel Finance, Voyager Digital, and BlockFi have also been hit by Terra's contagion, which will eventually reach Sam Bankman-Fried's FTX empire (even if it takes months).

June’s liquidity crisis was a dire reminder of the dangers of centralized exchanges and the extent to which these so-called “custodians” actually hold client funds. Hey, that's the core value proposition of CeDeFi - if you want attractive DeFi yields but don't have the time, knowledge or patience to do it yourself, you can ask a custodian to do it for you. But you have to be able to trust them to some degree and they also need to be honest with each other (what they do with their money).

The liquidity crisis also tests the boundaries of "terms," which have always been a thorn in the side of any user trying to interact with any given product. To its “credit”, Celsius has made it very clear that it will do whatever it wants with customer deposits: its terms of service clearly state that it is not a legal custodian of customer funds, but instead treats customer deposits as “loans” to the company , which can then be freely traded, mortgaged, lent, transferred, etc., while clarifying that "if Celsius becomes insolvent...you may not be able to restore or regain ownership of such digital assets, except as a creditor of Celsius under any applicable laws You may not have any legal remedies or rights other than your rights."

secondary title

U.S. Treasury Sanctions Tornado Cash

Tornado Cash is a privacy-preserving protocol that helps users obfuscate their on-chain transaction history. On August 8, the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) announced that it had placed the agreement on its sanctions list. In a statement, the agency claimed that cybercriminals, including the aforementioned Lazarus Group, use Tornado Cash as a money laundering tool.

Crypto firms such as Circle and Infura took immediate action to blacklist Ethereum addresses that had interacted with Tornado Cash in order to comply with the sanctions. Some DeFi protocols do this by blocking wallets that have interacted with Tornado Cash from their frontends from using its services.

Following OFAC's announcement, the Dutch Fiscal Information and Investigation Agency arrested Tornado Cash core developer Alexey Pertsev on suspicion of facilitating money laundering.

The Tornado Cash sanctions order is unprecedented, as it marks the first time a government agency has sanctioned open source code. Some crypto enthusiasts took the opportunity to voice concerns about Ethereum's ability to remain censorship-resistant.

secondary title

Ethereum is finally "merging"

There was so much bad news in 2022, but Ethereum brought some consolation to the industry over the summer as it looked like it was finally ready to “merge” — moving from Proof-of-Work (PoW) to Proof-of-Stake (PoS) - Improve energy efficiency by 99.95% and reduce carbon emissions by 90%.

After June’s liquidity crisis, investor hype over an Ethereum merger was enough to shake the market out of despair, while talk of a proof-of-work fork for the network ignited even more investor enthusiasm.

Ultimately, the merger will officially close on September 15, 2022. The merger has been hailed as the biggest crypto update since Bitcoin's launch, with ethereum developers widely credited for its success.

Interestingly, much of the mainstream media has focused on Ethereum’s increased carbon efficiency following the merger, but the true impact of the merger may not be felt for years to come.

secondary title

FTX crashes

By the fall of 2022, temporary hardships in the crypto world have almost become the norm. Terra crashed, a dozen high-profile companies shut down over the summer, the US Treasury sanctioned decentralized protocol Tornado Cash, and more. But despite our almost numbness, 2022 has saved its most egregious disaster for last.

Just a month ago, FTX was on top of the world. The Bahamas-based cryptocurrency trading platform is known for spending a lot of money promoting its image, and in doing so, has made its name "FTX" as household name as cryptocurrencies. Apparently, FTX is targeting US retail consumers, associating itself with sports events, striking sponsorship deals with sports stars like Tom Brady and Steph Curry, and acquiring the NBA's Miami Heat at a premium The home naming rights, traded to their own name, and hyped at the Super Bowl.

Its chief executive, Sam Bankman-Fried (SBF), makes a special effort to trade his usual T-shirt and cargo shorts for a shirt and tie when he visits politicians and regulators in Washington, D.C. They guarantee the credibility of FTX and their commitment to cooperation between regulators and the industry in developing regulations. He's graced magazine covers, hosted former heads of state at FTX events, and put on a grand display of his philanthropic leanings, insisting his ultimate goal is to make as much money as possible so he can donate all of it to Welfare.

As such, FTX became a bombshell in early November when rumors emerged that illiquidity at FTX's unofficial sister company, Alameda Research (also founded by SBF and fully controlled by him), could weigh on FTX. This triggered a "bank run" on the FTX platform, causing the platform to suffer from illiquidity. Most believe that FTX "lend" client funds to Alameda, which lost $10 billion on mismanaged, risky positions.

As more details of witness interviews and court documents come to light, it's surprising that FTX is not only not a good company, but a very bad one. We know at least two things for sure: there's plenty of evidence that FTX took $10 billion from its customer deposits to cover Alameda's bad trades, and they've barely bothered to track that money.

Losing a trade is one thing, but completely disrespecting client funds is quite another. It now appears that when FTX suspended withdrawals during the "bank run" it experienced on Nov. 8, it was likely partly because the company didn't even know where the money was.

Three days later, FTX filed for bankruptcy and SBF “resigned” as CEO. The new CEO is John J. Ray III, who has spent his career overseeing the bankruptcy and dissolution of companies. Ray testified to the court in legendary language:

“Never in my career have I seen a company of this size with such unreliable financial information. From compromised system integrity and faulty regulation, to the concentration of control among a handful of inexperienced, In the hands of unsophisticated and potentially compromised individuals, this situation is unprecedented."

He was also the one who oversaw the dissolution of Enron.

And yet SBF is doing a slew of ill-advised public interviews and tweets from its million-dollar penthouse in the Bahamas, doing nothing but irritating onlookers and adding to the prosecutors' list of evidence.

On December 13, SBF was formally arrested by Bahamian police.

According to the official statement of the Bahamas, the U.S. judiciary has formally filed criminal charges against SBF. The Bahamian police arrested SBF after receiving official notification from the U.S. and will extradite him as required. SBF was charged with wire fraud, wire fraud conspiracy, securities fraud, securities fraud conspiracy and money laundering, The New York Times reported, citing sources.

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.